Vol. 39 (Nº22) Year 2018. Page 3

Vol. 39 (Nº22) Year 2018. Page 3

Ekaterina L. VODOLAZHSKAYA 1; Andrey V. BYSTROV 2

Received: 02/03/2018 • Approved: 02/04/2018

ABSTRACT: The relevance of the issue stated in the paper is due to the fact that the acceleration and complication of economic and innovative processes in the modern economy poses a new task for the states – to ensure the transition to the formed sixth technological order and take a leading position in the global innovation development. The purpose of the paper is to analyze the socio-economic and innovative trends in the Russian industry and to develop factorial models of cyclic nature on their basis. The component and factor model of the Russian national innovation system cyclicality for allocated phases of the cyclicality is proposed. The materials of the paper are of theoretical and practical importance for the development of models for managing the cyclicality of socio-economic and innovative development, as well as while formation of the strategy of the state economic, industrial and innovation policy. |

RESUMEN: La relevancia del tema planteado en el documento se debe al hecho de que la aceleración y la complicación de los procesos económicos e innovadores en la economía moderna plantea una nueva tarea para los estados: asegurar la transición al sexto orden tecnológico formado y tomar un liderazgo posición en el desarrollo de la innovación global. El propósito del documento es analizar las tendencias socioeconómicas e innovadoras en la industria rusa y desarrollar modelos factoriales de naturaleza cíclica en su base. Se propone el modelo de componentes y factores de la ciclicidad del sistema ruso de innovación nacional para las fases asignadas de la ciclicidad. Los materiales del documento son de importancia teórica y práctica para el desarrollo de modelos para gestionar la ciclicidad del desarrollo socioeconómico e innovador, así como al tiempo que se forma la estrategia de la política económica, industrial e de innovación del estado. |

The state and proportions of economic development are an important basis for the competitiveness and economic sustainability of countries, regions, industrial complexes, enterprises, citizens. The evolution of technological changes, which is ideal in the classical developmental conditions of the economic system, is significantly transformed in the modern world under the influence of globalization processes, relative openness of production systems, different rates of development of economically developed and developing countries. Not being new one in the categorical aspect, the problem of ensuring stability of economic systems has specifics in Russia, with different success trying to adopt models of innovations of economically developed countries. This specificity has been further exacerbated by the forced transition to an import substitution policy, which seems to be an important and difficult tool for ensuring the stability and independence of the national innovation system functioning, increasing its scale and spreading the ideology of innovation among the broad masses of economic entities of the primary level in the economy (its real sector).

In our view, there is a theoretical and methodological problem of developing a paradigm for managing the transition to a new technological system in crisis conditions, the purpose of which is to achieve true sustainability of development with the preservation and development of internationally competitive potential. In the meantime, the efforts of the state are isolated, in spite of the fact it has formulated a list of priority directions for the development of science, technology, technique and critical technologies, for which priority funding is allocated, institutions for the development of innovation are created, strategic initiatives are formed in the direction of the development of a new technological mode, funds to support innovation are formed, on the one hand, and real efforts of enterprises are carried out, on the other, in the conditions of existing distortions in the structure of added value, not allowing to carry out full transition to new model of managing for the sectors relating to different technological arrangements. We must admit that the active development of the IT sector is due to its low need for capital investment, fast return. At the same time, being one of the final links in the progressive development of technological systems, innovative development will be sustainable in the situation of the entire chain reproduction of material production and services. The Russian economy is characterized by significant problems in the field of innovation, gaps for low - and medium-tech industries, some of which are lost, but it has not found a full replacement that guarantees the sustainability of macroeconomics, its self-sufficiency, on which we have to focus special attention. The recovery of demand for innovation from the real sector of the economy is possible through the formation of competitive supply throughout the life cycle of high-tech products creation and at different levels of the innovation process participants’ operation.

The issues of stability and equilibrium, the crisis phenomena in the economy, the logic of their emergence and driving forces, the content of sustainable development concept, life cycle at various levels of research are reflected in the studies of D. Riesman (1958), F. Machlup (1962), P. Drucker (1969), D. Bell (1973), P. Romer (1992), S.Yu. Glazyev (1993), D. North & J. Wallis (1994), E. Toffler (1999), D. Wolfe (2003), A.I. Shinkevich et al. (2016), S.S. Kudryavtseva et al. (2016) and other representatives of Economics. The problem of crisis phenomena in the domestic economy is also widely represented in the economic literature, but to a lesser extent it concerns anti-crisis solutions aimed at ensuring sustainable development.

In the course of the research the following methods were used: analysis, synthesis, system analysis, systematization and generalization of facts, modeling, and comparison method, descriptions, analogies, and component and factor analysis.

The theoretical basis of the research is formed by the fundamental and applied works of foreign and domestic scientists who study the regularities of national innovation systems cyclicality engaged in the development of management tools of the innovation economy.

The study was conducted in three stages:

– At the first stage-the preparatory stage-the current state of the studied problem in the theory and practice of innovation management was analyzed; a program of research technique was developed;

– At the second stage-the main stage - on the basis of available statistical data of social-economic and innovative development of the Russian economy, the analysis of trends with identification of regularities on these aspects was carried out, the factorial model was developed of modern Russia economy's cyclicality on the allocated phases of a cycle;

– At the third stage – the final stage – systematization, comprehension and generalization of results of research were carried out; theoretical conclusions were specified; processing and registration of the research’s received results were performed.

Turning to the modeling of cyclical factors as a basis for the development of a conceptual model of management the transition to the technological system, it is necessary to identify the following problematic points of methodological nature in the field of modeling and forecasting:

– with all the variety of modeling techniques and methods, the complexity of technical means for calculation the parameters of the model one has to take into account "the paradox of complexity", not allowing to reveal the flawless quality of the forecasting model, so the development of a quality management model of transition to new technological way requires guiding the development’s compact model that takes into account different scenarios of resource constraints;

– When developing models of innovative development in Russia it is necessary to take into account:

– first, the existence of an "institutional Pat" of assessment (Semenov, 2003) due to the non-comparability of innovative development quantitative assessment at different times, as they are characterized by different institutional environments;

- secondly, the related nature of changes model in the adequate level of the system macroeconomic development (if the issues of transition to a green economy are relevant for developed countries, then developing countries, which include Russia, will inevitably require overcoming the intermediate stages in development caused by the modernization of the 4-th and 5-f technological order, which are characterized by an increase in the consumption of raw materials in the mass production process). Otherwise, it is possible to degrade for the production complex of the macroeconomic system by the type of coexistence of the raw materials sector and the service economy);

- third, the need to ensure the implementation of the global optimum model for certain borders of the system development taking into account the needs of sustainable development of local economic systems; in the case of Russia, it can be both macroeconomic borders of the country (which is difficult to provide with small volumes of markets, small number of human resources, insufficient level of their skills) and the borders of the Customs Union.

Taking into account the above-mentioned provisions, as well as the theoretical provisions and results of the analysis of the Russian economic system’s specifics, one can analyze the main parameters of the macroeconomic system behavior from the beginning of market reforms to the present time from the position of cyclicality (Shinkevich et al., 2016).

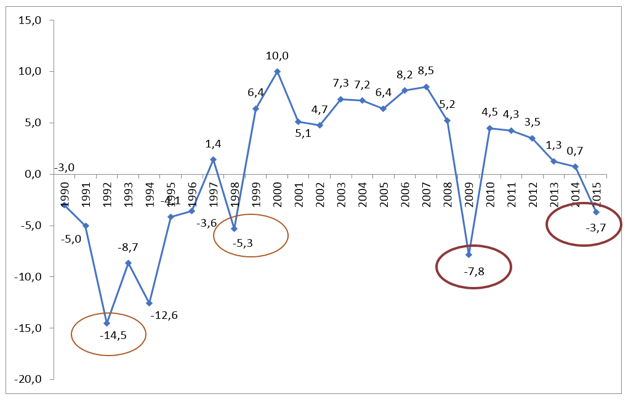

The data in Figure 1, which reflects the dynamics of growth (decline) of the main macroeconomic indicator – GDP, allow distinguishing 4 points of decline, which can be stated as the achievement of the recession phase of the Russian economy during the crisis: the 1st point – 1992. - the decline in GDP was 14.5%, the 2-nd point -1998. - 5.3%; the 3-d point-2009. - 7, 8%, the 4-th point-2015. - 3.7%.

Figure 1

The rate of growth (decrease) of GDP, in % to the previous year

The transition of the Russian economy to the model of catching-up development of economically developed countries has predetermined the change in the structure of production, since in the innovation economy the increase in gross added value is provided by the service sector, while industry has a secondary role. Until 1992, the share of industry in the structure of production in GDP formation exceeded the share of the services sector. However, after the turning point of the perestroika period, the ratio changed and only increased in subsequent years. The largest excess of the share of the service sector relative to industry in GDP formation is observed in 2003-61,2% against 32,6%; in 2009 – 61,7% against 33,6%; in 2014 - 63,7% against 32,1%. At the end of 2015 the service sector in GDP was 62.8%, the share of industry – 32.6%. According to the World Bank (from World Bank, 2018), the decline in the main macroeconomic indicators was accompanied by stagflation. The largest increase in CPI was observed in 2000-21.5%, in 2005 – 12.7%, in 2008 - 14.1%, in 2015 – 15.5%, which suggests the cyclicality associated with fluctuations in business activity, market conditions and psychological factors (Federal State of Statistics Service, (2018).

Analysis of innovation activity indicators has shown that the trends in Russia are similar to global trends. For example, despite the impact of the post-crisis consequences in the Russian economy after 2008, R & D spending as a percentage of GDP increased from 1% to 1.3%, a similar trend was noted in 2014, when the value of the indicator increased compared to the previous year from 1.1% to 1.2%. Consequently, the phase of fundamental and applied research in the life cycle of innovation, despite the post-crisis phenomena in the economy, was seen as an engine of development, a source of economic growth. However, the percentage ratio of R & D expenditures to GDP in Russia compared to developed countries has always been significantly lower (figure 2).

Figure 2

R&D expenditure (in percent to GDP)

According to Rosstat (from gks), the highest level of innovation activity of organizations was observed in 2011 – 10.4% of organizations, carried out technological, organizational, marketing innovations, in the total number of surveyed organizations. Further, the share of innovation-active organizations decreased annually, amounting to 9.3% in 2015.

Thus, the analysis showed that the economic development of the Russian economy clearly observed the following points of decline during the growth of crisis: the 1-st wave – 1992; the 2-nd wave – 1998; the 3-d wave – 2008; the 4-th wave – 2015.

Taking into account the simultaneous influence of many factors that cause crisis phenomena in the Russian economy, one can use modeling tools that are adequate for taking into account their mutual influence. Using the tools of economic and mathematical modeling, one can define the key factors of the Russian economy’s development using the principal component method. To identify the determinants of development, one can be abstracted by two medium-term periods characterized by economic cycles and achievements of the crises’ "bottom". The first stage will be limited to the following dates: 1998-2007.; the second stage-2008-2015.

Among the indicators of socio-economic development in the modeling will be used the following ones:

1. Bank outstanding loans to gross total loans gross, %;

2. Gross capital formation, % of GDP;

3. GVA industry, in % to GDP;

4. The GVA of the service sector in % to GDP;

5. Domestic credit to the private sector, in % to GDP;

6. Income in % to GDP;

7. Imports of goods and services in % to GDP;

8. Gini index;

9. The CPI for goods and services, %;

10. GDP growth, %

11. Foreign direct investment, net inflow, millions of United States dollars;

12. R & d expenditure in % to GDP;

13. Expenditure in % to GDP;

14. Reserves, millions of United States dollars;

15. Current account balance, millions of United States dollars;

16. Exports of goods and services in % to GDP.

At the first stage of the analysis, the main components were determined by The Kaiser criterion. The results of the main components’ selection showed that it is expedient to group the indicators into three groups in the factor model of the Russian economy’s economic development.

As a result of multidimensional statistical analysis for the first cyclic wave (1998-2007) 16 initial indicators using the method of rotation - Varimax raw (the value of factor loads was taken into account more than 0.6) were divided into 3 groups of integral factors, the economic interpretation of which shows their qualitative and quantitative contribution to economic development (table 1).

Table 1

Results of factor analysis using the principal component method for the first cyclic wave (1998-2007).)

Indicators |

Factor 1 (component of the internal and external operations) |

Factor 2 (sector component) |

Factor 3 (macroeconomic component) |

Domestic credit to the private sector, in % to GDP |

0,97 |

|

|

Reserves, millions of United States dollars |

0,93 |

|

|

Imports of goods and services in % to GDP |

-0,93 |

|

|

Foreign direct investment, net inflow, millions of United States dollars |

0,91 |

|

|

Gini index |

0,89 |

|

|

Current account balance, millions of United States dollars |

0,79 |

|

|

Exports of goods and services in % to GDP |

-0,73 |

|

|

Bank outstanding loans to gross total loans gross, % |

-0,64 |

|

|

The CPI for goods and services, %; |

-0,62 |

|

|

R & d expenditure in % to GDP |

|

-0,96 |

|

GVA industry, in % to GDP |

|

0,94 |

|

The GVA of the service sector in % to GDP |

|

-0,92 |

|

Income in % to GDP |

|

-0,60 |

|

Gross capital formation, in % to GDP |

|

|

0,94 |

GDP growth, % |

|

|

0,92 |

Expenditure in % to GDP |

|

-0,81 |

|

Total variance |

6,78 |

3,76 |

3,81 |

The proportion of the total variance |

0,42 |

0,24 |

0,24 |

So, the first integral factor is economically interpreted as "the component of internal and external operations" (includes 9 indicators; The share of the factor’s contribution in the development of the economy amounted to 42%), the second factor - as "industry component" (4 indicators; the percentage contribution of the factor – 24%), third factor as "macroeconomic" component (3 indicators; the percentage contribution of the factor – 24%). Thus, the total contribution of the selected factors in the cyclicality of economic development of the Russian economy in the period from 1998 to 2007 was 96%.

As a result of multidimensional statistical analysis for the second cyclic wave (2008-2015) 16 initial indicators using the method of rotation Varimax raw (factor loads were taken into account more than 0.6) were also divided into 3 groups of integral factors (table 2).

Table 2

Results of factor analysis using the principal component

method for the second cyclic wave (2008-2015).)

Indicators |

Factor 1 (external operations component) |

Factor 2 (sector and macroeconomic components) |

Factor 3 (internal operations component) |

Bank outstanding loans to gross total loans gross, % |

-0,91 |

|

|

Gini index |

0,91 |

|

|

Expenditure, in % to GDP |

-0,87 |

|

|

GDP growth, % |

0,85 |

|

|

R & d expenditure in % to GDP |

-0,84 |

|

|

Income in % to GDP |

0,72 |

|

|

The GVA of the service sector in % to GDP |

|

-0,96 |

|

GVA of industry, in % to GDP |

|

0,95 |

|

Domestic credit to the private sector, in % to GDP |

|

-0,83 |

|

Gross capital formation, in % to GDP |

|

0,70 |

|

Exports of goods and services in % to GDP |

|

0,70 |

|

Current account balance, millions of United States dollars |

|

0,65 |

|

Reserves, millions of United States dollars |

|

|

-0,92 |

The CPI for consumer goods, % |

|

|

0,85 |

Imports of goods and services in % to GDP |

|

|

0,61 |

Total variance |

5,55 |

5,27 |

3,37 |

The proportion of the total variance |

0,35 |

0,33 |

0,21 |

For the second cyclical wave, the first integral factor is economically interpreted as a "component of external operations "(includes 6 indicators; the share of factor contribution to economic development was 35%), the second factor – as "sector and macroeconomic component "(6 indicators; the share of factor contribution – 33%), the third factor – as a "component of internal operations " (3 indicators; the share of factor contribution – 21%). Thus, the total contribution of the selected factors in the cyclical nature of economic development of the Russian economy in the period 2008-2015 was 89%.

Based on the results of economic and mathematical modeling, it should be noted that the ratio of the components of the first and second cyclic waves has changed. However, in the first factor load in both cases, the following indicators were structure-forming ones:

1 factor: "Bank unsecured loans to gross loans,%" (for the first cyclic wave the factor load was "minus" 0.64, for the second - "minus" 0.91, strengthening the non-main influence on the development of crisis phenomena in the economy);

2 factor: "GVA of industry, in % to GDP" (for the first cyclic wave factor load was 0.94, for the second - 0.95); "GVS of the service sector, in% of GDP" ("minus" 0.92 and "minus 0.96, respectively).

The development of management technology based on the multidimensional statistical analysis of crisis factors / development of the domestic economy presupposes a choice that is relevant for stimulating the institutional unit at the micro level. Let us analyze the change in the size of enterprises in the context of global crisis processes, taking into account the existence of two hypotheses relevant to the study: large enterprises have less incentive to innovate; with the development of new technological structures, the networks of medium and small companies become relevant one. The analyzed model of anti-crisis measures, implemented in 2008 and compiled in 2014, indicates that the main support was provided to the systemically important enterprises of Russia.

To increase the sustainability of the Russian economy’s functioning, as well as to reduce the negative consequences of possible crisis phenomena, the Government of the Russian Federation (Minutes of the meeting of the Government Commission for Economic Development and Integration No. 1 of February 5, 2015) approved a list of backbone organizations (hereinafter - the List), which included:

- the largest legal entities in the jurisdiction of the Russian Federation, which have a significant impact on the formation of GDP, employment of the population and social stability and carrying out activities in the sectors of industry, agro-industrial complex, construction, transport and communications;

- legal entities in the jurisdiction of the Russian Federation, which have a significant impact on the formation of GDP, employment and social stability and are part of industrial groups, holding structures, vertically integrated companies (the list indicates the name of the management company or parent organization of the group);

- organizations that carry out their activities, including in the territory of the Russian Federation, which have a significant impact on the formation of GDP, the managing companies of which are located in foreign jurisdictions.

The list includes 197 organizations, including holdings and vertically integrated companies, whose profits form more than 70% of the total national income, and the number of employees is more than 20% of the total number of employed in the economy.

When preparing the List, the company's annual revenues, tax deductions to budgets of all levels, the number of employees, as well as the presence of a significant market share and the impact on social and economic stability in the constituent entities of the Russian Federation was taken into account.

The importance of such measures is due to the fact that as a result of the crisis processes large companies can significantly decrease in size and move to the rank of medium-sized firms.

The question of the expediency of supporting large enterprises in the context of stimulating during the transition to a new technological structure seems to be controversial, requiring consideration of the economic cycle’s existing phase. Investigations of the connection between the dominant business values in connection with the phase of the cycle are quite new for cyclicality researchers, but at the same time we use the data and conclusions obtained by V.E. Dementiev (2009) in the work. In particular, the idea of the insufficiency of "anchor" enterprises for the transition to a new technological structure, the presence of factors of large corporations’ dominance in times of crises of changing long waves of technological development is important. Researchers believe that the development of the 6th long wave (2015-2060) will be accompanied by network making in business within the post-industrial economy, which is certainly true, but only when taking into account the circumstances of maintaining the basic parameters of mass high-performance of primary resource production. The effectiveness of macro technologies, in the implementation of which the production sector of macroeconomic systems is involved, cannot be supported at the expense of small companies and their networks, since in this case the necessary economies’ scale will not be ensured.

Crisis conditions for functioning at the macro level leave an imprint on innovative development: in a stable development situation, innovations are the basis for its preservation, combating the crisis, and in an unstable situation, there is a depression in the innovation sphere. The stability of innovative development is affected by many factors and circumstances, based on the results of which a number of conclusions is made.

In the domestic economy, according to the results of the analysis, four distinct points of decline are singled out: the 1st wave - 1992; the 2-nd wave - 1998; the 3-d wave - 2008; the 4-th wave - 2015 - a consequence of structural crises and disruption of the "normal" cyclical nature of economic development under the influence of partly local, partly global factors - constraints on innovation.

The lack of incentives for innovative development is believed to be due to the lack of scale of the Russian-controlled technological zone, which implies the need for its expansion in order to bring the national innovation system to a self-sustaining break-even development, including through the proper use and redistribution of "investment influences" and the financial expansion of such zone.

The study of the interdependence of key factors in the development of the Russian economy allows us to draw the following conclusions. The study of the complex influence of factors is based on two periods: 1998-2007, and 2008-2015. As a result of the analysis, for the first period, three major factors are identified that affect the changes in economic development: the first and most weighty one characterizes the degree of openness of the Russian economy, the second -the established structure of the production contour of the macroeconomic system; the third - the macroeconomic parameters of the economy as a whole. After clarifying the relationship and its structuring within the framework of the second stage, a slightly different picture becomes noticeable. While the openness of the economy continues to determine the trajectory of the crisis, the macroeconomic and sector factors of the Russian economy have somewhat changed their influence, the third group contains the factors of the specifics of internal operations. This allows us to make a conclusion about the appropriate means of stimulating the transition to a new way of life. Determining ones are the influence of two factors - the financial sector and the structure of gross value added.

The materials of the paper are of theoretical and practical importance for the development of models of cyclicality management of socio-economic and innovative development, as well as in the formation of the strategy of state economic and innovation policy.

Taking into account the obtained results of this research, it is possible to single out a number of scientific issues and promising directions that require further consideration: the deepening and expansion of certain provisions set forth in the paper related to the transition to a new technological order and Russia's role in the innovation economy.

Bell, D. (1973). The coming of post-industrial society: A venture of social forecasting. New York: Basic Books.

Dementiev, V. E. (2009). Overtaking development through the prism of the theory of "long-wave" technological dynamics: the aspect of "windows of opportunities" in crisis conditions. Russian economic journal, 1, 34-48.

Drucker, P. (1969). The Age of Discontinuity, Guidelines to our changing society. New York.

Federal State of Statistics Service. (2018). Retrieved from: http://www.gks.ru.

Glazyev, S. Yu. (1993). The theory of long-term technical and economic development. - Moscow: ValDar.

Kudryavtseva, S. S., Shinkevich, A. I., Ostanina, S. Sh., Vodolazhskaya, E. L., Chikisheva, N. M., Lushchik, I. V., Shirokova, L. V. & Khairullina, E. R. (2016). The Methods of National Innovation Systems Assessing. International Review of Management and Marketing, 6(2), 225-230.

Machlup, F. (1962). The production and distribution of knowledge in the United States, Princeton: Princeton University Press.

North, D. & Wallis, J. (1994). Integrating institutional change and technological change in economic history: a transaction cost approach. Journal of Institutional and Theoretical Economics, 150(4), 609-624.

Riesman, D. (1958). Leisure and Work in Post-Industrial Society. Glencoe: Free Press.

Romer, P. (1992). Increasing Returns and New Developments in the Theory of Growth. NBER Working paper, 1, 30-98.

Semenov, V. P. (2003). Management of innovation-investment process in entrepreneurship: theory and methodology. St. Petersburg: St. Petersburg State University of Engineering and Economics.

Shinkevich, A. I., Kudryavtseva, S. S., Razdrokov, E. N., Lushchik, I. V., Vodolazhskaya, E. L., Ostanina, S. Sh. & Sharafutdinova, M. M. (2016). Method for Assessing of the Level of National Innovation Systems Openness from the Institutional Approach Perspective. International Journal of Environmental and Science Education, 9, 10505-10515.

The world Bank. (2018). Retrieved from https://data.worldbank.org/indicator.

Toffler, E. (1999). The third wave. Moscow: Academia.

Wolfe, D. (2003). Clusters Old and New: The Transition to a Knowledge Economy in Canada's Region. Kingston: Queen's School of Policy Studies.

1. Kazan National Research Technological University, Kazan, Russia. Contact e-mail: vodolazhskaya86@bk.ru

2. Plekhanov Russian University of Economics, Moscow, Russia