Vol. 40 (Number 6) Year 2019. Page 1

Yu.I. SOKOLOV 1; E.A. IVANOVA 2; L.O. ANIKEEVA-NAUMENKO 3; I.M. LAVROV 4

Received: 18/06/2018 • Approved: 25/11/2018 • Published 18/02/2019

ABSTRACT: In the context of active world markets expansion including actively emerging markets (such as Russia) the search for possible ways of integrated development of various industries becomes an issue of special state significance for the economy competitiveness improvement. This article focuses on finding ways to optimize travel business environment in Russia by improving passengers’ transportation service. |

RESUMEN: En el contexto de la expansión activa de los mercados mundiales, incluidos los mercados emergentes (como Rusia), la búsqueda de posibles formas de desarrollo integrado de varias industrias se convierte en un tema de especial importancia estatal para la mejora de la competitividad de la economía. Este artículo se enfoca en encontrar maneras de optimizar el entorno de negocios de viajes en Rusia mediante la mejora del servicio de transporte de pasajeros. |

Tourism services is the result of company or indi-vidual entrepreneur operations aimed at meeting tourist’s needs for the arrangement and implementa-tion of a tour or its separate parts. Tourism services should consult tourists’ interests, be life and health friendly for tourists and fully comply with GOST (All-Union State Standard) requirements.

Consumer behavior is a process of consumer de-mand generation for different goods taking into con-sideration consumers’ income and preferences.

Passenger railway transportation service is the combination of transportation services’ features which enable to meet passengers’ particular needs as intended. Thus, the concept of passenger transporta-tion service is inherently connected with consumer needs. The process of transportation service provi-sion should be fully based on consumer needs.

Since 2015 the emerging positive dynamics of inbound tourism in the Russian Federation has been replaced by a decline in the number of foreign tourist trips to this country due to the introduction and further toughening of economic sanctions. However, it hasn't led to drastic consequences (see Table 1). The number of incoming foreign tourists has decreased slightly below the level of 2012 and has been partly compensated by Russians’ refocus on domestic trips.

Table 1

Annual number of foreign tourists in the world’s

most visited countries, million people*

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

Tourism income in 2016, bln. US dollars |

France |

83.0 |

84.7 |

83.7 |

84.5 |

82.6 |

42.5 |

USA |

66.7 |

69.8 |

75.0 |

77.5 |

75.6 |

205.9 |

Spain |

57.8 |

60.7 |

64.9 |

68.5 |

75.6 |

60.3 |

P. R. China |

57.7 |

55.7 |

55.6 |

56.9 |

59.3 |

44.4 |

Italy |

47.7 |

46.4 |

48.6 |

50.7 |

52.4 |

40.2 |

Turkey |

35.7 |

37.8 |

39.8 |

39.5 |

25.3 |

- |

Germany |

30.4 |

31.5 |

33.0 |

35.0 |

35.6 |

37.4 |

Mexico |

- |

- |

29.3 |

32.1 |

35.0 |

- |

Great Britain |

29.3 |

31.2 |

32.6 |

34.4 |

35.8 |

39.6 |

Russia |

25.7 |

28.4 |

29.8 |

26.8 |

24.5 |

inbound – 8.5 (2015) total – 38 (2016) |

Thailand |

22.4 |

26.5 |

- |

29.9 |

32.6 |

49.9 |

According to the World Tourism Organization, in West European countries in general, as well as in Egypt, China and Canada the country’s share in the world’s total number of people annually traveling abroad is almost the same as the country’s share in the world’s total travel income. In such countries as the USA, Australia, Japan, India and Philippines the share in the world’s travel income exceeds the share of inbound tourists in the total number of incoming tourists. In Russia, Mexico, Malaysia, Tunisia and some other countries the share of inbound tourists exceeds the share in the world’s travel income. This difference is quite considerable in Russia, and there are a few reasons for this. On the one hand, it is explained by the specifics of drawing up statistical reports. An opportunity to view data regarding inbound foreigners grouped by the purpose of their visit appeared only about three years ago (see Table 2). Before that citizens arriving to work were also considered as tourists. On the other hand, it shows that Russia isn't attractive enough to tourists with the high level of income.

Table 2

The dynamics of trips to Russia grouped by purposes

(excluding former Soviet Union countries), thousand people*

Year |

2000 |

2005 |

2010 |

2011 |

2012 |

2013 |

2014 |

Total number of trips: |

7410 |

9398 |

8266 |

9194 |

10175 |

10869 |

10800 |

including those grouped by the following purposes: |

|

|

|

|

|

|

|

official trip |

1997 |

2591 |

3035 |

3753 |

4058 |

3516 |

3219 |

tourist trip |

2215 |

2251 |

2025 |

2228 |

2430 |

2506 |

2408 |

private trip |

2239 |

3516 |

2174 |

2121 |

2483 |

3582 |

3920 |

transit trip |

90 |

148 |

49 |

46 |

42 |

47 |

46 |

service personnel |

869 |

892 |

983 |

1046 |

1162 |

1218 |

1208 |

In 2015 China was the country with the greatest share of tourists who had visited Russia – 23.2% of expenses for international tourist trips in the world. The share of tourists from the USA amounted to 9.0%, from Germany – to 6.2%, from the UK – to 5.0%.

It has been defined that Moscow and St. Petersburg are the most popular cities among international visitors. Some other popular Russian cities are located not far from other countries: Vyborg (near Finland), Vladivostok (near South Korea and China), Kaliningrad (near Germany). Besides, tourists like to visit cities that form the famous Golden Ring of Russia.

Now the increasing number of foreign tourists consider Russia as an interesting tourist destination. International tourists positively estimate the quality of hotel infrastructure in big Russian cities. Nevertheless, some particular tourist directions still lack premium quality hotels (basically this is the case of Russian cities that are less popular for traveling).

According to Rosstat, 24.6 million international tourists visited Russia in 2016, which is 8.4% less, than in 2015. At the same time, according to Rostourism information, the total number of domestic trips in Russia increased by about 15% in 2016. Thus, we observe the growth of domestic tourism, the increase of attention to domestic cultural and recreational facilities. But in contrast to Russia where, according to the Ministry of Culture of the Russian Federation, the share of tourism industry income in the Russian GDP structure amounted to 3.4% in 2016, in many European countries that didn't have such a powerful raw materials base as Russia’s, but had a well developed manufacturing industry (Italy, France, Great Britain), a tourism share in GDP was around 8–12% or higher in different years.

It shows that there is a significant unused potential for travel business development in the Russian Federation aimed at the satisfaction of foreign and Russian citizens’ needs for rest, cultural and physical development.

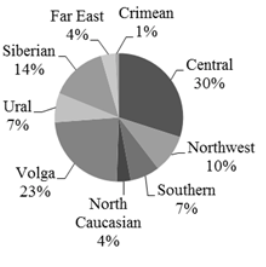

Possibilities for the development of cultural and sports tourism in the Russian Federation are predetermined by the presence of a considerable number of cultural and archaeological heritage objects in the country and also by numerous natural monuments which are officially protected at the federal and international levels. In Russia there are 26 objects which are included into the UNESCO World Heritage List. Among them are Lake Baikal, volcanoes and geysers of Kamchatka, Altai Mountains and other unique creations of the nature and people. Passenger transportation by federal districts in 2016 is shown in the Figure 1.

Figure 1

Passenger transportation by federal

districts in 2016, million people

Inbound tourism is quite promising and profitable business area. However, according to tourism industry experts, for successful growth of tourism in Russia there are still a number of restrictions to be completely eliminated (Ermakova, 2017):

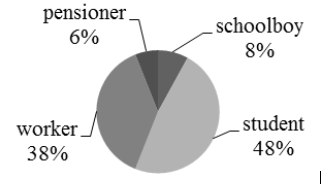

Considering from positions of studying consumer behavior, the transport market of tourist services represents a production and provision of services for individual (non-industrial) consumption. Let's look at the list of consumers at the passenger transportation market (the distribution of Moscow Region consumers by type of activity in 2016 is shown in the Figure 2.).

Figure 2

Structure of consumers by type of activity

An assessment of the quality of service, including passenger transportation service, can be made either on the basis of standard indicators and consumers claims control or on a research of consumers’ satisfaction level. In the latter case transport companies analyze passengers’ estimates or an assessment made by independent experts.

Service companies apply a number of methods to obtain necessary data about consumers’ reaction to service complex of the company and its perception (polls, focus groups) and various well-known techniques for the research of consumers’ satisfaction level: a method of critical cases (Flanagan, 1954), a SERQUAL method (Parasuraman, Zeithaml, Berry, 1985); a SERVPERF method (Cronin, Taylor, 1992); a Kano method (Kano, 1984) and others. The same methods can be used on passenger transport.

In Russia the assessment of transport availability for people is applied to determine the transportation service quality (Bugromenko, 1987). Scientists from the MIIT school have developed indicators for the assessment of transport work quality, and groups of passenger transportation service quality indicators. They have also created a technique for a complex assessment of passenger service quality on the basis of statistical data of passenger company (Galaburda, 2003). According to authors, the passengers’ satisfaction level, as well as the model of their consumer behavior, depends on a trip purpose.

1. Individual consumption. Consumers are the passengers who travel for personal purposes at their own expense. The selection of resort or vacation destination, hotel booking, excursions and other attributes of a trip are to be carried out by the consumer.

2. Organizational consumption. Consumers are the passengers who predominantly travel on business (business trips, trainings) at the expense of organizations that have sent them (Sokolov, Lavrov, 2015). The host company may organize an excursion, a sightseeing tour, a banquet at a restaurant, etc. for the arrived guest as a sign of encouragement or adherence to business ethics rules. Besides, the company may form tourist groups from its employees for visiting some resort or may ask order a group booking in a travel agency.

In market researches the consumer of tourist services is considered as a person who has his/her own aims and scale of values, but who is also influenced by cultural, social and political environment. The knowledge of various groups of buyers’ priorities allows travel transportation companies to develop new services (aimed at the satisfaction of these buyers’ needs) and an effective segmentation strategy.

A survey of 120 residents and guests of Moscow and the Moscow region was carried out to explore passenger transportation service requirements and its current satisfaction level. The most important transportation service criteria for travelling and business trips mentioned by respondents are shown in the Table 3.

Table 3

Important transportation service criteria for

passengers based on the purpose of their trip, %

|

Criterion |

|

|||||

Purpose of visit |

Safety |

Comfort |

Speed |

Price |

Additional services |

An opportunity to see more |

Total |

Travelling |

16 |

47 |

7 |

17 |

10 |

3 |

100 |

Business trip |

21 |

8 |

67 |

1 |

3 |

0 |

100 |

Hence, it follows that a tourist who travels to other countries or cities always wants to feel comfortable and relaxed during the trip. This results in a high demand for the indicator of comfort (47%). As for business trips, the travelling speed (67%) is the key factor for passengers. Besides, being on business trips, passengers pay more attention to safety.

The survey data helped to determine the reasons of passenger claims.

The main shortcomings noted by passengers on railway transport are: low speed (32% of respondents), high cost of service (32%), dissatisfaction with food (12%), unsatisfactory cleaning level (9%), etc.

As a result, when respondents use railway service, they are equally dissatisfied with both high cost of tickets, especially in compartment or lounge cars, and low train speed. The comfort level is generally high. There are some claims concerning cleanness in passenger cars and the meals served in a train and at the stations.

The Russian Railways are currently working on solving the problem of train speed increase. High-speed trains such as Sapsan, Lastochka and Strizh already operate on the territory of RF and meet the needs of travelers. A special attention is paid to the improvement of services provided at railway stations which will make traveling more safe and comfortable (Ivanova, 2016).

Each consumer has their unique final decision-making process of service acquisition which is influenced by a set of external and internal factors. Therefore, it is impossible to deduce the unified scheme of options assessment process, however, it is possible to formulate some basic principles helping to understand it.

1. Each consumer perceives the needed service as a certain set of attributes (characteristics). For example, the main attributes for an excursion are: originality, interesting route, attractions, transport convenience, safety, hospitality of travel agency staff. Various attributes are more or less relevant to different consumers as they meet consumers’ requirements.

2. Depending on buyers’ needs, each of these attributes (characteristics) can receive different attention from consumers.

3. As a rule a consumer develops their own view of enterprise rating based on the perception of each attribute (characteristic) that represents the company image. Consumer’s vision of company attributes may differ considerably from attributes themselves due to perception distortion of the apprehended information.

4. The consumer perceives each of attributes from the perspective of its functional advantage which can be identified by noticing general assessment changes that happen with the change of various attributes.

5. The consumers’ attitude towards various companies is established on the basis of certain assessment procedures. One or more assessment procedures are used based not only on a decision to buy a product, but also on the consumer’s character (Vaneeva, 2003).

As we can see, the major directions demanding a complex and joint work of business and tourist experts, companies working in transportation, construction and other industries, as well as federal and regional administrations are the development of transportation service, safety and communication in Russian regions. It is necessary to achieve the available tourism potential in Russia.

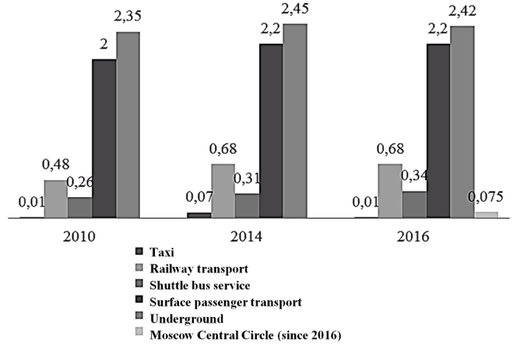

The number of tourists visiting the capital has increased by 40% over six years – from 12.8 million in 2010 to 17.5 million in 2016. Citizens of the Russian regions account for 74% of the total tourist inflow to Moscow. Foreigners account for 26%. The majority of tourists from far-abroad countries come from China, Germany, Turkey, Israel, France, Italy, USA, UK, and Spain. The tourism income plays a prominent role in the city’s economy, and this role is constantly increasing. While the share of the tourist consumption in the Moscow gross regional product (GRP) was about one per cent in 2010, in 2016 it increased fourfold – up to four per cent (457 billion rubles). This way tourism may be classified as one of the leading industries of Moscow economy. Distribution of Moscow passengers by a type of transport they use is shown in the Figure 3.

Figure 3

Volume of passenger transportation in Moscow, billion people

According to the poll held by VCIOM (Russian Public Opinion Research Center) in different regions of Russia, over 50% of respondents use commuter traffic at least once a week, the majority of them refuse using buses instead of commuter trains. So it follows that railway transportation is extremely important from the social point of view – for the period of nine months of 2017 755.9 million citizens have used the commuter traffic all over Russia, and the growth vs last year amounted to 10%. Central SPC JSC is ranked among 22 largest Russian commuter railway passenger carriers (see the results of a SWOT-analysis in the Table 4). Founded in 2006, CSPC now operates in 11 Russian regions. The share of the company in the commuter railway transportation all over Russia is 63.7%. The share of the company in the commuter traffic at Moscow Railway Terminal amounts to 91.4%.

Table 4

SWOT-analysis of CSPC JSC

Strengths |

Weaknesses |

1. High degree of transport safety and reliability in comparison with other means of transport in commuter traffic. 2. High carrying capacity. 3. The rolling stock renovation strategy. 4. Steady traffic frequency. 5. Independence from climatic conditions. |

1. Very low speed of rolling stock. 2. Dependence on railway infrastructure. 3. The unsatisfactory technical condition of some commuter trains. 4. Underdeveloped cleaning maintenance of the rolling stock condition. |

Opportunities |

Threats |

1. Enhancement of antiterrorist security at commuter stations and in the rolling stock. 2. Development of a set of activities aimed at building a positive image. 3. Improving the level of passenger satisfaction with the quality of provided services by updating the fleet of rolling stock, repairing stations, improving the ticketing system, etc. |

1. Imperfection of laws and regulations. 2. High level of competition with other means of transport. 3. Decrease in people’s paying capacity. 4. Dependence on state and regional support of the industry. |

In 2016, Central SPC JSC carried over 540 million passengers (in 2015 – 587.8 million). Within a nine- month period of 2017, trains of Central SPC JSC have transported 425.182 million passengers, which is 1 million passengers more than they carried during the same period in 2016. The commuter passenger traffic throughout the whole country is about 10 times more than that on the long distance lines. However, the survey of passengers in Moscow has identified the following issues related to commuter railway passenger carriages: the overall convenience of passenger trains leaves much to be desired and requires sufficient improvements while the schedule is considered to be one of the greatest advantages. Respondents report that the cleanness and timely arrival of trains are far from the standard. The places for baggage and the temperature inside the train are kept at the due level.

The level of services at the railway station is assessed as medium. Some respondents note that the overall positive impression of the trip may be spoiled by either a closed cash office, or an incompetent cashier.

As for the possible improvements of the service, the respondents are split into two groups. One group (over 40%) suggests replacing obsolete rolling stocks with new ones or, at least, performing their overhaul. The other group (38%) demands promotion of security while being on train, for example through the engagement of a police duty guard or security cameras. The remaining respondents note that WCs should be added, railcars should be kept cleaner, entrance ramps for handicapped people should be developed or carriage tariffs should be revised.

The study of the company positioning at the market has discovered that the majority of the respondents (80%) associate commuter passenger transportation with Russian Railways, and only 8.5% – with the Central Suburban Passenger Company (CSPC). And some respondents do not have any associations. The railway commuter passenger transportation is of great importance practically for all respondents. Over 60% of respondents can hardly imagine their life without it. According to the data received in the first part of the survey, the key users of electrical trains are students and office clerks travelling to their work or institute. Most frequently they travel early in the morning or in the evening, i.e. during rush hours. Closer attention should be paid to this category of passengers, as they are the main source of income for the company.

Over 60% of respondents believe that travelling by electrical trains is profitable for them. This is achieved thanks to special rate tickets or difference between the railway and bus transport tariffs.

In view of the problems identified, it is deemed expedient to pay special attention to the company market positioning.

Let’s analyze the international experience of using marketing instruments in the commuter passenger transportation by using the example of the National Railway Passenger Corporation, widely known as Amtrak, – a company performing passenger carriage operations all over the USA.

Amtrak started its operations in 1970. The operation line is 34 thousand km in length, and it covers 46 states including the capital and three federal constituent entities of Canada. The corporation owns 1,175 km of railways used for the passenger transportation, but while utilizing other lines, Amtrak pays exclusively for the use of infrastructure. The most loaded directions include New York, Washington, Boston and other cities, that is the North-East of the USA. The New York station has the most intensive traffic, it is daily used by over 10.4 million passengers, and its traffic can be compared only with that of Washington, Philadelphia and Chicago.

According to the company data, in 2016 its income amounted to over 3 billion US dollars, with expenses in the form of operating and capital expenditures making 4 billion US dollars. That’s why the government of the USA and some states where the company operates decided to provide subsidies to reduce company losses.

The subsidies from each state are allocated not directly to the Corporation, but to passenger carriages going through their territory. The government is considered to be the carriages buyer who may regulate tariffs.

Currently the company uses about 1,500 passenger cars, 440 locomotives and approximately 100 car carriers and baggage cars. Amtrak is considered to be a monopolist among railway companies that offer high speed transportation.

To expand their brand influence, the company decided to create a brand identification system, Journey Line, and completed a manual (entitled Brand Book) providing recommendations on brand management. This manual is available for partners and employees. And it provides them with a certain support and recommendations.

To engage its customers, the company has developed the first MasterBrand Amtrak campaign for the following 15 years. The assets include 15 commercials and a 30-second compilation for TV. The logo of the 500 Destinations. Endless Stories campaign is “Look where the train can get YOU”; the campaign was launched via the national two-week TV network, and was promoted on Facebook, YouTube, Twitter and other social media. This program became popular to such an extent that it practically turned into a separate structure. Millions of users shared their stories about railway transportation using special tags.

Using key mass media distributed all over the country via Endless Stories, the company builds “brand affinity” and promotes its values. A further analysis of clients’ responses to advertising demonstrates significant improvements in comparison with the situation that was before the implementation of that large-scale campaign.

The corporation is also actively involved in sports marketing. It finances such teams as Barclays Center, NY Mets, Verizon Center, Boston Red Sox, Boston Celtics, Chicago Cubs, Big Ten & NHL Winter Classic, Los Angeles Clippers, Minor League Baseball and Hockey, and others. Thanks to the support of various clubs, the number of clients among fans increased almost twice.

The Award Guest Rewards bonus program was introduced in 2015 but it was launched only in summer 2016. It was developed to accumulate bonus scores for travelling at various distances and at various prices. Currently its goal is to make the program more attractive to clients outside the North-Eastern region. Balancing methods of the scores accrual and repurchase will be the most significant improvement. Clients may spend their scores directly for payment of tickets without the need to call the call center.

Besides, a client loyalty system and travel privileges have been introduced. The loyalty program includes cards with different ranks – from the lowest (new client) to the maximum (VIP client). Accumulated scores can also be used here but they can be spent not on buying tickets but on receiving significant discounts for them. The higher is the rank, the more discounts and various bonuses are granted.

It makes sense to apply the above marketing instruments to CSPC JSC operations in order to increase consumer loyalty level, while simultaneous introduction of measures to promote the quality of transportation services for passengers (first of all to ensure comfortable and informative service) will enable the company to make its operations more efficient and drive development of the tourist business in the central region of Russia.

1. Bugromenko, V.N. 1987. Transport in territorial systems: Science, 1987. 112 p. Moscow.

2. Cronin, J.J., Taylor, S.A. 1992. Measuring Service Quality: A Reexamination and Extension. Journal of Marketing, Vol.56 (July 1992), 55-68.

3. Galaburda, V.G. 2003. Methods of transportation service assessment: Bulletin of transport information. №6, 2003.

4. Ermakova, S. 2017. Entrance tourism in the Russian Federation: concept, problems, prospects. In-formation site to FB.ru. June 14, 2017. URL: http://fb.ru/article/320693/vyezdnoy-turizm-v-rf-ponyatie-problemyi-perspektivyi

5. Flanagan, J.C. 1954. The Critical Incident Tech-nique. Psychological Bulletin. Vol.51, No.4, July, 1954. 33 p.

6. Ivanova, E.A. 2016. The quality of passenger service at the stations – the safety of the population in the country: Economy of the railroads. 2016, №8: 17-22. Moscow.

7. Kano, N., Nobuhiku, S., Fumio T., Shinichi T. 1984. Attractive quality and must-be quality: Jour-nal of the Japanese Society for Quality Control (in Japanese). 14 (2): 39-48. (April 1984).

8. Parasuraman, A., Zeithaml, V.A., Berry, L.L. 1985. A conceptual model of service quality and its implications for future research. Journal of Marketing, Vol. 49 No. 3, 1985, 41-50.

9. Sokolov, Yu.I., Lavrov, I.M. 2015. Features of consumer behavior studying at the market of rail transportation. ETAP: Economic Theory, Analysis, and Practice. 2015, №5: 104-110. Moscow.

10. Vaneeva, I.V. 2003. Behavior of the consumer at the market of tourist services. Culture of the peo-ple of Black Sea Coast: 12-18. Simferopol.

1. D.Sc. (Economics), Full Professor, Director of Institute of Economics and Finance, Russian University of Transport, Moscow, Russian Federation

2. Ph.D. (Engineering), Associate Professor of “Economics and Transport Management” Department, Russian University of Transport, Moscow, Russian Federation

3. Ph.D. (Economics), Associate Professor of “Economics and Transport Management” Department, Russian University of Transport, Moscow, Russian Federation

4. Ph.D. (Economics), Associate Professor of “Finance and Credit” Department, Russian University of Transport, Moscow, Russian Federation