Vol. 40 (Number 34) Year 2019. Page 24

DUBSKAYA, Oksana S. 1 & BOEVA, Kseniya Y. 2

Received: 25/06/2019 • Approved: 30/09/2019 • Published 07/10/2019

ABSTRACT: In the era of new technologies, there was an expansion of the use of Internet resources for everyday purposes, in the area of finance, crypto-currency has become such an innovation. The aim of the research is to study country-specific circulation of crypto-currency of different types in order to identify the potential directions for the development of crypto-market. As a result, the determinants of the development of the crypto-currency market were identified, as well as the factors constraining them. |

RESUMEN: En la era de las nuevas tecnologías, la utilización de los recursos de Internet para fines cotidianos ha aumentado, y la criptomoneda se ha convertido en una innovación financiera. El objetivo del estudio es examinar las características nacionales del funcionamiento de las criptomonedas de diferentes tipos a fin de identificar las posibles líneas de desarrollo del mercado de criptomonedas. En consecuencia, se identificaron los factores determinantes de la evolución del mercado de criptomonedas, así como sus limitaciones. |

Modern e-technologies have formed a new model of financial market based on activation of electronic payment systems and currency (Tetereva , 2016). Positive trends in the development of crypto-currency market are directly connected with a number of internal and external factors among which ecological factor is rather distinct (Trubnikova , 2014). However; it should be mentioned that crypto-currency has peculiarities of creation and use due to national special features (Xin & Chong , 2017). This fact is the main impulse for the growth in different types of crypto-currency markets. Author’s approach to the research is based on the study of crypto-currency special features in mutual dependency of retrospect experience and actual functioning of crypto-currency markets that will help to formulate the conclusions about potential trends of alternative digital currency development (Enyi & Le, 2017; Vakhrushev & Zheleznov, 2014).

Methodological framework of the research is formed by the authors in accordance with specifically prepared theoretical and concept basis that consist of scientific works of Russian and foreign researchers in the area of alternative monetary recourses (Akhmedov, Akhmetova, & Nilova, 2017; Vakhrushev & Zheleznov, 2014; Ivanova & Sysolyatina , 2016; Urlapov , 2014; Xin & Chong , 2017; Enyi & Le, 2017). Theoretical and methodological recommendations of scientific society on issues concerning the establishment, development and actual crypto-currency market dynamics were studied.

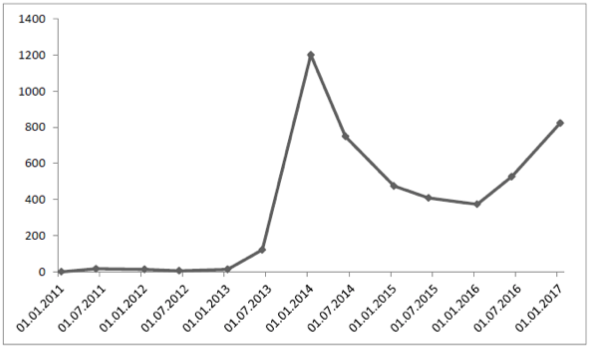

The value of crypto-currency is formed of components which are not traditional for fiat currency. Decentralization and absence of direct regulators allows preventing artificial volatility of crypto-currency and to ensure its “square deal” or fare rate in currency exchange. Initial value of digital currency includes the used electricity cost. Secondary value is influenced by the demand which, in case of crypto-currency, can be of three types: 1) investment (purchasing of crypto-currency for capitalization of monetary resources); 2) for purchasing goods and services; 3) commission-free transaction of crypto-currency to another account (or less than 0.1 %). Given nuances directly influence the fluctuations of digital currency market value and the dynamics of crypto-currency Bitcoin exchange rate which underwent significant changes in the period from 2011 till 2017 (Forget about the volatility of Bitcoin , 2017). At the beginning of the period the value was defined as a correlation of electricity production expenditure to the number of created coins, and was a minor amount. Later on has started depending on the following market factors: demand and supply on specialized exchanges, economic and political changes, different types of provocative information, introduction of legal restrictions and regulation assumptions (Figure 1).

Figure 1

The dynamics of Bitcoin exchange rate, US dollars.

(Forget about the volatility of Bitcoin , 2017)

The figure shows that during the first two years the rate was steady, which was 100$ per coin, after that a dramatic growth up to 1200$ can be seen and a less significant drop until 2016. Presently, the growth phase can be seen, which is characterized by a steady crypto-currency value growth and a regular demand increase from large businesses as well as the public.

Table 1

Comparative analysis of crypto-currencies

according to data available on March 01, 2017.

Name of currency |

Volume of currency in circulation |

Revenue per month at the exchange rate on 01 March 2017 |

Discrepancy with Bitcoin |

Bitcoin |

$1,256 million |

119 $ |

Benchmark |

Litecoin |

$ 61 million |

157 $ |

31% more remunerable then benchmark |

Namecoin |

$ 5.7 million |

10 $ |

92 % less remunerable then benchmark |

PeerCoin |

$ 5.6 million |

131 $ |

9 % more remunerable |

FeatherCoin |

$ 2.9 million |

329 $ (rating leader) |

173 % more remunerable (leader) |

Terracoin |

$ 1.5 million |

170 $ |

42 % more remunerable |

The most widely used types of crypto-currency, there are over 80, are Bitkoin, Litecoin (2011), Namecoin (2011), PPCoin (2012), Quark (2013) (Tetereva , 2016).

Table 2

Capitalization of the most popular

crypto-currencies on March 01, 2017

Name of currency |

Capitalization, US $ |

Price, US $ |

Bitcoin |

18 892 606 211.00 |

1 165.89 |

Ethereum |

1 541 053 511.00 |

17.21 |

Dash |

306 132 515.00 |

42.80 |

Ripple |

247 289 066.00 |

0.006611 |

Litecoin |

188 928 324.00 |

3.77 |

Monero |

178 439 235.00 |

16.67 |

Ethereum Classic |

116 222 501.00 |

1.30 |

Nem |

85 297 680.00 |

0.009478 |

Evolution of digital money depends on technological progress and high demand for electronic clearances and payments because they are fast and more convenient. Therefore, it should be mentioned that there are prospects for the development of related areas which can ensure maximum level of security of e-payments using blockchain technologies and cryptographic means (Forget about the volatility of Bitcoin , 2017).

Crypto-currencies exchange rate is difficult to predict as it is formed according to the demand (its volume depends on how many services and goods can be bought for Bitcoin), supply (volume is strictly limited), crypto-currency parity, available uses. In this aspect currency resembles gold: it is not collateral, volume is limited. Occasionally, exchange fluctuations reach 25%, it negatively affects crypto-currency use for trading transactions and leads to speculative trading (Tetereva , 2016).

For example, 5 December 2013, the price for one Bitcoin increased up to 1.141 US $, and then fell by 67% (364 US$) by October 3, 2014 (Ivanova & Sysolyatina , 2016).

Currently, volatility of crypto-currency Bitcoin decreased to 5%, at the same time gold volatility is about 1.2%, major global currencies volatility is from 0.5 to 1%. According to the forecasts of consulting company Chappuis Halder&Co by 2019 crypto-currency volatility will have become equal with fiat currencies volatility (Bucquet, 2018).

The dependency of e-payments and crypto-currency on technical and technological processes is obvious. Furthermore, prospects for virtual payment systems growth within individual country have become indicators of the level of social and economic development. The integration of world virtual crypto-currency market is at the stage of active development and growth, involving vaster areas of virtual world. In connection with this, a number of specific nuances of digital money should be mentioned, both positive and negative.

Positive points of payments in crypto-currency, that are intrinsic for the cashless payments, are the following:

-The absence of savings in “stockings” and attracting investment in the economy;

-Significant reduction of processing, holding and recovery expenses of bank-notes and coins;

-Secure transparency and security of payments for all market agents;

-In compliance with specific conditions certain tax collection rate can be achieved.

Among the negative points of crypto-currency can be highlighted the following:

-Fiat character of crypto-currency;

-Bitcoin issue is strictly limited;

-New possibilities and instruments for black markets functioning and tax evasion;

-New money laundering schemes;

-High volatility of crypto-currency rate (influence of news crypto-currency, including governmental statements in different countries) (Trubnikova , 2014).

Table 3

The peculiarities of crypto-currency

use in different countries

Countries |

Distinctive features of Bitcoin use |

Great Britain |

- Leader in the area of blockchain project and crypto-currencies; -There are no legal regulation on security tokens and ICO; - Dealing on currency conversion and mining are not liable to VAT (although high rates on income taxes and capital gains tax). |

Sweden |

- Since 2013 Bitcoin is considered a currency; - Mining income is considered in Sweden an employment income and is liable to tax according to tariff of 3% from earned profit. Trading activity is also liable to tax; - The possibility of substituting genuine money for digital is being considered. |

Germany |

- Crypto-currency is a legal payment means; - To exercise commercial activity connected with this crypto-currency it is necessary to possess a special permission (license); - A user, who is buying with crypto-currency, will pay only VAT. |

Denmark |

- FSA does not recognize Bitcoin as a currency; - Official crypto-currency markets function in the country, among which is popular CCEDK, Bitcoin-startups are being actively registered and developed. |

Spain |

-Until 2014 legal status of Bitcoin was not determined, Crypto-currency was considered “digital goods” or “things” in the framework of Civil Code (barter business); - From 20 September 2016 in Spain there is a law according to which mining is considered “economic activity”; - Crypto-currency can be exchanged in Spain without special Bitcoin- automated cash points or exchange market. |

USA |

- Salary payments in crypto-currency is liable to federal income tax and payroll tax; - In March 2013 FinCEN stated that transactions connected with any crypto-currency exchange to fiat money should be regulated as operations of fiat money exchange. |

China |

- Bitcoin is a «virtual commodity»; - Any operations connected with crypto-currency are prohibited for banking institutions and their employees, for citizens there is no prohibition. |

Singapore |

- At the beginning of January 2014 it emerged that Singapore taxation authorities would treat operations with Bitcoins as operations liable to tax on goods and services. |

The history of crypto currency use in Russia has a negative character as it used to have no holistic statutory regulations for digital finances; therefore it slowed the process development and market growth. However, at present the strategy of Russia concerning crypto-currencies has changed fundamentally and digital currencies are perceived now as a promising trend in economics. The Central Bank and connected departmental agencies are now developing common understanding about the status of crypto-currencies, means for their regulation and control (Ivanova & Sysolyatina , 2016).

The study of general trends in the crypto-currencies development allowed defining following results:

-The level of capitalization as at the date of research has been defined; it provides information on the level of competitiveness of individual types of digital money on the world market;

- The overview of the current state of rules and regulations and tax adjusting on nationwide level allowed defining the level of regulatedness and recognition of digital money market;

-For the development of crypto-currency market in Russia the following recommendations:- can be underlined: to allow legal buying and selling of crypto-currency in Russia; - research the processes connected with turnover and functioning; - development of Bitcoin embedding in economic activities of the country; - international discussions of necessary modifications to economic processes.

During discussion of the results received in this research with specialists in the area of the crypto-currency industry, comparison of results of relevant researches and allied industries of knowledge vision of the further scientific direction of the organizational and applied plan which consists in studying of a social role of crypto-currencies as alternative means of payment was created. This research will have an organizational and applied character which will focus on social role of crypto-currency as an alternative payment means. Therefore, despite the given disadvantages of crypto-currency, this specific type of digital money is an important instrument with such advantages as: low transaction commissions, possibility of micropayments, impossibility of sanctions and influences from third party.

Positive effect of crypto-currency development and introduction, which is a competitor to traditional banking institutions and financial instruments, can be provided in three conclusions. These conclusions can significantly effect the international economic development:

Firstly, it has become clear, that the existence of free, decentralized, uncontrolled currency is possible. This currency has a significant security from excessive control and abusive activity of different regulators and issuing centres.

Secondly, it is obvious, that the presence of banking agents as intermediators for financial transactions between counterparts is not a necessary condition any more. These actions are possible with insignificant time loss and at low financial costs because it is possible not to use issuing centres and operator banks.

Thirdly, the existence of decentralized currency leads to the equality between citizens of different countries in the area of crypto-currency industry. Crypto-currency offers them an opportunity for direct transborder investment activities «peer-2-peer» (p2p) of any means without commission losses on operators and without insurance regulatory charges.

Akhmedov, F. I., Akhmetova, A. R., & Nilova, A. D. (2017). Economic Forum ''Economics in a Changing World". Evolution of money in Russia:crypto-currency (pp. 200-203). Kazan: Kazan (Volga region) Federal Universaty.

Bucquet, P. (2018, October 18). Les banques ont un rôle à jouer pour amener les crypto-monnaies, au même niveau de services que les actifs traditionnels. http://analysefinanciere.org/2018/11/05/les-banques-ont-un-role-a-jouer-pour-. Analyse financiere, 1.

Enyi , J., & Le, N. (2017). The Legal Nature of Cryptocurrencies in the US and the Applicable Rules. SSRN, 5.

Forget about the volatility of Bitcoin . (2017, Feb 8). Insider Pro, pp. https://ru.insider.pro/investment/2017-02-08/zabudte-o–volatilnosti-bitkoina .

Ivanova, V. A., & Sysolyatina , E. V. (2016). Science of the XXI century: problems, search, solutions. Materials of the XL scientific and practical conference. Cryptocurrency: the concept, the possibility of introduction into the Russian economy (pp. 107-112). Miass: Geotour.

Tetereva , E. N. (2016). Crypto-currency in modern infrastructure: pros and cons. Education and Science without Borders: Social and Human Sciences(4), 105-109.

Trubnikova , E. I. (2014). Is crypto-currency a tool of shadow schemes or a monetary system of a free society? . Vestnik of Samara State University, 6, 151-157.

Urlapov , P. S. (2014, December 23). Crypto-currency in the economy of the Russian Federation: positive and negative sides. http://mpra.ub.uni-muenchen.de/60838/ (accessed 13 March 2018). MPRA Paper. https://mpra.ub.uni-muenchen.de/id/eprint/60838, pp. 1-7.

Vakhrushev , D. S., & Zheleznov, O. V. (2014). Crypto-currency as a phenomenon of modern information economy: problems of theoretical understanding . Naukovedenie, 5(24), 1-9.

Xin, L., & Chong , A. W. (2017). The technology and economic determinants of cryptocurrency exchange rates: The case of Bitcoin. Decision Support Systems, 118-121.

1. FSAEI HE ‘Southern Federal University’ Rostov-on-Don, Russian Federation Rostov-on-Don, Stachki street 200/1, Russia dubskaaoksana7@gmail.com

2. FSAEI HE ‘Southern Federal University’ Rostov-on-Don, Russian Federation Rostov-on-Don, Stachki street 200/1, Russia