Vol. 39 (Number 48) Year 2018. Page 34

Ibragim Agaevich RAMAZANOV 1; Svetlana Viktorovna PANASENKO 2; Tatyana Nikolaevna PARAMONOVA 3; Tatyana Ivanovna URYASEVA 4; Svetlana Afanasjevna KALUGINA 5

Recibido: 19/06/2018 • Aprobado: xx/08/2018 • Publicado 04/11/2018

ABSTRACT: So far, response of Russian consumers to price fluctuations in the context of consumption traditions and consumer expectations amid the globalization of markets has been little studied. The purpose of the study is to identify the relationship between fluctuations in prices of certain groups and types of commodities and Russian consumer sentiment in the context of consumption traditions and consumer expectations in the global market environment. The study is based on the use of the theory of time series and the systemic approach; the methods of scientific abstraction, analysis and synthesis, modeling and scientific generalization were applied. An approach has been developed to measure the response of Russian consumers to price fluctuations in the context of globalization of markets, consumption traditions and consumer expectations. |

RESUMEN: Hasta ahora, la respuesta de los consumidores rusos a las fluctuaciones de los precios en el contexto de las tradiciones de consumo y las expectativas de los consumidores en medio de la globalización de los mercados ha sido poco estudiada. El propósito del estudio es identificar la relación entre las fluctuaciones en los precios de ciertos grupos y tipos de productos y el sentimiento del consumidor ruso en el contexto de las tradiciones de consumo y las expectativas del consumidor en el entorno del mercado global. El estudio se basa en el uso de la teoría de series de tiempo y el enfoque sistémico; Se aplicaron los métodos de abstracción científica, análisis y síntesis, modelación y generalización científica. Se ha desarrollado un enfoque para medir la respuesta de los consumidores rusos a las fluctuaciones de los precios en el contexto de la globalización de los mercados, las tradiciones de consumo y las expectativas de los consumidores. |

The global market environment, coupled with modern information technology, becomes the determining factor in the shaping of consumer behavior, regardless of the national or regional area of consumer residence. Researchers distinguish various global processes that change the level and structure of consumption, attitude of consumers to the product, form new consumption traditions, consumer response to fluctuations in the commodity price, etc.

Transnational corporations strengthen their influence on the world economy (Adamanova and Biyazov, 2017, Adamenko and Belozerskaya, 2017, Goltzman and Gubert, 2015, Ermolaeva, 2012), erase the borders of national markets and determine the shape of the world economy. They change the socioeconomic situation and labor relations (Kubyshin and Soboleva, 2013, Popadynets, Shults and Barna, 2017), sectoral structure of the national and world economy (Muhammad et al., 2011; Savelieva and Tsalo, 2014). Besides, they promote the emergence of new approaches to the price policy of companies (Petinenko, 2007), increase in labor productivity (Kovalyov and Falchenko, 2015), development of global brands (Bartsch et al., 2016; Nitin Gupta, 2011; Surguladze, 2016).

Migration activity and growing mobility of the population contribute to the formation of a global consumer culture (GCC). Global information technologies turn information into a key resource of modern society (Nagirnaya, 2013), influencing human being (Dementiev, 2017) and the country's socioeconomic policy, creating challenges and enhancing international interaction (Smirnov, 2005), expanding the opportunities for interaction between brands, consumers, traders and other market participants in real time regardless of location (Potekhina, 2012). An information society is rapidly forming in the technologically developed countries, "... this has already become a reality in Japan, ... less developed countries, including Russia, are likely to follow it in the foreseeable future" (Belova, 2014).

The researchers prove the specifics of the rates of shaping the global consumer behavior in various countries. For example, the article "Globalization of Consumption Patterns: An Empirical Investigation" by Jagdish Sheth et al. uses the "lifestyle" as a measure of the globalization process for consumer behavior to reveal significant changes in the lifestyle of the population in some countries and slow changes without a significant impact on national and cultural features to form new consumption patterns in other countries (Abdolreza and Sheth, 2014).

When studying the consumer response to prices, many researchers confine themselves to finding the price demand elasticity (Andreyeva et al., 2010), prices are explored in the context of a healthy lifestyle and consumer confidence in the pricing policies of companies and the state (Somerville et al., 2015), as a factor of well-being and food security (Headey and Martin, 2016; Aftab et al., 2017), to manipulate customer behavior and boost sales efficiency (Deliens et al., 2016). As for the consumption patterns in Russia, it must be noted that the national traditions of consuming some products are very stable and therefore less exposed to global processes. In particular, it concerns the traditions of consuming buckwheat groats. On the contrary, some consumption traditions appeared to be less stable and changed under the influence of global factors. For example, globalization in Russia was accompanied by shaping a stable tradition of banana consumption, similar to their consumption pattern in other countries. The stability of tradition is reflected not only in the consumption pattern, but also in the structure of costs: the physical volumes of commodity consumption described by the stability of consumption traditions are constant, while the prices for them are volatile depending on the supply.

Modern European researchers draw attention to the importance of consumer awareness of prices, perception of their changes and the impact on their behavior. In particular, Gabriel (2015) has proved the need to take the buyer awareness of the price stored in long-term memory into account, as it has a significant impact on purchase behavior and purchase intentions, comparing their level with expectations.

The mechanism of price fluctuations, triggered by the influence of multiple global factors, is quite complicated and mainly studied in terms of influence of the well-known factors: inflation, level and structure of commodity supply, seasonality of supply and demand, fluctuations in foreign currencies, etc. However, fluctuations in demand and consumer response to price volatility due to changes in traditions and behavior of Russian consumers have been poorly studied at the current stage. As the authors’ research revealed, on the one hand, the rise or fall of prices that are consistent with the consumption traditions and consumer behavior are perceived as typical, objective and fair and, therefore, are not accompanied by pronounced emotional and sensory responses and changes in consumer sentiment. On the other hand, fluctuations in prices that are not consistent with these traditions and expectations aggravate them. Therefore, the pricing policy based on the adequacy of price fluctuations and specifics of the consumption traditions and consumer behavior in a country or a particular region that are changing under the influence of global factors will allow to avoid or minimize the occurrence of negative consumer responses and the formation of pessimism in the society in general. The authors explored the possibilities of managing emotionally sensual responses and preventing negative consequences associated with consumer perception of price fluctuations, based on taking the changes in the consumption for certain groups and types of goods and services into account. Particular attention is paid to the food products, whose consumers are significantly susceptible to prices.

Multiple studies on the price policy of companies in the context of quantitative characteristics of consumption relied on physiological consumption rates. However, the studies in recent years have shown that consumers are generally guided not by physiological rates, but rather by the established consumption traditions in the selection of commodities (mainly food) (Ramazanov, Paramonov, Uryasieva 2015). In Russia, consumption of potatoes, sugar and confectionery, meat and fish, eggs, vegetable oil and other products is much higher that physiological rates, while consumption of fresh fruits, milk and dairy products is much lower, on the contrary. It must be noted that these deviations vary considerably among different social groups and certain regions, which is due to national traditions and the living standards of the population, psychological perception of prices and other factors.

Based on the above, the following hypotheses have been suggested:

1. Traditions and behavior of consumers are changing unevenly under the influence of the global marketing environment in Russia.

2. The change in the emotional responses of consumers, revealed in the indices of consumer sentiment, is in direct or inverse correlation with the direction and level of fluctuations in prices for goods and services.

3. Price fluctuations consistent with the consumption traditions and consumer expectations do not cause negative emotional sensory responses in consumers and are perceived as typical and expected.

4. Some groups and types of goods and services have their own typical fluctuations in price indices due to consumption traditions and other relatively stable and recurring factors.

5. During periods of crisis, prices for most food products are more dynamic than prices for non-food products and services.

Various figures, indicators and methods of their measurement are offered to describe the market situation – in particular, Adenso-Díaz et al. (2016) offered methods for mathematical modeling of prices to prevent losses. However, their list is insufficient for studying the specifics of market development in the context of the globalization of the world economy, changes in consumption traditions and consumer perception of prices. Besides, the analysis of time series uses the actual values for a specific period as a benchmark in most methods: "relative to 2000 indicators", "relative to the corresponding month before the crisis 2008", etc. Doubts are raised whether such indicators are correct for assessing the specific socioeconomic processes, including when investigating emotional responses and consumer sentiment associated with price fluctuations. For example, the drop in the commodity price in relation to the previous period by some amount may not be accompanied by positive responses from consumers. The perception of the fairness of price fluctuations and the strength of emotional responses and consumer sentiment also depend on the consumer functions performed by the commodity: the higher the ability of the commodity to satisfy emotional sensory needs is, the lower the emotional responses associated with the increase in prices is; the more important the functional abilities of the commodity for the consumer are, and the stronger the negative emotional responses to the price increase are.

The authors used the method of correlation dependence between price indices and consumer sentiment indicators to find a relationship between price changes and consumer sentiment. Data on price indices and consumer sentiment were obtained from the databases of 88 regional statistical agencies, Rosstat and other public sources. Reliability of information on price indices is ensured by compliance with the requirements stipulated in the Rosstat's method [6]. Consumer sentiment was assessed on the basis of private indices of consumer expectations, the reliability of which was ensured by applying the standard Rosstat's method developed in accordance with international requirements [7].

Quarterly data of sample observation of consumer confidence and monthly monitoring of price indices for services, food and non-food products for the last decade (2008-2017) carried out by Rosstat were used to identify the relationship between consumer sentiment and price changes (Table 1). The value of the correlation index was calculated in Excel 2013.

Table 1

Consumer confidence indices (CCIs) and consumer price indices

for goods and services (CPIs), % of the previous period

Quarter |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

CCIs |

||||||||||

Q I |

0.4 |

-35 |

-10 |

-13 |

-5 |

-7 |

-11 |

-32 |

-30 |

-15 |

Q II |

-2 |

-32 |

-7 |

-9 |

-4 |

-6 |

-6 |

-23 |

-26 |

-14 |

Q III |

1 |

-25 |

-11 |

-7 |

-6 |

-7 |

-7 |

-24 |

-19 |

-11 |

Q IV |

-20 |

-20 |

-10 |

-7 |

-8 |

-11 |

-18 |

-26 |

-18 |

-11 |

CPIs for all goods and services |

||||||||||

Q I |

101.57 |

101.78 |

101.04 |

101.26 |

100.48 |

100.62 |

100.77 |

102.43 |

100.68 |

100.32 |

Q II |

101.25 |

100.62 |

100.39 |

100.38 |

100.57 |

100.53 |

100.81 |

100.33 |

100.40 |

100.44 |

Q III |

100.56 |

100.20 |

100.58 |

99.90 |

100.63 |

100.39 |

100.46 |

100.57 |

100.24 |

99.79 |

Q IV |

100.81 |

100.23 |

100.80 |

100.45 |

100.45 |

100.54 |

100.57 |

100.75 |

100.42 |

100.28 |

CPIs for non-food products |

||||||||||

Q I |

100.65 |

101.25 |

100.31 |

100.56 |

100.41 |

100.42 |

100.45 |

102.23 |

100.75 |

100.30 |

Q II |

100.80 |

100.81 |

100.32 |

100.57 |

100.34 |

100.27 |

100.49 |

100.58 |

100.49 |

100.14 |

Q III |

100.64 |

100.63 |

100.40 |

100.49 |

100.47 |

100.40 |

100.47 |

100.76 |

100.45 |

100.16 |

Q IV |

100.47 |

100.40 |

100.59 |

100.52 |

100.46 |

100.38 |

101.18 |

100.72 |

100.42 |

100.31 |

CPIs for food products |

||||||||||

Q I |

101.85 |

101.65 |

101.24 |

101.59 |

100.75 |

100.99 |

101.32 |

103.51 |

100.76 |

100.40 |

Q II |

101.78 |

100.62 |

100.51 |

100.05 |

100.80 |

100.72 |

101.14 |

99.98 |

100.30 |

100.74 |

Q III |

100.22 |

99.62 |

100.94 |

99.09 |

100.24 |

99.73 |

100.23 |

99.83 |

99.74 |

98.84 |

Q IV |

101.28 |

100.10 |

101.37 |

100.57 |

100.62 |

100.93 |

102.14 |

101.13 |

100.69 |

100.39 |

CPIs for paid services |

||||||||||

Q I |

102.46 |

102.77 |

101.77 |

101.72 |

100.20 |

100.38 |

100.45 |

101.10 |

100.48 |

100.26 |

Q II |

101.02 |

100.34 |

100.33 |

100.62 |

100.57 |

100.62 |

100.78 |

100.50 |

100.42 |

100.40 |

Q III |

100.96 |

100.43 |

100.29 |

100.29 |

101.42 |

101.35 |

100.78 |

101.43 |

100.69 |

100.69 |

Q IV |

100.54 |

100.19 |

100.22 |

100.18 |

100.18 |

100.23 |

101.32 |

100.24 |

100.02 |

100.08 |

The indicator of typical expectations of price changes was calculated as the average quarterly value of consumer expectations for the last 2 decades (Table 2), according to a survey of 5,000 respondents aged 16 and over that had been carried out by Rosstat quarterly since 1998 in 88 regions of the Russian Federation as a formalized personal interview.

Table 2

Expected change in prices, % of the

total number of respondents [8 ]

Year, quarter |

Total |

Of which, according to the response options |

|||||

will significantly decrease |

will slightly decrease |

will remain at the same level |

will slightly increase |

will significantly increase |

undecided |

||

1998 |

|

|

|

|

|

|

|

Q IV |

100 |

0.1 |

1.3 |

2.1 |

20.7 |

68.8 |

7 |

1999 |

|

|

|

|

|

|

|

Q I |

100 |

0.3 |

1.6 |

3.9 |

30.6 |

55.8 |

7.8 |

Q II |

100 |

0.3 |

0.8 |

4.7 |

34.1 |

50 |

10.1 |

Q III |

100 |

0.2 |

0.6 |

3.4 |

27.3 |

61.4 |

7.1 |

Q IV |

100 |

0.3 |

0.8 |

5.1 |

38.7 |

47.1 |

8 |

… |

… |

… |

… |

… |

… |

… |

… |

2008 |

|

|

|

|

|

|

|

Q I |

100 |

0.1 |

0.3 |

3 |

32.6 |

61.5 |

2.5 |

Q II |

100 |

0.2 |

0.2 |

1.3 |

29 |

66.7 |

2.6 |

Q III |

100 |

0 |

0.2 |

3.1 |

32.1 |

61.7 |

2.9 |

Q IV |

100 |

0.1 |

0.4 |

2.7 |

24.9 |

69.7 |

2.2 |

2009 |

|

|

|

|

|

|

|

Q I |

100 |

0.1 |

0.7 |

2.2 |

25.5 |

70.4 |

1.2 |

Q II |

100 |

0.1 |

1.4 |

5.1 |

35.2 |

56.5 |

1.7 |

Q III |

100 |

0.1 |

0.9 |

4.7 |

37.1 |

56.3 |

0.9 |

Q IV |

100 |

0.2 |

1.1 |

4.7 |

39.3 |

53.3 |

1.4 |

… |

… |

… |

… |

… |

… |

… |

… |

2013 |

|

|

|

|

|

|

|

Q I |

100 |

0.2 |

0.8 |

6 |

40.3 |

51.5 |

1.3 |

Q II |

100 |

0.1 |

0.9 |

8 |

46 |

44.1 |

0.9 |

Q III |

100 |

0.3 |

0.6 |

7 |

43.5 |

47.6 |

1.1 |

Q IV |

100 |

0.1 |

0.6 |

5.3 |

37.8 |

55.3 |

0.9 |

2014 |

|

|

|

|

|

|

|

Q I |

100 |

0.1 |

0.8 |

4.6 |

39.5 |

53.9 |

1.2 |

Q II |

100 |

0.2 |

1.1 |

6.7 |

42.6 |

48.4 |

1.1 |

Q III |

100 |

0 |

0.9 |

6.3 |

42.4 |

49.6 |

0.7 |

Q IV |

100 |

0.1 |

0.7 |

4.3 |

29.6 |

64.3 |

1 |

2015 |

|

|

|

|

|

|

|

Q I |

100 |

0.4 |

1.8 |

5.7 |

24.7 |

66.7 |

0.9 |

Q II |

100 |

0.3 |

3.7 |

11.3 |

37.8 |

45.4 |

1.5 |

Q III |

100 |

0.2 |

1.2 |

6.5 |

35.9 |

55.4 |

0.8 |

Q IV |

100 |

0 |

1.1 |

6 |

34 |

58.1 |

0.8 |

2016 |

|

|

|

|

|

|

|

Q I |

100 |

0.1 |

1.1 |

6.4 |

33.2 |

58.3 |

0.9 |

Q II |

100 |

0 |

0.8 |

7.9 |

39.8 |

50.1 |

1.4 |

Q III |

100 |

0.1 |

1.2 |

8.3 |

42.2 |

46.8 |

1.4 |

Q IV |

100 |

0.2 |

1.8 |

8.9 |

42.4 |

46.1 |

0.6 |

2017 |

|

|

|

|

|

|

|

Q I |

100 |

0.2 |

1.7 |

9.5 |

46.3 |

41.4 |

0.9 |

Q II |

100 |

0.2 |

1.9 |

11.7 |

46.6 |

38.1 |

1.5 |

Q III |

100 |

0.2 |

1.6 |

11.7 |

46.6 |

39 |

0.9 |

Q IV |

100 |

0.1 |

1.3 |

12.3 |

48.7 |

36.8 |

0.8 |

The resulting data (Table 3) indicate that more than 90% of Russian consumers on average always expect price increase in the future in Russia.

Table 3

Typical consumer expectations on price changes, % of the

total number of respondents (calculated by the authors)

Expectations |

Total |

Of which, according to the response options |

|||||

will significantly decrease |

will slightly decrease |

will remain at the same level |

will slightly increase |

will significantly increase |

undecided |

||

Typical expected change in prices |

100 |

0.14 |

0.76 |

5.60 |

38.96 |

51.50 |

3.06 |

The most positive expectations of price changes (Q IV, 2017) |

100 |

0.1 |

1.3 |

12.3 |

48.7 |

36.8 |

0.8 |

The most pessimistic expectations of price changes (Q I, 2009) |

100 |

0.1 |

0.7 |

2.2 |

25.5 |

70.4 |

1.2 |

The matrix price indices (Imp) can be calculated using the following formula (1).

The research of fluctuations in prices for goods and services in the context of emotional responses of consumers indicated an inverse correlation between price indices and individual consumer sentiment indices. As can be seen from Table 4, the rise in prices for goods and services is always accompanied by a drop in consumer sentiment. At the same time, it must be noted that the increase in prices for food products is accompanied by stronger negative (pessimistic) emotional responses than on non-food products and services.

Table 4

Correlation between price indices of goods and

services and consumer sentiment indicators

Goods and services |

Consumer sentiment indicators |

|||

Consumer confidence index |

Expected changes in personal financial situation in a year |

Favorable conditions for major purchases |

Index of current personal financial situation |

|

Food products |

-0.925 |

-0.927 |

-0.870 |

-0.799 |

Non-food products |

-0.864 |

-0.917 |

-0.754 |

-0.801 |

Services |

-0.835 |

-0.823 |

-0.792 |

-0.737 |

The study of responses to price changes (Table 5) indicated that 91% of Russian consumers had stable typical expectations of price changes at certain intervals. At the same time, a typical increase in prices was expected on average by more than 90% of the population.

Table 5

Typical consumer expectations of price changes, % of the

total number of respondents (calculated by the authors)

Expectations |

Total |

Of which, according to the response options |

|||||

will significantly decrease |

will slightly decrease |

will remain at the same level |

will slightly increase |

will significantly increase |

undecided |

||

Typical expected change in prices |

100 |

0.14 |

0.76 |

5.60 |

38.96 |

51.50 |

3.06 |

The most positive expectations of price changes (Q IV, 2017) |

100 |

0.1 |

1.3 |

12.3 |

48.7 |

36.8 |

0.8 |

The most pessimistic expectations of price changes (Q I, 2009) |

100 |

0.1 |

0.7 |

2.2 |

25.5 |

70.4 |

1.2 |

The resulting data indicate that more than 90% of Russian consumers on average always expect price increase in the future in Russia.

Measurement of price fluctuations and consumer responses to price changes has shown that there are typical but different fluctuations in price indices for certain classes of goods and services in Russia. Matrix price indices for food products and services (Table 6) are described by larger fluctuations than for non-food products. At the same time, the most significant price fluctuations for food products are observed at the end and the beginning of the year, and the lowest values of the indicator are observed in August. For services, the highest values of price fluctuations are observed at the end of the year and in the middle of the year. These fluctuations are not significant in other periods.

Table 6

Values of matrix indices for the main classes of goods and

services in the Russian Federation (calculated by the authors)

Month |

Food products |

Non-food products |

Services |

January |

101.9 |

100.8 |

102.5 |

February |

101.3 |

100.7 |

100.7 |

March |

101.1 |

100.7 |

100.3 |

April |

100.7 |

100.6 |

100.4 |

May |

100.8 |

100.5 |

100.6 |

June |

100.5 |

100.4 |

100.7 |

July |

100.0 |

100.4 |

101.6 |

August |

99.4 |

100.5 |

100.6 |

September |

100.2 |

100.7 |

100.3 |

October |

100.7 |

100.6 |

100.0 |

November |

100.9 |

100.5 |

100.3 |

December |

101.1 |

100.5 |

100.7 |

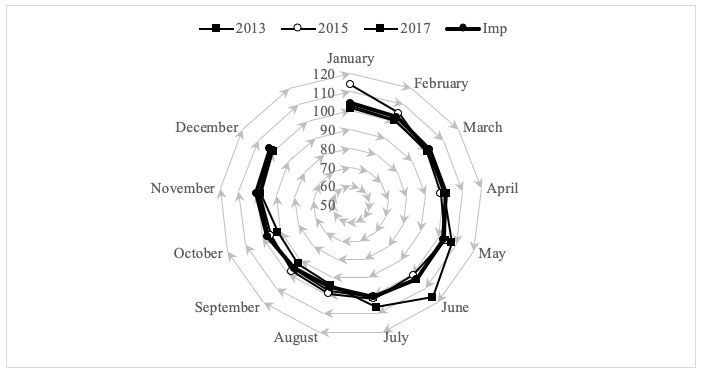

Results of the research (Figure 1) show that the configuration of the actual price indices differs significantly from the configuration of the matrix (typical, expected) fluctuations in prices for food products during the crisis (2014), when the political, macroeconomic and some other factors of the global consumption environment were described by high agility in comparison with the corresponding indicators in the pre-crisis (2013) and after-crisis (2017) periods, when the main factors of the consumption environment were described by relative stability.

Figure 1

Configuration of deviations of the actual price fluctuations from matrix price

fluctuations for food products in stable and crisis periods, % (built by the authors)

The change in prices for certain types of commodities is not accompanied by an adequate emotional sensual response from consumers. Therefore, it is advisable to develop appropriate price fluctuation matrixes by kinds, varieties and other characteristics, the configurations of which significantly differ. Studies have revealed that the configurations of typical fluctuations in the price indices for oranges and apples have a more stable agility than buckwheat groats and sugar (Figure 2).

The research in price fluctuations in the context of coverage of needs by internal or external sources indicated smoothing of seasonal fluctuations but strengthening of the global marketing environment factors’ influence. In particular, the analysis of the configuration of price fluctuations in matrix and actual price indices for apples (Figure 5) indicated the similarity of the price fluctuations in 2013 and 2017 (periods of relative stability of the global marketing environment) and matrix configurations compared to 2015 (aggravated changes in the global marketing environment).

Figure 2

Configurations of fluctuations in matrix price indices for

certain types of food products (built by the authors)

The research into the configurations of price fluctuations in matrix and actual price indices for buckwheat groats indicated more complex configuration (Figure 3), regardless of the state of the global marketing environment.

Figure 3

Configuration of fluctuations in matrix and actual price

indices for buckwheat groats (built by the authors)

A comparative analysis of the configuration of fluctuations in the matrix and actual price indices for potatoes in the context of stable or unstable internal and global environment indicated their relative equivalence (Figure 4).

Figure 4

Configuration of fluctuations in the consumer price index for potatoes

during crisis and stable periods under study (built by the authors)

-----

Figure 5

Configuration of fluctuations in the consumer price index for

apples in stable and crisis periods (built by the authors)

Analysis of the results of correlation between emotional responses and fluctuations in price indices (Table 4) allows to conclude that price fluctuations that are consistent with consumption traditions and consumer expectations are perceived as typical and are not accompanied by pronounced emotional responses and changes in consumer sentiment. This conclusion is also confirmed by the results of the survey of consumer responses to price changes (Table 5), which prove that 91% of Russian consumers have stable expectations of price changes. At the same time, typical increase in prices is expected by more than 90% of the population on average, which are not accompanied by significant changes in sentiment. In general, this situation is characteristic of periods of stable development of not just the national economy, but also the global environment. A significant excess of the actual price indices from the level of their traditional expectations and typical fluctuations is observed during periods of unstable development of the national economy and the global environment (Figure 1), accompanied by a drop in consumer sentiment and emotional responses, which also become additional factors of price growth. This situation could be observed during the crisis that began in late 2014 and early 2015: the emotional responses of buyers, heated by speculative actions of some market participants, boosted demand and prices rise not only for buckwheat groats, sugar, canned products and other socially important commodities, but also for cars, electronics, etc. After decline in excitement in 2017, the actual fluctuations in price indices for many commodities returned to the level of matrix values that were consistent with the typical expectations of buyers.

At the same time, it must be noted that the values of indices of typical price fluctuations (matrix indices), which do not exceed the limits of values determined by consumption traditions and other regular factors, are not accompanied by significant fluctuations in consumer sentiment and an increase in the intensity of emotional sensual responses of consumers. These responses are strengthened when the actual price indices deviate from the values of the indices of typical fluctuations, which necessitates an investigation of causes and consequences of such deviations. Such deviations may be significant, depending on the nature of the factors of the global marketing environment in terms of the enterprise operation and consumption in any given period.

In particular, the results of the research indicated that the configuration of fluctuations in the actual price indices for buckwheat groats in 2011 had significantly differed from the configuration of fluctuations in matrix price indices. This situation can be explained not only by the lack of coverage of the market needs by internal resources (according to Rosstat, gross yield of buckwheat was the lowest in recent years and amounted to only 339 thous. tons) and the stability of the buckwheat consumption traditions in Russia, but also by the lack of a reliable external source of supply.

According to the authors, significant deviation in the configuration of fluctuations in the actual price indices for buckwheat groats in 2014 was not only due to the lack of domestic resources (according to Rosstat, gross yield of buckwheat amounted to 662 thous. tons, which corresponded to the needs), but also due to subjective factors: deteriorated consumer sentiment, political situation in the country and the world, etc. However, the speculative collusion of some major market players who rule this market was the most significant factor. The Russian market of buckwheat is quite concentrated by territories. The lack of competition from the global market allows some producers to speculate in forecasts for a drop in yields, etc. The speculative nature of prices for buckwheat in late 2014 was also evidenced by the fact that fluctuations in the actual price indices merged with the matrix fluctuations in price indices against the drop in speculative activity of market players and the extent of consumer excitement (Figure 3).

As a rule, the configuration of fluctuations in the actual price indices approaches the configuration of fluctuations in the matrix price indices for buckwheat in periods with a stable yield of buckwheat, a lack of speculative activity of domestic market players, etc., regardless of the situation in the global environment. For example, the configuration of fluctuations in the actual price indices basically coincides with the configuration of fluctuations in matrix price indices in 2017. This confirms the fact that the demand for buckwheat was fully met by domestic resources: according to IKAR (Institute for Agricultural Market Studies: http://www.ikar.ru/lenta/628.html), the total buckwheat yield in 2017 covered the needs of the domestic market and amounted to 1,520 thous. tons. Probably, due to the achievements and prospects for the sustainable production of buckwheat, fluctuations in prices in the domestic consumer market for buckwheat groats will be as close to the values of matrix fluctuations in price indices as possible. Consequently, buckwheat groats will cease to be a source of pessimistic consumer sentiment, as it was in 2014.

It has been found that the matrix and actual price indices for certain types of food products, consumption of which is covered by domestic resources and has reliable external sources, are described by more stable configurations in price fluctuations close to their matrix values. For example, consumption of potatoes is secured by 97% from domestic sources, by a large number of producers from various regions of Russia and reliable suppliers in the global market space, which hinders the speculative activity of market players and contributes to the smoothing of seasonal supply fluctuations. Besides, it has complex and relatively stable configuration of fluctuations in price indices close to the configuration of matrix fluctuations in indices, which can be influenced by some factors of the global environment (exchange rate, foreign policy factors, etc.). The results of the research also confirm this conclusion. In particular, the configuration of fluctuations in potato price indices is consistent with the configuration of fluctuations in matrix price indices not only in the stable (2013) or post-crisis (2017) period, but also during the economic crisis (2014) (Figure 4). Besides, the lack of domestic resources due to a low yield of potatoes in Russia or due to other reasons is easily compensated by the sources of supply of this product from the global market space.

The ability of external sources to compensate for the lack of domestic resources, currency fluctuations and changes in the global political environment significantly influences the price fluctuations in most fresh fruits and vegetables, which are described by a lack of domestic resources. Availability of a large number of external producers in the context of globalization of markets facilitates the smoothing of seasonal fluctuations in supply and, as a consequence, a drop in the dependence of demand on this factor. The most typical example is the Russian apple market. The chart shows that the configuration of fluctuations in the actual price indices in the context of a stable foreign policy situation and the natural course of intraeconomic processes (in particular, in the pre-crisis 2013) fully coincides with the configuration of the fluctuations in matrix indices; these deviations became significant in the period of the political crisis aggravation (an embargo on the import of apples from the EU was introduced in early 2015) and during the period of a sharp drop in the ruble exchange rate (the ruble rate fell against the dollar and euro rates in mid-2017), and when the situation stabilized, they returned to the matrix values (Figure 5).

In conclusion, it can be noted that the globalization of markets is accompanied by certain changes in consumption traditions and consumer behavior of the Russians, smoothing of seasonal fluctuations in supply and demand, and shaping of stable and predictable configurations of fluctuations in the price indices for many types of commodities during periods of the natural course of economic processes.

Besides, it is established that consumers perceive the expected fluctuations in prices as typical, inevitable, without pronounced emotional responses and changes in sentiment. Fluctuations in the prices for commodities that are associated with consumption traditions not consistent with the configuration of fluctuations in matrix price indices are accompanied by an increase in emotional responses, a drop in consumer sentiment, etc.

Significant deviation in the configuration of fluctuations in the actual price indices from their matrix values is typical for certain types of commodities during crisis periods. At the same time, it has been established that the configuration of fluctuations in the actual price indices for commodities secured not only by internal resources but also by external suppliers from various regions is accompanied by smaller deviations from their matrix values in the context of globalization.

Vice versa, the configuration of fluctuations in the actual price indices for commodities secured by domestic resources is accompanied by an intensification of price index fluctuations and change in consumer sentiment. Prediction and warning of such a situation is not always possible. The reasons are that analysts and consumers use different criteria for assessing the situation. As a rule, analysts compare the efficient prices to the actual price values in the reference period (to the corresponding period of the previous year, previous month, etc.). Conclusions about the agility of prices are drawn and the prospects for their formation are predicted based on the obtained results. Consumers compare the price level with some conventional value, which is subjective in nature and is formed over a long period on the basis of personal experience of price monitoring. For consumers, fair fluctuations in price indices are the ones that are consistent with the configuration of fluctuations in the matrix price indices, match their expectations, and shape their sentiment.

The suggested scientific approaches allow to highlight strategic groups of commodities, the prices for which should be efficiently regulated by market mechanisms, combined with preventive measures of the state, in order to avoid manifestation of emotional responses from consumers, undesirable for society, at any given time.

The authors express their deep gratitude to their colleagues Elena Alexandrovna Mayorova and Alexander Fedorovich Nikishin for their support in the article preparation for publication.

Adamanova, Z. O., Biyazov, E. A. (2017). Finansovyye strategii transnatsionalnykh korporatsiy v usloviyakh globalizatsi [Financial strategies of transnational corporations in the context of globalization]. Proceedings of the Crimea Engineering Pedagogical University, 2(56), 12-17.

Adamenko, E. A., Belozerskaya, A. V. (2017). Rol transnatsionalnykh korporatsiy v protsesse globalizatsii mirovoy ekonomiki [Role of transnational corporations in the process of globalization of the world economy]. Economics of sustainable development, 1(29), 13-19.

Adenso-Díaz, B., Lozano, S., Palacio, A. ( 2016, December 1). Effects of dynamic pricing of perishable products on revenue and waste. Applied Mathematical Modelling. Vol. 45, 148-164.

Aftab, S., Yaseen, M. R., Anwar, S. (2017). Impact of rising food prices on consumer welfare in the most populous countries of South Asia. International Journal of Social Economics. Vol. 44, 8, 1062-1077.

Andreyeva, T., Long, M. W. , Brownell, K. D. (2010, February 1). The impact of food prices on consumption: A systematic review of research on the price elasticity of demand for food. American Journal of Public Health. Vol. 100, 2, 216-222.

Bartsch, F., Diamantopoulos, A., Paparoidamis, N. G., Chumpitaz, R. (2016, September 1). Global brand ownership: The mediating roles of consumer attitudes and brand identification. Journal of Business Research. Vol. 69, 9, 3629-3635.

Belova, L. G. (2014). Kontseptsiya "vezdesushchego obshchestva" i gosudarstvennyye programmy formirovaniya informatsionnogo i postinformatsionnogo obshchestva v Yaponii [Concept of "ubiquitous society" and state programs for the shaping of information and post-information society in Japan]. Bulletin of Moscow University. Series 6: Economics, 5, 43-60.

Deliens, T., Deforche, B., Annemans, L., De Bourdeaudhuij, I., Clarys P. (2016, November). Effectiveness of Pricing Strategies on French Fries and Fruit Purchases among University Students: Results from an On-Campus Restaurant Experiment. PLOS ONE. Vol. 11, 11. doi: 10.1371/journal.pone.0165298.

Dementiev, S. A. (2017). Stanovleniye globalnogo informatsionnogo mira: globalnyye transformatsii v bytii cheloveka [Establishment of the global information world: global transformations in human being]. Society and law, 2(60), 280-284.

Ermolaeva, M. G. (2012). Globalnyye tovarnyye rynki, globalnyye denezhnyye i kapitalnyye potoki: osnovnyye tendentsii i perspektivy [Global commodity markets, global monetary and capital flows: key trends and prospects]. Financial market, 33(513), 44-47.

Eshghi A., Sheth, J. (2014). Globalization of Consumption Patterns: An Empirical Investigation. Global Perspectives in Marketing, 133-148.

Fedulova, I. Yu., Shevtsova, N. M. (2015). Tendentsii i rezultaty investirovaniya v innovatsionnuyu deyatelnost [Trends and results of investing in innovative activities]. Strategy for sustainable development of Russian regions, 27, 70-74.

Gabriel, A. (2015, September 25). Price perception and long-term price knowledge of buyers of ornamental plants in Germany. Acta Horticulturae. Vol. 1099, 307-316.

Goltzman, I. A., Gubert, K. D. (2015). Vliyaniye transnatsionalnykh korporatsiy na mirovuyu ekonomiku [Impact of transnational corporations on the world economy]. Relevant problems of the humanities and natural sciences, 3, 57-61.

Gupta, N. (2011). Globalization does lead to change in consumer behavior: An empirical evidence of impact of globalization on changing materialistic values in Indian consumers and its aftereffects. Asia Pacific Journal of Marketing and Logistics. Vol. 23, 3, 251-269. Retrieved from https://doi.org/10.1108/13555851111143204.

Headey, D.D., Martin, W.J. (2016, October 5). The impact of food prices on poverty and food security. Annual Review of Resource Economics. Vol. 8, 1, 329-351.

Kostina, A. V. (2016). Obshchestvo potrebleniya i tsennosti rossiyskoy tsivilizatsii [Consumer society and values of the Russian civilization]. Knowledge. Understanding. Ability, 4, 45-55.

Kovalyov, V. I., Falchenko, O. D. (2015). Vliyaniye transnatsionalnykh korporatsiy na pishchevuyu promyshlennost Rossii [Impact of transnational corporations on the food industry of Russia]. Supervised, 4(56), 49-53.

Kubyshin, E., Soboleva, I. V. (2013) Vliyaniye globalizatsii na razvitiye sotsialno-trudovykh otnosheniy: rol transnatsionalnykh korporatsiy [Impact of globalization on the development of social labor relations: role of transnational corporations]. Bulletin of the Institute of Economics of the Russian Academy of Sciences, 4, 39-59.

Muhammad, A. Ch., Muhammad, A. F., Muhammad, K. B. D., Iqra, A. (2011, December). Globalization and its Impacts on the World Economic Development. International Journal of Business and Social Science. Vol. 2, 23, 291-297.

Muzichenko, A. V., Nazarova, N. S., Strizhova, I. A. (2014). Obshchestvo potrebleniya v epokhu globalizatsii: sotsialno-politicheskiye aspekty [Consumer society in the era of globalization: sociopolitical aspects] [monograph]. Odessa: Publishing House, 196.

Nagirnaya, A. V. (2013). Osobennosti globalnoy ekspansii informatsionno-kommunikatsionnykh tekhnologiy [Specifics of the global expansion of information and communication technologies]. PFUR Bulletin, 2, 87-98.

Petinenko, I. A. (2007). Osobennosti tsenoobrazovaniya v usloviyakh globalizatsii [Specifics of pricing in the context of globalization]. Bulletin of the Tomsk State University, 2, 174-176.

Popadynets, N., Shults, S., Barna, M. (2017, December 5). Differences in consumer buying behavior in consumer markets of the EU member states and Ukraine. Economic Annals XXI. Vol. 166, 7-8, 26-30.

Potekhina, I. P. (2012). Razvitiye Informatsionno-kommunikatsionnykh tekhnologiy v usloviyakh globalizatsii [Development of information and communication technologies in the context of globalization]. Bulletin of the Saratov State Socio-Economic University, 2 (41), 36-40.

Ramazanov, I. A., Paramonova, T.N., Uryasyeva, T. I. (2015). Vliyaniye marketingovoy sredy na traditsii potrebleniya rossiyan [Impact of the marketing environment on the consumption traditions of the Russians]. Practical marketing, 11 (225), 21-26.

Savelyeva, I. P., Tsalo, I. M. (2014). Vliyaniye konyunktury mirovykh rynkov na razvitiye vnutrennikh protsessov RF na natsionalnom i regionalnom urovne [Impact of the world market situation on the development of internal processes of the Russian Federation at the national and regional level]. SUSU Bulletin, Vol. 8, 2, 41-46.

Smirnov, A. I. (2005). Informatsionnaya globalizatsiya i Rossiya: vyzovy i vozmozhnosti [Information globalization and Russia: challenges and opportunities]. Moscow: Publishing house "Parade", 392.

Somerville, C., Marteau, T.M., Kinmonth, A.L., Cohn, S. (2015). Public attitudes towards pricing policies to change health-related behaviors: AUK focus group study. European Journal of Public Health. Vol. 25, 6, 1058-1064.

Surguladze, V. Sh. (2016). Marketingovyye instrumenty na sluzhbe transnatsionalnykh korporatsiy: globalnyy brending kak element “myagkoy sily” [Marketing tools used by transnational corporations: global branding as an element of "soft power"]. Humanities. Bulletin of the Financial University, 1(21), 37-44.

1. Plekhanov Russian University of Economics, 36 Stremyanny Lane, Moscow, 117997, Russia. E-mail: iaramazanov@mail.ru

2. Plekhanov Russian University of Economics, 36 Stremyanny Lane, Moscow, 117997, Russia

3. Russian State University for the Humanities, 6 Miusskaya sq., GSP-3, Moscow, 125993, Russia

4. Plekhanov Russian University of Economics, 36 Stremyanny Lane, Moscow, 117997, Russia

5. Plekhanov Russian University of Economics, 36 Stremyanny Lane, Moscow, 117997, Russia

6. Official statistical method of arranging statistical survey of consumer prices for goods and services and calculating consumer price indices (access mode: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/tariffs/#)

7. Method of survey of consumer expectations among the population (access mode: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/population/level/#