Vol. 41 (Issue 15) Year 2020. Page 3

VANKOVYCH, Danylo V. 1; KULCHYTSKYY, Myroslav I. 2; ZAMASLO, Olha T. 3; BOICHUK, Ruslan M. 4

Received: 20/09/2019 • Approved: 06/04/2020 • Published 30/04/2020

ABSTRACT: The main objective of the present research was to identify patterns between state regulatory measures of aggregate support for the agricultural sector of Ukraine and its development, using the tools of economic and mathematical modeling. The relationship modeling was done using Statistica's integrated data processing system. The agribusiness support in Ukraine should focus not on the reduction of intermediate consumption, but on budgetary payments (tax benefits) linked to the production of certain types of products or parameters of farming. |

RESUMEN: El objetivo principal de la presente investigación fue identificar patrones entre las medidas regulatorias estatales de apoyo agregado para el sector agrícola de Ucrania y su desarrollo, utilizando las herramientas de modelos económicos y matemáticos. El modelado de la relación se realizó utilizando el sistema de procesamiento de datos integrado de Statistica. El apoyo a los agronegocios en Ucrania debe centrarse no en la reducción del consumo intermedio, sino en los pagos presupuestarios (beneficios fiscales) vinculados a la producción de ciertos tipos de productos o parámetros de la agricultura. |

The need for state financial support is caused not only by economic factors, but above all by the multifunctionality of agricultural production, which produces not only goods but also indispensable public goods (services) of a non-commercial nature, the most important of which are food security, economic conditions of existence of the rural population, restoration of the peasantry, maintenance of ecological balance, conservation of biodiversity, sustainable development and poverty reduction (Kupchishina, 2017; Swinnen, 2018).

During the Soviet period, Ukrainian agriculture was oriented on continuous extension of production capacity to fully meet the food requirements of the entire USSR. This purpose was served by the intrinsic tools to the command-administrative system. In the transition to market-oriented economic relations and given the total restructuring of social and political system, the old functioning mechanisms operating in the agricultural sector, and its organizational and economic structure have changed dramatically, which affected agricultural development trends. Thus, in the 1990s, during the period of economic instability with permanent transformations and crises, estimated agricultural production, reportedly, almost halved. After 2000, a certain revival of the agricultural sector was observed. Its inductance vector was affected by various factors, such as institutional and financial support of private agricultural enterprises, introduction of a fixed agricultural tax, etc., as well as lobbying and influence of various business and political structures. This eventually led to the fact that in recent years the agricultural sector of Ukraine's economy became the driving force of its development, despite the extremely low extent of governmental support (Hasanov and Petrukha, 2014).

Agriculture encompasses a broad range of activities from small-scale farming to infrastructure projects to research and development. As a result, when referring to agriculture finance, the market clusters it in four groups. The groupings correspond to different approaches to addressing the needs of the sectors: (1) the needs of farmers and entrepreneurs, (2) the transactions between the actors along the value chain, (3) infrastructure needs and (4) generating knowledge to support the sector (Ruete, 2015).

The diverse system of agricultural finance enables a wide variety of actors to be financers. Different risks and instruments are covered by different actors. Farmers and small entrepreneurs play the most important role and are the first level, acting mainly within the informal sector (such as community savings systems) but also in more complex organizations, such as saving and credit cooperatives and unions or mutual credit guarantee schemes (Ruete, 2015).

Aside from private sources of finance, governments are also important sources of finance for developing country agriculture. Public financing can focus on particular actors, such as small farmers or enterprises; on particular issues, such as environmental protection and organic agriculture; or on particular geographic locations. Other promising government initiatives include the creation of financial institutions in agriculture, whose regulations are usually defined by central banks (Ruete, 2015).

State financial support for the development of the agro-industrial complex in Ukraine has been provided in two forms over the last 28 years: indirect state support (granting tax benefits), and direct government support (budgetary allocations, budgetary loans). Following the abolition of the special VAT tax regime in Ukraine -since January 1, 2017- only direct budget financing is currently used in Ukraine, in the form of budget subsidies for the development of agricultural producers, the stimulation of agricultural production, partial compensation for the cost of agricultural machinery and equipment of domestic production.

However -according to scientists- agricultural subsidies make little sense, because: 1) subsidies redistribute wealth upward; 2) subsidies harm the economy; 3) subsidies are prone to scandal; 4) subsidies undermine state trade relations; 5) subsidies are in addition to favorable taxation; 6) farmers can provide their own safety nets; 7) farmers would thrive without subsidies (Edwards, 2018).

Governmental intervention in agriculture finance is often directed towards managing risks in the sector. This includes support to farmers in the form of payment of indemnities, reductions in social security contributions and exemption of taxes during periods of crisis in the sector or subsidizing private insurance schemes. Creating credit guarantee funds or supporting credit guarantee schemes offered by private institutions through counter guarantees. The Mexican Fideicomisos Instituidos en Relación con la Agricultura (FIRA), the Indian Credit Guarantee Fund Trust for Micro and Small Entreprises (CGTMSE) and the Nigerian Agricultural Credit Guarantee Scheme Fund are among the longest-standing agricultural guarantee funds in the world. In the case where risk management is left to the farmer, governments can still support by providing information to the sector on potential risks. Finally, the government can act as a facilitator without disbursing public funds itself. This role is especially significant in value chain finance, where the government can develop a business model to link the different actors that would benefit from financing one another (Ruete, 2015).

The problems of state regulation of the agricultural sector of the economy are studied by many modern scientists. In particular, Ruete (2015) explored the financial needs of agriculture in developing countries and the instruments available to address these needs. He examined the challenges in obtaining financing for agricultural investments, the role of different actors, and the options for governments to enhance the legal and policy environment of the financial system to support agricultural development.

Divanbeigi, Paustian, and Loayza (2016) studied agricultural structural transformation.

In their view, developing countries has been shaped by three interrelated processes: improvements in productivity; change in composition and production; and change in the mode of commercialization.

Hmyria (2016) has focused on identifying major issues related to the implementation of state support for agricultural producers. Researcher justified proposals for improving state support for financing agricultural production through the use of incentive tools for both financial institutions and agricultural producers.

Koneva (2016) described the current state of public financing of agricultural enterprises, its shape and direction. Resercher identified the problems of state financial support to agricultural producers and informed strategic directions of development of agrarian sector of Ukraine's economy.

Mazur (2017) discussed the essence and importance of state support of agrarian sector of Ukraine's economy, its current state and impact on the activities of agricultural enterprises.

Sirenko, Mikulak, and Ihnatenko (2018) analyzed financial mechanisms of development of agrarian sector have found out that in order to achieve the maximum stimulating effect of development of agrarian sector, it is necessary to have a complex and effective interaction of all components of the mechanism of financial regulation, which involves a combination of internal sources of financing and available financial resources. credit institutions, which, with the proper state support for the development of financial and credit infrastructure of production, will allow to create a sound financial basis ting the agricultural sector of Ukraine.

Kolesnik and Nikolaienko (2018) studied the issues of taxation of agricultural enterprises and concluded that deals with the system of tax burden on agricultural enterprises of Ukraine: tax rates, mechanisms and types of taxes to be paid by agricultural enterprises.

Edwards (2018) examined the impact of subsidies on the development of the agricultural sector and justified their shortcomings. According to the scientist, farm subsidies are costly to taxpayers, but they also harm the economy and the environment. Subsidies discourage farmers from innovating, cutting costs, diversifying their land uses, and taking other actions needed to thrive in the competitive economy.

Despite their contribution to solving the current problems of state regulation of the agricultural sector of national economies, including Ukraine, a number of theoretical and methodological aspects of the problem of forming an effective mechanism for financial support of the agricultural sector remain insufficiently researched and need further elaboration.

Before assessing the relationship between government financial support for the agricultural sector and its development, the following two questions must be answered: 1) Who Needs Finance in the Agriculture Sector? 2) Who Finances Agriculture?

In an era of rapid globalization of world commodity and capital markets and, consequently, high dynamism of their parameters, the responsibility of national authorities to ensure proper, or at least more or less acceptable operating conditions of domestic agricultural production and compliance -with at least a minimum level of country's food security- increases significantly. Under conditions of limited budget resources, the importance of providing their acceptable efficiency of usage increasesthe ability to take advantage of the benefits that occasionally are given by the dynamics of world food markets, including to support the agricultural sector. High acuity of the above issues for modern Ukraine causes quite a significant relevance of problems showed in the article signed by Zelenska, Zelenskyi and Aleshugina (2016).

Food and agriculture have been subject to heavy-handed government interventions throughout much of history and across the globe, both in developing and in developed countries. Today, more than half a trillion US dollars are spent by some governments to support farmers, while other governments impose regulations and taxes that hurt them.

Given the above, the purpose of this study was to identify patterns between state regulatory measures of aggregate support for the agricultural sector of Ukraine and its development, using the tools of economic and mathematical modeling (classical regression).

As a theoretical basis for the research the authors used the works of ukrainian and foreign specialists: Tangermann (2005); Oliynyk (2012); Hasanov and Petrukha (2014); Kulakovska (2015); Zelenska, Zelenskyi, and Aleshugina (2016); Wdowichenko (2016); Kupchishina (2017); Prodivus (2017); Swinnen (2018).

The empirical information on the dynamics of development and financial support of the agricultural sector in Ukraine is taken from the official sites of the Organization for Economic Cooperation and Development and the State Statistics Service of Ukraine.

Statistical data processing (relationship modeling) was done using STATISTICA (Integrated data processing system), which provides the user with unique opportunities for in-depth analysis of statistical patterns.

According to the Law of Ukraine “On state support of agroindustrial complex”, the share of expenditures for financing agriculture should be at least 5% of the expenditures of the State Budget. The real amounts of funding do not reach the declared figures, as can be seen in table 1. If in 2017 the structure of expenditures for state support of the agrarian sector was dominated by financial support of agricultural producers (approximately 50% of all expenditures), in 2018-2019 the state support of the livestock sector (more than 25%) already prevailed, indicating changing the priorities of state agrarian policy in Ukraine.

Table 1

Analysis of the distribution of expenditures of

the State Budget for the state support of

the agricultural sector (2017-2019)*

Indicators |

2017 |

2018 |

2019 |

|||

(thousand UAH**) |

% |

(thousand UAH) |

% |

(thousand UAH) |

% |

|

Ministry of Agrarian Policy and Food of Ukraine |

9.442.263,1 |

100 |

14.154.691,7 |

100 |

13.858.052,5 |

100 |

General management and management in the field of agro-industrial complex |

122.250,9 |

1,29 |

163.011,2 |

1,15 |

176.230,0 |

1,27 |

Financial support measures in the agro-industrial complex by reducing the cost of loans |

300.000,0 |

3,18 |

66.000,0 |

0,47 |

127.160,0 |

0,92 |

Financial support for activities in the agro-industrial complex |

60.000,0 |

0,64 |

5.000,0 |

0,04 |

5.000,0 |

0,04 |

Financial support for the development of farms |

- |

- |

1.000.000,0 |

7,06 |

800.000,0 |

5,77 |

State support for the development, installation and supervision of young gardens, vineyards and berries |

- |

- |

300.000,0 |

2,12 |

400.000,0 |

2,89 |

State support of the livestock sector |

170.000,0 |

1,80 |

4.000.000,0 |

28,26 |

3.500.000,0 |

25,26 |

Financial support of agricultural producers |

4.774.300,0 |

50,56 |

945.000,0 |

6,68 |

881.790,0 |

6,36 |

Reference: |

|

|||||

Expenditures of the State Budget, UAH billion |

735,4 |

991,7 |

1.112,1 |

|||

Share of expenditures of the State budget for state support of the agrarian sector (%) |

1,28 |

1,43 |

1,25 |

|||

* Expenditure code 0421 Functional Classification of Expenditure and Budgeting

** The letter code of the Ukrainian currency

Source: compiled by the authors on the basis: The Laws of Ukraine “On the State Budget for 2017”,

“On the State Budget for 2018” and “On the State Budget for 2019” and own calculations.

As shown in table 1, the average share of the State budget expenditures on public support for the agricultural sector does not exceed 1,43%. The total amount of expenditures for the agricultural sector over the last years amounts to an average of UAH 12.485 billion. While in 2017, the largest share was 50.56% of expenditures on financial support of agricultural producers, in 2018-2019 the priority was received on state support for the livestock sector (28.26% and 25.26% respectively), which indicates a change of priorities of the state agricultural policy.

Along with the dynamics of the general volume of state financing of the agricultural sector, it is also important to analyze its impact on the development of the latter. The basis for such an assessment in the context of this article is the Organization of Economic Cooperation and Development (OECD) and the State Statistics Service of Ukraine (SSSU) data. Government support for agriculture, according to OECD experts, is defined as the annual monetary value of gross transfers to the agricultural sector from consumers and taxpayers (i.e., the movement of goods from different sectors of the economy), regardless of goals and economic consequences. In general terms, the amount of direct and indirect government support for an agro-sector can be represented through the Total Support Estimate (TSE), which is the sum of the Producer Support Estimate (PSE), the General Service Support for the Agri-sector (General Service) Support Estimate (GSSE) and the Consumer Support Estimate (CSE). The largest share in the total support for the agricultural sector comes from the support of agricultural producers (PSE).

Previously, in order to provide an objective assessment of State preferences for farmers, it is necessary to adjust the PSE to the value of the specific market price support indicator (MPS). According to Vdovichenko (2016), this is due to the following:

1) MPS is the product of all agricultural output and the difference between internal and external prices for these products. However, losses of manufacturers at negative values of this indicator only occur if they are not able to export their own products. Another point is that, in addition to producers' profits, there is also a factor such as food security for the state.

2) A key theoretical assumption for the calculation of this indicator is that agricultural markets are competitive. However, the markets in Ukraine are not competitive and not all agricultural producers have access to external trading venues, not because of government tariff policies, but because of significant institutional problems of the domestic economy.

3) A side effect of the negative value of MPS is the low relative value of livestock feed, leading to benefits.

4) The calculation of the difference between external and internal prices implies that prices for similar products are compared. According to the OECD support methodology for most commodities, the difference in quality for the domestic and foreign markets is not taken into account.

5) It raises the question of the MPS rate change. Hryvnia devaluation leads to widening gap between domestic and foreign currency denominated prices.

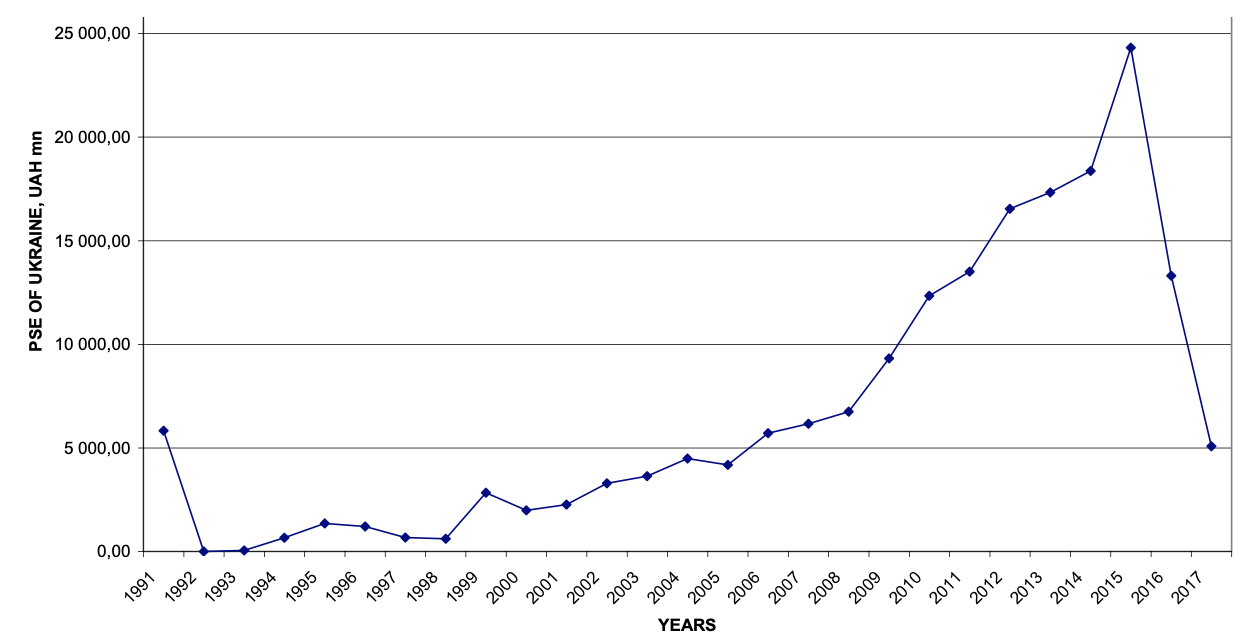

The above argument shows that the MPS indicator is rather ambiguous in terms of the characteristics of state support for the agricultural sector and has little to do with fiscal support for agriculture. Given the above, the dynamics of the adjusted PSE of Ukraine for the period 1991-2017 is shown in fig. 1. This indicator increased during 1993-2015, which is related to the dominance in the structure of state support of the agricultural sector of expenditures on Financial support of agricultural producers. Since 2016, the emphasis on state support has shifted to the benefit of farms and livestock, which has been reflected in its decline.

Figure 1

Dynamics of the adjusted value of PSE

of Ukraine for 1991-2017 (UAH mn)

Source: calculated by the authors on the basis of the database of the Organization

of Economic Cooperation and Development (OECD) and Vdovichenko (2016).

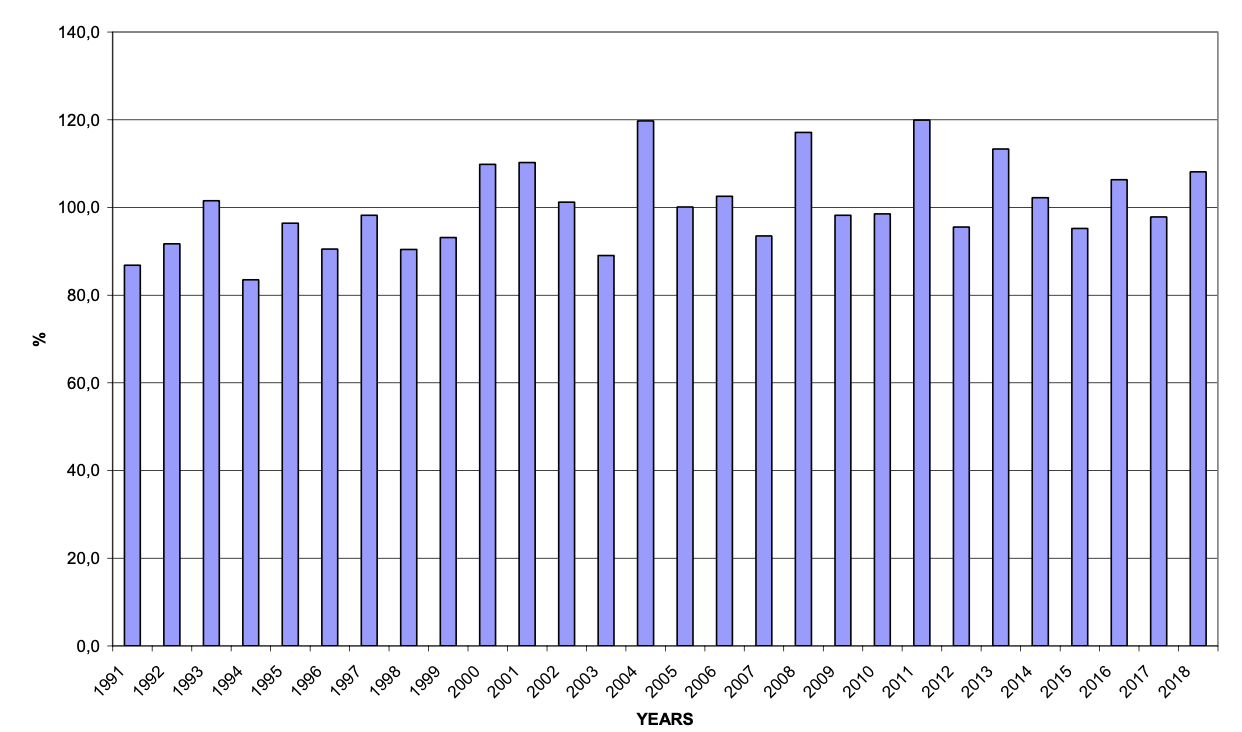

Based on the analysis of the dynamics of agricultural production indices (fig. 2), namely the constant alternation of their growth and a decrease with an average periodicity of two years, we can assume that in Ukraine there is no link between the support measures and the development of the agricultural sector.

Figure 2

Agricultural product indices of

all farm categories (1991-2018)

Source: database of the State Statistics Service of Ukraine

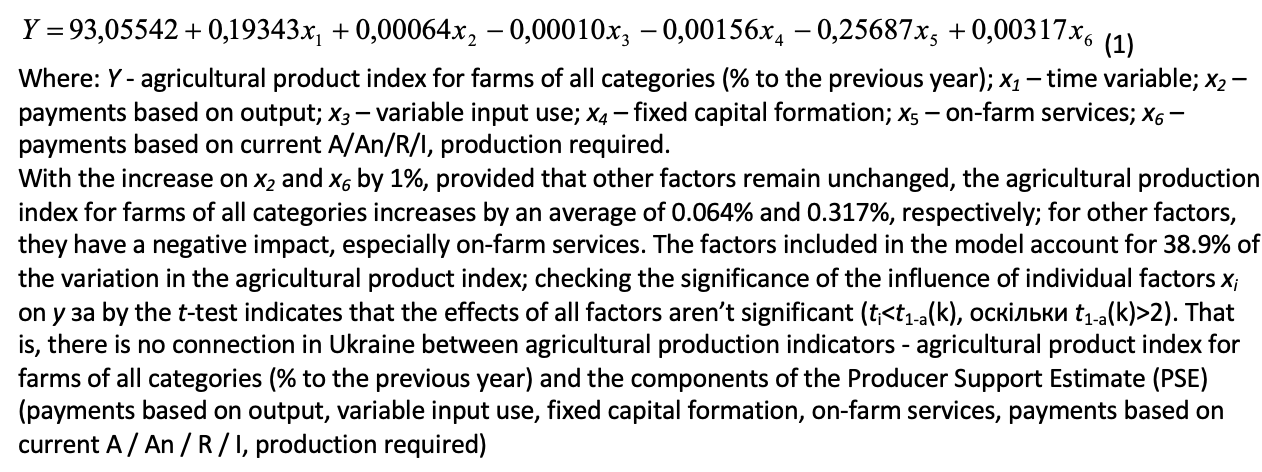

In order to confirm this hypothesis, the determination of the close relationship between agricultural production indicators - agricultural product index for farms of all categories (% to the previous year) and the components of the Producer Support Estimate (PSE) (payments based on output, variable input use, fixed capital formation, on-farm services, payments based on current A / An / R / I, production required) table 2. The results of the correlation analysis show that there is a significant time lag in the interaction of regulatory measures and the results of development of the agrarian sphere, which, of course, should be taken into account in the development of agrarian policy of the state. When establishing the closeness of the relationship between the studied indicators, based on absolute values, for the periods of delay on interaction, the highest value of the correlation coefficient (0.39) was obtained for the period of delay of 2 years.

Table 2

Regression summary for dependent variable: agricultural product

index for farms of all categories (% to the previous year).

|

R = 0,62331411; R2 = 0,38852049; Adjusted R2 = 0,18469398 F (6,18) = 1,9061; p < 0,13493; Std. Error of estimate: 9,1076 |

|||||

|

BETA |

St. Err. of BETA |

B |

St. Err. of B |

t (11) |

p-level |

Intercpt |

|

|

93,05542 |

6,633221 |

14,02869 |

0,000000 |

Time variable |

0,141137 |

0,441579 |

0,19343 |

0,605182 |

0,31962 |

0,752936 |

Payments based on Output |

0,075699 |

0,280378 |

0,00064 |

0,002358 |

0,26999 |

0,790240 |

Variable input use |

-0,057210 |

0,459136 |

-0,00010 |

0,000821 |

-0,12460 |

0,902218 |

Fixed capital Formation |

-0,055488 |

0,291770 |

-0,00156 |

0,008208 |

-0,19018 |

0,851298 |

on-farm services |

-0,233706 |

0,222430 |

-0,25687 |

0,244475 |

-1,05070 |

0,307301 |

Payments based on current A/An/R/I, production required |

0,435954 |

0,300624 |

0,00317 |

0,002184 |

1,45017 |

0,164214 |

Source: calculated by the authors based on data from the Organization of Economic

Cooperation and Development and State Statistics Service of Ukraine.

According to the table, the regression equation looks like this:

Innovation in finance to solve the needs of the rural sector should not be limited to financial institutions. The government can play a proactive role by promoting laws and regulations with new financial instruments or even raising awareness of existing ones to bring them to the attention of the financial and agricultural sectors. Specialization in agricultural finance in the government and in the financial sectors is an important driver to its development. However, financing is not a charitable activity; it is primarily profit driven. This necessarily means that all possible regulation and programs to attract financing must be realistic with the characteristics of the sector and the viability and rate of return. Managing the risks and understanding the opportunities of the agriculture sector is key for any successful policy or law. Thus, to attract finance and, consequently, investment in the agriculture sector, it is critical to strengthen both the agriculture and financial sectors. This requires a coherent strategy with consistent regulation and policies that match the sectors' needs and in line with the realistic capacities of all the actors in both sectors.

When looking for directions of reforming state regulation it is necessary to consider that agricultural transformation has been shaped by three interrelated processes. First, higher yields and lower costs from existing and new farming lands have increased agricultural productivity. Second, the types of agricultural products have changed, from subsistence to cash crops, from food staples to intermediate inputs, and from low-value/low-risk to high-value/high-risk varieties. Third, agricultural market transactions have become more integrated with the rest of the economy, more dependent on finance, and more oriented to international trade.

We believe there is every reason to affirm far from optimal efficiency of a current state agrarian policy of Ukraine, as well as the mentioned policy for the entire period of independence of our country in general. The mechanisms used, which are based primarily on direct budget payments to agricultural producers at the expense of taxpayers, are not well-judged and not properly adapted to the specific conditions of Ukraine with all its peculiarities and peculiarities of its population. The interrelation of significant amounts of budget financial resources to support agriculture with a very limited effect from their use does not allow to speak about the effectiveness of the current mechanism of agro-food system state support. With no overall more or less clear strategic line, the state financial policy for domestic agriculture (including the use of budgetary mechanisms) is focused on trying to solve some tactical problems, and therefore the mechanisms used are unsystematic, inconsistent and often incompatible with the principle of saving and more efficient use of very limited in today's Ukraine budget resources.

Therefore, in Ukraine, agribusiness support should focus not on the reduction of intermediate consumption but on budgetary payments (tax benefits) linked to the production of certain types of products or parameters of farming, as well as budget financing for the development of agricultural infrastructure.

Divanbeigi, R., Paustian, N. & Loayza, N. (2016). Structural Transformation of the Agricultural Sector: A Primer. World Bank Policy Research Paper 2/4.

Edwards, C. (2018). Agricultural Subsidies. Retrieved September 10, 2019, from: https://www.downsizinggovernment.org/agriculture/subsidies

Hasanov, S. and Petrukha, S. (2014) Theoretical essence of state support for agriculture in the state regulation system of agrarian sector. Economist. 7, 16-17

Hmyria, V.P. (2016). State support for financing agricultural production in Ukraine. Financial space. 3. Retrieved September 12, 2019 from: http://fp.cibs.ubs.edu.ua

Kolesnik, Ya.V. and Nikolaienko, A.V. (2018). Taxation of agrarian enterprises: past experience and realities of present. Agrosvit. 20, Retrieved September 15, 2019 from: http://www.agrosvit.info/pdf/20_2018/7.pdf

Koneva, I.I. (2016) State financial support for agricultural enterprises: the state and strategy of development. Global and national problems of the economy. 14, 802-807.

Kulakovska, T.A. (2015). Research of coherence and systematicity in the implementation of regulatory measures in the agrarian sphere of Ukraine. Scientific Journal «ScienceRise». 8/1 (13). 58-66.

Kupchishina, O.A. (2017) The Impact of State Regulatory Policy on the Functioning of the Agrarian Sector. Bulletin of KhNAU them. B.B. Dokuchaev. Series "Economic Sciences". 4. Retrieved September 5, 2019 from: https://knau.kharkov.ua/v_econ2017447.html

Mazur, Yu.V. (2017). State support for the agro-industrial complex of Ukraine: the essence, meaning and current state. Economy. Finances. Management: topical issues of science and practice. 7, 128-136.

Oliynyk, O. (2012) The estimate of agricultural support in the Ukraine using organisation for economic cooperation and development indicators. Folia Pomeranae Universitatis Technologiae Stetinensis. Folia Pomer. Univ. Technol. Stetin. Oeconomica 298 (69). 59-70.

On state support of agroindustrial complex. The Law of Ukraine. Retrieved September 5, 2019 from: https://zakon.rada.gov.ua/laws/show/1877-15?lang=en

On the State Budget for 2017. The Law of Ukraine. Retrieved September 5, 2019 from: https://zakon.rada.gov.ua/laws/show/1801-19

On the State Budget for 2018. The Law of Ukraine. Retrieved September 5, 2019 from: https://zakon.rada.gov.ua/laws/show/2246-19

On the State Budget for 2019 The Law of Ukraine. Retrieved September 5, 2019 from:

https://zakon.rada.gov.ua/laws/show/2629-19

Organization for Economic Cooperation and Development (2019). Ukraine. Producer and Consumer Support Estimates database. Retrieved September 11, 2019 from: http://www.oecd.org/countries/ukraine/producerandconsumersupportestimatesdatabase.htm

Organization for Economic Cooperation and Development. Methodology for the measurement of support and use in policy evaluation. Retrieved September 15, 2019 from: http://www.oecd.org/dataoecd/36/47/1937457.pdf

Ruete, M. (2015) Financing for Agriculture: How to boost opportunities in developing countries. Investment in agriculture Policy Brief #3 Retrieved September 11, 2019 from: https://www.iisd.org/sites/default/files/publications/financing-agriculture-boost-opportunities-devloping-countries.pdf

Sirenko N. M., Mikulak K. A., Ihnatenko Zh. V. (2018) Financial Mechanisms for the Development of the Agrarian Sector in Market Environment. Electronic Science Professional Edition in Economics "Modern Economics". 12, 185-190 Retrieved September 11, 2019 from: https://modecon.mnau.edu.ua

State Statistics Service of Ukraine. Retrieved September 11, 2019 from http://www.ukrstat.gov.ua.

STATISTICA. Retrieved September 15, 2019 from http://www.statsoft.ru

Swinnen, J. (2018). The Political Economy of Agricultural and Food Policies. Palgrave Macmillan, New York, ХІХ, 254

Tangermann, S. (2005). Is the Concept of the Producer Support Estimate in Need of Revision?, OECD Food, Agriculture and Fisheries Working Papers 1, OECD Publishing.

Vdovichenko A. (2016) Government support for agriculture: discussions on OECD assessment. Retrieved September 11, 2019 from: https://ngoipr.org.ua/blog/uryadova-pidtrymka-silskogo-gospodarstva

Zelenska O.O., Zelenskyi S.M., and Aleshugina N.O. (2016). Efficiency estimate of the state support mechanism for ukrainian agricultural sector. Scientific Bulletin of Polissia 3(7): 49-54.

1. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: dvankovych@ukr.net

2. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: mkulchyt@yahoo.com

3. Doc.Sc. in Economics, Professor. Department of Finance, Money Circulation and Credit. Ivan Franko National University of Lviv. Ukraine. E-mail: olga_zamaslo@ukr.net

4. PhD, Docent, Ivano-Frankivsk National Technical University of Oil. Ukraine. E-mail: boichukr1976@gmail.com

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License