Vol. 40 (Number 16) Year 2019. Page 22

NIKOLAICHUK Olga 1; ARKHYPENKO Svitlana 2 & MATUKOVA-YARYHA Daria 3

Received: 30/01/2019 • Approved: 21/04/2019 • Published 13/05/2019

ABSTRACT: The article generalizes the essence and conditions of enterprise value estimates, analyzes the methods of its estimation, proves the influence of intellectual capital on its value. The introduction of the subsystem of intellectual capital management of the corporate enterprise and its components are substantiated. The algorithm of evaluation of the effectiveness of the proposed management subsystem on the basis of a matrix model using structural and cost aspects is proposed |

RESUMEN: El artículo generaliza la esencia y las condiciones de las estimaciones de valor de la empresa, analiza los métodos de su estimación, demuestra la influencia del capital intelectual en su valor. La introducción del subsistema de gestión de capital intelectual de la empresa corporativa y sus componentes están fundamentados. Se propone el algoritmo de evaluación de la efectividad del subsistema de gestión propuesto sobre la base de un modelo matricial que utiliza aspectos estructurales y de costo. |

In the context of deepening globalization processes, the transition to a post-industrial economy and increased competition, companies are forced to seek new sources of long-term competitiveness. At this, the most effective tool that allows them the timely strategic and operational transformation of the business system is the process of managing the business value, which helps to increase capitalization and investment attractiveness, ensure the efficient use of all kinds of resources, the formation of competitive advantages in the long run and taking into account the interests of all those concerned parties.

The value of the company is relied on while conducting purchase and sale deals, mergers and acquisitions, it is necessary for effective management decisions. The question of maximizing the value of the company, which is the main distinguishing feature of corporate governance, is becoming relevant.

But in a knowledge economy that is characterized by innovation and increased influence of intellectual processes on economic performance at all levels of the economy, this process is impossible without determining the role of intellectual capital as an intangible component of the enterprise value and its efficient management.

This problem becomes important for corporate enterprises. With significant resources, large corporations are the initiators of the creation and implementation of technological innovations and thus can have an impact on the innovative development of society. The practice of successful world companies shows that it is precisely at the cost of intangible components - the intellectual capital - that the company generates additional value added flows, which contributes to increasing their economic value. However, in Ukrainian practice, unlike other countries, intangible components of business value are not fully taken into account.

The purpose of the paper is to substantiate the introduction of the intellectual capital management subsystem of the corporate enterprise as an effective organizational and managerial tool for increasing the enterprise value and to develop an algorithm for estimating its effectiveness.

The problem of estimating the enterprise value is a subject of the works of many scientists (Mendrul O., 2002). Intellectual capital is the subject of discussion by many theorists and management practitioners, including A. Brooking (Brooking A., 1996), O. Butnick-Siversky (O. Butnick-Siversky, 2002), L. Edvinsson, and M. Malone (Edvinsson, L. and Malone, 1997), O. Kendiukhov (O. Kendiukhov, 2007) B. Leontiev (Leontiev V.B., 2002), G. Roos, S. Pike, L. Fernstrom (Roos G., Pike S., Fernstrom L., 2005), K. Sveiby (Sweibe K.E., 2001), T. Stewart (Stewart T.A., 1997) and others. However, despite numerous studies on this issue, the problem of developing and implementing a subsystem of intellectual capital management and assessing the effectiveness of its functioning remains unsolved in the scientific and applied aspects of the problem, which actualizes the problem of necessity to form an appropriate organizational and economic mechanism.

The enterprise value is the cost of an operating company or the cost of 100% corporate rights in a business enterprise. The necessity to assess the enterprise value arises in the following cases (Shtanko L.O., 2009):

- during the investment analysis in the course of making decisions on expediency of investing funds in one or another enterprise;

- during the reorganization of the enterprise;

-in case of bankruptcy and liquidation of the enterprise (the assessment is carried out with the purpose of determining the value of the liquidation mass);

- in the case of sale of the company as an integral property complex (the assessment purpose is to determine the real takeover price of the property);

- in the case of mortgage and in determining the creditworthiness of an enterprise (the purpose of the assessment is to determine the real value of loan security);

- in the course of the sanitation audit in determining the sanitation capacity (the estimation of the property is carried out with the aim of calculating the efficiency of the sanitation);

- during the privatization of state-owned enterprises (the purpose of the assessment is to determine the initial takeover price of the privatization object).

The estimation of the enterprise value and its property belongs to the most complex issues of finance enterprises. Particularly noteworthy is the assessment of the enterprise value as a holistic property complex and assessment of corporate rights of the entity, if these rights are not quoted on the stock exchange. Although the cost of an enterprise may sometimes be equal to the market value of its assets, it should be understood that these concepts are different. In the first case, it is primarily said about the value that can be created as a result of a business operation. The estimation of an enterprise is usually based on market value - the probable amount of money at which the sale / purchase of an object of valuation is possible on the market (Shtanko L.O., 2009).

The domestic legislation in assessing the enterprise and property value as a whole recommends to be guided by the Law of Ukraine "On Appraisal of Property, Property Rights and Professional Appraisal Activity", the method of property evaluation during privatization, the provisions (national standards) of expert evaluation, and normative acts of the State Property Fund (Shtanko L.O., 2009).

There are a number of approaches to assessing the enterprise value: market, cost, revenue. A market approach means that the most probable value of an estimated enterprise may be the real takeover price of the identical company that has emerged on the market. The cost approach is to assess the current value of certain elements of the property complex of the enterprise and its intangible assets. The revenue approach considers an enterprise as an asset that generates earnings in the future. One of the main drawbacks of the revenue approach is the predictive nature of the information on which the assessment is based. Depending on the purpose of the assessment, the conditions, the state of the object of evaluation, the enterprise value is actually measured by several methods that are most relevant to the particular situation within the framework of the above approaches, and then the aggregate value as the weighted average is calculated (Glotova D., 2013).

However, the above approaches do not fully take into account the fact that in modern conditions the market value of an enterprise is determined by the capitalization of its value, the uniqueness, innovation and intellectualization of products, work and services. In particular, neither the profitable nor the market-based method generally takes into account the intellectual component of the enterprise's revenue.

In assessing the enterprise value by the cost approach it is noted (Nikolaichuk O., 2017) that it is not equal to the arithmetic sum of the value of individual property objects of the enterprise. This value should be adjusted to goodwill value, which is understood as the value of the firm, its business reputation, intangible asset, the value of which is determined as the difference between the intrinsic value of the enterprise and its market value arising from the best managerial qualities, market position, new technologies, etc.(Nikolaichuk O., 2017).

In the context of a cost-effective approach to enterprise value, intellectual assets are estimated using surplus profits, which in itself relates to capitalization methods. The basis of the method is the assumption that intellectual assets provide the company with additional profits that exceed the industry level. At the same time, the advantages of the company are reflected in the excess of profitability over the average industry level (Shtanko L., 2009). That is, in a certain way, this method recognizes that there is a certain intellectual, intangible component that in general increases the cost of the firm.

D. Glotova (Glotova D., 2013) offers a methodology for calculating the enterprise value which takes into account the influence of intellectual capital of the enterprise on the value created by them. Its essence lies in the fact that the enterprise value is the sum of the value of tangible assets and intellectual capital .

Some economists (Babiy P., 2013) instead of the notion of "intellectual capital" use the concept of intellectual assets as a series of rational use of information, intellectual and mental resources that interact in the internal and external environment of the entity to create unique competitive advantages for the purpose of obtaining a surplus profit. In this case, they are classified as such (Babiy P., 2013): intrinsic, including structural and human capital (formed and accumulated in the internal environment - technology, know-how, organizational culture, level of qualification, loyalty, intellectual personnel potential) and external, which includes consumer capital (image, brand reputation).

A. Brooking (Brooking A., 1996) defines intellectual capital as a set of intangible assets that enhances the competitive advantages of an enterprise. Intellectual capital includes market assets (brand, promising agreements, contracts, distribution channels), intellectual property (patents, copyrights, trademark) and infrastructure (business processes, enterprise management policy, culture and management processes), humanitarian assets (intellectual assets of employees and enterprise partners, which mean knowledge and skills).

Consequently, at the enterprise level, intellectual capital becomes the main source of competitive advantages and innovations, and the corresponding management subsystem is an effective organizational and managerial tool for enterprise development and increase of its competitiveness.

Our analysis of the main trends in the field of intellectual capital management of domestic corporate enterprises allowed us to identify a number of problems (Zhuravleva I., 2013, Senyura A., 2013) among which the main ones are: imperfection of the motivational mechanism for intellectual work, a small proportion of intellectual assets in the enterprise book value, fragmentary nature of work with corporate culture and organizational structure, lack of monitoring of the management efficiency of intellectual capital and so on.

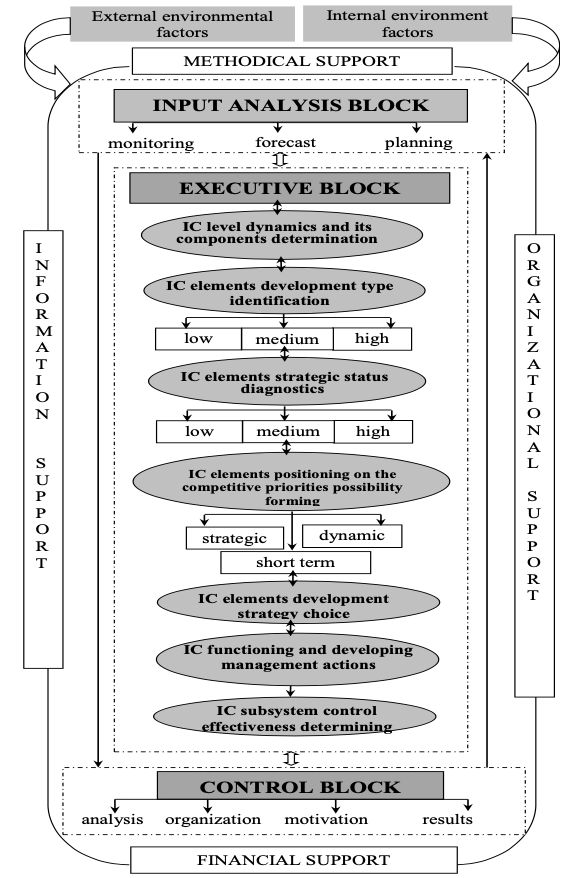

Thus, this necessitates the introduction of a subsystem of effective management of it (Figure 1).

Figure 1

Effective management subsystem of

corporate enterprises intellectual capital

The main purpose of the intellectual capital management subsystem is the rational organization of all processes related to forming, using, developing and reproducing of intellectual capital, ensuring its effectiveness. The central elements of this system are certain blocks: an input analysis block, an executive block and a control block.

Within the framework of the input analysis, functional responsibilities for monitoring the trends of the external and internal environment, the forecast of the enterprise and its intellectual capital development at the strategic level, planning of the goals, principles and objectives of the intellectual capital management of the enterprise at the operational level are provided.

The functional duties of the executive block are divided among the seven components, allocated in accordance with the stages of intellectual capital management: determining the dynamics of the intellectual capital level and its components, identifying the type of development of its elements, diagnosing the strategic status of elements of intellectual capital and their positioning in relation to the possibility of forming competitive advantages, the choice of strategy for the development of intellectual capital, management actions for the function and development of intellectual capital, determining the effectiveness of management of intellectual capital.

Within the stage of determining the level of intellectual capital and its components, it is expected to make managerial decisions on determining the value of intellectual capital, to determine the dynamics of changes in its components; within the stage of identification of the type of the development of elements of intellectual capital - on the basis of the proposed methodology, the type of the development of elements of intellectual capital (low, medium, high) is determined; within the stage of diagnostics of the strategic status of elements of intellectual capital - the status of elements of intellectual capital regarding the formation of enterprise value is identified; within the stage of positioning of elements of intellectual capital regarding the possibility of forming competitive advantages - the definition of the capabilities of elements of intellectual capital in relation to the formation of competitive advantages by means of positioning on the basis of the proposed matrix; within the stage of the choice of strategy for the development of intellectual capital - the determination of the development strategy of the intellectual capital elements based on the results of positioning the elements of intellectual capital on the possibility of forming competitive advantages using the matrix; within the framework of the stage of development of management actions on the functioning and development of intellectual capital - taking into account the choice of strategic directions for the development of elements of intellectual capital, tactical and operational measures are being developed and implemented for the formation, effective use and reproduction of intellectual capital elements.

In addition, it should be noted that managerial decisions in the context of all seven stages are closely interrelated and should be accepted taking into account the factors of the internal and external environment of the enterprise. To determine if management decisions were effective within the limits of the given block is offered on the basis of conformity of the resulting indicator - the index of efficiency of the subsystem of intellectual capital management, the algorithm of calculation of which is given below.

The functional responsibilities of the control-block include the implementation of the diagnostics of the functional responsibilities of the input analysis and executive blocks, ensuring the efficient organization of the intellectual capital functioning at the enterprise, the formation of a system of incentives and sanctions for top managers and managers of individual structural units, and the implementation of internal control and response to its results.

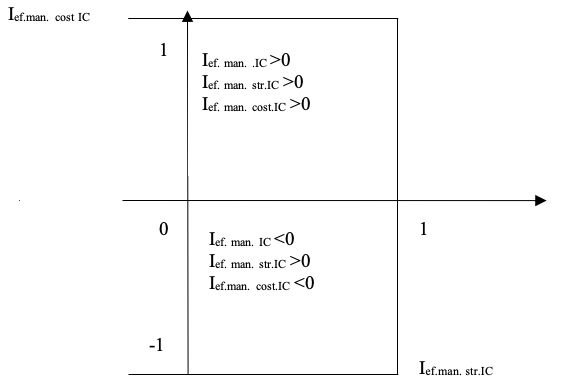

To determine the results of the introduction of effective intellectual capital management in the practice of corporate enterprise management, a matrix model of the efficiency of the intellectual capital management subsystem was used (Fig. 2).

Figure 2

Matrix model of the efficiency of the intellectual capital management subsystem of corporate enterprises

For the practical application of the model, the peculiarities of the components of intellectual capital at corporate enterprises and their cost estimation were taken into account.

Therefore, it is proposed to highlight two aspects of goal setting in order to determine the efficiency of the intellectual capital management system: structural and cost - based on determining the ability of intellectual capital to generate cost. The combination of two components in the subsystem allows us to manage the elements of intellectual capital and to comprehensively explore the effectiveness of the subsystem operation at corporate enterprises.

In the proposed matrix model, the zone corresponding to the positive value of the Іеf.man.str.ІC та Іеf.man.cost.ІC, testifies to the efficiency of the subsystem of intellectual capital management (Іеf. man.ІC>0). In contrast, the zone corresponding to the positive value of the Іеf.man.str.ІC and negative Іеf.man.cost.ІC, testifies to the ineffectiveness of management of intellectual capital (Іеf.man.ІC<0).).

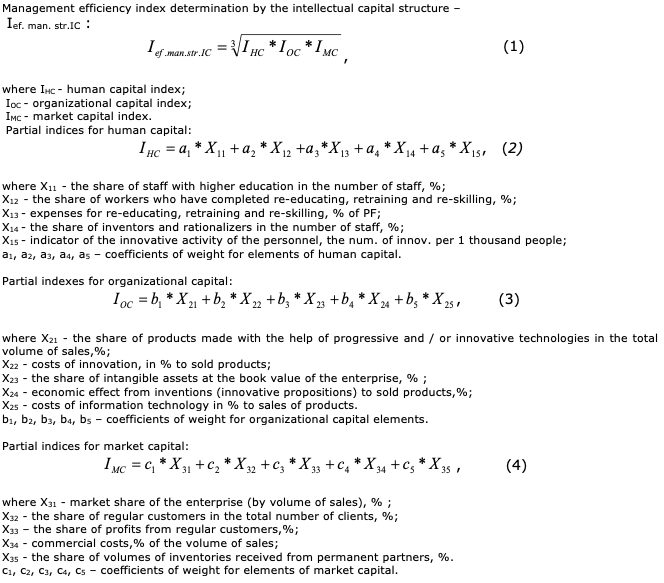

To calculate the efficiency index of the subsystem of intellectual capital management, the following algorithm was developed and used in which the requirements for efficiency are determined on the basis of the results of the analysis of the structural and cost component of the intellectual capital of the corporate enterprise and by analyzing the subsystem of intellectual capital management of the competitor enterprises:

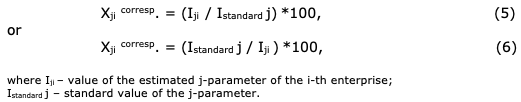

The calculation of partial indices for human, organizational and market capital is made by determining the level of compliance of the j-parameter of the assessment of the management efficiency of the intellectual capital structure of the i-th enterprise (Xji corresp) to the reference value:

Formula (5) applies when a larger value of the j-parameter provides greater economic benefits to the enterprise (e.g., the share of workers with higher education, the share of re-educated, retrained and re-skilled workers, the share of inventors and innovators), while formula (6) applies in cases when the smaller the absolute value of the j-parameter is, the greater economic benefits will be obtained by the enterprise (for example, commercial costs in % of sales).

The weighting factors in the determination of partial indices may be determined by an expert method.

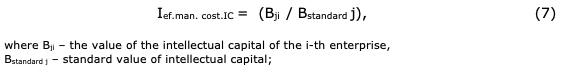

2) Calculation of the efficiency index of intellectual capital management by the value of the i-th enterprise by determining the level of compliance of the value of the intellectual capital of the enterprise (Bji corresp.) to the standard value (B standard j):

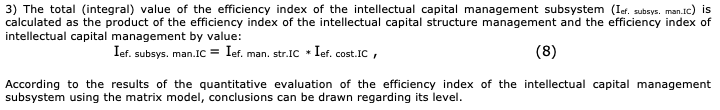

Іеf. subsys. man.ІC = Іеf. man. str.ІC * Іеf. cost.ІC , (8)

According to the results of the quantitative evaluation of the efficiency index of the intellectual capital management subsystem using the matrix model, conclusions can be drawn regarding its level.

Table 1

Scale of the efficiency index values of the intellectual

capital management subsystem of a corporate enterprise

Quantitative value of the efficiency index of the control subsystem |

Conclusion on the efficiency level of the control subsystem |

-1…0...0,30 |

low |

0,31...0,5 |

moderate |

0,51...0,75 |

medium |

0,76...1,0 |

high |

Therefore, the developed approach to the intellectual capital management in the value system of a corporate enterprise will allow its management to promptly take effective managerial decisions regarding the future development strategy and affect the value of business.

Conclusions Thus, the author's approach to the creation and implementation of a subsystem of intellectual capital efficient management of corporate enterprises is substantiated. The central elements of this system are certain blocks: an input analysis block, an executive block and a control block.

To determine the results of implementation of effective intellectual capital management in the practice of corporate enterprise management, the use of a matrix model of efficiency of intellectual capital management subsystem, which takes into account two aspects of target setting: structural and cost, was proposed.

In order to determine the resultant indicator of the efficiency of the subsystem under investigation, the calculation of the efficiency index of the intellectual capital subsystem based on the results of the diagnostics of the structural and cost component of the intellectual capital of corporate enterprises and by comparing the corresponding subsystem of intellectual capital management of the competitor enterprises is substantiated.

The obtained results are of practical importance for domestic and foreign enterprises, they are universal in nature and can be used in the intellectual capital management of enterprises in different business spheres.

Mendrul O. Management of the cost of the enterprise: Monograph. / O.G. Mendrul // KNEU, 2002. – 272 p.

Brooking A. Intellectual Capital, London - International Thomson Business Press, 1996.

Butnyk-Siversky O. Intellectual capital: the theoretical aspect/ O. Butnyk-Siversky // Intellectual capital– 2002 - №1 – P.19-27.

Edvinsson, L. and Malone, M.S. Intellectual Capital: Realizing your Company's True Value by Finding Its Hidden Brainpower, Harper Business, New York, 1997. – Р. 240

Kendiukhov O.V. Organizational and economic mechanism of intellectual capital management of the enterprise: abstract of dis. for obtaining Doctor of Economics Degree: spec. 08.00.04 «Economics and management of enterprises (processing industry)». / О.V. Kendiukhov. – Donetsk, Institute of Industrial Economics, NAS of Ukraine, 2007. -31 p.

Leontiev V.B. The Price of Intellect: Intellectual Capital in Russian Business / V.B. Leontiev – М. : PC «Aktzioner», 2002. – 200 p.

Roos G., Pike S., Fernstrom L. Managing Intellectual Capital In Practice. Butterworth Heinemann, 2005.

Sweibe K.E. The theory of a firm based on knowledge. Guidelines for formulating the strategy / К.-E. Sweibe // Intellectual Capital. – 2001. – № 4, v. 2. – [E-resource]. Access mode: http://www.knowledgeboard.com.

Stewart T.A. Intellectual Capital. The New Wealth of Organization. – NY: Double day, 1997.

Babiy P.S. Estimation and management of the value of the intellectual property of the entity // P.S. Babiy. – Sustainable development of the economy. – 2013. - №3. – p. 314-318.

Glotova D.V. Measurement of intellectual capital in the process of assessing the value of the enterprise // D.V. Glotova. – Economic magazine - ХХІ. – 2013. - №9-10(2). – p. 18-21

Tararuyev Y. O. Summary of lectures on the course "Economic Diagnostics"/ Y.O.Tararuyev – Kh.: KNAME, 2012. – 93 p.

Shtanko L.O. Economic diagnostics / L.О. Shtanko. – К.: NUFT, 2009. – 159 p.

Nikolaichuk O.A. Intangible components of creating a business value // Actual problems of the socially oriented economy [Monograph text]: Collective monograph ed. by Doctor of Sciences, Prof. Prokhorova V.V. - Kharkiv: Smugasta typographia, 2017. - P. 360- 372 - 391 p.

Zhuravleva I.V. Factor analysis of the functioning of intellectual capital of mechanical engineering enterprises [E-resource] / І. V. Zhuravleva // Actual problems of the economy. - 2013. - № 5. - P. 116-124. - Access mode: http://nbuv.gov.ua/UJRN/ape_2013_5_14

Senyura A. Yu. Practical bases of management of intellectual capital of personnel at the enterprises of mechanical engineering [E-resource] / А. Yu. Senyura // European perspectives. - 2012. - № 2(2). - P. 34-41. - Access mode: http://nbuv.gov.ua/UJRN/evpe_2012_2(2)__8

1. Candidate of Economics, Associate Professor of the Department of International Economics and Tourism, SIHE «Donetsk National University of Economics and Trade named after Mikhail Tugan-Baranovsky» (Ukraine). E-mail: nicol.olga18@gmail.com

2. Candidate of Economics. Krivoy Rog National University (Ukraine). E-mail: svetaken@ukr.net

3. Candidate of Economics. Senior Lecturer, National Medical University of O.O. Bogomolets (Ukraine). E-mail: deborah88@ukr.net