Vol. 41 (Issue 07) Year 2020. Page 23

LYSENKO, Julia Valentinovna 1; LYSENKO, Maxim Valentinovich 2 & GNATYSHINA, Elena Aleksandrovna 3

Received: 14/11x/2019 • Approved: 14/02/2020 • Published 05/03/2020

ABSTRACT: This article substantiates the relevance of applying the policy of optimizing the capital structure, examines methodological approaches to developing a regression model for analyzing the optimization of the capital structure of an industrial enterprise, which focuses on a concept that includes the principle of efficient use of equity, its profitability; the principle of efficient use of borrowed capital; the principle of balancing the sources of financing the company. |

RESUMEN: Este artículo confirma la relevancia de aplicar la política de optimización de la estructura de capital, examina los enfoques metodológicos para desarrollar un modelo de regresión para analizar la optimización de la estructura de capital de una empresa industrial, que se centra en un concepto que incluye: principio del uso eficiente de la equidad, rentabilidad, principio del uso eficiente del capital prestado, principio de equilibrar las fuentes de financiación de la empresa. |

The regression model for analyzing the optimization of capital structure is a popular tool in the financial management of industrial enterprise.

In this paper, we consider a regression model of analysis of capital structure optimization in an industrial enterprise, built on the basic principles of the concept.

«The policy of optimizing the capital structure determines the short-term and long-term financial stability of the agricultural company, which allows us to classify the sources of financing in accordance with their priority and cost. Therefore, depending on the priority, relations are established with suppliers, which are most often shareholders and creditors. Shareholders provide funds to the industrial enterprise in the form of equity, lenders - in the form of loans, loans and payables» [1]. The policy in the field of capital structure management (Higgins, R.L., 2003), (Tsolakis, N.K., 2014), examined in the study, is aimed at finding the most profitable structure of equity and borrowed capital in its aggregate, the ratio between own and borrowed funds.

The exact value of the capital structure, which is optimal, has not yet been identified, despite the large number of studies in this area. The reason for this is the economic, social, political conditions that operate in different countries. But much attention should be paid to industry characteristics, the life cycle of the company, the profitability of its activities, as well as macroeconomic cycles.

In all the mentioned works, the approaches of various scientists to the content of the concept of “capital” are presented [2; 3; 4; 5; 6; 7; 8].

The main attention of these works is focused on the principles of the Concept of optimizing the capital structure, which include the following:

1) the principle of efficient use of equity, which involves both maintaining a high level of return on equity, and the capitalization of net profit in the effective development of an industrial enterprise;

2) the principle of effective use of borrowed capital, expressed in a high level of profitability of borrowed capital;

3) the principle of efficiency and economical use of material and financial resources of the industrial enterprise;

4) the principle of balancing sources of financing activities, which consists in increasing the share of equity and reducing the share of obligations;

5) the principle of increasing the investment attractiveness of the agricultural company (by means of launching new investment projects).

The presented Concept will be implemented through analysis of the optimization of the capital structure of a production industrial enterprise.

The efficiency of capital use is characterized by its profitability (profitability). During the performance analysis, the dynamics of changes include indicators such as:

1) the profitability ratio of all used capital;

2) return on equity ratio;

3) the coefficient of profitability of borrowed capital.

Consider the indicators used in the regression model of the analysis of capital structure optimization [9; 10; 11; 12]:

Stage 1 - assessment of the dynamics and structure of sources of financing the activities of the industrial enterprise includes: analysis of changes in the cost of equity and borrowed capital of the industrial enterprise.

Stage 2 - assessment of financial stability:

determination of the type of financial stability (absolute assessment);

relative assessment (determination of financial stability):

the ratio of working capital (SOS). This ratio characterizes the possibility of financing current assets with own sources;

the reserve ratio of working capital (SOS) reserves characterizes the value of inventories financed from equity;

the financial independence ratio is necessary to determine the level of equity in the total amount of sources of funds;

maneuverability coefficient is necessary to assess the ability of businesses to acquire stocks using equity;

the financial leverage ratio (financing ratio) sets the amount of borrowed funds raised per unit of equity;

the long-term financial independence ratio shows the ratio of the amount of equity and long-term liabilities to the total amount of liabilities. Identifies the financial potential of the industrial enterprise;

the coefficient of long-term and short-term debt is aimed at determining the amount of attracted long-term liabilities per unit of short-term liabilities.

Stage 3 - assessment of the effectiveness and intensity of capital use.

Assessment of capital efficiency is presented by the following criteria:

profitability ratio of all used capital. The same indicator is called return on assets (ROA);

return on equity ratio;

profitability ratio of borrowed capital.

The assessment of the intensity of capital use took into account the following indicators:

total capital turnover ratio (shows the rate of turnover of all sources of financing the activities of the industrial enterprise);

the duration of one turnover of total capital;

capital intensity indicator.

Stage 4 - factor analysis of the profitability of total capital.

In the practical construction of a regression model for analysis and optimization of the capital structure of an agricultural company, the available data are indicators used to assess its financial stability, and the normative values of these indicators.

During the construction of the model, a qualitative and quantitative analysis of financing channels was used to calculate the degree of their reliability, which made it possible to analyze the capital structure of the industrial enterprise and determine the degree of availability of borrowed capital and the reliability of its receipt, as well as the efficiency of using its own funds.

According to Russian scientists, O.A. Gerasimenko, O.V. Molokova, E.V. Gubanova, L.V. Davydova, S.A. Ilminskaya, Yu.V. Kirillov, E.N. Nazimko et al. To select the optimal capital structure, it is necessary to achieve such a ratio of own and borrowed funds (Fountas S. etc., 2015, LiwangMa, 2016), which guarantees the most effective proportion between the ratios of financial profitability and financial stability (Antle J., Basso B., Conant R. etc., 2017) business leading to maximize market value [13; 14; 15; 16; 17; 18].

In the study, the optimal capital structure is a strategic parameter, which is a "lean" ratio of equity and borrowed capital, includes a set of tools (criteria) that are relevant only to specific existing conditions and subject to mandatory adjustment when they change. Based on this definition, we systematize the main methodological approaches to optimizing the capital structure through its analysis, presented in the study below.

Thus, the task of constructing a regression model for analyzing the optimization of the capital structure of the industrial enterprise and the optimization of leverage becomes relevant.

Let the optimization of the capital structure be based on the following steps [19; 20]:

1. analysis of the structure and sources of capital of an industrial manufacturing enterprise;

2. assessment of the main factors affecting the formation of the capital structure of an industrial manufacturing enterprise;

3. optimization of capital structure by increasing the maximum financial profitability of an industrial manufacturing enterprise;

4. selection of the optimal capital structure of an industrial manufacturing enterprise on the principle of maximum reduction in its value;

5. optimization of the capital structure of an industrial manufacturing enterpriseaccording to the criterion of minimizing the level of financial risks;

6. Formation of indicators of the capital structure of an industrial manufacturing enterprise by objectives.

Testing of the regression model for analyzing the optimization of capital structure was carried out at specific agricultural production companies. For this, the informational basis of the assessment was made according to the accounting (financial) statements.

Based on the studies, it was found that the normative value of the coefficient of provision with own funds from 0.1 is not fulfilled. The results are 0.02 in 2016, 0.04 in 2017 and 0.06 in 2018.

In the same way, we note the situation with the coefficient of provision of reserves with our own funds, at a rate of 1.0, in 2016 we got a result of 0.16, in 2017 the result was even lower - 0.15 and in 2018 the result repeated the situation in 2016 making up 0.16.

The value of the financial independence coefficient indicates a very low share of equity in the overall structure of financing sources (0.02 in 2016, 0.05 in 2017 and 0.11 in 2018), although the dynamics is positive.

Negative dynamics is observed according to the results of calculating the maneuverability coefficient from 1.00 in 2016 to 0.51 in 2018, that is, the provision with own working capital decreases.

Analyzing the results of calculating the financial leverage ratio, we note that borrowed capital significantly exceeds equity, namely, 43 times higher in 2016, 19 times higher in 2017 and 8 times higher in 2018,that is, the financial stability of the agricultural production company for the period 2016 - 2018 increases. due to the capitalization of net profit in activities in 2017 - 2018

Positive changes in the level of financial stability also characterize the results of calculating the coefficient of long-term financial independence. Despite the low values of this coefficient in 2016 - 2018, the plus is the positive dynamics from 0.02 to 0.11.

Thus, the industrial manufacturing enterprise needs to continue the course to increase its own capital due to the capitalization of net profit based on the results of activities in each reporting period for the future. Moreover, if in 2016 - 2017. there is a significant increase in liabilities (accounts payable), then in 2017 - 2018. these obligations decreased slightly, although the share of borrowed capital in its total structure is still high - 89% at the end of 2018.

This section shows the financial stability of the industrial manufacturing enterprise, built on the basis of a regression model for analyzing the optimization of capital structures. For this, a scheme of evidence for the practical application of the model was drawn up. Figure 1.

Figure 1

The algorithm for applying the regression model for analyzing the

optimization of the capital structure of a production industrial enterprise

When testing the model, it was recommended that industrial enterprise direct their profits to the development of their activities and increase financial results. This will contribute to the growth of capital and increase its share in the overall structure of sources of financing of industrial manufacturing enterprise.

Based on the regression analysis, we forecasted the profitability indicators of the industrial manufacturing enterprise and determined the regression equation by performing the corresponding calculations in the Statistica 6.0 program using statistical functions.

Table 1

The Results of the regression analysis of indicators

of profitability of production activities

Name of indicator |

Regression equation |

The value of representativeness (R3) |

1 |

2 |

3 |

Return on total capital |

y = 0,022х + 0,124 |

0,311 |

Return on equity ratio |

y = 0,967х + 0,899 |

1,706 |

Leverage ratio |

y = 0,028х + 0,131 |

0,381 |

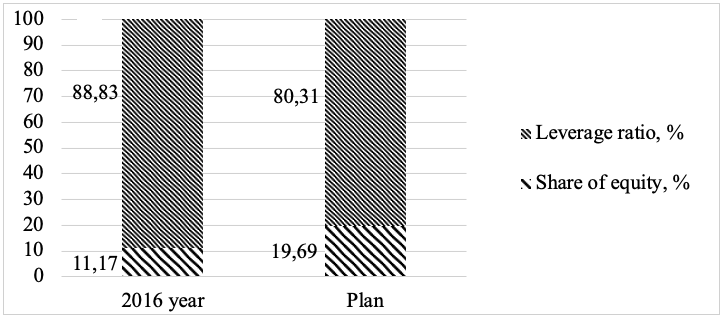

Changes in the capital structure of the agricultural production company in the planning period are presented in Fig. 2.

Figure 2

Capital structure of an industrial manufacturing

enterprise in the planning period

-----

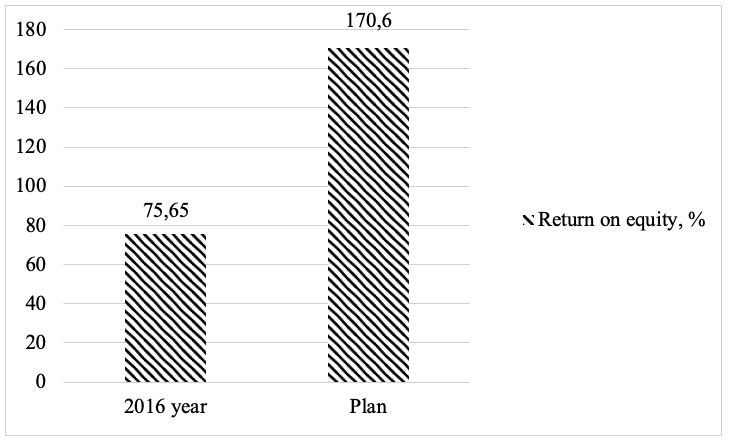

Figure 3

Return on equity of an industrial

manufacturing enterprise

The level of profitability of the aggregate, own and borrowed capital of the industrial manufacturing enterprise in the planning period will increase.

So, in fig. Figure 3 shows the change in return on equity of an industrial manufacturing enterprise, which will increase from 75.65% in 2016 to 170.60% in plan.

Such a significant increase is due to the fact that the amount of net profit will be significant, but, possibly, other expenses of the industrial enterprise will decrease. In addition, due to the capitalization of net profit, the amount of equity will increase.

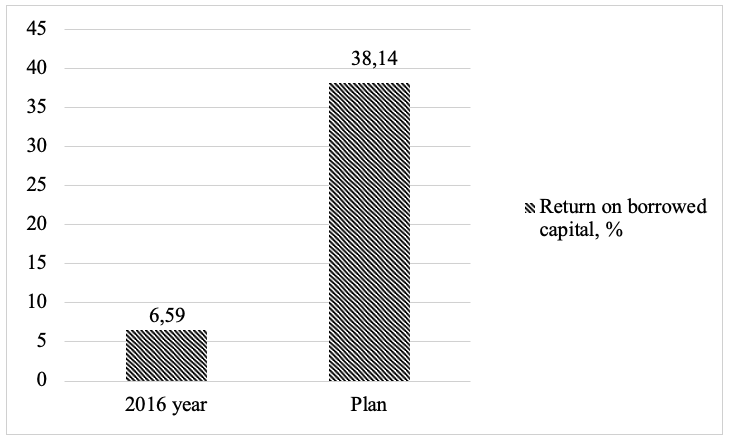

In fig figure 4 presents the results of changes in the profitability of borrowed capital, which will increase from 6.59% after 2016 to 38.14% in the plan.

Figure 4

Return on borrowing capital of an

industrial manufacturing enterprise

Agricultural production will not require additional borrowing in terms of bank lending or a credit line. But due to the postponement of suppliers of raw materials, materials payables will be formed.

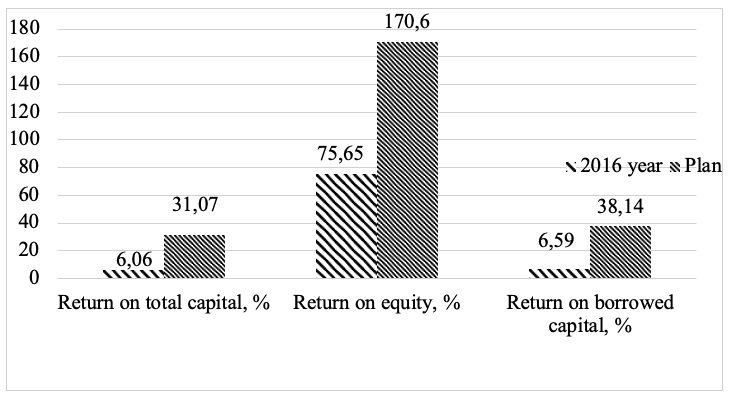

In fig. 5 presents the change in the profitability of the total capital of an industrial manufacturing enterprise.

Figure 5

The profitability of the total capital of

an industrial manufacturing enterprise

In fig. 6 shows the change in all profitability indicators. At the same time, the profitability of total capital and borrowed capital will smoothly change, with a big breakthrough - the profitability of equity (only due to the fact that the amount of equity at the end of 2016 was very small, and the net profit for industrial manufacturing enterprisewas very significant).

Figure 6

Indicators of profitability of capital of

an industrial manufacturing enterprise

In fig. 6 shows the change in all profitability indicators. At the same time, the profitability of total capital and borrowed capital will smoothly change, with a big breakthrough - the profitability of equity (only due to the fact that the amount of equity at the end of 2016 was very small, and the net profit for industrial enterprisewas very significant).

The main result of this work is a regression model for analyzing the optimization of the company's capital structure. The proposed methodology leads to the financial stability of the agricultural company based on the optimization of capital structure. The methodology is based on a model for optimizing the capital structure, built on the basic principles of the concept. This model is of independent interest and has advantages in using its own and borrowed capital:

simplicity of the attraction procedure;

the possibility of capitalizing net profit based on the results of production activities for the year and increasing equity on this basis;

a high share of own sources in the capital structure positively affects the level of financial stability of the industrial enterprise;

the ability to increase the value of the financial potential of the industrial enterprise, if necessary, increase its assets and scale of operations;

the ability to ensure the growth of return on equity due to the effect of financial leverage;

large amounts of borrowed funds in the presence of collateral, surety;

the ability to include the costs of servicing credit debt in the cost of production, which reduces the basis for calculating income tax.

Thus, the procedures of evidence schemes of “financial stability” proposed in this article, built on the basis of a regression model for analyzing the optimization of capital structure for industrial manufacturing enterprise, can be recommended for practical use.

Prosvirina II, Proskurin V.V. (2016) Optimizaciya kapitala predpriyatiya putem minimizacii urovnya finansovyh riskov po dannym buhgalterskoj otchetnosti [Optimization of enterprise capital by minimizing the level of financial risk according to financial statements]. Scientific and Analytical Economic Journal. Nauchno-analiticheskij ehkonomicheskij zhurnal. No. 9 (10), 3 p. (In Russian).

Rudenko А.М. (2014) Upravlenie kapitalom organizacii v usloviyah rynka [Capital management of the organization in market conditions]. Finance and credit. Finansy i kredit. No. 43, pp. 35-38. (In Russian).

Rusanova E.G. (2015) Teorii struktury kapitala: ot istochnikov do Modil'yani i Millera [Theories of capital structure: from sources to Modigliani and Miller]. Finance and credit. Finansy i kredit. No. 42, pp. 44-53. (In Russian).

Khlebnikova, Yu.V., Rakhimov, T.R. (2015) Optimizaciya finansovoj struktury kapitala [Optimization of the financial structure of capital]. National Research Tomsk Polytechnic University. Nacional'nyj issledovatel'skij Tomskij politekhnicheskij universitet. pp. 152-156. (In Russian).

Charaeva M.V. (2015) Optimizaciya struktury kapitala pri osushchestvlenii investicionnoj deyatel'nosti organizacii [Optimization of the capital structure in the implementation of the investment activities of the organization]. Finance and credit. Finansy i kredit. pp. 11-17. (In Russian).

Khabibullina L.R., Yangirov A.V. (2017) Kapital predpriyatiya i optimizaciya ego struktury [Capital of the enterprise and optimization of its structure]. Scientific and practical research. Nauchno-prakticheskie issledovaniya. No. 1 (1), pp. 33-39. (In Russian).

Blank I.A. (2017) Osnovy finansovogo menedzhmenta [Fundamentals of financial management]. Nika-center Elga. 512 p. (In Russian).

Bocharov V.V. (2014) Korporativnye finansy [Corporate Finance]. Peter. 289 p. (In Russian).

Fox M.I. (2014) Obzor modelej teorii struktury kapitala i analiz ih sostoyatel'nosti [Review of models of the theory of capital structure and analysis of their solvency]. Finance and credit. Finansy i kredit. No. 9, pp. 48-55. (In Russian).

Kovalev V.V. (2015) Vvedenie v finansovyj menedzhment [Introduction to financial management]. Finance and statistics. Finansy i statistika. No. 32, 768 p. (In Russian).

Kushnir I.V. (2010) Finansovyj menedzhment [Financial Management]. Finance and Statistics. Finansy i statistika. 768 p. (In Russian).

Nureev R.M. (2014) Kurs mikroehkonomiki [The course of microeconomics]. INFRA-M. no. 9, 562 p. (In Russian).

Gerasimenko OA, Molokova V.I. (2017) Struktura kapitala i vozmozhnosti ee optimizacii [Capital structure and the possibility of its optimization]. Innovation science. Innovacionnaya nauka. No. 3, рр. 154-157. (In Russian).

Gubanova E.V. (2017) Optimizaciya struktury kapitala organizacii [Optimization of the organization's capital structure]. Bulletin of the Voronezh Institute of Economics and Social Management. Vestnik Voronezhskogo instituta ehkonomiki i social'nogo upravleniya. No. 1, pp. 19-24. (In Russian).

Gubanova E.V., Orlovtseva O.M. (2016) Mnogokriterial'naya ocenka ehffektivnosti deyatel'nosti organizacii po dannym buhgalterskoj (finansovoj) otchetnosti [Multi-criteria evaluation of the effectiveness of the organization according to the accounting (financial) statements]. Manuscript. 80 p. (In Russian).

Davydova L.V., Ilminskaya S.A. (2015) Osobennosti formirovaniya struktury kapitala predpriyatiya [Features of the formation of the capital structure of the enterprise]. Finance and credit. Finansy i kredit. No. 47, pp. 42-51. (In Russian).

Kirillov, Yu.V., Nazimko, E.N. (2014) Mnogokriterial'naya model' optimizacii struktury kapitala [Multi-criteria model of capital structure optimization]. Economic analysis: theory and practice. EHkonomicheskij analiz: teoriya i praktika. No. 32, pp. 57-63. (In Russian).

Kirillov, Yu.V., Nazimko, E.N. (2015) Reshenie mnogokriterial'noj zadachi optimizacii struktury kapitala [Solution of the multicriteria problem of capital structure optimization]. Economic analysis: theory and practice. EHkonomicheskij analiz: teoriya i praktika. No. 28 (331), pp. 55-65. (In Russian).

Pinyaeva A.E. (2016) Optimizaciya struktury kapitala predpriyatiya [Optimization of the capital structure of the enterprise]. Politics, economics and innovation. Politika, ehkonomika i innovacii. No. 8 (10), 16 p. (In Russian).

Shokhina L.S., Brykina O.V. (2017) Optimizaciya struktury zaemnogo kapitala predpriyatiya [Optimization of the structure of borrowed capital of an enterprise]. Financial Bulletin. Finansovyj vestnik. pp. 26-33. (In Russian).

1. Doctor of Economics, Professor of the Department of Economics, Management and Law, South Ural State Humanitarian-Pedagogical University (CSPU), E-mail: lysenkoyuv@cspu.ru

2. Doctor of Economics, Professor of the Department of Economics, Management and Law, South Ural State Humanitarian-Pedagogical University (CSPU), Email: dec_eib@mail.ru

3. Doctor of Pedagogical Sciences, Professor, Director of the Professional Pedagogical Institute , South Ural State Humanitarian-Pedagogical University (CSPU)

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License