Vol. 40 (Number 10) Year 2019. Page 30

PONOMAREVA Nadezhda 1; ZVEREVA Anna 2; GOLUBTSOVA Ekaterina 3; NOVIKOVA Ekaterina 4 & MAXIMOV Denis 5

Received: 19/02/2019 • Approved: 15/03/2019 • Published 31/03/2019

ABSTRACT: This research paper investigates schemes that facilitate the illegal decrease of taxes through international deals with intangible assets, and its dissemination in Russia on the basis of statistical data. Findings confirm the need to launch special tools to avoid indecent tax competition. The implementation of the suggested risk-oriented approach with respect to the revealing facts of tax evasion by using intellectual property can be an effective tool at the end. For achieving this target, statistical and mathematical methods of data analysis are used and a linear regression model with two variables is constructed. This advanced method of tax auditing provides the opportunity to identify the companies facing the risk of being subjected to more detailed analysis with respect to fraudulent deals with non-tangible assets. It is based on the comparison of growth rate for non-tangible assets in a company and the value of its taxable profit. In the end, the need for such a method’s introduction to facilitate the efficiency increase of the beneficial owner concept implementation has been proved. |

RESUMEN: Este trabajo de investigación investiga esquemas que facilitan la disminución ilegal de impuestos a través de acuerdos internacionales con activos intangibles y su difusión en Rusia sobre la base de datos estadísticos. Los hallazgos confirman la necesidad de lanzar herramientas especiales para evitar una competencia tributaria indecente. La implementación del enfoque sugerido orientado al riesgo con respecto a los hechos reveladores de la evasión fiscal mediante el uso de la propiedad intelectual puede ser una herramienta eficaz al final. Para lograr este objetivo, se utilizan métodos estadísticos y matemáticos de análisis de datos y se construye un modelo de regresión lineal con dos variables. Este método avanzado de auditoría fiscal brinda la oportunidad de identificar a las compañías que enfrentan el riesgo de ser sometidas a un análisis más detallado con respecto a acuerdos fraudulentos con activos no tangibles. Se basa en la comparación de la tasa de crecimiento de los activos no tangibles en una empresa y el valor de su beneficio imponible. Al final, se ha demostrado la necesidad de la introducción de dicho método para facilitar el aumento de la eficiencia de la implementación del concepto de propietario beneficiario. |

According to the Organization for Economic Cooperation and Development (OECD) data (2013), the state budgets of many countries around the world lose up to 240 billion dollars annually because of tax evasion schemes and the use of intellectual property objects. Based on the OECD report on Base Erosion and Profits Shitting, there is a need to analyze approaches to taxation auditing due to innovations in entrepreneurship within an era of technological progress. The significant role played by intangible assets in value creation also contribute to such changes.

The improved risk-oriented approach is the actual one in the plan of visiting tax auditing in the case of operations with non-tangible assets for taxpayers. Such an approach can enlarge the practice of beneficial owner concept implementation in the Russian tax legislation. This, in turn, will contribute to the suppression of illegal decrease of tax obligations in international operations with intellectual property. This method’s flexibility will provide the opportunity to use it while performing tax auditing in other countries.

Next section includes the literature review, methodology, findings, and finally discussion with practical recommendations and conclusion.

Many researchers in different countries have studied aspects of aggressive international tax planning. Researchers agree that the intangible assets are used as a tool for decreasing tax liabilities in the frame of transnational groups through illegal deals with offshore companies. This phenomenon has negative consequences for budgets of different countries. As a result, combat methods with such schemes are essential.

The interaction among effects of multinationality, tax havens, intangible assets and transfer pricing has been outlined (Taylor et al. 2015). The regression results indicate that multinationality, tax haven utilization, and intangible assets are significantly positively associated with transfer pricing aggressiveness. The regression results also show that firms magnify their international transfer pricing aggressiveness through the joint effects of intangible assets, multinationality, and tax havens. Overall, the empirical findings demonstrate that the utilization of tax havens and the level of intangible assets are important factors that assist firms in getting tax benefits through transfer pricing aggressiveness.

The different techniques of the international tax planning, most commonly used by the Russian organizations, including the offshore method have been analyzed (Lipatova and Polezharova 2015). Using the analysis of current statistical data, they have assessed the impact of the international tax planning with the use of low-tax jurisdictions on the economies of capital donor countries.

Disadvantages in the Russian rules on Controlled Foreign Companies are defined, and solution ways are suggested (Pinskaya et al. 2014). They make a conclusion that taking into the consideration the Russian environment rules on CFC there is a need to revise carefully the whole system on the basis of the recommendations of OECD, which have been made in year 2015 within the framework of a “Base Erosion and Profit Shifting” program.

At the same time the growing systematic evidence of corporate tax base erosion and profit shifting out of most countries into other countries, including tax havens, by analyzing the situation in one of the post-communist economies has been contributed (Janský and Kokeš 2015).

In addition, the tax distortions have been appeared in cross-border flows of intangible assets (Neubig and Wunsch-Vincent 2018). This indicates some globalization problems in the field of tax auditing possibilities.

Before the analysis of Russian companies, this is essential to follow the experience of U.S. multinationals in the field of profit shifting (Dowd et al. 2017). This is analyzed with the help of unique panel data set of U.S. tax returns over the period of 2002-2012. During the research process, significant effects of tax rates in affiliate and parent countries on the profit shifting behavior of multinational entities have been found out.

Finally, this is important to investigate the process of legitimation in the corporate tax minimization taking into account the current economic problems both in Russia and in other countries around the world (Anesa et al. 2018).

Identification of causal links between different economic processes both at the macroeconomic level of a government and at the level of separate business units is essential element for different types of research. The definition of factors influenced on changes of a result, is essential to undertake using tools of qualitative and quantitative methods for more reasonable interpretation of such calculations.

Identification of stochastic dependence between indicators with the use of correlation analysis is based on the connection and its direction. Moreover, the character of such connection is defined on the basis of considered analytical equation. The correlation dependence can influence on the clarification and verification of research hypothesis. The research hypothesis includes the change in effective indication yt (the value of taxable profit in the company) because of factor ground impact (the value of non-tangible assets in the company) xt. The use of such tools for analysis is practiced in research papers with the same problem (Brushwood et al. 2018).

The establishment of statistical interaction is based on the identification interdependence of research objects in dynamics and the sample size (yt, xt), t=1…n is used for this purpose.

The correlation analysis is one of the most detailed methods, which defines the interaction between considered indicators with its values. The calculation of correlation coefficients provides the opportunity to define differences from the point of interaction between factor and result indications taking into account industry characters of considered objects in this research. The calculation of correlation coefficient gives the opportunity to verify the hypothesis on the interaction between

The Russian company as a selected research object has a leading position in the industry indicating all features of this sector in the economy.

The research paper includes special methods of collection and analysis of information including grouping, summaries, correlation and regression analysis.

Different programs such as Microsoft Excel and Statistica have been used for correlation and regression analysis.

Entrepreneurs in Russia can use economic transactions with intangible assets with a target to decrease tax liabilities. This is described in the world practice (Kubick et al. 2017). For example, there are deals with objects of intellectual property between legal entities within one group of companies. Such deals hardly expect to be carried out between independent entities due to economic inadvisability.

Russian scientists indicate the definition “tax auditing” as the controlling process of tax legislation implementation and address violations (Orlov 2011). Tax auditing is effective tool for setting stable functioning of national system of taxation (Sheshukova and Orlov 2011). The use of risk-oriented approach for taxpayers in the plan of visiting tax auditing increases the efficiency of such tool.

Schemes of tax planning in operations with objects of intellectual property are realized also with the attraction of foreign companies. The aim of deals with such companies is mainly the transferring of financial resources in low tax jurisdictions with simultaneous decrease of tax liabilities in the residence country of a buyer (Neubig and Wunsch-Vincent 2018). A seller of such object of intellectual property is usually tax resident of a country, which has an agreement with the Russian Federation on the avoidance of double taxation, taking into account the absence of income tax at a source during royalty payment.

Cyprus is used often as such country due to the Agreement between the Government of the Russian Federation and the Government of Cyprus Republic from 05.12.1998 (edited 07.10.2010) «Double taxation treaties with respect to income taxes and capital», which states the taxation to both paid and received with the zero rate royalties. Moreover, Cyprus has Intellectual Property box regime or IP – box. IP – box regime enables 80% income from the sale of objects of intellectual property as opportunity costs for tax purposes. Such opportunity costs decrease an income after deduction of all direct costs. At the same time, investment costs for purchasing and developing an object of intellectual property are subject to depreciation during 5 years. In accordance with statements of BEPS Plan, this regime is operating since year 2016 only in case if a company bears the costs in the creation and development of such object of intellectual property. Meanwhile, companies, starting to use IP-box regime before June 2016, will be able to apply these rules up to June 2021. Such taxation regimes but with less preferential terms are used in the Netherlands, Luxemburg, Belgium and other countries.

The realization of BEPS Plan statements contributes to the considerable input in the suppression of illegal decrease of tax liabilities with the use of objects of intellectual properties, assuming an allocation of income from the usage or transfer of intangible assets between two or more interrelated parties taking into account costs for its development and improvement. Recommendations on the allocation of costs are consolidated to interrelated parties, financing and bearing financial risks, excluding risk premium for investment non-payment. This case can be explained by the lack of other functions, related to the creation of intangible assets. Therefore, the remuneration should include also functions to be performed and not only risks and acting assets. The legal law on intangible assets is not the basement for getting profit of all interrelated parties.

The problem of tax auditing for describing schemes of tax evasion is the identification of real value for an object of intellectual property. The consideration of market value for such intangible assets is a difficult task due to several objective reasons (Anesa et al. 2018).

The Russian practice is based firstly on the proof of unfounded deals with intangible assets from the economic point of view, made due to the tax planning. It is defined the use of such object of intellectual property in company’s activities. Imaginary deals are invalidated for taxation targets. Secondly, the conception of beneficial owner is used. Thus, statements of international agreements on double taxation treaties about reduced rates are applicable only in case, if the beneficiary of copyright revenues in the Russian Federation is the final beneficiary.

The increased demand in intangible assets is not defined by the desire to use special methods of tax planning. However, based on statistical data, most payments for objects of intellectual property are transferred from the Russian Federation to such countries as Cyprus and Ireland (Table 1). This is explained mostly by the agreement on double taxation treaties with these countries, which allow using the reduced tax rate for a source under royalty payment.

Table 1

Trends in the volume of payments for import of rights to use objects of

intellectual property in the Russian Federation (thousands US dollars)

Countries |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

Cyprus |

871 371 |

1 261 592 |

1 377 562 |

1 542 881 |

892 425 |

591 117 |

589 539 |

Ireland |

943 649 |

1 143 517 |

1 138 368 |

925 923 |

631 311 |

563 868 |

685 331 |

The Netherlands |

472 077 |

503 935 |

632 366 |

643 384 |

439 910 |

407 116 |

508 746 |

Germany |

446 673 |

797 512 |

810 294 |

808 171 |

528 055 |

420748 |

480 269 |

Japan |

22 071 |

29 929 |

55 142 |

49 169 |

40 542 |

26 396 |

33 457 |

China |

18 120 |

20 590 |

68 926 |

115 941 |

123 606 |

59 376 |

71 266 |

Source: External Sector Statistics, 2018; External Trade in Services of the Russian Federation, 2015.

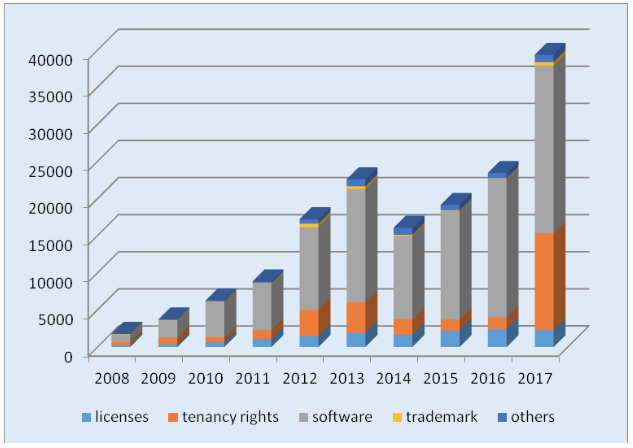

There is a need to consider the structure of intangible assets (Table 2) at the example of the Russian company as VAT payer due to the complex analysis and closer government control in the field of tax incentives by intangible assets.

Based on the data there is the difference in dynamics of intangible assets value depending on the industry. In general, it is related with the patterns of company activities. Companies in the trade sector is characterized by significant share of intangible assets due to the active cooperation with legal issues (including trademarks) and also active EDI processing with counterparties. This explains the price increase of software as one of a type of intangible assets. At the same time, this is obvious that the main reason of a decrease in years 2016-2017 is general negative economic situation in Russia during this period.

Below there is a structure of non-tangible assets at the example of a Russian company in the trade industry (Figure 1).

Figure 1

The structure of non-tangible assets in the Russian company 1, thousand US dollars

Source: Composed by the authors based on the financial reports of the company.

In practice, companies adjust the goodwill value as a part of unidentified intangible assets comparing the worth of using based on discounted cash flows. At the same time, the calculation of discount rates recommended by the Legislation of the Russian Federation can be optimized through a forecast of cash flows, which are confirmed by companies individually.

There is a need to consider intangible assets as one of factors directly influencing on the net profit of a company in order to define existing links between objects of this research.

Real retrospective data are used for the model construction defining some indicators of Russian companies-taxpayers.

Table 2

The structure of intangible assets at the example of a Russian

company as a taxpayer № 1 (trade industry) (thousand US dollars)

Year |

Value of intangible assets |

Growth rate, % |

Growth rate difference, % |

Company profit before taxes |

Growth rate, % |

Growth rate difference, % |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

2008 |

1776 |

х |

х |

259589 |

х |

х |

2009 |

3718 |

209,3 |

109,3 |

354700 |

136,6 |

36,6 |

2010 |

6283 |

169,0 |

69,0 |

448554 |

126,5 |

26,5 |

2011 |

8845 |

140,8 |

40,8 |

561134 |

125,1 |

25,1 |

2012 |

17223 |

194,7 |

94,7 |

1039238 |

185,2 |

85,2 |

2013 |

22619 |

131,3 |

31,3 |

1436637 |

138,2 |

38,2 |

2014 |

16079 |

71,1 |

-28,9 |

1614363 |

112,4 |

12,4 |

2015 |

19162 |

119,2 |

19,2 |

1167952 |

72,3 |

-27,7 |

2016 |

23470 |

122,5 |

22,5 |

1856517,0 |

159,0 |

59,0 |

2017 |

39374 |

167,8 |

67,8 |

2244901,0 |

120,9 |

20,9 |

Below results of correlated and regression analysis for such company have been presented (Figure 2).

Figure 2

Results of comparison between the value of non-tangible

assets and taxable profit in the company 1

In order to validate the hypothesis that changes in value of intangible assets in the company-taxpayer are matched by a systematic change in the profit of this company, the correlation should be defined. In this case the indicator is equal to 0.94367, and this shows close connection between considered values for the company in the trade industry. As this indicator is positive, there is a direct connection. This means that a change in the value of intangible assets in the company is influencing on the change in its net profit. The correctness of selected model can be confirmed by calculated indicator R2 = 0,8905. Additionally, the verification of statistical importance confirms the model importance. The calculation indicator is F=70,82 > F0,95 (1,8), and this shows the statistical reliability of this model for the analyzed company.

Based on the analytical data, coefficients of this model are defined а=57,189 и b=191627,08.

This analysis has verified hypothesis on the role of non-tangible assets in companies’ operations and its impact on the profit value.

Based on this research the development of approaches for identification of companies, using operations with intangible assets for illegal decrease of tax liabilities, is important due to taxation auditing. Additionally, the development of tax legislation and the improvement of risk-oriented approach in the plan of visiting tax auditing in operations with non-tangible assets for taxpayers will increase the value of such non-tangible assets.

Federal tax service of the Russian Federation (FTS Russia) implements risk-oriented model of control and auditing. The aim of its realization is the decrease in the number of visiting tax auditing and the increase in its efficiency. The international practice is following the same path (Radcliffe et al. 2018). The system of risk assessment is formulated in the Concept of visiting tax auditing, approved by the Order of FTS Russia from May, 30 2007 № ММ-3-06/333. This document consists of 12 criterion, which assist to identify risks, amount and areas of auditing activities. Visiting auditing activities are appointed based on risks, outlined by the systematic way. Indirect features of unjustified tax benefits are analyzed by following parameters: the tax burden in comparison with other companies in this sector of economy; the availability of losses during several taxation periods; the share of deduction in value added tax; growth rates of income and expenses; the level of average salary per one worker; the level of indexes providing the right to implement special tax regimes; the existence of business target when the contract is concluded with counterparties; notes of a taxpayer or its absence regarding mistakes identified; “migration” of a taxpayer between tax bodies; the level of profitability in comparison with profitability in this sector of economy based on statistics; doing business with high tax risk.

The research in profit shifting by transnational companies of US confirmed the hypothesis on the impact of tax rates and profit change of offshore subsidiaries. Results show that semi-elasticity of profits with respect to tax rates in highly non-linear (Dowd et al. 2017).

It seems reasonable to include in the Conception additional criteria to identify taxpayers with unjustified tax benefits due to deals with objects of intellectual property. This can be considered as an incentive to follow taxation law through avoidance of illegal schemes and as a result can contribute to additional tax revenues to the government budget (Jones et al. 2018).

Such approach can be used by tax administration of any country in the world.

The world community is concerned about the prevalence of tax base erosion and profits shitting from taxation in low tax jurisdictions. It is appropriate to bear in mind an efficiency for the implementation of a concept of beneficial owner under the royalty payment in the frame of national taxation laws. Statistical methods employed due to the analysis of interaction for different social and economic phenomena complement significantly existing tools against tax base erosion.

The government should use a balanced approach for the identification of such companies out of a risk group for more detailed analysis against illegal decrease of tax liabilities through fake deals with intangible assets. Data for the calculation of used indicators are in the report provided by taxpayers to fiscal bodies. This enlarges possibilities of risk-oriented approach implementation during tax auditing and increases its efficiency.

Calculations have verified the hypothesis on the role of non-tangible assets in the company and its impact on the profit value.

Results in the comparison of values between non-tangible assets and taxable profit in the company indicate the close correlation between these values. This means that an increase in the value of non-tangible assets is influencing on the change of net profit. Consequently, there are reasons to carry out the detailed analysis of operations with non-tangible assets by a taxpayer if there is the correlation between mentioned above indicators.

Existing methods of risk-oriented approach do not have indicators, which could help to outline possible disruptions in tax operations with objects of intellectual property, and this confirms the novelty of this research.

There are perspectives of new research issues in this field, which could influence on the tax auditing process of operations with non-tangible assets based on the correlation and other financial indicators of a taxpayer. This will help to indicate disruptions in most cases in many companies.

ANESA, M., GILLESPIE, N., SPEE, A., SADIQ, K. (2018). The legitimation of corporate tax minimization. Accounting, Organizations and Society. DOI: https://doi.org/10.1016/j.aos.2018.10.004.

BRUSHWOOD, J., JOHNSTON, D., LUSCH, S. The effect of tax audit outcomes on the reporting and valuation of unrecognized tax benefits. Advances in Accounting. Vol 42, year 2018, page 1–11. DOI: https://doi.org/10.1016/j.adiac.2018.06.001.

DOWD, T, LANDEFELD, P., MOORE, A. Profit shifting of U.S. multinationals. Journal of Public Economics. Vol 148, year 2017, page 1–13. DOI: https://doi.org/10.1016/j.jpubeco.2017.02.005.

External Sector Statistics. (2018). The Central Bank of the Russian Federation. Retrieved from: http://www.cbr.ru/eng/statistics/default.aspx?PrtId=svs.

External Trade in Services of the Russian Federation. (2015). Moscow: The Central Bank of the Russian Federation. Retrieved from: https://www.cbr.ru/statistics/credit_statistics/External_Trade_in_Services_2015.pdf.

JANSKÝ, P., and KOKEŠ, O. Corporate tax base erosion and profit shifting out of the Czech Republic. Post-Communist Economies. Vol. 27, year 2015, issue 4, page 537–546. DOI: 10.1080/14631377.2015.1084733.

JONES, Ch., TEMOURI, Y., COBHAM, A. Tax haven networks and the role of the Big 4 accountancy firms. Journal of World Business. Vol 53, year 2018, issue 2, page 177–193. DOI: https://doi.org/10.1016/j.jwb.2017.10.004.

KUBICK, T., LOCKHART, G., MILLS, L., ROBINSON, J. IRS and corporate taxpayer effects of geographic proximity. Journal of Accounting and Economics. Vol 63, year 2017, issue 2-3, page 428–453. DOI: https://doi.org/10.1016/j.jacceco.2016.09.005.

Law of Federal Tax Service of the Russian Federation. (2007). The concept of exit tax auditing. No. ММ-3-06/333.

LIPATOVA, I.V., and POLEZHAROVA, L.V. International tax planning methodology and best practices of Russian economy deoffshorization. Asian Social Science. Vol 11, year 2015, issue 19, page 316–328. DOI: 10.5539/ass.v11n19p316.

NEUBIG, T., and WUNSCH-Vincent, S. Tax distortions in cross-border flows of intangible assets. International Journal of Innovation Studies. Year 2018. DOI: https://doi.org/10.1016/j.ijis.2018.08.003.

Organisation for Economic Cooperation and Development. (2013). Action plan on base erosion and profit shifting. OECD Publishing. DOI: http://dx.doi.org/10.1787/9789264202719-en.

ORLOV, D. About tax auditing. Perm University Herald. Economy. Vol 4, year 2011, issue 11, page 6–17.

PINSKAYA, M.R., MALIS, N.I., MILOGOLOV, N.S. Rules of taxation of controlled foreign companies: A comparative study. Asian Social Science. Vol 11, year 2014, issue 3, page 274–281. DOI: 10.5539/ass.v11n3p274.

RADCLIFFE, V.S., SPENCE, C., STEIN, M., WILKINSON, B. Professional repositioning during times of institutional change: The case of tax practitioners and changing moral boundaries. Accounting, Organizations and Society. Vol 66, year 2018, page 45–59. DOI: 10.1016/j.aos.2017.12.001.

SHESHUKOVA, T., and ORLOV, D. The tax auditing as the independent area of auditing. Perm University Herald. Economy. Vol 1, year 2011, issue 8, page 62–70.

TAYLOR, G., RICHARDSON, G., LANIS, R. Multinationality, tax havens, intangible assets, and transfer pricing aggressiveness: An empirical analysis. Journal of International Accounting Research. Vol 14, year 2015, issue 1, page 25–57. DOI: 10.2308/jiar-51019.

1. Plekhanov Russian University of Economics, 36 Stremyanniy Lane, Moscow, 117997, Russia

2. Plekhanov Russian University of Economics, 36 Stremyanniy Lane, Moscow, 117997, Russia

3. Plekhanov Russian University of Economics, 36 Stremyanniy Lane, Moscow, 117997, Russia

4. Plekhanov Russian University of Economics, 36 Stremyanniy Lane, Moscow, 117997, Russia

5. Plekhanov Russian University of Economics, 36 Stremyanniy Lane, Moscow, 117997, Russia. Contact email: dennis.maksimov@yandex.ru