Vol. 41 (Issue 15) Year 2020. Page 7

SAKHNO, Andrii A. 1; POLISHCHUK, Nataliia V. 2; SALKOVA, Iryna Yu. 3; KUCHER, Lesia Yu. 4; KUDYRKO, Olena M. 5

Received:12/10/2019 • Approved: 26/01/2020 • Published 30/04/2020

ABSTRACT: This paper investigates the necessity of forming an agricultural mortgage lending system, which revealed the increase in the volume of products sold with the increase of short-term loans, which prevail in agricultural enterprises lending. The possibility of agricultural land capitalization as a potential source of project financing is substantiated. Estimation of the potential volume of credit provision for projects of agricultural enterprises of Ukraine shows the important role of this potential source of financing, depending on the value of the pledge of land and rights to lease. |

RESUMEN: Este documento investiga la necesidad de formar un sistema de préstamos hipotecarios agrícolas, que reveló el aumento en el volumen de productos vendidos con el aumento de los préstamos a corto plazo, que prevalecen en los préstamos a empresas agrícolas. La posibilidad de capitalizar la tierra agrícola como fuente potencial de financiamiento de proyectos está respaldada. La estimación del volumen potencial de la provisión de crédito para proyectos de empresas agrícolas de Ucrania muestra el importante papel de esta fuente potencial de financiamiento, dependiendo del valor del compromiso de la tierra y los derechos de arrendamiento. |

Agricultural mortgage lending is one of the main sources of financial resources in most countries of the world, but the system of agricultural mortgage lending has not yet been established in Ukraine, as there is no effective mechanism for its functioning and development. The agricultural mortgage lending system will allow more efficient use of free capital and allow landowners to purchase additional large-scale resources and/or land at high prices. Taking into consideration the global experience, it should be pointed out that the role of mortgage lending is increasing every year, because the developed economy is impossible without its functioning to ensure the debtors’ obligations.

The state and prospects of mortgage lending in Ukraine were investigated by A. V. Cherep and A. K. Yarova (2011), and also by F. A. Vazhinsky and A. V. Kolodiychuk (2010). D. S. Borysenko and S. O. Kushnir (2016) identified in their research the problems affecting mortgage lending to rural businesses in Ukraine, and outlined the prospects for lending, taking into account the specific features of agriculture that affect the organization of its lending.

Credit risks of mortgage lending are devoted foreign scientists’ works – A. L. Katchova, P. J. Barry (2005), B. J. Sherrick et al. (2000). Estimating Expected and Unexpected Losses for Agricultural Mortgage Portfolios was performed by J. B. Dressler and L. W. Tauer (2016). Features of mortgage lending to field of crop production were investigated by G. A. Kharchenko and T. O. Artyukh (2016).

Analytical review of the mortgage lending system in Russia was carried out by V. A. Fedorovich and also N. V. Kontsypko (2012), experiencing the directions of mortgage lending possible development in the post-crisis period, as well as the mortgage lending proposed mechanism.

The scientist B. M. Hnatkivskyi (2009) analyses the functioning of the mortgage lending system as a set of interrelated components of the mortgage lending that interact on the basis of mortgage principles and legal support. The author substantiated proposals for improvement of legal, regulatory and informational support of mortgage lending.

Stages of the mortgage lending system formation have been explored by K. M. Borisyuk (2005), taking into account the scope of the mortgage, the long-term nature of the mortgage, highlighting the advantages and disadvantages of the mortgage, as well as thoroughly exploring the mortgage lending system as a set of relationships that ensure the flow of financial flows from the investor to the secondary market of mortgage securities.

N. M. Kvit (2009) points out quite right that one of the important and urgent issues for every country, including Ukraine, is a mortgage system creation, and the process of its formation is the result of political, legal, economic, historical and other interaction factors. It is on the legal nature of the mortgage system formation that the author's attention is paid.

Possibilities and risks of mortgage lending in agrarian sphere of economy are investigated by a group of authors: R. I. Sodoma, et al.,(2012), who states that bank mortgage lending is a powerful source raising funds for agricultural production. An important prerequisite for its effective development, in addition to accessibility and transparency for borrowers, is the development of effective credit risk management tools for securing agricultural land. Thus, research on agricultural insurance and financial potential management based on crisis management is important in this context N. Tanklevska and V. Miroshnichenko, (2019); V. Yarmolenko, (2019).

E. S. Moldavan (2008) explores the problems and ways of solving mortgage lending to agricultural producers, taking into consideration the mortgage specificities, forming a sub-mechanism of the mortgage lending process, in which it is proposes to include legal, economic, organizational, motivational and political instruments.

O. V. Nagornyi (2010) deals with the topical issues of the mortgage lending financial mechanism in Ukraine, suggesting ways to improve the mortgage lending system.

O. D. Hnatkovych (2014) in his turn pays attention to the issues of land use efficiency of agricultural enterprises on the basis of credit operations, organization of credit system and formation of bodies that will carry out this process. The author substantiated the mechanism of mortgage operations with agricultural land plots. Scientists also examine the problems of agricultural enterprises efficiency (T. Pasichnyk et al., 2016) and the impact of credit resources on their productivity (A. Sakhno, et al., 2019).

T. P. Hrynchuk (2017) substantiates the role and importance of land-mortgage lending for agriculture, and examines also the reasons for the deterioration of full-fledged land-mortgage lending in Ukraine's agriculture, and argues that a loan of money secured by land is one of the most reliable and the safest way to obtain long-term investment.

O. V. Khodakivska and I. V. Yurchenko (2019) carry out research too, which is based on the experience of Israel, revealed the peculiarities of regulating the market and economic circulation of agricultural land rights, taking into consideration the current conditions maturation the introduction of the land market. In this aspect the researches are conducted by O. M. Shpychak (2018), who proposed methodological approaches to calculating the price of agricultural land in Ukraine before withdrawal a moratorium on its sale and carrying out an estimate of such prices. The scientist also proposed measures to be taken at the state level to ensure the effective functioning of the land market. In this context, research on innovative approaches to the economic valuation of arable land is important (Ye. Ulko et al., 2018).

The purpose of the article is to evaluate the impact of short-term loans of commercial banks on the volume of sales of agricultural enterprises and the formation efficiency of these enterprises (profitability of all activities) in relation to the increase (decrease) in prices for agricultural products to determine the need for mortgage lending.

The use of the correlation-regression method of analysis made it possible to determine the relationship between the volume of income from the sale of agricultural products and loans to agricultural enterprises. This method also allowed studying the effectiveness of the use of short-term loans to the agricultural sector, taking into account the prices for agricultural products and profitability of all activities of agricultural enterprises, which necessitates the formation of a mortgage lending system that would facilitate the functioning of long-term mortgage loans for rural development.

The use of the historical method of research of agricultural enterprises made it possible to determine the efficiency sufficiency (profitability of all activities) in relation to the increase (decrease) of prices for agricultural products in chronological order.

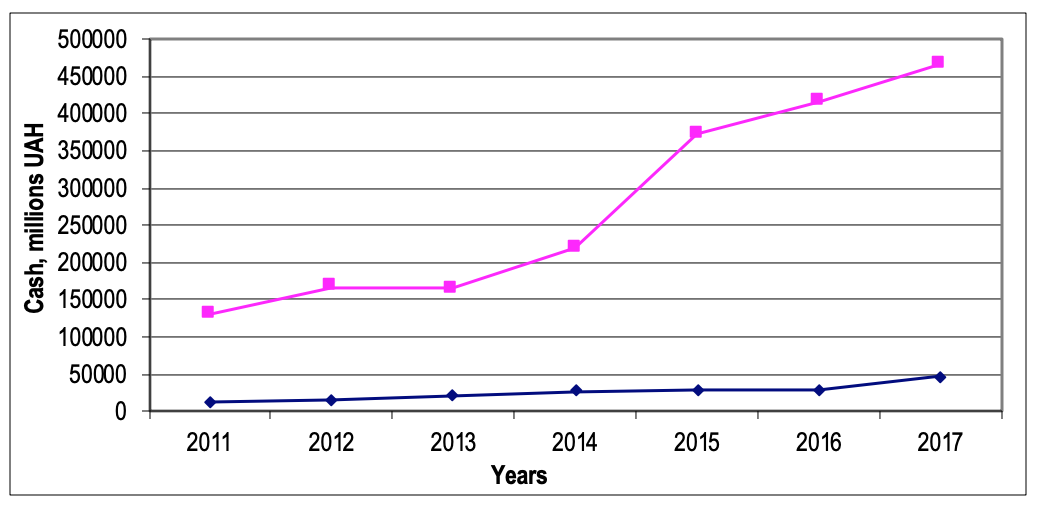

Maximizing the profits of enterprises is achieved by means of increasing the volume of sales and also by optimizing costs. The activity of agricultural enterprises depends on many economic factors, among them the most important are the level of costs, the volume of crediting, taxation policy together with such specific factors as the area of land, yields, climatic conditions, etc. We propose to consider the importance of short-term credits impact of commercial banks on the income from the sale of agricultural enterprises for the period of 2011-2017, according to the State Statistics Service of Ukraine, by applying the correlation-regression method of analysis (Fig. 1).

The obtained results indicate a high communication density since the correlation coefficient is 0.86. If banks do not provide short-term lending (x = 0), under such conditions, the income from the sale of products will be 4200.9 million UAH. In addition, linear regression has an increasing trend, where an increase in lending leads to an even larger scale of product sales.

Figure 1

Dependence of income from the sold products in agriculture of

Ukraine on granted short-term loans volume of banks, 2011-2017

Source: own composition on the basis data of the State Statistics Service of Ukraine.

Thus, there is a need for further growth of short-term lending by commercial banks to agricultural enterprises, which will increase the income from sales of products. During the period 2011-2017 (Fig. 2) only once (in 2013 compared to 2012) the sale income from products decreased while the volume of lending by commercial banks increased.

Figure 2

Dynamics of indicators income from sales of agricultural

products in Ukraine and short-term bank loans, 2011-2017

Source: own composition on the basis data of the State Statistics Service of Ukraine.

If we plan to increase the product revenue by optimizing business activities by reducing costs, the following factors must be considered:

- the sales volume for the previous period (SVPi, t-1);

- the size of the adjustment, which reflects the level of output sold in the calculation of short-term bank loans (Ai);

- the volume change of short-term bank loans compared to the previous period (Credits);

- the sales price index (SPI)

- the profitability of all activities of agricultural enterprises (Pe);

- the external factors that are independent of enterprises (EIFe).

Thus, we suggest for each period, the marginal level of sales volume in the calculation of short-term loans use of commercial banks to determine by the formula:

SVPi,t = (SVPi, t-1 + Ai · Credits) · (1 + SPI - Pe + EIFe) (1)

For the sake of convenience of calculations, we assume EIFe = 0, although further studies need to take into consideration the influence of external factors, in particular the occupation of Crimea and parts of Donbass by Russia. The amount of adjustment (Ai) is defined as the ratio of sales volume to the value of short-term bank loans (Table 1).

Table 1

Calculation of amount of the volume of sold products

adjustment on agriculture of Ukraine, 2011-2017

Year |

Income from sales of agricultural products, (SV), mln UAH |

Short-term bank loans (STL), mln UAH |

Changes of volume of short-term bank loans (Credits), mln UAH |

C = SV / STL |

C · Credits |

2011 |

130604.4 |

11966.9 |

- |

- |

- |

2012 |

167332.5 |

15707.1 |

3740.2 |

10.65 |

39833.1 |

2013 |

166277.9 |

22328.2 |

6621.1 |

7.45 |

49327.2 |

2014 |

220163.3 |

27629.9 |

5301.7 |

7.97 |

42254.6 |

2015 |

372033.4 |

27849.1 |

219.2 |

13.36 |

2928.5 |

2016 |

414799.9 |

29058.0 |

1208.9 |

14.27 |

17251.0 |

2017 |

467636.1 |

46853.5 |

17795.5 |

9.98 |

177599.1 |

Source: authors’ calculations based data on the State Statistics Service of Ukraine.

For the period under review, the maximum amount of adjustment is in 2016 (14.27), the minimum is in 2013 (7.45). Taking into consideration the change in short-term bank loans volume, the largest amount is for 2017 (177599.1 million UAH), the lowest is for 2015 (2928.5 million UAH).

It should be pointed out that the assessment of possibility of increasing the volume of sales should be made taking into account the factors of inflation and efficiency. We suggest to take into account inflation through sales price indices (ISPI), and efficiency – profitability of all activities of agricultural enterprises (Pi). Both indicators for 2011-2017 (Table 2) are given according to the State Statistics Service of Ukraine.

Since EIFe = 0, the factor of formula (1) has the form (1 + ISPI – Pi). Thus, there are two options:

- ISPI < Pi – coverage of the achieved efficiency (profitability of all activity) of rising prices for products;

- ISPI > Pi – insufficient efficiency (profitability of all activities) to cover the rise in product prices.

Thus, the level efficiency coverage (profitability of all activities) of the increase in the prices for sold products during 2011-2017 is determined in Table 2.

The cumulative amount of the differences obtained is: -4.4 – 8.8 – 10.9 + 15.4 + 25 – 15.7 – 4.5 = -3.9 %. Based on the latter value, we can conclude that the results of 2011-2017 show an increase in efficiency (profitability of all activities) over the increase in prices for products by 3.9 %.

Table 2

Sufficiency of efficiency (profitability of all activity) in relation to the

increase (decrease) of prices for agricultural products, 2011-2017

Year |

Agricultural price indices for agricultural products sold by agricultural enterprises (IPSP), % to the previous year |

Profitability of all activities of enterprises of agriculture, forestry and fisheries (P), % |

The difference between the level of increase (decrease) in the prices of sold agricultural products and the level of profitability of all activities of enterprises of agriculture, forestry and fisheries, % |

2011 |

113.6 |

18.0 |

13.6 – 18.0 = -4.4 |

2012 |

106.8 |

15.6 |

6.8 – 15.6 = -8.8 |

2013 |

97.1 |

8.0 |

-2.9 – 8.0 = -10.9 |

2014 |

124.3 |

8.9 |

24.3 – 8.9 = 15.4 |

2015 |

154.5 |

29.5 |

54.5 – 29.5 = 25.0 |

2016 |

109.0 |

24.7 |

9.0 – 24.7 = -15.7 |

2017 |

111.5 |

16.0 |

11.5 – 16.0 = -4.5 |

Source: authors’ calculations based data on the State Statistics Service of Ukraine.

For years the dynamics of excess (decrease) of efficiency (profitability of all activity) over the prices for the sold products looks as follows:

2011 year: (1 – 0.044) · 100 % = 95.6 %;

2012 year: (1 – 0.088) · 100 % = 91.2 %;

2013 year: (1 – 0.109) · 100 % = 89.1 %;

2014 year: (1 + 0.154) · 100 % = 115.4 %;

2015 year: (1 + 0.250) · 100 % = 125.0 %;

2016 year: (1 – 0.157) · 100 % = 84.3 %;

2017 year: (1 – 0.045) · 100 % = 95.5 %.

On the basis of the calculation of the volume of sold products value on agriculture of Ukraine (Table 1) and taking into consideration the existing dynamics of excess (decrease) of efficiency (profitability of all activity) over the prices for sold products, the marginal level of the volume of sold products in the calculation of short-term credits during 2011-2017 has the following form:

2012 year: (130604.4 + 39833.1) · 0.912 = 155439.0 mln UAH;

2013 year: (167332.5 + 49327.2) · 0.891 = 193043.8 mln UAH;

2014 year: (166277.9 + 42254.6) · 1.154 = 240646.4 mln UAH;

2015 year: (220163.3 + 2928.5) · 1.250 = 278864.8 mln UAH;

2016 year: (372033.4 + 17251.0) · 0.843 = 328166.7 mln UAH;

2017 year: (414799.9 + 177599.1) · 0.955 = 565741.0 mln UAH.

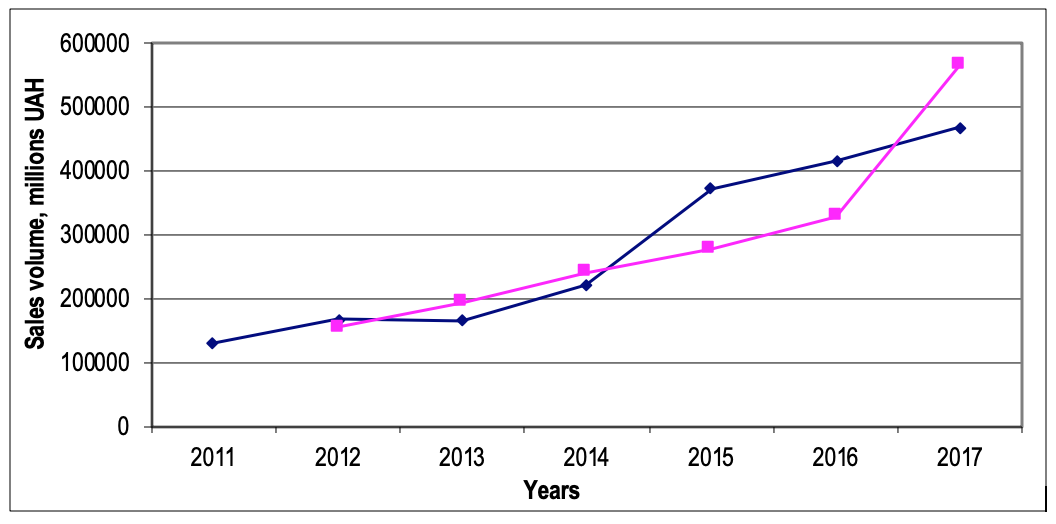

Let’s compare the marginal level of sales volume with actually obtained indicators of sales volume during 2011-2017 (Fig. 3).

Figure 3

Sales volume marginal

level during 2011-2017

Source: authors’ calculations based data on the State Statistics Service of Ukraine.

Therefore, during the analysed period in 2013, 2014 and 2017, the maximum level of sales volume exceeded the actual one by 26765.88 million UAH, 20483.15 million UAH, and 98104.93 million UAH, respectively. In 2012, 2015 and 2016, the actual level of sales volume exceeds the limit by 11893.47 million UAH, 93168.64 million UAH, and 86633.15 million UAH respectively.

Taking into account the reasonable possibility of agricultural land capitalization as a potential source of project financing (L. Kucher, 2018) the potential loan of agricultural enterprises of Ukraine volumes of projects were estimated, depending on the value of the land pledge and rights to lease. Since Ukraine has a moratorium on the sale and purchase of agricultural land, therefore there is no market price, so we used a normative monetary estimate in our calculations.

The results of potential volumes estimation of crediting of agrarian enterprises of Ukraine projects, depending on the value mortgage of the land and the right of its lease (Table 3), indicate that in the dynamics they tend to increase, which is connected with the increase of the normative monetary valuation and rent. For example, if in 2011, with 50 % of the mortgage value of the land, the potential amount of mortgage lending to innovative projects amounted 102.4 billion UAH, in 2017 – 267.6 billion UAH, i.e. 2.62 times more.

Table 3

Estimation of potential volumes of projects of agricultural enterprises of Ukraine

crediting depending on the value of the land mortgage and the right of its lease

Years |

Normative arable land monetary valuation, thsd UAH/ha |

Area of arable land, thsd ha |

Regulatory value of arable land, bln UAH |

Estimation of the potential amount credit provided the pledge of land value, bln UAH: |

Rent, UAH/ ha |

Assessment of the potential amount lending subject to the pledge of land lease, bln UAH: |

||||

40 % |

50 % |

60 % |

40 % |

50 % |

60 % |

|||||

2011 |

11.7 |

17510.4 |

204.9 |

81.9 |

102.4 |

122.9 |

470 |

3.3 |

4.1 |

4.9 |

2012 |

20.6 |

17632.6 |

363.2 |

145.3 |

181.6 |

217.9 |

539 |

3.8 |

4.8 |

5.7 |

2013 |

20.3 |

17712.4 |

359.6 |

143.8 |

179.8 |

215.7 |

616 |

4.4 |

5.5 |

6.5 |

2014 |

20.6 |

17158.3 |

353.5 |

141.4 |

176.7 |

212.1 |

664 |

4.6 |

5.7 |

6.8 |

2015 |

25.8 |

16166.1 |

417.1 |

166.8 |

208.5 |

250.3 |

736 |

4.8 |

5.9 |

7.1 |

2016 |

30.9 |

16528.7 |

510.7 |

204.3 |

255.4 |

306.4 |

862 |

5.7 |

7.1 |

8.5 |

2017 |

30.9 |

17320.0 |

535.2 |

214.1 |

267.6 |

321.1 |

1093 |

7.6 |

9.5 |

11.4 |

Source: authors’ calculations based data on the State Statistics Service of Ukraine

and the State Service of Ukraine on Geodesy, Cartography and Cadastre.

Since the main form of the land market in Ukraine is its lease, the question of using its value as an intangible asset for attracting financial resources is urgent. Provided 50 % of the value of the land lease (or its assignment) was available, the potential amount of mortgage lending to innovative projects in 2011 amounted to 4.1 billion UAH, and in 2017 – 9.5 billion UAH, which is 2.32 times more. Although that’s not a large amount relatively compared to the option of attracting mortgage loans, their use could increase the project financing potential of agricultural enterprises' innovation activities. It should also be noted that the rate of potential lending growth under the pledge of land value is much lower than the value pledge of the right to lease land, which is associated with the accelerating rate of increase in rent (L. Kucher, 2018).

Exceedance of the actual level of sales of marginal products should be estimated on the basis of two positions: firstly, due to effective lending, which contributed to the increase of profitability of all agricultural enterprises activities (2012); secondly, due to increased inflationary processes in the country, which led to higher prices than the profitability of all agricultural enterprises (2015 and 2016).

If the marginal level of sales volume exceeds the level of actual output (2013, 2014 and 2017), this indicates the unrealized potential of agricultural enterprises as a result of crediting their activities, in particular because of the high cost index, which significantly affects to profitability all activities of the entity management.

Thus, crediting the activity of economic entities in Ukraine agriculture allows to increase the volume of products sold significantly, however, by using the indicator of sales volume marginal level, it is possible to estimate the level of profitability not only in terms of dynamics, but also the effectiveness of achieving the development of the industry due to the influence of such factors, as prices for agricultural products and also all profitability activities of agricultural enterprises.

The possibility of agricultural land capitalization as a potential source of project financing is substantiated. Estimation of the potential volume of credit provision for projects of agricultural enterprises of Ukraine shows the important role of this potential source of financing, depending on the pledge of land value and on rights to lease. Thus, the potential amount of credit financing for projects of agricultural enterprises of Ukraine, provided 50 % of the value of the pledge of land is about 267.6 billion UAH. Attracting these funds to finance innovative agrarian projects will enhance the opportunities for practical implementation of these projects and ensure sustainable development.

Cherep, A. V. and Yarova, A. K. (2011). State and prospects of mortgage lending development in Ukraine. Economic space, 4: 171–180.

Vagynski, F. A. and Kolodiychuk, A. V. (2010). Essence of the bank mortgage crediting. Naukovyi visnyk NLUU, 20: 151–155.

Borysenko, D. S., Kushnir, S. О. (2016). Problems and prospects of mortgage lending of entities in the countryside in Ukraine. International Humanitarian University Herald. Economics and Management, 22: 114–117.

Katchova, A. L. and Barry, P. J. (2005). Credit Risk Models and Agricultural Lending. American Journal of Agricultural Economics, 87(1): 194–205. https://doi.org/10.1111/j.0002-9092.2005.00711.x.

Sherrick, B. J., Barry, P. J. and Ellinger, P. N. (2000). Valuation of Credit Risk in Agricultural Mortgages. American Journal of Agricultural Economics, 82(1): 71–81. https://doi.org/10.1111/0002-9092.00007.

Dressler, J. B. and Tauer, L. W. (2016). Estimating Expected and Unexpected Losses for Agricultural Mortgage Portfolios. American Journal of Agricultural Economics, 98(5): 1470–1485. https://doi.org/10.1093/ajae/aaw049.

Kharchenko, G. A. and Artyukh, T. O. (2016). Peculiarities of investment support of development of crop sector in agricultural enterprises. Efektyvna ekonomika, 6. Retrieved from: http://www.economy.nayka.com.ua/?op=1&z=5023.

Fedorovych, V. O. and Kontsypko, N. V. (2012). Analytical review of the modern mortgage lending system in Russia. Problems of Accounting and Finance, 4(8): 22–25.

Hnatkivskyi, B. M. (2009). Functioning of the system of mortgage lending system in Ukraine. Formation of market economy in Ukraine, 19: 179–187.

Borysiuk, K. M. (2005). The system of mortgage lending in Ukraine: problems and stages of development. Naukovi pratsi NDFI, 4(33): 242–250.

Kvit, N. M. (2009). Concept and Structure of System of Hypothec Crediting. Forum prava, 1: 242–251.

Sodoma, R., Agres, O., Havryliuk, O. and Melnyk, K. (2019). Mortgage lending in the agricultural economy: opportunities and risks. Financial and credit activity: problems of theory and practice, 1(28): 225–233. https://doi.org/10.18371/fcaptp.v1i28.161882.

Tanklevska, N. and Miroshnichenko, V. (2019). Theoretical basis of managing of enterprises’ financial potential on the basis of anti-crisis management. Agricultural and Resource Economics: International Scientific E-Journal, 5(2): 51–61. Retrieved from: http://are-journal.com.

Yarmolenko, V. (2019). Peculiarities of insurance of agrarian enterprises’ activity. Agricultural and Resource Economics: International Scientific E-Journal, 5(2): 74–85. Retrieved from: http://are-journal.com.

Moldovan, E. S. (2008). Mortgage as an element of the mechanism of crediting agricultural producers. Accounting and Finance, 4. Retrieved from: http://magazine.faaf.org.ua/ipoteka-yak-element-mehanizmu-kredituvannya-silskogospodarskih-tovarovirobnikiv.html.

Nahornyi, O. V. (2010). The financial mechanism of mortgage lending in Ukraine and ways to improvment. Sustainable economic development, 1: 164–170.

Hnatkovych, O. D. (2014). Ensuring of implementation of mortgage land operations to agricultural enterprises. Efektyvna ekonomika, 1. Retrieved from: http://www.economy.nayka.com.ua/?op=1&z=2656.

Pasichnyk, T. V., Kucher, A. V. and Khirivskyi, R. P. (2016). Efficiency of agricultural enterprises of various organizational and legal forms and the size of land use. Actual problems of economics, 1: 399–405.

Sakhno, A., Polishchuk, N., Salkova, I. and Kucher, A. (2019). Impact of credit and investment resources on the productivity of agricultural sector. European Journal of Sustainable Development, 8(2): 235–245. https://doi.org/10.14207/ejsd.2019.v8n2p335.

Hrynchuk, T. P. (2017). Land and mortgage lending in agriculture: problems and prospects of development. Economy. Finances. Management: actual issues of science and practical activity, 3(19): 116–124.

Khodakivska, O. V. and Yurchenko, I. V. (2019). Market turnover of agricultural land in Israel. Ekonomika APK, 2: 84–92. https://doi.org/10.32317/2221-1055.201902084.

Shpychak, O. M. (2018). Price levels of agricultural lands as a background for their effective market functioning. Ekonomika APK, 3: 38–48.

Ulko, Ye., Kucher, A., Salkova, I. and Priamukhina, N. (2018). Management of soil fertility based on innovative approaches to evaluation of arable land: case of Ukraine. Journal of Environmental Management and Tourism, IX, 7(31): 1559–1569. https://doi.org/10.14505/jemt.9.7(31).18.

Kucher, L. (2018). Capitalization of land in the system of financing of agricultural projects. International scientific conference «Socio-economic zoning – traditions, contemporary state and problems»: Book of abstracts, 19–21 October 2018. Plovdiv: Academic publishing house «Talent». P. 73.

Kucher, L. (2018). Capitalization of land in the system of financing of agricultural projects. Proceedings of the International scientific and practical conference «Bulgaria of regions», 19–21 October 2018. Plovdiv: Academic publishing house «Talent». Рp. 345–351.

1. Dr.S, Prof. Department of Finance, Vinnytsia Finance and Economics University, Ukraine. E-mail: andrijsahno@gmail.com

2. PhD, Assoc. Prof. Department of Finance, Vinnytsia Finance and Economics University, Ukraine. E-mail: paltschuk@i.ua

3. PhD, Assoc. Prof. Department of Economics, Vinnytsia National Agrarian University, Ukraine. E-mail: salkovairyna@i.ua

4. PhD, Assoc. Prof. Department of Applied Economics and International Economic Relations, Kharkiv National Agrarian University named after V.V. Dokuchayev, Ukraine. E-mail: kucher@knau.kharkov.ua .

5. PhD, Assoc. Prof. Department of Accounting and Taxation, Vinnytsia Institute of Trade and Economics KNUTE, Ukraine. E-mail: lena-kydurko@ukr.net

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License