Vol. 41 (Issue 10) Year 2020. Page 6

SHEREUZHEVA, Madina A. 1; KOLOMEEVA, Elena S. 2; PLESHAKOVA, Marina E. 3; KHEZHEV, Akhmed M. 4 & BOBOVNIKOVA, Tatiana Yu 5

Received: 09/09/2019 • Approved: 20/02/2020 • Published 26/03/2020

ABSTRACT: The study assesses the prospects of using IT in bank asset-liability management and deals with the rationale for their introduction into existing global financial system; increasing competition in the banking environment, interbank relations. Methodology: different variables show that new financial instruments heavily influence the capital structure of credit institutions and improve it not only quantitatively but also qualitatively. The proposed model involves the creation of a lending platform to strengthen the competitive position of the bank in the market. |

RESUMEN: El estudio evalúa las perspectivas de uso de TI en la gestión de activos y pasivos bancarios y aborda las razones para su introducción en el sistema financiero global existente; Creciente competencia en el entorno bancario, relaciones interbancarias. Metodología: diferentes variables muestran que los nuevos instrumentos financieros influyen en gran medida en la estructura de capital de las entidades de crédito y la mejoran no solo cuantitativamente sino también cualitativamente. El modelo propuesto implica la creación de una plataforma de préstamos para fortalecer la posición competitiva del banco en el mercado. |

In any state, economic progress is strongly governed by its innovation (Du, Song, Wang, Park and Shi, 2018). Scientific and technological progress determines the fundamental changes in the banking sector, which is manifested in the emergence of new types of services that replace the outdated ones. This factor leads to the emergence of new players in the financial market and a highly competitive environment (Thyaga, 2016). Accordingly, in an online store, a PayPal account can be used along with credit cards. Previously, only a bank gave a loan for business development, but now there is an opportunity to attract debt from special funds, P2P, and websites. Competition is becoming tougher among virtual banks for customer deposits, highlighting the level of accessibility and comfort as the main competitive advantages, which determines the vector of development of the modern banking system.

In order to meet modern customer needs, banks use innovative technologies in all processes of their activities, especially in terms of managing active and passive operations, as the basis of the banking business.

The objective of this study is to examine and explore the nature and the methods of use of IT in the field of ALM based on the example of Rosselkhozbank.

In the banking market, large retail banks still dominate, providing the traditional list of services: deposits opening, cash management services (Akhisar, Tunay and Tunay, 2015), and lending. Financial technologies are among the fastest growing industries. At the same time, the companies that create them are able to compete with the banking sector and change the entire financial world for the better (Matkova, 2017).

Changes are brewing in the banking sector; in particular, new players in the face of fintech companies appear (Jakšič and Marinč, 2019), new technologies, for example, the blockchain, are dynamically developing. Thus, in the era of digitalization of the economy, the problems of ensuring cybersecurity, information security, and reduction of the fraud level, which determine the operational risk of credit institutions, are emerging.

With the increasing popularity of Internet banking and the increasing use of merchant acquiring services in the retail network, the demand for security software for online transfers and plastic cards is increasing (Cavus and Chingoka, 2016). In this regard, there is an increasing need to develop own technologies to ensure the security of cash management services using new tools within the banking structure in order to ensure its competitiveness.

Therefore, today the position of a bank in the market is largely due to its ability and desire to introduce innovative products that meet both the needs of customers and the requirements of the mega-regulator in terms of the risks accepted by a credit institution for active-passive operations (Andryushin, 2017).

Digital banking currently covers the vast majority of players in the banking market, offering their services and products via the Internet or mobile applications at any time convenient for the client anywhere in the world (Gupta and Yadav, 2017). By virtue of modern IT technologies focused on the use of new digital channels, many banking products and services became available to customers in real time.

Internet technologies in the banking business do not exclude traditional banking services and the need to maintain additional offices. Nevertheless, the number of customers interested in financing start-ups and the need to expand customer service are growing with certain limitations: high costs and increasing risks.

Today, consumer expectations are increasing for the speed and efficiency of financial services in terms of money and speed. International money transfer rates are as high as 8%, and the time-lags for transfers are sufficient, which is unacceptable in the modern financial world where transactions are carried out in real time. The gap is huge from internal customer perspective as well as international business, which affects both today’s effectiveness and future perspectives of banking (Hosein, 2013). A series of bank-specific and other country-specific indicators are combined to show how to raise profitability of lower commissions (Trabelsi and Trad, 2017).

The introduction of a new banking platform that provides traditional banking services in real time (accounts, deposits, transfers, loans) and new solutions (lending to each other – crowdfunding, cryptocurrency) enables companies to develop their own financial services offerings.

At the same time, credit organizations are striving to develop the system of provided services based on interaction with financial and technological companies, which, in the current situation, determines the need to forecast cash flows from current accounts of private clients, which can be achieved by applying forecasting algorithms taking into account statistical data on operations stored in the database. The client’s participation in the online banking system is sufficient to make this forecast.

Thus, the development of technology has made life easier not only for the bank's clients (Kebede and Tegegne, 2018) but also for the banks themselves, which has helped to improve work efficiency and optimize many processes. The solution to most problems in the banking sector requires the use of modern equipment. The use of modern automated information technology is the key to success in banking.

The research is based on the concepts of risk and strategic management when mismatches between the assets and liabilities exist. Aimed to optimize profitability (Dash, 2013) and varying in a set of sometimes contrasting methodologies (Corlosquet‐Habart, Gehin, Janssen and Manca, 2015), it is focused not only on recently aroused risks but more on the long-term perspective.

The study was be guided by a formal policy, that is why the method of capital counting by the Central Bank of Russia (CBR) was applied for the study of financial indicators. At certain stages of the study, the liquidity gap analysis for 2013-2017, and the expert method for calculation of the average time and number of periods were applied.

The study is based on the basic methodological principles of management:

• the orientation of banks on the demand and needs of the market, the demands of consumers and the organization of the provision of those types of services that are in demand and can bring profit;

• the constant desire to improve production efficiency with minimal costs;

• autonomy, ensuring freedom of decision-making for those who are responsible for the end results of both the entire banking system and its individual elements;

• constant adjustment of the objectives and programs depending on the market condition.

Consider the introduction of IT technologies into the activities of one of the largest players on the Russian banking market, Rosselkhozbank, which is a key element of the national credit and financial system for serving producers in the agro-industrial complex and carries out commercial and retail banking operations in Russia, mainly lending agro-industrial enterprises. Like the other banks that finance agricultural producers, it is experiencing the challenges of growing needs, the need for innovation, and the competition for customers (Li and Zheng, 2017).

Rosselkhozbank provides financial services and financial support to agricultural producers, including as part of the implementation of the State Program for the Development of Agriculture for 2013-2020; at the same time, the Bank increased net loan debt in 2016 by 6.6%.

The main source of the formation of the resource base of the Bank is customer funds. At the end of 2017, their share was 87.1% in the total liabilities of Rosselkhozbank. The amount of customer funds in 2017 increased by 22.4%.

The Bank’s activities in 2016 were complicated by a number of adverse external factors, including: lack of access to external financial markets due to continued sanctions from the United States, the EU and a number of other countries; the stabilization of oil prices at a relatively low level, maintaining high volatility of world financial markets; the high cost of long-term financial resources in the domestic market, despite a reduction of the Bank of Russia key rate by 1 percentage point; the acceleration of production growth in the agro-industrial sector against the background of reduced profitability, the reduction in consumer demand.

Nevertheless, despite the unfavorable external conditions described, the Agricultural Bank provided, according to the results of 2017, the growth of the loan portfolio by 9.2% (160.2 billion rubles) – up to 1,896.1 billion rubles. Table 1 presents the values of indicators of mandatory standards of activity of Rosselkhozbank.

Table 1

Obligatory standards of

activity of Rosselkhozbank

Symbol |

Standard value |

Year |

Deviation of 2017 compared to 2013 in % |

||||

2013 |

2014 |

2015 |

2016 |

2017 |

|||

H1 |

10 |

16 |

13 |

16.3 |

16.3 |

15.5 |

-3.13 |

H2 |

15 |

53.4 |

55.8 |

148.3 |

92.3 |

126.3 |

136.52 |

H3 |

50 |

84.4 |

103.1 |

284.8 |

198.3 |

181.4 |

114.93 |

H4 |

120 |

95.2 |

86.9 |

67.9 |

51.4 |

53.9 |

-43.38 |

H6 |

25 |

13.2 |

23 |

17.4 |

16.6 |

17.1 |

29.55 |

H7 |

800 |

66.5 |

185.1 |

132.4 |

173.3 |

193 |

190.23 |

H10.1 |

3 |

1 |

1.7 |

1 |

0.9 |

0.7 |

-30.00 |

H12 |

25 |

14.6 |

14.8 |

8.6 |

8 |

7.6 |

-47.95 |

Calculated according to CBR (2019)

It should be noted that for the entire analyzed period, the bank complied with the obligatory requirements of CBR, including the level of instant and current liquidity, which indicates a quality ALM of Rosselkhozbank. The values of the standard of long-term liquidity for the study period reflects a reduction in the risk of losing the ability to fulfill its obligations as a result of placing borrowed funds in long-term instruments. The values of the indicators of the maximum risk per one borrower or a group of borrowers increased over the period of 2013-2017. The values of the indicator of the maximum size of large credit risk increased significantly in view of the increase in the volume of loans issued for the purposes of import substitution of agricultural products and an increase in the volume of output. The values of indicators for the aggregate risk values for bank insiders changed insignificantly in the period under study. The ratio of using the bank’s own funds (capital) for acquiring shares (equity shares) of other legal entities was not exceeded but increased significantly. In general, the indicators of mandatory ratios indicate a stable and self-sufficient financial system of a bank and a decrease in risks by a bank.

Consider the main indicators of the bank for the period of 2013-2017. The calculations are made on the basis of statistical data. Table 2 presents the main economic indicators of the bank’s activities for the period of 2013-2017.

Table 2

Key financial indicators

of Rosselkhozbank

Indicator (billion rubles) |

Year |

Deviation of 2017 compared to 2013 in % |

||||

2013 |

2014 |

2015 |

2016 |

2017 |

||

Loan and equivalent debt |

1,496.2 |

1,680.2 |

2,010.1 |

2,144.5 |

2,285.8 |

52.8 |

Investments in investment securities held to maturity |

48.6 |

32.3 |

31.3 |

11.6 |

68.5 |

40.8 |

Securities, available for sale |

105.0 |

145.3 |

227.5 |

224.6 |

265.0 |

152.3 |

Customer funds |

1,060.5 |

1,217.5 |

1,796.1 |

1,979.0 |

2,423.3 |

128.5 |

including deposits of individuals |

247.2 |

317.8 |

498.0 |

624.4 |

874.7 |

253.9 |

Debt issued |

180.2 |

191.3 |

234.9 |

226.2 |

224.4 |

24.5 |

Balance currency |

1,816.3 |

2,067.5 |

2,510.9 |

2,679.3 |

3,077.5 |

69.4 |

Capital (by CB) |

209.1 |

218.1 |

233.7 |

245.6 |

294.6 |

40.9 |

Profit |

1.0 |

-9.3 |

-75.2 |

0.5 |

1.8 |

73.6 |

Calculated according to CBR (2019)

The assessment of loan and equivalent debt is required for an adequate assessment of the bank’s risks and the formation of reserves. In this period, the volume of loan debt increased by 52.77%, which indicates an increase in the volume of loan funds issued. Customer funds have significantly increased (by 128.49% overall and by 253.89% among individuals), which is a positive aspect, indicating an expansion of the bank’s ecosystem and an increase in its share in the market of credit institutions.

The increase in the volume of issued debt obligations by 24.52% indicates an expansion of the bank’s activities; this is indicated by an increase in the balance sheet currency and the bank’s own capital. The amount of profit after tax did not change consistently. In 2014 and 2015, the bank suffered a significant loss due to a number of factors, including the financial crisis in Russia, sanctions, reduced solvency of borrowers and others. At the same time, Rosselkhozbank was able to provide a sufficient level of activity to support agricultural producers in order to implement the import substitution program, to increase the share of Russian producers in the agricultural market, which ensured Russia’s food security.

The modern system of lending to small and medium-sized businesses involves high interest rates due to high risks. The authors offer to introduce a new platform that will significantly reduce the risks. This platform will automate the process of lending to legal entities, reduce the application processing cost, and make the short-term loans available to organizations. At the initial stage, the platform involves the issuance of loans in three areas: the execution of the contract, material procurement, and state factoring support. In the future, it is planned to expand the areas of loans, taking into account the experience and established mechanisms for assessing the creditworthiness of borrowers.

For optimal operation of the platform, it is required to develop a powerful risk analysis system. Risk analysis involves the use of a number of new technologies and systems, such as artificial intelligence systems, risk analysis, Big Data systems, blockchain technology, and others.

For risk analysis, it is necessary to develop a model that involves 4 stages: analysis of the internal risk structure for a certain type of loan; loss model development; pilot testing techniques; updating the model.

The analysis of the risk internal structure involves consideration of all significant events that may lead to non-return of the funds. At this stage, it is crucial to use machine learning systems that will reduce the information processing time, qualitatively analyze the information and accurately determine the risk factors.

The development of a loss model includes the analysis of patterns and trends of a huge number of parameters and the formation of the Russian business database. This stage cannot be completed without the use of big data systems, high computing power of equipment, and the use of cloud technologies, such as: Microsoft Azure, the AWS platform and others, which will make it possible to unload the capacities, output some of the information to be analyzed in the cloud which will reduce the data processing time and equipment support costs and optimize the analysis process.

Pilot testing and updating of the methodology are important elements of the operation of the platform; constantly changing conditions and an unpredictable economic environment force to constantly update models for timely and effective analysis of the creditworthiness of borrowers and risk assessment for each application.

The approach with a thorough choice of types of loans and the use of a separate model for each type of loan makes it possible to credit without loss even the clients in a non-ideal financial condition. The described approach is very different from the approach used by most Russian banks. Most often, banks estimate a certain abstract “creditworthiness of the borrower” without taking into account the specific features of a particular type of borrowing. For example, for a conventional bank it does not matter if it issues credit for securing an application in a tender or for “replenishment of the working capital”, and it does not take into account that the risks of losing funds for these types of loans differ dramatically.

To reduce the risks, it is required to study the loan application of the borrower and determine the presence of stop factors, such as: company age less than 6 months; the presence of the company in the register of unfair borrowers; the incapacity of the general director established by the court or the director’s passport is lost or invalid; low payment discipline established by the company according to the data of the credit bureau, bailiff service or the tax service.

After analysis of these and other indicators, the application is further analyzed or rejected. Further, for the past initial analysis of applications, a risk analysis is carried out on the basis of possible significant events. A credit rating and the interest rate on the loan are calculated.

Consider the possible implementation of the project. It should be noted that the platform will work based on the resources of Rosselkhozbank without attracting external financing, with the development of the introduction of new technologies and systems, the involvement of existing employees in the new project. The volume of deposits of individuals and individual entrepreneurs in 2017 amounted to more than 24 billion rubles, the growth compared to 2016 and 2015 by more than 40% and 75%, respectively, based on an assessment of customer funds growth by 10% per year is presented in Table 3.

Table 3

Resources for

project implementation

Indicator, million rubles |

2017 |

2018 |

2019 |

2020 |

2021 |

Deposits (funds) of individuals and individual entrepreneurs |

247,169.89 |

271,886.88 |

299,075.57 |

328,983.13 |

361,881.44 |

Amount of resources for project lending |

12,358.49 |

13,594.34 |

14,953.78 |

16,449.16 |

18,094.07 |

Forecast based on the data of CBR (2019)

The volume of project resources is 5% of the client’s funds; the initial cost is 25% of the project’s resources and is equal to 3.089 billion rubles. Consider the interest rates for 3 areas of lending in Table 4.

Table 4

Interest rates and bank income,

percent per annum

Type of loan |

Annual interest rate, % |

Bank income on loan, % |

Total rate |

For contract execution |

23.00 |

5.10 |

28.10 |

For material procurement |

25.00 |

4.10 |

29.10 |

State factoring |

23.00 |

3.10 |

26.10 |

Compiled by the authors on the basis of data of Rosselkhozbank (2018).

By an expert method, it was established that the average loan term will be equal to two months, thereby setting the interest rates of the loan for a period of up to two months. Table 5 shows the interest rates on the first two months of the loan for the enterprise.

Table 5

Interest rates by type of loan

Type of loan |

Annual interest rate, % |

Bank income on loan, % |

Total rate |

For contract execution |

3.83 |

5.10 |

8.93 |

For material procurement |

4.17 |

4.10 |

8.27 |

State factoring |

3.83 |

3.10 |

6.93 |

Compiled by the authors on the basis of data of Rosselkhozbank (2018)

Thus, borrowers will be offered loans for the period of up to a year, where the average loan cost for a borrower in the first two months will be from 6.93 to 8.93, with the possibility of early repayment without any overpayments. If the borrower pays the loan not in the first two months, but during the entire term of the loan, the value rises to 26.1% or more in the subsequent two months.

Calculate the main indicators of the platform’s activities for the first year, taking into account the established rates (Table 6).

Table 6

Key performance indicators

of the platform

Indicator, million rubles |

For contract execution |

For material procurement |

State factoring |

Total |

Profit |

5,277.10 |

5,184.17 |

5,001.54 |

15,462.80 |

Expenses |

4,172.93 |

4,172.93 |

4,172.93 |

12,518.78 |

Other expenses |

596.13 |

596.13 |

596.13 |

1,788.40 |

Income |

508.04 |

415.11 |

232.48 |

1,155.62 |

Income tax |

101.61 |

83.02 |

46.50 |

231.12 |

Net income |

406.43 |

332.09 |

185.98 |

924.50 |

Calculated in the framework of the proposed project

Income is calculated on the basis of lending to organizations for an average period of 2 months and using a preferential interest rate. Income is calculated according to the formula of compound interest, on the basis of the fact that financing of directions is made in equal proportions (in the amount of 4.12 billion rubles for each direction of lending) and the number of periods is 2.89 times (the number of periods is established by an expert method based on loan issue for 2 or more months). Income interest for the first year will amount to 15.5 billion rubles.

Total expenses amount to 40% of the amount of funds allocated for each direction of lending (4.8 billion rubles per year for each direction or 14.3 billion rubles in general in the first year). Income tax is set at the level of 20%. For the first year, the net income of the site should reach 231.12 million rubles.

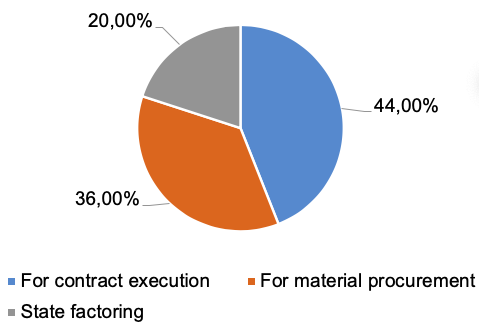

Consider the estimated income structure by type of loan in Figure 1.

Fig. 1

Estimated income structure

Calculated by authors

The figure shows that the largest share in the revenue structure is occupied by a loan for

contract execution. According to Peneza.ru, this service is the most in demand for this platform.

The authors set the discount rate at 20% and consider the cash flows from investments in this project in Table 7.

Table 7

Main indicators of the

platform for 5 years

Indicator, million rubles |

Period (year) |

|||||

0 |

1 |

2 |

3 |

4 |

5 |

|

Initial investment |

3,090 |

- |

- |

- |

- |

- |

Profit |

- |

15,462.80 |

17,009.08 |

18,709.99 |

20,580.99 |

22,639.09 |

Expenses |

- |

14,307.18 |

15,737.90 |

17,311.69 |

19,042.86 |

20,947.15 |

Income |

- |

1,155.62 |

1,271.18 |

1,398.30 |

1,538.13 |

1,691.94 |

Tax |

- |

231.12 |

254.24 |

279.66 |

307.63 |

338.39 |

Net income |

- |

924.50 |

1,016.95 |

1,118.64 |

1,230.50 |

1,353.55 |

Calculated in the framework of the proposed project

It can be seen from Table 7 that the cash flow is gradually increasing. This phenomenon indicates the profitability of the project. The net income of the project will grow from 0.92 billion rubles up to 1.4 billion rubles; the growth over 5 years will be 46%, which is positive and indicates an increase in the scale of the project and the volume of customer service.

Consider the project’s cash flow in Table 8.

Table 8

Project cash flows,

mln rubles

Year |

Initial costs |

Profit |

Expenses |

Cash flow |

Discounted cash flow |

Discounted cash flow by the accrued method |

0 |

3,089.62 |

0 |

3,089.62 |

-3,089.62 |

- |

- |

1 |

0.00 |

15,462.80 |

14,307.18 |

1,155.62 |

963.02 |

963.02 |

2 |

0.00 |

17,009.08 |

15,737.90 |

1,271.18 |

882.77 |

1,845.78 |

3 |

0.00 |

18,709.99 |

17,311.69 |

1,398.30 |

809.20 |

2,654.98 |

4 |

0.00 |

20,580.99 |

19,042.86 |

1,538.13 |

741.77 |

3,396.75 |

5 |

0.00 |

22,639.09 |

20,947.15 |

1,691.94 |

679.95 |

4,076.71 |

Calculated in the framework of the proposed project

Based on the data presented in the table, it can be concluded that the platform is profitable. The estimated amount of the discussed cash flow will be 4.1 billion rubles.

Consider the main indicators for assessing the investment attractiveness of the project in Table 9.

Table 9

Main indicators for assessment of the

investment attractiveness of the project

Indicator |

Value |

NPV, mln rubles |

987.08 |

PR, % |

31.95 |

ARR, % |

36.54 |

IRR, % |

33 |

Payback period, years |

3 years |

Calculated in the framework of the proposed project

The value of NPV is the net present value which indicates the payback of the project. Thus, the positive value of this indicator confirms the payback of the project in the amount of 0.99 billion rubles, which is positive. The profitability of the project (PR) is more than 31%, which is a positive and rather high value in Russian realities. The value of the project efficiency ratio is 36.54%, which is high and shows the project’s profitability without discounting. The value of the internal rate of return (IRR) is equal to 33%, which is higher than the rate of raising equity capital (by attracting customer funds through deposits at a rate of 6 to 7% per annum). The payback period of the project will be three years.

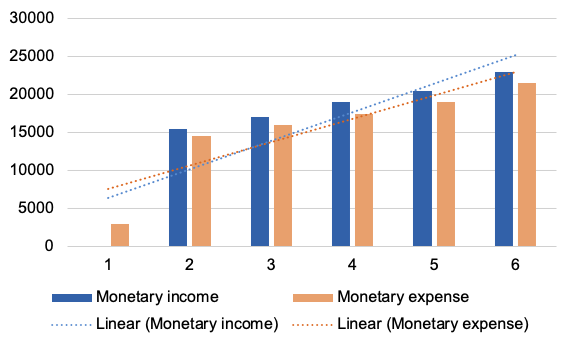

Consider the project cash flow dynamics in Figure 2.

Fig. 2

Dynamics of the project

cash flow, mln rubles

From Figure 2, it can be seen that the cash flow after the start of the project becomes positive, which indicates that the project’s revenues exceed expenditures. This ensures the return on initial costs.

The study results are applicable to the setting of overall policy for ALM and risk management.

Risk assessment and setting the interest rates will be adjusted based on previous experience; there will be a need for additional fundraising to increase the capacity of computer systems related to data processing by neural networks, promising to expand the use of cloud technologies, that is, expanding the use of Microsoft Azure/Amazon AWS/Google App Engine, and others SaaS (software as a service) sites.

It should be borne in mind that the trend of customer service mainly on the Internet, with the help of Internet technologies, is gaining momentum. The adopted program “Digital Economy of the Russian Federation” implies the transition of the Russian economy to the Internet space. The banks, as one of the important, backbone elements of the economy, should be the first in the implementation of this program. Similar projects, as proposed by the authors, are already close to implementation or at the stage of final development. For example, JSC CB “Modulbank” has launched a direct investment service through which people directly invest in the bids offered by companies; thereby, they receive funding for their projects.

The research covered the gap in the set of techniques of asset and liability management by the development of practical recommendations for expanding the range of operations and services based on a financial model using IT technologies.

Thus, the proposed project has development prospects. After launching it, it is necessary to analyze the experience gained and begin to expand the pilot project, as well as the proposed line of credits for agricultural producers in the segment of small and medium-sized enterprises, since these kinds of enterprises most often need cheap financial resources. This direction of development of the project will be a priority. Small and medium-sized enterprises will receive tangible support, preferential credit conditions, speed, transparency and security of external financing. Rosselkhozbank will be able to increase the share of its presence in the credit market, improve the credit system, optimize the expenses, reduce the riskiness of credit operations, thereby increasing its assets, which is extremely positive.

The support of the development of this direction will be due to the use of Blockchain technology which will protect both the bank and the company from fraud, by integrating the bank’s platform systems and financial (accounting) accounting software in the enterprise. This step will increase the speed of obtaining the necessary information by the bank and enterprises, will give unprecedented transparency of operations, the inability to fake information within the system, the extremely high complexity of hacking the platform.

Andryushin, S.A. (2017). Open banking, credit activity, regulation and supervision. Banking, 6, 26–35.

Akhisar, I., Tunay, K. B., & Tunay, N. (2015). The effects of innovations on bank performance: The case of electronic banking services. Procedia – Social and Behavioral Sciences, 195, 369–375. DOI: 10.1016/j.sbspro.2015.06.336.

Cavus, N., & Chingoka, D. (2016). Information technology in the banking sector: Review of mobile banking. Global Journal of Information Technology, 5(2), 62–70. DOI: 10.18844/gjit.v5i2.196.

CBR (2019). Russian Agricultural Bank. In: Guide to Credit Institutions. Retrieved from https://www.cbr.ru/credit/coinfo.asp?id=450039042.

Corlosquet‐Habart, M., Gehin, W., Janssen, J., & Manca, R. (2015). Asset and Liability Management for Banks and Insurance Companies. New Jersey: John Wiley & Sons, Inc.

Dash, M. (2013). A Study of the impact of asset-liability management on the profitability of banks in India. Journal of Applied Management and Investments, 2(4), 230–234. DOI: 10.1002/9781119184607

Du, J., Song, X., Wang, Z., Park, S., & Shi, T. (2018). Looking deeper into the factors regulating global innovation with PCA and rough sets.SAR Journal, 1(3), 95–106. DOI: 10.18421/SAR13-04.

Gupta, S., & Yadav, A. (2017). The impact of electronic banking and information technology on the employees of banking sector. Management and Labour Studies, 42(4), 379–387. DOI: 10.1177/2393957517736457

Hosein, S.S.M. (2013). Consideration the effect of e-banking on bank profitability; Case study selected Asian countries. Journal of Economics & Sustainable Development, 4(11), 112–117.

Jakšič, M., & Marinč, M. (2019). Relationship banking and information technology: the role of artificial intelligence and FinTech. Risk Management, 21(1), 1–18. DOI: 10.1057/s41283-018-0039-y

Rosselkhozbank (2018). Lending. Retrieved April 25, 2019, from https://www.rshb.ru/legal/credit/.

Kebede, A.M., & Tegegne, Z.L. (2018). The effect of customer relationship management on bank performance: In context of commercial banks in Amhara Region, Ethiopia. Cogent Business & Management, 5, 149–183. DOI: 10.1080/23311975.2018.1499183

Li, Z., & Zheng, X. (2017). A critical study of commercial banks’ credit risk assessment and management for SMEs: The case of agricultural bank of China. Journal of Applied Management and Investments, 6(2), 106–117.

Matkova, A.A. (2017). Why artificial intelligence can replace bank operators in next 3 years? Economy. Law. Management: Current Issues and Development Trends, 13, 10.

Thyaga, R.N. (2016). Impact of information technology (it) on the banking sector. International Journal of Current Advanced Research, 5(7), 1106–1111.

Trabelsi, M.A., & Trad, N. (2017). Profitability and risk in interest-free banking industries: a dynamic panel data analysis. International Journal of Islamic and Middle Eastern Finance and Management, 10(4), 454–469. DOI: 10.1108/IMEFM-05-2016-0070.

1. Department of Finance, Russian State Agrarian University – Moscow Timiryazev Agricultural Academy, Moscow, Russia.

2. Department of Finance, Russian State Agrarian University – Moscow Timiryazev Agricultural Academy, Moscow, Russia.

3. Department of Finance, Russian State Agrarian University – Moscow Timiryazev Agricultural Academy, Moscow, Russia.

4. Department of Finance, Russian State Agrarian University – Moscow Timiryazev Agricultural Academy, Moscow, Russia.

5. Department of Finance, Russian State Agrarian University – Moscow Timiryazev Agricultural Academy, Moscow, Russia. Contact e-mail: tbobov@rambler.ru

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License