Vol. 41 (Issue 07) Year 2020. Page 30

EREMEEVA, Olga S. 1

Received: 25/11/2019 • Approved: 24/02/2020 • Published 05/03/2020

ABSTRACT: The development of non-financial reporting and the active introduction of non-financial indicators into public accounting are driven by the needs of the users of accounting information. To improve the audit quality of this information, it is necessary to create a universal methodology for verifying the financial statements of enterprises that have a negative impact on the environment. The goal of this article is to present an original methodology for auditing financial statements that assess the reliability of reporting information on future events caused by environmental factors. The methodological basis of the research is the dialectical theory of scientific knowledge. This approach considers financial reporting with a focus on the interconnection and interdependence of all economic and financial processes in the audited organization. This article substantiates the audit approach considering environmental matters in a general manner in relation to the financial statements, rather than from an environmental audit outlook. The presented audit method focuses on environmental and economic interactions with financial activities, which makes it possible to assess the reliability of reporting information about future events caused by environmental factors. The study findings can be used by auditors when inspecting enterprises that pollute the environment, as well as by accountants and management when developing effective accounting to reflect environmental impacts. |

RESUMEN: El desarrollo de la información no financiera y la introducción activa de indicadores no financieros en la contabilidad pública están impulsadas por las necesidades de los usuarios de la información contable. Para mejorar la calidad de la auditoría de esta información, es necesario crear una metodología universal para verificar los estados financieros de las empresas que tienen un impacto negativo en el medio ambiente. El objetivo de este artículo es presentar una metodología original para auditar estados financieros que evalúe la confiabilidad de informar información sobre eventos futuros causados por factores ambientales. La base metodológica de la investigación es la teoría dialéctica del conocimiento científico. Este enfoque considera la información financiera con un enfoque en la interconexión e interdependencia de todos los procesos económicos y financieros en la organización auditada. Este artículo corrobora el enfoque de auditoría considerando los asuntos ambientales de manera general en relación con los estados financieros, en lugar de desde una perspectiva de auditoría ambiental. El método de auditoría presentado se centra en las interacciones ambientales y económicas con las actividades financieras, lo que permite evaluar la confiabilidad de la información de informes sobre eventos futuros causados por factores ambientales. Los resultados del estudio pueden ser utilizados por los auditores al inspeccionar las empresas que contaminan el medio ambiente, así como por los contadores y la gerencia al desarrollar una contabilidad efectiva para reflejar los impactos ambientales. |

Currently, users of accounting information want reports to include non-financial information and information about the future of enterprises. This determines the popularity of integrated reporting, non-financial reporting, as well as the inclusion of environmental information in financial statements (Osadchy et al., 2018; Ivlev et al., 2016; Sugiantiningsih et al., 2019).

According to Ernst & Young’s research, non-financial information is an important factor in making investment decisions: 68%of investors believe that non-financial results play a key role in making investment decisions. In 2017, 58 leading stock exchanges, representing more than 70% of the securities market, announced their intention to promote the principles of sustainable development in the target markets (EY, Clean Technology and Sustainable Development Services. Newsletter, 2017). The research papers considered in this article confirm the impact of environmental information on the behavior of investors and other interested users of accounting information (Darnall, 2009; Iatridis, 2013; Killian, 2016; Li, 2018; Qiu, 2016; Rezaee, 2017).

The global scientific community has paid great attention to environmental and social issues in relation to financial reporting. Working on this study, we considered various opinions on the development of accounting, reporting, and auditing from the perspective of sustainable development and the transition to integrated reporting (Xiao, 2006; Ashcroft, 2012; Bebbington, 2014; Bernardi, 2018; Contrafatto, 2014; Maroun, 2017; Chang, 2008; Yerdavletova, 2016; Baldarelli, 2017; Balynskaya et al., 2017; Yanchuk et al., 2013; Ghani et al., 2019).

We agree with the modern view on the significance of future integrated indicators in reporting. For instance, Villiers (2017) claims that integrated reporting cannot substitute financial reporting or sustainable development reporting, but is an integral part of both types of reporting. Based on the experience of international companies, Pavlopoulos (2017) has shown that the quality of information disclosure in integrated reporting is positively associated with corporate governance. Moreover, the role of materiality has changed for stakeholders: a more versatile, social understanding of materiality has emerged that is oriented toward the future rather than history (Edgley, 2015). Many environmental challenges can have far-reaching strategic implications for companies (Figge, 2003; Malysheva, 2013). In addition, national culture influences the specifics of accounting and management organization within certain aspects of sustainable development (Lee, 2018).

Although non-financial information is definitely useful and essential in reporting, its reliability can be questioned, and the audit community plays a great role in addressing this risk (Tarasova et al., 2018; Balynskaya & Koptyakova, 2015). All aspects of economic activity, including environmental, are to be analyzed by an auditor if they are capable of significantly affecting the current and future activities of the company.

Some researchers attribute environmental accounting to management accounting (Qian, 2008; Jasch, 2008; Kumarasiri, 2012; Truhachev, 2017). At the same time, accounting of environmental components, their impact on a company’s performance, as well as the audit of accounting and reporting, are considered from the perspective of environmental management and environmental auditing (Costantino, 2018; Patriarca, 2017; Earnhart, 2016; Wang J, 2011; Wang X, 2019; Houldin, 1999, Bartels, 1997, Mazhaysky, 2004). We believe that an environmental audit, according to its legal definition and its development over time, does not perform the function of assessing the reliability of financial statements. An audit of environmental components that impact a company’s activities are not only a part of environmental management, but also play an important role in the organization of accounting, the preparation of financial statements, and the audit of general financial information (Nadhir & Wardhani, 2019; Fedorenko et al., 2016). We consider financial statements to be an object of a general financial audit based on their interconnection and interdependence with all business and financial processes within an organization.

In this research, we focused on papers that studied the impact of environmental aspects of a company’s activities related to general audit procedures (Blinov, 2004; Borodin, 2004; Cohen, 2008; Du, 2018). However, researchers have not explored all the consequences of environmental matters, and there is no systematic organization or methodology for auditing companies that pollute the environment. The relevance of this research is determined by the need to provide a reasonable audit opinion on the dependability of information related to the environmental components of a company’s activity.

The aim of this study is to develop a set of systematic procedures for auditing financial statements that would provide a verification methodology that focuses on environmental and economic relationships in business activities and allows information about future events caused by environmental factors to be reliably assessed.

The main research objectives are to:

According to the hypothesis of this study, a financial statement audit methodology that focuses on environmental and economic relationships in business activities will ensure a comprehensive review of the reporting of information about future environmental events in financial statements, which would allow for reliable evaluations of the financial statements and business continuity of the audited organization.

The novelty of this approach is associated with the assessment of the environmental component of the activities of the inspected object during the general audit of financial statements, and not the environmental audit. The original approach allows considering the characteristics of enterprises polluting the environment at each stage of the general audit, rationally distributing the work of the audit team and reducing the risk of undetected threats of termination of the client’s activities due to environmental factors.

The article includes the following sections:

The basis of the study is the practices of audit firms in Russia. The work used international auditing standards, international financial reporting standards, and an international standard for integrated reporting. Therefore, the methodology presented in the article can be adopted by other countries whose national legislation allows using these international standards. The method considered in this study was tested at enterprises of the Republic of Khakassia (Russia).

The methodological basis of this study was the dialectical theory of scientific knowledge. This theory was applied to consider financial statements as an audit object in its interconnection and interdependence with all economic and financial processes in the organization.

To determine the impact of the environmental component on financial statements, we used the method of object-oriented modeling, where the object was a ledger or a group of ledgers with the same identifying features. The objective approach to audit segments entails each business transaction being reviewed by collecting evidence about the reliability of the information presented in individual ledgers, without establishing the relationship between them at the stage of evidence collection (Blinov, 2004). We identified the elements of accounting and control systems that are specific to organizations that pollute the environment. Next, we established the environmental audit objects of financial reporting that describe the specifics of accounting and control systems of organizations that pollute the environment. Following this, we proposed the concept of “contingent environmental facts of business activities” (CEFBA), which provides the qualitative characteristics of significant information on the consequences of the disruption of ecological balance and compliance with the principle of business continuity. The ecological objects of audit are the indicators that characterize the environmental component of the activities of the audited company, which are reflected in its financial statements, and they include the following:

CEFBA is an economic event that is occurring as of the reporting date due to present negative environmental factors, whose consequences and the probability of occurrence in the future are uncertain; that is, the occurrence of consequences depends on whether or not one or more uncertain events will take place in the future. CEFBA is caused by accidents and violations of environmental standards and regulations, leading to a negative impact on the environment, above-limit emissions, discharges, and waste.

Using structural and functional modeling, we developed an audit method that focuses on environmental and economic relationships in business activities. The process of auditing the enterprises that pollute the environment was used as a model. The audit process was divided into sections that an auditor can go through in chronological order. Each section performs a specific function aimed at achieving the ultimate goal of the audit: to assess the reliability of the reporting. The sections are interconnected by using and analyzing the information received by the auditor when working through the sections.

We used special audit methods to develop the methodology. Its elements are audit planning, audit risks, materiality in the audit, audit sample, audit evidence, audit documentation, control tests, and audit procedures (Defliese et al., 1997; Gusev, 2005). Traditional audit techniques are inventory, measurement, inspection, recalculation, overhaul, observation, surveys, inquiries, tracking, verification of documents and accounting records, comparison of documents, and analytical procedures (Alborov, 2000; Gusev, 2005; Barmuta et al., 2019).

In this research, we applied the following general and special cognition methods: comparison, combination of analysis and synthesis, generalization, grouping, observation, description, and measurement.

The information base of the study included legal acts regulating audit, accounting and reporting in the Russian Federation, international standards on auditing, and practical materials on the activities of commercial organizations and audit firms in the cities of the Republic of Khakassia (Russia). The methodology was developed in line with the Audit Guidance Statement (AGS) 1010: The Consideration of Environmental Matters in the Audit of Financial Reports.

The result of the study is a methodology for auditing future environmental events in financial statements (Table 1) based on the method of structural and functional modeling. The main advantage of the methodology is the fact that one can use it to assess future events, environmental and related financial risks, as well as risks of misstatements in the reporting.

Table 1

Structural and functional model of the audit methodology for future

environmental events in financial statements (developed by the author)

Methodology sections (structure) |

The main question to which the section answers |

The content of the section |

Environmental audit objects |

What is inspected? |

1. Environmental capital assets; 2. Environmental costs; 3. Environmental payments; 4. Contingent environmental facts of business activity. |

Work sequence during the audit |

In what sequence is the audit carried out? |

1. Preliminary planning; 2. Planning; 3. Substantive procedure; 4. The final stage. |

Audit planning procedures |

What are the misstatement risks of the audited entity? |

1. Acquaintance with the business; 2. Study and assessment of the system of internal environmental control; 3. Study and assessment of the accounting system; 3. Assessment of the level of materiality. |

Audit substantive procedures |

What methods and techniques should be used? |

1. Determining the assertions for the preparation of financial statements for each object of environmental audit; 2. Building the audit sample; 3. Selecting techniques for obtaining reliable audit evidence for each assertion; 3. Documenting the audit procedures. |

Analysis of the impact of identified misstatements on the financial statements |

What is the auditor’s opinion on the reliability of the statements? |

1. Analyzing the identified errors and choosing the type of the auditor’s opinion; 2. Analyzing the impact of the environmental component on the operational continuity of the organization. |

Violation of environmental law may indicate non-compliance with the operational continuity. Therefore, in the disclosed methodology, an inspection of each environmental audit object includes collection and analysis of evidence regarding compliance with regulatory legal acts in the field of environmental protection. Table 2 summarizes threats to compliance with business continuity identified during the inspection of each environmental audit objects. The threats were determined on the basis of Russia’s environmental legislation, the practical experience of the auditor, as well as using the expert assessment method. When forming an expert group, the main criteria were education and work experience in the field of environmental management and environmental protection.

Table 2

Threats to compliance with business continuity identified during the

inspection of each environmental audit objects (developed by the author)

Environmental audit object |

A threat to compliance with business continuity |

Environmental capital assets |

Significant disposal of environmental capital assets due to obsolescence and physical deterioration, breakdown, and disposal. The lack of capital assets whose mandatory presence is established by the environmental protection plan and the lack of intention to acquire them. |

Environmental costs |

A significant reduction in mandatory preventive costs, the emergence of significant subsequent costs. (Preventive environmental costs are the expenses aimed at environmental protection measures that prevent the emergence of negative environmental matters and are aimed at reducing the harmful effects on the environment. Subsequent environmental costs are the expenses aimed at eliminating the consequences of negative environmental impacts, compensation for damage, and paying fines in cases where the limits of the permissible negative impact on the environment have been exceeded. These groups of expenses can be both voluntary and mandatory). |

Environmental payments |

Significant payments for above-limit negative impact on the environment. |

Contingent environmental facts of business activity |

The presence of contingent environmental facts of business activity requires a compulsory assessment of compliance with the principle of business continuity. |

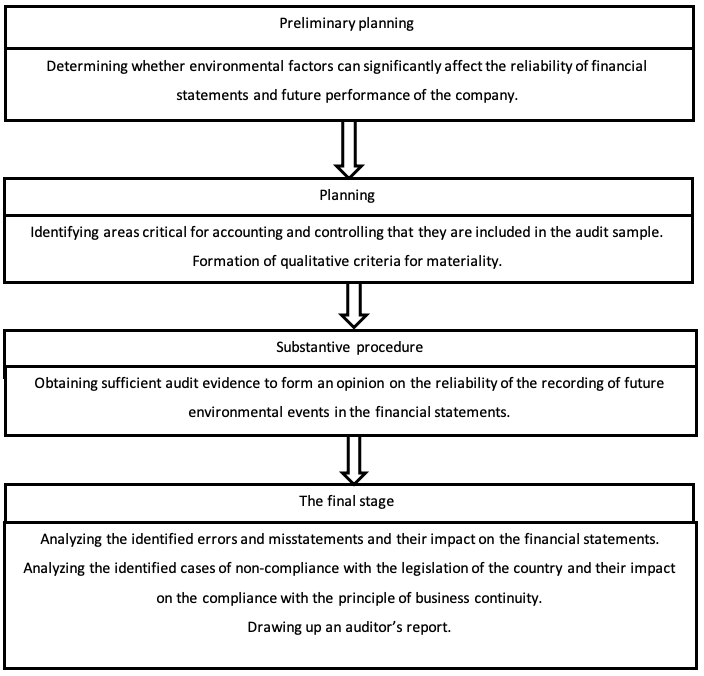

This methodology section was formed on the basis of structural and functional modeling method. Audit procedures were structured in interconnected stages placed in chronological order. For each stage, we considered functions and tasks determining its purpose.

Figure 1

The Procedures Sequence during the Audit of Future

Environmental Events in Financial Statements

Source: Developed by the author

This methodology section was based on the structural-functional modeling method. The process of audit planning consists of two major steps: preliminary planning and planning. In turn, each stage includes a set of characteristics of the audited company’s activities and its internal control system. We determined the factors essential for the auditor’s work, the actions necessary for this stage, and the functions of the stage. In addition to this, we established the final results of the process for each section.

Figure 2

The Procedures for Planning the Audit of Future

Environmental Events in Financial Statements

Source: Developed by the author

The audit of environmental capital assets:

- Audit of the enterprise’s provision with environmental capital assets;

- Analysis of the compliance of environmental capital assets with the amount of harmful effects on the environment;

- Assessment of the technical condition of environmental capital assets and hazardous objects.

Audit of environmental costs:

- Audit of the reasonableness of preventive environmental costs;

- Audit of the reasonableness of costs for obligatory payments directly established by regulatory legal acts:

Audit of the reasonableness of costs caused by the technological specifics of the audited entity in the field of environmental pollution;

Audit of the reasonableness of voluntary environmental costs;

- Audit of the validity of subsequent costs accounting;

- Audit of the creation of reserves for environmental measures;

- Audit of the recording of environmental costs in ledgers and reporting items.

Audit of environmental payments:

- Audit of the validity of environmental payments calculations:

Audit of the accuracy of estimating the object of taxation and polluting ingredients;

Audit of the accuracy of estimating the actual volume of harmful effects on the environment;

Audit of the validity of the applied environmental payment tariffs:

- Audit of the accuracy of the reporting on environmental payments and timeliness of its submission;

- Audit of the completeness and timeliness of environmental payments.

Verification of contingent environmental facts of business activity:

- Audit of the validity of CEFBA identification;

- Audit of the validity of CEFBA recognition;

- Audit of the validity of CEFBA assessment;

- Audit of the reserve for estimated environmental obligations in ledgers and reporting items.

To obtain audit evidence about the provision of the enterprise with objects of capital environmental assets, the following methods are used:

- Inventory;

- Inspection of documentary evidence of ownership of objects;

- Tracing the recording of objects in ledgers and reporting items.

Audit evidence examining whether environmental costs are reasonable or not is obtained by inspecting the records of incurred costs. The assertion “presentation and disclosure” is verified by inspecting the fairness of environmental cost attribution on ledgers and reporting items.

Verification of environmental payments is based on the laws of the country where the enterprise operates. The auditor should ensure that analytical records are kept for each type of pollutant or for each class of hazardous waste. The method of recalculation is applied to check the valuation assertion (the proper value of the environmental payment obligation).

Inspection of the contingent environmental effects of business activity is found in a summarizing section of the audit, and, in many respects, is based on the results of the inspection in the previous sections. The verification of CEFBA is the key to assessing the record of future environmental impacts in financial statements, since the very concept of CEFBA implies a forecast of future events. Contingent effects of business activity in recorded statements analyze future probabilistic events and determine the present threats to reduction or termination of the enterprise. CEFBA primarily determines the significant qualitative consequences of environmental violations.

The specifics of our approach is that the very presence of negative environmental aspects (emissions into the atmosphere, discharges to water, and waste disposal) is distinguished as a significant qualitative fact and is used as the key criterion to assessing compliance and risks to business continuity. Future environmental commitments can arise out of CEFBA. Future environmental events that are qualitatively significant for accounting and reporting, first of all, should be assessed in regards to the categories of essential or non-essential. To do this, we applied the method of expert assessments. In this case, the auditor should be guided by the International Auditing Standard 620: Using the Work of an Auditor’s Expert, which establishes the duties of the auditor regarding the relevant knowledge and experience in a field that helps the auditor obtain sufficient and appropriate audit evidence.

The methods used to obtain audit evidence when confirming the validity of CEFBA recognition include inspection of documents as well as inquiries and their written or oral responses to the organization’s lawyer, the inspection bodies that issued decisions on the environmental offense, the fiscal authorities, and the environmental authorities.

Table 5 was created by combining analysis and synthesis methods. All possible violations identified with the previously mentioned audit procedures are analyzed, their general properties and differences are estimated based on the auditor’s opinion. Violations are grouped by type of impact on the auditor’s report. The types of the modification of the auditor’s report are determined in accordance with International Standard on Auditing 700: Forming an Opinion and Drawing an Opinion on Financial Statements and International Standard on Auditing 705: Modifications to the Opinion in the Independent Auditor’s Report.

Table 3

Types of modification of the auditor’s report in connection with

violations related to environmental factors (developed by the author)

Violations associated with environmental factors |

Modification of the auditor’s report |

Significant violations of environmental legislation by the audited entity (while current information on environmental audit objects is accurately recorded in the statements). |

The auditor’s opinion on the reliability of the statements is unconditionally positive. However, the audit report is necessarily modified by including a section that draws attention to the situation in the field of environmental protection formed by the audited entity and disclosed in the notes to the financial statements. |

Limiting the scope of the auditor’s work regarding the information on environment pollution by the audited entity |

Modification of the auditor’s report consists in expressing an opinion that is not unconditionally positive. The auditor makes a decision either to give a qualified auditor’s report or refuses to express an opinion. |

Disagreements with the management of the audited entity regarding the accurate disclosure of information on environmental audit objects in financial statements. |

Modification of the auditor’s report consists in expressing an opinion that is not unconditionally positive. The auditor makes a decision either to give a qualified auditor’s report or refuses to express an opinion or expresses a negative opinion. |

Answering the pressing question about whether financial auditors can contribute to the field of environmental audits, whether they can assess the environmental consequences for a business (Dixon, 2004), we believe that the proposed methodology makes it possible to determine the accuracy of the reported information on future events caused by non-compliance with environmental laws, which helps solve some environmental problems.

The methodological aspects concerning particular environmental audit objects have been considered by researchers in the field of environmental audit and environmental management. However, the theory and practice of general audit did not have a comprehensive methodology for verifying the impact of environmental aspects on the indicators of financial reporting. The lack of methodological support for the audit that would analyze the environmental aspects leads to higher labor costs of auditors when inspecting organizations polluting the environment, increases the risk of undetected threats of termination due to environmental risks, and reduces the quality of inspections. Existing studies suggest that audit procedures should vary depending on the business risks characteristic to the entity, in particular when this risk is associated with environmental factors (Paino, 2014). For instance, this article provides an answer to the question about the modification of audit procedures in this case. The methodological approach to the audit of financial statements disclosed in the article focuses on environmental and economic interconnections of economic life, unlike the existing ones, and it can be used as part of a general audit, not an environmental audit. The proposed method is aimed at identifying the risks of misstatements arising due to environmental aspects of the entity’s operations.

It should be noted that the accounting tools used in the study are of methodological and practical importance for creating integrated reporting that focuses on recording the future value of the company.

The research results have the following limitations:

Speaking about the reporting audit, one should consider the quality of the reporting process itself. There has been no sufficient theoretical research on the problems of including non-financial information in general, and information on environmental aspects in particular in public reporting, while the practical implementation of these issues is even more complicated. Since it is important to reflect information on environmental protection measures both from the position of society and the development strategy of the enterprise and rely on the concept of integrated thinking, one should develop a procedure that would include the identified indicators reflecting the environmental component of activities into public reporting. This poses several problems: to identify a fact, to evaluate a fact, and to determine its place in the reporting.

At present, reporting is developing towards representation of the activities of the enterprise in perspective. For accurate and reliable forecasts, one should identify general possible categories for the accounting of future events. There is a need for further study of the conceptual framework and a classification of possible future events (not just environmental ones). The types of such events can vary greatly across industries. Evaluation of future events is a serious scientific and practical problem in accounting, especially when it comes to non-financial information or contingent events.

Due to the impact of environmental aspects on financial reporting indicators, there is a need for the audit of information on the environmental component of the company’s activities. To solve this problem, we substantiated the approach to reviewing financial statements with consideration of environmental aspects in the framework of the general audit. The article presents a methodology for auditing financial statements with a focus on environmental and economic relationships in business activity, which makes it possible to assess the reliability of reporting information on future events caused by non-compliance with environmental laws. The methodology is disclosed in the following sections: Environmental Audit Objects, the Sequence of Audit Procedures, Audit Planning Procedures, Audit Substantive Procedures, and the Analysis of the Impact of Identified Misstatements in Financial Reporting.

According to the hypothesis of the study, the methodology for auditing financial statements with a focus on environmental and economic relationships in business activity was to provide a comprehensive review of the reporting of information about future environmental events in financial statements, which enabled to assess the reliability of financial statements and the business continuity of the audited organization.

The arguments in support of the hypothesis were as follows.

1. The methodology proposed in the article includes verification methods adapted for auditing organizations that pollute the environment (acquaintance with the business of the audited entity regarding the characteristics of its negative impact on the environment, studying and evaluating the system of internal environmental control, determining qualitative characteristics of materiality, and procedures for inspecting environmental audit objects). These techniques were systemized and included into the traditional procedure of financial statements audit, which makes it simple and easy to use by auditors performing a general audit of financial statements.

2. The concepts of environmental audit objects introduced in this study are reflected in standard reporting decisions in accordance with International Financial Reporting Standards; therefore, the developed audit procedures contribute to assessing the reliability of financial statements produced in accordance with generally accepted forms. Environmental audit objects are components of larger audit objects: environmental capital assets are part of all capital assets of the audited entity, environmental costs are part of all expenses, environmental payments are part of all budget settlements, and contingent environmental facts of business activity are part of contingent facts of business activity. The methodology defines specific assessment procedures that are carried out in addition to the general audit procedures conducted at an enterprise polluting the environment.

3. The introduced concept of CEFBA and its audit procedures enable one to identify and assess future valuation obligations, business continuity risks, company risks associated with environmental factors, and future environmental events. The consequences of activities related to environmental pollution have a strong uncertainty factor as it is difficult to determine the perpetrators and the extent of future harm, and due to the instability of legislation. The information obtained on the basis of the proposed CEFBA audit procedures is audit evidence that is necessary for observing the principle of business continuity, as well as for assessing the reliability of the volume of reserves for environmental obligations.

The study was carried out with financial support of the Russian Foundation for Basic Re-search within scientific project No. 18-010-00163.

Alborov, R.A. (2000). Audit in industrial, trade and agribusiness companies. Moscow: Delo i Servis.

Ashcroft, P.A. (2012). Extent of environmental disclosure of U.S. and Canadian firms by annual report location. Advances in Accounting, 28(2), 279-292. https://doi.org/10.1016/j.adiac.2012.09.012

Baldarelli, M.G., Nesheva-Kiosseva, N. (2017). Environmental Accounting: Conceptual Framework. In: Environmental Accounting and Reporting. CSR, Sustainability, Ethics & Governance. Cham: Springer. https://doi.org/10.1007/978-3-319-50918-1_2

Balynskaya, N.R., Koptyakova, S.V. (2015). Specifics of Information Risks in the Municipal Administration System of Modern Russia. Journal of Advanced Research in Law and Economics, 6(2(12)), 284-290.

Balynskaya, N.R., Vasil'yeva, A.G., Gafurova, V.M., Kuznetsova, N.V., Rakhimova, L.M. (2017). Effective Management of the Financial Sustainability of Subjects of the Russian Federation as the Factor of Social and Economic Welfare of the Modern Territory: An Empirical. The European Proceedings of Social & Behavioural Sciences, 985-992. http://dx.doi.org/10.15405/epsbs.2017.07.02.127

Barmuta, K., Ponkratov, V., Maramygin, M., Kuznetsov, N., Ivlev, V., Ivleva, M. (2019). Mathematical model of optimizing the balance sheet structure of the Russian banking system with allowance for the foreign exchange risk levels. Entrepreneurship and Sustainability Issues, 7(1), 484-497.

Bartels, J. (1997). The Practice of Environmental Auditing, Environmental Accounting and Audit: Collection of articles. Moscow: FBK-PRESS.

Bebbington, J., Larrinaga, C. (2014). Accounting and sustainable development: An exploration. Accounting, Organizations and Society, 39(6), 395-413. https://doi.org/10.1016/j.aos.2014.01.003

Bernardi, C., Stark, A.W. (2018). Environmental, social and governance disclosure, integrated reporting, and the accuracy of analyst forecasts. The British Accounting Review, 50(1), 16-31. https://doi.org/10.1016/j.bar.2016.10.001

Blinov, O.A. (2004). Methods of auditing production costs and calculating the cost of grain. Dissertation of Candidate of Economic Sciences. Novosibirsk: Omsk State Agrarian University Press.

Borodin, A.I. (2004). Theoretical aspects of environmental and economic audit and its relationship with other types of audit. Audit and Financial Analysis, 3, 66-67.

Chang, H.C., Deegan, C. (2008). Environmental management accounting and environmental accountability within universities: Current practice and future potential. In: Schaltegger, S., Bennett, M., Burritt, R. L., Jasch, C. (eds). Environmental Management Accounting for Cleaner Production. Eco-Efficiency in Industry and Science, vol 24. Dordrecht: Springer. https://doi.org/10.1007/978-1-4020-8913-8_16

Cohen, J., Krishnamoorthy, G., Wright, A. (2008). Waste Is Our Business, Inc.: The importance of non-financial information in the audit planning process. Journal of Accounting Education, 26(3), 166-178. https://doi.org/10.1016/j.jaccedu.2008.08.004

Contrafatto, M. (2014). The institutionalization of social and environmental reporting: An Italian narrative. Accounting, Organizations and Society, 39(6), 414-432. https://doi.org/10.1016/j.aos.2014.01.002

Costantino, F., Di Gravio, G., Tronci, M. (2018). Environmental audit improvements in industrial systems through FRAM. IFAC-Papers OnLine, 51(11), 1155-1161. https://doi.org/10.1016/j.ifacol.2018.08.434

Darnall, N., Seol, I., Sarkisb, J. (2009). Perceived stakeholder influences and organizations’ use of environmental audits. Accounting, Organizations and Society, 34(2), 170-187. https://doi.org/10.1016/j.aos.2008.07.002

Defliese, Ph.L., Jaenicke, H.R., O’Reilly, V.M., Hirsch, M.B. (1997). Montgomery’s Auditing. Moscow: Audit, UNITI.

Dixon, R., Mousa, G.A., Woodhead, A.D. (2004). The necessary characteristics of environmental auditors: a review of the contribution of the financial auditing profession. Accounting Forum, 28(2), 119-138. https://doi.org/10.1016/j.accfor.2004.01.001

Du, X., Jian, W., Zeng, Q., Chang, Y. (2018). Do Auditors Applaud Corporate Environmental Performance? Evidence from China. Journal of Business Ethics, 151(4), 1049. https://doi.org/10.1007/s10551-016-3223-6

Earnhart, D., Leonard, J. M. (2016). Environmental audits and signaling: The role of firm organizational structure. Resource and Energy Economics, 44, 1-22. https://doi.org/10.1016/j.reseneeco.2016.01.002

Edgley, C., Jones, M. J., Atkins, J. (2015). The adoption of the materiality concept in social and environmental reporting assurance: A field study approach. The British Accounting Review, 47(1), 1-18. https://doi.org/10.1016/j.bar.2014.11.001

EY Clean Technology and Sustainability Services. (2017). Clean Technology and Sustainability. Issue 2. Non-financial reporting of companies: in pursuit of success. Retrieved from: https://docplayer.ru/81544876-Informacionnyy-byulleten-may-2017-chistye-tehnologii-i-ustoychivoe-razvitie-vypusk-2-nefinansovaya-otchetnost-kompaniy-v-pogone-za-uspehom.html

Fedorenko, R. V., Zaychikova, N. A., Abramov, D. V., Vlasova, O. I. (2016). Nash equilibrium design in the interaction model of entities in the customs service system. IEJME—Mathematics Education, 11(7), 2732-2744.

Figge, F., Hahn, T., Schaltegger, S., Wagner, M. (2003). The sustainability balanced scorecard as a framework to link environmental management accounting with strategic management. In: Bennett, M., Rikhardsson, P. M., Schaltegger, S. (eds). Environmental Management Accounting—Purpose and Progress. Eco-Efficiency in Industry and Science, vol 12. Dordrecht: Springer. https://doi.org/10.1007/978-94-010-0197-7_2

Ghani, L.A., Saputra, J., Muhammad, Z., Zulkarnaen, I., Alfiady, T. (2019). A Study of Societal Flow of Phosphorus and Its Effect on Environmental Sustainability in Landfill Sites Terengganu, Malaysia. Journal of Southwest Jiaotong University, 54(3).

Gusev, Yu. V., Ostapova, V. V. (2005). The Logic of Audit: From Theory to Practice. Novosibirsk: NSUU.

Houldin, M. (1999). New concepts in environmental auditing: The application of auditing techniques to environmental management Systems. In: Hitchens, D.M.W.N., Clausen, J., Fichter, K. (eds). International Environmental Management Benchmarks. Berlin: Springer. https://doi.org/10.1007/978-3-642-58442-8_9

Iatridis, G.E. (2013). Environmental disclosure quality: Evidence on environmental performance, corporate governance and value relevance. Emerging Markets Review, 14, 55-75. https://doi.org/10.1016/j.ememar.2012.11.003

Ivlev, V.Y., Barkova, E.V., Ivleva, M.I., Buzskaya, O.M. (2016). Environmental approach to the study of the modern stage of information society development: Research prospects. International Journal of Environmental and Science Education, 11(16), 9113-9124.

Jasch, C., Savage, D.E. (2008) The IFAC International Guidance Document on Environmental Management Accounting. In: Schaltegger, S., Bennett, M., Burritt, R. L., Jasch, C. (eds). Environmental Management Accounting for Cleaner Production. Eco-Efficiency in Industry and Science, vol 24. Dordrecht: Springer. https://doi.org/10.1007/978-1-4020-8913-8_17

Killian, Sh., O’Regan, Ph. (2016). Social accounting and the co-creation of corporate legitimacy. Accounting, Organizations and Society, 50, 1-12. https://doi.org/10.1016/j.aos.2016.02.004

Kumarasiri, J. (2012). Management Accounting Practices for Sustainability. In: Gregoriou, G. N., Finch, N. (eds). Best Practices in Management Accounting. London: Palgrave Macmillan. https://doi.org/10.1057/9780230361553_7

Lee, K.H., Herold, D.M. (2018) Cultural Relevance in Environmental and Sustainability Management Accounting (EMA) in the Asia-Pacific Region: A Link Between Cultural Values and Accounting Values Towards EMA Values. In: Lee, K.H., Schaltegger, S. (eds). Accounting for Sustainability: Asia Pacific Perspectives. Eco-Efficiency in Industry and Science, vol 33. Cham: Springer. https://doi.org/10.1007/978-3-319-70899-7_2

Li, Yiwei, Gong, M., Zhang X.-Y., Koh, L. (2018). The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. The British Accounting Review, 50(1), 60-75. https://doi.org/10.1016/j.bar.2017.09.007

Malysheva, M. (2013). Organization, the Main Directions and Objectives of Economic Analysis Environmental Performance. Journal of Contemporary Economics Issues, 4. https://doi.org/10.24194/41301

Maroun, W. (2017). Assuring the integrated report: Insights and recommendations from auditors and preparers. The British Accounting Review, 49(3), 329-346. https://doi.org/10.1016/j.bar.2017.03.003

Mazhaysky, Yu.A., Dorokhina, O.E. (2004). Environmental audit in the management system and certification. Ecological Bulletin of Russia, 1, 29-33.

Nadhir, Z., Wardhani, R. (2019). The effect of audit quality and degree of international Financial Reporting Standards (IFRS) convergence on the accrual earnings management in ASEAN countries. Entrepreneurship and Sustainability Issues, 7(1), 105-120. http://doi.org/10.9770/jesi.2019.7.1(9)

Osadchy, E.A., Akhmetshin, E.M., Amirova, E.F., Bochkareva, T.N., Gazizyanova, Y.Y., Yumashev, A.V. (2018). Financial statements of a company as an information base for decision-making in a transforming economy. European Research Studies Journal, 21(2), 339-350.

Paino, H., Hadi, Kh.A.A., Tahir W.M.M.W. (2014). Financial Statement Error: Client’s Business Risk Assessment and Auditor’s Substantive Test. Procedia - Social and Behavioral Sciences, 145, 316-320. https://doi.org/10.1016/j.sbspro.2014.06.040

Patriarca, R., Gravio, G., Costantino, F., Tronci, M. (2017). The Functional Resonance Analysis Method for a systemic risk based environmental auditing in a sinter plant: A semi-quantitative approach. Environmental Impact Assessment Review, 63, 72-86. https://doi.org/10.1016/j.eiar.2016.12.002

Pavlopoulos, A., Magnis, Ch., Iatridis, G. E. (2017). Integrated reporting: Is it the last piece of the accounting disclosure puzzle? Journal of Multinational Financial Management, 41, 23-46. https://doi.org/10.1016/j.mulfin.2017.05.001

Qian, W., Burritt, R. (2008). The Development of Environmental Management Accounting: An Institutional View. In: Schaltegger, S., Bennett, M., Burritt, R. L., Jasch, C. (eds). Environmental Management Accounting for Cleaner Production. Eco-Efficiency in Industry and Science, vol. 24. Dordrecht: Springer. https://doi.org/10.1007/978-1-4020-8913-8_12

Qiu, Y., Shaukat, A., Tharyan, R. (2016). Environmental and social disclosures: Link with corporate financial performance. The British Accounting Review, 48(1), 102-116. https://doi.org/10.1016/j.bar.2014.10.007

Rezaee, Z., Tuo, L. (2017). Voluntary disclosure of non-financial information and its association with sustainability performance. Advances in Accounting, 39, 47-59. https://doi.org/10.1016/j.adiac.2017.08.001

Sugiantiningsih, A.A.P., Weni, I.M., Hariyanto, T., Tutuko, P., Sedyowati, L. (2019). Enhancing Environmental Quality through Community Participation based on Traditional Rules: Empowering the New Role of Pecalang in Bali. Journal of Southwest Jiaotong University, 54(5).

Tarasova, V.I., Mezdrykov, Y.V., Efimova, S.B., Fedotova, E.S., Dudenkov, D.A., Skachkova, R.V. (2018). Methodological provision for the assessment of audit risk during the audit of tax reporting. Enterpreneurship and Sustainability Issues, 6(1), 371-397. http://doi.org/10.9770/jesi.2018.6.1(23)

Truhachev, V.I., Kostyukova, E.I., Bobrishev, A.N. (2017). Development of management accounting in Russia. Revista Espacios, 38(27), 31. https://www.revistaespacios.com/a17v38n27/17382731.html

Villiers, Ch., Umesh, Sh. (2017). A critical reflection on the future of financial, intellectual capital, sustainability and integrated reporting. Critical Perspectives on Accounting. Retrieved from: https://doi.org/10.1016/j.cpa.2017.05.003

Wang, J., Zhang, B., Chen, T. (2011). The case study of China’s environmental audit: taking the Taihu Lake as an example. Energy Procedia, 5, 2108-2113. https://doi.org/10.1016/j.egypro.2011.03.364

Wang, X. (2019). The National Ecological Accounting and Auditing Scheme as an Instrument of Institutional Reform in China: A Discourse Analysis. Journal of Business Ethics, 154, 587. https://doi.org/10.1007/s10551-016-3401-6

Xiao, H. (2006). Corporate Environmental Accounting and Reporting in China. Current Status and the Future. In: Schaltegger, S., Bennett, M., Burritt, R. (eds). Sustainability Accounting and Reporting. Dordrecht: Springer. https://doi.org/10.1007/978-1-4020-4974-3_20

Yanchuk, M. (2013). Application of Theory of Spiral Dynamics in Management of Integrative Development of Economic Systems. Journal of Contemporary Economics Issues, 3. https://doi.org/10.24194/31308

Yerdavletova, F. (2016). Environmental Accounting as Information Support for Ecological Controlling. In: Bilgin, M., Danis, H. (eds). Entrepreneurship, Business and Economics, Vol. 2. Eurasian Studies in Business and Economics, Vol 3/2. Cham: Springer. https://doi.org/10.1007/978-3-319-27573-4_3

1. Candidate of Economic Sciences, Katanov Khakass State University, Russia, Republic of Khakassia, 655017, Abakan, ul. Bogdana Khmelnitskogo 152-20, Russian Federation. ORCID ID: https://orcid.org/0000-0001-9258-4610. Contact e-mail: eremeeva.olga.s@yandex.ru

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License