Vol. 39 (Number 16) Year 2018 • Page 34

Vasiliev Vladimir DMITRIEVICH 1; Vasiliev Evgeny VLADIMIROVICH 2

Received: 20/12/2017 • Approved: 20/01/2018

ABSTRACT: The situation of selecting the best decisions for generating cash flows in the context of the three canonical scenarios (pessimistic, the most probable, optimistic) is considered. The authors demonstrate that traditional criterion evaluations lead to paradoxical selection results that do not meet the principle of rationality and can be attributed to a surrogate cluster of dominance. Criteria of optimality in the format of scenario cash flows, suggested by the authors, allow to form their objective cluster; selection of decisions is presented as a multi-objective task under conditions of risk and uncertainty; to show analysts and practicing top managers of various business types other windows of opportunity. |

RESUMEN: Se considera la situación de seleccionar las mejores decisiones para generar flujos de efectivo en el contexto de los tres escenarios canónicos (pesimista, más probable, optimista). Los autores demuestran que las evaluaciones de criterios tradicionales conducen a resultados de selección paradójicos que no cumplen con el principio de racionalidad y que pueden atribuirse a un grupo sustituto de dominancia. Los criterios de optimalidad en el formato de los flujos de efectivo de los escenarios, sugeridos por los autores, permiten formar su grupo objetivo; la selección de decisiones se presenta como una tarea multiobjetivo en condiciones de riesgo e incertidumbre; para mostrar a los analistas y a los altos ejecutivos de diversos tipos de negocios otras ventanas de oportunidad. |

"First of all, we need facts,

and then they can be misinterpreted"

(Mark Twain)

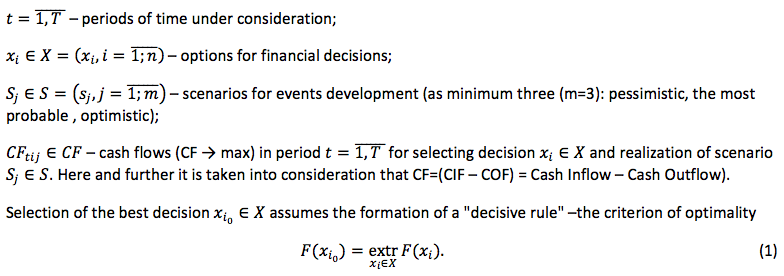

Top managers have an opportunity to select an effective financial solution (asset, option, etc.) from some set that satisfies the accepted system of objective-subjective constraints. The forecast period is quantized into a kind of time segments for which, for each financial solution, the possible values of cash flows are determined for at least three scenarios - pessimistic, the most probable, and optimistic. It is required for this scenario format to offer top-managers such optimality criteria, in the context of which the chosen dominant financial solution can be considered effective (the best, rational). In a variety of calculations related to the selection of effective solutions (projects, leasing, financial assets trading, schemes for issuing and repaying loans, options for mergers and acquisitions, etc.) on the basis of maximized cash flows (CFS – Cash Flows Stream) in a scenario format, usually analysts use the following data:

Among the numerous analysts, the following schemes for the formation of criterial valuation models are the most popular.

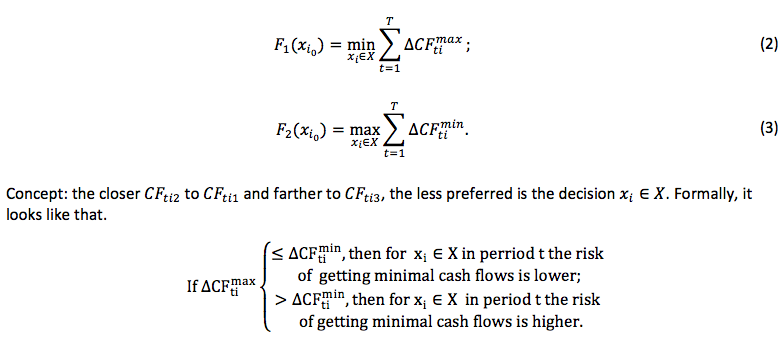

Let’s consider this scheme using authors’ fictional-conditional, elegant and methodically verified example (Table 1,2).

Table 1

Scenario Cash Flows (t=1)

-----

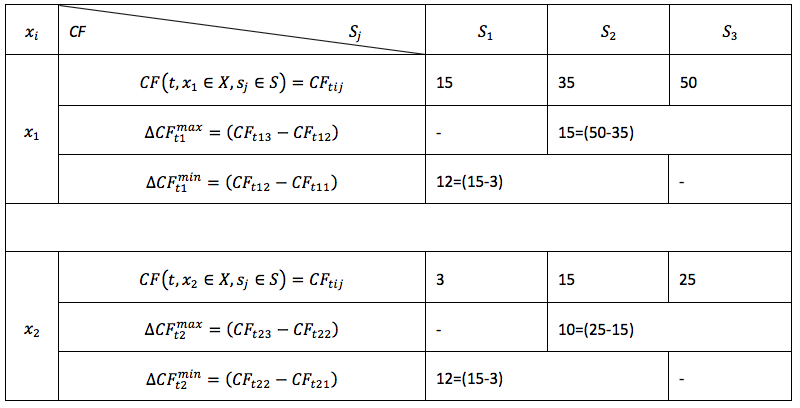

Table 2

Scenario Cash Flows (t=T=2)

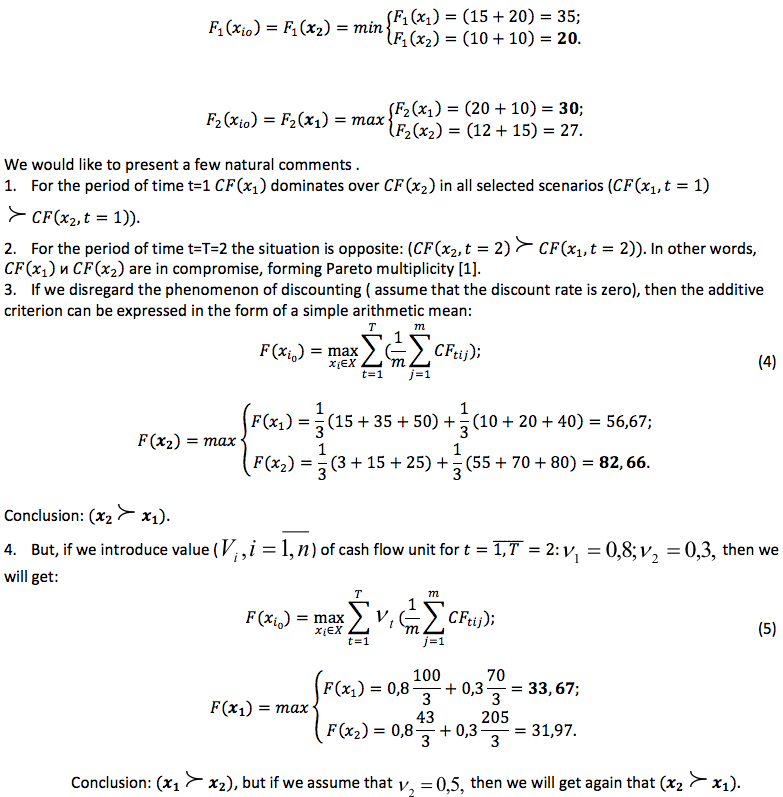

As a result we get:

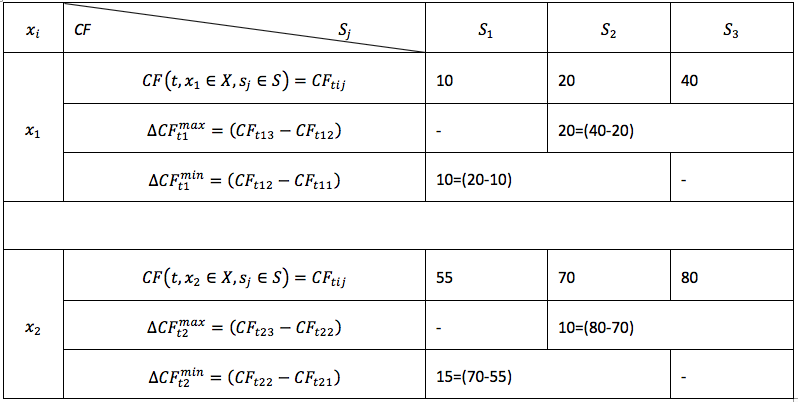

In these models, the following formalized concept is realized:

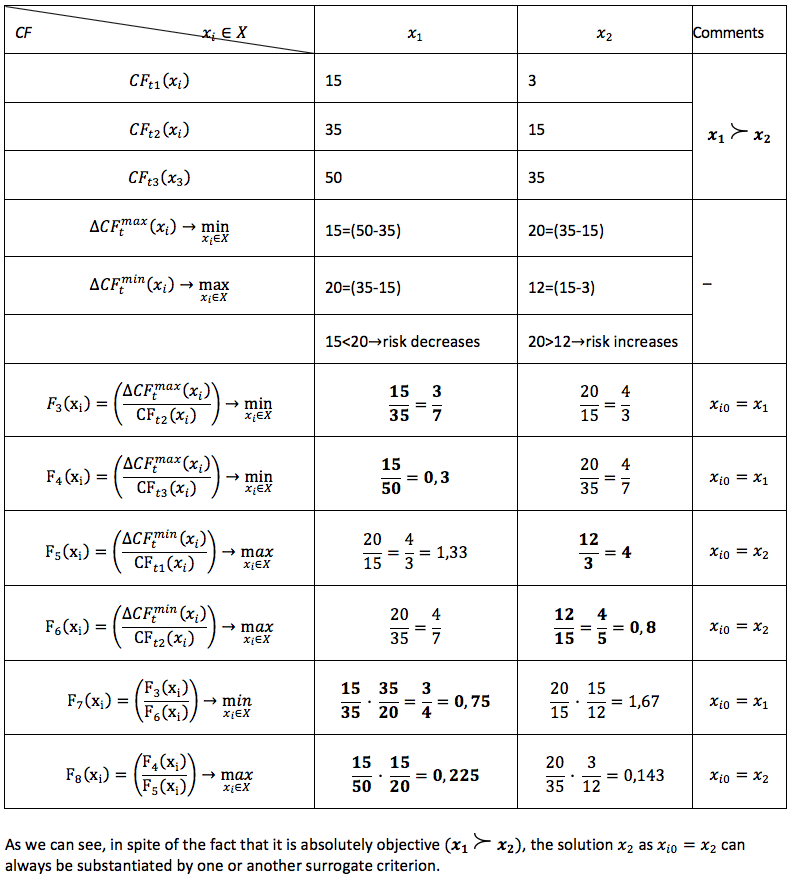

Illustrative example of calculations is presented in Table 3.

Table 3

Selection of the Best Decisions

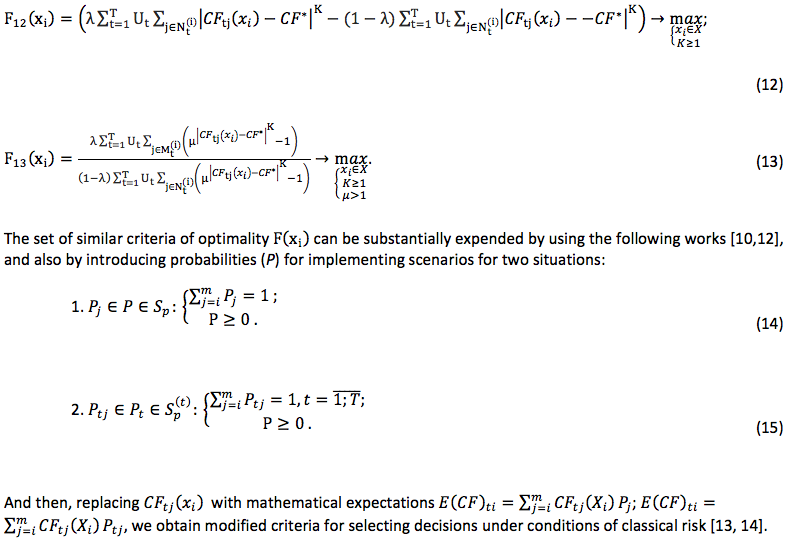

The conceptual foundations of the completed research constitute the methodological principles of forming scenarios for the events development; analytical models for calculating scenario cash flows, shown in deterministic and hyperbolic-reduced model form; application of a multi-criteria (Pareto) theory of decision-making (investment projects, assets); use of volatility estimates to justify authors integral (compromise) optimality criteria. The key theoretical and methodological foundations, concepts, messages that form a scenario approach in the aspect of economic and financial forecasting are presented in numerous fundamental scientific papers by H. Kahn [1,2], P. Schoemaker [3], P. Schwartz [4], R. Ayres [5], F. Knight [6], G. Ashworth [7]. Applied aspects of definition, formation, calculation and application of cash flows in investment, financial and foreign exchange markets are extensively presented in the works of A. Damodaran [8], R. Brealy [9], J. Van-Horne [10], F. Cheng [11], optimization models were considered by V.D. Vasiliev [12].

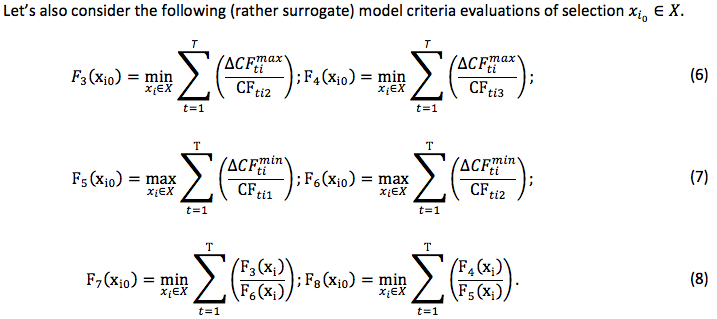

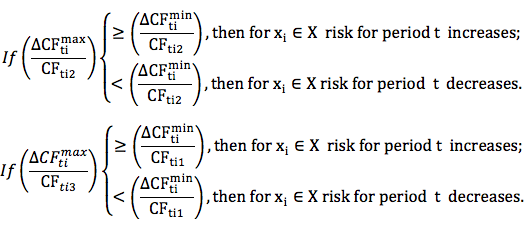

Let’s show some clean and as well as mixed manipulative directions that "improve" the criterion evaluations for selecting the "correct and unique" . Here are some components of this "gentleman’s" set:

We would like to note that in a situation where cash flows have a focus on minimization (for example, there are only expenses or capital outflows, rent or loan payments etc), then the pessimistic and optimistic scenarios simply change places (get reversed), and all calculation approaches, the schemes and models remain the same.

The traditional approach in the format of volatility is based on the assumption that any deviation from the mathematical expectation (or, simply saying, arithmetic average) of any result indicator is viewed negatively . This is a foundation for the following theories: VAR (Value at Risk), COV (covariance), COR (correlation), (the systemic risk factor of W. Sharp - beta in CAPM model), (dispersion).

The authors, with due respect to these methods and their authors- G. Markowitz [15], and W. Sharp [16], have a bit different point of view.

As something "negative", we consider only deviations of values from some accepted comfortable value. Any deviations for a better side are viewed as positive. So only criteria for quantifying these situations and comparing them with each other should be suggested. The authors propose to form the ratio of discounting negative and positive deviations on the hyperbolic utility function. Decisions that make this ratio extreme are declared the best from the position of volatility concept.

Such approach [12, 13, 14, 17] seems natural, reasonable, psychologically consistent, and in some aspects - in relation to risk assessment – it develops the ideas of analytical business calculations from Markowitz and W. Sharp models [15, 16].

Formed author's criteria for selecting solutions within the framework of a formalized conceptual paradigm are, of course, objective implementations of solutions from the field of effective Pareto sets. Thus, author's evaluation models can be considered dominant and rational in comparison with traditional ones.

1. The scenario approach expands the analytical capabilities of investigating cash flows in any companies with regard to selection of effective decisions. However, traditionally proposed models for forming optimality criteria have a weak theoretical justification, and their application in business practice can lead to the selection of inefficient, non-Pareto decisions from the field of consent.

2. The models of efficiency criteria proposed by the authors are based on the rational principle of "reasonable sufficiency" as applied to the standard theory of decision-making under conditions of risk and uncertainty. Presented optimality criteria in a formalized form are considered as risk criteria in the paradigm of volatility.

3. Formulated selection problem allows to use other concepts in order to develop the criteria for choosing business decisions: VAR (Value at Risk) model, risk and regret model by L. Savage, utility theory model, curve model by M. Lorenz. The authors suggest to other analysts to work further in this direction and to present the appropriate formalized tools to practicing top managers.

Kahn H. On Escalation. – New York: Frederick A. Praeger, 1965. – 134 p.

Kahn H., Wiener A.J. The Year 2000. – New York: Macmillan, 1967. – 431 p.

Schoemaker P.J.H. Scenario Planning: A Tool for Strategic Thinking // Sloan Management Review, 1995. – №36. – pp. 25-40.

Schwartz P. Your Official Future. The Art of Foreseeing and Planning for the Future. M.: FunkyInc.,2008.-256 p.

Ayres R. Technological Forecasting and Long-Range Planning/Trans. from English- M.: Mir, 1971.-296 p.

Knight F. Risk, Uncertainty, and Profit / Trans. from English- M.: Delo, 2003. - 360 p.

Ashworth G. Value-Based Management: Delivering Superior Shareholder Value / Trans. from English- M.: INFA-M, 2006. - 190 p.

Damodaran A. Investment Valuation: Tools and Techniques for Determining the Value of any Asset / Trans. from English- M.: Alpina Publisher, 2014. - 1316 p.

Brealy R., Myers S. Principles of Corporate Finance / Trans. from English- M.: Olimp-Business, 2008. - 1008 p.

VanHorne J., Wachowicz J. Fundamentals of Financial Management / Trans. from English- M.: Williams, 2016. - 1232 p.

Cheng F Lee, Joseph E. Finnerty. Corporate Finance: Theory, Method and Applications. / Trans. from English. – M.: INFRA-M, 2000. – 686 p.

Vasiliev V.D. Optimization Approach to the Selection of Investment Strategies and Projects in the Regional Construction Industry. – SPb. Publishing house of SPBSUEF, 2004. – 287 p.

Trukhaev R.I. Decision Models in Uncertainty. – Moscow: Science, 1981. – 258 p.

Vasiliev V.D., Vasiliev E.V. Some Specifics of Savage Risk Matrices // Management in Russia and abroad. - 2014. - №4. - p. 20-26.

Markowitz H.M. Portfolio Selection // Journal of Finance, 7, no. 1 (March 1952), pp. 77-91.

Sharp W.F. Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk // Journal of Finance, 19, no. 3 (September 1964), pp. 425-442.

Vasiliev V.D., Vasiliev E.V. Bankruptcy Risk : The Carnival of Models// Collection of papers from XII scientific conference of young scientists, postgraduate students, degree applicants at Tyumen State Architecture and Construction University (TSACU).- Tyumen: Publishing Department of TSACU, 2014 - p. 194-203.

1. Tyumen Industrial University, Volodarsky Street, 38, Tyumen, Russia.

2. Tyumen Industrial University, Volodarsky Street, 38, Tyumen, Russia. Contact Email: evg_vasil@mail.ru