Vol. 40 (Number 28) Year 2019. Page 16

PINKOVETSKAIA, Iuliia 1; LEBEDEV, Anton 2; SVERDLIKOVA, Elena 3 & ROZHKOV, Mikhail 4

Received: 09/05/2019 • Approved: 04/08/2019 • Published 26/08/2019

ABSTRACT: Purpose of the study is to assess three-factor production functions that describe dependence of small and medium enterprises turnover on workers wages, investments in fixed capital and current level of regional entrepreneurial capital development. Official statistical information for 2015 in 80 regions of Russia is used. Article shows that regional entrepreneurial capital has a significant impact on the turnover of small and medium enterprises. Number of workers employed in large enterprises of a given region used to estimate this capital. |

RESUMEN: El objetivo del estudio es evaluar las funciones de producción de tres factores que describen la dependencia de la rotación de personal en pequeñas y medianas empresas: salarios, inversiones en capital fijo y nivel de desarrollo empresarial regional. Se utiliza información estadística oficial para 2015 en 80 regiones de Rusia. El artículo muestra que el capital empresarial regional tiene un impacto significativo en la rotación de empleados de pequeñas y medianas empresas. Número de trabajadores empleados en grandes empresas de una región son determinantes para estimar este capital. |

At the end of the XX century in most developed countries small and medium enterprises significantly increased their share in gross domestic product and the number of employees (Brock & Evans, 1989; Wennekers, Uhlaner & Thurik, 2002). These enterprises act as the main sources of economic growth, the creation of new markets, and satisfying the population’s need for jobs (Feldman, Lanahan & Miller, 2011; Mirjam van Praag & Versloot, 2007). As experience shows (Chepurenko, 2017; Decker, Haltiwanger, Jarmin & Miranda, 2014), it is the entrepreneurial sector that is the main catalyst for regional growth, especially in underdeveloped areas, and creates the conditions for economic restructuring. Therefore, in recent years, small and medium businesses have become an essential element of the economic policy of both developed and developing countries.

Numerous small and medium enterprises operate in the business sector of Russia. In 2015, their number exceeded 2242 thousand (13517 thousand workers). At the same time, the share of small and medium enterprises amounted to about 20% of the gross domestic product and the number of employees of all enterprises and organizations in Russia. This shows that the contribution of small and medium enterprises to the Russian economy is insignificant. As compared to European Union, it can be noted that small enterprises there provide jobs for about 67% of the working population and produce 58% of gross domestic product (Development of small and medium entrepreneurship, 2015).

Thus, there is an urgent need for the accelerated development of small and medium enterprises in Russia. The development of the national economy`s entrepreneurial sector requires understanding of the factors that influence the activities of small and medium enterprises and their production volumes. One of the most pressing issues is determining the growth reserves of such enterprises in each region. The solution of such problems can be based on mathematical modeling of the turnover (volume of production) of small and medium enterprises using production functions. Production functions are widely used both in Russia and other countries in the analysis and management of socio-economic processes.

The first production functions calculations were carried out and presented by Cobb and Douglas (1928). They modeled the dependence of the production volume on the factors describing labor and capital expenditures in enterprises. The theoretical foundations as well as the evolution of the function’s development methodology are described in the article by Douglas (1948). It is important to note the work of Durand (1937) that developed the theory of production functions and suggested not to impose restrictions on the scale of production return.

Having studied the production functions describing the activities of small and medium enterprises, researchers, along with the use of two-factor functions, developed a new methodological approach in the early 2000s based on consideration of such additional factor variable as entrepreneurial capital. The purpose of this study is to assess the three-factor production functions small and medium enterprises in the regions of Russia, the third factor being the entrepreneurial capital development level.

A lot of studies based on two-factor production functions according to the data from small and medium enterprises have been conducted. In most cases, the factors that determine the volume of production are capital (the cost of all machinery, equipment and buildings) and labor costs. Modern academia discusses various indicators of labor input. For instance, in the works Bohórquez & Esteves, 2008; Husain & Islam, (2016) a number of full-time employees is used to describe the labor costs. The study Sage & Rouse, (2011) considers the indicator of the yearly person-hours total number. One should also note that most researches observe their data based on time series. For example, article Khatun & Afroze, (2016) uses the time series data for 1990–2014. The influence has been proved of the workers number and fixed capital on the real GDP of India, Bangladesh, China, Malaysia and Thailand. The analysis of these indicators impact on the production of small and medium enterprises in Pakistan is presented in Batool & Zulfiqar, (2013).

All the above-mentioned studies were based on the evaluation of two-factor functions. As shown in Pinkovetskaia, (2016; Pinkovetskaia, (2018), the most appropriate methodological approach to assessing the production functions of all small and medium enterprises in the regions is to develop functions similar to those of Cobb-Douglas. At the same time, the turnover of small and medium enterprises located in each region is used as a result indicator, and investments in fixed capital and wages of enterprises employees are considered as factors.

The following studies are of the greatest interest as they consider three-factor production functions, including entrepreneurial capital.

Romer (1986) proposed to consider an additional factor in production functions, taking into account accumulated knowledge and skills acquired as a result of education, professional training and experience. Entrepreneurial capital, as believed by the authors of (Hofstede, Noorderhaven, Thurik, Wennekers, Uhlaner & Wildeman, (2002), reflects a number of prerequisites in the regions that create the potential for entrepreneurial activity. The work Acs & Audretsch, (2003) verifies the assumption that entrepreneurial capital acts as a missing link in explaining differences in the economic performance of different entrepreneurial structures. The study Minniti, (2004) presents a set of socio-economic indicators that generate external effects contributing to future business activities.

In Audretsch & Keilbach, (2004) the authors introduce the concept of “entrepreneurial capital” and define it as a factor that shapes the environment of economic entities in a given region and influences it, including the creation of new enterprises. Using regional data for 327 West German districts, researchers show that entrepreneurial capital has a positive impact on the volume of small enterprises production. At the same time, we suppose that this work considers entrepreneurial capital in a narrow sense, i.e. it does not take into account that employees familiar with innovations are not only able to participate in the creation of new enterprises, but can also improve and increase the efficiency of existing ones by transferring acquired knowledge and mastered technologies. The further research Audretsch, Bönte & Keilbach, (2008) that innovations have a positive effect on the regional entrepreneurship development level.

The article (Chang, Chrisman & Kellermanns, (2011) considers entrepreneurial capital as a factor contributing to the creation of new enterprises and generating external effects in existing enterprises that facilitate increasing their efficiency.

The positive impact of entrepreneurial capital on the activities of textile production small enterprises in rural India is considered in article Bhagavatula, Elfring, van Tilburgc & van de Bunta, (2010).

The study Chang, Misra & Memili, (2012) examines the effect of entrepreneurial capital on production growth in 2940 US areas in three sectors - manufacturing, retail and services. The results show that entrepreneurial capital has a positive effect on long-term production growth rates.

The study Demartini & Paoloni, (2014) indicates that entrepreneurial capital is characterized by such features as entrepreneurial competence and knowledge, as well as entrepreneurial corporate culture.

The article Acs, Astebro & Audretsch, (2016) concludes that the entrepreneurial capital of large businesses and organizations can be used to create and develop small and medium enterprises. It is necessary to consider two aspects of the entrepreneurial capital formation and use. The first aspect takes into account the substantial differentiation of the level of entrepreneurial capital in the regions of the country. The second aspect takes place due to the presence of institutions that provide entrepreneurial capital or create the conditions for its development. According to the authors, the territorial proximity of small and medium enterprises to the resources that form entrepreneurial capital is a significant factor.

Thus, the issues of the entrepreneurial capital influence on the production of small and medium enterprises have been under considerable attention in foreign studies in recent years. At the same time, Russian researchers have not actually conducted studies based on the assessment of production functions describing the activities of small and medium enterprises, taking into account entrepreneurial capital.

As can be seen from the analysis of previous studies, entrepreneurial capital is determined by the presence of qualified workers with knowledge, skills and professional competencies that are able to establish new small and medium enterprises, as well as introduce innovations and effective technological solutions into existing enterprises. At the same time, entrepreneurial capital is considered in a broader context with functioning features of small and medium enterprises that specialize mainly in one type of economic activity.

As early as 1995 an important conclusion was made in the study Audretsch, (1995) that small enterprises are usually unable to generate innovative products by themselves, since they generally make a minimum amount of investment in technological innovations. This conclusion is confirmed by the Russian data. In particular, the statistical collection of the Higher School of Economy (HSE) presents data on the level of innovation business activity, i.e. the share of enterprises that have introduced innovations in the total number of enterprises of the corresponding size categories for 2015:

- small enterprises - 2.1%;

- large enterprises - 44.5%;

- very large enterprises - 83.7%.

At the same time, the innovation activity of enterprises for 2015 was:

- manufacturing industries - 12.1%;

- communication and information technology - 6.8%;

- mining and quarrying - 2.8%;

- construction - 2.0% Gorodnikova, Gokhberg & Ditkovsky, (2018).

Official statistics on Russian small and medium enterprises also show an insignificant level of innovation costs, even in manufacturing industries, which are known for the substantial need for innovation. Consequently, according to the 2015 data for small and medium enterprises related to manufacturing industries, the actual values of technological innovations costs did not exceed an average of 110 thousand rubles a year. Among the manufacturing industries only 4.8% of small and medium enterprises carried out innovative activities, and the share of innovative products was less than 1.7% of the total volume of goods, jobs and services. One should note that other types of innovative economic activity indicators of small and medium enterprises are significantly lower compared to manufacturing industries.

Thus, the Russian regional entrepreneurial capital is generated mainly in large enterprises, where innovation plays more important role than in small and medium enterprises.

The study Böente, Heblich & Jarosch, (2008) proposes the definition of regional entrepreneurial capital as the entrepreneurial-oriented population in a given region related to production activities and innovations; people who are ready to start a new business or improve the activities of already existing small and medium enterprises. The study makes an important conclusion about the existence of a regional culture of entrepreneurship, which affects the entrepreneurial orientation of the population, and also notes that entrepreneurial capital is not directly observable, therefore various indirect indicators can be used to express it. Also, the consideration of entrepreneurship as a regional phenomenon was conducted in Sternberg & Rocha,( 2007).

As the studies show, there are three main channels for raising entrepreneurial capital by small and medium enterprises in regions:

- establishing innovative small and medium enterprises by former employees of larger businesses;

- transferring of larger enterprises employees to work in small and medium enterprises;

- attracting employees of larger enterprises for implementation of innovations into small and medium businesses.

Implementation of the first and second methods in small and medium-sized enterprises using the experience of large enterprises located in different regions of Russia is extremely difficult. That is, the movement of business capital between different regions is extremely complicated. Multiple elements determining entrepreneurial capital are difficult to quantify. At the same time, entrepreneurial capital is multifaceted and heterogeneous like all other types of capital. The proposed methodology is based on the understanding that the number of workers in the region who possess the necessary knowledge and competencies to create new and increase the efficiency of existing small and medium enterprises is in direct ratio to the probability of increasing the production volumes of these enterprises in general. Accordingly, the more workers are employed in large enterprises, the more opportunities can be found to implement one of the three aforementioned directions for using the existing level of entrepreneurial capital in a given region. Thus, it is proposed to use an indicator such as the total number of all large enterprises employees in a region to describe the achieved amount of entrepreneurial capital.

Based on the above-stated conclusions, we propose to use the following approach to account the indicators characterizing regional entrepreneurial capital:

1. Entrepreneurial capital is generated by large enterprises (with rare exceptions).

2. It can be used to create new small and medium enterprises, as well as improve their operations and increase efficiency.

3. It is concentrated in the regions and has substantial impact on small and medium enterprises located in a respective area; interregional transfer of entrepreneurial capital requires significant additional costs.

4. It can be characterized by the indicator of employees` number in large enterprises of a particular region.

The following hypothesis is suggested in the process of research: the regional activity of small and medium enterprises can be estimated by a three-factor production function using besides factors of labor and capital, the factor of entrepreneurial capital.

The study shows that a number of problems arise in the process of evaluating production functions and valid results cannot be obtained without overcoming them. These problems create the following limitations: the use of data for ten years or more (time series) is complicated by taking into account the inflation processes. In addition, it is necessary to imply that the operating conditions of the given enterprises for a specific period of time are identical or undergo little change. Time series are often limited in length, especially since the dynamics of indicators changes are currently experiencing significant fluctuations due to the crisis in the economy. The influence of the indicated tendencies is especially great when evaluating functions which have restrictions on the sum of the exponents with factors, i.e. with constant returns to scale. Using a factor describing the cost of capital, the values of fixed assets, the main problem is the reliability of information on the share of fixed assets actually used in production processes. It should also be assumed that the principal funds are not fully used. The similar situation takes place with the second factor. The number of workers directly involved in production processes does not always correlate with actual labor costs, since workers are often not employed for the whole working day or week. This leads to erroneous indicators in assessing the factors of labor. A detailed rationale for estimating two-factor production functions using spatial data is given in the paper (Pinkovetskaia, 2017), which shows a high level of data approximation based on such factors as investment in fixed capital and wages of small and medium enterprises.

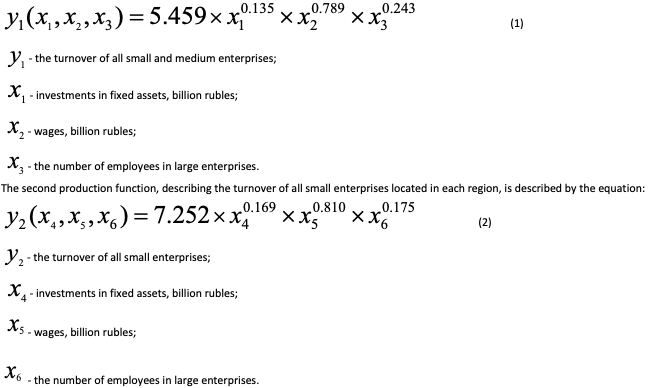

Consequently, we consider investments in fixed capital (the first factor), wages of workers in small and medium enterprises (the second factor) and the number of employees in large enterprises (the third factor) as the three factors of production functions. At the same time, the turnover values of small and medium enterprises located in each region of Russia, as well as the first and second factors, account for billions of rubles a year.

The study considers all small and medium enterprises located in each region of Russia. The current Federal Law “On the Development of Small and Medium Businesses in the Russian Federation”, No. 209, July 24, 2007 states the main criterion for classifying business entities as small and medium enterprises. This criterion is the number of employees, which does not exceed 100 workers for small enterprises, and 101-250 people for medium businesses. We estimate two production functions by considering both size categories of enterprises. The first function characterizes the turnover of all small and medium enterprises located in each region, and the second function deals with the turnover of small enterprises only. Evaluation of the production functions are based on the power functions regression analysis, namely linearization and the least squares method.

The quality check of the functions is carried out using correlation and determination coefficients, Fisher-Snedecor and Student's tests. In addition, the developed functions are tested for autocorrelation, heteroscedasticity and multicollinearity, as well as the normality of the distribution with zero mean value.

The study uses the official statistics of the Federal State Statistics Service of the Russian Federation, based on total monitoring of the small and medium businesses in Russia for 2015, as well as the official statistical information on the number of employees in large enterprises located in each region of Russia (Federal State Statistics Service, 2019; Russia in numbers, 2016). The use of observation data is explained by the fact that more accurate data are obtained as compared to sample annual surveys. The study is based on information for 80 regions of Russia. Thus, the number of empirical observations in the process of modeling exceeds the optimum value of observations proposed by Harris (1985), equal to 52.

The research features a comparative analysis of the small and medium enterprises turnover values in the regions based on three-factor production functions. The corresponding calculations are carried out using the STATISTICA software.

According to the described methodological principles, a calculation experiment is carried out concerning the evaluation of three-factor production functions, based on empirical data characterizing the turnover of small and medium enterprises located in each of the 80 regions of the country.

Two production functions are developed in the process of the experiment reflecting the dependence of the small and medium enterprises turnover on investments in fixed capital, wages of employees and entrepreneurial capital of a given region.

Here is the resulting function, describing the dependence of the small and medium enterprises turnover located in a given region:

The analysis of the functions quality is given in the chart. It presents the calculated values of the multiple correlation and determination coefficients, the Fisher-Snedecor and Student`s tests (columns 2 and 3), as well as the significance of the Fisher test for Snedecor and p-values for the Student test (column 4).

Table 1

Estimated values of three-factor production functions indicators

|

Quality Indicators |

Calculated Values by function |

Level of significance |

|

|

(1) |

(2) |

||

1 |

2 |

3 |

4 |

Determination coefficient |

0.963 |

0.967 |

– |

Multiple correlation coefficient |

0.982 |

0.983 |

– |

Average error |

0.248 |

0.237 |

– |

Statistics of Fisher-Snedecor coefficient |

632.224 |

707.465 |

< 0.01 |

t-statistics for y |

8.731 |

9.642 |

< 0.01 |

t-statistics for the first factor (investment in fixed assets) |

2.270 |

3.461 |

< 0.01 |

t-statistics for the second factor (wages) |

13.655 |

15.675 |

< 0.01 |

t-statistics for the third factor (the number of employees in large enterprises) |

4.356 |

3.123 |

< 0.01 |

Since the coefficient of multiple correlation and the coefficient of determination are close to one for each of the functions (1) and (2), one can conclude that the obtained regressions validly approximate the empirical data and attain the functional dependencies. The values of t-statistics for functions (1) and (2) are in the range from 2.27 to 15.68, i.e. greater than the table value, which accounts for 1.99 at the significance level of 0.05.

There is a close correlation between the resulting values and the three factors of functions (1) and (2). All significance levels have values less than 0.01. This signifies that the coefficients of the developed functions and their exponents are statistically significant with 99% validity.

There are also obtained residues in the process of the source data approximation using the method of least squares and showing deviations of the calculated values from the source data.

The audit shows that the residuals of the regressions by functions (1) and (2) are distributed according to the law of normal distribution. It is confirmed by the fact that Kolmogorov-Smirnov tests are performed for both function (1) and (2).

The obtained data makes it possible to formulate a general conclusion that the developed functions (1) and (2) fully satisfy the econometric requirements and can be used to describe the dependencies of the small and medium enterprises turnover in the regions of Russia not only on investment flows and wages of workers, but on the level of entrepreneurial capital.

The developed production functions (1) and (2) prove that the factors under consideration significantly influence the turnover of regional enterprises related to small and medium businesses. Three-factor production functions are of high quality. The study confirms the hypothesis about the significant impact of regional entrepreneurial capital on the resulting indicators of the considered production functions. The degree’s values for all three factors in functions (1) and (2) are positive; therefore, it can be stated that stimulating the development of small and medium enterprises can be achieved by increasing wage costs, investment in fixed capital, as well as raising the level of entrepreneurial capital. Production functions do not reach their maximum for the whole range of factor values, i.e. there is a significant potential for saturating the economy of all Russian regions with goods, jobs and services provided by small and medium enterprises. Accordingly, it is possible to increase the number of these enterprises and the number of their employees in all regions of Russia.

The amounts of the exponent’s values in functions (1) and (2) are greater than 1 and accounts for respectively 1.167 and 1.154, which indicates the increasing returns to scale. It should be noted that the amounts of the first function exponents values is greater than in the second one, which implies a greater influence of factors on medium enterprises compared to small enterprises. This seems to be justified, since the possibilities of using innovations, know-how and more technological equipment are higher in medium enterprises compared to small and micro enterprises that prevail in Russia.

The effect of returns to scale, characteristic of both functions and associated with an accelerated increase in production with the growth of factors, has an important economic and social significance. For a rapid increase in the production of regional small and medium enterprises, it is advisable to ensure the growth of the above sets of factors. It should be noted that in the regions with an excess of the working-age population (for example, the republics of the North Caucasus) the main direction of entrepreneurship development is associated with an increase in employment and the establishment of a family business. In regions with a shortage of labor (Siberia and the Far East), the main direction of increasing production volumes is connected to an increase in fixed assets investment. The analysis shows that for each of the factors, the cross-derivatives in functions (1) and (2) have positive values. Therefore, the growth of each factor leads to improving the conditions for the use of other production factors. Second order derivatives in isoquants are greater than zero. At the same time, their convexity decreases with increasing values of turnover. This suggests an increase in the elasticity of substituting factors. In addition, the second factor (workers’ wages of small and medium enterprises) has a greater impact on the net value compared to investments in fixed capital and the level of entrepreneurial capital in a given region.

The analysis of production functions has practical importance in the rating of regions in terms of use efficiency of the resources such as investments in fixed capital, wages of workers of small and medium enterprises, as well as the level of entrepreneurial capital development. Using the obtained tools as the research result, it is possible to monitor the turnover of small and medium enterprises, including small enterprises in the regions, to justify investment needs and the number of employees in the formation of various plans and programs for the development of entrepreneurship, as well as in research of the national economy`s business sector. The comparative analysis of the actual turnover of small and medium enterprises, and the turnover predicted on the basis of the production function, allows us to draw a conclusion on the effectiveness of the resources use in the regions of Russia. Thus, the relatively large positive value of this quantity (i.e., the excess of the actual turnover over the calculated turnover) indicates a high efficiency of resource use in the corresponding region. The large negative value of this quantity allows us to conclude that there are problems with the efficiency of using the resources available in the region. The corresponding calculations are based on the predicted turnover determination of small and medium enterprises located in each area. Such values of small and medium enterprises turnover are determined on the basis of three indicators of production functions (1) and (2) for each region. The results of calculations performed for small and medium enterprises for the production function (1) are presented further.

The comparative analysis of the data, used in the development of the production function (1) and the predicted values for the same function, show a high level of resource efficiency in the Voronezh, Sverdlovsk, Ivanovo and Yaroslavl regions, St. Petersburg, and the Altai Republic areas. This can be explained by the fact that the actual turnover of small and medium enterprises in these regions is significantly higher than the turnover predicted on the basis of the production function (1). The low level of efficiency in the use of resources, corresponding to the factors under consideration, is observed in such regions as Tyumen, Kemerovo, Novgorod areas and the Republics of Tyva, Chuvashia and Bashkortostan.

Thus, the developed production functions (1) and (2) indicate the possibility of further development of small and medium businesses in Russia; they determine the directions of this activity, and allow to evaluate the resource use efficiency level of small and medium enterprises in the regions of the Russian Federation.

The significance of the study and its relevance are based on the consideration of entrepreneurial capital as a factor influencing the production volumes of small and medium enterprises located in each region of Russia. As a rule, this capital is formed in large enterprises and then distributed and used by small and medium businesses. According to the results of the literature review, this approach has not previously been applied in Russian studies.

The academic significance of the study can be expressed by seven conclusions:

- it is proved that the business capital accumulated in the regions has a significant impact on the turnover of small and medium enterprises. A number of employees in larger enterprises of a given region can be used to estimate it;

- it is vitally important to consider methodological aspects of the three-factor production functions, which include entrepreneurial capital as one of the factors;

- it is proved that there is a high quality of production functions, describing the dependence of the turnover of small and medium enterprises located in the regions of Russia on factors such as investments in fixed capital, wages of workers of small and medium enterprises, as well as entrepreneurial capital;

- it is noted that increasing returns to scale in the regions are observed both for small and medium enterprises, especially for small enterprises;

- it is shown that the efficiency of entrepreneurial capital use is higher in medium enterprises compared to smaller ones;

- it is proved that there are significant reserves for further development of the economy`s business sector: none of the Russian regions have reached a sufficient amount of goods and services provided by small and medium enterprises;

- the regions of Russia with high and low levels of efficiently using available resources are identified.

The practical significance of the research can be implemented in the activities of governmental institutions, the national economy`s business sector and education experts.

The proposed methodological approach and tools for the evaluation of three-factor production functions describing the activities of small and medium enterprises can be used in research and applied in domestic entrepreneurship, as well as in the development programs for this sector of the economy both at the federal and regional levels. The methodology and tools that have been used in the research process can be applied in similar studies in countries with a significant number of territories and areas.

Further studies can be devoted to the assessment of production functions for small and medium enterprises that specialize in various types of economic activity and are located in the municipalities of the Russian regions.

Acs, Z., Astebro, T., Audretsch, D. & Robinson, D. (2016). Public policy to promote entrepreneurship: A call to arms. Small Business Economics, 47(1), 35-51.

Acs, Z. J. & Audretsch, D. B. (2003). Handbook of entrepreneourship research: An interdisciplinary survey and introduction. Dordrecht: Kluwer Academic Publ.

Audretsch, D. B. (1995). Innovation and industry evolution. Cambridge, MA: MIT Press.

Audretsch, D., Bönte, W. & Keilbach, M. (2008). Entrepreneurship capital and its impact on knowledge diffusion and economic performance. Journal of Business Venturing, 23(6), 687-698.

Audretsch, D. & Keilbach, M. (2004). Entrepreneurship capital and economic performance. Regional Studies, 38(8), 949–959.

Batool, S. & Zulfiqar, S. (2013). Analyzing the input output relationship of small and medium enterprises in Pakistan: An econometric approach. International Journal of Business and Economic Development, 1(1), 66-73.

Bhagavatula, S., Elfring, T., van Tilburgc, A. & van de Bunta, G. (2010). How social and human capital influence opportunity recognition and resource mobilization in India's handloom industry. Journal of Business Venturing, 25(3), 245-265.

Bohórquez, V. & Esteves, J. (2008). Analyzing SMEs size as a moderator of ERP impact in SMEs productivity. Communications of the IIMA, 8(3), 67-80.

Brock, W. A. & Evans, D. (1989). Small business economics. Small Business Economics, 1(1), 7–20.

Böente, W., Heblich, S. & Jarosch, M. (2008). Concept and measurement of regional entrepreneurship capital. Working Paper IAREG.

Cobb, C. W. & Douglas, P. H. (1928). A ttheory of production. The American Economic Review, 18, 139-165.

Chang, E. P. C., Chrisman, J. J. & Kellermanns, F. W. (2011). The relationship between prior and subsequent new venture creation in the United States: A county level analysis. Journal of Business Venturing, 26(2), 200-211.

Chang, E. P. C., Misra, K. & Memili, E. (2012). Expanding the notion of entrepreneurship capital in American counties: A panel data analysis of 2002–2007. Journal of Developmental Entrepreneurship, 17(3), 1-18. doi: 10.1142/S108494671250015X.

Chepurenko, A. Yu. (2017). Combining Universal Concepts with National Specifics: SME Support Policy. Public Administration Issues, 1, 7-30.

Decker, R., Haltiwanger, J., Jarmin, R. & Miranda, J. (2014). The role of entrepreneurship in US job creation and economic dynamism. Journal of Economic Perspectives, 28(3), 3-24. doi: 10.1257/jep.28.3.3.

Demartini, P. & Paoloni, P. (2014). Defining the entrepreneurial capital construct. Chinese Business Review, 13(11), 668-680. doi: 10.17265/1537-1506/2014.11.002.

Development of small and medium entrepreneurship. Foreign experience. (2015). Moscow: MSP Bank Publ.

Douglas, P. H. (1948). Are there laws of production? The American Economic Review, 38(1), 1-41.

Durand, D. (1937). Some thoughts on marginal productivity with special reference to Professor Douglas' analysis. Journal of Political Economy, 45(6), 740-758.

Federal State Statistics Service (2019). The results of continuous monitoring of small and medium-sized businesses in 2015. Retrieved from http://www.gks.ru/free_doc/new_site/business/prom/small_business/itog2015/itog-spn2015.html

Feldman, M., Lanahan, L. & Miller, J. (2011). Inadvertent infrastructure and regional entrepreneurship policy. In book: Handbook of research on entrepreneurship and regional development. M. Fritsch (Ed.). Cheltenham, Northampton, MA: Edward Elgar.

Gorodnikova, N. V., Gokhberg, L. M. & Ditkovsky K. A. (2018). Indicators of innovation: 2018: collection of statistics. Moscow: National Research University "Higher School of Economics".

Harris, R. J. (1985). A primer of multivariate statistics. New York, Academic Press.

Hofstede, G., Noorderhaven, N. G., Thurik, A. R., Wennekers, A. R. M., Uhlaner, L. & Wildeman, R. E. (2002). Culture's role in entrepreneurship. In book: Innovation, Entrepreneurship and Culture: The Interaction between technology, progress and economic growth. Ulijn J., Brown T. (Eds). Brookfield, UK: Edward Elgar.

Husain, S. & Islam, M. S. (2016). A test for the Cobb Douglas production function in manufacturing sector: The case of Bangladesh. International Journal of Business and Economics Research, 5(5), 149-154. doi: 10.11648/j.ijber.20160505.13.

Khatun, T. & Afroze, S. (2016). Relationship between real GDP and labour and capital by applying the Cobb-Douglas production function: A comparative analysis among selected Asian countries. Journal of Business Studies. XXXVII (1), 113-129.

Minniti, M. (2004). Entrepreneurial alertness and asymmetric information in a spin-glass model. Journal of Business Venturing, 19(5), 637-658.

Mirjam van Praag, C. & Versloot, P. H. (2007). What is the value of entrepreneurship? A review of recent research. Small Business Economics, 29(4), 351-382. doi: 10.1007/s11187-007-9074-x.

Pinkovetskaia, I. S. (2018). Factors influencing small and medium enterprises turnover: Evaluation of Russian regional data. Ars Administrandi, 10(2), 199-216. doi: 10.17072/2218-9173-2018-1-199-216.

Pinkovetskaia, I. S. (2017). Modeling of activity of small and medium enterprises with the use of production functions. Human. Society. Inclusion, 2(30), 92-100.

Pinkovetskaia, I. S. (2016). Models output sets of small and medium enterprises in the subjects of the Russian Federation. The World of New Economy, 2, 113-118.

Romer, P. M. (1986). Increasing Returns and Long-Run Growth. Journal of Political Economy, 94(5), 1002-1037.

Russia in numbers. (2016): statistic information. Moscow: Rosstat.

Sage, A. P. & Rouse, W. B. (2011). Economic systems analysis and assessment: Cost, value, and competition in information and knowledge intensive systems, organizations, and enterprises. New York: John Wiley and Sons.

Sternberg, R. & Rocha, H. O. (2007). Why entrepreneurship is a regional event: Theoretical arguments, empirical evidence, and policy consequences. In book: Entrepreneurship: The engine of growth. Rice M.P., Habbershon T.G. (Eds.). Westport/CT, London: Praeger, 3, 215-238.

Wennekers, S., Uhlaner, L. & Thurik, R. (2002). Entrepreneurship and its conditions: A macro perspective. International Journal of Entrepreneurship Education, 1(1), 25-64.

1. Corresponding Author, Associate Professor, Ph.D., Ulyanovsk State University, Ulyanovsk, Russia, E-mail: pinkovetskaia@gmail.com

2. Associate Professor, Ph.D., Mordovia N.P. Ogarev State University, Saransk, Russia

3. Associate Professor, Ph.D., Lomonosov Moscow State University, Moscow, Russia

4. Associate professor, Ph.D., Mordovia N. P. Ogarev State University, Saransk, Russia