Vol. 39 (Nº27) Year 2018. Page 31

Vol. 39 (Nº27) Year 2018. Page 31

Saltanat RAKYMZHANOVA 1; Parida ISSAKHOVA , Alma KARSHALOVA 2

Received: 17/04/2018 • Approved: 01/06/2018

4. Indicators of the social protection development in the Republic of Kazakhstan

6. Improving the social protection funding mechanisms in the Republic of Kazakhstan

ABSTRACT: The present article proves that social protection is an efficient tool for poverty reduction, which contributes to the integration of economic and social aspects of sustainable development. The main goal of this study is to assess the current state of the social protection system in the Republic of Kazakhstan and to develop measures to improve the level of social security and social protection funding mechanisms. Methods of comparative and retrospective analysis of statistical indicators describing the development of the social protection system in the Republic of Kazakhstan were used in the article. A comparative analysis of the level of social protection development in the Republic of Kazakhstan and the EAEU states was carried out based on the presented Index calculation method. The results obtained in the course of the study allow to conclude that the national model of social protection has been created over the years of independent development in the Republic of Kazakhstan, and several important social programs aimed at reducing the level of population poverty have been adopted. Despite the positive development trend, the level of social protection in the Republic of Kazakhstan remains relatively low compared to the majority of the EAEU states. The author concludes that the Republic of Kazakhstan has potential opportunity to increase the scale and level of social protection through the formation of fiscal space and the improvement of mechanisms for budget funding of social protection. |

RESUMEN: El presente artículo demuestra que la protección social es una herramienta eficiente para la reducción de la pobreza, que contribuye a la integración de los aspectos económicos y sociales del desarrollo sostenible. El objetivo principal de este estudio es evaluar el estado actual del sistema de protección social en la República de Kazajstán y desarrollar medidas para mejorar el nivel de los mecanismos de financiación de la seguridad social y la protección social. En el artículo se utilizaron métodos de análisis comparativo y retrospectivo de indicadores estadísticos que describen el desarrollo del sistema de protección social en la República de Kazajstán. Se llevó a cabo un análisis comparativo del nivel de desarrollo de la protección social en la República de Kazajstán y los estados de la UEEA en función del método de cálculo del índice presentado. Los resultados obtenidos en el curso del estudio permiten concluir que el modelo nacional de protección social se ha creado a lo largo de los años de desarrollo independiente en la República de Kazajstán, y se han adoptado varios programas sociales importantes destinados a reducir el nivel de pobreza de la población. . A pesar de la tendencia positiva de desarrollo, el nivel de protección social en la República de Kazajstán sigue siendo relativamente bajo en comparación con la mayoría de los estados de la UEEA. El autor concluye que la República de Kazajstán tiene la oportunidad potencial de aumentar la escala y el nivel de la protección social mediante la creación de espacio fiscal y la mejora de los mecanismos para la financiación presupuestaria de la protección social. |

Social protection system is a key element of national governance. They embody the social values of any society. The social protection system has three main objectives: to guarantee all members of society access to basic goods and services, to promote active social and economic security, and to develop individual and social potential for poverty reduction and sustainable development of society (European Communities, 2010). Social protection is an investment in the social and economic development of societies and individuals. As such, it not only helps people cope with risks and reduces inequalities, but also allows them to develop the full potential for personal growth and meaningful contribution to their societies throughout their lives.

Strengthening social protection system is supported by the joint efforts of United Nations agencies at various levels and through joint efforts with relevant international, regional, subregional and national institutions and social partners (Ortiz, Durán-Valverde, Pal, Behrendt and Acuña-Ulate, 2017).

The sustainable development goals (SDGs) adopted at the United Nations General Assembly in 2015 reflect joint commitment by countries to "implement appropriate social protection systems for everyone at the national level" in order to reduce and prevent poverty (Sdgnote. Social Protection. Sdg 1.3, n.d.).

At the same time, despite significant progress in expanding social protection in many countries, the human right to social security remains unrealized for the majority of the world's population. The report of the International Labor Organization (ILO) notes that only 29% of the world's population have access to comprehensive social protection, while 71% or 5.2 billion people do not have such access or are only partially protected (World Social Protection Report 2017-19, 2017).

The Republic of Kazakhstan was among other developing countries in 2012. Kazakhstan adopted the Social Protection Floors Recommendation, 2012 (No. 202) at the 101st session of the International Labor Conference in Geneva (Switzerland). The Government of the country is taking measures to strengthen the social protection system, and significant progress has been made in the implementation of social policy. For example, the pension system reform has been carried out, the three-tier system of social security of persons with disabilities successfully functions, and comprehensive measures for the medical, social and professional rehabilitation of people in difficult life situations have been developed at the state level.

Nevertheless, it is necessary to search for financial resources for social investments in order to achieve the SDGs, human development of children and women, and realization of human rights, especially during a crisis. Today, in times of fragile global recovery, austerity and slow growth, the need to create fiscal space and introduce mechanisms for innovative social protection funding is more urgent than ever.

Given the importance of public investment in human rights’ protection and inclusive development, it is necessary to explore all possible alternatives for expanding the financial space to promote the country's socioeconomic development through job creation and social protection.

This article proposes options that can be explored for additional mobilization of resources for social investments in the Republic of Kazakhstan.

The article consists of five parts. First, a review of the literature on the problem of the social protection development and formation of targeted support at the world level is conducted. Then the methodology for calculating the combined indicator of achievements in the social protection development is presented – the Social Protection Index (ISP). The third part reviews the system of social protection measures in the Republic of Kazakhstan. Then the results of the comparative analysis of the social protection development level in the Republic of Kazakhstan and the EAEU states are presented. In the end, the author's view on the direction of the social support system development and proposals on the formation of new social protection funding mechanisms in the Republic of Kazakhstan is presented.

Social protection refers to a number of strategies aimed at helping women, men and children achieve or maintain an adequate living standard and good health throughout their lives (Fiszbein, Kanbur and Yemtsov, 2017).

The main international human rights’ documents recognize the need for social protection. In particular, Article 22 of the Universal Declaration of Human Rights 1948 states that "everyone, as a member of society, has the right to social security". Article 9 of the International Covenant on Economic, Social and Cultural Rights 1966 also recognizes "the right of everyone to social security, including social insurance" (International Covenant on Economic, Social and Cultural Rights, 1966). Social protection is also enshrined in Articles 9, 11, 12 and 13 of the International Covenant on Economic, Social and Cultural Rights (1979).

Social protection also was an important issue of discussion in international forums. This topic became central to the World Summit for Social Development held in Copenhagen in 1995, when governments committed to "develop and implement policies to ensure that all people have adequate economic and social protection during unemployment, ill health, maternity, child rearing, widowhood, disability and old age" (Boerma, Eozenou, Evans, Evans, Kieny and Wagstaff, 2014).

Before proceeding to a substantive discussion on the social protection funding, it is necessary to consider approaches to the definition of the "social protection" concept.

ILO defines social protection as the set of public measures that a society provides for its members to protect them against economic and social distress that would be caused by the absence or a substantial reduction of income from work as a result of various contingencies (sickness, maternity, employment injury, unemployment, invalidity, old age, and death of the breadwinner); the provision of health care; and the provision of benefits for families with children (ILO: World Labor Report, 2000; ILO: Principles of Social Security, 1998).

The starting point is the definition adopted by the European System of Integrated Social Protection Statistics (ESSPROS), which itself is based on the definition used in the ILO Social Security (Minimum Standards) Convention 1952 (No. 102) but extends to it by incorporating the risk of "social exclusion". As defined by ESSPROS, social protection "encompasses all interventions from public or private bodies intended to relieve households and individuals of the burden of a defined set of risks or needs, provided that there is neither a simultaneous reciprocal nor an individual arrangement involved" (ESSPROS Manual, 2008).

Despite its achievements and contributions to human development, social protection has always been subject to intense criticism for economic reasons due to its negative impact on general economic indicators (García and Gruat, 2003). Critics argue that spending on social protection represents a financial burden that drains public funds and reduces opportunities for investing in other priority areas (Griffiths, 2014).

They also claim that social policy creates obstacles in the labor market, which leads to dependence on state support and undermines work ethics, also preventing structural changes (Hidrobo, Hoddinott, Kumar and Olivier, 2014).

In the late 20th century and now, critical remarks have largely lost power due to the successful practice of countries in the economic, political and social fields, which show that economic development and social protection mutually reinforce each other. However, the fact that more than half of the world's population does not have adequate social protection causes serious concern.

In response to the global financial and economic crisis, the United Nations Chief Executives Board for Coordination initiated the adoption of minimum levels of social protection for the population in April 2009. A tangible impetus to the implementation of this initiative was given with the adoption of the landmark Recommendation on Minimum Levels of Social Protection (202) at the 101st Session of the International Labor Conference on June 14, 2012 in Geneva (Recommendation concerning National Floors of Social Protection, 2012).

The urgent need to move towards universal social protection was highlighted by the ESCAP members at the 67th session of the Commission in May 2011 by adopting Resolution 67/8 "Strengthening social protection systems in Asia and the Pacific". This Resolution calls upon member states to “invest in building social protection systems that might form the basis of a ‘social protection floor’, which would offer a minimum level of access to essential services and income security for all, and subsequently enhance the capacity for extension, according to national aspirations and circumstances.” (ESCAP Resolution 67/8, n. d.).

The relationship between inequality and social protection is explored in the ESCAP publication "Time for Equality: The Role of Social Protection in Reducing Inequalities in Asia and the Pacific" (ESCAP, Time for Equality, n. d.). The authors of this paper claim that inequality in its many forms is growing in Asia and the Pacific, and this has a negative impact on their sustainable development.

Considerable attention of researchers is paid to investigating the problems of social protection funding. A comprehensive review of available funding options was carried out in the publication of ILO staff in 2004; their advantages, disadvantages and financial implications were analyzed, and a methodological toolkit for the work of social protection specialists, social policy managers and analysts was presented (Cichon, Scholz, van de Meerendonk, Hagemejer, Bertranou and Plamondon, 2004).

Various sources of social protection funding, including assistance from international donors, public spending of national governments, private, community and non-governmental funding, as well as savings of households and extrabudgetary expenses are considered in the works of A. Barrientos (2004).

Beitler D. (2010), Akyüz Y. (2014), Harris, E. (2013), Duran-Valverde F. (2014) and others noted the need to form fiscal space and search for new sources of funding for the social field in developing countries.

Despite the sufficient number of available publications on the development of social protection in developing countries, the introduction of efficient mechanisms for its development and the search for new sources of funding for social support measures require further research.

The goal of this article is to develop recommendations for improving the social protection funding mechanisms in the Republic of Kazakhstan. The following tasks have been accomplished in this study in order to achieve the goal:

The Social Protection Index (ISP) was used as one of the tools to measure the achievements in the social protection development, which includes nine indicators:

M1 – Active contributors to the pension system at working age (15 to 65), % of the employed population;

M2 – Proportion of population covered by the social protection system, % of population;

M3 – Personal expenditure of the population on healthcare (% of total expenditure on healthcare);

M4 – Poverty ratio by national poverty line (% of population);

M5 – Population aged 65 and over as a percentage of the total population;

M6 – Total expenditure on social protection, including healthcare (% of GDP);

M7 – Expenditure on the social protection of older people (% of GDP, excluding healthcare);

M8 – Expenditure on the social protection of children (% of GDP, excluding healthcare).

Countries are ranked by the normalized indicator, the value of which is in the range from 0 to 1 (0 is the lowest score, 1 is the highest score) and is calculated by the formula:

Xn1= (M1n-M1min)/(M1max – M1min)

In this formula, M1 is the actual indicator of country n,

Mmin and Mmax are the lowest and the highest values of the selected indicator for selected countries.

For indicators, the growth of which describes the worsening situation in the social protection system, the normalized indicator is calculated as 1-Xn.

The Summary Social Protection Index (ISP) is calculated as the arithmetic mean of the normalized indicators for each country.

ISP = (Х1 + Х2 + Х3+…Хn)/n

The level of the social protection development in the country is interpreted in accordance with the following scale:

The databases of statistical indicators of the World Bank, the United Nations, the ILO and national statistical offices were the information base for calculating this indicator.

The modern system of social protection in the Republic of Kazakhstan includes social assistance, social security and social insurance.

Social assistance is targeted at vulnerable groups and includes in-kind and cash allowances, such as family and child allowances, social pensions, housing allowances and benefits for certain disadvantaged groups.

Until 2018, social assistance included three types of social benefits:

state targeted social assistance,

child allowance;

housing assistance.

A decentralized system of social protection for poor families has been in place in Kazakhstan since 2000. In 2002, Kazakhstan launched the targeted social assistance scheme (TSA), which entitled all families to receive a living wage that could be established by each region (Law of the Republic of Kazakhstan No. 246 dated July 17, 2001). The importance of providing the targeted social assistance to support vulnerable groups of people is emphasized in the adopted strategic documents "Kazakhstan 2030" and "Kazakhstan 2050".

At the moment, targeted social assistance is provided as monetary assistance to a person or families below 40% of the living wage (11,134 tenge for 2018) (Law of the Republic of Kazakhstan No. 113-VI dated November 30, 2017).

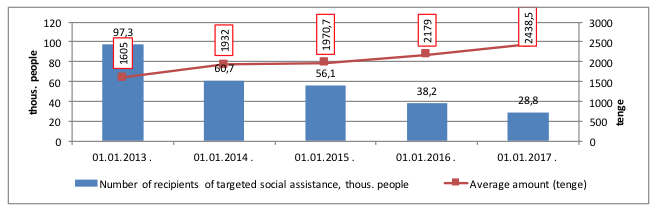

As of January 1, 2017, the state targeted social assistance was assigned to 28.8 thous. citizens with incomes below the poverty line. It must be noted that the number of recipients of targeted social assistance is decreasing from year to year as a result of measures aimed at employment of poor citizens. At the same time, the average monthly size of the TSA increased by 52% and amounted to KZT 2438.5 as of 01.01.2017 (Figure 1).

Figure 1

Indicators of targeted social assistance in the Republic of Kazakhstan in 2013-2016

There are several types of child allowances in the system of social assistance of the Republic of Kazakhstan:

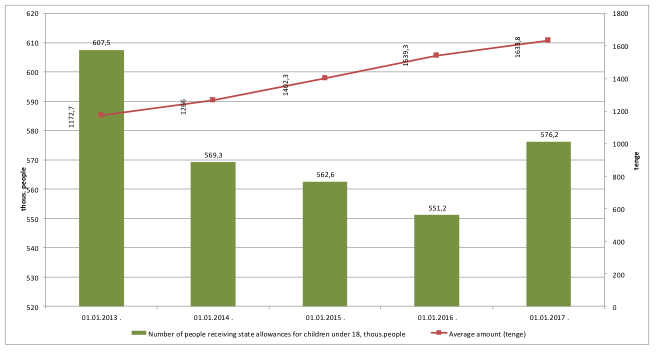

Figure 2

Indicators of receiving state allowances in the Republic of Kazakhstan in 2013-2016

The positive dynamics of the average amount of child allowances must be noted. Besides, there was an increase in the recipients of child allowances in 2016 compared with the previous year. This may indirectly indicate that comprehensive measures taken by the Government of Kazakhstan have had a positive effect on the demographic situation in the country, which is confirmed by the growing number of births.

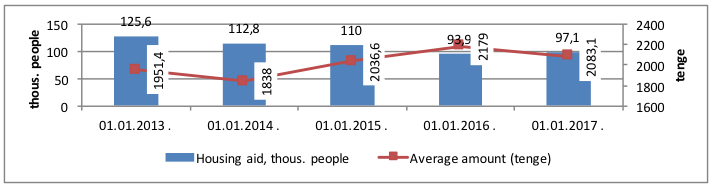

Another form of social assistance is housing aid for low-income families to pay for utilities, housing costs, rent and telephone services. The total number of social housing aid provisions fell from 125.6 thous. people to 97.1 thous. people for the period of 2013-2016. At the same time, the average amount of housing aid increased from 1,951.4 tenge to 2,083.1 tenge (Figure 3).

Figure 3

Indicators of social housing aid in the Republic of Kazakhstan in 2013-2016

People with disabilities are socially vulnerable, and therefore the state provides social assistance in the form of allowances for such categories of citizens of Kazakhstan. In 2017, the legislation of the Republic of Kazakhstan provides for the social assistance to disabled children: the allowance of 0.9 MCI is paid up until they turn 16, the allowance of 1.4 MCI (groups 1-2) and 0.6 MCI (group 3) is paid at the age 16 to 18.

During the years of independence, a multitier social security system has been created in the country, corresponding to the market principles of the economy. At the moment, Kazakhstan has a multicomponent pension system, where the responsibility for pension provision is divided among the state, the employer and the employee, through which citizens receive a pension: basic, solidarity and funded. The basic pension is steadily raised by the state and was at the level of 14,466 tenge in 2017. All pensioners in Kazakhstan without exception receive these pension payments. Labor, or solidarity pension is provided only to those citizens who had more than 6 months of employment record as of 1998. The labor pension does not replace but is added to the basic pension. The funded pension in Kazakhstan was completely transferred under the management of the unified funded Pension Fund JSC "ENPF" back in 2014. Now any citizen of Kazakhstan will be able to conclude an agreement with this funded Pension Fund to receive pension savings upon reaching the retirement age.

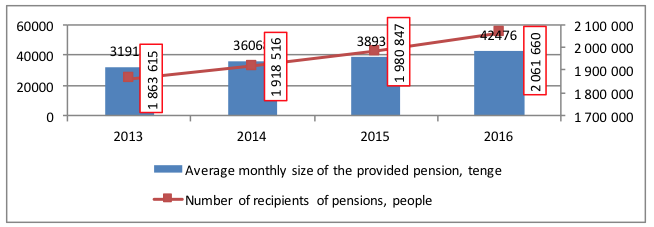

The number of recipients of pensions increased by almost 198 thous. people, the average monthly size of the provided pension in the Republic of Kazakhstan increased by almost a third and reached 42,476 tenge for the period of 2013-2016.

Figure 4

Indicators of pension provision in the Republic of Kazakhstan in 2013-2016

It must be noted that the mechanism for providing a basic pension changes from January 1, 2018. In accordance with the instructions of the head of state, solidarity or funded pension will be increased by 8%, the basic part of the pension increases by 6%. As such, the minimum pension including the basic pension will be 49,019 tenge, and the average pension will be 71,333 tenge in 2018. Besides, it is planned to change the method for providing a basic pension from July 1, 2018, taking the employment record before January 1, 1998 and the term of participation in the pension system after January 1, 1998 into account. This change will ensure an increase in the basic pension by 1.8 times on average. Starting from July 1, 2018, the average pension amount including the basic amount will be about 82 thous. tenge (Kostanai News, 2017).

In addition to the basic level of social protection, the employed population is covered by the compulsory social insurance. In case of disability risks and on the occasion of loss of the breadwinner, the State Social Insurance Fund of the Republic of Kazakhstan pays social benefits, the amount of which depends on the amount of wages received by the social risk worker and on the duration of participation in the compulsory social insurance system.

It must be noted that the Government of the Republic of Kazakhstan is actively working to improve the model of social protection. For example, a new format of TSA is introduced from January 1, 2018 for citizens or families whose incomes are below 50% of the LW value in the form of unconditional or conditional cash assistance.

The TSA of the new format is a Unified Allowance, which combines three existing social payments for low-income families:

a) TSA provided for each family member, if the per capita income of the family is less than 40% of the living wage;

b) child allowances provided to children under 18 in the amount of 1.05 MCI or 2,383 tenge in the current year, if the average per capita income of the family is less than 60% of the living wage;

c) special state allowance for families with four or more minor children, regardless of their income.

Expenditures of the budget system of the Republic of Kazakhstan on social provision and social security grow every year, while the growth rate outstrips both GDP growth and the total increase in expenditures (Table 1).

Table 1

Expenditures of the budget system of the Republic of

Kazakhstan for social assistance and social security

Indicators |

2012 |

2013 |

2014 |

2015 |

2016 |

Social assistance and social security, bln tenge (Annual reports on the execution of the republican budget for 2012, 2013, 2014, 2015, 2016) |

1,144.4 |

1,261.0 |

1,441.7 |

1,713.5 |

1,977.3 |

Growth rate of budget expenditure on social assistance and social security to the previous year |

100.0% |

110.2% |

114.3% |

118.8% |

115.4% |

Budget expenditure, total |

5,259.4 |

5,700.8 |

6,474.3 |

8,239.3 |

9,452.6 |

Growth rates of budgetary expenditure to the previous year, % |

100.0% |

108.4% |

113.6% |

127.3% |

114.7% |

GDP, bln tenge |

31,015.2 |

35,999.0 |

39,675.8 |

40,884.1 |

46,971.2 |

GDP growth rate to the previous year, % |

100.0% |

116.1% |

110.2% |

103.0% |

114.9% |

Share of expenditure on social protection in GDP, % |

3.69% |

3.50% |

3.63% |

4.19% |

4.21% |

Expenditure of the consolidated budget of the Republic of Kazakhstan on the item "Social assistance and social security" in 2016 amounted to KZT 1,977.3 bln or 4.21% of GDP. If compared to 2012, it is seen that the share of expenditure of the consolidated budget for social protection of the population of the Republic of Kazakhstan increased 1.7 times in 2016. Expenditure on the payment of solidarity pensions (58.3%), basic pension payments (16.4%), and State basic disability allowances (10.5%) take the largest share in the structure of expenditures of the consolidated budget on the "social assistance and social security" section.

At the same time, the share of expenditure on social protection in the Republic of Kazakhstan, including the costs of social protection of the elderly and children, remains one of the lowest among the EAEU member states. A set of statistical indicators that describe the current state of social protection systems in the EAEU states, including the Republic of Kazakhstan, is presented in Table 2.

Table 2

Statistical data on the state of social protection systems in the EAEU states (as of 2015)

Indicators |

Armenia | Belarus | Kazakhstan | Kyrgyzstan | Russia |

Active contributors to the pension system at the employable age (15 to 64), % of the employed population |

27 |

44 |

80 |

34.8 |

48.7 |

Share of the population covered by the social protection system, % of the population (World Social Protection Report 2017-19, 2017) |

68.5 |

100 |

82.6 |

100 |

91.2 |

Personal expenditure of population on healthcare (% of total expenditure on healthcare) |

53.5 |

32 |

45.1 |

39.4 |

45.8 |

Poverty rate by national poverty line (% of the population), as of 2015 |

29.80 |

5.10 |

2.70 |

32.10 |

13.3 |

Population aged 65 and older, % of the population |

11.00 |

15.00 |

7.00 |

4.00 |

14.00 |

Total expenditure on social protection, including healthcare (% of GDP) |

7.60 |

19.4 |

5.40 |

9.00 |

15.6 |

Expenditure on public social protection of the elderly (% of GDP, excluding healthcare) |

5.6 |

8 |

3.4 |

9 |

8.7 |

Expenditure on social protection of children (% of GDP, excluding healthcare) |

1.2 |

0.2 |

0.2 |

1.2 |

0.6 |

The result of the ISP index calculation for the EAEU states is presented in Table 3.

Table 3

Result of the ISP index calculation for the EAEU states

Indicators |

Armenia |

Belarus |

Kazakhstan |

Kyrgyzstan |

Russia |

Active contributors to the pension system at the employable age (15 to 64), % of the employed population |

0.00 |

0.32 |

1.00 |

0.15 |

0.41 |

Share of the population covered by the social protection system |

0.00 |

1.00 |

0.45 |

1.00 |

0.72 |

Personal expenditure of population on healthcare |

0.00 |

1.00 |

0.39 |

0.66 |

0.36 |

Poverty rate by national poverty line |

0.08 |

0.92 |

1.00 |

0.00 |

0.64 |

Population aged 65 and older, % of the population |

0.36 |

0.00 |

0.73 |

1.00 |

0.09 |

Total expenditure on social protection |

0.16 |

1.00 |

0.00 |

0.26 |

0.73 |

Expenditure on public social protection of the elderly |

0.39 |

0.82 |

0.00 |

1.00 |

0.95 |

Expenditure on social protection of children |

1.00 |

0.00 |

0.00 |

1.00 |

0.40 |

ISP |

0.25 |

0.63 |

0.45 |

0.63 |

0.54 |

So far, none of the countries under consideration has achieved a high level of social protection of the population. Three out of five countries (Belarus, Kyrgyzstan and Russia) have reached the social protection development level above the average. The current state of social protection in the Republic of Kazakhstan compared with other EAEU states is at an average level. The share of social protection spending as the ratio of GDP in the Republic of Kazakhstan is the lowest among the EAEU member states.

An increasing deficit of the republican budget may be the reason for this situation. Over the past 5 years, the growth rate of budget expenditures in the Republic of Kazakhstan in 2016 has hit record. Expenditures of the republican budget increased by an average of 0.5 trln tenge per year in the period of 2011-2015. The volume of expenditures grew by 2.1 trln tenge, or 31% in 2016. At the same time, the volume of increase in budget revenues could not make up a more significant increase in expenditures.

Despite the relatively low level of social protection in the Republic of Kazakhstan, there is room for scaling up and raising its level.

Even though the provided support is the lowest and the percentage of people covered is limited, the Governments of the EAEU states are trying to ensure a certain level of social protection for their people. At present, countries differ in the degree and type of social protection they provide. Therefore, they can shift to universal protection system through expanding the coverage of specific types of beneficiaries – for example, child and maternity allowances, old-age allowances, social support for disabled people and the unemployed.

At the same time, state revenues should cover the costs of social protection on a sustainable basis. The issue of social protection funding received increased attention in 2015 at the International Conference on Financing for Development in Addis Ababa (Overview of the Third International Conference on Financing for Development, n.d.). The Addis Ababa Action Agenda emphasizes that mobilizing local resources and increasing cost-efficiency will ensure stable sources of social protection funding.

An example for the social protection system funding is that such resources should be available on a sustainable basis. Discussion of the problems of social protection funding is sometimes formed in terms of increasing the "fiscal space". "Fiscal space" is room in a government's budget that allows it to provide resources for a desired purpose without jeopardizing the sustainability of its financial position or the stability of the economy" (Heller 2005). In this regard, the "fiscal space" emphasizes the current funding problem the governments face when they adopt or expand their social protection programs.

Reasonable fiscal policy should be built based not only on the criterion of long-term sustainability of obligations, but also on the ability to create financial buffers for unplanned costs and a temporary decline in economic activity.

The working paper 2015, prepared by the UN expert group Ortiz I., Cummins M., Karunanethy K. (2015), sets out options that should be explored to expand budget space and create resources to achieve SDGs, human rights and investment in women and children in the Republic of Kazakhstan and other EAEU states. These include:

A) Redistribution of public expenditure

One of the strategies for increasing social spending is revision of sectoral allocations within existing budgets. Reprioritizing public spending is usually a controversial and therefore complex approach.

Successful expansion of fiscal space is impossible without strong political will. The opinions of experts opposing the restructuring are obviously based on the assertion that no additional resources are considered accessible, and therefore other sectors or subsectors should be reduced in order to increase social investment, and these sectors often represent important property interests in the country.

Political and technical problems associated with the identification of sectors that can be reduced in order to promote fiscal space in the case of political consensus can be overcome through the implementation of the following strategies:

They are well-developed approaches to the public finance management, which ensure evidence and rationality in the development of the public policy.

New public investment can be revised; for example, social consequences of many large infrastructure projects or the rescue of banking systems are generally limited but require significant public resources. Budget items with high running costs but small social consequences should also be revised. For example, reduce military spending to fund the necessary social investment.

New public investments can be revised; for example, social consequences of many large infrastructure projects or the rescue of banking systems are generally limited but require significant public resources. Budget items with high operating costs but small social consequences should also be revised. For example, military spending should be reduced to fund the necessary social investment.

Optimization of energy subsidies can be an excellent opportunity for the development of social protection systems.

Both experts and governments recognize the nature of subsidies for fossil fuels as harmful in terms of sustainable development (in particular, in the final document "Rio+20", declarations of the G20 countries, OECD (2012)). Such subsidies cause low prices for energy consumers, stimulate its wasteful use. Studies and discussions on energy subsidies have already begun in Russia, but the situation in this area has not been widely discussed in the Republic of Kazakhstan yet.

Direct subsidization of producers in Kazakhstan is carried out mainly through supporting investment in the development and modernization of the energy infrastructure and development of the oil and gas sector. According to experts, the amount of such subsidies was $2.19 bln for the period of 2009-2015 (Organization for Economic Cooperation and Development, 2013).

Although this is related to the previous paragraph, a deeper analysis of investment in the sector is needed to eliminate inefficiencies.

In particular, the overall cost-effectiveness of a particular program or policy should be objectively assessed in accordance with various factors, including:

(i) coverage (by beneficiaries and benefits); (ii) total cost (as a percentage of GDP, government spending and sector expenditures); (iii) administrative costs (as a percentage of total costs and how costs are compared to other programs) – for example, testing of targeted use of funds is usually expensive, (iv) long-term social benefits and positive externalities, and (v) alternative costs (how this policy / program is compared to alternatives).

Improving the efficiency of sectoral resource allocation also involves strengthening supervision and inspections, as well as reducing corruption.

Corruption can also become a significant source of fiscal space for the socioeconomic development. Strengthening transparency and efficient governance practices, combating illegal financial flows can increase the availability of resources for socioeconomic development. Although reprioritization of spending in the public sector can be a good starting point for expanding the budget space, other options should also be considered.

B) Increase in tax revenue

Improving tax compliance and/or increasing tax rates are potential strategies for mobilizing additional public resources without sacrificing other expenditure priorities. However, new taxes improve state revenues only if they are properly developed and implemented.

Aside from strengthening the overall financial situation of the country, new tax proceeds can potentially contribute to the achievement of justice cause, especially in the face of widespread inequalities. For example, if income tax rates grow among the richest population groups in the country, additional income can be generated and invested in low-income and vulnerable households, which will lead to poverty and inequality reduction and support inclusive growth in the long term.

Unlike the justice-based progressive policy, the tax regime of the Republic of Kazakhstan can be described as regressive to the extent that it makes up a large percentage of income from poor households than from rich households.

In particular, the Government of the Republic of Kazakhstan largely relies on value-added taxes (VAT), on incomes that have the greatest impact on the poor population, as a rule, as they spend most of their income on basic goods and services if they are not exempt from taxes.

In the light of this reality, it is very important for distributional impacts to be at the forefront of tax policy discussions – between income groups and regions. Given the urgent need to expand the financial space for equitable development, the Government of the Republic of Kazakhstan needs to work on increasing tax revenues.

Since non-renewable natural resources are the most important source of the national wealth in the Republic of Kazakhstan, the Government of the country should consider ways to efficiently and equitably distribute the rent for minerals between the society in support of socioeconomic development initiatives.

The government can receive revenues either by extracting natural resources directly through a state enterprise, joint ventures or other forms, or by obtaining additional revenues for social investment through the sale of exploitation rights and taxation of mining assets.

As such, there are a national potential for funding social protection and other goals of sustainable development in the Republic of Kazakhstan. All options, including potential risks and compromises associated with each opportunity, should be carefully explored and considered in the framework of social dialogue to promote the socioeconomic development of the country with jobs and social protection of the population of the Republic of Kazakhstan.

The results, which allow to formulate the following conclusions, have been obtained within the conducted study:

Akyüz, Y. (2014). Internationalization of Finance and Changing Vulnerabilities in

Emerging and Developing Economies, UNCTAD Discussion Paper No. 217 Geneva, UNCTAD.

Annual reports on the execution of the republican budget for 2012, 2013, 2014, 2015, 2016. Official website of the Ministry of Finance of the Republic of Kazakhstan. Date View January 15, 2018 http://www.minfin.gov.kz/irj/portal/anonymous?NavigationTarget=ROLES://portal_content/mf/kz.ecc.roles/kz.ecc.anonymous/kz.ecc.anonymous/kz.ecc.anonym_budgeting/budgeting/reports_fldr/yearly_reports

Barrientos, A. (2004). ‘Financing Social Protection’, Draft Theme Paper 2, report prepared for DFID, Institute of Development Policy Management (IDPM), Manchester. Date View January 15, 2018 http://www.gsdrc.org/document-library/financing-social-protection/

Beitler, D. (2010). Raising revenue: A review of financial transaction taxes throughout the world, A report for Health Poverty Action and Stamp Out of Poverty. London: Just Economics.

Boerma, T., Eozenou, P., Evans, D., Evans, T., Kieny, M.-P. and Wagstaff, A., (2014).: Monitoring progress towards universal health coverage at country and global levels”, in PLoS Med, 11(9).

Cichon, M., Scholz, W., van de Meerendonk, A., Hagemejer, K., Bertranou, F. and Plamondon, P. (2004). Financing social protection. Quantitative Methods in Social Protection Series. Geneva, International Labour Office. International Social Security Association

Duran-Valverde F. and Pacheco, J.F. (2012). Fiscal space and the extension of social protection: Lessons from developing countries, Extension of Social Security (ESS) Paper No. 33. Geneva: International Labour Organization

ESCAP Resolution 67/8: Strengthening social protection systems in Asia and the Pacific. United Nations ESCAP. Date View January 15, 2018 http://www.unescap.org/ru/node/5560

ESCAP. Time for Equality: The Role of Social Protection in Reducing Inequalities in Asia and the Pacific. Date View January 15, 2018 http://www.unescap.org/resources/time-equality-role-social-protection-reducing-inequalities-asia-and-pacific

ESSPROS Manua. The European System of integrated Social PROtection Statistics (ESSPROS). Eurostat. (2008). Date View January 15, 2018 http://ec.europa.eu/eurostat/ramon/statmanuals/files/KS-RA-07-027-EN.pdf

European Communities (2010). European Report on Development: Social protection for inclusive development. San Domenico di Fiesole: Robert Schuman Centre for Advanced Studies. European University Institute

Fiszbein, A., Kanbur, R. and Yemtsov, R. (2013): Social Protection, Poverty and the Post-2015 Agenda. World Bank Policy Research Paper, 6469. Washington DC: World Bank

García A. B. and Gruat J.V. (2003). Social Protection Sector, ILO. Social protection: a life cycle continuum investment for social justice, poverty reduction and development. GENEVA

Griffiths, J. 2014. The state of finances for developing countries 2014. Brussels, European Network on Debt and Development (EURODAD)

Harris, E. (2013), "Social Security Financing Gender: Considerations of Fiscal Space. Comment Issa, 66 (3-4), 111-140.

Heller, P. (2005). “Fiscal space—what it is and how to get it”. Finance and Development. International Monetary Fund, 42 (2)

Hidrobo, M., Hoddinott, J., Kumar, N. and Olivier, M. (2014). Social protection and food security. Working paper prepared by the International Food Policy Research Institute. Washington: DC,IFPRI

ILO: Principles of Social Security. (1998). Geneva, pp. 8

ILO: World Labour Report: Income security and social protection in a changing world. (2000). Geneva, pp. 29;

International Covenant on Economic, Social and Cultural Rights. (1966). Adopted and opened for signature, ratification and accession by General Assembly resolution 2200A (XXI) of 16 December 1966 entry into force 3 January 1976, in accordance with article 27. Date View January 15, 2018 http://www.ohchr.org/EN/ProfessionalInterest/Pages/CESCR.aspx

Kak izmenitsya razmer pensiy v Kazakhstane v 2018 godu [How the size of pensions will change in Kazakhstan in 2018]. Kostanay News http://kstnews.kz/news/kazakhstan?node=39736

Law of the Republic of Kazakhstan No. 113-VI dated November 30, 2017 "O respublikanskom byudzhete na 2018 – 2020 gody [On the republican budget for 2018-2020]". Date View January 15, 2018 http://www.pavlodar.com/zakon/?dok=06380&uro=110002

Law of the Republic of Kazakhstan No. 246 dated July 17, 2001 "O gosudarstvennoy adresnoy sotsialnoy pomoshchi [On state targeted social assistance]". Date View January 15, 2018 http://adilet.zan.kz/rus/docs/Z010000246_/history

Law of the Republic of Kazakhstan No. 25-VI ZRK dated November 29, 2016 "O respublikanskom byudzhete na 2017-2019 gody [On the republican budget for 2017-2019]". Date View January 15, 2018 http://base.spinform.ru/show_doc.fwx?rgn=91709

Organization for Economic Cooperation and Development. Energy Subsidies and Climate Change in Kazakhstan: final draft report. Annual Meeting of the Task Force for the Implementation of the Environmental Action Program (EAP Task Force). September 17-18, 2013, Tbilisi, Georgia. ENV/EPOC/EAP(2013)7. Date View January 15, 2018 www.oecd.org EAP(2013)7_EHS report_RUS.pdf

Ortiz I., Durán-Valverde, F., Pal, K., Behrendt, C. and Acuña-Ulate, A. (2003). Universal social protection floors: Costing estimates and affordability in 57 lower income countries. International Labour Office. Geneva: ILO, 2017 (Extension of Social Security Series No. 58)

Ortiz, I. and Cummins, M. and Karunanethy, K. (2015)., Fiscal Space for Social Protection and the SDGs: Options to Expand Social Investments in 187 Countries. Available at SSRN: Date View January 15, 2018 https://ssrn.com/abstract=2603728

Overview of Third International Conference on Financing for Development. Investing in the future we want. UN Web Services Section, Department of Public Information, Date View January 15, 2018 http://www.un.org/sustainabledevelopment/ffd/

Recommendation concerning National Floors of Social Protection. Adoption: Geneva, 101st ILC session (14 Jun 2012). Status: Up-to-date instrument. Date View January 15, 2018 http://www.ilo.org/dyn/normlex/en/f?p=NORMLEXPUB:12100:0::NO::P12100_INSTRUMENT_ID:3065524

SDGNOTE. SOCIAL PROTECTION. SDG 1.3. International Labour Organization. Date View January 15, 2018 http://www.ilo.org/wcmsp5/groups/public/---dgreports/integration/documents/genericdocument/wcms_561758.pdf

The Law of the Republic of Kazakhstan No. 426-V dated November 30, 2015 "O respublikanskom byudzhete na 2016 - 2018 gody [On the republican budget for 2016-2018]". Date View January 15, 2018 http://online.zakon.kz/Document/?doc_id=1026672#pos=1;-117

The outcome document of the UN Conference on Sustainable Development "Rio+20" "The Future We Want" (2012). Date View January 15, 2018 http://www.uncsd2012.org/thefuturewewant.html

UN General Assembly, International Covenant on Economic, Social and Cultural Rights, (16 December 1966), United Nations, Treaty Series, vol. 993. Date View January 15, 2018 http://www.refworld.org/docid/3ae6b36c0.html

World Social Protection Report 2017–19: Universal social protection to achieve the Sustainable Development Goals. (2017). Geneva: ILO

1. Almaty Management University, 050060, Kazakhstan, Almaty, Rozybakiyev Ave., 227, E-mail: alma1984@mail.ru

2. Almaty Management University, 050060, Kazakhstan, Almaty, Rozybakiyev Ave., 227

3. Narxoz University, 050035, Kazakhstan, Almaty, Zhandossov Ave., 55