Vol. 40 (Number 34) Year 2019. Page 22

SCHAEFER, Jones L. 1; DOS SANTOS, Leonardo M. A. L. 2; DA SILVA, Aline R. 3; FAVA, Leandro P. 4; DE MORAES, Jaqueline 5; RUHOFF, Augusto 6; DA COSTA, Matheus B. 7 & SCHREIBER, Jacques N. C. 8

Received: 21/06/2019 • Approved: 24/09/2019 • Published 07/10/2019

ABSTRACT: This research purpose is to present a Competitiveness Assessment Method (CAM) for business association managers. The steps are: (i) context identification, (ii) decision tree modeling, (iii) survey preparation, (iv) data collection and treatment, (v) application of multicriteria method, and (vi) ranking of rates obtained. To test the method, a case study is presented. Results provide a reference for evaluating competitiveness of Business Associations in Rio Grande do Sul, Brazil. Simulations performed confirm the functionality of the CAM. |

RESUMEN: Esta pesquisa objetiva apresentar um Método de Avaliação da Competitividade (MAC) para gestores de associações empresariais. Etapas são: (i) identificação do contexto, (ii) modelagem da árvore de decisão, (iii) preparação da pesquisa, (iv) coleta e tratamento de dados, (v) aplicação do método multicritério e (vi) classificação das taxas obtidas. Para teste, é apresentado um estudo de caso. Os resultados fornecem referência para avaliar competitividade nas Associações Empresariais no Rio Grande do Sul, Brasil. Simulações realizadas confirmam funcionalidade do MAC. |

Competitiveness, as a concept and strategy, was popularized by Porter in 1980 and remains a relevant topic to governments, academia, and businesses (Bhawsar and Chattopadhyay, 2015). Competition between some companies encourages the development of strategies aimed at achieving market advantages (Nara et al., 2013), however this fierce globalized market presents obstacles for them. The high competitiveness index and the oscillations, to the influence of the external and internal market, make the organizations have at their disposal concrete information on the actual financial expenses of manufacturing, so that the process of strategic management and decision making happen in a way efficient (Costa et al., 2015).

The union of members from the business field constitute the Business Associations (BAs) (Dür and Mateo, 2013). The connection between government and business aims to increase regional competitiveness by increasing local development (Kingsbury and Hayter, 2006), because the BAs help companies in their interaction needs with the environment where they are inserted, as well as a back up of technical, financial, and commercial information.

Díaz-Chao et al., (2016) recommended a model and a practical tool for measuring and managing the competitiveness of small network enterprises. Kucherenko et al., (2016) proposed a method for the evaluation of intersectoral competitiveness in industries. Siluk et al., (2017), have indicated a model in which a comparative evaluation is performed between business suppliers.

The focus of this research were BAs from different countries. E. Costa et al., (2017) investigated the support provided by industrial BAs to small and medium-sized enterprises in Portugal for internationalization. Battisti and Perry (2015) explored the benefits and motives driving micro and small enterprises in New Zealand to join trade and industry associations. Newbery et al., (2015) analyzed the benefits sought by members of local BAs in the north of England.

Therefore, the purpose of this research is to present the Competitiveness Assessment Method (CAM) for BAs managers. This proposed method seeks to establish, in an organized way, a way to measure the competitiveness of BAs. Most of these researches investigate the companies’ view on BAs; thus, this research is novel in that it is to present a CAM for BAs managers.

The 6 steps of the CAM will be detailed below.

In this step, it will be investigated the existing literature by going through terms in databases and through document analysis. Additionally, it was necessary to identify the stakeholders of the sector analyzed.

The decision tree represents a decision process in a graphical and chronological way, indicating the phases to be performed to achieve the desired goal (L. F. A. M. Gomes and C. F. S. Gomes, 2012).

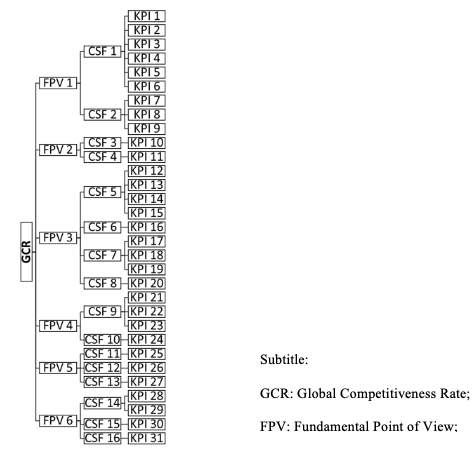

The Elementary Points of View (EPVs) break down a Fundamental Points of View (FPV) allowing an adequate analysis of the potential actions’ performance from the point of view being considered (Ensslin et al., 2001). The EPVs can be broken down into Elementary View SubPoints (sub-EPVs), which then become the subcriteria (Ensslin et al., 2001). In this research, the EPVs include the Critical Success Factors (CSFs) and the sub-EPVs include the Key Performance Indicators (KPIs). An example of a generic decision tree is shown below in Figure 1

Figure 1

Generic decision tree modeling

Figure 1 shows that Global Competitiveness Rate (GCR) is the objective; the KPIs are components of CSFs, which in turn belong to the FPVs.

The relevant aspects in assessing potential actions are considered as FPVs, (Ensslin et al., 2001). Generally, an FPV is formed by a set of correlated EPVs (Bana e Costa et al., 1999). The level following the FPV is the CSF.

The CSFs consist of areas in a company or project that are critical to its success (Jahangirian et al., 2017). They are used to administer, verify, and monitor the actions necessary to achieve results (Milichovský and Hornungová, 2013).

The use of KPIs is the most efficient method to monitor the performance of organizations (Sofiyabadi et al., 2016). KPI is a measurable quantity used to classify or compare performance against strategic and operational goals. The managers should focus on a set of KPIs rather than a few or just one to enable better observation of perspectives (Sofiyabadi et al., 2016). However, the choice of indicators is not a simple task due to the complexity of the measurable areas (Milichovský and Hornungová, 2013). In summary, KPIs aligned to the objectives and in adequate quantity allow a correct monitoring of the performance of the organizations, being used in different areas and obtaining relevant results.

Surveys are widely popular for collecting opinions, expectations, and experiences (Torchiano et al., 2017). Therefore, it is deemed appropriate to gather the opinions of business association managers through a survey. Three steps are suggested for its construction:

Elaboration of questions: The items in the questionnaire should be clear, simple, and consistent (Torchiano et al., 2017).

2. Appropriate language for respondents: The adequacy of the terms in the questionnaire (based on the profiles of the respondents) is essential to ensure clarity of the questions which leads to the collection of appropriate responses (Yamin and Sim, 2016).

3. Definition of a scale for respondents: The questions may be standardized in a specific manner to obtain answers according to a chosen scale (Tarka, 2017), and for this, it is possible to use a widely used instrument for measurement, that is, the Likert scale (Vonglao, 2017). Scale labels are written according to what is being measured and the most appropriate way of referencing to the respondents must be established (Li, 2013).

Data is usually collected through the telephone, internet, or in person. As in (Nara et al., 2014), data collection is a kick-start. Research tools may be employed with the advantage of reducing cost and time, in addition to ensuring respondents’ anonymity.

Regarding data treatment, eliminating outliers is recommended since it is a common occurrence in the survey method. Outliers refer to data that do not follow the expected pattern (Chandola et al., 2009), when the data are free from outliers the results become more reliable.

The study population should be identified and their size and means to identify their declared individuals (Creswell, 2010).

In this step, it will be shown the detailed steps in applying the Multi-Attribute Utility Theory (MAUT) method.

To carry out the measurement of competitiveness, the MAUT method disclosed by Keeney and Raiffa (1976) is recommended. MAUT was chosen for this research because it aims to support decision-making in situations involving various criteria and attributes (Frank et al., 2013).

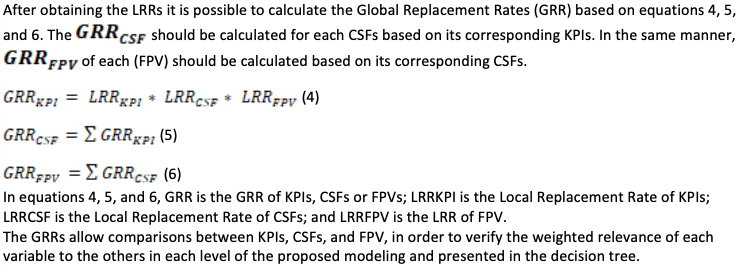

Figure 2, where it is possible to check the order of calculations.

Figure 2

Methodological procedures

In this step, after finding the rates, they are organized in the order of relevance, that is, in descending order of the rates.

This section illustrates the method through a case study of BAs in Rio Grande do Sul, Brazil. Also there will be presented below the results and analyzes obtained in this case study.

This investigation was carried out from available literature by researching the terms: “competitiveness”, “business association,” and “service” in the databases of Scopus, Web of Science, and Science Direct. The social statutes of these BAs were also analyzed. In this way, the research was characterized as bibliographical and documental.

The stakeholders were categorized as business association managers and associated companies, the government, and civil society. Among these stakeholders, this research focuses on the business association managers.

The construction of the decision tree was based on Soliman (2014) and began with the investigation of literature and documentary research. Considering the accessibility of data, it was appropriate to use documentary research as the means to analyze samples of BAs in Rio Grande do Sul to collect specific FPV.

From the list of references gathered through documentary research, relevant literature were identified and used to analyze the elements which shape the competition in companies, services and BAs. Subsequently, similarities between the FPV indicated by different sources were verified as presented the Table 1.

Table 1

FPVs identified in the social

statutes and literature

FPV |

References |

Quality |

Turi et al., 2014; Koroteeva et al. 2016; Androniceanu, 2017; Sun and Pang, 2017; Kwateng and Darko, 2017; Park et al., 2018; García-Arca et al., 2018; Ali et al., 2018 |

Representation |

Doner and Schneider, 2000; Bennett and Ramsden, 2007; Battisti and Perry, 2015; Kohler-Koch et al., 2017; A; B; C; D; E; F; G; H, I; J; K; L; M; N; O |

Services |

Kingsbury and Hayter, 2006; Gallego et al., 2013; Mesquita et al., 2007; Nora et al., 2016; A; B; C; D; F; G; I; J; L; M; N |

Benchmarking |

Bennett, 1998; Sáez and Periáñez, 2015; Battisti and Perry, 2015; B; D; E; F; G; H |

Citizenship |

Boehm, 2005; A; B; C; D; E; F; K |

Financial |

Frank et al., 2013; Poveda-Bautista et al., 2013; Turi et al., 2014; Koroteeva et al. 2016; Kuteesa and Mawejje, 2016; Kohler-Koch et al., 2017 |

* A: Associação Comercial e Industrial de Santa Cruz do Sul; B: Câmara de Comércio, Indústria e Serviços de Venâncio Aires; C: Associação Comercial e Industrial de Lajeado; D: Associação Comercial, Industrial e de Serviços de Novo Hamburgo e Campo Bom; E: Associação Comercial, Cultural, Industrial, Serviços e Agropecuária de Santo Ângelo; F: Câmara de Indústria, Comércio e Serviços de Farroupilha; G: Câmara de Indústria, Comércio e Serviços de Canoas; H: Câmara de Indústria, Comércio e Serviços de Caxias do Sul; I: Associação Comercial de Porto Alegre; J: Câmara de Comércio da Cidade do Rio Grande; K: Associação Comercial, Industrial, Serviços e Agronegócios de Santa Rosa; L: Associação Comercial, Industrial, de Serviços e Tecnologia de São Leopoldo; M: Associação Comercial, Industrial e de Serviços de Sapucaia do Sul; N: Associação Comercial, Industrial, de Serviços e Agronegócio de Passo Fundo; O: Centro Empresarial de Alegrete.

After determining six points that were considered as fundamental, these points were stratified into a second level, the CSFs. Sixteen CSFs were identified as shown in Table 2, each one with different sources.

Table 2

CSFs identified in the social

statutes and literature

FPV |

CSF |

References |

Quality |

Customers |

Koroteeva et al. 2016; Cheung and To, 2016; Programa Gaúcho de Qualidade e Produtividade, 2017; Aqlan et al., 2018; Park et al., 2018 |

People |

Programa Gaúcho de Qualidade e Produtividade 2017; C; K |

|

Representation |

Support and assistance |

Bennett and Ramsden, 2007; Kebaili et al., 2015; Newbery et al., 2015; Ndyetabula et al., 2016; D; F; I; L; M |

Interests defense |

Doner and Schneider, 2000; Ndyetabula et al., 2016; A; B; G; H; I; J; K; L; M; N |

|

Services |

Events |

Bennett, 1998; A; B; D; F; H; J; L; M |

Credit protection |

Oliveira and Labre, 2015; L |

|

Consulting and advisory services |

Brown et al., 2005; Bennett, 1998; A; D; E; F; G; H; I; J; L; M; N |

|

Marketing |

Doner and Schneider, 2000; Kingsbury and Hayter, 2006; Bennett and Ramsden, 2007; Koroteeva et al., 2016; Yen and Hung, 2017; A; B; C; F; G; H |

|

Benchmarking |

Internal and external learning |

A; B; D; F; G; H; I; J; K; L; O |

Exchange of information and ideas |

Kingsbury and Hayter, 2006; Bennett and Ramsden, 2007; Mshenga and Richardson, 2013; Newbery et al., 2015; Ndyetabula et al., 2016; Costa et al., 2017; B; I; J |

|

Citizenship |

Social |

Bennett, 1998; Kiron et al., 2012; Fonseca and Lima, 2015; A; B; D; E; G; I; J; K; L; N; O |

Environmental |

Kiron et al., 2012; Fonseca and Lima, 2015; Park et al., 2018; A; D |

|

Cultural |

A; B; D; E; F; H; I; J; K; L; N |

|

Financial |

Liquidity and activity |

Assaf Neto and Lima, 2014; Ersoy, 2017 |

Indebtedness and structure |

Assaf Neto and Lima, 2014 |

|

Profitability |

Assaf Neto and Lima, 2014; Ersoy, 2017 |

* A: Associação Comercial e Industrial de Santa Cruz do Sul; B: Câmara de Comércio, Indústria e Serviços de Venâncio Aires; C: Associação Comercial e Industrial de Lajeado; D: Associação Comercial, Industrial e de Serviços de Novo Hamburgo e Campo Bom; E: Associação Comercial, Cultural, Industrial, Serviços e Agropecuária de Santo Ângelo; F: Câmara de Indústria, Comércio e Serviços de Farroupilha; G: Câmara de Indústria, Comércio e Serviços de Canoas; H: Câmara de Indústria, Comércio e Serviços de Caxias do Sul; I: Associação Comercial de Porto Alegre; J: Câmara de Comércio da Cidade do Rio Grande; K: Associação Comercial, Industrial, Serviços e Agronegócios de Santa Rosa; L: Associação Comercial, Industrial, de Serviços e Tecnologia de São Leopoldo; M: Associação Comercial, Industrial e de Serviços de Sapucaia do Sul; N: Associação Comercial, Industrial, de Serviços e Agronegócio de Passo Fundo; O: Centro Empresarial de Alegrete.

The KPIs were elaborated according to the CSFs to which they belonged. From the readings of the social statutes of BAs and the papers, a knowledge base was built that enabled the creation of KPIs and the indication to which CSF each of them belong (Table 3).

Table 3

KPIs drawn from the social statutes and literature

FPV |

CSF |

KPI (Indicator) |

Quality |

Customers |

Associate size |

Segment differentiation of associates |

||

New associates |

||

Loyalty of associates |

||

Associate satisfaction |

||

Complaint of associates |

||

People |

Technical qualification of business associations employees |

|

Higher education of business associations employees |

||

Periodic training of the business associations employees |

||

Representation |

Support and assistance |

Associate couseling |

Interests defense |

Representative actions |

|

Services |

Events |

Courses |

Speeches |

||

Diversification of courses/lectures |

||

Opinion poll on desired events by associates |

||

Credit protection |

Credit protection service |

|

Consulting and advisory services |

Legal advisory service |

|

Technical advisory service |

||

Administrative consultancy service |

||

Marketing |

Marketing service |

|

Benchmarking |

Internal and external learning |

Meetings between the business associations employees |

Participation in meetings of other entities |

||

Participation in meetings between of business associations managers |

||

Exchange of information and ideas |

Meetings between members for exchange of information and ideas |

|

Citizenship |

Social |

Social activities |

Environmental |

Environmental awareness and protection activities |

|

Cultural |

Development activities and incentive to culture |

|

Financial |

Liquidity and activity |

Measurement of the capacity to comply with liabilities assumed |

Measurement of the service cycle |

||

Indebtedness and structure |

How third-party resources are used and their relative performance relative to equity |

|

Profitability |

Evaluation of the result of the return obtained comparing it with the investment applied |

The decision tree resulting from this process is presented in Figure 3.

Figure 3

Decision tree

Subtitle:

GCR: Global Competitiveness Rate;

FPV: Fundamental Point of View;

CSF: Critical Success Factor;

KPI: Key Performance Indicator.

Figure 3 reveals that in order to find the GCR, it is necessary to identify six FPV. These FPV are subdivided into sixteen CSFs, which in turn are subdivided into thirty-one KPI. The KPI represent the levels which are considered measurable.

A survey was prepared and it followed the steps: The questions asked were based on the KPIs; All questions were elaborated in order to obtain the importance of each KPIs for BAs’ managers; A formal and clear language, that was considered appropriate for BAs’ managers, was used.

The questions were grouped in a sequence that made possible a later analysis, facilitating the grouping of the KPIs, CSFs, and FPV.

Data was collected from February to March 2018, and the survey instrument was sent through e-mail. The software used for data collection was Sphinx.

The population covered in this study include municipalities of Rio Grande do Sul, Brazil, particularly those with either a very high or high Índice de Desenvolvimento Humano Municipal (IDHM). IDHM was chosen because it uses the same criteria as the Índice de Desenvolvimento Humano Global (IDH), which includes longevity, education, and income, and is also adapted to analyze the development of Brazilian cities and metropolitan regions through appropriate indicators (Atlas Brasil, 2017). Furthermore, this criterion makes it possible to present the most developed municipalities which are deemed to have a high number of competitive BAs, the focus of this study.

There are 312 cities in Rio Grande do Sul with a high IDHM, and only one city with a very high IDHM. Considering that associations are more prevalent in large cities (Tavares and Carr, 2013), cities comprising more than 50,000 voters were identified. As a result, 31 cities which rank high in the list of cities with the largest number of active companies in Rio Grande do Sul (Empresômetro, 2017), were chosen. The BAs of these cities have an average of 347 members.

The survey was sent to 31 (study population) BAs, out of which, 16 responded (sample size), resulting in a sampling error of 14% and a confidence level of 95%. This response rate of 52% is higher than other studies which used surveys to study BAs when investigating the members' point of view (for e.g., Newbery et al., 2015, which obtained a response rate of 37%; and Battisti and Perry, 2015, which obtained a rate of 43%). Kohler-Koch et al., (2017) achieved a response rate of 29.5% when questioning business association managers.

For data treatment, a multivariate analysis was performed using ChemoStat. The software’s use is to detect anomalous samples through hierarchical cluster analysis and principal cluster analysis. The software’s use is to detect anomalous samples through hierarchical cluster analysis.

Following are detailed steps in applying the MAUT method.

In this step, values of the calculated rates are presented in sequence.

Global Replacement Rates of FPVs, CSFs, and KPIs

Table 4, Table 5, and Table 6 present the rankings in descending order of importance.

Table 4

Ranking of FPVs Global

Replacement Rates

FPV |

Function of FPV |

Global Replacement Rate |

1 |

Quality |

30.41% |

3 |

Services |

19.57% |

6 |

Financial |

16.45% |

4 |

Benchmarking |

16.10% |

5 |

Citzenship |

9.88% |

2 |

Representation |

7.58% |

Table 4 confirms that FPV Quality is considered the most important with 30.41% of the respondents choosing it, and the FPV Representation (at 7.58%) was considered the least important. It can be noted that FPV Services, with 19.57% of importance, did not reach the first place, even if it is directly from BA where the main focus would be the services provided to the members.

Table 5

Ranking of CSFs Global

Replacement Rates

CSF |

Function of CSF |

Global Replacement Rate |

1 |

Customers |

20.96% |

9 |

External and internal learning |

12.25% |

5 |

Events |

12.05% |

2 |

People |

9.46% |

14 |

Liquidity and activity |

8.34% |

4 |

Interests defense |

4.34% |

16 |

Profitability |

4.23% |

15 |

Indebtedness and structure |

3.88% |

10 |

Exchange of information and ideas |

3.85% |

7 |

Consulting and advisory services |

3.58% |

11 |

Social |

3.50% |

12 |

Environmental |

3.29% |

3 |

Support and assistance |

3.24% |

13 |

Cultural |

3.09% |

8 |

Marketing |

3.08% |

6 |

Credit protection |

0.86% |

Table 5 shows that the CSF Customers, with a score of 20.96%, was chosen by the BA managers as most relevant proving that for these BAs surveyed all aspects involving customers are critical to obtain success. In second place, with a score of 12.25%, was the Critical Success Factor External and internal learning, followed by Events with a score of 12.05%. At the other side is the Critical Success Factor Credit Protection was the least relevant, scoring well below at 0.86%.

Table 6

Ranking of KPIs Global Replacement Rates

KPI |

Function of KPI |

Global Replacement Rate |

28 |

Measurement of the capacity to comply with liabilities assumed |

4.38% |

11 |

Representative actions |

4.34% |

23 |

Participation in meetings between of business associations managers |

4.32% |

22 |

Participation in meetings of other entities |

4.26% |

31 |

Evaluation of the result of the return obtained comparing it with the investment applied |

4.23% |

29 |

Measurement of the service cycle |

3.96% |

30 |

How third-party resources are used and their relative performance relative to equity |

3.88% |

24 |

Meetings between members for exchange of information and ideas |

3.85% |

3 |

New associates |

3.72% |

5 |

Associate satisfaction |

3.72% |

21 |

Meetings between the business associations employees |

3.67% |

4 |

Loyalty of associates |

3.67% |

6 |

Complaint of associates |

3.56% |

25 |

Social activities |

3.50% |

7 |

Technical qualification of business associations employees |

3.43% |

9 |

Periodic training of the business associations employees |

3.34% |

2 |

Segment differentiation of associates |

3.30% |

26 |

Environmental awareness and protection activities |

3.29% |

10 |

Associate couseling |

3.24% |

15 |

Opinion poll on desired events by associates |

3.18% |

27 |

Development activities and incentive to culture |

3.09% |

20 |

Marketing servisse |

3.08% |

14 |

Diversification of courses/lectures |

3.05% |

1 |

Associate size |

2.99% |

12 |

Courses |

2.96% |

13 |

Speeches |

2.87% |

8 |

Higher education of business associations employees |

2.69% |

17 |

Legal advisory service |

1.33% |

18 |

Technical advisory service |

1.27% |

19 |

Administrative consultancy service |

0.99% |

16 |

Credit protection service |

0.86% |

Table 6 shows that only five KPIs obtained GRRs above 4%. KPI 28 (measurement of the capacity to comply with liabilities assumed, at 4.38%), was considered by the managers as the most relevant. KPI 11 (which addresses the actions of representativeness) obtained a rate of 4.34%. Two KPIs in the sequence are related to benchmarking, KPI 23 (meetings between other BA managers, at 4.32%) and KPI 22 (meetings among other entities, at 4.26%). The last KPIs obtaining a rate above 4% is KPI 31 (on the evaluation of the result of the return obtained comparing it with the investment applied), which earned a rate of 4.23%. Four KPIs were considered the least important: Legal advisory service with a score of 1.33%; Technical advisory service with a score of 1.27%; Administrative consultancy service with a score of 0.99%; and Credit protection service with a score of 0.86%. Given the low score obtained by these four KPIs, it can be inferred that there is no imminent need of control of these indicators by the BA managers.

Table 7 shows the established ranking of the BAs ICR. This ranking was established to range from 1 to 5, so it can be seen that 13 BAs have ICR equal or above 4, that represents a level of 80% of competitiveness, and just 2 BAs have it below 4.

Table 7

Ranking of ICRs in BAs

Business Association |

ICRs |

4 |

4.870967742 |

14 |

4.741935484 |

1 |

4.612903226 |

3 |

4.516129032 |

2 |

4.451612903 |

5 |

4.419354839 |

12 |

4.129032258 |

16 |

4.096774194 |

6 |

4.064516129 |

15 |

4.064516129 |

10 |

4.032258065 |

11 |

4.032258065 |

9 |

4 |

8 |

3.903225806 |

13 |

3.903225806 |

For better illustration, Figure 4 graphically shows the results of the ICR in reference to GCR.

Figure 4

Graphic of ICRs in reference to GCR

* Note: Business Association 7 was removed from the sample in the data treatment step.

Considering a GCR of 4.2559, it can be seen in Figure 4 that only six BAs (4, 14, 1, 3, 2 and 5) were above this GCR. Besides being considered more competitive, the activities of these six BAs above the GCR can serve as benchmark for the others. These other BAs that are below the GCR can perform a detailed analysis of KPIs, CSFs, and FPV to check for improvement opportunities.

This study present a CAM for assessing business association managers. It presents an assessment method to identify BAs’ most relevant indicators. A detailed discussion of CAM is included, allowing its replication in different segments.

Through a simulated case study, rankings of the global replacement rates of KPIs, CSFs, and FPVs applicable to individual BAs were formulated, which were then translated to global replacement rates. Results reveal useful information that will enable BAs to focus their activities and decision making on the most relevant factors.

The FPV Quality ranked as the most important while the FPV Representation ranked the least, signifying less relevance to business association managers. As for the CSFs, Clients rated the highest, revealing the associations’ focus on attracting and retaining their members. The most relevant KPI for managers is the measurement of the capacity to meet liabilities assumed. It can be inferred that this result reflects the concern that managers have on the financial administration of their BAs.

The ICRs confirm that 60% of BAs are below the GCR of 4.2559 on a scale of 1 to 5. This means that only 40% can be classified as competitive. Considering that the GCR index was obtained based on the managers’ ranking of the indicators in terms of importance, it is believed that these results are exemplified in the daily management of these BAs. Therefore, associations that have not achieved this rate can focus on accomplishing the indicators identified as most relevant, i.e., those at the top of the GRR ranking of KPIs.

Results of this research provide a valuable reference for evaluating the competitiveness of BAs in Rio Grande do Sul, Brazil. The application of the method yielded a global index that can serve as a benchmark and guide association managers in decision-making.

For future research, it is recommended that CAM be applied on the BAs members to verify whether their opinions on competitiveness coincide with that of the managers' notes.

Given the importance of BAs in the development of local companies and the limited existing research in this area, this study aims to contribute both to literature and provide a useful tool (CAM) for the BAs.

Ali, S. S., Basu, A., y Ware, N. (2018). Quality measurement of Indian commercial hospitals–using a SERVQUAL framework. Benchmarking: An International Journal, 25(3), 815-837.

Androniceanu, A. (2017). The three-dimensional approach of total quality management, an essential strategic option for business excellence. Amfiteatru Economic, 19(44), 61-78.

Aqlan, F., Ahmed, A., Ashour, O., Shamsan, A., y Hamasha, M. M. (2017). An approach for rush order acceptance decisions using simulation and multi-attribute utility theory. European Journal of Industrial Engineering, 11(5), 613-630.

Assaf Neto, A., y Lima, F. G. (2014). Curso de administração financeira [Financial Management Course]. São Paulo: Editora Atlas.

Associação Comercial, Cultural, Industrial, Serviços e Agropecuária de Santo Ângelo [Commercial, Cultural, Industrial, Services and Agriculture Association of Santo Ângelo] (2017). Social Status, Santo Ângelo.

Associação Comercial e Industrial de Santa Cruz do Sul [Commercial and Industrial Association of Santa Cruz do Sul] (2015). Social Status, Santa Cruz do Sul.

Associação Comercial, Industrial e de Serviços de Novo Hamburgo, Campo Bom e Estância Velha [Commercial, Industrial and Service Association of Novo Hamburgo, Campo Bom e Estância Velha] (2007). Social Status, Novo Hamburgo.

Associação Comercial de Porto Alegre [Commercial Association of Porto Alegre] (2012). Social Status, Porto Alegre.

Associação Comercial, Industrial, de Serviços e Tecnologia de São Leopoldo [Commercial, Industrial, Services and Technology Association of São Leopoldo] (2016). Social Status, São Leopoldo.

Associação Comercial, Industrial e de Serviços de Sapucaia do Sul [Commercial, Industrial and Services Association of Sapucaia do Sul] (2010). Social Status, Sapucaia do Sul.

Associação Comercial, Industrial, de Serviços e Agronegócio de Passo Fundo [Commercial, Industrial, Services and Agribusiness Association of Passo Fundo] (2016). Social Status, Passo Fundo.

Associação Comercial e Industrial de Lajeado [Commercial and Industrial Association of Lajeado] (2017). Social Status, Lajeado.

Associação Comercial, Industrial, Serviços e Agronegócios de Santa Rosa [Commercial, Industrial, Services and Agribusiness Association of Santa Rosa] (2017). Social Status, Santa Rosa.

Atlas Brasil (2017). Show informations about Índice de Desenvolvimento Humano Municipal.

Bana e Costa, C. A., Ensslin, L., Corrêa, E. C., y Vansnick, J. C. (1999). Decision support systems in action: integrated application in a multicriteria decision aid process. European Journal of Operational Research, 113(2), 315-335.

Battisti, M., y Perry, M. (2015). Small enterprise affiliations to business associations and the collective action problem revisited. Small Business Economics, 44(3), 559-576.

Bennett, R. J. (1998). Business associations and their potential contribution to the competitiveness of SMEs. Entrepreneurship & Regional Development, 10(3), 243-260.

Bennett, R. J., y Ramsden, M. (2007). The contribution of business associations to SMEs: strategy, bundling or reassurance?. International Small Business Journal, 25(1), 49-76.

Bhawsar, P., y Chattopadhyay, U. (2015). Competitiveness: review, reflections and directions. Global Business Review, 16(4), 665-679.

Boehm, A. (2005). The participation of businesses in community decision making. Business & Society, 44(2), 144-177.

Brown, J. D., Earle, J. S., y Lup, D. (2005). What makes small firms grow? Finance, human capital, technical assistance, and the business environment in Romania. Economic Development and Cultural Change, 54(1), 33-70.

Câmara de Comércio da Cidade do Rio Grande [Commerce Chamber of the city of Rio Grande] (2010). Social Status, Rio Grande.

Câmara de Comércio, Indústria e Serviços de Venâncio Aires [Commerce Chamber, Industry and Services of Venâncio Aires] (2017). Social Status, Venâncio Aires.

Câmara de Indústria, Comércio e Serviços de Farroupilha [Chamber of Industry, Trade and services of Farroupilha] (2006). Social Status, Farroupilha.

Câmara de Indústria, Comércio e Serviços de Canoas [Chamber of Industry, Commerce and Services of Canoas] (2013). Social Status, Canoas.

Câmara de Indústria, Comércio e Serviços de Caxias do Sul [Chamber of Industry, Commerce and Services of Caxias do Sul] (2007). Social Status, Caxias do Sul.

Centro Empresarial de Alegrete [Business Center of Alegrete] (2017). Social Status, Alegrete.

Chandola, V., Banerjee, A., y Kumar, V. (2009). Anomaly detection: A survey, ACM computing surveys (CSUR), 41(3), 15: 1-58.

Cheung, F. Y. M., y To, W. M. (2016). A customer-dominant logic on service recovery and customer satisfaction. Management Decision, 54(10), 2524-2543.

Costa, E., Soares, A. L., y Sousa, J. P. (2017). Institutional networks for supporting the internationalisation of SMEs: the case of industrial business associations. Journal of Business & Industrial Marketing, 32(8), 1182-1202.

Costa, R, Siluk, J, Neuenfeldt Júnior, A, Soliman, M, y Nara, E. (2015). The management of industrial competitiveness through the application of methods UP and multi-criteria in a bovine slaughterhouse. Ingeniare, 23(3), 383-394.

Creswell, J. W. (2010). Research project: qualitative, quantitative and mixed methods. Porto Alegre: Artmed.

Díaz-Chao, Á., Sainz-González, J., y Torrent-Sellens, J. (2016). The competitiveness of small network-firm: A practical tool. Journal of Business Research, 69(5), 1769-1774.

Doner, R. F., y Schneider, B. R. (2000). Business associations and economic development: Why some associations contribute more than others. Business and Politics, 2(3), 261-288.

Dür, A., y Mateo, G. (2013). Gaining access or going public? Interest group strategies in five European countries. European Journal of Political Research, 52(5), 660-686.

Empresômetro (2017). It presents the ranking of the active companies in Brazil.

Ensslin, L., Montibeller, G. N., y Noronha, S. M. (2001). Apoio à decisão: metodologias para estruturação de problemas e avaliação multicritério de alternativas [Decision support: methodologies for structuring problems and multicriteria evaluation of alternatives]. Florianópolis: Insular.

Ersoy, N. (2017). Performance Measurement in Retail Industry By Using A Multi-Criteria Decision Making Methods. Ege Academic Review, 17(4), 539-551.

Fonseca, L. M., y Lima, V. M. (2015). Countries three wise men: Sustainability, Innovation, and Competitiveness. Journal of Industrial Engineering and Management, 8(4), 1288-1302.

Frank, A. G., Souza, D. V. S. D., Ribeiro, J. L. D., y Echeveste, M. E. (2013). A framework for decision-making in investment alternatives selection. International Journal of Production Research, 51(19), 5866-5883.

Gallego, J., Rubalcaba, L., y Hipp, C. (2013). Services and organisational innovation: the right mix for value creation. Management Decision, 51(6), 1117-1134.

García-Arca, J., Prado-Prado, J. C., y Fernández-González, A. J. (2018). Promoting structured participation for competitiveness in services companies. Journal of Industrial Engineering and Management, 11(2), 196-206.

Gomes, L. F. A. M., y Gomes, C. F. S. (2012). Tomada de decisão gerencial: enfoque multicritério [Managerial decision making: multicriteria approach]. São Paulo: Editora Atlas.

Jahangirian, M., Taylor, S. J., Young, T., y Robinson, S. (2017). Key performance indicators for successful simulation projects. Journal of the Operational Research Society, 68(7), 747-765.

Kebaili, B., Al-Subyae, S. S., Al-Qahtani, F., y Belkhamza, Z. (2015). An exploratory study of entrepreneurship barriers: the case of Qatar. World Journal of Entrepreneurship, Management and Sustainable Development, 11(3), 210-219.

Keeney R. L., y Raiffa H. (1976). Decisions with Multiple Objectives: Preferences and Value Tradeoffs. New York: John Wiley & Sons.

Kingsbury, A., y Hayter, R. (2006). Business associations and local development: The Okanagan wine industry’s response to NAFTA. Geoforum, 37(4), 596-609.

Kiron, D., Kruschwitz, N., Haanaes, K., y von Streng Velken, I. (2012). Sustainability nears a tipping point. MIT Sloan Management Review, 53(2), 69-74.

Kohler-Koch, B., Kotzian, P., y Quittkat, C. (2017). The multilevel interest representation of national business associations. West European Politics, 40(5), 1046-1065.

Koroteeva, N. N., Hasanov, E. L., Mushrub, V. A., Klochko, E. N., Bakharev, V. V., y Shichiyakh, R. A. (2016). The conditions of economic efficiency and competitiveness of tourism enterprises. International Journal of Economics and Financial Issues, 6(S8), 71-77.

Kucherenko, S., Levaieva, L., y Semenenko, O. (2016). Methodological approaches to assessment of intersectoral competitiveness. In Economic Annals-XXI, 162.

Kuteesa, A., y Mawejje, J. (2016). Between the market and the state: the capacity of business associations for policy engagement in Uganda. The Journal of Modern African Studies, 54(4), 617-644.

Kwateng, K. O., y Darko, J. E. (2017). Total quality management practices in aquaculture companies: a case from Ghana. The TQM Journal, 29(4), 624-647.

Li, Q. (2013). A novel Likert scale based on fuzzy sets theory. Expert Systems with Applications, 40(5), 1609-1618.

Mesquita, L. F., Lazzarini, S. G., y Cronin, P. (2007). Determinants of firm competitiveness in Latin American emerging economies: Evidence from Brazil's auto-parts industry. International Journal of Operations & Production Management, 27(5), 501-523.

Milichovský, F., y Hornungová, J. (2013). Methodology for the selection of financial indicators in the area of information and communication activities. Business: Theory and Practice, 14(2), 97-102.

Mshenga, P. M., y Richardson, R. B. (2013). Micro and small enterprise participation in tourism in coastal Kenya. Small Business Economics, 41(3), 667-681.

Nara, E. O. B., Kipper, L. M., Benitez, L. B., Forgiarini, G., y Mazzini, E. (2013). Strategies used by a meatpacking company for market competition. Business Strategy Series, 14(2-3), 72-79.

Nara, E. O. B., Moraes, J. A. R., de Freitas, A. M. V., Rediske, G., y Benitez, G. B. (2014). Addition of alternative materials to ceramic slabs. Cerâmica, 60(355), 340-347.

Ndyetabula, D. W., Sørensen, O. J., y Temu, A. A. (2016). Agribusiness development and the role of value chain business associations: The case of dried fruits and vegetables in Tanzania. African Journal of Economic and Management Studies, 7(4), 510-534.

Newbery, R., Gorton, M., Phillipson, J., y Atterton, J. (2015). Sustaining business networks: Understanding the benefit bundles sought by members of local business associations. Environment and Planning C: Government and Policy, 34(7), 1267-1283.

Nora, L. D. D., Siluk, J. C. M., Júnior, A. L. N., Soliman, M., Nara, E. O. B., y Furtado, J. C. (2016). The performance measurement of innovation and competitiveness in the telecommunications services sector. International Journal of Business Excellence, 9(2), 210-224.

Oliveira, J. L., y Labre, R. A. P. (2015). Um olhar sobre atuação da associação comercial e industrial da cidade de Araguatins-TO [A look at the performance of the commercial and industrial association of the city of Araguatins-TO]. Humanidades & Inovação, 2(1), 80-89.

Park, K., Kremer, G. E. O., y Ma, J. (2018). A regional information-based multi-attribute and multi-objective decision-making approach for sustainable supplier selection and order allocation. Journal of Cleaner Production, 187, 590-604.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries. New York: Competitors, The Free Pres.

Poveda-Bautista, R., García-Melón, M., y Baptista, D. C. (2013). Competitiveness measurement system in the advertising sector. SpringerPlus, 2(1), 1-14.

Programa Gaúcho de Qualidade e Produtividade – PGQP, Displays information about the PGQP.

Sáez, L., y Periáñez, I. (2015). Benchmarking urban competitiveness in Europe to attract investment. Cities, 48, 76-85.

Siluk, J. C. M., Kipper, L. M., Nara, E. O. B., Neuenfeldt Junior, A. L., Dal Forno, A. J., Soliman, M., y Chaves, D. M. D. S. (2017). A performance measurement decision support system method applied for technology-based firms’ suppliers. Journal of Decision Systems, 26(1), 93- 109.

Sofiyabadi, J., Kolahi, B., y Valmohammadi, C. (2016). Key performance indicators measurement in service business: a fuzzy VIKOR approach. Total Quality Management & Business Excellence, 27(9-10), 1028-1042.

Soliman, M. (2014). Avaliação da competitividade em indústrias de transformação de plástico [Competitiveness assessment in plastic processing industries]. (Tesis de Doctorado). Federal University of Santa Maria, Santa Maria, RS.

Sun, W., y Pang, J. (2017). Service quality and global competitiveness: evidence from global service firms. Journal of Service Theory and Practice, 27(6), 1058-1080.

Tarka, P. (2017). Managers’ beliefs about marketing research and information use in decisions in context of the bounded-rationality theory. Management Decision, 55(5), 987-1005.

Tavares, A. F., y Carr, J. B. (2013). So close, yet so far away? The effects of city size, density and growth on local civic participation. Journal of urban affairs, 35(3), 283-302.

Torchiano, M., Fernández, D. M., Travassos, G. H., y de Mello, R. M. (2017). Lessons learnt in conducting survey research, in Proceedings of the 5th International Workshop on Conducting Empirical Studies in Industry, (33-39). IEEE Press.

Turi, A., Goncalves, G., y Mocan, M. (2014). Challenges and competitiveness indicators for the sustainable development of the supply chain in food industry. Procedia-Social and Behavioral Sciences, 124, 133-141.

Vonglao, P. (2017). Application of fuzzy logic to improve the Likert scale to measure latent variables. Kasetsart Journal of Social Sciences, 38(3), 337-344.

Yamin, M., y Sim, A. K. S. (2016). Critical success factors for international development projects in Maldives: Project teams’ perspective. International Journal of Managing Projects in Business, 9(3), 481-504.

Yen, Y. X., y Hung, S. W. (2017). The influences of suppliers on buyer market competitiveness: an opportunism perspective. Journal of Business & Industrial Marketing, 32(1), 18-29.

1. Industrial Systems and Processes Department. University of Santa Cruz do Sul. jonesschaefer@mx2.unisc.br

2. Industrial Systems and Processes Department. University of Santa Cruz do Sul. lnsantos@mx2.unisc.br

3. Industrial Systems and Processes Department. University of Santa Cruz do Sul. aramos.aline@gmail.com

4. Industrial Systems and Processes Department. University of Santa Cruz do Sul. leandro@unisc.br

5. Industrial Systems and Processes Department. University of Santa Cruz do Sul. jaquelinemoraes@mx2.unisc.br

6. Industrial Systems and Processes Department. University of Santa Cruz do Sul. augusto_ruhoff@hotmail.com

7. Industrial Systems and Processes Department. University of Santa Cruz do Sul. matheusbdacosta@gmail.com

8. Industrial Systems and Processes Department. University of Santa Cruz do Sul. jacques@unisc.br (Corresponding author)