Vol. 41 (Issue 05) Year 2020. Page 28

USMAN, Elena V. 1 & MIKHAILOVA, Lubov V. 2

Received: 20/11/2019 • Approved: 08/02/2020 • Published 20/02/2020

2. Risks associated with investment projects in the aviation industry

3. Methodology for risk analysis of aviation industry investment projects

4. Comprehensive Indicative Risk Assessment of Aircraft Industry Investment Projects

ABSTRACT: This article develops the technique of complex indicative estimation of factors of risk-influence of investment projects of enterprises of aviation industry. The purpose of the authors is to form a comprehensive risk assessment of investment projects of aircraft building enterprises considering changing environmental factors and specifics of the industry. The theoretical-methodological basis of the problem research is a complex approach that takes into account a variety of factors that determine the complex nature of risks of investment projects in the aviation industry, considering the situational modeling. On the basis of the complex approach, the specific features of risks of investment projects for the enterprises of aircraft building are analyzed, the multistage procedure of the analysis of risk factors is defined, exogenous and endogenous indicators of an estimation of risks of investment projects of the enterprises of the aviation industry are revealed and methods of calculation of an indicator of an integrated estimation are offered and the scale of risks is generated. The model of risk assessment proposed by the authors can be used for assessment of investment projects both for operating aircraft building enterprises and for newly created ones. |

RESUMEN: En el presente artículo se desarrolla una metodología para una evaluación indicativa integral de los factores de riesgo de los proyectos de inversión de empresas de la industria de la aviación. Los autores tienen como objetivo formular una evaluación integral del riesgo de los proyectos de inversión de las empresas de fabricación de aeronaves tomando en consideración tanto factores ambientales cambiantes como las características de la industria. La base teórica y metodológica para el estudio del problema es un enfoque integrado que tiene en cuenta la variedad de factores que determinan la naturaleza compleja de los riesgos de los proyectos de inversión en la industria de la aviación, prestando especial atención al modelado situacional. Sobre la base de un enfoque integrado, se analizan las características específicas de los riesgos de los proyectos de inversión para las empresas de fabricación de aeronaves, se determina un procedimiento de etapas múltiples para analizar los factores de riesgo, se identifican los indicadores exógenos y endógenos para evaluar los riesgos de los proyectos de inversión de las empresas de la industria de la aviación, se desarrollan métodos para calcular un indicador de evaluación integral y se forma una escala de riesgos. El modelo de evaluación de riesgos propuesto por los autores se puede utilizar para evaluar proyectos de inversión tanto para empresas existentes de fabricación de aviones como para empresas recién creadas. |

The uniqueness of investment projects of aviation industry enterprises, which does not allow carrying out risk assessment by analogy, leads to the need to search and improve the methods of research of risk-influence on investment projects. Traditional and modern improved approaches to assessing the risk-influence (Christoffersen, 2003; Batkovsky, Klochkov, Khrustalev, 2018) on the projects of aircraft building enterprises both to increase the innovation potential of the production system and to produce specialized military and civilian products are quite diverse, they have their own advantages and disadvantages, but sometimes give contradictory results. The most frequently used in modern investment design analysis of project sensitivity allows to give only one factor risk assessment of real investment without taking into account the possible correlation of project parameters, which, considering the specifics of aircraft construction, does not give an objective assessment of risks. The application of multifactor regression models also does not give a stable picture of the assessment in the conditions of constantly changing environmental factors. Application of the complex indicative approach will allow improving the system of risk assessment of investment projects of the enterprises of aircraft building, to take into account the specificity of their implementation that will allow reducing losses not only of the enterprise implementing the project, but also of all participants of the project in the future.

Risk assessment of an investment project should take into account a set of factors that determine the specifics of its implementation. Worldwide globalization and informatization implies the development of the sectors of industry, which are keys for the country's economy, high-tech and science-intensive, and also have a great importance for the strategic security of any state, including the aviation industry. Furthermore, the globalization requires a systematic and objective justification of the significance of various assumed challenges of the present and specific problems of aircraft building enterprises (Arsenieva, Sazonov, Mikhailova, 2018).

The research of the global market of military aircraft building and aerospace industry has shown that the total projected income of all the enterprises of the world (their number amounted to 1888) in 2019 will be more than $244 bn. Russian aviation enterprises occupy a large segment of the world market of military aircraft building, but a very insignificant segment in the market of civilian products. At the same time, the global passenger transportation market is steadily growing, with a combined average annual growth rate (CAGR) of 4.4% over the next 20 years. By 2038, the annual growth rate of revenue passengers kilometers (RPK) in the Middle East will be 5.4%; in the Asia-Pacific region, 5.5%; in Latin America, 5.1%; in Africa, 4.7%; in Europe - 3.7%; in the Commonwealth of Independent States (CIS), 3.4%; and in North America, 2.7%. Global air transport demand will be more than double by 2038, reaching almost 18 trillion RPKs. The Asia-Pacific region will be the largest market, accounting for 38% of the world's RPKs. Europe and North America will produce 37% of the required air transport.

High dynamism of the world aircraft industry development, high competition in dynamic markets (Thompson, Strickland III, 2003) and innovativeness and complexity of the modern external environment require a special approach to risk assessment of real investment projects. Investment projects of aircraft building enterprises have a significant number of specific features: high capital intensity, high scientific intensity (as a result of the special complexity of the industry's products, its operation and after-sales service conditions), low level of project liquidity, special requirements to technological parameters and industrial safety and high innovative component, as well as greening of production, which implies both the use of resource-saving technologies and production of resource-saving products. In other words, the general tendency of the world aircraft building enterprises for a long period of time is further tightening of existing high technical, economic and environmental requirements (reliability, efficiency, reduction of fuel consumption, reduction of noise and hazardous emissions, etc.). All of these characteristics are additional risk factors that require special consideration in the assessment system.

The conditions of the project implementation, as well as the need to implement a reasonable and flexible strategic management (Dzhamay, Vnuckov, Mikhailova, 2017) determine the approaches to the assessment of efficiency and risk. If we are talking about the scheme of "enterprise-project", the risk assessment is carried out for a specific project based both on the analysis of cash flows of the aircraft manufacturer implementing the project and the cash flows of the project participants. If the investment project is implemented at an existing aircraft building enterprise, it is necessary to study the impact of risk on the enterprise, that is, not only the risk of a particular project, but also the change of risk factors of the enterprise itself as a result of the project.

Let's define the main specific features of risks of investment projects of aircraft building enterprises:

- complexity of environmental factors implying a multi-criteria system of risk assessment;

- very high volume of required investments, which makes it necessary to increase their efficiency;

- long payback period of the projects, leading to the growth of liquidity risk;

- increased premium to the risk discount rate for investment projects, taking into account the specifics of innovation activity;

- design and technological peculiarities of both military and civilian profile products and the production system as a whole, which determine high technological risks;

- need for risk analysis in the scheme "project at the operating enterprise" taking into account the maximum allowable indicator of risk capacity and the possibility of implementing a portfolio of real investments;

- consideration of various sources of financing in the system of risk assessment of projects on cash flows of participants;

- necessity to consider qualitative parameters of risk assessment;

- high level of concentration of borrowed capital, and consequently, high risk of loss of financial stability;

- long production cycle and, as a consequence, high operational risks;

- special requirements for project manageability and related personnel risks.

The listed specific features of risks of aircraft construction companies determine the necessity to develop a multistage analysis and assessment procedure.

The method of risk assessment of investment projects of the aircraft building enterprise by the indicative method, offered by the authors, includes a certain sequence, conditions and rules of analysis. Let's consider the stages of analysis.

The process of identification of risks of the investment project of the aircraft building enterprise assumes drawing up the list of the basic kinds of risk which can influence company activity as a result of realization of the investment project. The limiting parameter for the further analysis of the project is the risk appetite of the company that is the amount of risk which the management of the enterprise and its owners consider acceptable for achievement of strategic goals (Kanashchenkov, Novikov, Veas Iniesta 2019).

Stage condition: risk-influence factors of macro-environment and micro-environment are studied.

Stage rule: no acceptable risks are taken into account, which entail insignificant losses for the enterprise with low probability of realization.

Restrictive factors may have a significant direct and indirect impact on the enterprise. The direct limiting factors for risk parameters are the payback period, investor's requirements to the profitability of the project, the volume of financing, and the volume of sales. An example of the formation of risk restrictions is presented in Table 1.

Stage condition: project is accepted for the further analysis in case of passing the boundary of acceptability.

Stage rule: system of restrictions is determined based on the specifics of the industry, the market and a specific point in time.

Table 1

Example of risk-restriction

system formation

Indicator |

Acceptable risk |

Risk boundary |

Unacceptable risk |

Payback period |

Less investor requirements |

Fulfill investor requirements |

More investor requirements |

Internal rate of return (IRR) |

More than industry average |

Corresponds to industry average |

Less tan industry average |

Sales |

Less than expected demand |

Meets expected demand |

More than expected demand |

Funding |

Less than expected total funding |

Equal to expected total funding |

More than expected total funding |

Stage condition: if the investor is not defined, i.e. the requirements on the profitability level of the investment project are not known, the final assessment should be carried out according to the internal rate of return (IRR) criterion. If an investor is identified, the choice can be made on the basis of the net present values (NPVs), subject to risk limits. Investment risk criteria are presented in Table 2.

Table 2

Investment risk criteria

Indicator |

Acceptable risk |

Risk boundary |

Unacceptable risk |

Resistant risk |

Risk parameters |

Selection |

NPV |

>0 |

=0 |

0 |

- |

CF, r |

Max |

Profitability index (PI) |

>1 |

=1 |

<1 |

>1,2 |

CF, r |

Max |

IRR |

>r |

=r |

<r |

>r at 15-20% |

CF |

Max |

Discount payback period (DPP) |

<LC |

=LC |

>LC |

- |

CF, r |

Min |

Here LC is the life cycle of the project; CF is the cash flow of the investment project.

Stage rule: analyzing projects under conditions of inconsistency of value indicators, making a choice according to Fisher's criterion may lead to selection of a project that is unstable in terms of risk. Therefore, the selection of a project should be based on the Fisher's rule based on the NPV criterion only if the IRR and PI indicators of the project are risk-resistant (Usman, Bochkareva, 2015). In the case of equity financing, the final selection can be made on the basis of the PI criterion.

Sensitivity assessment of the project allows identifying the most critical factors that can have a significant impact on the change in value indicators.

Stage condition: key indicator of the project's value should be identified to serve as the basis for assessing the project's risk sensitivity. As a rule, the elasticity coefficient is estimated based on the percentage change in NPV in relation to the percentage change in the factor. However, the use of the indicator is possible only if the investor's requirements to the profitability of the project are known. If no investor is identified, the IRR is used.

Stage rule: if the factor elasticity coefficient is higher than one, special attention should be paid to further study of the factor, as the risk factor influence is high and the risk factor can be defined as critical. If the elasticity coefficient is less than one, the risk for this factor is acceptable.

An additional stage to the sensitivity analysis can be the study of the scenario development of events, which implies modeling of situations depending on environmental factors. In the process of modeling, pessimistic, basic and optimistic scenarios of development are developed (Novikov, 2019).

Stage condition: compliance with the requirements of the baseline scenario, namely:

- application of moderately pessimistic forecasts of technical and economic parameters of project formation and factors of economic environment (political, legal, economic, social);

- positive value of cumulative cash flow balance for extended time intervals (e.g. annual or quarterly);

- compliance with the boundaries of the project value criteria;

- availability of financial feasibility reserve.

Stage rule: calculation of the project's integral value indicator based on the key criterion (formula 1).

Interpretation of the obtained results is carried out according to the following principles:

- If the obtained value of the integral effect of NPV is positive, the risk of the project is acceptable;

- If the integral effect was calculated using IRR, the excess of the discount rate value characterizes the acceptable risk of the project.

In order to clarify the calculation parameters, it is necessary to use the coefficient of variation of the criterion value as the ratio of the standard deviation of the criterion value to the integral value indicator, expressed as a percentage. If the coefficient of variation of the project development scenarios exceeds 25%, therefore, the project risk is high. The average risk of the project is determined by the intermediate interval value of the coefficient of variation from 10 to 25%.

In case the probability of the situation development cannot be estimated, the Gurvitsa coefficient λ should be used for uncertainty conditions, taking into account only the extreme outcomes of each alternative.

Stage condition: project is risk-resistant if the expected integral effect is positive.

Stage rule: risk assessment is carried out on the basis of cash flows of each participant on the basis of development scenarios.

Stage condition: project is risk-resistant if the level of risk is acceptable to all project participants.

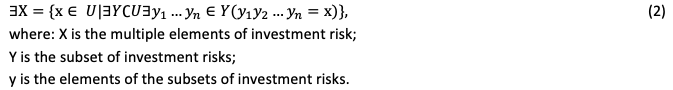

The specificity of investment risk assessment is that this risk is complex, involving many risks, each of which in turn has a significant number of subsets, which are also complex (formula 2).

Considering the specifics of the company's activity, the nature and scope of the project, the project's focus on the domestic or foreign market, the selection of indicators for evaluation should be based on the following rules:

- number of indicators is limited by the expediency of their calculation;

- indicators should not duplicate or be inverse;

- indicators should be as informative as possible.

A multistage analysis scheme allows identifying and clarifying the risks significant for investment projects and carrying out their preliminary analysis.

Risk assessment of investment projects of aircraft building enterprises by indicators assumes compliance with the following basic principles:

- Principle of consistency is the study of quantitative and qualitative indicators.

- Principle of importance: determination of weighting of each indicator.

- Consistency principle: exclusion of inverse values of indicators from the evaluation system.

- Principle of multicriteria: inclusion of endogenous and exogenous risk criteria into the evaluation system.

- Principle of uniqueness: the choice of significant criteria for the analysis of the project, taking into account the specifics of its development and implementation.

Let's present the sequence of risk assessment by indicators.

The structure of key risk factors of investment projects of aircraft building enterprises includes endogenous (internal) risks and exogenous (external) risks.

In general, the composition of key endogenous risks of investment projects of aircraft building enterprises is presented in Table 3.

The list of endogenous indicators can be significantly expanded and determined on the basis of investor requirements, taking into account the specifics of specific projects. In particular, the lack of consideration of marketing risks and their detailed analysis may lead to additional losses for companies. An example of this is the launch of MC-21, the start of serial production of which was planned for 2017. However, insufficient study of the market and requirements for modern performance has led to the need for significant improvements in the project.

Table 3

Composition of key endogenous risks of

investment projects of the aviation industry

Impact level |

Multiple-risk characterization |

Multiple-risk elements of risk subset |

Endogenous risk |

Risk of deterioration of the financial condition of the enterprise in connection with the implementation of the project |

Risk of loss of financial stability and independence of the enterprise; liquidity risk; risk of loss of solvency |

Innovation risk |

Research and development (R&D) risks; patentability risk; commercialization risk |

|

Personnel risk |

Risk of outflow of highly qualified personnel; risk of insufficient qualification of personnel |

|

Production risk |

Reduction of production volumes; risk associated with failures of production processes, violation of technology and operations; risk of injuries and deterioration of employees' health |

|

Risk of unreliability of project participants |

Risk of unfairness of participants; risk of insolvency of project participants |

|

Resource risk |

Risk of increasing resource costs (material, investment, stock) |

Exogenous components may include analysis of market, environmental, industrial, social and country risks (Table 4).

Table 4

Composition of key exogenous risks of investment

projects of aviation industry enterprises

Impact level |

Multiple-risk characterization |

Multiple-risk elements of risk subset |

Exogenous risks |

Market risk |

Price risk; interest rate risk; currency risk; inflation risk |

Environmental risk |

Risk of landscape damage; risk of energy pollution; risk of industrial waste generation; risk of noise pollution; risk of water pollution; risk of air pollution |

|

Industry risk |

Risk of growth of intra-industry competition; risk of entry barriers; risk of technological changes in the industry; risk of low profitability of the industry, etc. |

|

Social risk |

Strike risk, labour dispute risk |

|

Country risk |

Political risk; economic policy risk; economic and structural risk; liquidity risk, etc. |

It should be noted that the composition of country risk elements may vary, depending on the calculation methodology used. In Table 4, the structure of country risk is determined on the basis of the Economist Intelligence Unit calculation methodology. The choice of the country risk assessment method is determined by the counterparty country in the foreign economic activity system (Dmitriev, Novikov, 2019).

Indicators for the assessment of risk factors are determined on the basis of relative indicators, rating estimates and expert forecasts.

Criteria for endogenous and exogenous indicators are presented in tables 5 and 6, respectively.

The complexity of complex evaluation of endogenous indicators is that a number of them are statistical in nature. Block Y1 has a current character, requires analysis in dynamics and in case of exceeding the critical value of liquidity ratios, it is necessary to carry out an additional assessment of cash flow liquidity.

Block Y2 characterizes the indicators of innovation risk, determined on the basis of basic indicators of the degree of innovation of products and can be supplemented by an assessment of the total costs of R&D by sources of funding, as well as qualitative information, including the time spent on research and development, the level of qualification and experience of personnel engaged in R&D, etc.

Particular care should be taken in assessing the indicators of block Y4. If the overall occupational injury rate exceeds the industry average, the project should be adjusted or the project should be abandoned.

The value of average industry indicators should be given at the time of development of the investment project, which will make it possible to consider the current state of the industry. Similar requirements are imposed on the due diligence index for block Y5. The source of information may be the SPARK Interfax data, grouped by type of activity. In case of implementation of local projects, it is advisable to use adjusted average industry data for the region.

It should be taken into account that if the indicators of blocks Y7, Y8 go beyond the critical parameters of the assessment, the project implementation should be abandoned.

Table 5

Criteria for endogenous indicators

Indicators |

Name of the subset of indicators |

Elements of the indicators of the subset of investment risks |

Critical value of risk |

Minimum risk |

Block Y1 |

Indicators of deterioration of financial condition in connection with the implementation of the project |

Autonomy coefficient |

Average industrial value of the indicator |

Maximum value of the indicator in the industry |

Current liquidity ratio |

1 |

2 |

||

Solvency loss Ratio |

1 |

Maximum sectoral value of the indicator |

||

Block Y2 |

Indicators of innovation risk |

Share of new products in total production |

1 |

0 |

Share of products sold in new markets |

1 |

0 |

||

Share of R&D funding in total funding |

1 |

0 |

||

Block Y3 |

Personnel risk indicators |

Security factor by type of project work (for each type) |

1 |

0 |

Share of employees over 50 years of age |

1 |

0 |

||

Staff turnover rate |

1 |

0 |

||

Block Y4 |

Production risk indicators |

Technical efficiency indicator |

1 |

0,5 |

Total occupational injury rate coefficient |

Maximum industry average |

0 |

||

Block Y5 |

Risk of unreliability of project participants |

Due diligence index for each participant |

99 |

1 |

Block Y6 |

Due diligence index for each participant |

Resource security for each process |

0 |

1 |

-----

Table 6

Criteria for exogenous indicators

Indicators |

Name of subset of indicators |

Indicators elements of subset of investment risks |

Critical risk value |

Minimum risk |

Block Y7 |

Market risk indicators |

Value at risk (VaR) by risk type |

Critical loss value for the company (VaR loss ratio is 0.5) |

Permissible risk value (VaR loss ratio is 0.1) |

Block Y8 |

Indicators of environmental risk |

Indicator of environmental risks associated with failure to comply with environmental requirements |

Average industry value of the indicator |

0 |

Block Y9 |

Indicators of sectoral risk |

Integral indicator of sectoral risk |

100 |

0 |

Block Y10 |

Social risk |

Probability of strikes |

1 |

0 |

Probability of labour disputes |

1 |

0 |

||

Block Y11 |

Country risk indicators |

Economist Intelligence Unit risk rating |

50 |

0 |

The comprehensive indicator assessment is carried out using Formula 3:

Wi is the weight value of the indicator, determined by the expert method (the total value of the weightings should be equal to units of weight).

The rules for calculating scores by indicator are as follows:

- If Yi goes beyond the critical assessment of the indicator, the assessment for this indicator is assigned a value of zero. Each situation is analyzed separately and a further decision is made on the feasibility of the project.

- If Yi goes beyond the optimal assessment for the indicator, the assessment for this indicator is assigned a unit value (e.g. for block Y1).

Compliance with these rules will help to achieve comparability of indicators on the one hand, and to identify additional high-risk areas on the other hand.

The rules for determining the indicator weighting are as follows:

- Indicator weights are determined by the expert method based on the opinions of a group of specialists formed in accordance with the risk blocks identified in the projects.

- Final group assessment of the block is determined on the basis of summing up individual expert assessments adjusted for the degree of competence of each expert.

- Competence of the experts may be determined on the basis of the analysis of the level of consistency of their assessments with the group assessment.

If the R value is greater than 0.9, the project risk is therefore low. The project can be implemented with a minor adjustment for the discount rate risk (within 5%).

With an R value of 0.6 to 0.9, the project has an acceptable risk. Depending on the significance of the indicators, the risk adjustment for such projects may range from 5 to 15%.

If the R value is less than 0.6, the project must be substantially adjusted. In case of implementation with the conditions of acceptance of the identified risks - the correction for the project risk may be up to 20%.

If the value of the indicator is close to zero - the project should be abandoned.

The complex nature of risks associated with investment projects in the aviation industry requires the development of a special, comprehensive approach to risk assessment, which includes:

use of single-factor and multi-factor methods of assessment;

application of qualitative and quantitative characteristics of risk factors;

early identification of projects with unacceptable risk;

comprehensive assessment by indicators;

scale of risks of integrated assessment.

As a result of the research the authors developed a model of risk assessment of investment projects of the aviation industry on the basis of a comprehensive indicative approach. The proposed model allows taking into account quantitative and qualitative assessments, endogenous and exogenous factors, to obtain a comprehensive assessment that has a numerical interpretation and risking scale. The level of risk identified by the results of the analysis can be reduced in the process of managing the development and implementation of investment project management on the basis of the measures provided for in the business plan of the investment project.

Arsenieva N.V., Sazonov A.A., Mikhailova L.V. (2018). Analysis of structure of innovative capacity of the enterprise on the example of the aviation industry. Bulletin of University (State University of Management. 8, 38-41.

Batkovsky A.M., Klochkov V.V., Khrustalev E.Yu. (2018). Assessment of Investment Project Risks in Aviation. Digest Finance. 23(2), 142-149.

Christoffersen P.F. (2003). Elements of Financial Risk Management. New York: Academic Press.

Dmitriev O.N., Novikov S.V. (2019). Verification of Feasibility Studies at High-Technology Enterprises. Russian Engineering Research. 39(9), 780-781.

Dzhamay E.V., Vnuckov Yu.A., Mikhailova L.V. (2017). Methods of enterprise investment activity financing. Bulletin of Moscow Region State University. Series: Economics. 3, 169-174.

Kanashchenkov A.I., Novikov S.V., Veas Iniesta D.S. (2019). Technology formation of the mission of micro-level management enterprise in aviation. IOP Conference Series: Materials Science and Engineering. 537(4), 1-6.

Novikov S.V. (2019). Peculiarities of training of high-tech enterprise specialists under the modern conditions. IOP Conference Series: Materials Science and Engineering. 537(4), 1-7.

Thompson A.A., Strickland III A.J. (2003). Strategic Management: Concept and Cases. Boston: McGraw-Hill/Irwin.

Usman E.V., Bochkareva T.N. (2015). Assessment of investment efficiency in the coal industry. Mountain magazine. 12, 33-36.

1. PhD, Associate Professor, Moscow Engineering Physics Institute (MEPhI), Russia, Moscow, E-mail: elenusman@rambler.ru

2. PhD in Economics, Associate Professor, Moscow Aviation Institute (MAI), Russia, Moscow, E-mail: lubov999999@mail.ru

[Index]

revistaespacios.com

This work is under a Creative Commons Attribution-

NonCommercial 4.0 International License