Vol. 39 (Number 19) Year 2018 • Page 32

Tatiana Grigorievna BONDARENKO 1; Gyuzel Shayachmetovna ISHKININA 2; Ibragim Arbievich KHALIDOV 3; Anzor Uvaysovich SOLTAKHANOV 4

Received: 05/03/2018 • Approved: 25/03/2018

ABSTRACT: The article considers the modern principles of business planning at oil and gas companies in order to find uniform methodological principles and approaches to it, to forming management reporting at these companies and their subsidiaries and associated companies, as well as the procedure of interaction among them in terms of preparation, protection, adjustment and execution of business plans. The proposed method establishes uniform requirements for the management cost accounting and the cost formation of each technological process at the oil and gas enterprises. The aim of the method is to obtain operative and reliable information on each technological process and for each business unit. The goal of this study is to develop approaches to describing the list of planned financial and non-financial indicators, as well as algorithms for their planning in terms of detailing the methodology for planning indicators for the one-year horizon (12 months of the planned period and one month of the anticipated fact of the current period) and monthly sliding planning for the purpose of automation based on the existing practice at the oil and gas enterprises, as well as for enabling the calculation of the detailed budget models developed for their implementation in an automated system. The article describes the model of the prototype of the annual planning level of the plant, holding or joint-stock company, which can be implemented both in SAP modules and in MS Excel format for the purpose of visualizing the methodology of the future system implemented on the unified budget classifier. |

RESUMEN: The article considers the modern principles of business planning at oil and gas companies in order to find uniform methodological principles and approaches to it, to forming management reporting at these companies and their subsidiaries and associated companies, as well as the procedure of interaction among them in terms of preparation, protection, adjustment and execution of business plans. The proposed method establishes uniform requirements for the management cost accounting and the cost formation of each technological process at the oil and gas enterprises. The aim of the method is to obtain operative and reliable information on each technological process and for each business unit. The goal of this study is to develop approaches to describing the list of planned financial and non-financial indicators, as well as algorithms for their planning in terms of detailing the methodology for planning indicators for the one-year horizon (12 months of the planned period and one month of the anticipated fact of the current period) and monthly sliding planning for the purpose of automation based on the existing practice at the oil and gas enterprises, as well as for enabling the calculation of the detailed budget models developed for their implementation in an automated system. The article describes the model of the prototype of the annual planning level of the plant, holding or joint-stock company, which can be implemented both in SAP modules and in MS Excel format for the purpose of visualizing the methodology of the future system implemented on the unified budget classifier. |

Accounting for production costs and cost calculation for production/refining of oil, oil products and gas is part of a comprehensive accounting system at an enterprise based on primary documentation and inventory. The task of the cost calculation procedures is to timely and reliably determine the actual costs of production and primary cost of the oil and gas products, and to monitor costs at all stages of the company's operations. This requires the creation of a universal system of management accounting at enterprises, which allows to obtain actual costs for each area of activity or for each allocated subdivision in a comparable form, regardless of the organizational and production structure. Such an accounting system should allow to analyze the prevailing costs by the selected business units in terms of the following analytical aspects: technological processes, cost centers and calculation items. Large oil and gas companies are developing or have already implemented their own methodological and practical solutions to the issue under review. Small and medium-sized companies either don’t have cost calculation by processes or by business units at all or involve consulting companies in solving such problems. This is due to the lack of proprietary resources in medium-sized and small companies for developing quite extensive methodological and information solutions able to provide such accounting, in contrast to large companies with highly qualified personnel and corporate scientific and technical centers, such as in PJSC "OC Rosneft" or PJSC "LUKOIL". Implementation of typical projects on automation of financial and economic planning and analysis of its execution requires to develop business planning and management reporting methodology that includes the solution of tasks such as formalization of the financial structure and unification of management reporting, as well as its transition to the international financial reporting standards (hereinafter IFRS) .When such a project on financial and economic planning is implemented, close cooperation of specialists among the following structural divisions is extremely important: budgeting department by segments (business units, financial responsibility centers), IFRS department, IT department, methodology and tax planning department, legal department, internal audit department. It is important to correctly account for all the costs – for all technological links in the process chain, from oil and gas production to finding the primary cost of each process by a separate business unit, – in the process of developing algorithms for the transition to a uniform (from a methodological standpoint) standard of the planning and accounting process at oil and gas enterprises. The goal of the proposed methodical approach to the financial and economic planning at oil and gas enterprises is to obtain prompt and reliable information on each technological process or each business unit.

The works of the following Russian and foreign scientists in the field of technical, economic and financial analysis, financial management and budgeting in the fuel and energy sector of the economy served as theoretical and methodological basis of the study: A.V. Bukalov (Bukalov A.V., 2009), M.N. Grigoryev (Grigoryev M.N., 2002), A.A. Konoplyanik (Konoplyanik A.A., 2011), K.N. Milovidov (Milovidov K.N., Zhermolenko V.I., 1990), E.A. Telegina (Telegina E.A., 1996), P. Kotier (Kotier Philip, 1967).

Theoretical and methodological basis of the study. The authors relied on academic papers and applied developments of Russian and foreign scientists and practitioners on the reviewed problems in the field of setting and automating the planning processes at enterprises in general and at oil and gas companies in particular. The conducted study is based on general and special methods of economic analysis and scientific generalization. The authors used methods of mathematical statistics, correlation and regression analysis during the study, as well as other methods ensuring reliable processing and interpretation of analytical data, efficiency, consistency and unbiasedness of the parameters to be determined. The dialectical method of cognition and systematic approach to the problem examination were used in the work; general scientific and special research methods were applied: analysis (in particular, comparative analysis), synthesis, as well as historical and logical methods, table and graphical techniques.

Informational base. The study used materials provided by the Ministry of Industry and Energy of the Russian Federation, the Ministry of Natural Resources of the Russian Federation, the Ministry of Economic Development and Trade of the Russian Federation, and publications on the oil industry (The Russian Ministry of Energy expects that the transition to a profit-based tax for the oil industry will take place by 2016. URL: http://quote.rbc.ru/news//fond/2014/21/341000694.html), as well as the materials of conferences and workshops, official annual reports of oil and gas companies, domestic and foreign literature.

The purpose of introducing the fundamentals of end-to-end analytics is to describe the list of planned financial and non-financial indicators, as well as algorithms for their planning, which definitely must be recorded. This document assumes that the algorithms for planning the indicators for the one-year horizon (12 months of the planning period and from one month to one quarter of the anticipated fact of the current period) and monthly sliding planning are detailed.

The detailed planning should be determined on the basis of the company's existing practice and the requirements set by its internal business units, directorates/departments and enterprises in the group or holding in the course of financial and economic planning.

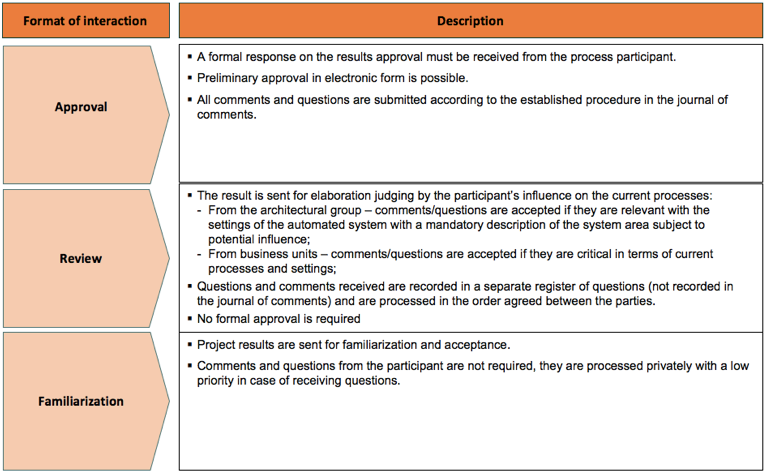

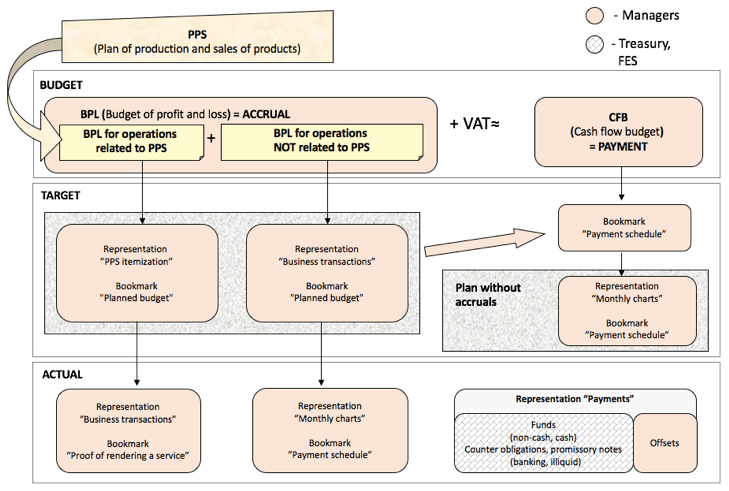

The recommended form for such planning is to plan in the budget model, in the appropriate automated system (for example, in the SAP module or in MS Excel). To ensure that the budget model meets the needs of all business structures, it is recommended to form it on the basis of articles and analytics of a unified budget classification (reference book). Such a reference book of the unified budget classification should be developed on the basis of the principle of maximum unification of all key analytics between the planning contour and various modules of the transaction system within the existing automated system (complex) of the enterprise. Types of participation in the procedure to set up end-to-end analytics are presented in Figure 1.

Figure 1

Types of participation in the procedure to set up end-to-end analytics

In this case, planning will be available both in a horizontal dimension (for example, revenue is planned in the context of the following main units: proceeds from the sale of finished goods, proceeds from the sale of resale goods, proceeds from the sale of services) and in vertical (for example, revenue will be planned in the context of the following key analytics according to the budgeting principles: sales regions (recipient's country), business partners (to allocate operations by counterparts), profit centers (allocation of a business structure in revenue), hierarchy of products (allocation of product groups), reference book for services (allocation of groups of sold services)).

After the corresponding plan for the one-year horizon (12 months of the planned period and 3 months of the anticipated fact of the reporting period) is released, it is edited by representatives of all business structures. This division will be required both for the preparation of the shareholder's report and for modeling the distribution of revenues by the employees of the budgeting department in amounts equal to the business units’ sales along the external perimeter and prices considering the specified intra-group margin among the business units of the company / holding / group of enterprises.

In turn, costs will also be planned in accordance with the budgeting principles in the context of primary cost elements, i.e. planning is carried out based on the primary source of costs (for example, the reference book for services (itemization of cost elements by certain services), type of internal orders (itemization of certain costs and complex collection of costs "by nature" into one group, for example: costs of cultural events), project types (to allocate costs for supporting fixed assets and costs for project activities), business partners (to allocate operations by counterparties), cost type (to allocate categories in the calculation of the conditional-constant costs).

In this case, the company's variable costs include the costs of raw materials, fuel, electricity, heat and other types of energy, which are normalized for the product output (or raw materials processing for certain enterprises). The non-standard material costs and the costs of non-standard energy are taken as fixed. The variable costs of enterprises are not limited. The rate of consumption for production/processing of a unit of finished goods (or raw materials in the case of processing) is controlled.

Volumetric figures of variable costs should be planned based on the production data, consumption rates from the specifications of the corresponding automated system module; prices for the raw materials write-off.

All non-standard material costs and other costs of the enterprise will be attributed to fixed costs and limited to: key accrual limits (regulated by the appropriate reference books) and limits for supporting fixed assets (with their further "descent" to the relevant enterprises of the group or business structure, including the execution of budgets of previous periods).

In turn, the key accrual limits will be formed on the basis of the following key indicators:

- actual data of the base period, or indicators of the business plan of the base period, depending on which indicator is smaller);

- material changes (new costs or savings on the costs of the base period that must be included in the base of future periods);

- deflator index, formed in business units;

- one-time costs (additional charges).

It is proposed to form limits for supporting fixed assets on the basis of indicators of the annually updated three-year program. Programs for supporting fixed assets must be ranked by their importance/relevance for the safety and efficiency of production of each individual enterprise and are approved by the internal business units / responsible functional unit.

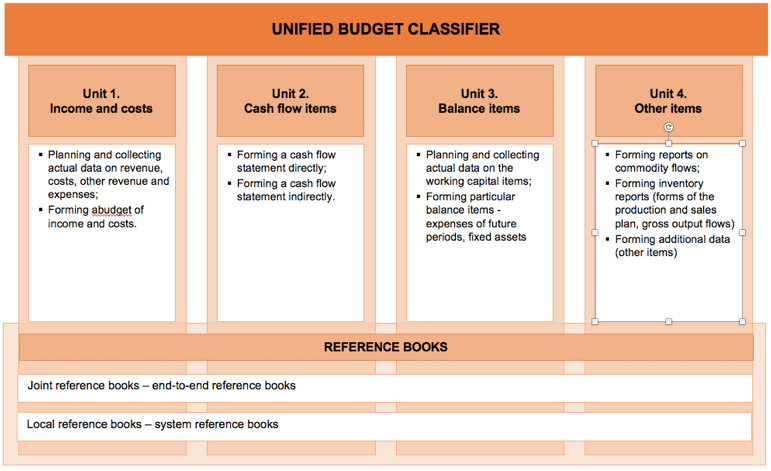

As already mentioned above, building a unified approach to the planning system requires to introduce a unified budget classifier, which is a set of items hierarchy (level 1) and analytical sections (level 2) used for planning and target-actual analysis of economic results of financial and economic activities of the oil and gas companies.

Level 1: the formation of a unified budget classifier is based on a hierarchical reference book of items intended for the initial input and reflection of planned and actual data.

It is assumed that this reference book consists of 4 units:

Unit 1. Income and costs

Unit 2. Cash flow items

Unit 3. Balance items

Unit 4. Other items

The items of the unified budget classifier are formed on the basis of the composition and level of itemization of the reporting forms and are grouped taking into account the homogeneity of items according to their economic content.

Level 1: analytical reference books should represent additional information direction of management reporting reflecting various aspects of financial and economic activities. Each value entered or calculated in the system of financial and economic planning and management reporting can be represented as an element of a multidimensional space that has a clearly defined property for each of the analytical dimensions.

Unified principles for the formation of a unified budget classifier should be adhered to:

- ensuring the completeness and adequacy of items and analytics in order to form the necessary planned reporting and conduct a target-actual analysis;

- no duplication of items and analytics, eliminating redundancy;

- providing end-to-end analytics for the most efficient data management:

- possibility of using homogeneous analytics to detail various items,

- maximum use of reference books of the existing automated system that are relevant for planning purposes;

- harmonization of items used at different levels of management and time horizons;

- itemization of reference books in accordance with the current needs of business (functions).

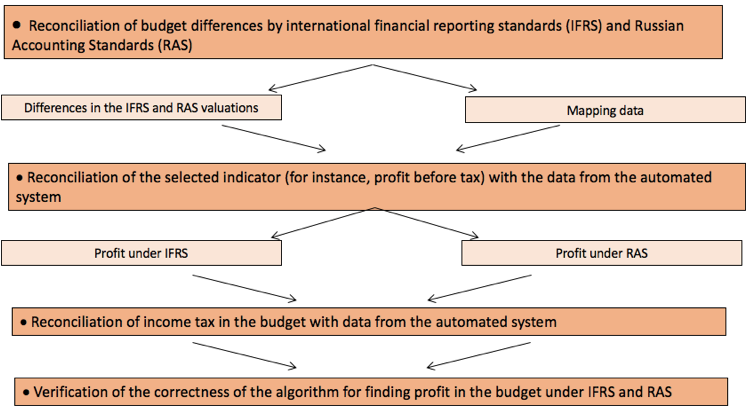

Schematic structure representation is shown in Figure 2.

Figure 2

Schematic representation of a unified budget classifier

As such, the use of a unified budget classifier in the planning and target-actual analysis by all companies in the oil and gas sector will ensure:

- the possibility to form main reporting packages of the structural divisions of the enterprise in the group/holding using a common, unified data structure;

- the comparability of target and actual data;

- the simplification of the consolidating procedure for the planned reporting at all management levels of all structural divisions of the enterprise, group of companies/holding.

Let's consider the basic principles of building and functioning of the prototype planning model. Its basis should be built on one planning period (for example, one month), which will enable its further transfer for any planning period. Part of the model reference books will be represented by real elements (for example, accounts, balance units, factories), and part will be represented by conditional elements (for example, catalog, product hierarchy, internal orders).

In this case, when the data are added to such a model for the required period of time, it will become a prototype of the one-year planning system of the plant or holding/group level, which will be implemented in the corresponding modules of the existing automated system as part of the project for its integrated implementation at the enterprise, group, or holding.

The present prototype model can be realized in MS Excel for the purpose of visualizing the methodology of the future system implemented on the reference books of the unified budget classifier.

The proposed list of aspects covered by this prototype model should include availability of the following functions:

- demonstration of analytical contexts and target view of various forms of data input and import (revenue, costs, material balance, semi-finished products, etc.);

- demonstration of analytical contexts and target view of various auxiliary reporting forms (reports on raw materials, reports by functions);

- explanation of the rules for selecting the elements of analytical reference books on forms for the purposes of input, analysis and viewing of data in the required contexts;

- explanation of the relationships among various analytical reference books (one reference book element is uniquely determined by the value of another reference book element, or the choice of one reference book element limits the choice of another reference book elements);

- color marking of various categories of data in the system (input, imported, estimated);

- color marking of integration points with data by the operating automated system;

- implementation of the method for forming the basic and auxiliary reporting forms on test data using links to data input/import forms or other reporting forms.

The prototype model will consist of three major form units:

- unit 1 "Forms of data input/import" – plan data are entered and imported in the forms manually.

- unit 2 "Auxiliary reporting forms" – the data for auxiliary report forms are calculated in the forms.

- unit 3 "Basic accounting forms" – the data for basic reporting forms are calculated in the forms.

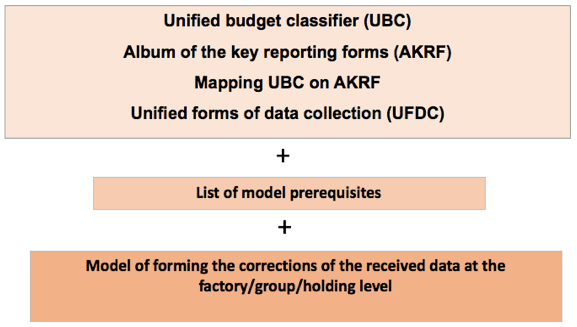

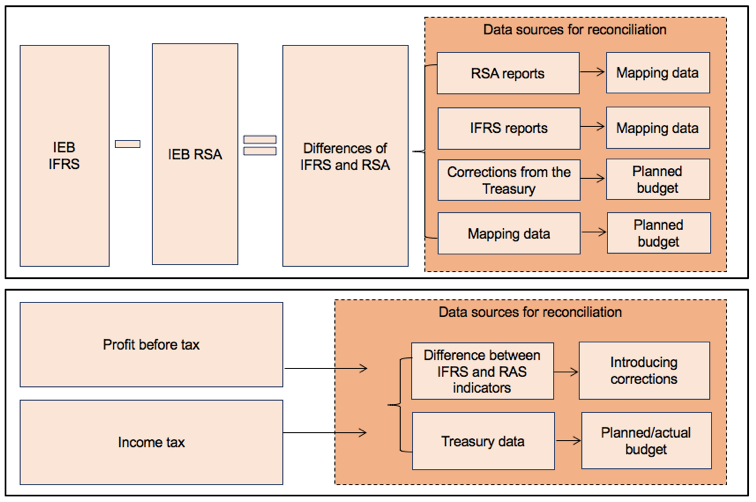

Then the formula for the prototype model of one-year planning will be visualized as follows: see Figure 3.

Figure 3

Schematic representation of setting up a planning prototype model

The key methodological solution underlying the prototype model is cost planning according to the rules similar to primary accounting of revenue and costs reflected in the automated system employed. In terms of accounting, planning is conducted in the analytical contexts of 3 debit accounts. Comparable actual data for the purposes of target-actual analysis will also be imported from 3 debit accounts. As a consequence of this solution, some groups of data input/import forms that correspond to various options of primary accounting are implemented in the prototype model. Table 1 provides an example of the groups of data input/import forms corresponding to the primary accounting options.

Table 1

Example of the groups of data input/import forms corresponding to the primary accounting options

Form code in the model |

Name of a group of data input/import forms |

Primary data accounting options |

I.1.Х. |

"Revenue and costs associated with sales" |

Accounting for sales orders |

I.8. Х |

"Costs for internal orders" |

Cost accounting for real internal orders |

Each of the data forms can be implemented as a template on a separate model sheet and contains four areas:

The hard filter form – it is assumed to list all the analytical dimensions of the unified budget classifier in this area, the elements of which will be fixed for a specific form without allowing the users to edit them (for example, the element of the "Subject of realization" reference book for the form of proceeds from sales of finished products to external contractors will be specified as "Finished products", while the element of the "Business partner" reference book will be specified as "External contractor").

Form lines – it is assumed to list all analytical measurements of a unified budget classifier in this area, the elements of which can be deployed in the form by lines.

Form columns – it is assumed to list all analytical dimensions of the unified budget classifier in this area, the elements of which will be deployed in the form by columns.

Flexible form filter – it is assumed to list all analytical dimensions of the unified budget classifier in this area, the elements of which are selected by the user to adjust the necessary data context, or are determined automatically based on the selected elements in other directories (for example, the user selects a reference book element "Area of sales. Country" for the form of the proceeds from the sale of finished products to external contractors, while the analytics values "Area of sales. Sales market", "Area of sales. Sales region" and "Area of sales. Sales direction" are defined automatically).

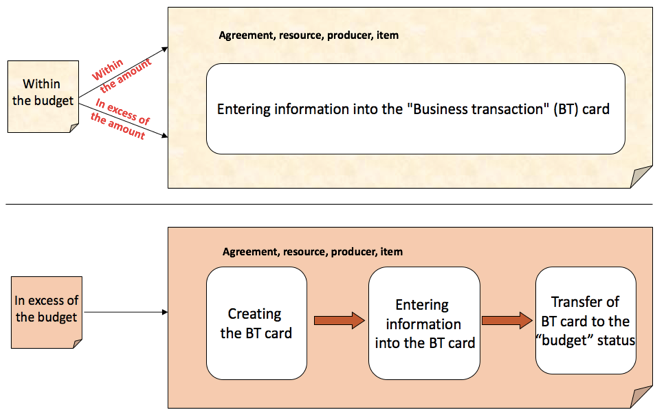

Figure 4 shows the schematic data input to the structure of the planning model prototype.

Figure 4

Schematic data input to the structure of the planning model prototype

All forms of unit 1 are universal from the standpoint of planning:

- debiting the own and customer's raw materials – determined by the "Factory" reference book in a flexible form filter or lines. For example, the user selects a factory with code "1ххх", "2ххх", "3ххх" or "4ххх". The balance unit that corresponds to the factory code will be selected automatically. The reference book will define the type of resource: "purchased" – raw materials purchased from external or internal contractors; raw materials moved from other factories at book prices; in-house half-finished products.

- by legal entities – determined by the "Balance unit" reference book in the flexible form filter;

- by structural business units – determined by the reference book in the flexible input filter;

- by scenarios – determined by the "Scenario" reference book in the flexible form filter;

- by years – determined by the "Year" reference book in the flexible form filter;

- by currencies – determined by the "Currency" reference book in the flexible form filter or lines.

The planning method for each item is embedded in the model by formulas and links to these models. To reduce the formula audit time, it is suggested to use a simplified model of forming the Financial results report. The simplified model allows to consistently enter the most typical plan data and adjustments in the cells to assess the impact of each planned operation on the performance of the factory/group/holding.

Three groups of auxiliary reporting forms should be provided in the prototype model.

- Reports on factor analysis of debiting raw materials and energy resources – a group of forms for factor analysis of debiting raw materials (own and customer's) and energy resources. Factors for normalized resources include the resource driver (product output, installation operation time, number of vehicles), rate of resource consumption per driver unit, amount of resources, cost of resource debiting. Factors for non-normalized resources include the amount of consumed resources and cost of debiting. The normalized and non-normalized resources are allocated to different forms due to a different number of analyzed factors. The sum of data in the auxiliary reports for raw materials in the system will correspond to the amount of data on raw materials in the unit 1 forms. In fact, these are the same data grouped in a different way.

- Responsibility centers/Functions reports – two forms that allow generating a report in the context of the income and expenditure report items that are part of the financial responsibility of a particular function or a particular structural unit.

- KLN control – this form will be used in the budgeting process to control the factory/group/holding costs conformity by items.

This unit will have to contain the key reporting forms provided in the album of the key reporting forms (AKRF). The formation method implemented in the prototype model will consist of three consecutive stages:

1. Mapping of primary data for input/import forms in the structure of the unified budget classifier on reporting items (capitalized expenses at the primary accounting level are eliminated in mapping).

2. Calculation of correcting items.

3. Calculation of the reporting form indicators.

As such, the prototype model allows to assess the effect of entering the most representative data on the selected indicator and its deviation from the target value.

The prototype model does not replace the formation of the consolidated planning reporting for the factory/group/holding, but the input forms contain the required analytical capacity to form consolidated reports. The chart of the information flow in the structure of the planning prototype model, which allows to make adjustments at any stage by the example of the production plan formation, is shown in Figure 5.

Figure 5

Example of visualizing the information flow in the structure of a planning prototype model

All the questions received during the preliminary approval of the prototype model must necessarily be recorded in the journal of open questions on the model. The decision on open questions can be made and the adjustments to the model can be introduced after a general approval of the model at any time, which allows to conduct both retrospective and perspective factor analysis.

As described above, the forms of the prototype model are universal; the applicability of the forms, as well as the procedure of filling in the forms are described in paragraph 3.2 of this article.

Patterns of the data flow in the prototype model by the example of the consolidated profit forecast for the purposes of implementing this algorithm in the existing automated enterprise system are presented in Table 2 (for the group of forms "Auxiliary data", "Revenues and expenses associated with sales") and in Figure 6.

Table 2

Source parameters for generating the enterprise data flows

Name of forms |

Applicability (filled in individually for a particular enterprise, taking the specifics of its operation into account) |

Procedure of filling in the forms |

Group of forms "Auxiliary data" |

||

Cost of raw materials debiting |

Yes |

Manual input |

Inventory balance for processing products |

No |

Leave blank |

Inventory balance for own production |

No |

Leave blank |

Semi-finished products |

No |

Leave blank |

Procurement |

Yes

|

1. Opening balance: import of data from the forecast forms for the prior period 2. Debit turnover: import of data from the automated system, from the standard primary forms (hereinafter) 3. Credit turnover: import of data 4. Closing balance: automatic calculation in the given form 5. Purchases on operations of hidden transfers: import of data |

Transfer prices |

Yes |

Manual input |

Residual stock of finished products |

Yes |

1. Opening balance: Amount – import of data Price – import of data from the forecast forms for the prior period Cost – automatic calculation in the given form 2. Closing balance: automatic calculation in the given form |

Residual stock |

Yes |

Leave blank |

Processing price |

Yes |

Import of data from the forecast forms for the prior period, availability of manual adjustment in case of necessity |

Subprocessing price |

Yes |

Import of data from the forecast forms for the prior period, availability of manual adjustment in case of necessity |

Group of forms "Revenue and expenses associated with sales" |

||

Revenue and expenses associated with the sale of finished products to third parties |

Yes |

1. Amount: import of data 2. Price: import of data 3. Cost: automatic calculation in the given form 4. Transportation costs: import of data, manual input |

Revenue and expenses associated with the sale of finished products to the companies in the group |

Yes

|

1. Amount: import of data 2. Price: import of data 3. Cost: automatic calculation in the given form 4. Transportation costs: import of data, manual input |

Revenue and expenses associated with the sale of products to third parties |

Yes

|

1. Amount: import of data 2. Price: import of data 3. Cost: automatic calculation in the given form 4. Transportation costs: import of data, manual input |

Revenue and expenses associated with the sale of products to the companies in the group |

Yes

|

1. Amount: import of data 2. Price: import of data 3. Cost: automatic calculation in the given form 4. Transportation costs: import of data, manual input |

Revenues from the sale of processing services to third parties |

No |

Leave blank |

Revenues from the sale of processing services to the companies in the group |

No |

Leave blank |

Revenues from the sale of other services to third parties |

Yes

|

Manual input |

Revenues from the sale of processing services to the companies in the group |

Yes

|

Manual input |

Accounting revenue from the sale of finished products |

Yes

|

1. Amount: import of data 2. Price: import of data 3. Cost: automatic calculation in the given form |

Accounting revenue from the sale of subprocessing services |

Yes

|

1. Amount: import of data 2. Price: import of data 3. Cost: automatic calculation in the given form |

-----

Figure 6

Patterns of the data flow in the prototype model by the example of the consolidated profit forecast

Several "deployments" of the form where the test data are entered can be provided under the form template in order to fill in the model with representative target data. Each deployment has a heading, which allows to understand the rules for selecting the reference book elements of the unified budget classifier in a flexible form filter. Target data from the form deployments fall into the key reporting forms. The form template and the form deployment have a different color fill. The meaning of each color separately for the form reference books and the form data is provided in the "legend" (see Figure 7).

Figure 7

Sources of filling in the model with representative target data

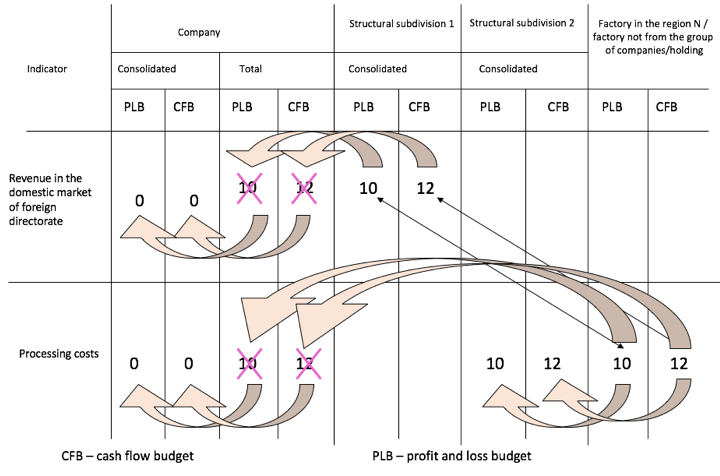

As such, the formation of the unified algorithm for implementation of the project for financial and economic planning at the oil and gas enterprises in the automated system both ensures the due level of analyticity and itemization (no lower than currently used by the automated system) and allows to calculate subtotals in any planning period (month-quarter-year) with the availability of identifying and subsequently analyzing the reasons for the emerging actual deviations from target data. The algorithm for implementing the project on financial and economic planning at the oil and gas sector in the automated system is based entirely on the prototype model and uses all its elements (real and conditional), while the primary mapping allows to form a consolidated forecast for the enterprise in general and its specific business units, which allows to visualize the methodology for the formation of some of the most complex report items (see Figure 8).

Figure 8

Example of generating the report on the revenue consolidation in the domestic market from the outside factory

Procurement planning, debiting raw materials and materials for core and auxiliary production, generation of expenses for the project activities – all this is to be unified for the development of a unified budget in the planning processes, followed by the harmonization of all costs and revenues realized in terms of the selected business units of the company/group/holding, both in quantitative and value terms, or aggregated in value terms.

In the part of the time interval, integration with the data of the annual model (in terms of months, quarters) is provided, with the availability of correction based on the operational cost forecast. Besides, the algorithm for implementing the project for financial and economic planning at the oil and gas enterprises provides for the generation of an operational report on costs on a monthly (weekly) horizon based on monthly (weekly) needs in materials and services in the automated system of the enterprise/group/holding. The developed prototype model and algorithm allow for the mapping of these forms into reports in Russian and international financial reporting systems, as well as the generation and downloading of consolidated reporting data and forecasts for selected indicators.

Practical relevance of the study results and their applicability are as follows:

the target model of financial and economic planning at all levels of management of a group of companies, a holding or an oil and gas enterprise has been standardized and systematized;

the methodology has been formalized for the purposes of further implementation in the automated system based on the SAP platform or in MS Excel format;

prerequisites for the possible application of the methodology of financial and economic planning for the purposes of implementing the system of financial consolidation, as well as in the process of forming business plans have been defined.

The following conclusions can be drawn from the results of the study on the methodology of financial and economic planning at the oil and gas enterprises:

The key objectives of improving the methodological approaches to financial and economic planning at the oil and gas enterprises are the following:

unification of the planning reporting forms, normalization and harmonization of planning items;

unification of the planning method and model for the purposes of further implementation on the basis of the automated platform in SAP modules or in MS Excel format;

ensuring the compatibility of target and actual data (achievement of consistency between target and actual data), including resulting from their use within the automated platform in SAP modules or in MS Excel format;

unification of the planning processes among the companies in the group or holding, as well as among the internal structural business units of the same company.

The key results of the conducted study include proposals for improving the methodological approaches to financial and economic planning at oil and gas enterprises: the need to generate the universal forms for collection data for a single budget classifier and a set of unified accounting reporting forms for the companies in the group or holding, as well as for internal structural business units of the same company, and to introduce them into the automated systems.

Bukalov A.V. (2009). Uchet zatrat i kalkulyatsiya sebestoimosti [Cost accounting and cost calculation]. Audit and financial analysis, 3.

Ermilov O.M., Milovidov K.N., Chugunov L.S. and Remizov V.V. (1998). Strategiya razvitiya neftegazovykh kompaniy [Development strategy for the oil and gas companies]. Moscow: Nauka, pp. 623.

Grigoriev M.N. (2002). Uchet kachestva zapasov nefti pri otsenke effektivnosti investitsiy [Accounting for the quality of oil reserves in evaluating the investment efficiency]. Oil, 6, 90-93.

Konoplyanik A.A. (2011). Osnovnyye vidy i usloviya finansirovaniya investitsionnykh proyektov v neftegazodobyvayushchey promyshlennsoti [Major types and conditions of funding the investment projects in the oil and gas industry]. Moscow: Gubkin Russian State University of Oil and Gas, pp. 62.

Kotler P. (1967). Marketing Management: Analysis, Planning and Control. Englewood Cliffs, NJ.- Prentice-Hall.

Milovidov K.N. and Zhermolenko V.I. (1990). Ekonomiko-matematicheskoye modelirovaniye osvoyeniya nevosproizvodimykh resursov nefti i gaza [Economic and mathematical modeling of developing the non-reproducible oil and gas resources]. Moscow: Gubkin SAOG, pp. 70.

Minenergo RF ozhidayet, chto perekhod na nalog na finansovyy rezultat dlya neftyanoy otrasli sostoitsya k 2016 g. [The Russian Ministry of Energy expects that the transition to a profit-based tax for the oil industry will take place by 2016]: [Electronic resource]. RosBusinessConsulting. http://quote.rbc.ru/news//fond/2014/21/341000694.html. (Access date: 26.09.2017).

Telegina E.A. (1996). Investitsionnaya deyatelnost korporatsii v neftegazovom komplekse: Analiz i upravleniye investitsiyami v usloviyakh formiruyushchegosya rynka [Investment activities of the corporation in the oil and gas sector: Analysis and management of investment in the context of the emerging market]. Moscow: SAOG, pp. 207.

1. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny per. 36, E-mail: t.g.bondarenko@gmail.com

2. The Kazakh-American Free University. Kazakhstan, 070018, Ust-Kamenogorsk, pr.Nezavisimosti

3. Gubkin Russian State University of Oil and Gas (National Research University), Russia, 119991, Moscow, Leninsky Prospekt

4. Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny per