Vol. 38 (Nº 62) Year 2017. Páge 21

Vol. 38 (Nº 62) Year 2017. Páge 21

N.P. VINOGRADOVA 1

Received: 06/10/2017 • Approved: 30/10/2017

4. Assessment of the innovation position of the metallurgical industry of the Republic of Kazakhstan

ABSTRACT: The goal of this work is to develop methodological aspects of assessing the strategic position and innovation-driven growth of the metallurgical industry in the Republic of Kazakhstan. Practical application of this method allowed the author to define the strategy of innovation-driven growth taking into consideration the available innovation potential and share of Kazakhstan in the world exports of steel products. The results obtained allowed to make a number of conclusions that can be used in the development of strategic plans for the development of the industry and at the microlevel: |

RESUMEN: El objetivo de este trabajo es desarrollar aspectos metodológicos para evaluar la posición estratégica y el crecimiento impulsado por la innovación de la industria metalúrgica en la República de Kazajstán. La aplicación práctica de este método permitió al autor definir la estrategia de crecimiento impulsado por la innovación, teniendo en cuenta el potencial de innovación disponible y la participación de Kazajstán en las exportaciones mundiales de productos de acero. Los resultados obtenidos permitieron llegar a una serie de conclusiones que pueden ser utilizadas en el desarrollo de planes estratégicos para el desarrollo de la industria y en el nivel micro: |

Metallurgical industry is one of the key branches of the economy of the Republic of Kazakhstan, which accounts for 14.3% of the country's industrial output in value terms. Due to the multiplier effect, metallurgical industry of the Republic of Kazakhstan shapes the environment for the development of related industries. Metallurgy drives the growth of high-tech and science-intensive final products, supplying such industries as engineering, construction, defense, aviation and space industries with raw materials (Lakshmanan, Roy and Ramachandran 2016).

The metallurgical complex of Kazakhstan has significant prospects for growth in production and exports due to the projected growth in metal consumption in foreign markets, availability of raw materials, and the low cost of electricity.

At the same time, the industry has been retaining focus towards the exports of primary metals, and the production technology used at metallurgical enterprises does not fully meet environmental requirements and the requirements for rational use of mineral resources.

Like in many other industries of Kazakhstan, environmental friendliness and energy efficiency of production are of great importance in the metallurgical industry today. These issues cannot be solved without the development of new technology. The enterprises in the industry currently face an urgent need to intensify research activities focused at technological renewal of the industry.

Increase in the competitiveness of the products of the metallurgical industry and transition to highly efficient and environmentally friendly technology that allow to produce modified metal goods with high added value corresponding to the highest quality standards become strategic objectives of the industry.

The transition of the industry to an innovation development type is indicated by the Government of the Republic of Kazakhstan as one of the strategic directions of the country's development. One of the tools for implementing the strategy of industrial development of the Republic of Kazakhstan is encouragement of the innovation activity of metallurgical enterprises with the subsequent creation of high-tech and environmentally safe metallurgical production and transition to the production of competitive and high-tech goods popular in the global market.

To date, the state has a number of approved strategic documents that declare the transition from a raw-materials export model of the economy to the competitive knowledge- and technology-based economy. Thus, the President of the Republic of Kazakhstan, N. Nazarbayev, in his message "The Third Modernization of Kazakhstan: Global Competitiveness", has tasked the Government of the Republic of Kazakhstan and the business community with implementing the Third Modernization of Kazakhstan and mainstreaming the elements of the Fourth Industrial Revolution, which assume creating new promising and developing traditional basic industries.

One of the most important factors that influence the possibility of an innovative breakthrough is planning of innovation activities of the Kazakhstan’s metallurgical enterprises at the macrolevel. In comparison with short-term planning, the goal of which is to achieve profit and efficient use of resources, strategic planning has its own specifics and is aimed at increasing the competitiveness of the industry, one of the tools of which is innovation activities of metallurgical enterprises (Burenin 2012).

Insufficient development of strategic approaches to innovation planning constrains enterprises in the implementation of the objectives of innovation-driven industry growth and does not allow to realize the innovation potential in full.

Theoretical tools of strategic planning were studied in the papers of I. Ansoff, H. Mintzberg, E. Olson, M. McKeown, and others. Methodological aspects of strategic planning at enterprises of the Republic of Kazakhstan were developed in the papers of Kazakhstan researchers E. Utembaev, R.S. Karenov, V.P. Shelomentseva, Z.R. Karbetova, A. Ilyas, Yu. Kazbekova, and others.

At the same time, the issues of further development of methodological and applied aspects of strategic planning of innovation-driven growth of metallurgical enterprises at the macrolevel have been studied insufficiently. The solution of these issues will allow innovatively active enterprises of the metallurgical complex to competently develop and efficiently implement their own strategy of innovative development.

The goal of this article is to define the strategic position of Kazakhstan's metallurgical enterprises and shape a strategy of innovation-driven growth for expanding the share in the world exports of metal products.

A number of tasks are being solved in the work to achieve this goal:

The study is based on statistical data and analytical reports of the Association of Mining and Metallurgical Enterprises of the Republic of Kazakhstan, the Committee on Statistics of the Republic of Kazakhstan, the Ministry for Investments and Development of the Republic of Kazakhstan, the World Steel Association (WSA), the World Bank, the United Nations Conference on Trade and Development, as well as open databases on the metals market Infogeo.ru, Steelland.ru and others.

Theoretical, general scientific and special methods were used in this work:

The vertical axis of the matrix reflects the specific weight of the country in the world exports of steel products.

The horizontal axis of the matrix reflects the level of innovation potential of the metallurgical industry of countries, which is determined by a set of indicators:

1) Institutional resources

Political situation

Ease of payment of taxes

Simplicity of protection of minority investors

Expressed as an expert score, information for determining the data is derived from the annual report "Global Innovation Index" (GII)

2)Financial resources

Gross expenditure on R&D (% of GDP)

Foreign direct investment (FDI), net inflow (% of GDP, average for three years)

3) Primary resources

Share in the world reserves of iron ore, %

4) Human resources

Number of researchers per million people

5) Innovation demand

High-tech net imports (% of total amount)

6) Infrastructure resources

Cluster development

Since the indicators reflecting the industry innovation potential have different dimensions, a normalization principle is applied to bring them to a comparable type. The normalized indicator is calculated using the following formula:

Table 1

Matrix of the strategic position of the national metallurgical industry

Share of the national industry in the world steel export market |

large |

А Strategy of vertical and horizontal integration |

В Strategy of conglomerative and/or concentric diversification |

small |

D Strategy of building the resource supply |

С Strategy of intensive innovation development |

|

Low |

high |

||

Innovation potential |

|||

In recent years, studies have shown that the metallurgical center of the world has completely moved to Asia (Stainless Steel Market Review of the Republic of Kazakhstan). Possessing a significant mineral and raw material potential, the Republic of Kazakhstan is one of the most prominent players not only in the Asian metallurgical market, but also on the world market as well. For example, the Republic of Kazakhstan ranks 7th in the world in terms of iron ore reserves. The explored iron ore reserves are 9,700 mln tons, or 4.0% of the world's reserves (U.S. Geological Survey, Mineral Commodity Summaries, 2017).

The metallurgical industry is the most dynamically developing sector and makes a significant contribution to the country’s economy. For example, the share of the metallurgical industry in the total volume of industrial output has increased from 11.6% to 17.8%. 77 organizations, or 3% of the total number of Kazakhstan’s manufacturing enterprises, operated in the metallurgical industry of Kazakhstan as of January 1, 2017.

The volume of production of the metallurgical industry in general is described by a positive growth: it increased by 1,445.2 billion tenge, or by 74.7%, in 2012-2016. However, in terms of the volume of production of metallurgical products in US dollars, the industry output was down by 7.9% in 2015-2016 compared to the same period of 2014.

The key indicators of development of the metallurgical industry of the Republic of Kazakhstan in 2012-2016 are presented in Table 2.

Table 2

Indicators of development of the metallurgical industry in 2012-2016

Indicators |

2012 |

2014 |

2015 |

2016 |

Growth(+)/decline (-) |

|

2016/2012 |

2016/2015 |

|||||

Total volume of the industrial production of the Republic of Kazakhstan, mln tenge |

16,618,425 |

18,492,753 |

14,903,099 |

19,026,781 |

14.5% |

27.7% |

Total volume of the industrial production of the Republic of Kazakhstan, mln USD |

112,017.21 |

119,467.63 |

81,141.51 |

55,226.45 |

-50.7% |

-31.9% |

Volume of products of the metallurgical industry, mln tenge |

1,935,014 |

1,915,250 |

2,140,058 |

3,380,172 |

74.7% |

57.9% |

Volume of products of the metallurgical industry, mln USD |

13,043.0 |

12,373.0 |

11,651.8 |

9,811.2 |

-24.8% |

-15.8% |

Share of the metallurgical industry in the total volume of industrial production, % |

11.64% |

10.36% |

14.36% |

17.77% |

52.6% |

23.7% |

- including production of iron&steel industry, mln tenge |

700,983 |

765,441 |

773,549 |

1,134,246 |

61.8% |

46.6% |

- volume of production of iron&steel products, mln USD |

4,725.01 |

4,944.93 |

4,211.67 |

3,292.22 |

-30.3% |

-21.8% |

Specific weight of production of iron&steel industry in total volume of metallurgical production, % |

36.2% |

40.0% |

36.1% |

33.6% |

-7.4% |

-7.2% |

- production of precious and non-ferrous metals, mln tenge |

1,224,107 |

1,141,898 |

1,360,432 |

2,239,522 |

83.0% |

64.6% |

- production of precious and non-ferrous metals, mln USD |

8,251.15 |

7,376.94 |

7,407.02 |

6500.36 |

-21.2% |

-12.2% |

Specific weight of precious and non-ferrous metals in total volume of metallurgical production, % |

63.26% |

59.62% |

63.57% |

66.25% |

4.7% |

4.2% |

- metal casting, mln. tenge |

9,923 |

5,826 |

6,077 |

6,403 |

-35.5% |

5.4% |

- metal casting, mln. USD |

66.89 |

37.64 |

33.09 |

18.59 |

-72.2% |

-43.8% |

Specific weight of metal casting in total volume of metallurgical production, % |

0.51% |

0.30% |

0.28% |

0.19% |

-63.1% |

-33.3% |

- production of finished metal products, excluding machinery and equipment, mln tenge |

127,399 |

150,163 |

176,733 |

234,453 |

84.0% |

32.7% |

- production of finished metal products, excluding machinery and equipment, mln USD |

858.73844 |

970.08909 |

962.24165 |

680.5147987 |

-20.8% |

-29.3% |

Specific weight of finished metal products in total volume of metallurgical production, % |

6.58% |

7.84% |

8.26% |

6.94% |

5.4% |

-16.0% |

As of 01.01.2017, the metallurgical production of the Republic of Kazakhstan consisted of 66.3% of the production of precious and non-ferrous metals and 33.6% of the production of iron and steel industry. The share of production of finished metal products (excluding machinery and equipment) was 6.9%. Metal casting was insignificantly represented in Kazakhstan’s metallurgy (0.2%).

Domestic consumption of industry of the Republic of Kazakhstan is currently fully supplied with ferroalloys, ferrochromium, copper and aluminum ores.

80.3% of ferrochromium, 78% of ferroalloys, 58% of ferrosilicon, 71.3% of untreated aluminum, 91.9% of untreated lead, 88.1% of untreated zinc, 97.5% of untreated copper and copper alloys produced in the country are exported.

100% of ferromanganese, 98.7% of pipes and cast iron sections, 100% of cast iron and 95% steel pipe fittings, 91.4% of semi-finished products from copper and copper alloys, 84.2% of radiators for centralized heating from ferrous metals; 82.1% of wire manufactured by cold drawing; 61% of pipes of various diameters and steel profiles are imported into the country.

Analysis of the capacity utilization of the industry in 2016 indicates its relatively high load (over 60%) in the production of traditional products for the republic: cast iron (93.6%), ferroalloys (83.3%), steel (76.7%), rolled steel (73%), aluminum (88.1%), lead (79.8%), copper (78.3%), etc.

Low production capacity utilization (less than 30%) is observed in the production of sandwich panels from coated steel sheets, prefabricated building metal structures (16.8%), sinks from ferrous metals (11.2%), etc.

In general, it must be noted that, despite the recent crisis, the metallurgical industry retains its investment potential and the forecast of its development is quite positive. Given the positive dynamics that emerged in 2016 and the state support of the industry, one can hope for further growth of the industry in the near term.

It is required to study the innovation position of enterprises of metallurgical industry of the Republic of Kazakhstan in comparison with the leading players in the world market in order to define the strategy of innovation development.

The innovation potential was assessed for 10 countries, which are leaders in the world steel production. The source data for calculation are presented in Table 3.

Table 3

The source data for calculation of innovation potential of countries

China |

Japan |

India |

The USA |

Russia |

The Republic of Korea |

Germany |

Ukraine |

Sweden |

Kazakhstan |

||

Institutional resources |

|||||||||||

Political situation, average score |

50.25 |

87.55 |

41.5 |

80.8 |

38.4 |

66.24 |

81.19 |

16.96 |

87.25 |

62.46 |

|

Ease of payment of taxes, average score |

60.46 |

77.03 |

46.6 |

83.85 |

82.96 |

86.56 |

82.1 |

72.72 |

85.28 |

79.54 |

|

Simplicity of protection of minority investors, average score |

45 |

60.0 |

73.3 |

64.7 |

60.0 |

73.33 |

60.0 |

56.7 |

71.7 |

80 |

|

Financial resources |

|||||||||||

Gross expenditure on R&D (% of GDP) |

2.09 |

3.49 |

0.83 |

2.80 |

1.13 |

4.23 |

2.88 |

0.62 |

3.28 |

0.17 |

|

FDI net inflow (% of GDP) |

2.62 |

0.2 |

1.77 |

1.65 |

1.55 |

0.67 |

1.1 |

2.15 |

0.67 |

3.67 |

|

Primary resources |

|||||||||||

Share in the world reserves of iron ore, % (S. Geological Survey, Mineral Commodity Summaries, 2017) |

12.4% |

0.2% |

4.8% |

1.8% |

14.7% |

1.8% |

1.9% |

3.8% |

2.0% |

1.5% |

|

Human resources |

|||||||||||

Number of researchers per million people |

11,763.58 |

5,230.72 |

156.64 |

4,231.99 |

3,131.1 |

7,087.35 |

4,431.08 |

1,006 |

7,021.88 |

7,34.05 |

|

Innovation demand |

|||||||||||

High-tech net imports (% of total amount) |

19.26 |

14.87 |

9.17 |

17.7 |

8.5 |

15.19 |

11.61 |

7.98 |

9.3 |

7.62 |

|

Infrastructure resources |

|||||||||||

Cluster development, average score |

4.66 |

5.22 |

4.52 |

5.56 |

3.36 |

4.52 |

5.36 |

2.95 |

4.99 |

3 |

|

Estimated figures were normalized to reach comparability.

Expertly determined weights of significance were distributed as follows:

Results of calculating the integral indicator of the innovation potential of countries are presented in Table 4.

Table 4

Calculation of the integral indicator of the innovation potential of countries

|

China |

Japan |

India |

The USA |

Russia |

The Republic of Korea |

Germany |

Ukraine |

Sweden |

Kazakhstan |

Political situation |

0.57 |

1.00 |

0.47 |

0.92 |

0.44 |

0.76 |

0.93 |

0.19 |

1.00 |

0.71 |

Ease of payment of taxes |

0.70 |

0.89 |

0.54 |

0.97 |

0.96 |

1.00 |

0.95 |

0.84 |

0.99 |

0.92 |

Simplicity of protection of minority investors |

0.56 |

0.75 |

0.92 |

0.81 |

0.75 |

0.92 |

0.75 |

0.71 |

0.90 |

1.00 |

Normalized indicator for the group of institutional resources (I1*0.15) |

0.28 |

0.40 |

0.29 |

0.40 |

0.32 |

0.40 |

0.39 |

0.26 |

0.43 |

0.39 |

Gross expenditure on R&D (% of GDP) |

0.49 |

0.83 |

0.20 |

0.66 |

0.27 |

1.00 |

0.68 |

0.15 |

0.78 |

0.04 |

FDI net inflow, % of GDP |

0.71 |

0.05 |

0.48 |

0.45 |

0.42 |

0.18 |

0.30 |

0.59 |

0.18 |

1.00 |

Normalized indicator for the group of financial resources (I2*0.25) |

0.30 |

0.22 |

0.17 |

0.28 |

0.17 |

0.30 |

0.25 |

0.18 |

0.24 |

0.26 |

Share in the world reserves of iron ore, % |

0.84 |

0.01 |

0.33 |

0.12 |

1.00 |

0.12 |

0.13 |

0.26 |

0.14 |

0.10 |

Normalized indicator for the group of primary resources (I3*0.2) |

0.17 |

0.00 |

0.07 |

0.02 |

0.20 |

0.02 |

0.03 |

0.05 |

0.03 |

0.02 |

Number of researchers per million people |

1.00 |

0.44 |

0.01 |

0.36 |

0.27 |

0.60 |

0.38 |

0.09 |

0.60 |

0.06 |

Normalized indicator for the group of human resources (I4*0.15) |

0.15 |

0.07 |

0.00 |

0.05 |

0.04 |

0.09 |

0.06 |

0.01 |

0.09 |

0.01 |

High-tech net imports (% of total amount) |

1.00 |

0.77 |

0.48 |

0.92 |

0.44 |

0.79 |

0.60 |

0.41 |

0.48 |

0.40 |

Normalized indicator for the group of innovation demand (I5*0.1) |

0.10 |

0.08 |

0.05 |

0.09 |

0.04 |

0.08 |

0.06 |

0.04 |

0.05 |

0.04 |

Cluster development |

0.84 |

0.94 |

0.81 |

1.00 |

0.60 |

0.81 |

0.96 |

0.53 |

0.90 |

0.54 |

Normalized indicator for the group of infrastructure resources (I6*0.15) |

0.13 |

0.14 |

0.12 |

0.15 |

0.09 |

0.12 |

0.14 |

0.08 |

0.13 |

0.08 |

Integral indicator II |

1.12 |

0.90 |

0.70 |

1.00 |

0.87 |

1.01 |

0.93 |

0.63 |

0.97 |

0.81 |

The analysis shows that China has the strongest innovation potential, being the largest steel producer. This country accounts for 49.6% of the world steel production and 24.1% of the world steel exports.

The high innovation potential of China's metallurgical industry is secured by large iron ore reserves, human resources, imports of high-tech products and services, and a significant inflow of direct investment.

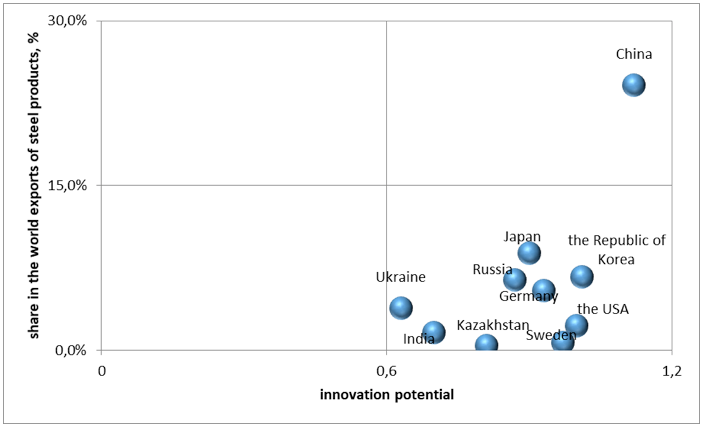

The results of assessment of the strategic positions of the metallurgical industry in the countries under study are presented in Figure 1.

Figure 1

Matrix of strategic positions of innovation-driven growth of metallurgical industry of the countries

As the matrix shows, all the countries under study (except for China) are located in quadrant C. This is a group of countries with significant innovation potential, but their share in the exports of steel products to the world market does not exceed 15%.

Taking a position in the group of leaders, the Republic of Kazakhstan has a strong innovation potential for the development of the metallurgical industry, but with a low share in the exports of metallurgical products.

The strengths of the Republic of Kazakhstan are institutional resources, availability of the iron ore base, availability of direct investment to the economy, and availability of capacities for high value added production.

At the same time, the innovation development of Kazakhstan's metallurgical industry is constrained due to inadequate funding and human resourcing for R&D.

The preferred strategy for Kazakhstan's metallurgical enterprises is the strategy of intensive innovation product development, i.e. improvement of the competitive position and sales in the external market through improvement and modification of metal products.

The goal of this strategy is to maximize benefits of the existing resource potential of the industry. This strategy assumes intensification of research activities, which will require additional investment and financial support for R&D from business and the state.

The activities of Kazakhstan’s enterprises should be carried out towards creating product innovations: new types of ferroalloys, advanced types of AHSS, HSS, etc. steel grades, as well as the development of breakthrough technologies in the production of powders from metal alloys for 3D printing, combined and light alloys, etc.

A significant resource base and a high level of integration of key players in the chain secure a stable competitive position for the Kazakhstan’s metallurgical industry. Experts predict that the industry will rapidly develop in the medium term. To make this development sustainable, the enterprises of the metallurgical complex of the Republic of Kazakhstan need a new strategy of innovation-driven growth, which requires intensive efforts from business and the state.

The strategy of innovation-driven growth of enterprises of the metallurgical industry of the Republic of Kazakhstan should be aimed at improving and modifying the produced metal goods, as well as establishing the resource-saving production facilities and switching to modern low- and non-waste technology (Chermoshentsova 2015).

The strategy of the innovation-driven growth should be planned taking into account general specifics (scale, high concentration, complexity of the technological cycle, etc.) and regional specifics of the Kazakhstan’s metallurgical industry (high concentration of MMC at low-added value level in iron and steel metallurgy and production of basic metals in the non-ferrous metallurgical industry, high energy intensity of production in comparison with countries with developed economies, low quality of finished products of metal processing, etc.).

Besides, global trends in the metallurgical industry and related industries (energy, automotive, nuclear energy, etc.) that form the demand for innovative products must be taken into account in the process of developing a strategy for innovation-driven growth of enterprises.

Regular forecast and foresight studies allow to identify global trends that influence the scientific and technological development of the metallurgical industry and the economy of Kazakhstan in general:

1) Steel consumption is projected to grow 1.5 times by 2050.

According to forecasts, total consumption of steel might grow by 30%, copper by 70%, aluminum by 50%, and zinc by 70% by 2030.

Besides, demand today shifts from traditional metallurgical products to its qualitatively new types and materials with properties of high strength, efficiency, functionality in use and other important properties. For example, it is a steel grade of new generation – AHSS, various powders from metal alloys for 3D printing, combined and light alloys, etc.

Key drivers for the industry growth in the long term are the following (Global trends in iron and steel industry):

According to the UN projections, the world population will reach 9 bln people by 2050, of which 66% will reside in cities and megacities. This will require more metals for comfortable existence. The need for electricity generation will increase 1.6 times by 2050, which will shape additional demand for transportation through aluminum cable and distribution through copper wires in cities.

For example, wind and solar energy sources require more steel than any other energy source (a typical wind turbine requires an average of 180 tons of steel, an offshore turbine requires 450 tons). Additional demand for non-ferrous metals is expected in the field of new transport: for example, 1 electric vehicle requires 67.5 kg of copper, which is 4 times the amount in a traditional vehicle. Besides, according to WorldAutoSteel forecasts, the automotive corporations are going to massively introduce new steel grades described by special strength, weight reduction and environmental friendliness (WorldAutoSteel).

The policy against "dirty" productions (with harmful CO2 emissions) is being tightened under the Kyoto Protocol and the Paris Climate Conference.

Many experts note that Kazakhstan's metallurgical industry has growth prospects only if it meets the requirements of "green standards", high productivity and efficiency, produce innovative and high grades of steel. Otherwise, there is a risk of production loss, primarily for export positions.

The method for assessing the strategic position of Kazakhstan's metallurgical industry presented in the paper allowed to define its place on the global market and to outline the strategy of innovation-driven growth of the industry. The completed study allows to make the following conclusions:

The results of the completed study can be used to develop a strategy for innovation-driven growth of the metallurgical industry of Kazakhstan.

Burenin V.A. (2012). Rol natsionalnykh innovatsionnykh sistem v razvitii konkurentosposobnostey predpriyatiy [The role of national innovation systems in the development of competitiveness of enterprises. Russian foreign economic bulletin], 3, 16-25.

Chermoshentsova, E.V. (2015). Innovatsionnoye razvitiye kak faktor povysheniya konkurentosposobnosti predpriyatiy gorno - metallurgicheskogo kompleksa Kazakhstana [Innovation-driven growth as a factor of improving competitiveness of enterprises of the mining and metallurgical complex of Kazakhstan]. Bulletin KazNU economy series, 90 (2), 53-57

Globalnyye trendy chernoy metallurgii [Global trends in iron and steel industry]. (n. d.). Date View June 17, 2017 kidi.gov.kz›docs/otchety/6034648.pdf

Lakshmanan V.I., Roy R., Ramachandran R. (2016). The Need for Process Innovation. In: Lakshmanan V., Roy R., Ramachandran V. (eds) Innovative Process Development in Metallurgical Industry. Springer, Cham

Obzor Rynka Nerzhaveyushchey Stali Rk [Overview of the RK Stainless Steel Market]. Analytical Service of the RFCA Rating Agency. Date View June 17, 2017 http://rfcaratings.kz/wp-content/uploads/Obzor-rynka-nerzhaveyushhei-stali-1.pdf

U.S. Geological Survey, Mineral Commodity Summaries. IRON ORE. (January 2017). Date View June 17, 2017 https://minerals.usgs.gov/minerals/pubs/commodity/iron_ore/mcs-2017-feore.pdf

1. Kostanay branch of the Federal State-financed Educational Establishment of the Higher Professional Education “The State University of Chelyabinsk”, 110000, Kazakhstan, Kostanay, Borodina str., 168A; E-mail: vin.natalya@gmail.com