Vol. 39 (Number 39) Year 2018 • Page 29

Elvira I. BAKHTIGOZINA 1; Elena EFREMOVA 2; Elena A. SHEVEREVA 3; Anna A. KURASHOVA 4; Ekaterina I. NALBATOVA 5

Received: 04/04/2018 • Approved: 15/05/2018

2. Directions of control and methods for determination of fraudulent actions

3. Approaches to the organization of internal control system

ABSTRACT: Economic fraud is defined as a crime based on deceit and committed in order to obtain economic benefits. It’s called corporate fraud in international practice. According to the auditing standards, actions with the aim of extracting illegal benefits, which have led to material misstatements in the accounting statements, are considered unfair. Herewith, the accounting can be distorted both because of its unfair composition and as a result of assignment of assets. Fraud can occur in various forms: both internal fraud, caused by fraudulent operations of personnel, and external one, connected with illegitimate operations between organizations, individuals and legal entities, who are unemployed. Economic crimes in various forms can be caused by external circumstances of different nature (blackmail, threats, financial problems, including from competitors); with desire to realize an additional profit. Higher risks of fraud are associated with insufficient aimed at preventing and detecting fraud; a wide range of powers given to one employee; lack of an evaluation system for staff performance; impunity, disregard of the rules of professional ethics; lack of organizational culture; access to confidential information by unauthorized employees, who aren’t related to it; high risks of misrepresentation or insufficiency of information; lack of a double control system; incompetence and insufficient qualification of the personnel; lack of inventory, internal control and external one. |

RESUMEN: El fraude económico se define como un delito basado en el engaño y se comete para obtener beneficios económicos. Se llama fraude corporativo en la práctica internacional. De acuerdo con los estándares de auditoría, las acciones con el objetivo de extraer beneficios ilegales, que han llevado a errores significativos en los estados contables, se consideran injustas. Con esto, la contabilidad puede distorsionarse tanto por su composición desleal como por la cesión de activos. El fraude puede ocurrir de varias formas: tanto el fraude interno, causado por operaciones fraudulentas de personal, como el externo, relacionado con operaciones ilegítimas entre organizaciones, individuos y entidades legales, que están desempleados. Los crímenes económicos en diversas formas pueden ser causados por circunstancias externas de diferente naturaleza (chantaje, amenazas, problemas financieros, incluso por parte de la competencia); con ganas de obtener un beneficio adicional. Los mayores riesgos de fraude se asocian con insuficientes para prevenir y detectar fraudes; una amplia gama de poderes otorgados a un empleado; falta de un sistema de evaluación para el desempeño del personal; impunidad, desprecio de las reglas de la ética profesional; falta de cultura organizacional; acceso a información confidencial por parte de empleados no autorizados, que no están relacionados con ella; altos riesgos de tergiversación o insuficiencia de información; falta de un sistema de doble control; incompetencia y calificación insuficiente del personal; falta de inventario, control interno y externo. |

The relevance of fraud in accounting for the company of all industries is associated with cost reduction in the control system, business expansion in new regions and growing instability in the economy because of the financial crisis, subsequent political decisions and economic sanctions. This leads to an increase in financial risks for all enterprises.

Fraud is illegal actions with the purpose of personal enrichment. Therefore, the receipt of information, related to direction of the control activity, must be aimed at preventing fraud within the company, discovery of reasons and liquidation of fraudulent actions at the stage that still hasn’t escalated into implementation.

Table 1 presents possible directions of control and key indicators that confirm fraudulent actions in the internal control system, using an example of the trading and industrial company (Kazakova and Yefremova, 2015).

Table 1

Recommended directions of the audit of key indicators

of fraudulent actions in the internal control system

No. |

Direction of control |

Indicators of problem areas requiring control monitoring |

Control and analytical procedures |

1. |

Accounting system |

- High debtor and credit indebtedness. - Additions in payment documents. - Overdue postings and double payments. |

- Analysis of dynamics, composition and quality of debtor and credit indebtedness. - Arithmetical verification and logical control of information with the help of standard means of control that ensure the legality of operations, their documentary confirmation, completeness of accounting recognition. |

2. |

Human factor |

- Additions and reclassification. - “Rollbacks” and price manipulations. - Regular overhaul of equipment. |

- Periodic comparison and inventory of actual assets with amounts reflected in business accounting. - Distribution of responsibilities for authorizing operations, their accounting and maintaining security of the relevant assets in order to reduce the risks of information hiding and fraud. |

3. |

Financial features |

- Unreasonable reduction of gross profit. - Increase of stores with a decrease of storage costs. |

- Authorized access to assets and records (use of electronic access codes, numbering of documents, required signatures on documents on retirement or movement of assets). |

4. |

Rationing arrangements |

- Shortages or surplus of products. - Excess of normalized losses and excessive ones. - Excess of losses during manufacture of products. |

- Periodic comparison and inventory of actual assets with amounts reflected in business accounting.

|

5. |

Indirect features |

- Large transactions at the end of the reporting period. - Lack of internal audit. - Turnover of the staff composition of the top management structure. |

- Distribution of powers and responsibilities, as well as accountability of subjects of internal control. - Participation of the board of directors in the personnel policy, in the estimation of the knowledge, experience, honesty and ethical qualities of people, who create and evaluate the internal control system, the degree of independence from management, and involvement in the internal control process. |

In addition to the features of internal fraudulent activities that are intentional in nature, presented in Table 1, for example, in trade and industrial companies, also in the process of identifying and assessing risks, special attention should be paid to the following questions:

- analysis and evaluation of various types of fraud (falsification of reporting, loss of assets, corruption due to various types of fraud and occupational violations);

- assessment of motivation and pressure;

- assessment of the possibility for committing illegal actions (the possibility of unauthorized acquisition, use or disposition of assets, changes in reporting materials and other illegal actions).

When identifying fraud risks, it is advisable to test the internal control system, and also to calculate and to evaluate the relevant financial indicators.

Testing the internal control system can be called the first step in the process of assessing and identifying fraud risks. Significant deficiencies identified during the testing will signal the ineffectiveness of the internal control system in terms of fraud risks.

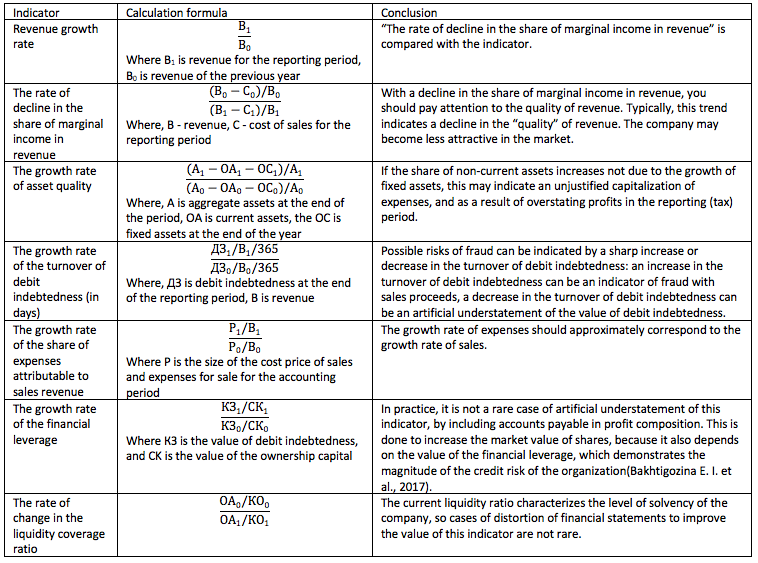

You should calculate the financial indicators, developed by Professor Messod Benish, for more accurately assessment of fraud risks, identification of distorted articles in the financial accounting. In international practice, such a system of indicators is called the “Card of normative deviations of financial indicators” (Table 2).

Table 2

Card of normative deviations of financial indicators

To apply the card of normative deviations, it’s necessary to have reports from the company for several periods (at least two years), as well as reports of comparable companies operating in the same industry.

Regardless of the volume of activities, different organizations should consider ways to prevent and to fight against fraud in advance. They also include:

- construction of an internal and external control system as a whole;

- systematic audit of the financial accounting of the organization;

- development and implementation of internal policies of the organization, including a code of corporate ethics and much more.

Let us consider approaches to the organization of internal control system of illegal actions and financial violations of the company (financial security).

Firstly, functioning of the internal control system of financial security should be based on the principles of complexity, timeliness, continuity, legality and accounting of the industry specialization of business. The principle of complexity involves ensuring the safety of personnel, properties (assets) of the company, information bases and confidentiality of information from all types of threats in accessible ways. This is achieved by personnel selection policy, the use of technical security facilities and information security facilities, deployed information and analysis activities aimed at preventing potential risks of financial security of the company. The principles of timeliness and continuity assume the existence of a system of constant control, prevention of present and future state of the company, which is ensured by constant analysis and forecasting of security threats to the company, as well as development of effective protection measures.

Secondly, functioning of the financial security system must be carried out in accordance with the legislative base of the Russian Federation in the field of entrepreneurial activity, informatization and information protection, private security activities and other regulatory acts on security (Federal law of 25/12/2008 No. 273-FL “On countering corruption”). The specialists, who are the most prepared for a particular type of activity and have sufficient experience of practical work, must be involved in developing and implementing measures to protect the company’s interests, in order to take into account the industry specialization of the business.

Thirdly, financial security is an indicator of well-being of the company, because it reflects the effectiveness of financial management within the company, how stably the organization may be developed in conditions of high microrisks and macrorisks, that’s why the methodology for controlling illegal actions and financial violations (financial security of the company) includes a set of procedures: identification of financial security risks and, accordingly, determination of directions of verification, analysis and assessment of financial and economic indicators and their comparison with the criteria, formation of a retrospective information base for subsequent analysis and control of financial security.

External threats to the company are caused by geopolitical relations connected with relations between states, for example, imposition of sanctions on certain products and, accordingly, restriction of the activities; instability of local currency; monetary defaults and acceleration of inflation; changes in the legal framework; growth of interest rates on credits; unfair competition and fraud; high level of economic crime. Internal threats to business are caused by unfair work of the personnel, low level of its qualification and quality of work; corporate fraud; inadequate control by management; an outdated technical base, equipment malfunctions; low level of liquidity of assets; leakage of information, fall of reputation of the company, ineffective policy of the company and unjustified management decisions (Kozyrev and Maslikov, 2016).

In order to ensure the financial security of the company, it’s necessary to build an internal control system with the responsibility centres, for which it’s required to identify the directions, subjects of control, the system of financial and economic parameters and criteria for assessing financial security risks, as well as the principles of financial security, in accordance with specifics of the business.

The objects of control of illegal actions and financial violations of the company may be: assets (property); information; personnel; reputation of the company.

The centres of control of financial security of the company may be internal subsystems of management (personnel department, top management, Internal Control Service, Internal Audit Service), as well as external ones, independent auditors, as well as counterparty representatives, tax authorities, international organizations, etc. In order to reduce the risks of financial security for dedicated audit centers, there used the following recommendations:

1. raising of qualification of accounting, financial and economic personnel;

2. availability of experience and high professional managerial competencies of senior managers;

3. constant monitoring, analysis and assessment of the level of financial security of the company, continuous and mandatory legal support;

4. increase of effectiveness of the internal control system (double control, increased attention to untypical operations, availability of internal audit, performance of annual initiative audits)

5. compliance with strict cash, tax and payment discipline;

6. control of distributive, marketing, personnel activity and efficiency of personnel management;

7. improving security of the security of internal information systems.

Financial security of the company is determined by the level of maintaining stability of the state and financial capability of the company, adequacy of funds for conducting operating, financial and investment activities, balance of cash flows, sufficient independence from counterparties and business partners.

Thus, in order to control the level of financial security, it’s necessary to comply with specified requirements, this is measurability of financial security parameters (availability of qualitative and quantitative indicators) and availability of threshold values, which can be used to judge the degree of financial security of business.

In addition, control of financial security of the company should ensure the development of its complex potential, rise in value, financial capability in the long-term and short-term. Express analysis based on accounting data can also be used in the areas of control of financial security. This will allow us not only to determine the position of the organization, but also to access the effectiveness of management to ensure its financial capability.

Bakhtigozina, E. I., Ustinova, N. D., Stulov, G. A. (2017). Assessment of fraud risks in financial accounting. Economics and Enterprise, 5-2 (82-2), 595-598.

International standards of audit (put into effect in the territory of the Russian Federation by Order of the Ministry of Finance of Russia of 24.10.2016 No. 192n). Available at: https://minjust.consultant.ru/documents/21357

Kazakova, N. A., Efremova, E. I. (2015). The concept of internal control of effectiveness of the organization. Monography. Series “Scientific thought” / edited by N. A. Kazakova. Moscow: INFRA-M, 2015.

Kozyrev, M.S., Maslikov, V.A. (2016). The use of correlation analysis for the study of some crimes committed in Moscow. Criminology Journal of Baikal National University of Economics and Law, 10(1): 28-39.

Federal law of 25/12/2008 No. 273-FL «On countering corruption» (as amended and supplemented), Methodical recommendations on development and adoption of measures to prevent and to counteract corruption by organizations (approved by the Ministry of Labour and Social Security of the RF on November 8, 2013), Federal law of 28/12/2010 No. 390-FL «On security». Available at: http://base.garant.ru/12164203/

Federal law of 02/02/2011 No. 402-FL (as amended on 04.11.2014) “On accounting”. Available at: http://pravo.gov.ru/proxy/ips/?docbody=&nd=102152685

1. Plekhanov Russian University of Economics, Moscow, Russian Federation. E-mail: elvira.bi@list.ru

2. Plekhanov Russian University of Economics, Moscow, Russian Federation. E-mail: es-audit@mail.ru

3. Moscow Technological University, Moscow, Russian Federation. E-mail: shevereva.ea@gmail.com

4. Moscow Technological University, Moscow, Russian Federation. E-mail: an4ka89@mail.ru

5. Moscow Technological University, Moscow, Russian Federation. E-mail: nalbatovaei@yandex.ru