Vol. 38 (Nº 62) Year 2017. Páge 19

Vol. 38 (Nº 62) Year 2017. Páge 19

Irina K. STEPANYAN 1; Galina A. DUBININA 2; Dmitry A. NIKOLAEV 3; Ludmila D. KAPRANOVA 4; Leyla G. PASHTOVA 5

Received: 06/10/2017 • Approved: 25/10/2017

ABSTRACT: This paper gives insight into the cross-disciplinary activity of the instructors in Investment Management, Risk Analyses, Higher Mathematics and English as a Foreign Language, aimed at providing students with the up-to-date standards of professional training. The authors of the article dwell upon the techniques of case analysis in a foreign language and ways to develop skills in problem identification, decision making and communication (e.g. oral presentation or report writing). The case to be considered by a team of educators concerns the effectiveness of investment activity and assessment of risk exposure. Suggestions are made as to progress evaluation and assessment. The article infers that close cooperation between the instructors makes it possible to share the accumulated potential of knowledge in several disciplines including preparation for the graduation paper. |

RESUMEN: Este documento da una idea de la actividad interdisciplinaria de los instructores en Administración de inversiones, Análisis de riesgos, Matemáticas superiores e Inglés como lengua extranjera, con el objetivo de proporcionar a los estudiantes los estándares actualizados de capacitación profesional. Los autores del artículo abordan las técnicas de análisis de casos en un idioma extranjero y las formas de desarrollar habilidades en la identificación de problemas, la toma de decisiones y la comunicación (por ejemplo, presentación oral o redacción de informes). El caso que debe considerar un equipo de educadores se refiere a la efectividad de la actividad de inversión y la evaluación de la exposición al riesgo. Se hacen sugerencias en cuanto a la evaluación y evaluación del progreso. El artículo deduce que la estrecha cooperación entre los instructores hace posible compartir el potencial acumulado de conocimiento en varias disciplinas, incluida la preparación para el trabajo de graduación. |

Socioeconomic changes in today's society have urged for the upgrading of the current professional education system so that it could comply with the up-to-date standards of professional training. This challenge can be met first and foremost through applying various innovative ways of training students for gaining professional competence at contemporary schools of higher learning.

Nowadays it has become common practice to have problem business situations for academic purposes worked out by a multidisciplinary team of lecturers and trainers, especially when it refers to teaching a special academic discipline in a foreign language on the one hand and teaching a foreign language for special purposes on the other.

This paper gives a considerable thought to a challenging situation in which investment decision has to be worked out so that maximum profit could be made. The case is considered by the students of the Financial University under the supervision of the team of instructors including experts in Corporate Finance, Investment Management, Risk Analyses, Mathematics and a Foreign Language (English in the situation under discussion, at the International Financial Faculty of the Financial University under the Government of the Russian Federation, where all the academic disciplines are taught in it).

Within education and training pedagogies several academic disciplines are often combined when mastering bachelors’ and masters' competence in analyzing relevant information, applying suitable methods and writing a thesis on major academic subjects. In relation to finance most situations can hardly be considered without applying such mathematical tools as dynamic programming. Another item which is part and parcel of any investment analyses is the assessment of risk exposure. Teamwork involving multiple disciplines is notably efficient in education. The terms multidisciplinary, interdisciplinary and transdisciplinary have been buzzwords for the last few years, especially in education.

Although the terms are used often interchangeably some investigators stick to the term “cross-disciplinarity” because it suggests making connections rather than blending everything together, it is about understanding connections and patterns rather than normalizing them. (Polaine A. 2010). There is certain difference between cross-disciplinarity and multidisciplinarity. Petrie (Petrie, Hugh G. 1992) discusses multidisciplinarity as “the idea of a number of disciplines working together on a problem, an educational program, or a research study. The effect is additive rather than integrative.”

Bernard C. Choi and Anita W. Pak (Choi et al. 2006) conclude that multidisciplinarity draws on knowledge from different disciplines but stays within their boundaries while interdisciplinarity analyzes synthesizes and harmonizes links between disciplines into a coordinated and coherent whole. Transdisciplinarity or cross-disciplinarity integrates several sciences and transcends their traditional boundaries.

Multidisciplinary approach can be used to develop new products and training programs in the educational process, to share experiences, in interdisciplinary research, and offer a new way of integrated assessment of students' knowledge. The use of a cross-disciplinary approach in the process of training makes it possible to develop interdisciplinary competencies, skills and helps to find the necessary methods and ways of solving the tasks posed in the knowledge obtained by analyzing information extracted from different disciplines. (Dubinina, Pashtova, Stepanian, 2017). An integrative approach to the mathematical preparation of economists is investigated by L. Konnova, A. Rylov and I. Stepanyan (Konnova, 2016a), who prove the necessity of teaching students to apply the mathematical apparatus in solving economic problems from the first year of study at the university, despite their initial level of knowledge, both in mathematics and economics. "Economic Applications of Higher Mathematics i Case Studies", the training manual of these authors (Konnova, Rylov, Stepanyan, 2016b), presents a selection of economic cases with an increasing level of complexity, involving the use of mathematical tools from the initial course of mathematical analysis. Some aspects of interdisciplinary approach are reflected by D. Nikolaev (2017) who considers case analysis as one of key instruments of teaching and interdisciplinary cooperation. In particular, the case studies on professional disciplines show the interrelation of knowledge in various fields and improve skills of students on decision making (Nikolaev, 2016).

The application of a cross-disciplinary approach to the student's analyses of topical financial and economic problems in English becomes especially fruitful when innovative learning technologies and the system of integrated assessment of knowledge are applied.

When studying such basic disciplines as Corporate Finance, Investment Management, Risk Analyses and so on and so forth, students should master higher mathematics, mathematical programming, financial analysis and risk assessment.

Below will be given the analysis of the task aimed at optimizing investments by means of dynamic programming, which is to be done in English, and this example will clearly demonstrate the need for a cross-disciplinary approach.

Cross-disciplinary methodology allows educators to make the learning process more profound and active, as students begin to share the accumulated potential of knowledge in several disciplines.

Training on the basis of a cross-disciplinary methodology allows:

The impact of cross-disciplinary collaboration is at its highest when students write literary reviews for their theses or complete their qualification papers.

It’s common knowledge that graduation work has to reflect an understanding of the theory and practice of the academic discipline in question. Preparing the graduate and post-graduate papers with their corpus of documents and literature in close cooperation with their advisors students determine the theme of it, formulate the basic hypothesis, purpose and objectives and develop a plan of studies on the selected theme. The selection of topics and research direction depends largely on the information derived from the analysis of the facts and the concept of the research, its further development on the basis of conclusions and generalizations, to be tested in practice. The team of instructors help to formulate a hypothesis selected as the basis of the graduation paper and make the assumptions through the preliminary investigation.

Teaching a foreign language for special purposes, namely, when it concerns training for scientific writing, an instructor aims at shaping the ability to express the students’ reasoned opinion about the scientific publications under consideration in a literary review. Writing a literary review contributes not only to working out the ability to process information in a foreign language from various sources, drawing up a review of the arguments and theories, but also to critically analyze and make logical conclusions. This is the process which requires close interaction between the instructors of special disciplines and a teacher of a foreign language, which allows such a team to organize training in the context of the particular discipline (Dubinina, 2014).

This approach involves the creation of generalized subject schemes in order to develop a generic approach to the research problem presented in the graduation work. Harnessing the potential of integrated education technology due to objectively existing need for integrated knowledge of students of the University should and would create the basis for the comprehensive solution to the real life problems. Interdisciplinary links help to disclose the particular processes and phenomena in their development and at the same time unveil their relationship.

Moreover, with the aim of mastering a Bachelor’s and a Master’s competence in preparing and delivering theses on their major academic subjects it is of paramount importance to have a sufficient knowledge of a foreign language.

During the educational process students acquire knowledge, upgrade their practical skills and competences in the field of corporate governance, the design of cash flows of investment projects, analysis of investment efficiency, selection of sources and methods of financing investment activities. Increasing the scale of investment and achieving a certain level of investment efficiency leads to stable economic growth. Therefore, investment policy is part of the overall strategy of the enterprise. It is aimed at choosing and implementing effective forms of investment in order to ensure high growth rates of the company and increase its market value.

The focus of the educational process is on the total volume of the investment activity of the enterprise, the ratio of the particular areas of investment activity, the level of its diversification in the sectoral and regional sections, which is determined by the degree of compliance of this level with the sectoral and regional policies for the development of its operating activities, and the efficiency of the enterprise's investment activity in the period under review. With this in view the system of indicators to assess the profitability of the investment activity in general is used, including that for the different areas of investment, the comparison of these indicators with the return on assets and equity is made, and the investment resources turnover indicators are considered.

It is essential that students understand how investment strategies of a company are designed so that they could reach financial goals of the company development. They have to learn the theory that underlies strong investment decisions, as well as practical, real-world skills that they could apply when discussing investment proposals. Competition in the market leads to the most severe diversification of marketing, investment and promotion of goods and services, which in turn leads to the emergence of a completely new direction in economic management – investment management.

This article implies that "investment management" is a set of management functions aimed at the formation of effective investments and management of them in order to maximize profit, increase profitability, increase sales or modernize production. The main task of the company is to create optimal conditions for quality management of these facilities.

One of the main challenges in the management of the company's investments is that it is impossible to predict its efficiency with adequate accuracy.

To obtain adequate results of the prospective evaluation of investment projects it is necessary to use integrated assessment methods.

The complexity of the assessment process is also one of the reasons that call for the study of investment processes in the company by means of solving practical problems with students through cross-disciplinary business cases. It is all due to the fact that investment activity has always been extremely dependent on the human factor, and investment management in any enterprise also depends on the decisions of individual people.

The process of investment management must be divided into certain stages, each of which requires agreement within the vertical management. The technology of investment and investment management distinguishes 6 main stages of work:

1. Formation of own investment fund;

2. Determination of investment directions;

3. Definition of directions of investment outside the enterprise;

4. Evaluation, forecasting and selection of the best investment directions;

5. Formation of a loan or attracted investment fund;

6. Control and accounting of investment activities.

Correct definition of investment directions is a key stage in investment management technology. Investment managers should identify the main advantages and disadvantages of capital allocation, identify priority objects and the best options for short, medium and long-term investments.

When analyzing an investment project, it is necessary to take into account many factors:

1. Profitability;

2. Risk;

3. Discount rates;

4. Influence of inflation;

5. Duration.

Due to inflationary processes, the duration of project implementation, increased competition, changes in market conditions and other economic factors, the assets of the enterprise are constantly depreciating. That is why evaluation uses complex dynamic methods.

Each variant of capital allocation requires special management and monitoring methods, and therefore the process of current investment management is also very important. This process cannot be interrupted, it must be carried out throughout the life of the company.

Methods of factor analysis allow investigators to identify the degree of influence various indicators have on the efficiency of investment activity, which determines the growth of the market value of enterprises, and which is regarded as one of the main indicators of efficiency of investment activities in the strategic aspect. The increase in the enterprise value, as a criterion of economic efficiency, takes into account virtually all information related to its operation.

All the mentioned above calls for an integrated approach to the study of various phenomena in the economy. An answer to this challenge is collaborative educational activity of a team of instructors which makes it possible to use experience and knowledge of experts in different spheres.

Collaborative teaching under discussion involves three instructors in major financial disciplines (Financial Management, Investment Management and Risk Analysis), an instructor in Higher Mathematics and an instructor in English as a Foreign Language for Specific Purposes (Dudley-Evans, 1998). Advantages of this collaboration lie in the exposure to the connections across the disciplines of the instructors, the support that a multidisciplinary teaching team can provide.

The criteria for the case to be selected is its topicality, it should be borrowed from the real business, be characteristic for the students’ future professional activity, develop the trainees analytical thinking, engage students in discussion (Dubinina, 2010).

Below will be given an example of case analysis on investment optimization in a foreign language carried out with the help of dynamic programming. Analysis is made by the students of Financial University under the guidance of a team of instructors.

Design assignments that allow room for varied interpretations. Different types of problems might focus on categorizing, planning, taking multiple perspectives, or forming solutions. Try to use a step-by step procedure for problem solving. Mark Alexander explains one generally accepted problem-solving procedure:

1.Identify the objective

2.Set criteria or goals

3.Gather data

4.Generate options or courses of action

5.Evaluate the options using data and objectives

6.Reach a decision

7.Implement the decision

Collaborative learning relies on some feedback. Students need to respect and appreciate each other’s viewpoints for it to work. For instance, class discussions can emphasize the need for different perspectives. Create a classroom environment that encourages independent thinking. Teach students the value of multiplicity in thought. You may want to give historical or social examples where people working together where able to reach complex solutions.

The analyzed situation is given in accordance with the state program "Development of the pharmaceutical and medical industry”. In the near future the Government of Moscow plans to allocate funds in the amount of 5 billion monetary units that must be distributed between three pharmaceutical companies: "A" (company 1), "I" (company 2), "F" (company 3). The aim of the program is the creation of an innovative Russian pharmaceutical and medical industry of the world level.

In the course of analysis students, led by the team of instructors will draw an investment allocation plan for the companies under review. The will aim at providing the greatest overall profit, and apply the method of dynamic programming and Bellman's optimality principle.

Table 1 shows the data on the profits of pharmaceutical companies with different investment size.

Table 1

Dependence of companies' profits on the size (volumes) of investments

Investment |

No. 1 “A” |

No. 2 “I” |

No. 3 “F” |

1 2 3 4 5 |

3,6 8,1 9,6 14,4 16,8 |

3,3 5,7 9,3 12,9 17,1 |

3,6 6,9 9,3 14,1 15,6 |

Students are to find an optimal way to distribute 5 billion monetary units between 3 pharmaceutical companies in accordance with Bellman's principle of optimality (Bellman, 1957; Bertsekas, 2012).

Table 2.

Each student should be able to navigate in the entire range of knowledge gained, be able to apply their skills in the comprehensive and balanced way, especially in solving practical problems. Critical assessment of the result obtained and applying the result on economic realities is one of the main objectives of the cross-disciplinary approach in training.

It seems that a simple and step-by-step algorithm, described above, allows students to make a final decision on the distribution plan, but this is not entirely true.

The desire of companies to get the maximum profit is not disputed. It is definitely the main goal of their activities along with an increase in the value of their assets. But the maximization of profit in the reality can lead to an increase in the number and in the likelihood of risks accompanying the activities of companies.

When making a final decision on the allocation of investments, one must also take into account the risks that each investment project bears itself.

Risk analysis and risk assessment can be carried out both quantitatively and qualitatively. In this regard the student must be able to apply not only mathematical methods, but also critically evaluate the results of using them, participating in discussions, debates, brainstorming, using method of expert assessments in decision-making.

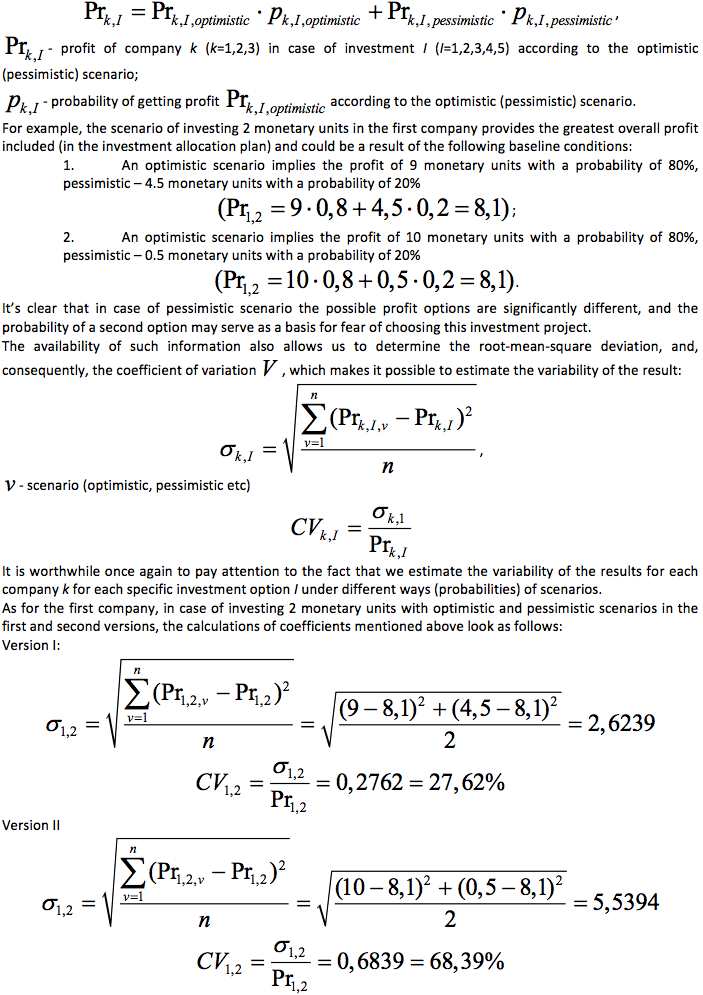

The companies' profit for different volumes of investments is used as the initial parameter of the investment allocation plan considered in the article. But the profit can be considered as an averaged indicator (expected value or mathematical expectation), obtained as a result of taking into account vast variety of scenarios (for example, optimistic or pessimistic) with a certain probability. In this case, the average expected profit is calculated as follows:

These two versions show a vivid example of the fact that the same value of the expected average profit can be the result of completely different initial situations.

It is generally accepted that the higher the variability, the higher the risk level. With a coefficient of variation less than 10% the dispersion is insignificant, and the risk is negligible; from 10 to 20% the risk is average, from 20 to 33-35% – significant; above 35% – it can already be regarded as catastrophic.

At the same time, the calculation of the coefficient of variation does not make it possible to achieve a comprehensive risks analysis and risks assessment. It is necessary to take into account a multitude of factors affecting the economy: changes of social and economic policy, financial legislation, including tax policy, the dynamics of exchange rates, the availability of analog goods (substitutes), the behavior of competitors, etc.

A risk-based approach to investment decision-making is impossible without multidisciplinarity, which makes it possible to use the symbiosis of knowledge from various areas in decision-making and allows students to identify a significant number of factors and, therefore, the risks that are generated by them.

The segregation of risks and factors affecting them is an important but not the main item. The main thing is to understand how the company should behave in relation to the risk, what kind of risk management policy to accept.

In this case, it is very important to be able to assess the nature of cause-effect relationships among risk factors. It will make it possible to determine the nature of the consequences of the risk itself (insignificant, medium, high, catastrophic, etc.).

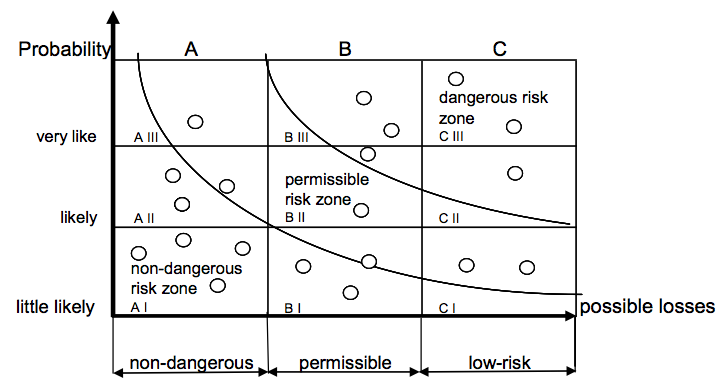

The systematic character and complexity in the issue of risk analysis and risk assessment should be provided by appropriate schematic ways of displaying them: "bow tie", risk map, risk album, etc.

Figure 1

Risk map

The risk map (Fig. 1) practically allows the investigator to rank the risks by two main criteria: probability of occurrence and possible losses.

Figure 2

“Bow-tie” risk analysis

Figure 2 shows the “bow tie” method which gives a more complete risk analysis and risk assessment including causes and consequences of risks, and also provides a schematic representation of possible preventive measures and means to reduce the negative consequences of risky events.

Of course, each of the methods has its own assumptions, advantages and disadvantages, but one way or another they allow an investigator to segregate the priority risks in order to take all possible and necessary measures for risks optimization.

The probability of any risk does not mean the necessity to abandon any activity at all. Our life is riddled with risks. In many cases strong and weak positions of the company, reflected in the SWOT analysis, arise as a result of taking certain risks, including significant ones.

It is important to understand which method of risk management will be optimal and acceptable in a particular situation: risk avoidance, risk acceptance (absorption), risk minimization (reduction) or risk transfer.

It should also be taken into account that in case of different volumes of investment, the structure of the investment plan itself may be completely different in terms of the proportions of resource allocation. The company can neglect one share for the benefit of others and vice versa. The comprehensive knowledge of the fundamentals of corporate finance functioning by students allows them to provide a weighted assessment of such items.

By reaching a consensus, co-instructors dramatically improve their chances of offering compelling, coherent case analyses.

Conversely, by not working together in such a course design process, co-instructors run the risk of demotivating students and making educational process inefficient.

One of the challenging items in case-analyses conducted by a team of instructors is progress evaluation and assessment of students’ performance. No doubt, collaborative teaching integrates the strengths of multiple instructors and welds several disciplines into the meaningful whole. Thus students benefit from the fruitful exchange of ideas, which result in stronger motivation. Still, teaching styles may differ, let alone approach to progress evaluation.

A comprehensive, balanced assessment is a combination of several factors. Co-instructors should consider the following questions:

However it is difficult to decide the amount of credit a student receives for participating in case analyses.

Authors suggest applying two-dimensional assessment strategies: criterion-referenced assessment for subject-matter competence and holistic approach for assessing the language ability. A ten-point scale may be recommended where 5 points are granted for the subject-matter competence, 2 points for the use of mathematical apparatus, 2 points for the foreign language ability, and 1 point for originality and critical thinking (table 3).

Table 3

No. |

Name |

Subject-Matter Competence (0-5) |

Use of Mathematical Apparatus (0-2) |

Foreign Language Ability (0-2) |

Originality And Ability to Think Critically (0-1) |

Total (0-10) |

1 |

Petrov Ivan |

|

|

|

|

|

|

|

|

|

|

|

|

In the course of cross-disciplinary case-analyses on investment management, supplemented with risk analyses, and dynamic programming, a student should be able to analyze different disputable matters and participate in discussing different viewpoints, thereby proving that s/he has deeply mastered the theory and all the particulars of the problem under discussion. The main components of individual subject-matter competence assessment are:

Preliminary analysis of the situation is presented, algorithm of case analyses is formulated (0 - 1 point).

Significant elements which should be taken into account are highlighted, tradeoffs in solving the problem are proposed (0 - 1 point).

Investment and financial management tools are applied (0 - 1 point).

Risk analysis and risk assessment are implemented (0 - 1 point).

Reasoned decision is made, conclusions are argued (0 - 1 point).

Construction of a mathematical model is well-founded (0 - 1 point).

Mathematical tools of different levels of complexity are used (0 - 1 point).

In the above scale is holistic and focuses on the assessment of whole communicative activity rather than specific elements of it. Points should be distributed as follows:

2 points – clear message, coherent discourse, topical vocabulary, perfect cohesion, correct grammar.

1 point – the message is recognizable, some passages do not belong to the subject; vocabulary is general and only some topical vocabulary is used; some connective are erroneous; there are grammar errors.

0 points – the message is mostly off the given subject; grammars errors make comprehension difficult.

The objective of measuring language performance in oral interaction is testing oral ability. Oral ability of the students should be scored validly and reliably. Items to be scored are: expression (attitudes, opinions), manipulation (directions, instructions, persuading, advising, warning), eliciting (information, clarification, explanation), narrating (presenting own point of view). The participants of case-analyses must show the ability not only to monologue and dialogue, but first and foremost to a multi-participant interaction.

Criteria for scoring the performance of participants of case analyses in a foreign language are:

- accuracy (there are some errors, but they do not impede communication);

- appropriacy (logic of the utterance - the intention of the speaker is clear);

- range of the language (vocabulary sufficiency, grammar adequacy, appropriate of message communication, there is no search for words, adequate fluency);

- cognitive flexibility (the assessed student is able to take initiative in the conversation, adapt to the peculiarities of discussion, even to change the subject);

- size of discourse (longer and more complexity utterances);

- interaction with the peers. (Mil'rud, 2007)

It should be noted that team teaching envisages collaboration between teachers and students. It is general practice to include students decision-making as a result of case analyses. This facilitates critical thinking and students’ ability to apply their knowledge and foster their attaining professional competence. In terms of assessment, it may be beneficial to grade students on the quality of discussion, engagement, and adherence to group norms.

Students in their turn assess the performance of their peers and it provides motivation for students to learn how to behave in groups. Instructors should provide a model of how a successful group may function. Students should work together on the task. Task functions may include (Clifford, 2014):

Initiating Discussions;

Clarifying points;

Summarizing;

Challenging assumptions/devil’s advocate;

Providing or researching information;

Reaching a consensus.

It stands to reason that case-analysis is an arena not only of instructors' but also that of students' interaction. Students combine their knowledge and cooperate in advancing different ideas on working out and making a decision, using open-ended questions which is really very engaging. Participants mutually control each other and even evaluate progress.

Analyses are considered to be satisfactory if:

Cross-disciplinary analysis of problems solved by students studying in a foreign language becomes especially important when introducing innovative learning technologies and the system of integrated assessment of knowledge.

When teaching such profile disciplines as "Corporate Finance", "Investment Management" and other disciplines, educators conclude that knowledge acquired by students in higher mathematics, mathematical programming, risk assessment is enhanced by collaborative approach.

The above example of analysis in a foreign language of the task of optimizing investments by means of dynamic programming clearly demonstrated the need for a cross-disciplinary approach.

Cross-disciplinarity contributes to the learning process and makes it more profound and active, as students begin to share the accumulated potential of knowledge in several disciplines.

Thus training on the basis of a cross-disciplinary methodology allows:

As a result, the technology of the cross-disciplinary approach can be used to develop new products and training programs in the educational process, to share experiences, in interdisciplinary research, and offer a new way of integrated assessment of students' knowledge. The use of a cross-disciplinary approach in the process of training, as practice shows at the Finance University under the Government of the Russian Federation, makes it possible to develop interdisciplinary competencies, skills and helps to find the necessary approach and methods of solving the tasks posed using the knowledge obtained by analyzing information extracted from different disciplines.

An integrated cross-disciplinary approach allows educators to undertake a comprehensive study and develop the students’ research skills. It is case study that fosters the comprehensive analysis of the situation and makes it possible to scrutinize and assess various cases obtained from various sources of information both in Russian and a foreign language. Making use of interdisciplinary links, students should develop a common vision of research and only after that make a decision.

Organization of educational process on the basis of the integrated approach implies student participation in scientific conferences, seminars, contests, that broadens the horizons and contributes to the students’ creative potential.

Bellman, R. 1957. Dynamic Programming. Princeton University Press, Princeton, Nj. Republished 2003: Dover

Bertsekas D. 2012. Dynamic Programming And Optimal Control. Vol. Ii, 4th Edition: Approximate Dynamic Programming, pp. 712.

Choi B.C., Pak A.W. 2006, Multidisciplinarity, Interdisciplinarity And Transdisciplinarity In Health Research, Services, Education And Policy. Clin Invest Med. Dec; 29(6):351-64. Available Online: Http://Uvsalud.Univalle.Edu.Co/Pdf/Politica_Formativa/Documentos_De_Estudio_Referencia/Multidisciplinarity_Interdisicplinarity_Transdisciplinarity.Pdf

Clifford M. 2014. 20 Collaborative Learning Tips And Strategies For Teachers. Available Online: Http://Www.Teachthought.Com/Pedagogy/20-Collaborative-Learning-Tips-And-Strategies

Dubinina, G. 2010. Tekhnologiya Primeneniya Kejs-Analiza V Podgotovke Po Inostrannomu Yazyku Bakalavrov [The Techniques Of Case Analysis In Foreign Language Teaching]. In Innovacionnye Podhody V Obuchenii Inostrannym Yazykam, 12 (591), 81-90

Dubinina, G. And Savchenko, N. 2014. Obuchenie Pismu Nauchnoi Napravlennosti V Magistrature [Teaching Writing Of Scientific Orientation At Master Programmes]. In: Nauka V Sovremennom Mire: Teoriya I Praktika [Science In The Modern World: Theory And Practice]. Moscow, pp. 42-49.

Dubinina, G. And Stepanian, I. 2016. Obespechenie Disciplin Matematicheskogo Tsicla Dlya Napravleniy “Ekonomica” I “Menedgment” Inoyasichnoy Poddergkoi [Providing Disciplines Of Mathematical Cycle For Economics And Management With A Foreign Language Support].In: Standarti I Monitoring V Vischem Obrazovanii, 4(3), 52-56.

Dubinina, G., Pashtova And L. Stepanian, I. 2017. Interdisciplinary Cooperation In Case Studies On Corporate Finance In A Foreign Language. In: International Research Journal, 01 (55), 30-32.

Dudley-Evans, T. 1998. Developments In English For Specific Purposes: A Multi-Disciplinary Approach. Cambridge: Cup, pp. 301

Konnova L., Rylov A. And Stepanyan I. 2016. Economic Applications Of Higher Mathematics In Case Studies: Tutorial. Мoscow: Financial University, pp. 132

Konnova L., Rylov A. And Stepanyan I. 2016. Elementy Integrativnogo Podhoda K Bazovoj Matematicheskoj Podgotovke Ehkonomistov [Elements Of Integrative Approach To Basic Mathematical Training Of Economists]. Vestnik Finansovogo Universiteta, 20(5), 158-166.

Mil'rud R. P. 2007. Metodika Prepodavaniya Anglijskogo Yazyka [English Teaching Methodology]. Moscow: Labirint, pp. 216-218

Nikolaev, D. 2016. Mezhdistsiplinarnoye Sotrudnichestvo Pri Ispol'zovanii Keysov Po Distsipline “Analiz I Otsenka Riskov” [The Interdisciplinary Cooperation In Case Analysis Using On The Discipline "Risks Analysis And Risks Assessment"] In Gumanitarnaya Obrazovatel'naya Sreda Tekhnicheskogo Vuza: Materialy Mezhdunarodnoy Nauchno-Metodicheskoy Konferentsii. [Humanitarian Educational Environment Of A Technical University: Proceedings Of The International Scientific And Methodological Conference]. St. Petersburg Polytechnic University Of Peter The Great, pp. 81-83.

Nikolaev, D. 2017. Keys-Analiz Kak Instrument Predmetno-Yazykovogo Integrirovannogo Obucheniya [Case-Analysis As A Tool For A Language-Integrated Learning] In Innovatsionnyye Idei I Podkhody K Integrirovannomu Obucheniyu Inostrannym Yazykam I Professional'nym Distsiplinam V Sisteme Vysshego Obrazovaniya: Materialy Mezhdunarodnoy Konferentsii 27-30 Marta 2017 Goda [Innovative Ideas And Approaches To Integrated Learning Of Foreign Languages And Professional Disciplines In The Higher Education: Materials Of The International School-Conference. March 27-30, 2017]. St. Peresburg: The Publishing House Of The Polytechnical University, pp. 372-373.

Petrie, Hugh G. 1992. Interdisciplinary Education: Are We Faced With Insurmountable Opportunities? , Review Of Research In Education, 18, 299-333

Polaine A. 2010. Interdisciplinarity Vs Cross-Disciplinarity. Available Online: Http://Www.Polaine.Com/2010/06/Interdisciplinarity-Vs-Cross-Disciplinarity

1. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49; E-mail: ikstepanyan@fa.ru

2. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49; E-mail: gadubinina@fa.ru

3. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49; E-mail: DNikolaev@fa.ru

4. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49; E-mail: LKapranova@fa.ru

5. Financial University under the Government of the Russian Federation, 125993, Russia, Moscow, Leningradsky prospect, 49; E-mail: LPashtova@fa.ru