Vol. 39 (Number 18) Year 2018 • Page 22

Makka Alaudinovna KHAMATKHANOVA 1

Received: 21/02/2018 • Approved: 03/02/2018

ABSTRACT: As a result of the study, approaches to defining the essence and features of the generation of an enterprise’s financial resources were refined; the analysis of the managerial elements, functions, and principles of the generation of an enterprise’s financial resources was carried out in order to maximize their effectiveness. The article states that defining "an enterprise’s financial resources" as a set of an enterprise’s own funds and external revenue, which can be used for entrepreneurial activities and ensures a better production process, is more efficient. An enterprise’s financial resources have several features that help distinguish them from other forms of financial resources. As such, an enterprise’s financial resources are an object of financial management and the ownership right exposed to the impact of time, as well as a source of income, risk and financial obligations liquidation; they have a high transformative capacity and appear to be the main component of the financial potential, and an economic and social development factor. |

RESUMEN: Como resultado del estudio, se refinaron los enfoques para definir la esencia y las características de la generación de los recursos financieros de una empresa; el análisis de los elementos, funciones y principios gerenciales de la generación de los recursos financieros de una empresa se llevó a cabo para maximizar su efectividad. El artículo establece que definir "los recursos financieros de una empresa" como un conjunto de fondos propios e ingresos externos de una empresa, que puede utilizarse para actividades empresariales y garantiza un mejor proceso de producción, es más eficiente. Los recursos financieros de una empresa tienen varias características que los ayudan a distinguirlos de otras formas de recursos financieros. Como tal, los recursos financieros de una empresa son un objeto de gestión financiera y el derecho de propiedad está expuesto al impacto del tiempo, así como una fuente de ingresos, riesgo y liquidación de obligaciones financieras; tienen una gran capacidad de transformación y parecen ser el principal componente del potencial financiero y un factor de desarrollo económico y social. |

The financial resources generation process is one of the key factors that determine the effectiveness of an organization’s market activities, its financial stability and competitive abilities (Gorfinkel 2013; Gryzunova 2015). In the context of many Russian manufacturing organizations being in a difficult financial state, the financial resources generation process becomes important since the nature of activities currently influences organizational competitive abilities beyond the country’s borders (Kozenkova 2013; Kyshtymova 2014). The financial development of organizations in the domestic economy, therefore, is carried out through the managerial mechanism of financial resources generation that represents the direction, nature, and essence of organizational finances in the market economy.

The study and systematization of approaches to developing and managing an organization’s financial resources required the use of basic scientific methods, such as the analysis and synthesis method, the analog method, the generalization method, the spreadsheet analysis method, the morphological analysis method, etc. Since the financial resources management and generation approaches are the same for enterprises of different fields of economy and organizational and legal status, the results of such methods can be considered universal.

In the context of the economic system transformation, an enterprise’s financial resources play the key role in the effective functioning of organizations and are the main factor in the process of extended reproduction. To continue operation in the market environment, Russian enterprises not only need to sustain the financial stability and paying capacity but also to manage the process of financial resources use and generation effectively.

Since financial resources are the origin that creates all the other resources, their effective management is one of the major premises, which characterize an organization’s ability to adapt to the market’s dynamic conditions.

One of the most important determinants that ensure an organization’s functioning and development in the market economy is to generate financial resources from different channels. This ability of financial resources generation constantly improves according to the production and sales objective requirements, the growing complexity of economic ties and other manufacturing features (Balabanov, 2009).

It is necessary to get a nearer view of both terms "financial resources generation" and "financial resources" to understand the detailed essence of financial resources.

In general, the term "resource" means the instruments, which allow achieving the intended result through their specific changes and use. In the broad meaning, "financial resources" are the means that can be used to fulfill certain tasks according to the given plan and allow achieving the intended economic result.

Let us consider the evolution of the term "financial resources" from the 1960s-1970s till our time. The combination of the two words "finance" and "resources" defines the term "financial resources" as payments that appear in the reproduction process and characterize the funds circulation, transformation and returning.

The appropriate way of considering the term "financial resources" is to divide it into three approaches. The first approach considers the meaning of financial resources at the governmental level, the second one involves financial resources at the level of corporate finances, and the third one includes the reproduction level of financial resources. It is important to review the second and the third approaches for better understanding of the financial resources nature (Balabanova 2013).

Let us consider the level of corporate finance in financial resources, and define its constituents in terms of the functioning of organizational finance. Despite the scientific literature of the 1960s-1970s mainly paying attention to the governmental level of financial resources generation, A. Biermann rightly pointed out the necessity of a more in-depth consideration of the nature of economic processes and relations at the organizational level. He justified his views, pointing out that the main part of financial resources was generated in the process of material production in organizations from different industries, which meant the process of their generation was decentralized (Kirichenko 2014).

The supporters of the reproduction approach define financial resources in monetary terms as a part of the gross national product. This approach mostly draws attention to the features of financial resources, such as their purpose and limits in the total product value. Nevertheless, this definition of financial resources lacks the specificity in terms of financial resources being a part of the monetary circulation (Kirichenko 2014).

Reconsidering the definitions of financial resources, given in the scientific literature (Balabanov, 2009; Lyubushin, 2014; Khamatkhanova, 2016; Khamatkhanova, 2015; Financial Resources Management (FiRM), n.d.; Finding Financial Support Resource, 2015), it can be argued that the definitions, which consider financial resources as source of the foundation of the monetary fund or the organizational means of gaining monetary incomes and earnings, significantly reduce the meaning of financial resources in the organization since financial resources include both stock and non-stock derivatives.

Therefore, an enterprise’s financial resources are a set of an organization’s own funds and external incomes that can be used for the formation of fixed and current assets required for the business and extended production support. Figure 1 gives a more specific definition of the nature of financial resources in the enterprise by structuring the financial resources in the enterprise. The structure is based on science literature systematization (Figure 1). The author divided financial resources into three groups: internal funding, raised funding and outside funding.

Figure 1

Composition of an enterprise’s financial resources

Internal funding is an enterprise’s funds being in a constant state of circulation. The duration of using internal funding is not established. It is generated by the means of the organization’s own capital, which includes assets left after the total use of the organization’s assets (Isaeva 2014).

Raised funding includes the funds, directly or indirectly received from individuals and/or legal entities on a repayment basis, financial asset balances emerged as a result of ordinary economic activities in the interests of individuals and legal entities.

External funding involves the reimbursable repayable funds received by the enterprise for a limited period of time. Usually, the organization generates external funding from short and long-term bank loans (Isaeva 2014).

The financial resources of an enterprise and its production and business activities, aimed on profits, include all of the above-listed sources.

Enterprises are able to use in their functioning internal funding which means the resources generated from own sources (share capital, capital surplus and reserve capital, retained earnings) and external funding in short-term use on a basis of specified principles (credits and loans, accounts payable, other liabilities).

There are certain features and characteristics that help distinguish and explicitly identify particular types of resources. Let us take a look at the features of financial resources (Table 1).

Table 1

The features of financial resources

No. |

Feature |

Characteristics of the feature |

1 |

2 |

3 |

1 |

The object of financial management |

This feature is connected to financial management, namely the system of principles and methods of managerial decision-making and implementation, and the allocation and use of an enterprise’s financial resources. |

2 |

The source of risk |

There is a constant connection between the profit generating all types of assets, and risk – the higher the income, the higher will be the risk related to that income. |

3 |

The main component of financial capacity |

Financial resources define the financial aspect of an organization’s economic potential. Liquid assets and ability to generate positive cash flow are the basic elements making it possible to assess liquidity, paying capacity, creditworthiness and investment appeal of an organization. |

4 |

The object of ownership right |

Following the property grounds, financial resources are divided into the organization’s own and borrowed resources. From the point of view of the organization’s own resources, financial resources can be controlled only in the case of existing ownership, accommodation right and the right of disposal. |

5 |

Assets with a high rate of transformative capacity |

The specific aspect of financial resources is their direct involvement into the process of production. The importance of the transformative capacity lies in its temporal aspects. Firstly, it means a permanent, not limited in time, transformative capacity of a resource. Secondly, the increasing temporal period must not cut the transformative value of the resource and must not lead to the growth of costs. |

6 |

The source of income |

An enterprise with temporary untied funds can lend them to other economic entities in exchange for certain remuneration, such as the interest lend. The fund placement on the current, settlement, currency and deposit accounts in banks provides income, which means it is carried out on a fee basis. The deposit interest is the profit. |

7 |

The object of the impact of the time factor |

The basic modern financial theory concept about the temporal changing value of money claims that of two alternatives the best way of getting the funds is the quickest one. In a certain period of time, a part of untied financial resources can be invested and generate an additional income. |

8 |

The source of financial liabilities repayment |

There is a strong necessity of paying the enterprise’s financial liabilities to owners, lenders and investors, and in the case of the payment capacity absence, it leads to the liquidation of the business and its functioning. The financial liabilities payments can be carried out in the ways of the property transfer, the netting, the assignment of rights, etc. |

9 |

Economic and social development factor |

Different levels of an organization’s life circle are directed to gaining three objectives like financial stability, profitability and economic development. The long-term objectives are aimed at gaining the economic development. The key factor of that strategy is, on the one side, the internal funding and, on the other side, access to external sources of financing. |

It is notable that financial resources are limited and they are the dominant element of the whole resource base in any organization, which influences the process of their effective management. The availability of the needed financial resources amount gives a company the access to the land, material, labor, intellectual resources and so on. Unfortunately, nowadays financial resources are the scarcest resources in the domestic entities, and their lack slows the general development and leads to a reduction in other elements of the enterprise’s resource base.

It also should be noted that financial resources, compared to other resources, are the most mobile resource base elements, and in the conditions of the constant external environmental changes the financial resources are the key effectiveness factor.

Thus, the effective financial resources generation and management are the main elements of domestic businesses’ ability to survive and success in the market economy (Dikalo 2014).

An enterprise’s financial resources management style is an important element of effective financial and business activities maintenance, and one of the key factors that influences an organization’s production and business performance (Kozenkova 2013, p. 24).

Financial resources management is aimed at achieving the following objectives:

the organization’s survival within the context of market competition;

avoiding bankruptcy and gross financial losses;

leadership against the competitors;

increasing the market value of the enterprise;

achieving the acceptable growth rates of the enterprise’s economic potential;

increasing profits;

reducing costs;

business profitability maintenance.

For a better understanding of the term "an enterprise’s financial resources generation in the contexts of their limitation", it is important to take a view of several definitions and analyze their meanings (Table 2).

Financial resources are most fully defined by V. Balabanov (Balabanov, 2009; p. 23], who distinctly determined that financial resources are a set of internal and external funds, and their management process includes the design of specific generation and usage methods of that funds.

The generation and management of an enterprise’s financial resources are aimed at proving the enterprise owners’ maximal prosperity in the current and future periods of time.

Table 2

Existing approaches to defining the term "an enterprise’s

financial resources generation and management"

Author (source) |

Definition |

Keywords |

S. Dicalo (2014) |

A set of managerial activities in the field of generation and usage of fund and non-fund money |

Generation and usage, money |

T. Kozenkova (2013) |

Incoming and outgoing sources management aimed at generating, allocating and using the required financial resources, maximizing the enterprise’s income and increasing its profitability and paying capacity. |

Cash flow management, financial resources usage, income maximization, profitability increase |

N. Lytneva (2014) |

A set of activities aimed at optimizing the enterprise’s financial mechanism, financial operations coordination and proving streamlining and accurate "balancing". |

Set of activities, financial mechanism, financial operations, streamlining and "balancing" |

M. Mokiy (2015) |

A set of own capital, outside funds and capital structure management activities/methods which would set the optimal capital structure and minimize the weighted average capital value and maximize the market value of the enterprise. |

Set of activities (methods), own capital and outside funds, definition of the ideal capital structure |

The objective of generation and further financial resources management has a concreate meaning in providing the maximum enterprise market value, which supports its owners’ final financial interests, namely maintaining the functions of an enterprise’s financial resources management.

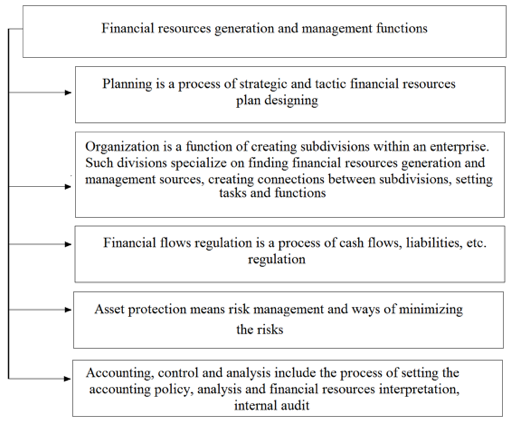

The functions of an enterprise’s financial resources management can be defined on the basis of financial management functions. Financial resources generation and management functions are given in Figure 2. These functions include planning, organizing, flow regulation, assets protection, accounting, control and financial resources analysis.

Figure. 2

Financial resources management functions

The financial resources generation policy is a part of the organization’s general financial strategy. Its main objective is achieving the intended level of self-sustained production and financial development financing.

Figure. 3

Financial resources generation and management principles

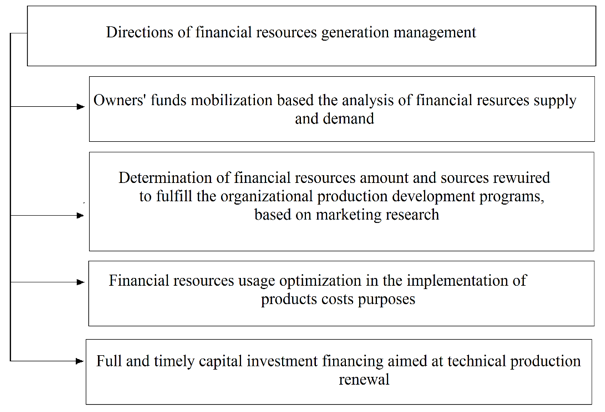

The analysis of market and structural changes in Russian industries brings up a need for developing a new financial resources generation and management system fitting the new environment (Figure 3). Financial resources generation management is mainly aimed at providing the required financial resources for the organization’s functioning, and has several directions.

Further analysis includes financial resources generation management through the means of enterprise financial management (Figure 4).

Figure. 4

Directions of an enterprise’s financial resources management

Thus, an enterprise’s financial resources generation management is a set of activities aimed at equity and external funding management, and establishing and managing the capital structure, which would minimize the weighted average capital value and maximize the market value of the organization. This set is sufficiently important for the entity as a base for the generation of production and financial fields and development of manufacturing enterprises. The variety of the ways of financial resources management usage makes this set of activities a complicated issue with many elements.

The article research has established that it is expedient to define "an enterprise’s financial resources" as a set of an organization’s own funds and external funding which can be used for fixed and current funds generation required for business and extended production maintenance.

An enterprise’s financial resources have several characteristics separating them from other types of financial resources. These characteristics are: the object of financial management, the object of ownership right, subject to the impact of the time factor, source income, risk and financial liabilities’ repayment. An enterprise’s financial resources are a financial potential component and an economic and social development factor, and have a high transformative capacity rate.

According to the analyzed information, financial resources generation management is a set of activities aimed at equity and external funding management and establishing and managing the capital structure, which would minimize the weighted average capital value and maximize the market value of the organization. This set is sufficiently important for the entity as a base for the generation of production and financial fields and development of manufacturing enterprises. The variety of ways of financial resources management usage makes this set of activities a complicated issue with many elements.

Balabanov, V.T. (2009). Osnovy finansovogo menedzhmenta [Fundamentals of Financial Management]. Moscow: Finansy i statistika. (p. 512).

Balabanova, L.V. (2013). Upravlenie finansovymi resursami [Financial Resources Management]. Moscow: Tsentr uchebnoi literatury. (p. 468).

Dikalo S.V. (2014). Upravlenie finansovymi resursami promyshlennykh predpriyatii [Financial Resources Management in a Manufactural Enterprise]. Vserossiiskii ekonomicheskii zhurnal, 1, 156-160.

Financial Resources Management (FiRM). (n.d.). Retrieved October 8, 2017, from https://www.monash.edu/vpfinance/our-divisions/firm

Finding Financial Support Resource. (2015). Retrieved October 8, 2017, from http://www.cancer.net/navigating-cancer-care/financial-considerations/financial-resources

Gorfinkel, V.Y. (2013). Ekonomika predpriyatiya (firmy) [Enterprise (Firm) Economics]. St. Petersburg: Prospekt. (p. 640).

Gryzunova, N.V. (2015). Upravlenie denezhnymi potokami predpriyatiya i ikh optimizatsiya [Enterprise Cash Flow Management and Optimization]. Vestnik UMO, 1, 67-72.

Isaeva, E.V. (2014). Mekhanizm otsenki finansovoi ustoichivosti predpriyatiya, opirayushchiisya na kontseptsiyu svobodnogo denezhnogo potoka [A Mechanism for Assessing the Financial Sustainability of an Enterprise Based on the Concept of Free Cash Flow]. Finansovyi biznes, 2, 42-46.

Khamatkhanova, M.A. (2015). Formirovanie globalnoi sistemy finansovykh tsentrov [Global Financial Centers System Generation]. Fundamentalnye issledovaniya, 12, 859-863.

Khamatkhanova, M.A. (2016). Investitsionnoe sotrudnichestvo Rossii i Slovakii v sovremennykh usloviyakh [Investment Cooperation between Russia and Slovakia in Modern Conditions]. Ekonomika i predprinimatelstvo, 3(Part 1), 438‑441.

Kirichenko, T.V. (2014). Finansovyi menedzhment [Financial Management]. Moscow: Dashkov i K. (p. 284).

Kozenkova, T. (2013).Organizatsiya upravleniya finansovymi resursami [Financial Resources Management Organization]. Risk: resursy, informatsiya, snabzhenie, konkurentsiya, 1, 19-25.

Kyshtymova, E.A. (2014). Instrumenty mekhanizma vnutrifirmennogo i strategicheskogo planirovaniya promyshlennykh predpriyatii [Tools of the Firm and Strategic Planning of Manufacturing Enterprises]. Vestnik OrelGIET, 1, 50-56.

Lytneva, N.A. (2014). Sovremennye podkhody sovershenstvovaniya metodologii mekhanizma upravleniya ustoichivym razvitiem promyshlennykh predpriyatii [Modern Approaches to Improving the Mechanism Methodology of the Industrial Enterprises Sustainable Development Management]. Nauchnye zapiski OrelGIET, 1(9), 121-127.

Lyubushin, N.P. (2014). Sistema pokazatelei analiza finansovogo sostoyaniya organizatsii i metody ikh opredeleniya [System of Indicators of the Financial State Analysis of the Organization and Methods for Determining Them]. Ekonomicheskii analiz, 2, 18-24.

Mokii, M.S., Azoeva, O.V., & Ivanovskii, V.S. (2015). Ekonomika firmy: uchebnik i praktikum [Organizational Economics: Lectures and Practice]. Moscow: Yurait-Izdat. (p. 334).

1. Tyumen Industrial University 625000, Russia, Tyumen, Volodarskogo, 38; Email: E-mail: a_ahilgov@mail.ru