Vol. 40 (Issue 42) Year 2019. Page 11

BOSE, Binoy K. 1; PATRA, Anita 2; DASH, Sisir R. 3 & BHUJABAL, Bijay 4

Received: 25/07/2019 • Approved: 03/12/2019 • Published 09/12/2019

ABSTRACT: Motivated by the regulatory changes undertaken in India through the banking system for enhancing access of people to financial services, this study investigates relationship of financial inclusion with economic growth. It has drawn its conclusions from empirical evidences collected from beneficiaries of inclusive policies in a chosen district of the country. Using statistical hypothesis testing procedures like t-Test and ANOVA for inferential analysis, it has been found that financial inclusion has significantly positive relation with growth and poverty alleviation. |

RESUMEN: Motivado por los cambios regulatorios realizados en la India a través del sistema bancario para mejorar el acceso de las personas a los servicios financieros, este estudio investiga la relación de la inclusión financiera con el crecimiento económico. Ha extraído sus conclusiones a partir de evidencias empíricas recopiladas de beneficiarios de políticas inclusivas en un distrito elegido del país. Utilizando procedimientos de prueba de hipótesis estadística como t-Test, Z-Test y ANOVA para el análisis inferencial, se ha encontrado que la inclusión financiera tiene una relación significativamente positiva con el crecimiento y el alivio de la pobreza. |

It all started in the 1960s in Indian economy when policy makers of the country realized that financial inclusion can be used as a tool for enhancing economic growth. The country was highly under banked during the sixties as banking was concentrated only in cities and major towns. Hence, the way banks were getting managed in Indian economy was considered insensitive to the actual needs of the society (Nayak, 2014). That is why this issue of banking was getting politically a hot debate and soon became a part of political attention during those years. The first step for providing services to unbanked areas of the country was taken by Reserve Bank of India (RBI) in 1965 by liberalizing norms of branch-licensing and starting to put focus on rural areas. Later on it became the foundation stone of bank nationalization, but the commercial banks were reluctant to work in this direction till RBI forced them to do so. In fact, it was the eighth Governor of RBI Lakshmi Kant Jha only who first of all talked about discouraging branch expansion in urban areas while addressing the Bombay bankers in 1967. After this meeting, the representatives of commercial banks told the Governor unofficially that they will definitely work in this direction provided if RBI will keep on putting checks on their competitors and foreign banks. Since Jha had already observed that foreign banks kept on concentrating on port towns only to make profits and licensing to new banks is already in the hands of RBI, he agreed to it. After a week of this happening, he recommended to open more branches in comparatively smaller places instead of urban areas in a policy note to the then finance minister of India Morarji Desai. It is only after this event that the expansion of banking services even in the most unbanked areas of the country started getting done though in a phased manner. Due to the initiatives of Jha only that the commercial banks were insisted to open new branches in a ratio of 2:1 between banked and unbanked areas. But still banking in the unbanked areas across the country was not getting improved rapidly. And because of the pressures from syndicate members of the ruling Congress party, the then honorable prime minister of India Indira Gandhi was forced to nationalize 14 banks who were controlling over 70 percent of the deposits in the country (www.forbesindia.com). The bank nationalization of 1969 had been undertaken with the implementation of Banking Companies Ordinance (Acquisition and Transfer of Undertakings) on July 19. 1969. This enabled the banks to channelize credit to agriculture and small and medium enterprises in a better manner. There has been a noteworthy expansion of bank branches in rural areas as the figure rose from a mere 8261 in 1969 to 65621 by the year 2000. But the policy also resulted much delegated regulation and the shareholders of the nationalized banks including Government itself have made a lot of negative returns on investments. Probably that is why as per the Nayak Committee Report appointed by RBI; enactment of a Companies Act. may allow nationalized banks function in a better manner.

RBI’s financial inclusion agenda includes provision of universal access to services in banking and improvement of credit delivery system that is too with special focus on people who are in weaker sections of the economy. Additionally, the needs of the most productive sectors in Indian economy specifically agriculture, micro, small and medium enterprises has to be taken into account at the time of policy formulation and implementation related to financial inclusion by RBI. For this purpose there are three major strategies adopted by RBI that includes: 1) provision of new products, 2) relaxation in RBI guidelines and 3) introduction of other supporting measures (www.rbi.org).

During the last one decade, RBI has not only made a strong policy approach towards financial inclusion in the country, but also it has made the following policy interventions (www.rbi.org).

Now, after such optimistic interventions by the Indian Govt. through its central bank RBI for promoting inclusive growth in the economy the question that arises is ‘has financial inclusion initiatives led to growth and poverty alleviation or not’.

In this context many researchers in the country have tried to answer the question on financial inclusion vis-à-vis growth and poverty alleviation. In one of the study the researchers investigated the actual scenario of the Pradhan Mantri Jan Dhan Yojana accounts and found out that the average balance in all these accounts are considerably low and a significant proportion of them are not getting operated at all. So, if we will consider this scenario then it can be concluded that the project did not achieve much because financial inclusion does not only stand for opening bank accounts but also it should give access to credit to the account holders from formal sources (Sinha and Azad, 2018). One of the study sconsidered the period 1980 to 2014 and the annual time series data on variables like: number of bank branches in proportion to 1,000 adults, number of deposit and credit account from scheduled commercial banks in proportion to 1,000 adults, amounts of deposits and credits as ratio of GDP, number of bank employees as the ratio of bank branches have been considered for analysis. By application of principal component analysis (PCA), autoregressive distributed lag (ARDL) and at the end error correction model (ECM) it has been found in the study that there is positive correlation between financial inclusion and economic growth in the short run as well as in the long run (Lenka and Sharma, 2017). Then in another research initiative a study with the main objective of assessing whether financial inclusion can become responsible for poverty reduction or not got conducted. The results of the study revealed that the participants or beneficiaries of this scheme could actually improve their standard of living and reduce multidimensional poverty (Khaki and Sangmi, 2017). Another major finding of this study is that the scheme is not able to reduce deprivation specifically to ‘education’. Additionally, it has been found that the scheme is targeting non-poor sections more instead of absolutely poor category of population. Similarly there are many other studies reviewed in this context [see Saxena and Anand, 2017; Ghosh, 2017; Yadav and Sharma, 2016; Lenka and Bairwa, 2016] and in each of the studies it has been discovered by the researchers that there is a positive relationship between financial inclusion and economic growth.

Most of the studies discussed in the above section have used secondary data at country level or state level but not district level. However, there are a few primary research studies found which concentrate at district level analysis but still they are either focused on perceptual mapping of people regarding financial inclusion or concentrated on services of Self Help Groups (SHGs). There is no study found done at district level and considering the roles of banks and SHGs simultaneously on economic growth. That is why probably while describing about the impact of financial inclusion on economic growth of people often the authors have been found to be couched in ‘soft’ statements like: ‘it seems that’, ‘one is lead to believe that’, ‘it is likely that’ etc. This shows that most of the past researches are not absolutely certain about their findings and the present study is an attempt to fulfill this gap.

The problem statement of the present study is: ‘macroeconomic evidence indicates that financial inclusion has a positive correlation with economic growth over a long period of time; so it is also worthy to take a measurement of this correlation’. A district level analysis at a state like Odisha to explore positive correlation between financial inclusion and economic growth based on empirical evidences to formulate concrete conclusive statements has not been found in the review of extant literature. The present study is an attempt to fulfill this research gap. The central bank of our country which is popularly known as Reserve Bank of India (RBI) has its regional office for the state of Odisha at Bhuabaneswar only and that is why Khordha district has been always a place for first experimentation for programmes related to financial inclusion and many other programmes undertaken by RBI. Hence, Khordha district has been purposively taken in the present study.

The need for developing a structured quantitative questionnaire was felt in order to collect the primary data in empirical phase of research in the present study. The objective was to verify whether financial inclusion has positively influenced the socio-economic life of people in the chosen district of Khordha or not. The following is the description of components in the questionnaire.

Total Number of Sections: three i.e. Screener, Demographic Profile, Economic Status Before and After Financial Inclusion,

Total Number of Constructs: three i.e. Economic Status Now, Economic Status Before Opening Bank Account, Economic Status before Joining SHG,

Total Number of Items in Each Construct and Scale Used for Measurement:

Construct 1: Economic Status Now: three items in terms of assets and Dichotomous Scale used in the form of Yes/No where Yes = 01 and No = 00

Construct 2: Economic Status Before Opening Bank Account: three items in terms of assets and Dichotomous Scale used in the form of Yes/No where Yes = 01 and No = 00

Construct 3: Economic Status Before Joining SHG: three items in terms of assets and Dichotomous Scale used in the form of Yes/No where Yes = 01 and No = 00

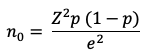

Even if the size of the population is not necessary to determine sample size, but since this information is available in the present case it has been used to compute the size of sample. In such a scenario, for the purpose of determining the sample size a pilot study got conducted with 60 numbers of respondents (who are not included in the main study) and the data generated from it got used for determining the sample size. The responses have been sought with regard to economic growth due to financial inclusion in terms of peoples’ agreement on it. The sample size has been determined using the “sample size determination for a proportion method”. If we denote the sample size by n0 the formula for estimating it can be represented as:

Where;

Z = Desired level of confidence

p = True proportion of success (people agreeing that economic growth has been achieved because of financial inclusion)

e = Error permitted

In order to adjust the sample size for the population by application of correction factor, the actual sample size (n) is calculated as per the following:

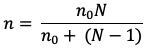

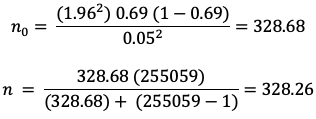

Since in most of the literatures reviewed in the present study 95% level of confidence has been taken, the sample size here also got estimated at 95% confidence level with a permitted error of 0.05 (5%). The ‘p’ has been defined here as the proportion of respondents agreeing that financial inclusion has an impact on economic growth in their lives. The opinion on the agreement or disagreement of people regarding impact of financial inclusion on economic growth has been taken from the pilot study.

As per the census of India 2011, the total number of households in Khordha district is 4, 89, 636 out of which 2, 47, 940 are living in rural areas while 2, 41, 696 are living in urban areas. The total number of households availing banking services in Khordha district is 255, 059 (52.09%) out of which 85, 345 (34.42%) are in rural areas while 169, 714 (70.22%) are in urban areas. N is referred to the population. Here, the number of households availing banking services in the study area of Khordha district has been taken as the population. Hence, Z = 1.96 (95% confidence level), e = 0.05 and p = 0.69 is applied in the equation to estimate the sample size.

The actual sample size is estimated as 329. Since the households are either in rural areas or urban areas, as per their proportionate size the sample has again got divided.

Table 1

Sample size

(Source: Researcher’s Distillation)

Household |

Sample Size |

Bank A/C |

SHG |

Total (489636 = 100%) = |

329* |

165 |

164 |

Rural (247940 = 51%) = |

168 |

84 |

84 |

Urban (241696 = 49%) = |

161 |

81 |

80 |

‘*’ total simple size |

|||

From the review of extant literature, the following research questions have been formed that are needed to be answered in the present study;

1. Have the financial inclusion initiatives led to economic growth in Khordha district?

2. If economic growth due to financial inclusion has at all happened in Khordha district, has it happened uniformly across demographic segments of the society?

The overall objective of the present study is to establish a relationship between financial inclusion and economic growth and the specific objectives of the study are as per the following:

1. To analyze the current status of financial inclusion in Khordha district.

2. To explore whether financial inclusion initiatives have led to economic growth in Khordha district.

3. To assess whether economic growth led by financial inclusion in Khordha district has happened uniformly across demographic segments.

The following null (H0) and alternative (H1) hypotheses have been formulated in the present study which will be tested in the next chapter:

1. H0: There is no significant economic growth led by financial inclusion in Khordha district.

H1: There is significant economic growth led by financial inclusion in Khordha district.

2. H0: The economic growth led by financial inclusion in Khordha district does not significantly differ across demographic segments.

H1: The economic growth led by financial inclusion in Khordha district significantly differs across demographic segments.

As per the review of extant literature having a valid bank account or membership in SHG are indicative of financial inclusion. So, here there has been no ambiguity and in the present study also these two have been accepted as indicators of financial inclusion. But, for economic growth the major indicators considered in the literature are: Gross Domestic Product (GDP), Gross National Product (GNP), productivity, spending, reduced unemployment, income and wages, Consumer Price Index (CPI), currency strength etc. Now, here there are a few problems in taking into account these indicators. The problem is that when we talk about financial inclusion at national level, state level or district level it is not an event, rather it is an ongoing process. So, it is not possible to demarcate a time period before financial inclusion and a time period after financial inclusion at national level, state level or district level since it is an ongoing process and not an event. But, at individual level if opening a bank account or having membership in SHG will be considered as indicators of financial inclusion then it is an event only because there remain always a date of opening a bank account or having membership in SHG. One can easily take the period before this date as period without FI intervention and period after this date as period with FI intervention. And that is what has been done in the present study. The data on financial inclusion at individual level has been taken through structured questionnaire and since the present study is aimed at discovering the functional relationship between financial inclusion and economic growth, the indicators on economic growth needs also to be taken at individual level and not national, state or district level. Now, when we look at GDP, GNP, and CPI as indicators of economic growth, these indicators are never computed at individual level. However, information on the indicators like reduced unemployment, income and wages can be captured at individual level. But, again these are ever fluctuating. Unemployment, income and wages may go on fluctuating over the considered period of time and since collection of information through structured questionnaire is always memory based, reliable information may not get captured. Hence, after discussions with experts it has been found that possession of assets can be taken as an indicator of economic status and thereby consequently economic growth. Here, it has been assumed that increment in possession of assets indicates improvement in economic status and thereby economic growth.

There are three types of analysis i.e. reliability analysis, descriptive analysis and inferential analysis on the basis of which conclusions have been drawn in the present study. In reliability analysis the Chronbach’s Alpha value has been taken as the measure of predictability. For descriptive analysis arithmetic mean, range, standard deviation and variance have been taken for describing the nature of data. As part of inferential analysis Z Test and t Test have been conducted.

In Table 2, it can be it can be seen that there two control characteristics chosen in this study: geography and FI intervention type. The geography of the respondents has been categorized as: rural and urban while the FI intervention type has been categorized as: bank A/C and bank A/C and SHG. From Table 2, it can be easily seen that 51% of respondents in the sample are living in rural areas and rest 41% are from urban areas. Similarly, out of the total sample size half i.e. 50% are bank a/c holders while the rest half i.e. 50% are having bank a/c as well as SHG membership.

Table 2

Sample profile of respondents (n = 329)

(Source: Primary Data)

Control Characteristics |

Category |

Frequency |

Percentage |

Geography |

Rural |

168 |

51% |

Urban |

161 |

49% |

|

FI Intervention Type |

Bank A/C |

165 |

50% |

Bank A/C & SHG |

164 |

50% |

|

Variables |

Category |

Frequency |

Percentage |

Age |

19-30 |

85 |

26% |

31-60 |

207 |

63% |

|

>60 |

37 |

11% |

|

Gender |

Male |

274 |

83% |

Female |

55 |

17% |

|

Marital Status |

Married |

308 |

94% |

Unmarried/Divorced |

21 |

6% |

|

Family Size |

<=5 |

237 |

72% |

5+ |

92 |

28% |

|

Occupation |

Labourer |

145 |

44% |

Small Business |

130 |

40% |

|

Others |

54 |

16% |

|

Education |

No Formal Education |

31 |

9% |

<=10 |

155 |

47% |

|

10+ |

143 |

44% |

|

Servicing Bank |

Public Sector Bank |

323 |

98% |

Private Bank |

6 |

2% |

The test of reliability is generally done through a popular statistical tool ‘Cronbach’s Alpha’ for measuring the degree of consistency among items under consideration. If different variables under consideration are having high degree of correlation, it means that they are measuring the same construct and they are contributing to the overall construct. When reliability is measured by Cronbach’s Alpha, by convention a lenient cut off of 0.65 is acceptable in empirical research. And, in the present study when the data got tested for reliability, it yielded a Cronbach’s Alpha score ranging from 0.68 to 0.85 which is much better than the reliability score obtained in the pilot study. The inter-item correlations are also found to be high which means that the items under consideration are measuring the same underlying construct. The overall reliability of the research instrument in terms of Chronbach’s Alpha is equal to 0.738579785 which is much more than the lenient cut off of 0.65. Then the Chronbach’s Alpha values for different constructs taken in the questionnaire namely: economic status now, economic status before bank a/c, economic status before SHG, carrying 30, 30, and 30, items respectively. It has been found that the constructs under consideration are having reliability scores of 0.687764837, 0.731816685, and 0.715873685, respectively which are also more than the generally acceptable cut off of 0.65. It shows overall fitness as well as segment wise fitness of the 90 items questionnaire.

Descriptive statistics analyzed on interval and ratio scale data generally include the measures of location, variability and shape. In the present study, for first three constructs proportion has been taken and for the last two constructs arithmetic mean has been taken as a measure of location because it is a rigidly defined average and most suitable for further statistical treatments like hypothesis testing. Then range, standard deviation and variance have been computed for studying the variability only for the last two constructs. The descriptive analysis here has been carried out only after proper cleaning of the raw data obtained in the survey.

Now, the question is whether a normal distribution can be assumed or not. Since most of the theoretical distributions in statistics like Binomial, Poisson, Beta, Gamma, t, F, χ2, etc. conform to normal distribution for large values of n, we can use the normal test of significance for large sample (Gupta, 2011). However, for small n, usually less than 30, the exact sample tests are used. In the present study since we have taken sample more than 30 i.e. large sample for each of the groups/classes, we have adopted the large sample test as the measure of testing the hypothesis which can be computed.

Once the debate on type of theoretical probability distribution to be assumed for the set of data in hand is over, now let us discuss the descriptive statistics of each of the constructs. The constructs in a social research like the present study are proposed attributes of respondents that often cannot be measured directly but can be assessed using a number of indicators or manifest variables.

Inferential analysis uses statistical tests to see whether a pattern we observe is due to chance or due to the program or intervention effects. Research often uses inferential analysis to determine if there is a relationship between an intervention and an outcome as well as the strength of that relationship. Testing of hypothesis is a major inferential analysis undertaken in the present study through various phases so that the underlying research questions can be answered.

t – Test: Paired Two Samples for Means: The first task in the present study is to find out whether there is a significant increment in possession of assets listed in the questionnaire among the respondents after FI intervention through bank accounts and SHG membership compared to before FI intervention. For this purpose, “The Before-After Approach” has been followed in which the possession of assets before FI intervention and the possession of assets after FI intervention have been compared. And in order to detect any significant change between these periods vis a vis possession of assets, difference between the means method is the most ideal one. One of the most robust statistical techniques in this context i.e. paired t-test for difference of means has been employed in this study to determine the significance of difference between possession of assets before FI intervention and possession of assets after FI intervention. It has been found that since the inherent job in this study is to test a predefined hypothesis, an appropriate method of hypothesis testing would be ideal to implement. For this purpose, t-Test: Paired Two Sample for Means has been chosen. One can use a paired test when there is a natural pairing of observations in the samples, such as when a sample group is tested twice — before and after an experiment. This analysis tool and its formula perform a paired two-sample Student's t-Test to determine whether observations that are taken before a treatment and observations taken after a treatment are likely to have come from distributions with equal population means. This t-test form does not assume that the variances of both populations are equal. In this case, the treatment is FI intervention through bank accounts and SHG membership and we are required to study the mean value of the chosen indicators before FI intervention and after FI intervention. The t-Test: Paired Two Sample for Means works as follows: For example, Mr. X opened a bank account in his name in 2014 under the most optimistic financial inclusion campaign of the country popularly known as Pradhan Mantri Jan Dhan Yojna after which his ownership of some new assets got witnessed and if we will take it as an event then we can consider the possession of assets before 2014 as economic status without FI intervention and possession of assets after 2014 as economic status after FI intervention. The t-Test: Paired Two Sample for Means require equal number of observations in both samples and that is why if we take 30 selected assets before FI intervention then we are required to take the same 30 assets after FI intervention. The mean values of selected variables (which are assets in the present case) in pre intervention period and post intervention period are then has to be compared by calculating the t-value and then comparing it with the critical value of t at the given degrees of freedom and chosen significance level (0.05 in this case). The null and alternative hypotheses taken in the present analysis can be stated as follows:

Null Hypothesis - H0: There are no significant differences in possession of assets before FI intervention and after FI intervention.

Alternative Hypothesis - H1: There are significant differences in possession of assets before FI intervention and after FI intervention.

Table 3

Test: Paired two samples for means (n = 329)

(Source: Primary Data)

Variables |

Before (Mean) |

After (Mean) |

t |

Df |

Sig. |

air conditioner |

0.00 |

0.02 |

2.009 |

328 |

.045* |

air cooler |

0.02 |

0.03 |

1.737 |

328 |

.038* |

all Pucca Residence |

0.17 |

0.29 |

6.259 |

328 |

.000* |

almirah, dressing table |

0.52 |

0.61 |

5.841 |

328 |

.000* |

bedstead |

0.63 |

0.77 |

7.209 |

328 |

.000* |

bicycle |

0.56 |

0.70 |

6.710 |

328 |

.000* |

camera & photographic equipment |

0.01 |

0.01 |

2.009 |

328 |

.045* |

carpet, daree & other floor mattings |

0.03 |

0.05 |

5.945 |

328 |

.000* |

chair, stool, bench, table |

0.84 |

0.94 |

6.249 |

328 |

.000* |

clock, watch |

0.85 |

0.96 |

6.864 |

328 |

.000* |

electric fan |

0.80 |

0.93 |

4.608 |

328 |

.000* |

electric iron, heater, toaster, oven & other electric heating appliances |

0.25 |

0.31 |

3.850 |

328 |

.000* |

foam, rubber cushion (dunlopillo type) |

0.28 |

0.33 |

3.958 |

328 |

.000* |

Lantern, lamp, electric lampshade |

0.33 |

0.38 |

8.748 |

328 |

.000* |

mobile phone handset |

0.71 |

0.93 |

1.737 |

328 |

.038* |

motor car, jeep |

0.02 |

0.04 |

14.825 |

328 |

.000* |

motor cycle, scooter |

0.24 |

0.64 |

3.037 |

328 |

.003* |

musical instruments |

0.03 |

0.05 |

2.670 |

328 |

.008* |

furniture & fixtures (couch, sofa, etc.) |

0.06 |

0.09 |

4.357 |

328 |

.000* |

other machines for household work |

0.23 |

0.29 |

2.009 |

328 |

.045* |

personal computer |

0.01 |

0.02 |

6.047 |

328 |

.000* |

pressure cooker/pressure pan |

0.44 |

0.54 |

1.416 |

328 |

.008* |

radio |

0.02 |

0.03 |

5.415 |

328 |

.000* |

refrigerator |

0.14 |

0.22 |

3.562 |

328 |

.000* |

sewing machine |

0.09 |

0.13 |

6.447 |

328 |

.000* |

suitcase, trunk, box, handbag and other travel goods |

0.82 |

0.93 |

2.009 |

328 |

.045* |

tape recorder, CD player |

0.01 |

0.02 |

8.833 |

328 |

.000* |

television |

0.57 |

0.77 |

2.670 |

328 |

.008* |

VCR/VCP/DVD |

0.01 |

0.03 |

2.859 |

328 |

.005* |

washing machine |

0.02 |

0.05 |

2.009 |

328 |

.045* |

‘*’ Significant at 0.05 Level Note: Hypothesis Tested@0.05 Level of Significance |

|||||

From Table 3, it is evident that the null hypothesis has been rejected in all the cases. It means it has been statistically proved that there are significant differences in possession of assets before FI intervention and after FI intervention. The implementation of t-Test: Paired Two Sample for Means tells about the presence or absence of significant differences between sample mean values. Hence, the student’s t test has given answer of the question whether the average possession of selected assets has significantly changed in the post FI intervention period or not.

Two-way ANOVA: For the purpose of understanding the effect (if any) of control characteristics or other variables on the economic status (before and after), Analysis of Variance (ANOVA) has been implemented in the present study on the scores in terms of number of assets possessed for economic status. There are two control characteristics maintained under the quota sampling followed in this study. They are: geography (rural and urban) and FI intervention type (bank a/c and bank a/c with SHG membership). Apart from these control characteristics, there are seven other variables: age, gender, marital status, family size, occupation, education and servicing bank which can put impact on the responses. And in order to testify whether these control characteristics and variables have any effect on the responses or not first of all it is necessary to form the null and alternative hypotheses. The following are the null and alternative hypotheses that have been formed to be tested through application of ANOVA. Let us consider the hypotheses for the first construct i.e. economic status of people (before and after). Now, the question is whether one way or two way ANOVA ideally should be applied in this case and the answer is ‘two way ANOVA’. It is because there are two variables in the present construct i.e. economic status which is affecting responses of people. First of all, individually the control characteristics or variables under consideration and secondly the before and after effect is also present on possession of assets. Hence, in order to study the effects of these two variables and their interaction effects, the two way ANOVA has been applied that revealed the following results. It is noteworthy here that equal weight age for each of the assets possessed by respondents have been given while running two way ANOVA for analysis.

In TABLE – 3. 3, the results of two way ANOVA run for the first construct i.e. economic status has been presented. As per the table, considering the two control characteristics geography and FI intervention type it has been found that geography has a significant impact on economic status of people while the economic status is not significantly different on the basis of FI intervention type. In rural areas, the economic growth of people due to financial inclusion has been significantly more as compared with in urban areas as revealed by results of two way ANOVA. The impact of FI intervention type i.e. bank a/c or bank a/c and SHG membership is insignificant on level of economic growth due to financial inclusion. For each of the control characteristics, the interaction effect with before and after economic status has also not been found significant. Additionally, it has also been verified that the before and after effect is significant in both the cases.

Table 4

Two way Anova (n = 329)

(Source: Primary Data)

Control Characteristics |

|||||

Source |

Computed F |

Sig. |

Source |

Computed F |

Sig. |

Geography |

FI Intervention Type |

||||

Before and After |

44.80 |

0.000* |

Before and After |

82.81 |

0.000* |

Geography |

88.58 |

0.000* |

FI Intervention Type |

0.091 |

0.763 |

Interaction Effect |

0.10 |

0.748 |

Interaction Effect |

0.064 |

0.800 |

Variables |

|||||

Source |

Computed F |

Sig. |

Source |

Computed F |

Sig. |

Age |

Gender |

||||

Before and After |

51.45 |

0.000* |

Before and After |

36.63 |

0.000* |

Age |

5.10 |

0.006* |

Gender |

6.30 |

0.012* |

Interaction Effect |

0.093 |

0.911 |

Interaction Effect |

1.36 |

0.243 |

Marital Status |

Family Size |

||||

Before and After |

0.914 |

0.339 |

Before and After |

69.11 |

0.000* |

Marital Status |

0.033 |

0.968 |

Family Size |

15.01 |

0.000* |

Interaction Effect |

0.133 |

0.875 |

Interaction Effect |

0.014 |

0.907 |

Occupation |

Education |

||||

Before and After |

84.35 |

0.000* |

Before and After |

49.69 |

0.000* |

Occupation |

35.02 |

0.000* |

Education |

25.12 |

0.000* |

Interaction Effect |

0.82 |

0.438 |

Interaction Effect |

0.511 |

0.600 |

Servicing Bank |

|

|

|||

Before and After |

5.85 |

0.016* |

|

|

|

Servicing Bank |

0.65 |

0.419 |

|

|

|

Interaction Effect |

0.00 |

0.987 |

|

|

|

‘*’ Significant at 0.05 Level Note: Hypothesis ested@0.05 Level of Significance |

|||||

After the control characteristics, seeing the results of two way ANOVA for other variables in Table 4, it revealed that the before and after effect is significant in all the cases except marital status. And interaction effect is insignificant in all the cases. Hence, it can be interpreted that marital status does not have any significant impact on economic growth of the people due to financial inclusion. Additionally, servicing bank i.e. whether the bank is public or private does not matter or not significantly influencing the economic growth of people due to financial inclusion. Apart from it all other variable including age, gender, family size, occupation and education has been found to be significantly impacting economic growth of people by financial inclusion.

The deductions of the present study has been shown in Table 5 where the research questions and their answers deducted out of the study has been given and research hypotheses and their deducted results has been shown.

Table 5

Deductions of the study

(Source: Primary Research Findings)

Research Questions Answered |

||

Sl. No. |

Research Questions |

Answers |

1 |

Have the financial inclusion initiatives led to economic growth in Khordha district? |

Yes, the financial inclusion initiatives led to economic growth in Khordha district. |

2 |

If economic growth due to financial inclusion has at all happened in Khordha district, has it happened uniformly across demographic segments of the society? |

No, though there are a few demographic variables like FI intervention type, marital status and servicing bank found to be not significantly impacting economic growth led by financial inclusion, still there are a other demographic variables like geography, age, gender, family size, occupation and education which are found to be significantly impacting economic growth led by financial inclusion. |

As per the key findings of the study, it has been statistically proved through empirical evidences that there has been significant interventions from the side of the Government for financial inclusion in Khordha district and because of these financial inclusion initiatives a significant economic growth led by financial inclusion has happened in the district. But, as per the study economic growth led by financial inclusion has not happened uniformly across demographic segments. Rural population, people in younger age group, male, well educated and mostly with small businesses as their occupation have been benefitted most by the FI intervention. Though there are many positive signs in this, still it cannot be ignored that female population and those who are less educated have not been benefitted more. Hence, the first policy implication of the present study is to empower women to take the benefits of financial inclusion and consequently witness economic growth. It is hereby suggested to focus more on women masses for inclusive growth at policy level. Secondly education has cropped up as one of the major hindrance in economic growth led by financial inclusion. Hence, it is also suggested that if the role of financial inclusion in economic growth can be taught at school level then more people can be benefitted of inclusive growth.

Ghosh S. (2017), Did MGNREGS improve financial inclusion? Economic and Political Weekly, 52 (12).

Khaki A. R., Sangmi M. (2017), Does excess to finance alleviates poverty? A case study of SGSY beneficiaries in Kashmir valley, International Journal of Social Economics, 44 (08).

Lenka S. K. , Bairwa A. K. (2016), Does financial inclusion affect monetary policy in SAARC countries?, Cogent Economics & Finance, 04, 01 – 08.

Lenka S. K., Sharma R. (2017), Does financial inclusion spur economic growth in India?. The Journal of Developing Areas, 51 (03), 215 – 228.

Nayak G. (2014), Financial inclusion: It all started in the 1960s, The Economic Times,25/06/2014.

Saxena D., Anand S. (2017), A study of the impact of technology based financial inclusion initiatives by Indian commercial banks to reach out to unbanked consumers of Delhi NCR, India, IJMBF, 06 (01), 04 – 13.

Sinha D., Azad R. (2018), Can Jan Dhan Yojana achieve financial inclusion?, Economic and Political Weekly,53 (13).

Yadav P., Sharma A. (2016), Financial inclusion in India: an application of TOPSIS, Humanomics, 32 (3), 328 – 351.

http://www.forbesindia.com/article/independence-day-special/economic-milestone-nationalisation-of-banks-(1969)/38415/1 accessed on 27/01/2019

https://rbi.org.in/scripts/NotificationUser.aspx?Id=10339&Mode=0

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=9688&Mode=0

Monetary Policy Statement of April 2011, www.rbi.org

Report on Trend and Progress of Banking in India 2015 – 16, www.rbi.org

Gupta, S. C. (2011). Fundamentals of Statistics, Himalaya Publishing House, New Delhi

1. Fellow Chartered Accountant (FCA). Professor cum Chief Financial Officer (CFO) of Centurion University of Technology and Management, Odisha, India. e-mail: binoy.bose@cutm.ac.in

2. Ph. D. (Management). Professor cum Registrar of Centurion University of Technology and Management, Odisha, India. e-mail: anita@cutm.ac.in

3. Ph. D. (Management). Assistant Professor at Centurion University of Technology and Management, Odisha, India. e-mail: sisir.dash@cutm.ac.in

4. Ph. D. (Management). Professor cum Dean at Centurion University of Technology and Management, Odisha, India. e-mail: bijay.bhujabal@cutm.ac.in