Vol. 39 (Number 32) Year 2018 • Page 11

Victor KOVALEV 1; Oksana FALCHENKO 2; Irina SAVELYEVA 3; Alexander SEMIN 4

Received: 03/03/2018 • Approved: 15/04/2018

ABSTRACT: The paper analyzes the integration processes within the Eurasian Economic Union (EEU or EAEU), and special attention is paid to the study transport logistics customs effects arising when it is an expansion of the customs territory and transferring all "places of importation" and checkpoints across the customs border of the EEU from the internal borders of the EEU countries to their common external customs border. It is noted that integration within the framework of the EEU leads to the emergence of trade effects, implemented at macro and micro levels. The article substantiates the customs effect of transport logistics and quantifies the impact of these effects on the efficiency of agricultural deliveries from China to Russia through the transit territory of Kazakhstan, which together with the territory of Russia forms a single customs territory of the EEU. |

RESUMEN: El documento analiza los procesos de integración dentro de la Unión Económica Euroasiática (EEE o EAEU) y presta especial atención al estudio de los efectos aduaneros de logística de transporte que surgen cuando se trata de una expansión del territorio aduanero y la transferencia de todos los "lugares de importación" y puntos de control el borde aduanero de la EEE desde las fronteras internas de los países de la EEE hasta su frontera aduanera común exterior. Se observa que la integración en el marco de la EEE conduce a la aparición de efectos comerciales, implementados a nivel macro y micro. El artículo corrobora el efecto aduanero de la logística del transporte y cuantifica el impacto de estos efectos en la eficiencia de las entregas agrícolas de China a Rusia a través del territorio de tránsito de Kazajistán, que junto con el territorio de Rusia forma un único territorio aduanero de la EEE. |

In recent decades, international economic integration has become an integral part of the economic and political transformation of most countries, as well as the subject of close attention and research of economists. The variety of forms of integration processes, effects and contradictions of integration stimulate scientific discussions and define conceptual discrepancies concerning the essence of this phenomenon.

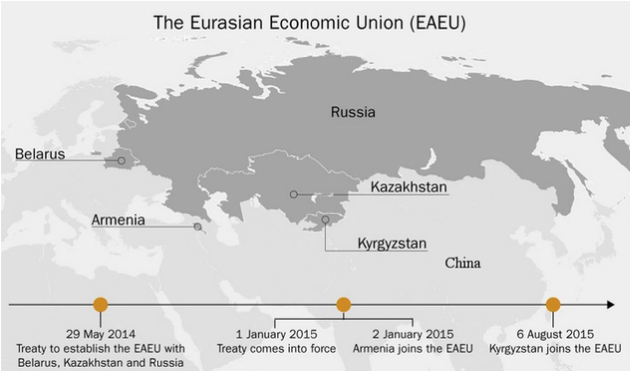

In the modern world economy, the attention of researchers is attracted by the regional trade agreement - the Eurasian Economic Union (EEU), which has been operating since January 1, 2015. Formation of the EEU begins in 1993, since the creation of the CIS free trade zone. Considering the development stages of the EEU in terms of the concept of Bela Balassa, it should be noted that for 25 years the project has gone through four stages of development, demonstrating high rates of implementation of integration processes: 1) free trade zone (1993-2010), 2) customs union (2010-2011), 3) a single economic space (2012-2014), 4) an economic union (2015 - present time). Currently, the EEU unites five states - Russia, Belarus, Kazakhstan, Armenia and Kyrgyzstan - with a total population of 182.5 million people.

The formation of a single customs territory within the framework of the Eurasian economic integration, now allows us to take a fresh look at the methodology for assessing the effectiveness of logistics solutions. It should be especially emphasized that when analyzing the efficiency of the transport component in the implementation of foreign trade transactions, very often the participants in foreign economic activity do not pay sufficient attention to assessing the impact of this component on the calculation of customs payments. This circumstance, in turn, has a negative impact on a comprehensive understanding of the efficiency of the foreign trade transaction and can lead to additional economic losses in choosing the mode of transportation within the framework of foreign trade cooperation.

The purpose of this article is to consider integration effects, identify, substantiate and quantify the customs effects of transport logistics in the context of implementing integration processes within the framework of the EEU.

Sustainability and success of any integration agreement determine, above all, the positive economic effects that each participant of integration receives. Following the studies of Bela Balassa (1961), describing international economic integration as the process of applying government regulation to avoid discrimination in markets, and the state of affairs where discrimination between national economies is completely absent, there appeared a lot of works devoted to the study of various effects of this phenomenon.

Two types of trade effects of international economic integration are described in detail in the literature: static effects and dynamic effects. Static effects, according to Viner (1950), are realized, firstly, in the creation of new trade flows (trade creation effect), which implies an increase in the volume of mutual trade of countries as a result of the removal of trade restrictions; secondly, static effects are manifested in the deviation of trade flows (trade diversion effect), which involves the redirection of trade flows to the products of the member countries of the integration association (Jošić and Jošić, 2013). According to Bhambri (1962), S. Linder (1966), Sakamoto (1969), the effect of trade diversion effect can have tangible positive consequences for developing countries due to switching to more efficient domestic suppliers. The predominance of the trade creation effect within the framework of the EEU says in his research, S.V. Shkyotov (2016).

The concept of dynamic effects developed by Bela Balassa is of the greatest interest for the study of the integration effects of the EEU. So, in the paper of M. Golovnin, A. Zakharov, D. Ushkalova (2016), the conclusion is made about the increasing role of dynamic effects and it is proved that for developing countries and emerging markets positive integration effects may be even more pronounced than for developed countries.

The dynamic integration effects described by Bela Balassa are the subject of numerous scientific studies. Effects on economies of scale, according to Corden (1972), are due to the fact that mass production within the regional integration association reduces the average cost of producing a unit of production, and the increase in the size of the market allows firms to receive the corresponding effect from an increase in the scale of production.

Effects on terms of trade: According to Rueda-Junquera (2006), economic integration schemes as an instrument for a more competitive insertion into the global economy and international trade. Terms of trade of member countries may improve because they can now have greater bargaining power.

Effects on competition. The increase in competition among enterprises forces the economic subjects to be more efficient in order to gain a new market share. As noted Meade (1955), an economic integration agreement may be welfare increasing if the partner countries are actually competitive but potentially complementary. The increase in the number of enterprises that each producer is considering as their competitors, and the opening of borders between countries, contributes to the weakening of monopolistic and oligopolistic market structures in individual countries (Taranova, 2015).

Effects on investment and capital formation. These effects, described in terms of the creation and rejection of investment flows, have been studied in detail by Baldwin et al. (1995), Dunning and Robson (1988), Dee and Gali (2003). So, for example, the effect of creating investment flows, arising when the production is transferred to a country that is part of an integration grouping, where the costs are lower due to the removal of barriers to the movement of capital, is shown in the works of I.V. Andronova (2016) by the example of the transferring of Russian businesses to Kazakhstan.

Knobel's (2015) typology of integration effects for emerging markets suggests the highlighting creative effects and redistributive effects. The creative effects are due to the removal of trade barriers and constraints, which helps to make more efficient use of resources and increase the competitiveness of countries (Gruber, 2000; Egger and Larch, 2008; Pahre, 2008; Fugazza and Robert-Nicoud, 2010; Baldwin and Jaimovich, 2012; Kovalev, Falchenko, Vyazovskaya and Maydanik, 2017). Redistributive effects are often caused by non-economic reasons and involve the involvement of new members through the partial transfer of their resources to partners under the integration agreement (Baier and Bergstrand, 2004; Kovalev, Falchenko, Vyazovskaya and Maydanik, 2017). Exploring the specifics of the EEU, Knobel (2015) notes the dominance of redistributive effects over creative effects. It should be emphasized that the dominance of redistributive effects over creative effects in the EEU enhances the problem of the inequality of member countries in terms of the benefits derived from integration, especially in the light of anti-Russian sanctions.

The study of integration effects mainly affects the macroeconomic level. Meanwhile, it is of great interest to identify integration effects at the microeconomic level. In modern studies, there is practically no analysis of the implementation of integration effects within the framework of the EEU at the micro level. Nevertheless, the manifestation and interrelation of transport-logistical and customs effects, which influence the economic efficiency of the firm, is of scientific interest.

Substantiation of the customs effect of transport logistics in the context of economic integration: the case of the EEU

In the most cases of foreign trade transactions, the customs value of imported goods shall be the transaction value, that is the price actually paid or payable for the goods when sold for export to the country of importation adjusted in accordance with the provisions of Article 8 in WTO Customs Valuation Agreement (Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade 1994).

In framing its legislation, each Member shall provide for the inclusion in or the exclusion from the customs value, in whole or in part, of the following:

(a) the cost of transport of the imported goods to the port or place of importation;

(b) loading, unloading and handling charges associated with the transport of the imported goods to the port or place of importation; and

(c) the cost of insurance.

For the purposes and tasks of this article, the term "place of importation" is of great interest. This term is used both in the WTO Customs Valuation Agreement and in the common customs code of the Eurasian Economic Union, which extends to the five states forming this economic union (Russia, Kazakhstan, Belarus, Armenia, Kyrgyzstan).

The customs territories of individual countries that decided to participate in the formation of the EEU in 2014-2015 can be seen in Figure 1.

These are five states and today their customs territories constitute a single customs territory (dark gray background in Figure 1), which means the following:

– there are no customs borders between these countries, except for Armenia, which has no common borders with the rest of the union (between Armenia and Russia is Georgia, which does not participate in the EEU) and this is a unique case in world practice, since customs and economic unions are never countries that have no common borders;

– there is a single external customs border of the EEU, passing along the external borders of countries participating in Eurasian economic integration;

– all "place of importation" and checkpoints across the customs border of the EEU were moved from internal borders of the EEU countries to their common external customs border.

Figure1

Unified customs territory of the Eurasian Economic Union

Thus, now, for example, there is no customs border between Russia and Kazakhstan and similarly between Kazakhstan and Kyrgyzstan, but there is a common customs border of the EEU with China, passing along the external customs borders of Russia, Kazakhstan and Kyrgyzstan.

Transferring all "places of importation" and checkpoints across the customs border of the EEU from the internal borders of the EEU countries to their common external customs border allows us to take a new look at the following reservations specified in the second paragraph of Article 8 in Agreement on the implementation of Article VII of the General Agreement on Tariffs and Trade 1994:

(a) the cost of transport of the imported goods to the port or place of importation;

(b) loading, unloading and handling charges associated with the transport of the imported goods to the port or place of importation; and

(c) the cost of insurance.

One can cite a specific example related to the possible supply of goods from China to Russia through transit territory – the Republic of Kazakhstan. If prior to the formation of a single customs territory within the framework of the EEU, the costs specified in subparagraphs a, b and c of the second paragraph of Article 8 of the Agreement on Tariffs and Trade 1994, incurred in the territory of Kazakhstan, were to be included in the customs value goods imported by Russia from China. This circumstance, in turn, increased the taxable base - the customs value, with which it is necessary to pay customs duties in Russia - customs duty, excise tax, VAT, customs clearance fee. Now this is not necessary, since the territory of Kazakhstan is part of the unified customs territory of the EEU and "place of importation" is moved from the Kazakh-Russian border to the Kazakh-Chinese border, if transportation of goods from China to Russia is planned through Kazakhstan.

Moreover, if the costs specified in subparagraphs a, b (other than c) of the second clause of Article 8 of the Agreement on Tariffs and Trade 1994 incurred in the territory of Kazakhstan were included in the invoiced (contract) price (or value) by virtue of INCOTERMS – these costs can be excluded from the calculation of customs value, which leads to a reduction in the tax base, a reduction in customs payments and allows to justify the appearance of the customs effect of transport logistics in the conditions of the Eurasian economic integration.

The customs effect of the transport logistics of the micro-level is the result of the influence of the customs policy of the state in the conditions of economic integration on the adoption of the optimal managerial decisions of the firm when delivering goods within the framework of foreign trade operations.

The presence of this customs effect of micro-level transport logistics allows Russian companies to make full use of the transit potential of the Republic of Kazakhstan by reviewing possible transport schemes for the delivery of goods from China to Russia.

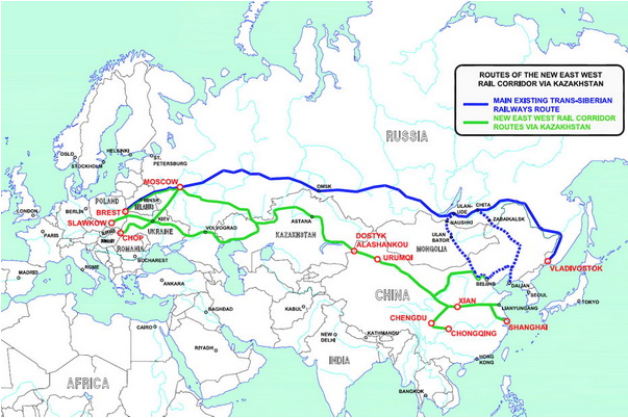

If the main existing Trans-Siberian Railways Route was more in demand before the advent of the EEU, now the companies are getting an interesting and profitable scheme for delivering goods from China to Russia via the new East-West Rail Corridor Route via Kazakhstan (this is the railway route with "place of importation" in Alashankou – a railway station on the border of China and Kazakhstan) and especially the Western Europe-Western China international transport corridor (road route with "place of importation" in Khorgos - customs checkpoint at the border of China and Kazakhstan) - Figures 2 and 3.

Figure 2

New East-West Rail Corridor Route via Kazakhstan

-----

Figure 3

The Western Europe-Western China international transport corridor

In the context of the Eurasian economic integration, an assessment of the effectiveness of a logistics solution must take into account the impact of the customs effect considered in this article on the overall efficiency of a foreign trade transaction. Criteria for the efficiency of the logistics solution - the factor "time" (the delivery time of the goods) and "transportation costs" (the cost of delivery of the goods) should be supplemented by the factor "customs costs". The consideration of this criterion in a number of cases makes it possible to reveal, at first glance, the paradoxical dependence - the choice of higher "transportation costs", the choice of a more expensive transportation method can ensure the maximum efficiency the foreign trade transaction as a whole.

On the example of imports of agricultural products from China to Russia, this dependence was demonstrated and a quantitative analysis of the customs effect of transport logistics at the micro level in the context of the Eurasian economic integration is presented.

The aim of our paper is to assess the customs effects of transport logistics at the micro level. As an example, we consider the following foreign trade transaction, related to the supply of garlic from China to Russia.

We should note that the import requirements of the Russian Federation in the supply of garlic are quite large. In Russia, more than 95% of garlic is imported, more than 85% of all garlic supplied to the Russian Federation are Chinese products (Table 1). Garlic in Russia also comes from Iran and Egypt in relatively large amounts. Table 1 presents the dynamics of garlic import in the Russian Federation.

Table 1

Dynamics of garlic imports to the Russian Federation in 2014-2016

Indicator |

2014 |

2015 |

2016 |

Import of garlic to the Russian Federation, thousand USD |

|||

Import of garlic from all countries |

66,239 |

71,033 |

79,087 |

Including imports from China |

58,076 |

63,950 |

70,480 |

China's share in the supply of garlic in Russia,% |

87.68 |

90.03 |

89.12 |

Import of garlic to the Russian Federation, tons. |

|||

Import of garlic from all countries |

52,149 |

52,555 |

51,161 |

Including imports from China |

46,485 |

47,554 |

44,857 |

China's share in the supply of garlic in Russia,% |

89.14 |

90.48 |

87.68 |

Source: compiled and calculated by data ITC Trade Map. Retrieved from: https://www.trademap.org/

Thus, China is the largest supplier of this product to the Russian Federation. On the conditional example of the garlic supply from China to the Russian Federation, we made an attempt to assess the micro-level customs effects for Russian importing enterprises.

A foreign trade contract was concluded between the Russian and Chinese firms for the garlic supply to the Russian Federation at the price of 1,728 USD per ton. The volume of the batch is 18 tons. According to the code of the commodity nomenclature of external economic activity of the EEU 0703200000 (garlic), an ad valorem rate of the customs duty of 10% is provided. In accordance with Decision No. 8 of 13.01.2017 of the Council of The Eurasian Economic Commission "On the list of goods originating in developing countries or from least developed countries for which tariff preferences are granted to the customs territory of the EEU" this product falls into the list of goods for which, tariff preferences are granted if product is originated from developing, least developed countries and CIS countries. Preferences are granted subject to all the necessary conditions: the availability of a certificate of origin, direct delivery of goods, etc. According to the Tax Code of the Russian Federation (Part No. 2) and Government Decree No. 908 of 31.12.2004 (Lists of food and children's goods subject to 10% VAT), the value-added tax rate for imports is 10%. The country of origin of the imported goods is China, which is documented. China is included in the list of countries (as amended by the Decision of the Collegium of the Eurasian Economic Commission of 16.05.2012 No. 46).

Various variants of terms of delivery and transportation of garlic from China to Moscow (Russia) are considered.

Option No. 1. When delivering goods by road, the following route is considered: Jinxiang (China) - Urumchi (China) - Khorgos ("place of importation" - a customs checkpoint at the border of China and Kazakhstan) - Almaty (Kazakhstan) - Moscow (Russia). At the same time, transportation costs for the delivery of goods by road from Urumqi to Khorgos will amount to 5,700 USD. From Khorgos to Moscow, cargo is delivered by road. The cost of transporting the lot on the Khorgos-Moscow section is estimated at 3,000 USD. The cost of transporting the goods can be confirmed by the buyer documentarily in the course of customs clearance. When delivering goods by road with China, the delivery condition of CIP-Moscow (INCOTERMS - 2010) is discussed.

Option No. 2. When delivering cargo by sea, the following route is considered: Jinxiang (China) -Shanghai (China) -Vladivostok (Russia, "place of importation") - Moscow (Russia). Transportation costs to the customs border are estimated at 1,700 USD, after the customs border - at 5,000 USD. When shipping cargo from China, the delivery condition of CIF-Vladivostok (INCOTERMS-2010) is discussed.

The exchange rate at the time of submission of the declaration to the customs authorities of the Russian Federation is projected at the level of 67.96 RUR per 1 USD.

It is necessary to justify the choice of the mode of transportation taking into account the delivery terms discussed with China and to confirm its choice by calculations, taking into account the influence of transportation costs when making a foreign trade transaction for the formation of customs value in Russia. It is necessary to calculate the amount of costs for different delivery conditions and for different methods of transportation, which will be formed by a Russian firm with foreign trade cooperation with China.

If we operate only with the criteria "transportation cost" and "delivery time", then the interpretation of the situation on our foreign trade transaction will definitely act in favor of sea shipping. In our case, the total cost of transportation by the first method (road transport) will be 8,700 USD, and the second method (sea transport) will bring to the Russian company total costs of 6,700 USD (Table 2).

Table 2

Distribution of transportation costs for the options for a foreign

trade transaction for the supply of garlic from China to Russia

Element of calculation |

Option No. 1 |

Option No. 2 |

Delivery condition |

CIP-Moscow |

CIF-Vladivostok |

Transportation costs to the customs border ("place of importation"), USD |

5,700 (included in the contract value) |

1,700 (included in the contract value) |

Transportation costs after the customs border ("place of importation"), USD |

3,000 (included in the contract value) |

4,700 (paid by the importer in addition) |

Source: compiled and calculated by the authors.

However, if under the terms of the contract the transportation costs can be confirmed by the buyer documentarily in the course of customs clearance. The way of transportation by truck from China to Russia through the territory of the EEU can also be assessed from the point of view of the influence of transportation costs on the customs payments formation. Customs cost calculation of in two options is presented in Table 3.

Table 3

Calculation of the customs value of a lot of

garlic according to the transaction options

Element of calculation |

Option No. 1 |

Option No. 2 |

Delivery condition |

CIP-Moscow |

CIF-Vladivostok |

Contract price, USD / ton. |

1,728 |

1,728 |

Contract price, USD |

31,104 |

3,1104 |

Additional accruals to the currency basis of customs value, USD |

0 |

0 |

Deductions to the currency basis of customs value, USD |

3,000 |

0 |

Currency basis of customs value, USD |

28,104 |

31,104 |

Customs value, RUR |

1,909,947.84 |

2,113,827.84 |

Source: compiled and calculated by the authors.

Calculation of customs payments using the CIP-Moscow delivery basis (option No. 1) is presented in Table 4.

Table 4

Calculation of customs payments using the

CIP-Moscow delivery basis (option No.1)

Customs duty (at a basic ad valorem rate of 10% of customs value) |

1,909,947.84 RUR × 0.1=190,994.78 RUR |

Customs duty (on preferential ad valorem rate, coefficient = 0.75) |

190,994.78 RUR ×0.75 = 143,246.09 RUR |

VAT (10% of the amount of customs value and customs duty) |

(1,909,947.84 RUR +143,246.09 RUR)×0.1 =2,053,193.928 RUR×0.1=205,319.39 RUR |

Customs fee for customs clearance (electronic declaration) |

Since the customs value of the lot was in the range of 1 200 000 RUR up to less than 2 500 000 RUR, the customs clearance fee is 4,125 RUR |

The total customs payment (the amount of customs duty, VAT and customs duty) |

143,246.09 RUR + 205,319.39 RUR +4,125 RUR = 352,690.48 RUR |

Source: compiled and calculated by the authors.

Calculation of customs payments using the CIF-Vladivostok delivery basis (option No.2) is presented in Table 5.

Table 5

Calculation of customs payments using the CIF-Vladivostok delivery basis (option No.2)

Customs duty (at a basic ad valorem rate of 10% of customs value) |

2,113,827.84 RUR × 0.1 = 211,382.78 RUR |

Customs duty (on preferential ad valorem rate, coefficient = 0.75) |

211,382.78 RUR ×0.75=158,537.09 RUR |

VAT (10% of the amount of customs value and customs duty) |

(2,113,827.84 RUR+ 158,537.09 RUR)×0.1 = 2,272,364.93 RUR ×0.1=227,236.49 RUR |

Customs fee for customs clearance (electronic declaration) |

Since the customs value of the lot was in the range of 1 200 000 RUR up to less than 2 500 000 RUR, the customs clearance fee is 4,125 RUR |

The total customs payment (the amount of customs duty, VAT and customs duty) |

158,537.09 RUR +227,236.49 RUR +4,125 RUR =389,898.58 RUR |

Source: compiled and calculated by the authors

The distribution of customs costs for the options No.1 and No.2 is presented in Table 6.

Table 6

Distribution of customs costs in two delivery options

The total customs payment |

Option No. 1 CIP-Moscow |

352,690.48 RUR |

Option No. 2 CIF-Vladivostok |

389,898.58 RUR |

|

The difference between customs costs, depending on the chosen mode of transportation |

389,898.58 RUR - 352,690.48 RUR = 64208,1 RUR (equals 944,79 USD) |

|

Source: compiled and calculated by the authors.

At its core, 944.79 USD is a savings that is hidden in transportation costs, which occurs only at the stage of customs clearance through the unified customs territory of the EEU, when a firm uses shipping method by car.

Therefore, a comparison of transport costs alone of 8,700 USD (option No. 1) and 6,700 USD (option No.2) can not afford to fully assess the effectiveness of logistics solutions. It should be borne in mind that under the conditions of the Eurasian economic integration, the transportation costs for this transaction, taking into account the hidden savings, will look like this when comparing: (8,700 USD -944.794 USD = 7,755.21 USD - for option No. 1) and (6,700 USD - for option No2). This, in turn, may lead to a change in the firm's decision regarding the choice of delivery basis and the mode of transportation in favor of car transport. A comprehensive assessment of the transportation method impact on the customs payments calculation can seriously supplement the methodological basis for calculating the effectiveness of logistics solutions in the conditions of the Eurasian Economic Union.

In addition, we can assess the impact of the customs effects of the Eurasian economic integration on the example of calculating the total costs for importers for the two options of the considered foreign trade deal on the supply of garlic from China to the Russian Federation. Suppose that the macro environment is stable and the exchange rate for the period under review remains at this level. The calculation of the total costs of the importer is presented in Table 7.

Table 7

Calculation of the cumulative expenses of the importer for

the supply of garlic from China to Russia in two options

Element of calculation |

Option No. 1 CIP-Moscow |

Option No. 2 CIF-Vladivostok |

Payment of the contract |

31,104 USD × 67.96 RUR/USD =2,113,827.84 RUR |

31,104 USD × 67.96 RUR/USD =2,113,827.84 RUR |

Payment of transportation, not included in the contract value |

- |

4,700 RUR × 67.96 RUR/USD = 319,412.0 RUR |

The total customs payment |

352,690.48 RUR |

389,898.58 RUR |

Total incoming value of garlic lot |

2,466,518.32 RUR |

2,823,138.42 RUR |

Source: compiled and calculated by the authors.

Thus, we can state that despite the apparent excess of transportation costs for the first option (CIP-Moscow), under the influence of the customs effect in general, the efficiency of this option is higher than when delivered under CIF-Vladivostok conditions. The savings of the importer's funds under the first option are estimated at 356,620.1 RUR, and the efficiency of the transaction is 14.45% higher.

The study presented in this article confirms the following hypotheses of the authors:

1) The formation of a single customs territory within the framework of the Eurasian economic integration, now allows us to take a fresh look at the methodology for assessing the effectiveness of logistics solutions. It should be especially emphasized that when analyzing the efficiency of the transport component in the implementation of foreign trade transactions, very often the participants in foreign economic activity do not pay sufficient attention to assessing the impact of this component on the calculation of customs payments. This circumstance, in turn, has a negative impact on a comprehensive understanding of the efficiency of the foreign trade transaction and can lead to additional economic losses in choosing the mode of transportation within the framework of foreign trade cooperation.

2) In the context of the Eurasian economic integration, an assessment of the effectiveness of a logistics solution must take into account the impact of the customs effect considered in this article on the overall efficiency of a foreign trade transaction. Criteria for the efficiency of the logistics solution - the factor "time" (the delivery time of the goods) and "transportation costs" (the cost of delivery of the goods) should be supplemented by the factor "customs costs". The consideration of this criterion in a number of cases makes it possible to reveal, at first glance, the paradoxical dependence - the choice of higher "transportation costs", the choice of a more expensive transportation method can ensure the maximum efficiency the foreign trade transaction as a whole.

3) On the example of imports of agricultural products from China to Russia, this dependence was demonstrated and a quantitative analysis of the customs effect of transport logistics at the micro level in the context of the Eurasian economic integration is presented.

We would appreciate to receive feedback and comments on the paper from its readers. They will help us complete and enhance the research.

The paper was prepared with the support of Russian Foundation for Basic Research (RFBR), project № 18-010-01209 А “Formation of the Organizational and Economic Model of Managing the Customs Effects of the Eurasian Economic Integration and Assessing their Impact on the Mechanism for Implementing the Agreed Agro-Industrial Policy”.

Andronova, I. (2016). Eurasian Economic Union: Opportunities and Barriers to Regional and Global Leadership. International Organisations Research Journal, Vol. 11, No. 2, pp.7-23.

Baier, S.L., and Bergstrand, J.H. (2007). Do free trade agreements actually increase members’ international trade?. Journal of International Economics. Vol. 71, No. 1, pp. 72—95.

Balassa, B. (1961). The Theory of Economic Integration. Homewood, Illinois: R. D. Irwin, Inc. Retrieved from: http://ieie.itam.mx/Alumnos2008/Theory%20of%20Economic%20Integration%20(Belassa).pdf.

Baldwin, R., and Jaimovich, D. (2012). Are free trade agreements contagious?. Journal of International Economics, Vol. 88 No. 1, pp. 1—16.

Baldwin, R., Forslid, R., and Haaland, J. (1995). Investment creation and investment diversion: Simulation analysis of the single market programme. NBER Working Paper no. 5364. Cambridge: National Bureau of Economic Research,

Bhambri, R. S. (1962, May). Customs unions and underdeveloped countries. Economia Internazionale, Vol. XV, May.

Corden, W. M. (1972). Economies of scale and customs union theory. The Journal of Political Economy, Vol. 80 (3), pp. 465-475.

Dee, P., and Gali, J. (2003). The Trade and Investment Effects of Preferential Trading Arrangements. NBER Working Paper No. 10160, December. doi: 10.3386/w10160.

Dunning, J. H., and Robson, P. (1988). Multinational Corporate Integration and Regional Economic Integration. In Dunning, J. H., and Robson, P. (Eds.), Multinationals and the European Community (pp. 1-23).Oxford: Basil Blackwell.

Egger, P., and Larch, M. (2008). Interdependent preferential trade agreement memberships: An empirical analysis. Journal of International Economics. Vol. 76 No. 2, pp. 384—399.

Fresh garlic market: over 95% of garlic in Russia - imported products (2015, October). Analytical and Analytical Center of Agribusiness. Retrieved from: http://ab-centre.ru/news/rynok-svezhego-chesnoka-svyshe-95-chesnoka-v-rossii---importnaya-produkciya.

Fugazza, M., and RobertNicoud, F. (2010). The emulator effect of the Uruguay round on US regionalism. Discussion Paper No. 7703. London: Centre for Economic Policy Research.

Golovnin, M., Zakharov, A., and Ushkalova, D. (2016). Economic integration: lessons for the post-soviet space. World Economy and International Relations, 2016, Vol. 60 No. 4, pp. 61-69.

Gruber, L. (2000). Ruling the world: Power politics and the rise of supranational institutions. Princeton, NJ: Princeton University Press,

ITC Trade Map. Retrieved from: https://www.trademap.org/

Jošić, H., and Jošić, M. (2013). Static and dynamic effects of customs union creation. In Economic integrations, competition and cooperation. Accession of the Western Balkan Countries to the European Union 2013 proceedings of the conference in Rijeka, Croatia, 2013, University of Rijeka, Faculty of Economics, Rijeka, Croatia, pp. 53-65. Retrieved from: https://www.efri.uniri.hr/sites/efri.uniri.hr/files/cr-collections/2/euconf_2013.pdf (accessed 25 February 2018).

Knobel, A. (2015). Eurasian Economic Union: Prospects and Challenges for Development. Voprosy Ekonomiki, No. 3, pp. 87—108.

Kovalev, V., Falchenko, O., Vyazovskaya, V., and Maydanik, V. (2017). The trade effects of economic integration in emerging market of the Eurasian Economic Union. In The 10th Annual Euromed Academy of Business Conference «Global and national business theories and practice: bridging the past with the future Rome», September 13-15, 2017, pp. 794-806. Retrieved from: http://euromed2017.com/bop2017.pdf.

Linder, S. B. (1966), Customs Unions and Economic Development. Latin American Economic Integration (pp. 32-41). In Miguel S. Wionczek, ed. New York: Praeger,

Meade, J. E. (1955). The theory of customs unions. Amsterdam: North Holland,

Pahre, R. (2008). Politics and trade cooperation in the nineteenth century. Cambridge: Cambridge University Press.

Rueda-Junquera, F. (2006) . European integration model: Lessons for the Central American common market. Jean Monnet/Robert Shuman Paper Series 6 (4). Florida: University of Miami.

Sakamoto, J. (1969). Industrial development and integration of underdeveloped countries. Journal of Common Market Studies. No. 7 (4), pp. 283-304.

Shkiotov, S.V. (2016). Analysis of the effects of the customs union creation in the economic literature. Scientific bulletins of the Belgorod State University. Series: The Economy. Computer science. No. 2 (223) Vol. 37, pp. 57 – 62.

Taranova, H. (2015). Economic effects of integration in the network of institutionalism. Journal of Economics and Management. No. 1 (41), pp. 59-62.

Viner, J. (1950), The Customs Union Issue (pp. 41-55). New York: Carnegie Endowment for International Peace.

1. Foreign Economic Activity Dept., Ural State University of Economics, Yekaterinburg, Russia. Contact e-mail: kovalev@usue.ru

2. Foreign Economic Activity Dept., Ural State University of Economics, Yekaterinburg, Russia. Contact e-mail: falchenko@usue.ru

3. Foreign Economic Activity Dept., Ural State University of Economics, Yekaterinburg, Russia. Contact e-mail: enterprises). Contact e-mail: irinasavelyeva2008@yandex.ru

4. Foreign Economic Activity Dept., Ural State University of Economics, Yekaterinburg, Russia. Contact e-mail: enterprises). Contact e-mail: aleks_ural_55@mail.ru