Vol. 40 (Number 24) Year 2019. Page 4

VISHNEVER,Vadim Y. 1; KHANSEVYAROV, Rustam I. 2; SAVINOVA, Valentina A. 3; SOROKINA, Marina G. 4 & MIKHAILOV, Alexander M. 5

Received: 23/12/2018 • Approved: 20/05/2019 • Published 15/07/2019

ABSTRACT: The objective is to build an interaction model of economic and institutional cycles in the dynamics of development of national economies. Basing upon the analysis of the cost indicators, an interaction model of economic and institutional cycles in the developing and developed countries was offered.The theoretical and applied significance of the research is accumulation of scientific knowledge and revealing the methods of policy correction of developing countries. |

RESUMEN: Objetivo: construir un modelo de interacción de los ciclos económicos e institucionales en la dinámica del desarrollo de las economías nacionales. Sobre la base del análisis de los indicadores de costos, se ofreció un modelo de interacción de ciclos económicos e institucionales en los países en desarrollo y desarrollados. El significado teórico y aplicado de la investigación es la acumulación del conocimiento científico y la revelación de los métodos de corrección de políticas de los países en desarrollo. |

The interaction of the economic and institutional cycles in the dynamics of the development of national economies in modern theory and practice of management becomes especially significant in the studies of national and foreign scientists. Currently, the developing processes of the formation of the digital economy can promote the elimination of borders between the development of national economies. The integration of capital, labor force, information, technologies and also the directions and method of government regulation form the new conditions of functioning of national economies, certain regions and the world economy in general. Initially, the theoretical base of the research of international integration was prepared by the classical scholars of economic science: Smith, Ricardo, Marx, Marshall, Hilferding (Blinova, 2007, p. 6). The works of modern researchers focused their attention on certain aspects of the research of capital integration problem, its structure and movement in the developing and developed countries. Despite the great attention of national and foreign scientists to this problem, many questions are left unsolved. As the literature review shows, the contradictions of the integration processes in the developing and developed countries are not completely determined as well as the causes of their occurrence, main directions of the institutional and economic interaction between them. At the same time, it is this interaction in the movement and formation of the new structure of capital as the factors of the progressive development of the national economies and the developed and developing countries was not studied properly by national and foreign science. The research of this aspect of world capital integration is the basis for the development of the author’s approach.

Therefore, the objective of this research is to build an interaction model of the economic and institutional cycles in the development dynamics of the national economies.

The main objective determined the necessity of the solution of the following problems:

- to analyze the cost indicators of the technical composition of capital, the ratio of the material and human factors of production, profit margins in some developed and developing countries;

- to reveal the general regularities in the dynamics of the economic and institutional processes in the developed and developing countries on the basis of the formation of the author’s model.

The set goal and tasks determined, to a large extent, the peculiarities of the scientific approach to the research of the economic and institutional processes in the developed and developing countries. Taking into account the theoretical and methodological and applied best practices in the field of international integration, it is based upon the following principles: the systematicity principle, the principle of study comprehensiveness of the social and economic processes and phenomena, the principle of objective consideration of the economic phenomena and processes, the principle of general development, grounding the objective character of change of social and economic phenomena and processes, the principle of the unity of theory and practice.

The implementation of these principles, to a large extent, is possible within the framework of the system approach that is used by the authors to build the interaction model of the international capital movement and cyclic processes in the economies.

As is mentioned by Makarov (2016, p.16), the modern situation is characterized by the close interrelation of the two processes: the objective transition to the knowledge-based economy and the further development of the processes of international integration that promotes the growth of public production informatization forming the basis for the new economic conditions of the development of the world economy and not only of the particular country or region. "Information and knowledge under the impact of the scientific and technical revolution (STR) become the most important economic resources. Knowledge turns into the independent fifth factor of production.

At the same time, as Karova is fair to say (2010,p. 31), "not all knowledge is required but only innovative". For its successful implementation and further application, sufficient amount of property as well as private assets are necessary. Thus, as a result of theoretical and empirical studies, the close interaction between the macroeconomic development of the country and free flow of factors of production was proved. As the works of many authors show, the countries with more open systems and systems integrated into the world economy achieved higher economic growth and development of the financial sector than others (Malkhasyan 2010, p.12). The quantitative aspect of formation of the new technical structure of the factors of production within the frameworks of the international cash flows is represented in the monography of Yudina et al. (2014, p.4).

In the applied research of this problematics, priority was given to the formation of econometric models that studied the impact of the dynamic factors on the macroeconomic development indicators of different countries (Tóth 2017, p.107; Grassetti 2018, p.220; Barhoumi et al. 2013, p.73; Klucik and Juriová 2010, p.7; Liu et al. 2011, p.10).

Minin (2013, 6) notices that analyzing capital the following problem is solved: "theoretical representation of the production relations connected to the initial form of capital, i.e. with the economic relation that shall be used to start the logical building of the integral system of economic categories…".

In the studies existing now, the change of the capital structure is made using the cost indicators of the technical composition of capital (TCC). Calculating the cost indicator of TCC on the base of the formula offered in the scientific literature (the ratio of the mass of accumulated capital to the total sum of man-hours worked), we revealed that from 1960 till 2016 the TCC increased in the developed countries, and according to the estimation of Campbell (2018, p.128), it can be due to the fact that many large European companies showed significant fluctuations in their capital structures from 2006 until now. In the opinion of Drobetz et al. (2015, p.936), the revealed positive dynamics can be related to the non-uniformity of the correction rate of capital structure in the different countries determining their common dynamics of a business cycle. Also, the problems of impact of the capital structure on the macroeconomic processes in the national economies were studied in the works of Cook et al. (2010, p.73), Erel et al. (2012, p.341), Faulkender, & Petersen (2006, p.45).

At the same time, the significant positive dynamics of the profit margin is observed in the developed economies. However, when the capital cost structure increases, the profit margin shall decrease. Also, this formula does not take into account the change of capital structure during its movement between the countries.

Despite the primary nature, the economic cycle is determined, to a large extent, by the change of phases in the institutional dynamics. Such dependence is clearly reflected in the works of Foster (2015, p. 163), and Kingston (2006, p. 97). Studying the cyclical nature of the economic development, the scientists distinguish the significance of the state impact on its origin, for example, Tungusov (2002, p. 18) believes that "… cyclical nature is rather sensitive to the state influence on the social and economic processes in the society". Ahuja, & Murthy (2017, p. 1154) mention that the procyclical and anti-cyclic measures implemented within the framework of the reforms can promote the leveling of the negative tendencies in the economic and social development and also to determine the efficiency of the implemented reforms from the point of view of the strategic development of the country. The impact of the institutional factors on the production rates in the country is represented in the works of Zhu (2016, p. 402), on social development – Hasselbladh, &Bejerot (2016, p. 1), on volumes of consumption and production – Brizga et al. (2014, p. 45).

When studying capital, it is important to pay attention to the possibility to change its structure directly during the process of its movement between the national economies. Similar changes occur in regard to the material (material capital (Cm)) and human (human capital (Ch)) factors of production expressing the technical composition of the factors of production (TCFP). Under current conditions, studying the changes of the capital structure it is reasonable to use the category of TCFP instead of the technical composition of capital (TCC).

It is related, first of all, to the fact that in the postindustrial economy the capital elements being the part of the ratio of material and human factors of production changed greatly because in the production process the informational resources and the factor of "knowledge" play the critical role.

It was decided to start studying the change of capital and the structure of factors of production at the modern stage from the qualitative changes of the elements Cm and Ch.

Investments into R&D, values of imported high-tech products, license payments are necessary for reflection of the most important role of the resource “information” in the international production and international capital movement.

The changes of ratio (Cm:Ch) influence the change of phases of economic cycle and it can be used for prediction of the capital movement in the mid-term period. The ratio Cm:Ch allows studying the changes in the interaction of the production factors in the modern economy.

The value Cm:Ch reflects the cost structure of capital specifying a higher ratio of Cm:Ch in developing countries than in developed economies; indicating the specified processes under conditions of the intensive internationalization of production.

The mentioned processes occur under the conditions of the intensive internationalization of production, and international economic integration. Many economists point out the positive side of this process, for example, Panasenkova (2011, p. 11) believes that the enforcement of the economic relations within the framework of these processes "makes it possible for the countries participating in the integration association to increase the efficiency of the national economies, optimize the use of the national resources and accelerate the rate of economic growth".

To reveal the regularities of the institutional cycle, the authors offer using the indicators reflecting the main tendencies of the dynamics of the institutional environment, which, by analogy with some indicators, applied for the determination of the macroeconomic dynamics, allows using them for the analysis of the institutional cycle.

The interaction model of international capital movement and cyclic processes in the economies of the developed and developing countries was built on the base of the authors’ calculations using the data of the world statistics of two groups of indicators: the first group – cost indicators of technical composition of capital (TCC), the ratio of material and human capital (Cm:Ch) and profit margin, the second group – the authors’ estimation of the institutional changes and changes of the structure of industrial production.

Many researchers point at the positive possibilities for the economy in the phase of depression. Thus, Loginov (2012, p. 16) believes that "… the state of depression … is characterized by the external state of chaos and high uncertainty but, at the same time, it is rather favorable for the introduction of brand new basic technologies capable of taking the economy into a new phase of long-term recovery".

The stability of economic development is influenced by many factors capable of changing significantly the positive dynamics of economic growth. Dimov & Sarishvili (2013, p.13) point at some of them: "… frequent changes of legislation, high tax level, unleveled competitive conditions, tax management, economic instability in the country, difficulty of capital attraction…". Consequently, institutional changes are necessary that will promote economic growth. Many researchers point at the necessity of transformations in the institutional sphere to achieve the positive activity of the economic agents and stability of economic development in general, in particular, Zeldner (2013, p.8) shares the same opinion: "...it is possible to avoid the destructive consequences in the development of the sustainable economic system when combining the institutions of the state, market and non-market institutions".

The necessity of economic growth can lead to the phase of recession in the institutional cycle and to a decrease in the institutional profit. In the institutional cycle, the transition to stagnation is possible at the sustainable growth of economy when the active institutional transformations are not required. The phase of growth of the institutional cycle takes place under conditions of recession in the economy, in the period of the institutional transformations directed to the support of the economic development. At the same time, there is a certain threshold, the limit for the economic recession, because the existing old institutes will not allow deep recession in the economy, and with the appearance of the new institutes (or reorganization of the old ones that can refer to the institutional transformations of the 1st kind) economic development will get to the phase of expansion. The question of the economic efficiency of the institutional transformations of the 2nd kind is raised (appearance of the absolutely new institutions that have not existed before in these economic and institutional systems). When the existing institutional system and institutions can support the current economic situation, the institutional transformations of the 2nd kind can seem unprofitable. The real prerequisites for introduction of efficient institutional transformations of the 2nd kind are shifted to the phase of the crisis in the economy. The institutional transformations of the 2nd kind decrease the institutional profit as the more cost-based transformations.

Thus, the analysis of the structural changes in capital movements shall be started from the study of the technical structure of production factors.

The structure of production factors is a ratio of payment-in-kind form between the applied material production factors and human factors that make them move. To determine the technical composition of capital (TCC) in monetary measures, or capital-labour ratio, the following formula was used:

TCC = the whole accumulated capital/ total sum of labour-hours

Under the indicator “whole accumulated capital” we will understand the aggregation of accumulated capital, including the sum of the fixed assets and current assets. At the same time, existing statistic databases, for example, the database of statistical indicators of the World Bank, allow making calculations using the total indicator of the fixed assets and current assets.

The quality of the dynamics analysis of structural changes in the capital movement is determined by its comparison with the indicator of profit margin. To determine the profit margin we used the following formula:

Profit margin = National income/ (fixed assets + current assets) + payroll of employees

The changes of the production factor ratio can be expressed via capital invested into the material production factors (Cm) and capital invested in the human production factors (Ch).

Cm includes: the investments into the fixed assets and material elements of the current assets, funds invested in research and developments, acquired imported high-tech products. Ch includes: human capital, investments into the factor ‘knowledge” by the entrepreneurs: license payments.

Cm and Ch are calculated in the monetary measures (in our case, US dollars). The ratio Cm:Ch is a coefficient that indicates how many times the capital invested in the material production factors exceeds the capital invested into the human production factors.

The formula developed by the authors was used for calculations:

where:

- “Inv.” are inventories

- “Cfix+Inv” are investments into the fixed assets and material elements of the current assets (inventories);

- “R&D” is funds invested in research and scientific developments;

- “Ch” is human capital (investments into specialists, i.e. payroll, education expenditures);

- “license payments” are investments of businessmen into the factor “knowledge”.

Basing upon the peculiarities of the research methodology described above, the authors compiled the table (Table 1) on the basis of the authors’ calculations using the data of the world statistics that represented the dynamics of the cost indicators TCC, Cm:Ch and profit margins for the long term for the groups of the developed and developing countries. Calculations Cm and Ch were made in currency units (US dollars) on the base of the data of OECD Factbook (Organisation for Economic Co-operation and Development 2011). The ratio of material capital and human capital (Cm:Ch) was calculated on the base of the obtained values Cm and Ch (US dollars). The table shows the coefficient (ratio Cm:Ch) and not the growth rates. That is why there is no units of measurement.

Table 1

Dynamics of cost values of technical composition of capital (TCC), ratio of

material and human capital (Cm:Ch) and profit margins (1960 – 2016)

Indicator |

Years |

||||||||

1960 |

1970 |

1980 |

1990 |

2000 |

2005 |

2008 |

2015 |

2016 |

|

TCC |

|

||||||||

Italy |

- |

5.7 |

8.7 |

8.5 |

9.1 |

9.2 |

9.4 |

9.3 |

9.35 |

France |

3.1 |

6.0 |

7.9 |

9.6 |

10.7 |

11.5 |

12.8 |

11.9 |

12.2 |

Great Britain |

- |

4.0 |

4.7 |

6.8 |

7.8 |

8.3 |

8.5 |

8.2 |

8.3 |

USA |

4.7 |

5.8 |

7.6 |

7.6 |

10.8 |

11.5 |

10.3 |

10.5 |

10.6 |

Indonesia |

- |

- |

- |

- |

- |

- |

- |

|

|

Malaysia |

- |

- |

- |

- |

- |

- |

- |

|

|

Philippines |

- |

- |

- |

- |

- |

- |

- |

|

|

Brazil |

0.8 |

1.2 |

2.1 |

1.6 |

1.7 |

1.5 |

2.1 |

2.0 |

2.1 |

Profit margin |

|

||||||||

Italy |

- |

- |

- |

- |

2.9 |

4.1 |

4.6 |

4.5 |

4.5 |

France |

- |

- |

- |

- |

3.3 |

4.5 |

4.8 |

4.7 |

4.7 |

Great Britain |

- |

- |

- |

- |

4.0 |

5.5 |

6.5 |

6.5 |

6.4 |

USA |

- |

- |

- |

- |

4.1 |

4.6 |

5.5 |

5.4 |

5.3 |

Indonesia |

- |

- |

- |

- |

1.6 |

1.2 |

1.5 |

1.3 |

1.6 |

Malaysia |

- |

- |

- |

- |

1.1 |

2.0 |

2.6 |

2.7 |

2.8 |

Philippines |

- |

- |

- |

- |

1.8 |

1.6 |

2.3 |

2.4 |

2.5 |

Brazil |

- |

- |

- |

- |

2.6 |

2.7 |

3.6 |

3.5 |

3.6 |

Cm (USD): Ch (USD) |

|

||||||||

Italy |

- |

- |

- |

- |

3.0 |

2.3 |

2.0 |

2.1 |

2.1 |

France |

- |

- |

- |

- |

2.0 |

1.6 |

1.5 |

1.5 |

1.5 |

Great Britain |

- |

- |

- |

- |

3.0 |

1.9 |

2.0 |

2.1 |

2.1 |

USA |

- |

- |

- |

- |

3.1 |

3.2 |

2.7 |

2.7 |

2.8 |

Indonesia |

- |

- |

- |

- |

9.6 |

7.4 |

7.8 |

7.8 |

7.9 |

Malaysia |

- |

- |

- |

- |

6.7 |

5.8 |

5.2 |

5.2 |

5.3 |

Philippines |

- |

- |

- |

- |

7.7 |

10.4 |

6.3 |

6.2 |

6.4 |

Brazil |

- |

- |

- |

- |

3.4 |

2.7 |

6.9 |

6.8 |

6.9 |

Source: calculated by the authors on the base of the statisticsdata

(World Data Atlas, 2018; Organisation for Economic Co-operation and Development, 2011)

To build the institutional cycle, we used the indicators reflecting the main tendencies in the dynamics of the institutional environment, which, by analogy with some indicators applied for the definition of the macroeconomic dynamics, allows using them for the analysis of the institutional cycle. The institutional changes and changes of the structure of the industrial production can be estimated by determining the ratio of the cycle dynamics and costs.

A = Cn/(Trcn+Exp n) = Cn/Kn,

where:

Cn is the aggregate changes of macroeconomic and institutional indicators;

Kn is an aggregate of the limiting indicators: transactional (Trc n) and process expenses (Exp n);

A is a coefficient determining the future dynamics of the economic system.

If A>1, the cycle is successful, that means the economy moved to a new stage, having overcome the existing obstacles in the form of the cost rate and system disturbance. For A<1, the backward chaining is typical. The situation when A=1 is not possible because in this case there are no cyclic fluctuations. The random "disturbances" of the system will not allow stabilizing this state.

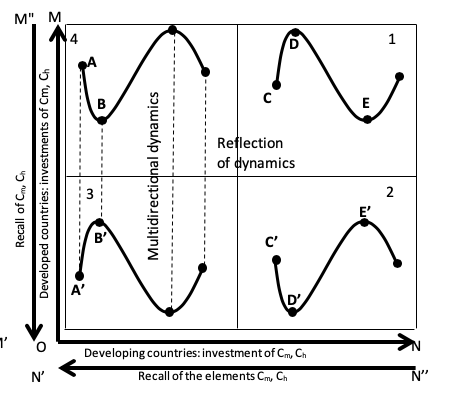

We developed a diagram allowing formulating the provisions of interaction of the economic and institutional cycles (Figure 1).

Figure 1

Interaction diagram of international movement of capital and cyclic processes in the economies

The direction ON reflects the movement of capital from the developed countries into the developing ones (investment Cm, Ch). The direction N"N’ shows the recall of elements Cm, Ch through the export of the added value and some factors of production back to the developed countries. The axis OM reflects the movement of capital from the developing countries into the developed ones (investment Cm, Ch). The direction M"M’ shows the recall of elements Cm, Ch from the developed economies.

Using the corresponding authors’ calculations of the cost indicators of the technical composition of capital (TCC), the ratio of the material and human capital (Cm:Ch) and profit margin, the research revealed the non-uniformity of the dynamics between the developed and developing countries, and also determined the higher values of the ratio Cm:Ch in the developing countries than in the developed countries. In our opinion, it is explained by the inclusion of the factors of production into the structure of the material capital that was exported from the developed economies. On that basis, we can conclude about the overestimated structure of capital in the developing economies. The large part of the added value produced at the enterprises of the developing countries belongs to the foreign companies organizing the production in these countries.

Super-profits arising as a result of functioning of the elements of material capital and factor "knowledge" in the developing countries are obtained by the developed countries that are the owners of these factors of production. Basing on the above, it is possible to explain the following contradiction. According to the Heckscher–Ohlin’s theory, we can presuppose that if the import of high-technology goods exceeds the export of the similar goods, the informational resource is in short supply and rather expensive; if the export exceeds import, the information is a cheap resource; therefore, the import of high-technology goods in the developed countries exceeds the import in the developing countries. It turns out that Great Britain, USA, Germany and France have a deficit of informational resources and Malaysia, China, Philippines, Thailand, Indonesia and Vietnam have a surplus of such resource as "information".

Thus, according to the data of the indicators of the World Bank, the import of high-technology goods in Germany was 103.4 bln dollars; in the USA it reached 303.2 bln dollars; in Malaysia it increased up to 87.6 bln dollars; in Philippines it grew up to 40.1 bln dollars. The explanation of such a paradox, in our opinion, is the following. The import of high-technology goods by the developed countries from the developing countries is related to the fact that the former transfer the production of high-technology goods into the developing countries to save the operating and transaction costs, to reduce the tax payments, etc. The results of most studies that are made in the developing countries belong to the developed countries.

On the basis of the built interaction model of international movement of capital and cyclic processes in the economies of the developed and developing countries, it was determined that under conditions of the strong correlation of economies there is a specific paradox now: the dynamics of the economic cycle in the developed (segment 4) and developing countries (segment 3) is multidirectional. It is explained by the dynamics of the institutional cycle, in the developed (segment 1) and developing economies (segment 2) that is also multidirectional. The dynamics of the economic cycle in the developing countries (segment 3) reflects the institutional cycle in the developed economy (segment 1).

The developing countries observing the economic tendencies in the developed states (and vice versa) strengthen the particular institutions: they improve the legislation in the field of contractual relations, reorganize the government institution (for example, they liquidate the non-efficient government departments) and this explains the phase of growth of the institutional cycle. The caveat shall be made: the institutional cycle in the developing countries, being the reflection of the economic cycle in the developed countries, does not occur at the same time, but with a delay. In other words, when a developed country goes through the phase AB in the economic cycle, a developing economy goes through the phase D’E’ in the institutional cycle. This presumption is true in the short-term period. In the medium-term and long-term periods, the institutional cycle in the developing economy repeats the economic cycle of the developed country. Thus, the developing economy is levelling its cyclic development by copying the economic dynamics of the developed country.

The institutional cycle has a great impact on capital movement. When investing, the international companies that make most of the capital movements, first of all take into account the institutional infrastructure: government regulation, easy establishing and conduction of business, etc. Thus, the conclusion is confirmed by the reports of the largest transnational corporations of the world – Apple, Google, Berkshire Hathaway, General Electric, Wal-Mart Stores, PetroChina, Chevron and IBM: the export volumes of their capital mostly to the newly industrialized countries are connected mostly to the institutional transformations in the field of legislation, taxation that were performed during the last decade of the twentieth century creating by this the conditions for the "breakthrough" in the field of scientific and technological progress (Adam 2017, 184).

Generalizing the experience of the national anti-crisis regulation in Latin America, Krasilschikov (2014, 107) noticed the increased sustainability of the coutries of the continent faced with the fluctuations of the world conjuncture. He explains this relative sustainability by the extension of the economic relations with China, and reorientation of the Latin America economies to the internal factors of growth. In his opinion, the countries that found the optimal balance between the development of the internal market and extension of export, between the expenditures for social needs and a budget component (Brazil, Argentina, Urugvay) suffered less from the crisis. On the contrary, the monodirectional orientation to the external markets made some countries too vulnerable when they facedcrisis (Mexico, Chile, Costa-Rica and also small island countries of the Carribean that counted on foreign tourism). Krasilschikov emphasized especially the insitutional potential accumulated in Latin America, the base of which are the institutional transformations of the credit and financial sphere including the reforms of the central banks that were performed in the 1990s.

In the modern world, as a result of the crisis three groups were distinguished, each of them finds its own was of regional integration:

• The first group (Mexico, Columbia, countries of the Central America and the Caribbean), oriented mainly on the market of the USA, and adopting their institutional transformations;

• The second group (Southern Cone, forming the common market of the South (MERCUSOR): Argentina, Brazil, Paraguay, Uruguay). In 2012, Venezuela also joined MERCUSOR. Their direction is based upon the "socialization" of the relations connected to the integration of the capital from the USA;

• The third group is combined with ALBA (Bolivarian Alliance) established following the initiative of Hugo Chavez that includes beside Venezuela the poorest and backward countries of the continent: Bolivia, Cuba, Nicaragua, Ecuador and also Antigua and Barbuda, Dominica, Saint Vincent and the Grenadines. This alliance has anti-business character and distinguishes by the clearly expressed anti-American sentiments that refuse the efficiency of the institutional transformations of the USA.

• The cooperation in ALBA is built on the base of the intragroup interaction around the projects in the field of power engineering, education, healthcare and development of culture.

Basing upon the represented research, the following conclusions can be formulated:

Firstly, non-uniformity was revealed in the dynamics during the long term and also some contradictions were found between the development of different types of countries: thus, the cost structure of capital and profit margin in the developed countries has a sustainable tendency to decrease; at the same time the ratio of the material and human factors of production in the economies of the developing countries has a sustainable tendency to growth.

These contradictions are explained, to a large extent, by the peculiarities of the import structure of the developed and developing countries. The research showed that the import of high-technology goods by the developed countries is determined by the transfer of production and scientific developments into the developing countries. Thus, simultaneously with the capital flow, the developed countries export the institutions providing the formation of the conditions of the progressive development of the national economies in the medium and long-term perspective.

Secondly, the interaction model of the institutional and economic cycles between the developed and developing countries built by the authors allowed revealing the general regularities in their dynamics: 1) multidirectionality of the economic and institutional cycles in different types of economy; 2) availability of the time lag (delay) of the institutional cycle in the developing countries that is a reflection of the economic cycle in the developed countries; 3) availability of advantages of the developing countries for the development of their own concept of the institutional transformations taking into account the results of the dynamics of the economic and institutional development of the developed countries; 4) the conditions for policy correction of the developing countries taking into account the results of the institutional transformations in the developed countries; 5) availability of the high degree of impact of the institutional cycle on the movement and structure of capital that are considered as the factors of the progressive development of national economies.

These conclusions are explained, to a large extent, by the intensive internationalization of production and international economic integration that are subjected to the general regularities of the institutional cycle.

The revealed regularities are general and can become the base of the policy correction of the developing countries taking into account the results of the institutional transformations in the developed countries and also the management of the phases of the institutional cycle that influence the movement and structure of capital that can promote the formation of new opportunities of extension of the economic and technological cooperation between the countries.

The non-uniformity discovered by the authors in the dynamics of the cost indicators of the technical composition of capital, the ratio of the material and human factors of production, profit margins in some developed and developing countries and also the non-compliance of the ratio of these indicators to the theories of movement of the factors of production are stipulated by:

• the transfer of the production facilities abroad,

• the increasing role of informational resources in the factor analysis,

• excessive or unused production facilities determined by the level of investments and savings,

• non-fulfilment of their functions of the technical innovations by the direct foreign investments.

Adam, S.M. (2017). The place and role of transnational corporations in the modern world economy. Young Scientist, 11, 183-186. Retrieved January 08, 2018, from https://moluch.ru/archive/145/40719.

Ahuja, D., and Murthy, V. (2017). Social cyclicality in Asian Countries. International Journal of Social Economics, 44 (9), 1154-1165.

Barhoumi, K., Darné, O. and Ferrara, L. (2013). Dynamic factor models: a review of literature. OECD Journal: Business Cycle Measurement and Analysis Journal, 2, 73-107.

Blinova, I.S.(2007). Government Regulations of Integration Processes of Production Capital in the Modern Russia. Political problems of the modern society: Collection of scientific articles, Saratov, Publishing house Science, 8, 11-16. (In Russian)

Brizga, J, Mishchuk, Z. and Golubovska-Onisimova, A. (2014). Sustainable consumption and production governance in countries in transition. The Journal of Clean Production, 63, 45-53.

Campbell, G.(2018). Capital structure volatility in Europe. International Review of Financial Analysis, 55, 128-139.

Cook, D. O. and Tan, T. (2010). Macroeconomic conditions and speed of capital structure adjustment. Journal of Corporate Finance, 16 (1), 73-87.

Dimov, V.A. and Sarishvili, G.N. (2013). Institutional traps for manual management of the Russian economy. Economic Sciences, 10 (107), 11-17. (In Russian)

Drobetz, W., Schilling, D.C. and Schröder, H. (2015). Heterogeneity in the speed of the capital structure adjustment across the countries and over the business cycle. European Financial Management, 21 (5), 936-973.

Erel, I., Julio, B., Kim, W. and Weisbach, M.S. (2012). Macroeconomic conditions and attracting capital. Review of Financial Studies, 25 (2), 341-376.

Faulkender, M. and Petersen, M. A. 2006. Does the source of capital affect the structure of capital? The Financial Times, 19 (1), 45-79.

Foster, J. (2015). Joseph Schumpeter and Simon Kuznets: Comparing their evolutionary economic approaches to business cycles and economic growth. Journal of Evolutionary Economics, 25 (1), 163-172.

Grassetti, F.(2018). On the theory of economic growth with the production function of Kadiyal. Communication in Nonlinear Science and Numerical Modeling, 58, 220-232.

Hasselbladh, H. and Bejerot, E. (2016). Performing policy: the case of swedish healthcare reforms. Critical Policy Studies, 19, 1-20.

Karova, E.A. (2010). Peculiarities of Production Process of the Modern Innovative Company. Economic Sciences, 2 (72), 31-35. (In Russian)

Kingston, W. (2006). Schumpeter, business cycles and co-evolution. Industry and Innovation, 13 (1), 97-106.

Klucik, M. and Juriová, J. (2010). Slowdown or decline? Forecasts based on a complex indicator Central European. Journal of Economic Modeling and Econometrics, 2 (1), 17-36.

Krasilschikov, V.A. (2014). Regional researches and global generalizations. World Economy and International Relations, 2, 100-108. (In Russian)

Liu, P., Matheson, T. and Romeu, R. (2011). Real-time economic activity forecasts for Latin America. IMF Working Paper, Washington, DC, International Monetary Fund.

Loginov, S.A.(2012). Modern interpretation of planned economic dynamics. Economic Sciences, 10 (95), 13-17. (In Russian)

Makarov, P.Yu. (2016). Formation of national intellectual capital in the context of international integration. Property Relations in the Russian Federation, 9: 56-67. (In Russian)

Malkhasyan, V.R. (2010). Integration of financial markets and economic growth of countries. Russian Entrepreneurship, 6 (2), 22-29. (In Russian)

Minin, A.I.(2013). Goods are starting point of logical system of K.Marx’ "Capital". Bulletin of Samara State University of Economics, 11 (109), 6-16. (In Russian)

Panasenkova, T.V. (2011). Globalization of Modern International Economic Relation and International Economic Integration. Economic Sciences, 12 (85), 7-11. (In Russian)

Sang, J.N. (1999). Placce for Asian values in East Asia’s economic development. Development and Society, 28 (2), 191-204.

Tóth, P. (2017). Nowcasting Slovak GDP by a small dynamic factor model. EkonomickyCasopis, 65 (2), 107-124.

Tungusov, D.V. (2002). Financial and economic crises, their essence and the role of tax policy in their overcoming. Economic Sciences, 7 (68), 11-24.

Worlds Data Atlas. Word and Regional Statistics, National Data, Maps, Ratings. Retrieved January 08, 2018, from https://knoema.ru/atlas/topics/%D0%AD%D0%BA%D0%BE%D0%BD%D0%BE%D0%BC%D0%B8%D0%BA%D0%B0

Yudina, E.A., Istomina, Yu.V., Pyatin, A.N. and Yuvovich, L.I. (2014). Peculiarities of real investments under conditions of capital integration: international and Russian aspects, Academy of Natural History, Moscow. (In Russian)

Zeldner, A. G. (2013). The essence and origins of destructive tendencies in the economic system of Russia. Economics, 4 (101), 7-12.

Zhu, Q.(2016). Institutional Pressure and Support of the Industrial Zones to Stimulate Sustainable Production Among Chinese Producers,International Journal of the Production Economics, vol. 181, 402-409.

Organisation for Economic Co-operation and Development(2011). OECD Factbook, Economic, Environmental and Social Statistics. World Bank Indicators. Retrieved January 03, 2018, from http://www.oecd-ilibrary.org.

1. Associate Professor, Chair of Economic Theory, Samara State University of Economics, Samara, Russia. Research interests: Economic cycles and Finance. E-mail: ab3535@mail.ru

2. Associate Professor, Chair of Economic Theory, Samara State University of Economics, Samara, Russia. Research interests: Finance, Operational Research.E-mail: rust1978@mail.ru

3. Professor, Chair of Banking and Finance, Samara State University of Economics, Samara, Russia. Research interests: Finance and Credit.E-mail: SavinovaVA@yandex.ru

4. Professor, Head of Chair of Banking and Finance, Samara National Research University named after S.P. Korolev, Samara, Russia. Research interests: Economic cycles. E-mail: Ipoteka_sorokina@list.ru

5. Corresponding author: Professor, Samara State University of Economics, Samara, Russia. Research interests: Finance, Mutual Funds. E-mail: alexander-michael@rambler.ru