Vol. 40 (Number 22) Year 2019. Page 3

СНERNYH Elena G. 1; ZOTOVA Natalia A. 2 & BOGDANOVA Olga V. 3

Received: 26/12/2018 • Approved: 13/06/2019 • Published 01/07/2019

ABSTRACT: Theoretical and practical material on cadastral valuation of real estate in the Russian Federation and the procedure for its implementation to determine the cadastral value was considered. A scheme for observation real estate’s prices has been developed to create a single official source of prices. |

RESUMO: Material teórico e prático sobre valoração cadastral de imóveis na Federação Russa e foi considerado o procedimento para a sua implementação para determinar o valor cadastral. Um esquema para observação de preços de imóveis foi desenvolvido para criar uma única fonte oficial de preços. |

Today, it is possible to find out the cadastral value of real estate in our country using an interactive cadastral map, which is located on the website of the Federal Service for State Registration, Cadastre and Cartography (next - Rosreestr). The data for calculation the cadastral value are conditional and shouldn’t affect the selling or purchase price of the real estate object, but its information is of great importance, since it is recorded in the document of the Rosreestr.

Cadastral value of real estate – it’s a calculated quantity which is determined as a result of the state cadastral valuation which is a sequential chain of procedures. It’s regulated by federal law of July 3, 2016 № 237-FL «About state cadastral valuation» and guidelines on state cadastral valuation (Order of the Ministry of Economic Development of Russia of June 6, 2016 № 358 "On approval of guidelines on state cadastral valuation"). January 1, 2017, the issues of state cadastral valuation were regulated by the Federal Law “On appraisal activity in the Russian Federation” of July 29, 1998, № 135-FL [1-3].

Insofar as in real time tax and rent calculated on the basis of the cadastral value, its estimated value is an important component of the cadastral activity.

The importance of updating the cadastral value of real estate is not only for determining tax and rent payments, but can also be widely used to calculate the amount of payment upon receipt of inheritance, property insurance, property registration fees, that is, the cadastral value can be used for different purposes.

So, the procedure for conducting the state cadastral valuation and the procedures which it includes for determining the cadastral value is an important mechanism for regulating cadastral activities, both for the state and for owners of real estate objects.

The state cadastral valuation includes the following procedures, presented in Figure 1.

Figure 1

The procedure and types of procedures for state cadastral valuation

In connection with the adoption of the Federal Law of July 3, 2016 No. 237-FL “On State Cadastral Valuation”, the number of state cadastral valuation procedures decreased, as there was no need for competitive work and conclusion of state contracts for state cadastral valuation. After all, the authority to conduct cadastral valuation is transferred to established budgetary institutions.

For public purposes, the object of state cadastral valuation can be any real estate, regardless of whether the ownership rights are registered to it or not. To conduct a state cadastral assessment, it is necessary to have a “legal” existence of the real estate object, which is expressed in the cadastral registration of the object.

The value of the property is determined as a result of:

1) The state cadastral assessment according to methodical instructions on the state cadastral assessment;

2) Determining the cadastral value of newly registered real estate objects, previously registered real estate objects in the case of USRT about them and real estate objects in respect of which their quantitative or qualitative characteristics have changed in the period between the date of the last state cadastral assessment and the date of the next state cadastral ratings;

3) Consideration of requests for correction of errors made in determining the cadastral value;

4) Consideration of disputes about the results of determining the cadastral value [2, 5, 6].

Figure 2

Authority of state budgetary institution

For these targets, the structure of the Institutions will have three departments: the department for collecting and processing information, the department for monitoring the real estate market and the department for determining the cadastral value. According to the director of the department of property relations of the Tyumen region, will be required 20-30 profiled specialists. The selection of professional staff will pay special attention.

The Federal Law of July 3, 2016 No. 237-FL "On State Cadastral Valuation" determines two categories of employees of the Institution, which exercises authority for state cadastral valuation:

1) Employees who are involved in determining the cadastral value;

2) Employees who directly determine the cadastral value and sign the report.

In accordance with article 195.3 of the Labor Code of the Russian Federation, if federal law and other regulatory legal acts of the Russian Federation establish requirements for the qualifications needed by an employee to perform a certain labor function, professional standards must be applied. The Federal Law of July 3, 2016 No. 237-FL "On State Cadastral Valuation" imposes the relevant requirements.

Specialists of the first group should have a higher specialized education. It Is allowed non-core education with professional retraining. An employee should not have an outstanding or un-removed conviction for crimes in the economic sphere, as well as for crimes of moderate severity, grave and especially grave. The authorized body of the subject of the Russian Federation has the right to establish additional requirements.

Specialists of the second group, in addition to the above, also should have at least three years’ experience in determining cadastral and (or) other types of real estate value and perfom professional activities related to determining the value of real estate objects, or at least three years’ experience in a budget institution associated with the determination of cadastral value.

In addition, the order of the Ministry of Labor and Social Protection of the Russian Federation of August 4, 2015 No. 539 approved the professional standard «Specialist in valuation activity». He assigns real estate valuation specialists to the seventh category, highlighting two job functions:

- Determination of the cadastral value of land;

- Determination of the cadastral value of capital construction objects (building, structure, facility, facilities, construction of which has not been completed, except of temporary structures, kiosks, sheds and other similar structures).

Professional standard make demands education and work experience. So, a specialist must have a specialized higher education and work experience of at least three years. Is allowed non-core education with professional retraining.

Thus, the name of the position, profession or specialty, qualification requirements for them must comply not only the requirements established by Federal Law No. 237-FL of July 3, 2016 «On State Cadastral Valuation», but also by the professional standard.

The new structure will not start determination of the cadastral value and interaction with the applicants immediately, because the cadastral valuation of certain groups of real estate objects is carried out within the statutory deadlines - once every three years or every five years, depending on the type of such property.

For the first time, the Federal Law of July 3, 2016 No. 237-FL “On State Cadastral Valuation” introduces such a procedure as «preparation for cadastral valuation». Such training should be carried out before January 1 of the year for determining the cadastral value.

The source of the primary information on the objects of evaluation prior to the adoption of federal law No. 237-FL was the State Real Estate Cadastre, and from January 1, 2017, the Unified State Register of Taxpayers.

One of the main problems of cadastral valuation so far has been the lack of sufficient information to evaluate certain properties. Many land plots have not a certain type of use, which does not allow them to be grouped correctly for evaluation. In their work, the appraisers used information from the Real Estate Cadastre formed by the cadastral registration authority and provided by the customer, and they had to clarify the available information and collect additional information that was not available in the Real Estate Cadastre, and without which an adequate cadastral estimate is impossible.

The Institution will been gage din determining the cadastral value on anon going basis, also it will begin collecting and processing information about real estate objects, including challenging the cadastral value and monitoring there are state market, which will allow collecting and systematizing the data. Consequently, the quality of information based on which will be conducted the state cadastral valuation, will improve. Thus the continuity of the assessment results will be observed, the results will be more consistent and predictable.

In addition, the new law provides that at the stage of preparing for the cadastral assessment, as well as at the stage of the formation of the reporting documents, the owners of real estate objects will be able to provide the Institution a declaration on the characteristics of the relevant objects. The law also provides for the constant interaction of the Institution, which is entrusted the functions of determining the cadastral value, and the authority for registration of rights in the framework of maintaining the Unified State Register of Taxpayers and obtaining information from it.

It is the responsibility of the Institution to provide the Rosreestr with the available information necessary to maintain the Unified State Register of Taxpayers. When determining the cadastral value of newly recorded properties and objects for which the characteristics have changed the budget institution will receive information from the Federal Register of Registers, which entail a change in the cadastral value, and send information about the cadastral value for inclusion in the Unified State Register of Taxpayers.

Federal Law of 03.07.2016 No. 237-FL “On State Cadastral Valuation” provides that the Institution provided information on the real estate market to the rights registration authority on a quarterly basis, and the rights registration authority will calculate and publish the property market index on a quarterly basis in the state cadastral valuation data subject of the Russian Federation. In the event that the real estate market index is reduced by 30% or more, a decision is taken on an extraordinary state cadastral valuation. And its results are approved only if they do not exceed the already valid results of the cadastral valuation, and if they are exceeded, the results of the extraordinary cadastral valuation are not applied.

Another norm of the Federal Law “On State Cadastral Valuation”, aimed at improving the quality of cadastral valuation and protecting the interests of real estate holders, is the introduction of federal state supervision over compliance with the procedure for conducting state cadastral valuation, including the frequency of its cadastre, as well as the methodology for determining cadastral value. This control is vested in Rosreestr.

Irina M. Filippova, Head of Appraisal Evaluation of the Financial and Banking and Investment Development Department of the Ministry of Economic Development and Trade of the Russian Federation, in her report of October 30, 2018, reported that state budget institutions were established in 33 regions of Russia. Federation. In 14 of them, new state budgetary institutions were created, in 15 — the reorganization of federal state unitary enterprises, in 4 constituent entities of the Russian Federation, the existing state budgetary institutions are vested with respective powers.

In 35 regions were carried out activities to harmonize the procedure for creating new state budgetary institutions within the subject. In 17 constituent entities of the Russian Federation, the timing of the transition to the creation of a state budgetary institution or the form in accordance with which they will be created is not defined.

Table 1

The main problems arising from the cadastral valuation

Problem |

Description of the problem |

Solutions State budgetary institution |

The absence of sufficient information to assess |

Uncertain type of land use - the difficulty in objective cadastral valuation |

Creation of the state budget institution for collecting, processing, systematizing the accumulation of information, creating guidelines for the state cadastral valuation, evaluation by the state institution staff, setting a date for the establishment of the state institution in the Tyumen region. |

Absence of information exchange |

The inability to use the updated information for the subsequent rounds of cadastral valuation |

|

Separates tatecadastral valuation |

State cadastral valuation is carried out separately to determine the cadastral value of land and separately to determine the value of capital construction objects |

Assessment work for the property as a whole (the land plot and capital construction objects related to it), which will lead to budget savings and increase the reliability of the assessment results |

The results of state cadastral estimates are published on the websites of state authorities of the constituent entities of the Russian Federation |

Open and transparent informing users of the valuation both at the stage of appraisal works and when communicating the results to property owners by sending notifications, which will lead to a reduction of lawsuits related to challenging the cadastral value |

The results of state cadastral estimates are published on the websites of state authorities of the constituent entities of the Russian Federation |

Unsystematic property market research |

Real estate market research is carried out periodically, as part of the collection of baseline information when conducting a mass real estate valuation |

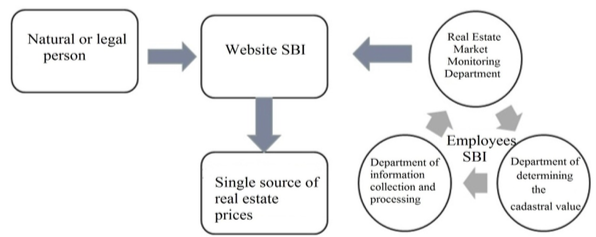

Creation of a single official source of prices for real estate objects on the website of the state budget institution, which will allow individuals and legal entities to orient themselves on the real estate market, and employees of the state budgetary institution of the real estate market monitoring department will have professional access to work with availability a wider range of evaluation criteria. Within the framework of the Digital Economy Program in the Russian Federation, the goal of which is to create an ecosystem of the digital economy of the Russian Federation, information will be exchanged online and accordingly responds quickly to price changes and constantly updated information on the site. The algorithm of interaction of citizens and employees of the state budget institution with an information resource is presented in Figure 3. An example form of a request on the State Budgetary Institution website is presented in Figure 4. |

-----

Figure 3

Algorithm of interaction of citizens and employees of the GBU with information resource

-----

Figure 4

Algorithm of interaction of citizens and employees of

the state budget institution with an information resource

After the entry into force of the Federal Law No. 237-ФЗ “On State Cadastral Valuation”, the definition of cadastral value in the Russian Federation should become more accurate and correct for the following reasons: should be less for are reasons:

1. Introduction of the institute of state cadastral appraisers, i.e. the transfer of authority to state budgetary institutions, the determination of the cadastral value is carried out on an ongoing basis.

2. State budgetary institutions will have to determine the cadastral value of each property when it is registered on the state cadastre.

3. The state budgetary institutions should carry out continuous monitoring of the real estate market, as well as the collection and systematization of information about real estate objects.

4. The list of objects of assessment, formed by the Federal Registration Service.

5. The assessment is carried out at least once every five years, and more often once every three

years, except for cities of federal significance. Such a period of time is not chosen by chance. It is determined on the basis of statistical data on the frequency of changes in the infrastructure around the property, which has a direct impact on the final cost.

6. If a system error is made in relation to land plots, with one apparently authorized use located in the same cadastral quarter, and the error is proved, then the cost is recalculated automatically.

7. Cadastral value will be determined by a single method.

But this law requires a number of improvements and amendments that would reduce the risks in determining the cadastral value:

- establishment of requirements for state budgetary institutions;

- input responsibility of staff and institutions of the state budgetary institutions;

- input expertise of the report on the determination of the cadastral value.

Entering the above amendments to the Federal Law settles relations between owners, performers and customers.

The principles necessary for the successful implementation of the concept of conducting cadastral valuation, for determining the cadastral value are: a uniform assessment methodology, publicity and openness of procedures, a balance of interests of rights holders and authorities, the use of reliable market information

1. Federal Law “On appraisal activity in the Russian Federation” of July 29, 1998 No. 135-FL (last version) [Electronic resource] // Consultant plus http://www.consultant.ru

2. Federal Law “On State Cadastral Evaluation” of July 3, 2016 No. 237-FL (last version) [Electronic resource] // Consultant plus http://www.consultant.ru

3. Decree of the Government of the Russian Federation “On Approval of the Rules for Conducting State Cadastral Valuation of Land” dated April 8, 2000 No. 316 (last version) [Electronic resource] // Consultant plus http://www.consultant.ru

4. Order of the Ministry of Economic Development of Russia “On Approval of Guidelines on State Cadastral Evaluation” of May 12, 2017, No. 226 (last version) [Electronic resource] // Consultant plus http://www.consultant.ru

5. All about the cadastral value, the method of its calculation and the impact on land tax [Electronic resource] / Official website of the Russian Society of Appraisers - 2018.http://www.sroroo.ru/.

6. Vandervelde, E. (1903). L'Exode rural et le retour aux champs. Paris: Alcan

7. Baudrillard, J. (1976). L'Échange symbolique et la mort. Paris: Gallimard.

8. Fisher, C., Lauria, E., Chengalur-Smith, S. & Wang, R. (2011). Introduction to Information Quality. Bloomington IN: AuthorHouse.

9. Floridi, L. & Illari, P. (2014). The Philosophy of Information Quality. NY: Springer.

10. Floridi, L. (2004). Open problems in the philosophy of information. Metaphilosophy, 35(4), 554-582.

11. Floridi, L. (2011). The philosophy of information. Oxford [England]. New York: Oxford University Press.

12. Montgomery, Ch. (2013). Happy City: Transforming Our Lives through Urban Design. NY: Farrar, Straus, and Giroux.

1. Tyumen Industrial University, assistant professor , chernyheg@tyuiu.ru

2. Bashkir State Agrarian University, assistant professor , zotova-na85@mail.ru

3. Tyumen Industrial University, assistant professor , bogdanovaav1@tyuiu.ru