Vol. 41 (Issue 08) Year 2020. Page 2

KHARITONOVICH, Alexander V. 1

Received: 16/05/2019 • Approved: 28/02/2020 • Published 12/03/2020

ABSTRACT: The purpose of this study is to define the stages and content of the resource potential for the investment-construction complex (ICC). The study surveyed the composition and proposed a set of indicators to assess the resource potential, including natural, labor, informational, property, financial, energy, scientific and technical potentials. The findings provide a rational basis for decision-making in infrastructure planning, resource utilization, and optimization of benefits at the corporate and government levels. |

RESUMEN: El objetivo del presente es el de identificar las fases y contenido del potencial de recursos de desarrollo del conjunto de inversión y construcción (CIC). Se precisa la estructura y se propone un conjunto de indicadores para evaluar el potencial de recursos que incluye los siguientes potenciales: natural, laboral, patrimonial, financiero, energético, científico técnico y de información. Los resultados proporcionan una base racional para la toma de decisiones en el campo de planificación de la infraestructura, empleo de recursos y optimación de los beneficios al nivel corporativo y al nivel de gobierno. |

The relevance of the study of the investment-construction complex (ICC) life cycle is due to the fact that it is one of the critical factors in the development of its territory, because the possibility and efficiency of reproduction of its fixed assets depend on its state and level of development.

Since the construction industry is highly fragmented and characterized by the uncertainty of a cyclical industry, the management of enterprises in this sphere has its own specifics (Fulford, 2018; Wanberg et al., 2013; Song, 2010; Costa & Porto, 2012). Enterprises face numerous challenges that require the implementation of corporate strategies to remain competitive (Mwai, Namada & Katuse, 2018).

Therefore, governments need to define standards for the ICC activities (Mohammadi, Tavakolan & Khosravi, 2018) and promote innovation. For this, they need to determine a knowledge management strategy from a development perspective of the ICC (Chen & Fong, 2015).

The structuring of innovation stages and analyzing organizational resources that are catalysts for innovative solutions (Teodorovicz et al., 2017; Costa & Porto, 2012) are important not only to understand innovation behavior in medium-sized companies but also to raise questions that can be useful in developing public policy to support innovation in medium-sized companies.

The purpose of this study is to define the stages and content of the ICC resource potential to develop this strategy.

The hypothesis of this study is the assumption that the development of the investment-construction complex is a process of change that can be explained based on life-cycle theory and the concept of balancing development.

The author used the methods of analysis, synthesis, classification, modeling, tabular and graphical data visualization techniques. To describe the composition of the ICC resource potential, the researcher used abstraction methods and the classification method. The analysis method has already been partially implemented in relation to the issue under study since there are several studies that specifically refer to the private potentials constituting the resource potential. However, the problem of fragmented results of these works remains unsolved; therefore, they require further systematization, correction, and generalization.

The works devoted to the issues of resource potential development, assessing its use, its development programs at the regional, national and international levels, along with the author’s own data obtained in the process of researching the resource potential of the investment-construction complex, served as primary source materials for this study.

A.G.Fotonov (Fotonov, 1985) outlines the following principal differences between the resource potential and the concepts of national wealth and economic potential. First, the latter two concepts characterize the existing development level of the social production system, while the resource potential is necessary to assess the potential development of the management object (country, region, industry complex) in the long term. Although a distinction is made between the existing and prospective economic potential, the content of the latter does not coincide with the meaning of resource potential, as a prospective economic potential constitutes the maximum capacity of the existing economic system in ideal conditions (Kuznetsov, 2010, p. 13). Secondly, the analysis of economic potential and national wealth takes into account only current existing factors, while the analysis of resource potential should consider the possibility of new factors, as well as their transition to the category of resources (Fonotov, 1985, p. 15).

The author defines the resource potential as “the volume of resources compared with the national economic needs (reflected in the goals of the socio-economic development of the country) given the potential of expanding and replenishing these resources in the long term” (Fonotov, 1985, p. 14). Thus, the labor potential is an assessment of the availability of the working-age population in the long-term and the potential of mineral resources – an estimate obtained considering both explored and exploited deposits, and preliminary estimated reserves. Considering the resource potential as a set of deposits, the scientist attributes to this category various stocks of natural, material, financial, informational and population resources.

R. S. Ziyatdinov and F. S. Ziyatdinov consider the concepts of resource potential and production potential as synonyms and define the production potential as a potential determining the production output based on the quantity and quality of production resources (Ziyatdinov, 1997, pp. 12, 84; Ziyatdinov, 2001, p. 7). Examining the resource potential of the agro-industrial complex, F. Ziyatdinov highlights the following groups of resource factors in the composition of its resource potential: natural, material and technical, labor, organizational, economic and technological.

The author used the life-cycle theory to consider topical issues of the investment-construction complex.

Changes are crucial for enterprises functioning in a growing, highly competitive business environment. Theories of change describe the effectiveness with which enterprises can change their strategies, processes, and structures (Hussain et al., 2018).

To adapt the biological theory, management researchers proposed the concept of a life-cycle of enterprise development from birth to death along with several different models describing from three to ten stages of development (Lester, Parnell & Carraher, 2003). This paper suggests a five-stage model of enterprise development that does not depend on the life-cycle theory, and a set of indicators reflecting the ideas of managers on the current stage of development of their companies. Knowledge of the company’s current state or stage of development can help top managers understand the relationship between the life-cycle of an enterprise, its competitive strategy, and efficiency.

Today, the life-cycle concept is actively used in management. Most often, it is used in relation to such objects as a project, enterprise, industry, and territory. Such a wide application of this concept is explained by the fact that it makes it possible:

However, despite the active use of the life-cycle theory for the purpose of analyzing, forecasting and managing the development of an object, in some respects, scientists still do not understand the role and stages of development of the ICC resource potential.

The content of the resource potential of the investment-construction complex (ICC) can be revealed only through the comprehension of resource potential itself. Economists give different definitions of resource potential, often confusing it with productive capacity and economic potential.

There are three main paradigms in which the concept of economic potential is considered as:

Representatives of the first paradigm include Sosnenko (2007), who consider the economic potential as a set of resources (assets) and sources of their formation.

Within the framework of the second paradigm, the economic potential can be considered as “the state’s economic possibilities depending on the level of development of productive forces and production relations, the availability of labor and production resources, and the efficiency of the economic mechanism” (Kuznetsov, 2010, p. 175).

As for the third paradigm, the economic potential is closely linked to the national wealth, depends on the amount of labor resources and the quality of their training, the volume of production capacity of industrial and construction enterprises, the production capacity of agriculture, the intensity of transport routes and the availability of vehicles, the level of development of the non-production sphere, achievements of science and technology, resources of explored mineral deposits, i.e. elements, constituting the productive forces of society.

The first paradigm considers the economic potential as a set of available resources, which is closest in meaning to the concept of resource potential. However, even with this interpretation of the economic potential, its differences from the resource potential described by Fonotov (the author of one of the first works on the resource potential) do not lose their relevance.

The scope of the term “production potential” is narrower than that of the term “resource potential”, since the production potential does not cover the entire resource potential, only a certain part of it that is used in the production process.

The notion of the resource potential of a construction enterprise emphasizes the relation between the state of resource potential of the management object and its external environment, characterizing the ability of the system to implement targeted activities, given the influence of internal and external factors. The resource potential is required to determine the possibilities of future development, as it provides for the directions of expansion, replenishment, and reproduction of sources of resources.

The analysis of definitions of the resource potential resulted in a conclusion that the control object with resource potential can be:

Therefore, the term “management object” should be used as a more general concept to define the carrier of the resource potential when it is necessary to abstract from the level specifics under which the resource potential is considered.

Thus, the author suggests to consider the resource potential of the country as a set of resource potentials of its meso-level management objects (regions, regional agro-industrial complexes (RAICs), and regional investment-construction complexes (RICCs)), the resource potentials of which, in turn, are determined by the resource potentials of the micro-level control objects.

The relationship between the resource potentials of control objects belonging to the micro‑, meso- and macro-levels is shown in Figure 1.

It should also be noted that currently, there are two main approaches to the interpretation of resource potential, according to which it can be considered as:

1) part of the economic potential;

2) an indicator containing economic potential.

The first approach essentially contradicts the second one, since it implies the interpretation of resource potential as part of the economic potential. Let us disagree with the interpretation of resource potential inherent in the first approach, and prove the validity of the second approach.

Figure 1

Tree of resource potentials

(compiled by the author)

The author suggests defining the ICC life cycle as a set of stages of transitioning from one state to a qualitatively different state. It should be noted that the mentioned transition can be both positive (progressive) and negative (regressive). Balanced development is a key concept in terms of differentiating the stages of the ICC life cycle. This work interprets the balanced development of the ICC as a process of the ICC transformation by adjusting its qualitative and quantitative characteristics based on the controlled imbalance (consistent with the requirements and limitations of its external environment) to achieve and maintain a balance of interests of the ICC participants and subjects of its external environment in the long term.

Managed imbalance should be considered as a deliberate disequilibrium of the ICC, its participants to overcome the inert behavior of the ICC participants, adjust the values, principles, and goals of its functioning, as well as the methods and mechanisms for implementing these principles, achieving the goals. Values, principles, goals, appropriate methods and mechanisms for implementing the principles, achieving goals in their unity constitute the management model of an object.

At a certain stage of the ICC operation, an imbalance may occur, caused by the interaction of the ICC with the external environment (external imbalance) or the ICC environment itself (internal imbalance). By way of example, an internal imbalance may arise when the ICC has already passed into a qualitatively different state, while the methods and mechanisms of interaction of its participants remained unchanged, which prevents its effective functioning. External imbalance can be illustrated by the discrepancy between the ICC state and the requirements of the external environment. Such circumstances might be typical when the ICC fails to perform the reproduction of its fixed assets in the volume that is necessary for the subjects of its external environment. Late detection and elimination of the imbalance is the primary reason for the possible transition of the ICC to the decline stage. Internal and external imbalances can arise from a number of circumstances.

First, it should be noted that the objects of management can function without considering the consequences of their activities in the long term. Furthermore, organizational inertia in its negative manifestation, as well as the desire to enjoy the success of the progress being made, impede the implementation of timely changes to the object of management to prevent the imbalance mentioned. The distortion of information in the management process, especially its perception by various subjects involved in management, also contributes to the emergence of internal and external imbalances. Focusing on the ICC, let us stress that it consists of various business entities, as well as institutions whose individual interests in certain conditions may prevail over the general interests of ICC participants as a whole.

The life cycle of an ICC can include the following stages: start of operation, growth, peak, weakening, decline, and destruction (the extreme degree of decline). In the first stage of the life cycle, the functioning of the ICC begins based on the updated management model; its members still have to adapt to the new conditions of activity. The growth stage involves active improvement of the ICC operation based on the current management model. At the peak stage, the ICC reaches the highest degree of development based on the applied management model, which may mean a transition of the ICC to a qualitatively different state. The weakening stage is characterized by the strengthening of organizational inertia, the desire to preserve the current situation on the part of the ICC participants, as well as the growing contradiction between the qualitatively new ICC state and the applied management model.

At the stage of weakening, the above circumstances result in internal imbalance and/or external imbalance. At this stage, the threats to the ICC operation caused by internal imbalance and/or external imbalance become more obvious, while actions performed under current management practices do not result in a substantial improvement in the situation. Considering the above threats to the ICC operation, the causes of the imbalances are identified at the final stage. The management model and the ICC participants get updated; internal and external balances get restored.

National wealth includes fixed and working production capital, non-production assets, personal property of the population, inventories of enterprises and organizations, state reserves, mineral resources involved in economic turnover, and hydropower resources.

Since all personal property of the population (for example, consumer durable goods) can hardly be considered as part of the resource potential, the author suggests to distinguish two main parts in the structure of national wealth (NW) in terms of formation and realization of the resource potential (RP):

1) part of the national wealth, which is part of the resource potential;

2) part of the national wealth, which is not included in the resource potential (Figure 2).

Figure 2

The relationship between resource

potential and national wealth

Furthermore, it is possible to allocate the newly created part of national wealth, which is formed as a result of resource capacity realization through industrial potential.

The latter is part of the resource potential involved in the reproduction process through the use of various technologies and organizational forms, that is, as a functioning resource potential, which results in the production effect.

Let us note that the newly created part of national wealth is subsequently divided into the two above-mentioned parts (the part of national wealth that is part of the resource potential and the part of national wealth that is not included in the resource potential). Thus, on the one hand, national wealth is created through resource potential realization, and on the other hand, it is involved in the formation of resource potential.

Summarizing the discussion above and returning to the essence of the resource potential of the investment-construction complex (ICC), the author suggests to define it as follows: “The resource potential of the ICC is a set of resources that can be used by ICC enterprises to ensure the economic and social development of its territory within the existing legal framework and according to the requirements of environmental safety”.

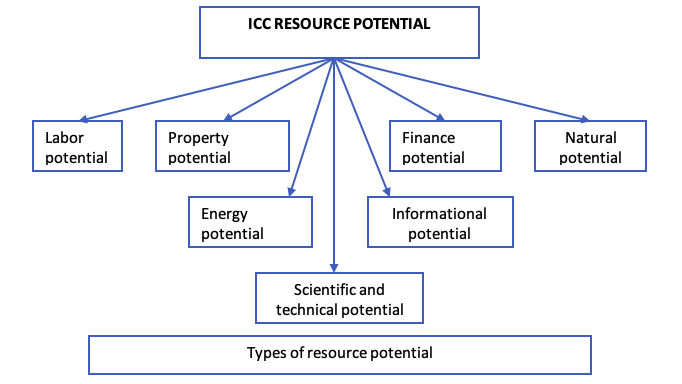

As for the structure of the ICC resource potential, let us consider the following types of specific potentials in its composition (Figure 3).

Figure 3

Composition of the ICC resource potential

The indicators characterizing each of the specific potentials are shown in Table 1.

Table 1

Indicators characterising

specific potentials

Specific potential |

Indicators |

Labor potential |

|

Property potential |

|

Finance potential |

|

Natural potential |

|

Energy potential |

|

Informational potential |

|

Scientific and technical potential |

|

As for the components of the ICC resource potential, financial and property potentials do not raise big questions. Discrepancies may occur with other components of resource potential, which are clarified below.

Representatives of the resource approach to the study of labor potential distinguish the gender and age structure of the population, along with differences in education, vocational training, and professional qualification. Within the framework of the factor approach, when determining the qualitative side of labor potential, the authors focus on the employees’ motives, value orientations, personal characteristics, socio-economic conditions, and production relations.

The natural potential is determined by the availability of natural resources, their quantity, quality, combination, and consumer value. The natural resource potential covers the entire aggregate productivity of the natural resources as a means of production and consumer goods, expressed in the public use value.

The informational potential, as a rule, is considered as an aggregate of means, methods, and conditions, which enable the effective use of information resources.

The allocation of scientific and technical potential as a separate specific potential (as part of the resource potential) is due to a particular role of science in post-industrial society. The latter is characterized by the increasing role of innovation in production, science, and education, since the developing competition, including international, forces enterprises to search for new, more effective ways to satisfy consumers’ needs related to the improvement of existing products or the creation of new ones, the production of which requires innovative ideas, knowledge and highly qualified specialists.

The study allowed revealing the relationship of the resource potentials in control objects belonging to the micro-, meso- and macro- levels, as well as the relationship of resource potential and national wealth.

Moreover, this work clarifies the composition and suggests a set of indicators to assess resource potential, including natural, labor, informational, property, financial, energy, scientific and technical potentials. The author defines the concept of resource potential as a set of resources that can be used by ICC enterprises to ensure the economic and social development of the territory within the existing legal framework and according to the requirements of environmental safety.

Summarizing the discussion above, this article reviews the topical issues of the life-cycle theory application to ICC enterprises. In addition, the author substantiated the idea that the concept of balanced development is essential in delineating the stages of the ICC life cycle. Particular emphasis was given to the emergence of threats to the ICC operation, caused by the appearance of internal and external imbalances in the process of its activities.

The importance of the construction sector in management, social policy and stimulation of economic growth is indisputable (Hung et al., 2019; Mavridis & Vatalis, 2015). Due to its direct relationship with many different sectors of the economy, the construction industry is vital for breaking out of stagnation in countries experiencing a severe economic or political crisis (Ozkan, Ozkan & Gunduz, 2012; Mavridis & Vatalis, 2015; Kapelko & Abbott, 2017).

The study revealed that the economic potential and resource potential are two different concepts that cannot be regarded as synonyms, otherwise their essence is distorted, which, in turn, leads to their misuse. This provision is important for managerial science – it is more appropriate to consider resource potential as an indicator comprising the economic potential than to treat it as part of the economic potential. After all, if one considers the development of a country solely in the economic aspect – in the end, this will result in a crisis caused by environmental, social and other problems. Therefore, it is not appropriate to use the economic potential as a general indicator characterizing the development opportunities of a country, or a region. Obviously, the economic potential should be assessed and taken into account not in isolation from other aspects of the development of a country or a region, but in combination with them. Consequently, there is a need for a different integral indicator of the development possibilities for an object of management (country, region) – the resource potential.

Theoretical conclusions and practical suggestions developed as a result of this study can be applied both by economic entities of the construction industry and by federal and regional authorities in the development of the resource potential of the investment-construction complex.

The resource potential of the ICC is a set of resources that can be used by ICC organizations to ensure the economic and social development of the territory within the existing legal framework and according to the requirements of environmental safety. Since the development of the resource potential implies its coordinated development in various spheres, the author specified the components of the ICC resource potential. Those include labor potential, property potential, financial potential, natural potential, energy potential, informational potential, scientific and technical potential.

Opportunities for the development of the resource potential depend on the state of the scientific and technical potential, as it is the source of qualitative changes, which ensure the increased use of the resource potential. Development of the resource potential is a process of qualitative changes in the resources included in its composition. Thus, the increased results of their realization can involve a reduction in resource costs. In turn, the growth of the resource potential means a quantitative increase in its constituent resources. Increased capacity of the resource potential is achieved through extensive use of resources and is associated with a transformation of its quantitative characteristics. Development of the resource potential is achieved through the knowledge of the ICC development stages, intensive approach to the use of resources, and is associated with changes in its qualitative characteristics. Thus, the development of scientific and technical potential serves as a foundation for resource potential developing.

Prospective directions for ongoing research on this subject are connected with a new research question: what was the management system in the housing sector so far and what should be undertaken in the near future to avoid crises and continue the ongoing development?

To date, within the framework of priority directions of socio-economic policy, it is necessary to increase the role of research and development in the economic development of the country and individual enterprises, to turn the scientific and technological potential into a major resource for economic growth. The importance of scientific and technical potential is underlined in the “Strategy for Socio-Economic Development of the North-West Federal District until 2020” (p. 7). Therefore, further research will focus on the issues of ensuring the accumulation and realization of the ICC scientific and technical potential.

Chen, L. & Fong, P.S.W. (2015). Evaluation of knowledge management performance: An organic approach. Information & Management 52(4), 431-453. DOI: 10.1016/j.im.2015.01.005

Costa, P.R. & Porto, G.S. (2012). Innovation stages and organizational resources at midsized companies in Brazil. Future Studies Research Journal: Trends and Strategies, 4(2), 23-32. DOI:10.7444/fsrj.v4i2.123

Fotonov, A. G. (1985). Resource potential: planning and management. Moscow: Ekonomika.

Fulford, R.G. (2018). The implications of the construction industry to national wealth. Engineering, Construction and Architectural Management, 118, 12-16. DOI: 10.1108/ECAM-03-2018-0091

Hung, C.W., Hsu, S.C., Pratt, S., Chen, P.C., Lee, C.J., & Chan, A.P.C. (2019). Quantifying the linkages and leakages of construction activities in an open economy using multiregional input-output analysis. Journal of Management in Engineering, 35(1), 48-54. DOI: 10.1061/(ASCE)ME.1943-5479.0000653

Hussain, S.T., Lei, S., Akram, T., Haider, M.J., Hussain, S.H., & Ali, M. (2018). Kurt Lewin's change model: A critical review of the role of leadership and employee involvement in organizational change. Journal of Innovation & Knowledge, 3(3), 123-127, DOI: 10.1016/j.jik.2016.07.002.

Kapelko, M. & Abbott, M. (2017). Productivity growth and business cycles: Case study of the Spanish construction industry. Journal of Construction Engineering and Management, 143(5). DOI: 10.1061/(ASCE)CO.1943-7862.0001238

Kuznetsov, S.V. (2010). Labor potential of the region in transition to an innovative economy. St. Petersburg: Saint Petersburg State University of Aerospace Instrumentation (SUAI).

Lester, D.L., Parnell, J.A., Carraher, S. (2003). Organizational life cycle: A five‐stage empirical scale. The International Journal of Organizational Analysis, 11(4), pp. 339-354, DOI: 10.1108/eb028979

Mavridis, S.C. & Vatalis, K.I. (2015). Investment in construction and economic growth in Greece. Procedia Economics and Finance, 24, 386-394. DOI: 10.1108/ECAM-03-2018-0091

Mohammadi, A., Tavakolan, M. & Khosravi, Y. (2018). Factors influencing safety performance on construction projects: A review. Safety Science, 109, 382-397. DOI: 10.1016/j.ssci.2018.06.017.

Mwai, G.M., Namada, J.M., & Katuse, P. (2018). Influence of organizational resources on organizational effectiveness. American Journal of Industrial and Business Management, 8(6), 1634-1656. DOI: 10.4236/ajibm.2018.86109

Ozkan, F., Ozkan, O., & Gunduz, M. (2012). Causal relationship between construction investment policy and economic growth in Turkey. Technological Forecasting And Social Change 79 (2), 362-370. DOI: 10.1016/j.techfore.2011.04.007

Song Y. (2010). Building cycles: Growth and instability. Construction Management and Economics, 28(5), 546-547. DOI: 10.1080/01446191003674493

Sosnenko, L.S. (2007). Comprehensive economic analysis of economic activity. Moscow: KnoRus.

Teodorovicz, T., Lazzarini, S.G., Cabral, S., & Nardi, L. (2017). Integrating organizational, resource-based, and practice-based views of heterogeneous performance. Academy of Management Proceedings, 1, 1-3. DOI: 10.5465/AMBPP.2017.14718abstract

The Strategy for Socio-Economic Development of the North-West Federal District until 2020 (2001). Order of the Government of the Russian Federation of November 18, 2011 № 2074-p.

Wanberg, J., Harper, C., Hallowell, M.R., & Rajendran, S. (2013). Relationship between construction safety and quality performance. Journal of Construction Engineering and Management, 139(10), 20-23.

Ziatdinov, R.S. (1997). Resource potential and ways to improve its effectiveness. Kazan: Tatarskoe knizhnoe izdatelstvo.

Ziyatdinov, F.S. (2001). Resource potential of the agro-industrial complex: analysis, evaluation and efficiency of use. Kazan: Kazan State Financial and Economic Institute (KSFEI).

1. PhD in Economics, Associate Professor, Department of Construction Management, Saint Petersburg State University of Architecture and Civil Engineering, 190005, Russia, St. Petersburg, 2-ya Krasnoarmeyskaya str., 4, cab. 402 E. Contact e-mail: manager881@rambler.ru

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License