Vol. 39 (Number 28) Year 2018 • Page 35

Irina MARKINA 1; Svetlana TERESHCHENKO 2; Elena VARAKSINA 3

Received: 17/04/2018 • Approved: 25/05/2018

ABSTRACT: The agro-industrial complex carries out an important task of providing the population with food products. Therefore, its economic growth is required for the society to live a normal life. The rightly calculated cost of a product, without which the enterprise will perform at a loss, is one of the economic aspects of the agricultural enterprise growth. Based on four analyzed approaches to allocating indirect production costs (sales costs, hard costs, marginal income, labor inputs), we have chosen the most optimal one in terms of the fair product cost setting. The analysis was carried out in the Zhovten LLC (Stanychno-Lugansk District). It was carried out at the industry-based and product-based levels. We have calculated the profitability index and allocated an approach for the most optimal product cost calculation. |

RESUMEN: El complejo agroindustrial lleva a cabo una importante tarea de proporcionar a la población productos alimenticios. Por lo tanto, se requiere su crecimiento económico para que la sociedad viva una vida normal. El costo calculado correctamente de un producto, sin el cual la empresa tendrá pérdidas, es uno de los aspectos económicos del crecimiento de la empresa agrícola. Con base en cuatro enfoques analizados para asignar los costos de producción indirectos (costos de venta, costos fijos, ingreso marginal, insumos de mano de obra), hemos elegido el más óptimo en términos del ajuste del costo justo del producto. El análisis se llevó a cabo en Zhovten LLC (Distrito de Stanychno-Lugansk). Se llevó a cabo en los niveles basados en la industria y en productos. Hemos calculado el índice de rentabilidad y asignado un enfoque para el cálculo del costo del producto más óptimo. |

A significant number of Ukrainian farms, engaged in the national agricultural production, are diversified – they produce different types of products. Current market situation forces the enterprises to expand their product lines and look for the related activities. Such a step is a right and a logical measure. However, the one, who has taken it, should be prepared for a more complicated process of product cost calculation. In practice, therefore, it turns to be a problem to calculate the real cost of different products by analyzing each product cost through the indirect cost allocation bases. Such situation arises because indirect costs cannot be attributed to a specific object, but only to the chosen base.

N.S. Andryushchenko (2017), S.F. Golov (2003), B.V. Melnichuk (2015) and L.V. Napadovskaya (2013) are highlighting the issue of indirect cost allocation at determining the farm product costs quite deeply. In developed countries, there are the following the most common indirect cost allocation bases: work hours (Andryushchenko, 2017), direct salaries of production workers (Napadovskaya, 2013), hours worked by production workers or equipment, or sales revenue.

The management accounting data can be the most informative and useful only if they are recorded on a regular basis (Kolmakov, Ekimova, Polyakova, 2015; Kolmakov, Polyakova, & Shalaev, 2015). In this case, management reporting becomes an important element in planning, controlling and reaching the agricultural production efficiency (Suk, Suk & Melnichuk, 2015; Volkova, 2014; Savytska, 2004).

In the agricultural enterprise, management accounting system organization is dependent directly on the nature of agricultural production, production processes classification, cultivation and/or animal breeding technologies, and the agricultural enterprise profile (Johnson, 2016; Gerasimov et al., 2015; Mishulina et al., 2017).

Modern economists allocate the product cost as one of the components of the economic stability of an enterprise. They identify the economic stability as the availability of competitive advantages, based on the compliance of material, financial, workforce, technological capacities and the organizational structure of the enterprise with its strategic goals. In this case, product cost is stacked up to the each criterion of the economic stability and is an important part of the competitive advantage (Markina, Diachkov & Adedeji, 2017; Markina, Somych & Hniedkov, 2016; Markina, 2016).

Thus, product cost determination is not only a way to calculate the financial component of production (income/spendings), but also one of the enterprise stability criteria in the context of the modern market. In this regard, enterprise profitability generally depends on the product cost calculation.

Unsolved Aspects of a Common Problem. Each approach can be applied under the favorable indices recorded in relation to a particular economy, but the problem of cost allocation is that there is no multi-faced approach. They all are intended for specific cases.

Research purpose is to determine a fair cost of farm products, based on the optimal allocation of indirect costs.

Theoretical and methodological research basis involves the theory of the agricultural production development regulation under a multitude of management and integration processes, as well as the domestic and foreign research papers in the field of agricultural production.

Conclusions section was written after the domestic and foreign experience was generalized, and after the abstract-logical, analytical and economic-statistical methods were applied (in particular, the method of economic groupings and comparative analysis).

Calculations were made in the Zhovten LLC (Stanychno-Lugansk District).

Zhovten LLC (Stanychno-Lugansk District) is specialized in selling crop and livestock products. However, significant part of sales revenue is allocated to crop production (wheat, barley and sunflower). The standard value of company’s products is preliminary set through the application of the indirect cost allocation base, intended for allocating the sales costs. This approach is that direct and indirect costs are taken into account while calculating the product cost by the percentage of sales revenue.

In the Zhovten LLC, direct costs allocated to crop production include: the wage-and-salary disbursements and supplies (seeds, fuel and lubricants, fertilizers and plant-protecting agents) expenses. As the money is earned, it is directly allocated to the object of costing, namely – to a specific product. This money accumulates on the Production Account 23.

Indirect costs (power costs, amortization costs, organization costs, sales and promotion costs etc.) are accumulated on the Account 9.

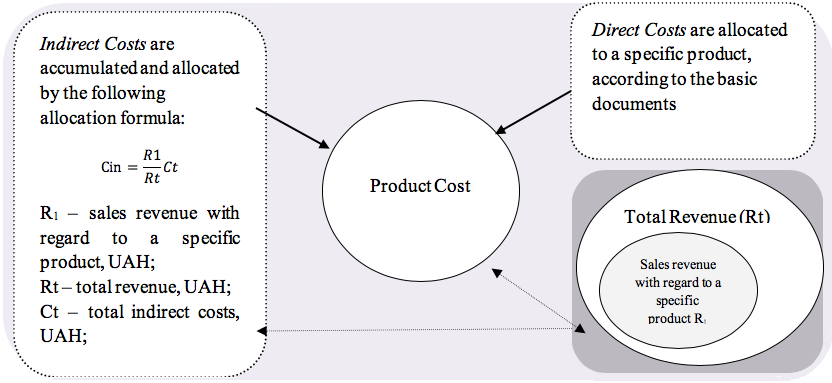

According to the existing approach, indirect costs are allocated to products in the line of their share in total sales.

Figure 1

Product Cost Setting under the Indirect Cost Allocation by Sales (Zhovten LLC)

Source: original diagram

Such an approach to cost allocation has allowed the Zhovten LLC to set the fair product cost in the light of the following:

In 2014, company’s top management has decided to expand the range of company’s activity, namely – to introduce the livestock production. In this case, significant financial investments were not required, as the livestock space and the fodder growing machinery remained.

However, Zhovten LLC has faced the situation, when a single indirect cost allocation base could not been applied to crop and livestock products separately. The indirect cost allocation by receipts does not take into account the fixed costs, which are much higher in the livestock production than in the crop production. Besides, the crop rotation system was enriched with new crops (fodder beet and corn) as the livestock production was introduced.

Some of the output (5-10%) was sold. Therefore, significantly increased (+18%) indirect costs were allocated only to those products that were sold. In 2006, however, only 12% of livestock products were sold. This led to an increase in the crop product cost (+8%), as well as to a significant reduction in the marginal income (-24.7%). It should be noted that the market prices differ significantly when it comes to the crop and livestock products, which are characterized by non-identical production processes.

The company performance analysis has shown that indirect cost allocation by sales was a wrong approach, and implied for reviewing the accounting policy in the field of indirect cost allocation (The Tax Code of Ukraine) once a year at most.

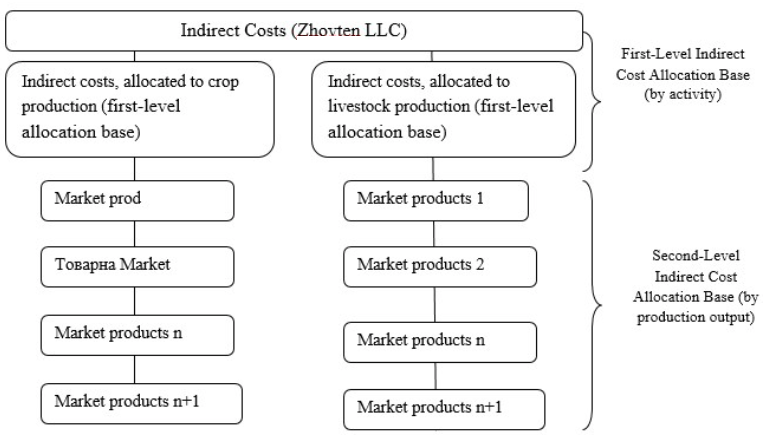

We have proposed the Zhovten LLC to apply a fundamentally new approach to the indirect cost allocation. This approach includes two levels of allocation (Figure 2), based on the marginal income by product.

As reflected by the above diagram, all indirect costs are first allocated by activity (Level I). The introduced allocation scheme is applied within these enterprise activities: cost allocation by the marginal income (Level II).

Let’s suggest that if we take the marginal income level as a basis, the enterprise will allocate indirect costs to products that not only bring more profit, but also cover the fixed costs.

Let’s consider the introduced mechanism for indirect cost allocation in more detail.

Figure 2

Two-Level Mechanism for Indirect Cost Allocation

Source: original diagram

The following steps were taken before choosing the most favorable base for allocating indirect costs by activity.

We have analyzed the prime costs of basic crop and livestock products by various options of indirect cost allocation (Table 1). We have also proposed to set the total product cost after calculating the operation and sales costs (Accounts 92 and 93, respectively) in accordance with the base of general production costs (Account 91). This will contribute to the effective decision-making.

The list of applied allocation bases:

Table 1

Indirect Cost Allocation by Activity and Different Approaches: Data Comparison for the Zhovten LLC

Activity |

Basic data for choosing the indirect cost allocation base |

|||

Sales, UAH thousand |

Materials cost, UAH thousand |

Marginal income, UAH thousand |

Labor input, thousand men-hour |

|

Crop production |

15857.6 |

6400 |

6983.6 |

27 |

Livestock production |

2152.4 |

1350 |

1856.4 |

29.7 |

Total |

18020 |

7750 |

8840 |

56.7 |

Cost allocation coefficient at the crop production level (Cc) |

88 |

82.5 |

79 |

47.6 |

Cost allocation coefficient at the livestock production level (Cl) |

12 |

17.5 |

21 |

52.4 |

Total |

100.0 |

100.0 |

100.0 |

100.0 |

Source: original calculations

As reflected in Table 1, crop product cost (Cc cost allocation coefficient) will differ by bases in the range from 47.6% (by labor input) to 88% (by sales).

The indirect costs were then allocated in regards to all common and specified allocation bases (4 approaches) within the framework of accounting (table 2).

Table 2

Indirect Cost Allocation across the Business Accounts (Zhovten LLC)

|

Activity |

Sales, UAH thousand |

Materials cost, UAH thousand |

Marginal income, UAH thousand |

Labor input, thousand men-hour |

Regarding to the Cost Allocation Coefficient |

|||||

Account 91 |

Crop production |

924.0 |

866.3 |

829.5 |

499.8 |

Livestock production |

126.0 |

183.8 |

220.5 |

550.2 |

|

Total |

1050.0 |

1050.0 |

1050.0 |

1050.0 |

|

Account 92 |

Crop production |

994.4 |

932.3 |

892.7 |

537.9 |

Livestock production |

135.6 |

197.8 |

237.3 |

592.1 |

|

Total |

1130.0 |

1130.0 |

1130.0 |

1130.0 |

|

Account 93 |

Crop production |

931.0 |

872.9 |

835.8 |

503.6 |

Livestock production |

127.0 |

185.2 |

222.2 |

554.4 |

|

Total |

1058.0 |

1058.0 |

1058.0 |

1058.0 |

|

Total indirect costs, allocated to crop production |

2849.4 |

2671.4 |

2558.0 |

1541.3 |

|

Total indirect costs, allocated to livestock production |

388.6 |

566.7 |

680.0 |

1696.7 |

|

Source: original calculations

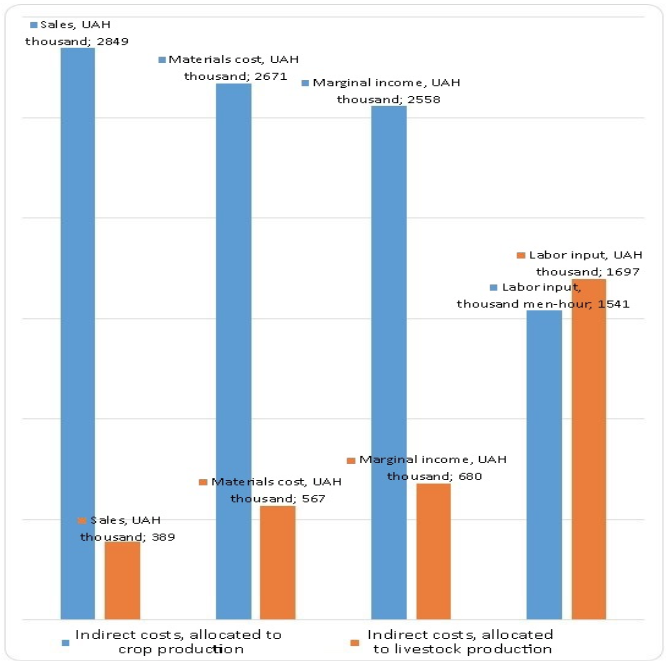

All indirect costs, accumulated on business accounts, are allocated in regards to the above approaches, according to the Table 1 (cost allocation coefficients). Results analysis shows that different approaches contribute to different product costs both in cases of crop production, and livestock production (fig. 3). The company has the right to choose an approach at its own discretion. In case, when the company continues to apply the existing approach (by sales), the great part of indirect costs will be accrued to crop production (88%). In the case of cost allocation by labor inputs, the greatest part of indirect costs (52.4%) will be allocated to livestock products. In any case, price and the quality indicators remain without attention. The introduced cost allocation method, based on the marginal approach, will allow reducing the indirect costs, allocated to crop production by 9%, and minimizing the number of disadvantages inherent in other approaches. The result is such, since the livestock profit margin is good (21% in total), despite the insignificant sales (12%).

Figure 3

Results of Indirect Cost Allocation by Activity at Different Approaches (Zhovten LLC)

Source: original calculations

Product costs were allocated by sales within the Zhovten LLC activities according to a similar algorithm.

Table 3

Indirect Cost Allocation to Production Unit by Different Cost

Allocation Bases within Each Type of Activity (Zhovten LLC)

№ |

Activity / Product Name |

Sales, UAH thousand |

Materials cost, UAH thousand |

Marginal income, UAH thousand |

Labor input, thousand men-hour |

||||

UAH/t |

Ratio,% |

UAH/t |

Ratio,% |

UAH/t |

Ratio,% |

UAH/t |

Ratio,% |

||

1 |

Indirect costs, allocated to crop production |

2849.4 |

100 |

2671.4 |

100 |

2558.0 |

100 |

1541.3 |

100 |

Winter wheat grain |

1675.4 |

58.8 |

683.9 |

25.6 |

480.9 |

18.8 |

439.2 |

28.5 |

|

Barley grain |

222.3 |

7.8 |

272.5 |

10.2 |

319.7 |

12.5 |

331.4 |

21.5 |

|

Sunflower seeds |

501.5 |

17.6 |

913.6 |

34.2 |

1117.8 |

43.7 |

382.2 |

24.8 |

|

Corn |

450.2 |

15.8 |

801.4 |

30.0 |

639.6 |

25.0 |

388.4 |

25.2 |

|

2

|

Indirect costs, allocated to livestock production |

388.6 |

100 |

566.7 |

100 |

680.0 |

100 |

1696.7 |

100 |

Hog raising in live weight |

353.2 |

90.9 |

248.8 |

43.9 |

193.8 |

28.5 |

699.0 |

41,2 |

|

Pig breeding (production gain) |

35.4 |

9.1 |

317.9 |

56.1 |

486.2 |

71.5 |

997,7 |

58,8 |

|

Source: original calculations

The second-level results of indirect cost allocation once again confirm that different approaches to indirect cost allocation contribute to different product cost setting (Table 3).

If indirect costs are allocated by sales, then the greatest part of indirect costs will be allocated to the winter wheat grain (55.8%) and hog raising (90.9%).

In the case of cost allocation by materials costs, sunflower seeds take the first place in crop production (34.2%), while pig breeding is in the lead in the livestock production (56.1%). At the same time, sunflower seed remain in the lead when the costs are allocated by the marginal income (43.7%). A similar situation can be observed in the case of the third approach: in the livestock production, 71.5% of all indirect costs are allocated to pig breeding.

If indirect costs are allocated by labor input, then the greatest part of indirect costs will be allocated to the winter wheat grain (in crop production) and pig breeding (in livestock production). Thus, the enterprise has the opportunity to regulate the product cost and sales revenues by choosing one of the introduced approaches, since our calculations show that the product cost contains a high share of indirect costs (table 4).

Table 4

The Share of Indirect Costs Allocated to Production Unit by Different

Cost Allocation Bases within the Zhovten LLC Activities, UAH per ton

№ |

Activity / Product Name |

Sales, UAH thousand |

Materials cost, UAH thousand |

Marginal income, UAH thousand |

Labor input, thousand men-hour |

||||

Product cost less indirect costs, UAH |

Total indirect costs, UAH |

Product cost less indirect costs, UAH |

Total indirect costs, UAH |

Product cost less indirect costs, UAH |

Total indirect costs, UAH |

Product cost less indirect costs, UAH |

Total indirect costs, UAH |

||

1 |

Corp product cost |

||||||||

|

Winter wheat grain |

266 |

1675.4 |

266 |

683.9 |

266 |

480.9 |

266 |

439.2 |

Barley grain |

212 |

222.3 |

212 |

272.5 |

212 |

319.7 |

212 |

331.4 |

|

Sunflower seeds |

463 |

501.5 |

463 |

913.6 |

463 |

1117.8 |

463 |

382.2 |

|

Corn |

351 |

450.2 |

351 |

801.4 |

351 |

639.6 |

351 |

388.4 |

|

2 |

Livestock product cost |

||||||||

|

Hog raising in live weight |

33260 |

353,2 |

33260 |

248.8 |

33260 |

193.8 |

33260 |

699.0 |

Pig breeding (production gain) |

47011 |

35.4 |

47011 |

317.9 |

47011 |

486.2 |

47011 |

997.7 |

|

Source: original calculations

The above calculations show that at the existing approach to indirect cost allocation, the lion's share of these costs are accrued to winter wheat grain and hog raising in live weight (Table 5). In the case of cost allocation by marginal income, most of them are allocated to products that bring more profit and cover a certain part of direct costs. In crop production, such a product was determined to be sunflower seeds, while in the livestock production – piglets were determined to be a profitable product. The livestock product cost, however, is almost not maximized under this approach, although is maximized under the approach applied in the Zhovten LLC. Similar results are obtained in the case of indirect cost allocation by materials costs. In this case, however, sales revenue and the share of direct costs remain without attention. According to research results, indirect cost allocation by marginal income contributes to the fair product cost setting.

Table 5

Product Cost Calculated under Different Approaches

to Cost Allocation, UAH per ton (Zhovten LLC)

№ |

Activity / Product Name |

Sales, UAH thousand |

Materials cost, UAH thousand |

Marginal income, UAH thousand |

Labor input, thousand men-hour |

1 |

Corp product cost |

||||

|

Winter wheat grain |

1941.4 |

949.9 |

746.9 |

705.2 |

Barley grain |

434.3 |

484.5 |

531.7 |

543.4 |

|

Sunflower seeds |

964.5 |

1376.6 |

1580.8 |

845.2 |

|

Corn |

801.2 |

1152.4 |

990.6 |

739.4 |

|

2 |

Livestock product cost |

||||

|

Hog raising in live weight |

33959 |

33508.8 |

33453.8 |

33613.2 |

Pig breeding (production gain) |

47046.4 |

47328.9 |

47497.2 |

48008.7 |

|

In red and bold Max product cost. Source: original calculations

The company's performance is evaluated through the profitability indicators. Let's compare (through the sales profitability) how the Zhovten LLC profitability will change over the activity areas in the case of the actual approach to indirect cost allocation (Figure 4).

In the specified case, average sales profitability (crop production case) has increased by 7.7%. This is a significant change for any enterprise operating at the same level as the Zhovten LLC is.

Such an increase was sparked by the increase in returns on the winter wheat sales, as well as by a slight reduction in returns on all other products (except for the sunflower seeds, which return on sales decreased by more than 20%). Sunflower turned out to be a product with a high profit margin. Thus, it was allocated with the greatest part of indirect costs.

Figure 4

Livestock Sales Profitability: Actual and Recommended Approaches to Indirect Cost Allocation (Zhovten LLC)

Source: original calculations

The original approach will reduce the livestock sales profitability by 0.2%. Such a change is not significant compared to the increase in this figure in the case of crop production. The reduction will occur due to a decrease in pig sales profitability (-0.9%), which cannot cover the increase in pork sales profitability.

Product cost is analyzed through the solution of the following basic problems (Dzyubiak & Kopytko, 2017; Rebane, Parts & Värnik, 2016):

It should be noted that weakening the control over the product cost would cause an internal threat to economic stability.

An internal audit is recommended to be introduced in order to reduce the error risk that may arise during the product cost calculation and the enterprise performance evaluation. The internal audit should be carried out before the accounting reports are prepared. This will also increase the economic stability of the enterprise.

Research results have shown that indirect cost allocation by the marginal income allows setting a fair farm product cost. Such kind of cost allocation is based on profits, which the enterprise receives from particular products and the share of direct costs, allocated to them. We believe that this approach contributes to a fair cost, since the share of indirect costs that set product cost will change after the sales revenue reduction/increase.

Andryushchenko, N.S. (2017). Indirect Cost Allocation at the Agriculture Industry Level. Accounting and finance of the agro-industrial complex. [Electronic resource]. Assess mode: http://magazine.faaf.org.ua/rozpodil-nepryamih-virobnichih-vitrat-v-silskomu-gospodarstvi.html

Brannon, D. L., & Wiklund, J. (2016). An analysis of business models: Firm characteristics, innovation and performance. Academy of Entrepreneurship Journal, 22(1), 1.

Dzyubiak, V.B., & Kopytko, B.I. (2017). Agricultural Production Cost and How to Reduce It.

Gerasimov, A. N., Gromov, Y. I., Nesterenko, A. V., Bezdolnaya, T. Y., & Klishina, J. E. (2015). Government control of regional agricultural economic systems under institutional transformations. Mediterranean Journal of Social Sciences, 6(5), 200.

Golov, S.F. (2003). Management Accounting. Libra Publishing House, Kiev, 720.

Johnson, D. G. (2016). World agriculture in disarray. Springer.

Kolmakov, V. V., Polyakova, A. G., & Shalaev, V. S. (2015). An analysis of the impact of venture capital investment on economic growth and innovation: Evidence from the USA and Russia. Economic Annals, 60(207), 7-37. doi:10.2298/EKA1507007K

Kolmakov, V.V., Ekimova, K.V., Polyakova, A.G. (2017) “The Credit Channel of Monetary Policy Transmission: Issues of Breadth Measuring”. EconomicAnnals XXI. Vol. 7-8.

Markina I. (2016). Administrative-legal mechanism of economic security system of the country. Actual Problems of Economics: Professional Economics Journal, 9, 69-77.

Markina, I., Diachkov, D., Adedeji, O. (2017). Monitoring the level of sustainable development of the enterprise. Problems and Perspectives in Management. Vol. 15. Issue 1, 210-219

Markina, I., Somych, M., Hniedkov, A. (2017). The Development of the Shadow Entrepreneurship in Ukraine. Revista ESPACIOS, 38(54).

Mishulina, O. V., Dambaulova, G. K., Baranova, N. A., Gorelova, N. S., & Utebaeva, Z. A. (2017). MANAGEMENT OF EFFICIENCY OF AGRICULTURAL PRODUCTION ON THE BASIS OF MARGIN APPROACH. Journal of Fundamental and Applied Sciences, 9(1S), 49-64.

Napadovskaya, L.V. (2013). Management Accounting: monograph. Nayka I Osvita [Science and Education] Publishing House, Dnipro, 450.

Rebane, M., Parts, V., & Värnik, R. (2016, April). Calculation of product cost in dairy farming: examples from Estonia. In Proceedings of the 2016 International Conference" ECONOMIC SCIENCE FOR RURAL DEVELOPMENT": ECONOMIC SCIENCE FOR RURAL DEVELOPMENT, Jelgava, LLU ESAF, 21-22 April 2016 (pp. 268-273).

Savytska, V.G. (2004). Economic Analysis of Enterprise Performance. Znannia Publishing House, 654.

Suk, L.K., Suk, P.L., Melnichuk, B.V. (2015). Product/Service Cost Accounting Guideline for Agriculture Enterprises. Accounting and finance of the agro-industrial complex, 12, 6-14.

Volkova, O.N. (2014). Management Accounting. Prospekt Publishing House, 472.

1. Doctor of science, head of Department of management, Poltava State Agrarian Academy, 1/3 Skovorody str., 36003, Poltava, Ukraine. Email: imarkina@yahoo.com

2. Doctor of science, head of Department of economy, Sumy National Agrarian University, ul. G.Kondratieva, 160, Sumy, Ukraine

3. Candidate of Economic Sciences, Director of the Institute of Postgraduate Education Associate Professor of the Department of Management, Poltava State Agrarian Academy, ul. 23 September 5, ap. 48, Poltava, Ukraine