Vol. 40 (Number 32) Year 2019. Page 29

WAJEETONGRATANA, Prateep 1

Received: 13/062019 • Approved: 20/09/2019 • Published 23/09/2019

4. Conclusions and recommendations

ABSTRACT: Despite all the obvious economic advantages RSE (renewable sources of energy) have, there is still a great deal of scepticism observed when it comes to discussing the potential consequences from large-scale introduction of RSE. When this issue is being discussed, it often concerns not only economic feasibility but also political context around it. In this article we present the theoretical analysis of the cyclic dynamics of the world economy along with the more empirical statistical data so that to determine the logic and the economic feasibility behind the inevitable process of the global energy market modernization on the basis of massive introduction of RSE. Within this framework, we will study the key economic reasons for RSE wider use along with the future prospects and consequences from this use. |

RESUMEN: A pesar de todas las ventajas económicas obvias que tienen las RSE (fuentes de energía renovables), todavía se observa un gran escepticismo cuando se trata de discutir las posibles consecuencias de la introducción a gran escala de la RSE. Cuando se discute este tema, a menudo se refiere no solo a la viabilidad económica sino también al contexto político que lo rodea. En este artículo presentamos el análisis teórico de la dinámica cíclica de la economía mundial junto con los datos estadísticos más empíricos para determinar la lógica y la viabilidad económica detrás del proceso inevitable de la modernización del mercado energético global sobre la base de la introducción masiva de RSE. Dentro de este marco, estudiaremos las razones económicas clave para un uso más amplio de RSE junto con las perspectivas y consecuencias futuras de este uso. |

The prospects of global economy’s sustainable development are always tightly connected with the availability of opportunities for more efficient use of the renewable sources of energy. No matter what, the latter have been gradually substituting traditional fossil fuels, thus getting more and more important role in national economies and also in the global one. Introduction and further spread of RSE will stimulate the overall modernization of the global energy sector and energy market in particular, and this, in turn, will surely have significant social, political, economic and environmental effects.

From the economic standpoint, RSE are highly efficient when it comes to stimulation of both innovative and business activities within national economies: they create additional employment opportunities, generate new sources of incomes (for example, from the import of equipment etc.).

Inside the RSE sector, the offer of an innovative technology may concern radical innovation of the already existing technology or it may concern the modifying innovation (which is slightly changed technology in use; for example, a new element for solar batteries). Another type is the so-called combinatory innovations: for example, in the wind electric energy generators such combinatory innovations together serve as the construction elements of a larger innovation.

In any of these cases, all promising innovations presented and implemented in the RSE sector are nearly always aimed at saving financial resources. Also, they are oriented on the end consumer, especially when it comes to calculations of the payback period (Is it acceptable or not?), or in other words, how soon ROI will be achieved.

At the global level, RSE always have a huge potential in what concerns fighting poverty (Onyusheva et al, 2018). Unlike more traditional large electric energy plants, the RSE objects are smaller and thus, more flexible. This can, inter alia, enable much quicker electrification of the whole country (region) without the involvement in huge and expensive infrastructure projects which are usually covering huge territories. Optimization of costs through introduction of local RSE solutions allows avoiding serious damages from economic fluctuations in the longer term (Ushakov & Kharchenko, 2017). After all, nearly any RSE is just a simple technical innovation, thus, its implementation and exploitation can be gradual and also relatively cheap. Any of the RSE available today is comparable - in terms of economic costs - to the price of renovating the whole infrastructure network.

At the same time, despite all these, rather obvious, economic advantages from the innovative development of RSE (explained not only by the political establishments and corporations (Helder, 2015) but also by the famous representatives of science (Imperial College London, 2018), there is still enough space for some scepticism when it comes to measuring the actual potential of RSE and its probably mass-scale use. In particular, as of today, development and implementation of the RSE solutions is often seen as a purely political process, thus, its promotion by means of business efforts only is considered to be almost senseless.

There is also another view on the situation with political and business influences on the RSE sector: promotion of the RSE sector is sometimes seen as the regulatory competence of the state authorities through which the state is trying to control (and/or limit) the competitiveness of regional/national businesses.

In this study we will try to present and explain the logical economic grounding why innovative modernization of the global energy sector on the basis of the RSE subsector development is inevitable. We will also consider the fundamental economic causes and consequences from the growing popularity of RSE worldwide from the standpoint of their business expediency. Such motivation has predetermined the following aims and tasks of our research.

Research tasks:

- to outline the historic stages in the development of technologies inside the energy sector on the basis of the Kondratiev’s wave theory and the concept of technological modes of the economic systems;

- to determine the directions of stabilizing and limiting impacts on the world economy due to the ongoing process of innovative, RSE-based modernization in the energy sector;

- to analyze the input of corporate research in the field of RSE as an additional factor of strategic management modernization and reputation improvement for today’s international corporations;

- to evaluate the current trends in codevelopment of traditional energy sector and RSE-based innovative energy sector, using the most recent and relevant statistical data for that.

According to our central research aim and the accompanying research tasks we have put forward the following hypotheses:

Hypothesis 1. Innovative development of the world energy sector on the basis of RSE implementation has been not only the consequence but also one of the key causes for the formation of the so-called fifth wave of innovations (since the 1980s). The key idea behind this wave of innovations has been formation of the sustainable world economic model. This fully explains and predetermines the inevitability of the RSE active use in the global energy sector.

Hypothesis 2. Dynamic development of the RSE subsector has already passed the point of no return. Moreover, active development of RSE today serves as the catalyst for the reduction of separate phases in the Kondratiev’s cycles, which indirectly also means that RSE have the potential to save financial resources.

Hypothesis 3. There is a stable trend of the traditional energy sources being gradually substituted by the renewable ones. This gradual substitution is taking place disregarding all changes in prices for fossil fuels, it is mostly predetermined by the levels of political, financial, information and institutional support for innovative entrepreneurship in the field of RSE development.

The UN experts offer the following classification of the renewable energy sources: solar and wind energy; energy from peat, biomasses etc., including wastes of the agricultural sector, forestry, industrial production and public utilities; energy of the falling water, including that of hydro plants with the capacity of at least 1 megawatt; geothermal energy; tidal energy, including the energy obtained from ocean thermal energy conversion; energy from the Earth internal heat (low-grade energy) (Report of the United Nations Conference on New and Renewable Sources of Energy, 1981).

Energy Statistics Manual by the International Energy Agency (Mandil, 2007) mentions the following types of renewable energy: energy produced from such sources as the Sun, the wind, biomasses and also geothermal, hydro and ocean resources, solid biomass, biogas and liquid types of biofuels. Wastes can be treated as fuels if it is produced from burnable wastes coming from industrial enterprises, other organizations and/or households. These wastes can be solid or liquid, biodegradable or not.

When classified by the source of input, RSE can be presented as: wastes from agriculture and forestry; solid urban waste, such as plastic, carton, food wastes, industrial waste (including those produced by pulp-and-paper plants (Varfolomeev, 2009)); a separate category is the so-called 3R - Reduce, Reuse, Recycle (according to G8 (Global energy and G-8, 2011), and finally biomass. In the overall energy balance of the world biological resources make up to 92,5% of all today’s biofuels. Obviously, RSE is a category of vital importance for the global energy sector, especially considering the fact that fossil fuels processed at thermal energy plants are only increasing the greenhouse effect globally (Electricity information, 2012) while the risks from the functioning of nuclear power plants are still a serious problem, same as the issue of nuclear wastes’ storage.

Some of the experts in the field suggest a change in classification of RSE (Martinez & Schlupmann, 1991) - to add one more classification feature “(in)capacity to store the primary source of energy”. For example, energy obtained from the Sun, wind or tidal waves cannot be properly “caught for storage”, while various industrial and household wastes can be relatively easy stored prior to actual production of biogas or other types of biofuels.

Intensity of RSE use in a particular country/region is always predetermined by such parameters as the overall national demand for energy, availability of own energy resources (including own fossil fuels) and geographical location of the country/region in question. However, economic and geographical factors are not the only determinants of country’s active engagement in RSE use. Political motivation may have rather significant impact here as well, since energy independence has become a political top priority for many national economies worldwide (Katorgina, 2010).

Even a brief historic overview can show us that the history of the energy sector as such is a cycle of changes, from one clearly dominating type of resource to another. On average, every new type of energy has a life cycle of about 30-50 years: first, it is considered to be innovative, then it starts gradually substituting other sources, slowly reaching at least 70% share in the overall energy balance. The leading position usually lasts for about 15-20 years.

This is exactly what happened to coal at the brink of 19th and 20th centuries. Joseph Schumpeter was describing the course of the related events as the so-called “second wave of innovations” (invention of steam driver, rapid spread of railway transportation, active development of steel production during 1840-1900 and so on) (Schumpeter,1939). Later, roughly the same was also the storyline of oil and gas.

During the times of the “third wave” (1900-1950) people gradually came to understanding that oil is not only a convenient fuel, but also a highly important product for chemical production. This understanding turned out to be steps away from the invention of biodiesel and bioethanol.

The “fourth wave” was covering three decades from the 1950s till the very end of the 1980s. This was the time when energy was first extracted from biomasses, thus, this was also the time to prove that the evolution of the energy sector is essentially anthropogenic. Centuries ago, biomass was actually the very first type of fuel for ancient humans, and it remained to be relevant even after thousand years of human evolution! However, thanks to quite a few of innovative technologies biomass has made its way from being one of the most toxic and damaging sources of energy to becoming one of the purest and most technologically promising type of fuels (Reiche, 2005).

Widespread application of RSE will always reduce the impact of one of the key components of the Kondratiev’s long cycles (Kondratiev, 2002) (according to this theory, the long cycle lasts for about 40-60 years) - the energy-servicing infrastructure, while fundamental factors of infrastructure, such as building, roads and complex production facilities, remain unchanged. Besides that, we need to note that at the second phase of a Kondratiev’s cycle, that is, on the peak, straight after the phase of active growth, we can always observe the growth of prices for energy carriers in parallel to boosting business activity overall. Intensive production of renewable energy, the cost of which is not subject to fluctuations in the business environment, will also reduce the influence of this factor.

During the phase of depression, when the economy experiences the need for additional energy capacities, the innovative modernization of the RSE subsector would help solving this and the related problems. N.D. Kondratiev stated that economic growth is always stimulated by various novelties which often attract investors and capital overall. Innovations always cause further innovations, they provoke more active search for additional technological solutions to support them. For example, when the RSE subsector became developing quicker than before, it started requiring new equipment and new technological solutions, thus, encouraging further technological search.

Very similar situation can be observed in the sector of mobile communications, on African continent in particular: traditional telephone connection was a troublesome business for many African countries due to huge areas to be covered by rather expensive cables, infrastructural costs were very high too. Mobile communications minimized these costs, thus, today about 65% of the overall population on the continent has access to mobile, including Internet, communication.

Renewable energy is gradually becoming a separately meaningful economic sector; companies producing equipment for this sector are already trying to establish long-term relations with the largest consumers of renewable energy, thus becoming also the suppliers of their own innovative solutions.

Strengthening their positions in specific segments of the RSE market, these producers are trading their unified solutions to a growing circle of consumers. Since their solutions are quite complex in nature, their life-long servicing is usually integrated into the sales process, thus, the process of renewable energy provision to end consumers indirectly includes servicing by equipment producers as well.

The intention to sell innovative solutions in the sector of alternative energy is often explained by the investor’s desire to get higher (as compared to market average) profits. Besides that, as soon as national legislation catches up with the technological development of the energy sector, taxation and other preferences began serving as an additional stimulation for all involved - producers, suppliers and end consumers.

Strategic interest to research and implementations in the RSE field demonstrated by the global economic leaders along with the legal and tax support have made the process of RSE development irreversible (Samarina et al, 2018). However, we need to keep in mind that real efficiency of the RSE sector’s innovative development in a particular country will always depend on the state of the local investment market and the level of the national credit market preparedness to such radical technological changes. Tax preferences, in this context, become of vital importance. Also important are: support by the local environmentalists, promotion of the “green marketing” standards, wider implementation of “green” principles in the life cycle of other equipment, higher tariffs for the use of more traditional equipment, strict rules of the industrial waste utilization etc. All of the above would together become quite effective stimuli for the development of RSE sector.

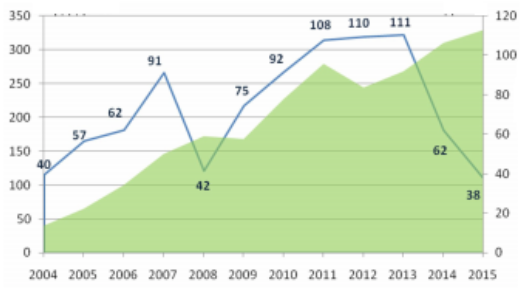

To assess the correlation between investment activity in the RSE sector and the oil prices, let us consider the dynamics of investments into this sector, see Figure 1.

First of all, we need to note that investment activity in the RSE sector tends to grow when the prices for oil are also growing, however, there is no similar correlation once the oil price reduces. This trend is also confirmed by the calculations presented in Table 1. Lower volumes of investments during 2012 can be explained by the innovational cheapening of the RSE technologies, especially in the segment of solar energy production. Later on, this also caused the growth in production of various solar-related equipment. The overall capacity of this segment grew from 31 gigawatt per year to 39 gigawatt.

Figure 1

The volumes of investments in

renewable energy production

(in bln USD; author’s own calculations on the data from: Bloomberg New Energy Finance.

http://www.bloomberg.com /europe/; BNEF. http://www.bloomberg.com/europe/)

-----

Table 1

Correlation between the volume of investments in RSE development and the world oil prices

(2004 to 2015) (Author’s own calculations on the data from: Bloomberg New Energy Finance

http://www.bloomberg.com/europe/ )

Parameter/ Year |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

RSE investments |

40 |

65 |

100 |

146 |

172 |

168 |

227 |

279 |

244 |

268 |

310 |

329 |

Oil prices |

40 |

57 |

62 |

91 |

42 |

75 |

92 |

108 |

110 |

111 |

62 |

38 |

As you can see above, significant reduction in prices for oil was observed in 2009, 2014 and in 2015, however, these reductions have hardly any impact on the rates of RSE introduction (see Figure 2).

According to the data of the marketing experts at Clean Edge, Inc., back in 2009, that is, during the most severe times of the financial crisis, the overall sales of wind energy, solar energy and energy from biofuels grew by 11,4%, reaching the level of 139,1 bln USD. Noteworthy, prices for all three types of energy were at the same time going down (Clean Energy Trends, 2010).

According to the UNEP data (2015), in 2014 global investments in RSE reached the level of 290 bln EUR, and in one year only, that is, by 2015, this indicator jumped over 329 bln USD.

Therefore, significant fall in oil prices (to the 2004 level) demonstrated stability of the innovative development in the RSE sector in relation to fluctuations in prices and other parameters of the business environment. The initial target in development of the RSE subsector was to get the share of 12,5% of all electric energy by 2010, and this target was in fact reached by the end of 2007 already (Renewable energy sources in figures, 2009).

Serious progress in the field of environmental protection, minimization of production costs and a range of innovational improvements in the RSE sector together have encouraged a real wave of private investments in this sector. As private investments were joining state and social investments in RSE, in 2013 already the volumes of CO2 emissions into the air went down by 1,2 bln tons (BNEF. 2014).

Figure 2

Correlation between annual average investment volume

in RSE and the prices for Brent oil (in bln USD)

(Author’s calculations on the basis of data from: Bloomberg New Energy Finance.

http://www.bloomberg.com /europe/)

Therefore, we can conclude that availability of sufficient number of technological innovations has led to implementation of significantly improved RSE technologies and products, while resource spending on them was steadily going down.

In today’s conditions the potential of both wind and solar energy is quite high, while oil prices are often unpredictable (see Figure 2). At the same time, infrastructural costs in both these segments are becoming quite comparable, thus, RSE start competing with the traditional energy segment, and more and more often win in this competition. Thus, we can conclude that at the initial stage of the RSE segment development investment activity in this field strongly depended on oil prices and their fluctuations, however, as of today, RSE has already lost this dependence, being at the stage of active growth already. The current volumes of investment in RSE clearly show that this segment has a range of competitive advantages, primarily thanks to breakthrough technologies that emerged in the segments of Sun and wind energy. Another observable trend is that today developing countries are investing in RSE segment quite proportionately to developed countries (Data from: www.isep.or.jp/gfr).

In 2015 implementation of various innovative solutions in the field of wind energy generation was especially successful, thus, the ratio between investments in wind and in solar energy generation changed significantly: now 60% of all capital incoming into the RSE segment was directed on wind energy, while only 30% were invested in production and improvement of solar batteries. All other types of alternative energy got the rest of 10%.

Also noteworthy here is that mass production of the devices converting renewable energy into electric and thermal ones has reached the point of no return some time ago, and this was the key reason why the investment plans in 2015 were overfulfilled in the majority of countries involved in production of such energy. During these 32 years since the oil crisis of 1973 new intersectoral connections have been formed, brand new employment opportunities have been created, new, truly innovative segments of machine- and equipment-building have now guaranteed deals and orders for several years to go.

Figure 3

The split of substituted spendings

due to RSE in Germany, as of 2012

(data from: Erneurbare Energien. Bundesministerium

fur Umwelt, Naturschutz und Reaktorsicherheit, 2014)

Let us consider in more detail the potential opportunities for financial saving due to active use of renewable energy.

Germany is one of the best examples in this regard. In this country mass-scale application of RSE has been gradually minimizing the volume of spending on import of non-renewable fuels. At the same time, RSE sector in Germany has already reached the level when it is capable of providing its own tax revenues (see Figure 3), apart from all other benefits.

If we compare the volume of substituted spending on RSE in Germany with the volume of tax revenues from them, in percentage, we will note that even one third of all results from RSE application is able to prevent all spending on compensating the damages for the environment. 27% substitute the costs of energy imports (no less importantly, thus leaving significant amounts within the boundaries of national economy), and the rest of 39% form the tax revenues.

Economic attractiveness of RSE on the background of innovative development of all the related technologies has formed a solid basis for further growth of investments in the segment of the energy sector. Today in the RSE subsector we can actually observe a classical manifestation of the synergy effect: the rate of technological progress overall is getting higher due to the sum of all pioneering technologies being implemented at the same time. If all these technologies have been implemented in a standalone mode, or one by one, for some reason, the overall effect would have never been so impressive. Today’s expansion of RSE is changing the whole energy sector, as it becomes the key generator of capital and the central point of interest for all categories of investors.

RSE as a separate subsector is becoming more and more competitive as compared to the so-called traditional energy sector. The prime cost of alternative energy production is decreasing all the time, as all related technologies are being improved. Previously, this subsector has relied heavily on state subsidies, however, today this dependence is getting weaker, while RSE themselves are becoming a new (and relatively stable) source of tax revenues.

Renewable energy is a vital component of national energy security for so many countries globalwide, as it makes all economies significantly less dependent upon carbon prices instability and fluctuations. This is the key reason why not only the states and the societies, but also businesses across all sectors and sizes become so interested in RSE development and implementation.

When analyzing the roles of political and informational support for efficient use of the alternative energy sources, we need to keep in mind two provisions: a) Schumpeter’s innovative cycles fit the segment of alternative energy perfectly, as the latter goes through all the same phases, as we have observed here; b) we all have to admit retrospectively that both economic and environmental consequences from the use of fossil fuels have been greatly underestimated.

The very concept of active implementation of renewable energy has been offered at times of oil prices fluctuations and energy supply instability overall, however later on it has transformed into long-term state-approved and supported programmes.

According to some forecasts, by 2025 the share of RSE will reach the level of 25%, provided the current level of investments would remain (at least) on the same level. Such investment-backed development would be able to create new job places and contribute to innovative development of many related industries. Tax and technological support is supposed to become some sort of regulatory measures, also contributing to progressive development of the RSE subsector.

Therefore, we can state that we have revealed quite a stable trend of traditional energy sources’ substitution by the renewable ones. And this trend demonstrates very weak dependence from the prices of fossil fuels. In this context, political support, publicity and advocacy seem to have much more important roles as contributors to development of innovative entrepreneurship in the RSE subsector.

Dynamic development of RSE has already passed the point of no return, and today serves already as a catalyst in reduction of phases within Kondratiev’s cycles. Additionally, development of RSE has a huge potential in terms of financial resources’ saving for enterprises and state budgets and also as an additional source of tax revenues.

Anpilogov, A. 2017. Kapitsa turned out to be right: it is no use waiting for a revolution in alternative energy. https://riafan.ru/883959-kapica-okazalsya-prav-revolyucii-v-alternativnoi-energetike-zhdat-bez-tolku (in Russian).

BNEF, 2014. Frankfurt School-UNEP Centre. Global Trends in Renewable Energy Investment 2014, http://www.fs-unep-centre.org.

Clean Energy Trends 2010. 2010. Portland: Clean Edge, Inc. P. 15.

Electricity information. 2012. IEA statistics.IEA Publications, Paris Cedex 15. P. 71.

Global energy and G-8. 2011. http://www.ereport.ru /articles/ecunions/g8.htm.

Helder, M. 2015. Renewable energy is not enough: it needs to be sustainable. https://www.weforum.org/agenda/2015/09/renewable-energy-is-not-enough-it-needs-to-be-sustainable/

Imperial College London. 2018. Running on renewables: How sure can we be about the future? https://techxplore.com/news/2018-03-renewables-future.html

Katorgina, E. 2002. New Manhattan project. Expert, 39. P. 55. (in Russian).

Kondratiev, N. 2002. Large conjuncture cycles and prediction theory. Moscow, Economika. (in Russian).

Mandil, K. 2007. Energy Statistics Guide of the International Energy Agency. IEA Publications, Paris Cedex 15. P.18.

Martinez Alier J., Schlupmann K. 1991. La ecologia y la economia. Fondo de Cultura Economica С. Техtos de economia. Сiudad de Mexico (Mexico), P.89. (in Spanish).

Onyusheva, I., Ushakov, D., Van, H.T. 2018. The eco-problems and green economy development in Kazakhstan: An analytical survey. International Journal of Energy Economics and Policy, 8(2). P. 148-153.

Reiche, D. 2005. Grundlagen der Energiepolitik. Frankfurt am Main: Peter Lang. P. 21. (in German).

Renewable energy sources in figures, status 2009. (2009). Berlin, Germany: Federal Ministry for the Environment, Nature Conservation and Nuclear Safety. P. 59.

Report of the United Nations Conference on New and Renewable Sources of Energy. (1981). New York: United Nations, p.7.

Samarina, V., Skufina, T., Samarin, A., Ushakov, D. 2018. Alternative energy sources: Opportunities, experience and prospects of the Russian regions in the context of global trends. International Journal of Energy Economics and Policy, 8 (2). P. 140-147.

Schumpeter J.A. 1939. Business cycles. A theoretical, historical and statistical analysis of the capitalist process. Vol. 1. N.-Y.– L. P. 130-135.

United Nations Environment Programm. 2015. http://www.ecolife.ru/infos.

Ushakov, D., Kharchenko, L. 2017. Environmental factors of national competitiveness in modern MNCs’ development. International Journal of Ecological Economics and Statistics. 38 (2). P. 141-149.

Varfolomeev S.D., Moiseev I.I., Myasoedov B.F. 2009. Energy sources from renewable raw materials. Bulletin of the Russian Academy of Sciences. 79, 7. P. 597. (in Russian).

1. Faculty of management science, Suan Sunandha Rajabhat University, Bangkok, Thailand. E-mail: prateep.wa@ssru.ac.th