Vol. 40 (Number 32) Year 2019. Page 22

LUEBECK, Ju. V. 1

Received: 01/08/2019 • Approved: 18/09/2019 • Published 23/09/2019

ABSTRACT: The research purpose is to develop an integrated stakeholder analysis layout in the investment project implementation under a concession agreement in a region of Russia with mineral and raw material orientation. The paper addresses the organizational and economic nature and analyzes the effectiveness of the special-purpose company’s cooperation with stakeholder groups when implementing an investment project under the concession agreement in the region of Russia with mineral and raw material orientation. |

RESUMEN: El objetivo de la investigación es desarrollar un diseño de análisis integrado de grupos de interés en la implementación del proyecto de inversión bajo un acuerdo de concesión en una región de Rusia con orientación de minerales y materias primas. El trabajo aborda la naturaleza organizativa y económica y analiza la efectividad de la cooperación de la compañía para fines especiales con los grupos de interés al implementar un proyecto de inversión bajo el acuerdo de concesión en la región de Rusia con orientación de minerales y materias primas. |

Sustainable, balanced, and socially productive development of the national economy is determined not only by the economic potential of its territories, which is constituted by competitive advantages, but largely depends on the smooth coordination between the regional public administration systems and the federal government agencies. One of the mechanisms for implementing management policies based on the principles of partnership between state and municipal authorities with real economic actors is a concession mechanism.

The mechanism of partnership between the state and private businesses when implementing socially significant projects under concession agreements that is being formed in Western countries represents a new level of the state regulation of the economy that is reflected in the doctrine of corporate social responsibility.

Having emerged as a normative concept describing the ethical principles of business, the concept of corporate social responsibility soon turned into a synthetic one, penetrating various areas of the economy and actualizing the well-known paradigm “principles-processes-results”. Such progressive development contributed to the emergence of alternative directions, among which a stakeholder concept is high on the agenda, reflecting the objective process of the relations between a corporation and society complicating with an increasing variability of external and internal business environments represented by various agents-stakeholders. The above mentioned has also been noted both in the works of Western researchers who stood at the stakeholder concept origins, such as Freeman (1984), Donaldson and Preston (1995), and others and Russian, such as Luchko (2006), Blagova (2011), and others.

In a particular case, when implementing investment projects in the format of concession agreements, the stakeholder impact assessment allows one to personalize the objects of responsibility to the maximum, which in turn leads to a more specific analysis of the principles, processes, and results, logical subordination of which increases the effectiveness and efficiency of concession project implementation. This is noted both by the representatives of Western scholarly traditions (Wikström et al., (2010) and domestic scholars (Dolgopolov ( 2012); Vazhenin, & Gerasimov (2011) etc.).

Applying the tenets of the concept in the sectoral context when creating, reconstructing and modernizing infrastructure facilities needed to develop the specialization industries of regional economic systems is largely determined by the effect of industry-specific features. The nature of mining industry enterprises, associated with unbiased difficulties of their own financial asset provision due to a high level of capital, labor and material intensity of production and a special profit distribution system with diversion of significant financial amounts into financial arrangements to counter risks, predetermine their special relationship with the government budget. In this regard, the integrated stakeholder analysis in the investment project implementation under a concession agreement, starting from identifying the main stakeholders, their grouping, and subsequent ranking and ending with determining the effectiveness and efficiency of resource interchange between the key players provides an investment project with the data required for major operational and strategic decision making (Jelnova, (2013); Minakova & Anikanov, (2013); Shvetsova et al., (2018); Osadchy et al., (2018).

The research hypothesis: Integrated stakeholder analysis results in enhanced efficiency of an investment project under concession agreements, implemented in the regions of Russia with mineral and raw material orientation.

The research purpose is to elaborate an integrated stakeholder analysis layout in the investment project implementation under concession agreements in the regions of Russia with mineral and raw material orientation.

In accordance with the purpose, the main objectives of the research are the following:

- elaborate an integrated stakeholder analysis layout in the investment project implementation under concession agreements;

- explore the organizational and economic nature of cooperation between a special-purpose company with the stakeholders involved in the investment project implementation under concession agreements;

- analyze the effectiveness of cooperation between a special-purpose company with stakeholder groups involved in the investment project implementation under concession agreements in the regions of Russia with mineral and raw material orientation.

The formation of a concession mechanism in Russia has gone a long way, starting from the first concession forms to contemporary forms, taking into account the influence of various concepts, including the institutional stage of development, operating in the context of dynamism and variability of the internal and external project implementation environments.

Historically, the notion of concession forms of public-private partnerships (PPPs) developed in the late 19th century as a right granted to an individual to engage in any type of activity that the state considered its prerogative. Thereon, the first concession enterprises in Russia were established, primarily in resource-based industries (coal mining, oil, iron and steel, forest industries), as well as in infrastructure–railway transport and utility lines, which gave a powerful impetus to the industry development.

Concession forms gained further traction during the NEP aimed at industry rebirth after the First World War and the Civil War. Using other countries’ practices in franchising, the country extensively involved foreign investment, especially in those sectors that were of the greatest importance to the state (in mining, metallurgical, and manufacturing sectors). Thus, concession projects during the period of NEP contributed to intensify development of national economy sectors and introduction of innovative technologies in the sectoral context. In addition, the Soviet concessions were well fitted in the legislative and doctrinal terms, which reflected in the works of Bernstein (1930), Landau (1935), Schreter (1923), and others. A sufficient number of various legislative documents were issued at various levels, designed to coordinate and control the process of granting and operating concessions in Russia.

In order to restructure the national economy, the issue of resuming concession production began to be raised in the early 1990s because the environment deterioration was traced in many areas of economic activity, in particular the mining enterprise development. A significant contribution to the concession mechanism revitalization during this period was made by Karass (1925); Landau (1935); Reikhel (1927); Bernstein (1930); Schreter (1923), Nosov (1926), Doronina (2003), and others. These scholars’ developments laid the foundation to a revival of lost private business patterns and practices of operating the government property and to establishing comprehensive concession legislation in Russia (passing “sectoral” concession bills taking into account the specifics of concession activities in certain sectors of economy, based on general provisions of the foundations of concession relations).

In the mining industry, concession agreements are worked out and implemented in the format of industrial development strategy for the period until 2030 aimed at performing high-priority tasks within the framework of each strategic area and providing for enhanced cooperation of public authorities of all tiers with business community and non-governmental organizations. At the same time, the effectiveness of particular socially significant federal and regional projects largely depends on their coordinated actions aimed at implementing the corporate social responsibility doctrine. The study of international practices and features of implementing the principles of corporate social responsibility in domestic business were addressed in the works of such scholars as Semenenko (2008), Luchko (2006), Belyaeva & M.A. Eskindarova (2016), Blagova (2011), teblyanskaya et al., (2019) and others. According to these papers, the elaborateness and personalization introduced by the stakeholder concept and furthering the interests of individual participants, on the one hand, as well as their optimal coordination in solving investment issues, on the other hand, contribute to improving the investment project performance. In the mining industry, when implementing PPP projects, the integrated stakeholder analysis leads to better informed project implementation. This is noted in the contributions of domestic scholars (Kozlov et al., (2018), Bataeva, 2018, and others).

Thus, in the Russian context, the development of an integrated approach to elaborating a stakeholder analysis layout in the investment project implementation under concession agreements in the regions with mineral and raw material orientation would interlink the project development efficiency with the strategic course of regional development.

The investment project development and implementation in the format of concession agreements involves the stakeholder analysis based on the tenets of the stakeholder concept.

The stakeholder concept began to develop in the 1930s against the background of institutional tools mainstreaming in many Western countries, which caused inevitable institutional changes, necessitated the establishment of new market institutions and creation of effective forms of ownership that would actively influence economic development. The first assumptions were put forward in the academic circles that the goal of a firm was much broader than mere creation of wealth for its owners (Berle and Means, 1932). In the context of expanding market, the ambitions also include job security for employees, better quality products for consumers, and increased contribution to the local community welfare (Dodd, 1932). Further developments were aimed at studying the institutional environment of economic agents as well as mutual dependence of institutional changes and economic growth during the period of market relations development In particular, the works of H. Simon (the model “encouragement*contribution”) reflected the assessment of internal and external factors impacting the buildup of firms (Simon, 1952). The papers of and Sethi (1975) substantiated a high correlation between the legitimacy of a firm and its social responsibility. According to the researchers, substantiating one’s existence to other “alignable” organizations means unhindered access to resources for an organization, while substantiating its existence to a “higher-level system”, primarily the state, means ensuring its “utility” (that is, attaining high business performance) and “responsibility”. Thereby, in 1984 E. Freeman presented a full-scale stakeholder theory in his contribution Strategic Management: Stakeholder Approach. This work reflected the objective process of relations between a corporation and society complicating as a result of an increasing variability of external and internal business environments represented by various agents-stakeholders. Representation of a firm and its environment as a set of stakeholders whose interests and requirements should be taken into account and satisfied by managers contributed to the formation of a new era of managerial thinking.

Further research has somewhat transformed the concept giving it required clarity and its own place in the system of managerial knowledge. In particular, the contributions of T. Donaldson and L. Preston (Donaldson, & Preston, (1995) were aimed at developing the substantive part of the stakeholder theory, which allows one to explain the nature of the latter and to specify its focus areas. According to Jones & Hill (1992), it was this approach that added the stakeholder concept the logic characteristic of theory and provided the systematization necessary for this theory. In this sense, while agreeing with the interpretation of E. Freeman, the researchers recognize the stakeholder concept as “managerial in the broad sense of the word”. It does not simply describe the existing situations or predict cause-effect relationships; it recommends attitudes, structures and practices that collectively determine stakeholder management (Freeman, 1984).

The emergence of “stakeholder approach” of Post et al., (2002), who viewed the concept from the perspective of strategic management was a certain advancement of E. Freeman’s ideas, as well as the resource concept, as well as the tenets of new institutional theory (Coase (1937), Buchanan (1997), Williamson (1996), and others). The reference point of the proposed line of reasoning is linking the process of stakeholder system management with generation of organizational wealth, especially for such firms as complex “extended enterprises” that include not only the focal firm’s interactions with other businesses, but also its relationships with other stakeholders, both internal and external. According to the researchers, the extended enterprise as the nodal element within a network of interrelated stakeholders that create, sustain, and enhance its value-creating capacity. At the same time, “the long-term survival and success of a firm is determined by its ability to establish and maintain relationships within its entire network of stakeholders, which implies continuity and multiple occurrence” (Post et al., 2002, p.7).

Further studies undertaken on the basis of the above specify a particular aspect, whereby the developments of a strategic nature stand out, among which contributions of foreign researchers Wikström et al., (2010), and others can be distinguished. Tactic analysis is presented in the works of the following researchers, both foreign (Yang, et al., (2011), and others), who evaluate the analysis of short term management problem solving, and domestic (Ershova, & Bolotin, (2008); Efimova, & Samohina, (2014) and others), who develop approaches to the analysis with reference to the Russian context.

The analysis issues in the framework of public-private partnership mechanism were addressed internationally (Brugha, & Varvasovszky, (2000). In Russian practice, the works of Tatarkin & Tarakanina (2008), which link the stakeholder analysis carried out as a part of regional strategic development investment project evaluation, stand out. In addition, the works of Boush et al. (2012) are aimed at forming innovative structures–regional clusters, and researchers Kitova et al., (2007) analyze the role of the state in such projects. The works of Kozlov et al., (2018), Bataeva, 2018, distinguished by their raw-material and mineral resource orientation, substantiate that the stakeholder analysis leads to better informed and more effective project implementation.

Thus, the stakeholder concept formation analysis justifies the necessity of stakeholder identification, taking into account the legitimate interests of all relevant stakeholders both in the organization management and in the development of specific investment projects. Long-term survival and success of a company (project) is determined by their ability to establish and maintain relationships within the network of stakeholders, otherwise the company is not able to maximize welfare if it ignores the interests of stakeholders (Jensen, (2002), Nikitina et al., (2018), Takhumova et al., (2018), Brinza et al., (2015).

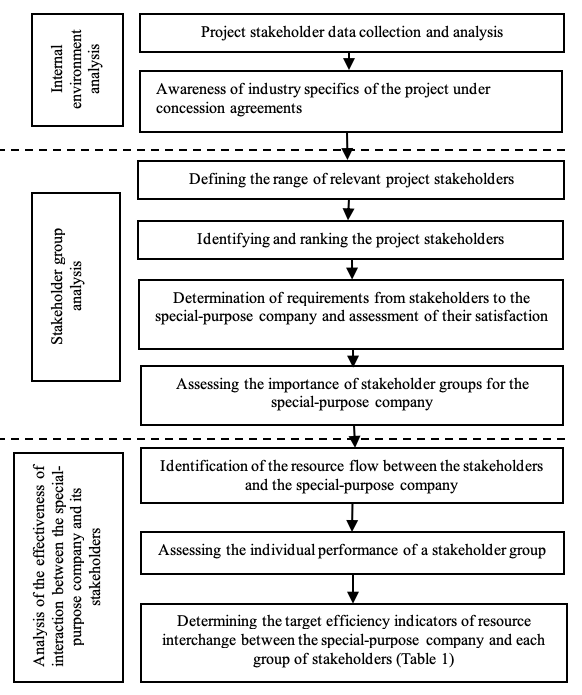

The fundamental principles of the above concept allow stakeholder analysis in the process of developing and implementing investment projects with mineral and raw material orientation under concession agreements. The integrated analysis involves the following steps (Figure 1):

Figure 1

Stakeholder analysis layout for an investment project with mineral

and raw material orientation under a concession agreement

Source: Compiled by the authors

As a part of the first stage, the project internal environment is analyzed within the scope of a concession agreement aimed at assessing the internal resources and capabilities of the special-purpose company and the investment potential of the project and at identifying its strengths and weaknesses.

The second stage of the integrated analysis involves analysis of the project stakeholder groups. According to the analysis algorithm, the range of relevant project stakeholders is defined, the stakeholders are identified and ranked by identifying primary and secondary stakeholders that are directly and indirectly related to the project development and implementation, taking into account the industry-specific features; stakeholder prioritization according to the degree of their influence on the project and their dependence on it; a balance between varying interests of the parties should be struck.

The third stage aims to determine the degree of efficiency of the resource flow between the special-purpose company and stakeholder groups. In the course of the stage, overall performance indicators are determined (Table 1): individual performance of the stakeholders and the target efficiency indicators of the resource interchange between the special-purpose company and each group of stakeholders.

Table 1

Major categories and indicators for assessing the efficiency of interaction

between the project special-purpose and a group of stakeholders

Source: Compiled by the authors

Assumptions for the layout:

- the presence of resource interchange between the k-th group of stakeholders and the special-purpose company, in which a certain amount of resources can be identified;

- a specific resource has been assigned the following characteristics: importance from the standpoint of its contribution to the resource base for meeting the special-purpose company’ objectives and its satisfaction with the quality and quantity of the resource received;

- the importance of resources and satisfaction with the resource received is assessed according to a point rating method: the former is assessed on a scale (from 0 to 1), the latter is assessed on a scale (from 0 to 10).

The presented layout (Figure 1) implementation is accentuated by the impact of industry-specific features on the design, which leads to a diversion of significant extra-budgetary resources to providing technological, financial and credit, and insurance elements, since the presence of mineral assets in a region mandates a particular trend of its economic development, while the objective production features of spatial combination of minerals determine the development of a specific industrial complex. Such development is aimed at creating closed technological production chains and is possible only within the scope of territorial economic systems based on production integration. The formation of such networks aimed at implementing single integrated programs contributes, on the one hand, to effective production development of thermal power plants with due account for comprehensive use of local reserves and environmental protection, and on the other hand, to development of infrastructure facilities.

Based on the presented methodology, the integrated stakeholder analysis was performed in the following investment project implementation under a concession agreement in the mining industry: “Construction of Elegest-Kyzyl-Kuragino railway and a coal terminal in the Far East as a part of development of the mineral and raw material base of the Republic of Tyva” (the project data were provided by the administration of the Republic of Tyva).

The goal of the presented project is to create a supporting transport infrastructure construction to accelerate the socio-economic development of the Republic of Tyva based on involving valuable mineral deposits in the economic turnover.

The investment project includes the following areas (subprojects):

- Construction of the Elegest Kyzyl-Kuragino railway 410 km long with a capacity of 15 million tons per year with an increase to 27 million tons in perspective.

- Construction of an ore mining and processing industrial complex at the Elegestskoye deposit with a capacity of more than 15 million tons of coking coal concentrate as a part of a coal mine and a full-circle concentration plant with related industrial engineering, transport, and social infrastructure.

- Construction of a coal port terminal in the vicinity of Cape Burny in the port of Vanino in the Khabarovsk Territory.

Government of the Russian Federation approved the conclusion of a concession agreement with JSC Tuva Energy Industrial Corporation Kyzyl-Kuragino by its decree of April 17, 2018 No.687-r in order to set up public railway transport infrastructure as part of the project implementation.

The above information makes it possible to fill in the following table (Table 2), whereby the strengths and weaknesses of the project as well as its opportunities and threats come into focus.

Table 2

Analysis of the internal project environment

Strengths: |

Weaknesses |

- construction of mining and manufacturing industry facilities (a mine and a concentrator); - construction of industrial and social infrastructure facilities; - creation of employment; - increase tax revenues. |

- the scale and duration of the investment project and, consequently, low and delayed project economic indicators; - complexity of the project organization due to an inter-ethnic nature of the project; |

Opportunities: |

Threats: |

- further development of the extractive industries of the territory; - development of industrial and social infrastructure facilities; - attraction of additional investment due to a multiplier effect, including the development of small and medium-sized businesses in the Republic; - decreasing social tension of the population in the region; - strengthening interregional and international relations (with access to new markets). |

- reduction of the project funding from all the project participants; - the concessionaire failing to meet its obligations in full; - changes in the geological description of the project and, as a result, overestimated project cost of the mining facilities construction |

Source: Compiled by the authors

Analyzing the data in Table 1, one can say that the investment project implementation (by the end of 2023, amounting to a total of more than 217 billion rubles), which is large-scale and has a long lag, will have a positive effect on the investment potential of the Republic of Tyva and will enhance its production and infrastructure capacity and social sector development.

The following estimated effect of the project is expected:

- creating about 15 thousand jobs (taking into account related sectors)

- reduced social strain of the population in the Russian Federation, arising from poorly developed regional transportation networks, rolling stock, and terminal complexes;

- strengthened interregional and inter-ethnic links (especially for the territories of Western and Central Siberia, since the abovementioned railway is the shortest way to the growing markets of the Asia-Pacific Region, primarily China (the transport leg is reduced by 2.5 thousand km)).

Thus, the project implementation coupled with elaboration of relevant legislation will affect the investment environment in the Republic of Tyva, which has risen by 35 positions to be ranked 46th in the national rating. Sustainable development of the Republic lies with agglomeration structures combining the industrial potential with highly developed infrastructure and research and development centers.

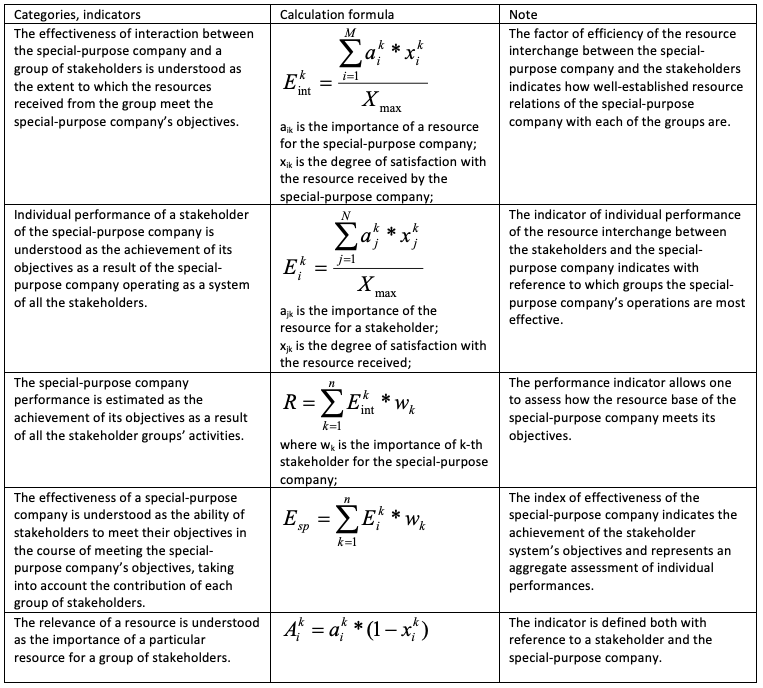

When developing and implementing an investment project as a part of a concession agreement (the subject of a concession agreement is concession relations of granting an individual (concessionaire) on a temporary basis the right for economic use of state or municipal property in return for which such individual pays the state or municipality (concession grantor) the taxes, fees, and other payments established by law a special-purpose company has relationships with a large number of groups and individuals (stakeholders) constituting its environment (internal and external), which affect or may be affected by the decisions made by the special-purpose company. When implementing a project under a concession agreement, the stakeholders are: a concession grantor and a concessionaire (principals), as well as an operator, contractors, creditors, suppliers, buyers, insurance companies, and other investment intermediaries.

In the framework of doctrine of fair contracts (the doctrine of fair contracts developed by E. Freeman is based on interpreting value creation as a contractual process whereby the company's stakeholders are involved), stakeholders are seen as rational actors seeking to forward their own interests. Internal stakeholders (managers, employees, shareholders) aim to maximize the value of the special-purpose company. External ones, whereby suppliers stand out, aim to ensure the speed (timeliness) of effecting payments and continuity of orders; creditors aim to ensure reliable fulfillment of the contractual provisions, etc. At the same time, legitimacy of the stakeholders’ interests is determined by their following certain contracts (Figure 2). For example, the operator regulates its activities with an operations and maintenance contract; the building contractor–with a construction contract; the creditors–with a credit agreement; the grantor and the special-purpose company enter into a contract in the form of a concession agreement.

Figure 2

Project stakeholders under concession agreements

Source: Compiled by the authors

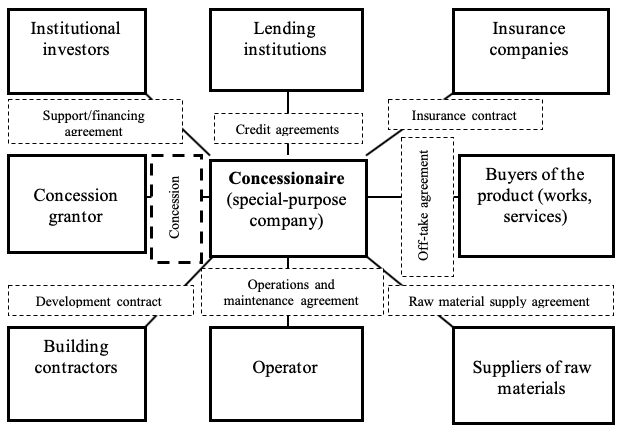

Within the scope of descriptive dimension, the above groups of stakeholders can be grouped according to the model of Mitchell et al, (1997) as follows (Figure 3).

Figure 3

Stakeholder typology according to the

model of Mitchell, Agle, and Wood

Source: compiled according to the

model of Mitchell et al., (1997)

According to this typology, the greatest importance in the development and implementation of concession projects is acquired by meeting the expectations of “particular” stakeholders that combine three attributes (power, legitimacy, and urgency): the grantor and the concessionaire. Discretionary stakeholders that meet two criteria are in the intermediate position: on the one part, these are buyers and suppliers, on the second part, certification authorities and judicial bodies, on the third part, creditors–banks and insurance companies. Latent stakeholders are the least significant with only one attribute: institutional investors, government agencies, and contractor organizations.

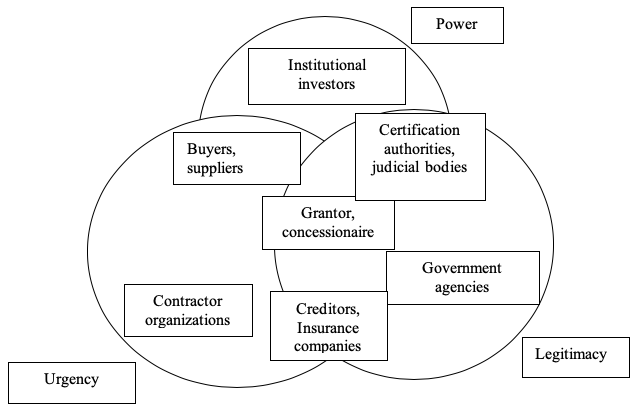

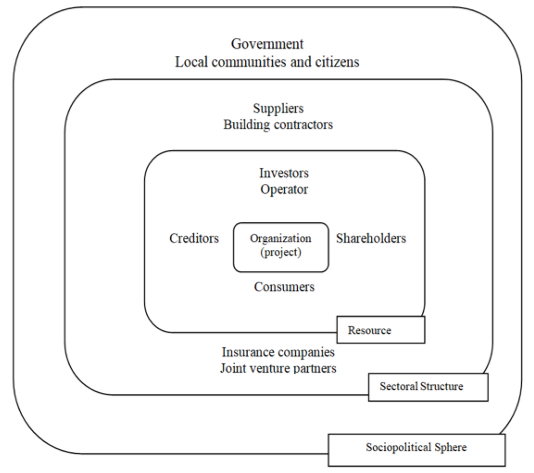

When further developing and modifying the model of Mitchell et al.,(1997), for example, in terms of the stakeholder agency model, it is possible to represent a different stakeholder typology. According to the stakeholder agency model proposed in the contributions (Jones, & Hill 1992), managers must act as agents of the entirety of stakeholders. At the same time, relations with stakeholders are the essential asset that project managers must manage and the ultimate source of organizational wealth. Organizational wealth created in the course of long-term relationships acts as a resulting indicator of an organization’s (project) activity, including all its assets, competencies, and capabilities, whereby intangible “relational assets” that arise in the course of stakeholder engagement are essential. Stakeholders can be divided into groups referred to as “resource base”, “sectoral structure”, and “sociopolitical sphere” (Figure 4).

Figure 4

Stakeholder typology from the

standpoint of agent-based model

Source: Compiled by the authors

At the same time, stakeholders are able to influence the competitive position of an enterprise in the industry; contribute to its unique resources and capabilities; act as sociopolitical actors that determine the legitimacy of enterprise in society. It is dynamic stakeholder engagement that forms the ability of an organization to generate wealth over time (Post et al., 2002, p. 53). Furthermore, the development and maintenance of respective relational assets becomes the key managerial competency, the main means to gain long-term competitive advantages.

One important criterion for the effectiveness of development and implementation of an investment project under a concession agreement is the degree to which the stakeholder groups’ objectives have been achieved. In this regard, the special-purpose company’s performance is largely determined by the efficiency of its interaction with the main groups of stakeholders. In turn, the major objective of analyzing the efficiency of special-purpose company’s interaction with the main groups of stakeholders is to assess the degree of resource flow coordination between the special-purpose company and the groups of stakeholders. An expert review (based on case study of investment projects implemented in the Republic of Tyva) of the resource flow between the special-purpose company and a particular stakeholder group is represented below (Table 3–4).

Table 3

Appraisal of resources received by the stakeholders from the special-purpose company

Name of capital resources |

Attributes reviewed |

||

Importance of a resource to the stakeholder |

Degree of satisfaction by the resource received |

Relevance |

|

Public Sector Group |

|||

Execution of the concession agreement |

0.35 |

6 |

1.4 |

Employment |

0.24 |

4 |

1.44 |

Taxes |

0.36 |

6 |

1.44 |

Regional Finance Projects |

0.05 |

3 |

0.35 |

Operators Group |

|||

Financial resources |

0.51 |

8 |

1.02 |

Meaningful cooperation |

0.43 |

4 |

2.58 |

Discount system |

0.06 |

3 |

0.42 |

Creditors Group |

|||

Financial resources |

0.54 |

7 |

1.62 |

Participation in projects |

0.21 |

4 |

1.26 |

Image |

0.25 |

3 |

1.75 |

Buyers (of works, services) Group |

|||

Works (services) |

0.56 |

9 |

0.56 |

Discount (bonus) system |

0.32 |

2 |

2.56 |

Image |

0.12 |

3 |

0.84 |

Suppliers Group |

|||

Collaborative effort to promote cost-optimized processes and technologies |

0.12 |

6 |

0.48 |

Financial resources |

0.41 |

6 |

1.64 |

Involvement in projects |

0.24 |

4 |

1.44 |

Discount (bonus) system |

0.23 |

3 |

1.61 |

Construction Contractors Group |

|||

Financial resources |

0.41 |

7 |

1.23 |

Involvement in projects |

0.32 |

4 |

1.92 |

Discount (bonus) system |

0.27 |

3 |

1.89 |

Insurance Companies Group |

|||

Financial resources |

0.51 |

8 |

1.02 |

Involvement in projects |

0.35 |

4 |

2.1 |

Discount (bonus) system |

0.14 |

3 |

0.98 |

Other Institutional Investors Group |

|||

Financial resources |

0.53 |

6 |

2.12 |

Involvement in projects |

0.32 |

4 |

1.92 |

Image |

0.15 |

3 |

1.05 |

Source: Compiled by the authors

-----

Table 4

Appraisal of resources received by the

special-purpose company from the stakeholder

Name of capital resources |

Attributes reviewed |

||

Importance of a resource to the special-purpose company |

Degree of satisfaction by the resource received |

Relevance |

|

Public Sector Group |

|||

Execution of the concession agreement |

0.41 |

7 |

1.23 |

Employment |

0.22 |

6 |

0.88 |

Grants (subventions) |

0.13 |

3 |

0.91 |

Tax incentives |

0.08 |

2 |

0.64 |

Target programs |

0.11 |

3 |

0.77 |

Other support of government programs |

0.05 |

2 |

0.4 |

Operators Group |

|||

Maintenance and project management |

0.43 |

7 |

1.29 |

Meaningful cooperation |

0.25 |

6 |

1 |

Project reputation |

0.32 |

7 |

0.96 |

Creditors Group |

|||

Financial support |

0.47 |

7 |

1.41 |

Involvement in regional programs |

0.38 |

4 |

2.28 |

Image of the organization |

0.15 |

4 |

0.9 |

Buyers (of works, services) Group |

|||

Financial resources |

0.46 |

7 |

1.38 |

Involvement in projects |

0.42 |

3 |

2.94 |

Image |

0.12 |

1 |

1.08 |

Suppliers Group |

|||

Supplies of commodities and materials |

0.54 |

7 |

1.62 |

Collaborative effort to promote cost-optimized processes and technologies |

0.33 |

6 |

1.32 |

Discount (bonus) system |

0.13 |

2 |

1.04 |

Construction Contractors Group |

|||

Work (services) performed |

0.48 |

7 |

1.44 |

Involvement in projects |

0.22 |

6 |

0.88 |

Joint financial arrangements |

0.19 |

4 |

1.14 |

Discount (bonus) system |

0.11 |

2 |

0.88 |

Insurance Companies Group |

|||

Insurance coverage |

0.44 |

6 |

1.76 |

Common projects |

0.32 |

3 |

2.24 |

Image of the organization |

0.24 |

3 |

1.68 |

Other Institutional Investors Group |

|||

Works (services) |

0.53 |

6 |

2.12 |

Mutual project support |

0.31 |

4 |

1.86 |

Involvement in projects |

0.16 |

4 |

0.96 |

Source: Compiled by the authors

Table data (3–4) show that in the process of the relationship policy implementation and attention paid simultaneously to the legitimate interests of relevant stakeholders, both during an organizational and general policy set-up and in particular projects adopted, different responsibilities of the parties arise. It manifests itself and reflects on the concession project participants in different ways: depending on the nature and complexity of an object, the regulatory framework in place, forms of support for the grantor, and special aspect of the concessionaire’s production and investment activities. The above impacts the characteristics of the resource flow between the special-purpose company and a group of stakeholders (importance, satisfaction, relevance), which were obtained following the expert evaluation of projects implementation results in the Republic of Tyva.

Based on the data presented above, we determined (in Table 5) performance indicators of the special-purpose company’s activities: individual performance and interaction efficiency.

Table 5

Performance indicators of the special-purpose company

Name of stakeholder |

Individual performance |

Interaction efficiency |

Public Sector Group |

0.537 |

0.517 |

Operators Group |

0.598 |

0.675 |

Creditors Group |

0.537 |

0.541 |

Buyers of products (works, services) Group |

0,604 |

0.460 |

Suppliers Group |

0.483 |

0.602 |

Construction Contractors Group |

0.496 |

0.566 |

Insurance Companies Group |

0.590 |

0.432 |

Other Institutional Investors Group |

0,491 |

0.506 |

Source: Compiled by the authors

Note: when calculating the efficiency and effectiveness indicators of the special-purpose company, the following significance factors (in table 6) were used, determined with regard to the industry-specific features of the project implementation

Table 6

Significance factors for calculating

Public Sector Group |

0.185 |

Operators Group |

0.155 |

Creditors Group |

0.145 |

Buyers of products (works, services) Group |

0.06 |

Suppliers Group |

0.14 |

Construction Contractors Group |

0.155 |

Insurance Companies Group |

0.1 |

Other Institutional Investors Group |

0.06 |

Source: Compiled by the authors

Calculations show that the overall performance of the special-purpose company is 0.5391, and the value of performance is 0.5519. Such correspondence of the obtained values of efficiency and effectiveness of the special-purpose company’s activities (despite some differences between the contribution of individual groups of stakeholders and their individual performance) indicates a balanced aggregate resource flow between the special-purpose company and the groups of stakeholders. Against this background, there is some greater discrepancy in the resource interchange between the special-purpose company and the groups: “Operators” (0.598 and 0.675, respectively), “Buyers of products (works, services)” (0.604 and 0.460), and “Suppliers” (0.483 and 0.602); the discrepancy with the other groups is smaller.

An additional research involves performing a regression analysis and establishing correlation dependences between the key indicators describing the effectiveness and efficiency of resource interchange between the special-purpose company and stakeholder groups. For example, one of these types of analysis can be carried out when studying the influence of factors (the resource importance, satisfaction, and relevance) on the resulting indicator (individual performance or interaction efficiency). The calculation uses the mean characteristics of resources by groups of stakeholders Based thereon, the following key result was obtained (Figures 5-6) in the form of deriving a regression equation and regression statistics (using LINEAR function):

Figure 5 In the first case, the equation is written as y1=0.5448+1.5064x1-0.0061x2-0.31120x3 |

Figure 6 In the second case, the equation is written as y2=0.5203+1.3990x1+0.0017x2-0.299x3 |

||||||||||||||||||||||||||||||||||||||||

Regression analysis

|

Regression analysis

|

Source: Compiled by the authors

The resulting regression model is a multiple linear regression. The quality of the model obtained is characterized by: determination coefficient R2=0.995 and R2=0.997 in the first and second cases, respectively; the proportion of residual sum of squares in the total sum of squares and a comparison of the F-test according to the table. For a more detailed analysis of regression statistics, MS Excel “Data Analysis-Regression Analysis” can be used. The analysis data show that the resource importance, satisfaction, and relevance affect the investment project effectiveness. Moreover, while the first indicator is in direct relationship, the second behaves differently depending on the situation, and the third describes inverse relationship. In addition, a detailed study involves the analysis of resource interchange effectiveness for a group of stakeholders. In this case study, it is possible to trace which resource characteristics are claimed by a stakeholder for the time being and how they influence the research result.

The above should be taken into account when carrying out project feasibility studies and concluding specific contracts with partners. This is especially true for the projects aimed at mining field development. The need for a large amount of infrastructure work when preparing mining fields for operation in underdeveloped and hard-to-reach areas, complicated by the influence of natural environment and climatic factors, increases the cost of infrastructure facilities construction. The capital, labor, and material intensity of mining production caused by permanent duty station displacement in the course of mining predetermines the compositional nature of production and economic features that affect the cost of construction and operation of infrastructure facilities that ensure mining and processing of minerals. The special nature of these features during the development and operation of concession projects forces the concessionaire’s enterprises to opt for a more reasonable approach to choosing an investment partner. Moreover, while the relationship with the grantor are regimented (sometimes enforced by the authority of law), the relationships with other partners are implemented under a specific contract. The above emphasizes the analysis performed and its results: higher resource flow performance in the first group of partners and lower in the other ones.

Thus, the stakeholder analysis carried out according to a certain layout and aimed at taking into account industry-specific features makes it possible to correlate certain indicators with a particular stakeholder, which ultimately leads to increased effectiveness of investment project implementation.

The public-private partnership mechanism introduced in many Western countries in the implementation of socially significant projects has been developed within the framework of the corporate social responsibility concept. Such progressive development has reflected the objective process of business globalization and, as a result, more complex relations between the corporation and society, represented by various agents-stakeholders. Concession projects are of no exception, for which the stakeholder influence assessment allows for maximum personalization of the objects of responsibility, which leads to a more specific analysis of the principles, processes, and results. This has been noted by many researchers belonging to Russian and foreign schools of thoughts; the results of these studies have been described above.

The application of the presented concept provisions in the sectoral context when creating, reconstructing, and modernizing infrastructure facilities in Russia needed to develop the specialization industries of regional economic systems and for mining enterprises to form the basis of industrial agglomerations is largely conditioned by the influence of industry-specific features. Such features need to be considered when elaborating a methodology for stakeholder analysis through a more detailed description of stakeholders and of a particular resource flow.

The study performed in this paper involves elaborating a conceptual framework for analyzing stakeholders in the investment project implementation as a part of concession agreements in the regions of Russia with mineral and raw material orientation. The presented framework involves phased analysis and consideration of industry-specific features of the concession project implementation. The integrated stakeholder analysis in the implementation of such projects, starting with identifying the main stakeholders, their grouping, ranking, identifying indicators characterizing the resource interchange between stakeholders and ending with determining the effectiveness and efficiency of such an interchange between the main partners allows one to provide an investment project with the data necessary for major operational and strategic decision making.

The introduction of such patterns is particularly noticeable in the Russian economy that is institutionally poorly prepared to use such mechanisms. A concept and strategy of transition to such a management mechanism is still not in place, the instruments of state regulation of enterprise activities on a public-private partnership basis are unclear, and there is a lack of comprehensive scientifically validated studies supported by concrete calculations of a similar problem research in general and in individual sectors in particular. The specificity of the current stage of property reforming on a PPP basis in Russia lies in the fact that a legal framework is being created and a real-life mechanism for the operation of such facilities is being tested at the same time.

The integrated stakeholder identification analysis has a decisive influence on the effectiveness of the investment project implementation under concession agreements in the regions of Russia with mineral and raw material orientation and is aimed at:

• phased analysis starting with identification of stakeholders, their grouping and ranking, stakeholder prioritization according to the degree of their influence on the project and dependence on it, striking a balance between varying interests of the parties, and ending with determining the effectiveness and efficiency of resource interchange between the main stakeholders;

• awareness of industry-specific features of the stakeholder analysis in the investment project implementation related to the development of mineral deposits within mining and industrial agglomerations;

• making informed managerial decisions on personalizing the objects of responsibility, which contributes to improving the effectiveness and efficiency of the investment project implementation and generates sustainable interest in the concession mechanism development in potential investors.

Berle, A., & Means G. (1932). The Modern Corporation and Private Property. Commerce Clearing House, New York

Bernstein, I.G. (1930). Essays on the concession law of the USSR. Moscow-Leningrad: Gosizdat.

Blagov, Yu.E. (2011). Corporate social responsibility: evolution of the concept. St.Petersburg: Higher School of Management Press.

Boush, G.D., Grasmik, K.I., Pyatkov, M. V. (2012). Potential risks of atracting direct foreign investments to the formation of regional clusters. Economy of Region, 1, 118-127.

Brinza, V.V., Ilyichev I.P., Ugarova O.A., and Loginova V.V. (2015). Prognostic simulation of external economic activity for an industrial company. CIS Iron and Steel Review, 10, 27 – 39.

Brugha, R., and Varvasovszky, Z. (2000). Stakeholder analysis: a review. Health Policy and Planning, 15(3), 239-46

Buchanan, J. (1997). The Limits of Liberty: Between Anarchy and Leviathan. Nobel laureates in economics, 1, 207-444.

Coase, R. (1937). The Nature of the Firm. Economica, 4(16), 386—405

Dodd, М. (1932). The Framemork of the Gospel Narrative.

Dolgopolov, D.V. (2012). The notion of “Institute” in neo-institutional and evolutional paradigms. Problems of Modern Economics, 1 (41), 46-48.

Donaldson T., and Preston L. E. (1995). The stakeholder theory of the corporation: concepts, evidence, and implications. Academy of Management Review, 20 (1), 74.

Doronina N.G., Semiluna N.G. (2003). State and investment regulation. Moscow: Gorodets-izdat, 2003

Efimova, O., and Samohina, V. (2014). Stakeholder approach to identification and analysis of value creation drivers. Review of Business and Economics Studies, 2(4), 62-70.

Ershova, I.V., and Bolotin A.V. (2008). THE ORGANIZATION MODEL OF INTERACTION BETWEEN INVESTORS AND RECIPIENTS. Economy of Region, 4, 103-114.

Freeman ,R. E. (1984). Strategic Management: A Stakeholder Approach. Pitman: Boston, 25

Jelnova, C. (2013). ANALYSIS OF THE PRACTICE OF DECISION-MAKING IN THE FIELD OF INVESTMENT POLICY. Journal of Contemporary Economics Issues, 0(4). Retrieved from: http://economic-journal.net/index.php/CEI/article/view/83

Jensen, M.C. (2002). Value maximization, stakeholder theory and the corporate objective function. Business Ethics Quarterly, 12(2), 235-256.

Jones T. M., and Hill C. L. (1992). Stakeholder agency theory. Journal of Management Studies, 29 (2), 131–154.

Karass, A.B. (1925). Concessions in the Soviet Law. Sovietskoye Pravo, 2, 30-49).

Kitova, G.A., Kuznetsova, T.E., and Samovoleva, S.A. (2007). The Government’s Role in Innovation Projects: Capabilities and Constraints. Foresight, 1(1), 54-60.

Kozlov, A. V., Teslya, A. B., and Chernogorskii, S. A. (2018). Game theory model of state investment into territories of advanced development in the regions of mineral resources specialization. Journal of Mining Institute, 234, 673-682.

Landau, B.A. (1935). Concession Law of the USSR. Moscow: Pravo i Zhizn.

Luchko, M.L. (2006). Business ethics is a success factor. – Moscow: Eksmo.

Maurer, J. G. (1971). Readings in Organization Theory: Open-System Approaches. Random House: N. Y., 361.

Mitchell, R. K., Agle, B. R., and Wood, D. J. (1997).Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Academy of Management Review, 22 (4), 853–86.

Minakova, I., and Anikanov, P. (2013). MODELLING OF AREA OF POSSIBLE RESULTS OF THE INNOVATIVE INVESTMENT PROJECT. Journal of Contemporary Economics Issues, 0(1).Retrieved from: http://economic-journal.net/index.php/CEI/article/view/34

Nikitina, M.G.; Pobirchenko, V.V.; Shutaieva, E.A.; Karlova, A.I. (2018). The investment component in a nation’s economic security: the case of the Russian Federation. Entrepreneurship and Sustainability Issues, 6(2), 958-967.

Nosov Ye.N. (1926). Revisiting the Crisis of Concession Agreement Concept. Sovietskoye Pravo, 3, 47-56.

Osadchy, E. A., Akhmetshin, E. M., Amirova, E. F., Bochkareva, T. N., Gazizyanova, Y. Y., and Yumashev, A. V. (2018). Financial statements of a company as an information base for decision-making in a transforming economy. European Research Studies Journal, 21(2), 339-350.

Post, J. E., Preston, L. E., Sachs, S. (2002). Redefining the Corporation: Stakeholder Management and Organizational Wealth. Stanford University Press: Stanford.

Reikhel, M.O. (1927). Concessions in the Soviet Legislation and Practice. Soviet Law, 4, 3-27.

Schreter V.N. (1923). Concession Law. Bulletin of Industry, Trade and Transport, 9(10), 1-15

Sethi, S. P. (1975). Dimensions of corporate social performance — An analytical framework. California Management Review, 17(3), 58–64.

Shvetsova, O.A., Rodionova, E.A., Epstein, M. Z. (2018). Evaluation of investment projects under uncertainty: multi-criteria approach using interval data. Entrepreneurship and Sustainability Issues, 5(4), 914-928.

Simon, H. A. (1952). Comments on the theory of organizations. American Political Science Review, 46 (4), 1130–1139.

Steblyanskaya, Alina, Wang Zhen, Ryabova E. V., and Razmanova, S. V. (2019). Russian gas companies’ financial strategy considering sustainable growth. Economy of Region, 15(1), 231-241.

Takhumova, O.V., Kasatkina, E.V., Maslikhova, E.A., Yumashev, A.V., Yumasheva, M.V. (2018). The main directions of increasing the investment attractiveness of the russian regions in the conditions of institutional transformations. Espacios, 39(37), 6.

Tatarkin, A.I., and Tatarkin, D.A. (2008). Self-developing regions in the economic system of Russia. Federative Relations and Regional Policy, 11, 4-5.

Vazhenin S.G.,and Gerasimov, N.M. (2011). Designing state-private partnership in modernized economy. Economy of Region, 2( 97), 102.

Wikström, K., Artto, K., Kujala J., and. Söderlund, J. (2010). Business models in project business. International Journal of Project Management, 28, 832–841.

Williamson, O. (1996). Economic institutions of capitalism. Saint Petersburg, 1996.

Yang, J., Shen, P. Q., Bourne, L., Ho, C. M., and Xue, X. (2011). A typology of operational approaches for stakeholder analysis and engagement. Construction Management and Economics, 29, 145–162.

1. Ph.D. in Economics, Associate Professor. Department of Economics of Accounting and Finance. St. Petersburg Mining University, St. Petersburg, Russia. juliyaluebeck@yandex.ru