Vol. 38 (Nº 62) Year 2017. Páge 20

Vol. 38 (Nº 62) Year 2017. Páge 20

Andrey TYULIN 1; Alexander CHURSIN 2; Alexander YUDIN 3

Received: 06/10/2017 • Approved: 25/10/2017

2. Economic-mathematical model of production capacity optimization in a company

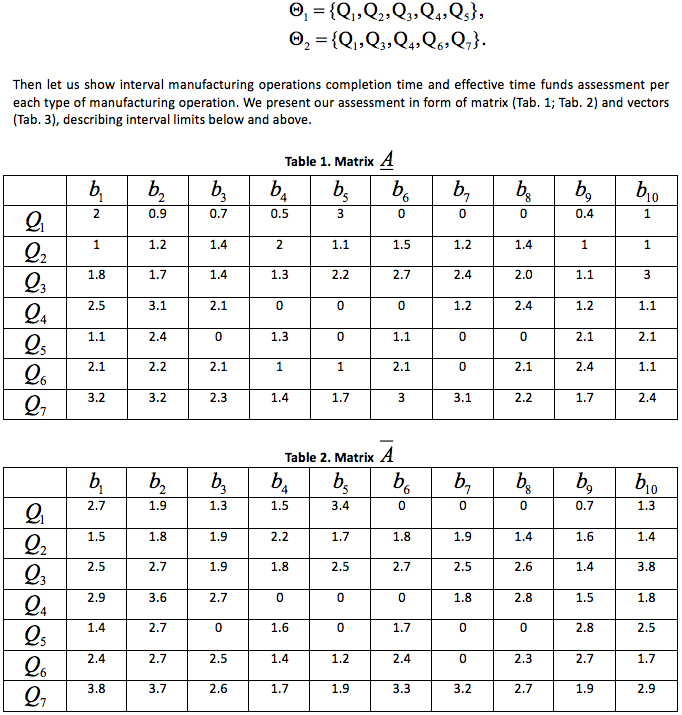

3. Example of high-tech company production capacity optimization

ABSTRACT: Situation of the country in the modern world depends not only on the possession of scientific knowledge; reflect the latest achievements of scientific and technological progress, but also on the ability to apply this knowledge in practice. High technologies play a huge role in the development of the economy and society. Formation and execution of the production program of high-tech enterprises should be carried out in accordance with established expertise, available production capacity and portfolio on high technology in general. This work analyses approaches to optimizing production capacity in cases of a new business line launching in a company. The idea of optimization is the effective involvement of production capacity with free effective time fund. Production capacity planning is based on factors, which affects its value. Improve the use of existing production capacity allow improving the organization of production, labor and management, as well as the intensification of production. In this paper the optimization model that takes into account the characteristics of high-tech enterprises, is created. |

RESUMEN: 1245/5000 La situación del país en el mundo moderno depende no solo de la posesión del conocimiento científico; reflejar los últimos logros del progreso científico y tecnológico, pero también sobre la capacidad de aplicar este conocimiento en la práctica. Las altas tecnologías juegan un papel muy importante en el desarrollo de la economía y la sociedad. La formación y ejecución del programa de producción de empresas de alta tecnología debe llevarse a cabo de acuerdo con la experiencia establecida, la capacidad de producción disponible y la cartera de alta tecnología en general. Este trabajo analiza los enfoques para optimizar la capacidad de producción en casos de lanzamiento de una nueva línea comercial en una empresa. La idea de la optimización es la participación efectiva de la capacidad de producción con un fondo de tiempo efectivo libre. La planificación de la capacidad de producción se basa en factores que afectan su valor. Mejorar el uso de la capacidad de producción existente permite mejorar la organización de la producción, el trabajo y la gestión, así como la intensificación de la producción. En este trabajo se crea el modelo de optimización que toma en cuenta las características de las empresas de alta tecnología. |

In current market conditions businesses are forced to conduct continuous work, connected to development and mastering new production technologies, implementation of new production activity organization schemes, security of new production release. Main aim of conducting these processes is company and product competitiveness increase to secure current market position and expand to new markets (Kolmakov et al, 2014). Matters of competitive product creation and perspective markets penetration is a key point of interest among economists, entrepreneurs and managers of all grades (Cantwell and Santagelo, 2000). Research on competitiveness management is connected to theoretical justification of different approaches to evaluate product, company or industry branch competitiveness, with background and mathematical proof of competitiveness management laws and with development and approbation of appropriate economic-mathematical models (Bhattacharya and Van den Bergh 2014; Bird 2011; Siedel and Haapio 2011). According to Chursin and Makarov (2015) creation and development of competitive advantages allows stable economic development of manufacturer by creating healthy conditions for goods and services, having fundamentally new consumer parameters, production, and also creating additional sales markets for such goods and services.

It is natural to assume, that companies do not always have the financial capability and economic justification to build a new manufacture. Certainly, in some cases (automobile factory, for example) new production line can be organized by ramping up production capacity. On the other hand, in case of need for new types of machinery production, optimization of product capacity becomes a key factor of competitiveness increase. Performance of a manufacturing company is not infrequently linked to the need of special, high-tech, and highly specialized equipment usage (Mensch, 1975; Schumpeter, 1926). Such equipment is often just partly used in production cycle of a company, but costs of production infrastructure maintenance (room heating, for example) and specialists’ salary (the one who operates the machinery) are permanent for the company. On the other hand, production area can be occupied by equipment, which remained in working condition after production modernization. Effective time fund of such equipment could be also used just partially. In such case, company also has to conduct huge financial expenses, connected to production infrastructure and proper working conditions maintenance. Finally, manufacturers’ production structure change, application of modern production technologies, increasing automation of manufacturing operations currently allow to complete production program using less volume of production capacity (Aydın and Takay, 2012).

Based on stated background to increase effectiveness of manufacturing capabilities of an enterprise usage we get a problem of optimal usage of liberated production capacity and need of fixed costs share decrease in operating profit structure of a company. One of the methods of such optimization is production diversification, which implies using companies’ free production area, funds, workforce and other resources to create new types of product or carry out orders from other companies. Thereby a task to evaluate manufacturing capabilities of these area and resources (taking into account probable plan of their involvement) occurs. Solving the matter helps to develop effective scheme of production diversification. Resolution of this issue will be based on optimization model of manufacturing capabilities calculation, taking into account specific characteristics of production, modeling different scenarios of diversification using methods of imitational modeling and evaluation of diversifications’ market effectiveness with the help of economic KPI of a company.

Manufacturing capabilities of a company (its’ technological conversion) are expressed in maximum possible volume of production output in case of certain production target taking into account optimal companies’ resource usage during considered period (Goedhuys and Srholec 2015).

It’s natural to assume, that manufacturing capabilities’ indicators are under influence of different factors, which can both decrease and increase their values. For instance, they can increase in case of technical “rearmament” and decrease in case of qualified staff lack.

Methods of manufacturing capabilities evaluation of a company or its’ divisions can be based on data on staff, list of equipment, laboriousness of product manufacturing (reference examples, for instance) and following imitational modeling of production program with a possibility of a differentiated assortment structure review. Data specification can be different (depending on quantitative indicators available), so that modeling can be implemented by some enlarged product groups.

Based on data on equipment and cadre, limits of effective working time fund are assessed. Then a model is formed, that should have maximum possible volume of production under stated limits on effective working time fund during a certain period as a result. Maximization of equipment working time can be the objective function of this model. Ergo, initial data for optimal usage of production capacity model will be as follows:

Let us suppose that a company has free effective equipment and workforce working time funds. We need to provide optimal charge for free production capacity to increase operating profit. Period of calculation for current example – 1 month.

Ergo, first product assortment allows to provide significant operating profit and its’ usage is more effective in case of production area optimization.

Current research reviews approaches to production capacity optimization in cases of a new business line launching in a company. The idea of optimization was to use production capacity, which has free effective time fund, effectively. An optimization task was formed; solution to this task is set as optimal output volume, which allows providing maximum operating profit. Outstanding characteristics of high-tech companies were considered in process of optimization model creation.

This paper was financially supported by the Ministry of Education and Science of the Russian Federation on the project No.26.1146.2017/4.6 «Development of mathematical methods to forecast efficiency of using space services in the national economy”

Aydın D.G. & Takay B.A. (2012) The role of competition in the techno-economic paradigm on the market. Economic Annals, vol. LVII, 193, pp. 137-150.

Azshepkov, L.T. & Davydov, D. (2006). Universal solution of interval optimization problems and management. Science.

Bhattacharya, Sh. & Van den Bergh, R. (2014). The Contribution of Management Studies to Understanding Firm Behaviour and Competition Law. World Competition: Law and Economics Review, 37(4), pp. 37-56.

Bird, R.C. (2011). The Final Frontier of Competitive Advantage. University of Connecticut - School of Business. Retrieved from: http://ssrn.com/abstract=1793169

Cantwell, J. & Santagelo G.D. (2000). Capitalism, Profits and Innovation in the New Techno-Economic Paradigm. Journal of Evolutionary Economics, vol.10, pp.131-157.

Chursin, A. & Makarov, Yu. (2015). Management of Competitiveness. Theory and Practice. Springer International Publishing.

Goedhuys, M. & Srholec, M. (2015). Technological Capabilities, Institutions and Firm Productivity: A Multilevel Study. European Journal of Development Research, 27 (1), pp. 122-139

Kolmakov, V.V. Polyakova, A.G. & Shalaev, V.S. (2014) An analysis of the impact of venture capital investment on economic growth and innovation: evidence from the USA and Russia. Economic Annals, vol. LX, 207, pp. 7-37.

Mensch, G. (1975) Stalemate in Technology: Innovations Overcome the Depression, International Institute of Management Science Center Berlin, Cambridge, Mass and Ballinger Publishing Co.

Schumpeter, J.A. (1926). The Theory of Economic Development. Cambridge Mass: Harward University Press.

Siedel, G. & Haapio, H. (2011). Proactive law for managers: a hidden source of competitive advantage. Burlington, Vermont, and Surrey, England: Gower Publishing Company, pp. 172

Vasilyev, F.P. & Ivanitskiy, A.Yu. (1998). Linear programming. Factorial, pp. 176

1. JSC Russian Space Systems, 111250, Russia, Moscow, Aviamotornaya st, 53

2. Peoples' Friendship University of Russia (RUDN University), 117198, Russia, Moscow, Miklukho-Maklaya st., 6; E-mail: Achursin2008@yandex.ru

3. Peoples' Friendship University of Russia (RUDN University), 117198, Russia, Moscow, Miklukho-Maklaya st., 6; E-mail: yudinorel@gmail.com