Vol. 38 (Nº 62) Year 2017. Páge 6

Vol. 38 (Nº 62) Year 2017. Páge 6

Anna Alexandrowna URASOVA 1; Pavel Alexandrovich KUZNETSOV 2; Andrei Viktorovich PLOTNIKOV 3

Received: 06/10/2017 • Approved: 20/10/2017

ABSTRACT: Research methods: economic and mathematic modeling, optimization theory, game theory, utility theory, theory of random functions. The following basic results were obtained in the course of research: first of all, it was demonstrated that enterprises have always got more incentives to horizontal integration in the markets characterized by uncertainty of demand or production costs, in case mentioned data is a matter of private information. A joint company can aggregate the information of its departments and streamline production among its business units accordingly. Besides, intensified volatility in the financial markets increases the incentives of enterprises to horizontal integration. Joint ventures may be profitable even in low concentration markets. In this work, we analyze the incentives of enterprises to horizontal integration and the impact the horizontally integrated companies produce on the national welfare in the markets characterized by uncertainty of demand or production costs. The obtained results are compared with the incentives of enterprises to horizontal integration and the impact the horizontally integrated companies produce on the national welfare in determined markets. |

RESUMEN: Métodos de investigación: modelos económicos y matemáticos, teoría de la optimización, teoría de juegos, teoría de la utilidad, teoría de las funciones aleatorias. Los siguientes resultados básicos se obtuvieron en el curso de la investigación: en primer lugar, se demostró que las empresas siempre tienen más incentivos para la integración horizontal en los mercados caracterizados por la incertidumbre de la demanda o los costos de producción, en caso de que los datos mencionados sean una cuestión de privacidad información. Una empresa conjunta puede agregar la información de sus departamentos y optimizar la producción entre sus unidades de negocios en consecuencia. Además, la volatilidad intensificada en los mercados financieros aumenta los incentivos de las empresas a la integración horizontal. Las empresas conjuntas pueden ser rentables incluso en mercados de baja concentración. En este trabajo, analizamos los incentivos de las empresas para la integración horizontal y el impacto que las empresas integradas horizontalmente producen en el bienestar nacional en los mercados caracterizados por la incertidumbre de la demanda o los costos de producción. Los resultados obtenidos se comparan con los incentivos de las empresas para la integración horizontal y el impacto que las empresas integradas horizontalmente producen en el bienestar nacional en mercados determinados. |

Relevance of the research topic. The choice of efficient forms and strategies of growth of enterprises' capital and assets determines to a large extent long-term and effective industrial activity, enhancement of competitiveness and provision of sustained high levels of economic development. One of the most popular and important decisions made by the companies refers to the search of effective arrangement forms of consolidation. However, experience suggests that market volatility is a major determinant of integration activity. According to conventional assumptions, enterprises have more incentives to integration in areas (markets) characterized by a higher degree of uncertainty. In this regard, analyzing the incentives of enterprises to horizontal integration and the impact the horizontally integrated companies produce on the national welfare in oligopolistic markets characterized by uncertainty of demand and/or production costs is highly relevant.

The issue of research and optimization of market structures is becoming more and more relevant among the scientists of the world (Qing Yang, Lei Zhang, Xin Wang 2017; Kadiyali, Sudhir & Rao 2001; Kumar, Srivastava, & Singh 2005; Harrigan 1986), the structures in which the company that occupies a downstream position in the technological chain provides the upper companies with input resources and, at the same time, is vertically integrated with one of the upper stream companies. This analysis is still more important from the point of view of assessing the possible anti-competitor effect of those vertically integrated structures as well as the influence of information flows between the downstream and upper-stream enterprises of the area on the incentives to develop the innovations and the National Wealth. The above mentioned problems are especially relevant in case it is required to make the essential information, information on technology, design or specific characteristics of the product in particular, available both to the downstream and upper-stream enterprises of the area. This situation is characteristic of high-technology areas where information exchange regarding downstream and upper-stream products is required in order to provide product compatibility and to avoid additional costs for adjustment and functional improvement. From the antimonopoly point of view, the issue of assessing whether it is feasible or not to prohibit different divisions of a horizontally integrated company to share non-public information received by one of the divisions from third-party sources is really essential.

Enterprises often make long-term decisions without having a clear idea of short-term market conditions. Decisions on horizontal integration are taken in case there is uncertainty of demand and production costs. For example, oil companies can discover more economical (in terms of costs) developments of oil deposits or biotechnological companies can generate new products that will be in great demand. In this context, we can say, the created model assumes that the enterprises study the demand and production costs after they have made the decision on integration. More than that, the enterprises may be to some extent aware of their competitors' demand and production costs. For instance, information on institutional developments, regarding the demand and/or production costs is, as a rule, available to public. On the contrary, the quality of oil deposit development or the results of innovation studies are private information of the companies. Both types of uncertainty are taken into consideration in the model and it is shown that the identified difference plays a fundamental role.

In this work we make an attempt to analyze the incentives of enterprises to horizontal integration and the impact the horizontally integrated companies produce on the national welfare in the markets (Cournot Oligopolies [according to previous studies of Cournot Theory and his followers (Friedman 1982; Amir 1996; Satoh & Tanaka 2016; Shinozaki & Kunizaki 2017)], characterized by uncertainty of demand or production costs. The obtained results are compared with the incentives of enterprises to horizontal integration and the impact the horizontally integrated companies produce on the national welfare in determined markets.

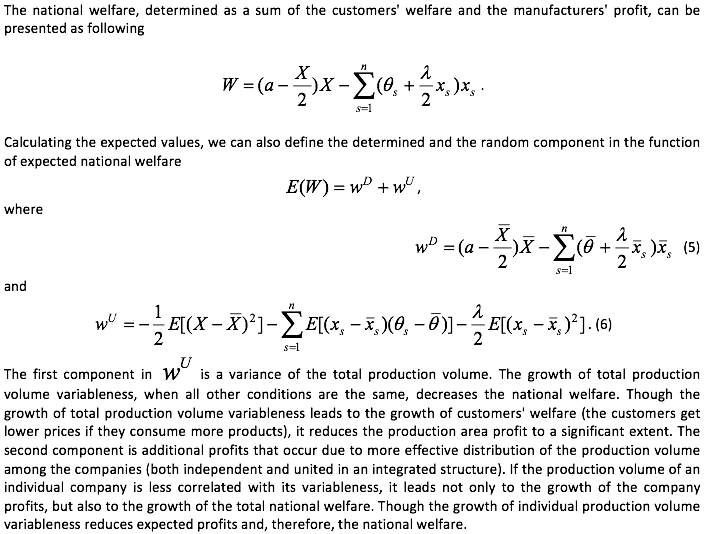

The impact of horizontal integration on the national welfare in the markets characterized by uncertainty also depends on the type of information. In case the uncertainty in the market is private information, horizontally integrated companies can produce a less negative impact on the national welfare than when they act in determined markets. After the integration, the aggregate production output is achieved in a more efficient way, while the divisions characterized by lower production costs produce a relatively larger amount than those characterized by higher production costs. Besides, the variability of the aggregate amount of production goes down, therefore, the national welfare grows. It is established that if the uncertainty is high and the market is very concentrated, horizontally integrated companies lead to growth of national welfare.

If the uncertainty in the area (in the market, for example (Hoskisson & Busenitz 2002)) is private information, horizontally integrated companies are a more frequent phenomenon and are more favorable for the national welfare. In the markets characterized by high volatility, these benefits can compensate for the anti-competitor effects of horizontal integration and, therefore, horizontally integrated companies, in case the uncertainty in the area is private information, increase the national welfare.

The results, in case the uncertainty in the area is private information, can be achieved under the condition that the enterprises receive ideal signals regarding their uncertain and independent characteristics. The enterprises also have more incentives to integration in case these characteristics are interrelated. However, in case these characteristics are correlated to a large extent, the enterprises can have more incentives to integration than in determined markets. Actually, in this case, the enterprises can estimate all the information on their competitors and, therefore, the situation is close the one when the uncertainty in the area (in the market) is public information. Consequently, integration in the markets characterized by uncertainty is more profitable in case the enterprises save a certain part of the private information.

In this work we, firstly, develop a theoretical game model of horizontal integration in stochastic conditions, further on we provide an analysis of the enterprises' incentives to horizontal integration and the impact the horizontally integrated companies produce on the national welfare in case the uncertainty is private information of the enterprises, then we analyze the incentives of enterprises to integration and the impact the integrated companies produce on the national welfare in case the uncertainty is public information.

The theoretical and methodological basis of this research is represented by scientific works in the area of mathematic modeling of economic processes and systems, the enterprise theories, the game theory, methodology of optimization, methods of mathematical statistics.

The following methods were used in the process of research: economic and mathematic modeling, the theory of optimization, the game theory, the theory of utilization, the theory of random functions, analysis of differential equations, comparative statistics of equilibrium.

In this section we make an attempt to analyze the incentives to integration and the impact the joint companies produce on the national welfare in case the uncertainty is private information of the enterprises. The first target is to determine in which market structures we can find integrated companies. The second target is to assess their influence on the national welfare.

In the previous section, we showed that uncertainty of market conditions increases the incentives of enterprises to integration and reduces the impact of horizontal integration on the national welfare. These results are due to information exchange among divisions of an integrated company and consequent streamlining of production output among integrated enterprises. In this section, we determine that information exchange among the enterprises of an integrated company is crucial for such conclusions. In this section, we show that in conditions when the uncertainty of company production costs is public information, the companies may have less incentives to integration and horizontally integrated companies may be less efficient than in determined conditions. In this case, horizontal integration does not contribute to the aggregation of information, for the production costs of divisions within an integrated company are common knowledge even without any information leaks.

The next Assumption compares incentives to integration under the condition when uncertainty of company production costs is public information, with the situation when uncertainty of production costs is private information of enterprises and when there is no uncertainty as such.

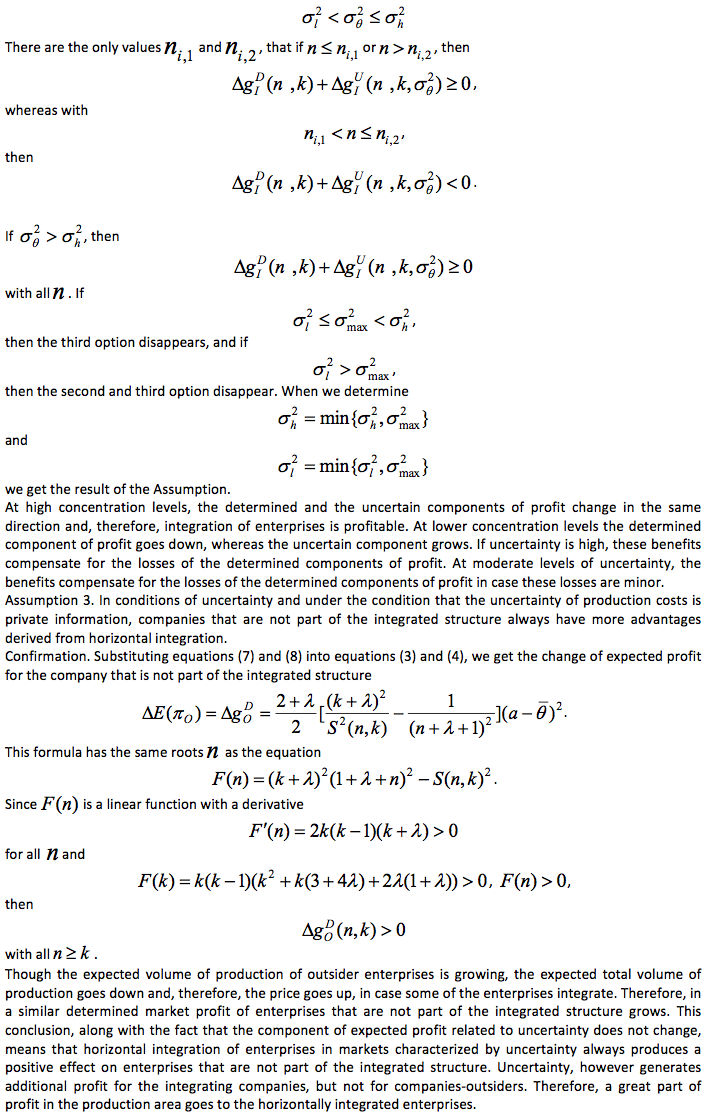

Assumption 6. In the uncertain market reality, companies have less incentives to integration in conditions when uncertainty of company production costs is public information, than when uncertainty of production costs is private information of enterprises. Besides, in the uncertain market reality and under the condition that uncertainty of production costs is public information:

1. if the number of integrated companies is small and the original number of companies in the production field is large, companies have less incentives to integration than in determined markets;

2. if the number of integrated companies is large and the original number of companies in the production field is small, companies have more incentives to integration than in determined markets.

Confirmation. In case integration took place on the first stage, determining

In the conditions when uncertainty of company production costs is public information, streamlining of production output among horizontally integrated enterprises is not so strong as in the conditions when uncertainty of company production costs is private information. First, integrating companies would be responsible for utilizing the costs of their partners even if they are not part of the integrated system. Second, enterprises that are not part of the integrated system can react to utilization of costs of each integrated company in this particular situation. As a result, variation of the stochastic component of the expected profit is lower than in conditions when uncertainty of company production costs is private information. The difference may even be negative which may make horizontally integrated companies less profitable than in determined markets. In fact, integrating companies face a compromise between less aggressive behavior and higher price. In the long run, whether uncertainty leads to profits or loss again depends on the relative percentage of enterprises that join an integrated structure. In case this percentage covers a significant part of the market, integrating companies benefit from the uncertainty present at the market, whereas if this percentage covers an insignificant part of the market, integrating companies bear losses from the uncertainty present at the market. In the following Assumption we show that the latter phenomenon occurs only when the enterprises have no incentives to integration in determined circumstances.

Assumption 7. In conditions when uncertainty of company production costs is public information, more integrated structures tend to appear than in determined market conditions.

For a fixed number of integrating companies, both the determined and the random components of expected profit are negative in case the initial number of companies in the market (in the production area) is big. In the presence of a big number of enterprises that are not part of the integrated structure, the rundown of production volume for integrating enterprises is not compensated by a moderate rise of price. The problem, however, is much more serious in the determined sector of expected profit than it is in the random component of expected profit. As expected, a horizontally integrated company reduces the production volume evenly among the divisions, however, de facto, the integrated company can distribute the rundown of production volume more efficiently.

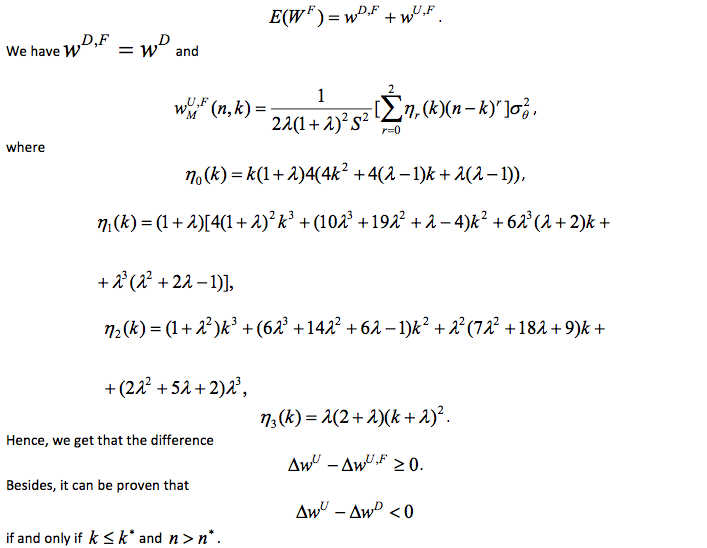

Assumption 8. In the uncertain market reality, horizontal integration produces a significantly more negative impact on the national welfare in conditions when uncertainty of company production costs is public information, than when uncertainty of production costs is private information of enterprises. Besides, in the uncertain market reality in case uncertainty is public information:

1. in case the number of companies that join an integrated structure is insignificant and the initial number of companies in the area is great, horizontally integrated companies produce a significantly more negative impact on the national welfare than in determined markets;

2. in case the number of companies that join an integrated structure is significant and the initial number of companies in the area is small, horizontally integrated companies produce a significantly less negative impact on the national welfare than in determined markets.

Confirmation. Suppose that

In volatile markets, horizontally integrated companies are not only less profitable, in case uncertainty of company production costs is public information, but also lead to decrease of national welfare. In case uncertainty is public information, variability of the random component of the expected national welfare is lower than if uncertainty is private information, since, as it was stated above, streamlining of production among enterprises is less efficient. This difference may even be negative, which proves lower efficiency of horizontal integration in these conditions than in a similar determined market. Though production is more efficiently performed, the variance may grow. A higher variance increases the consumers' welfare, however, it reduces the total national welfare. In the long run, the impact produced by horizontal integration on the national welfare depends on the relevant significance of the determined and stochastic components of profit.

In the present work we analyzed the impact of uncertainty and private information on the horizontal integration in production area (in the market). According to conventional assumptions, enterprises have more incentives to integration in areas (markets) characterized by a higher degree of uncertainty. Formal analysis that was done in this work shows that this is not always the case. If the uncertainty in the area (in the market) is public information, the enterprises may have less incentives to integration than in determined markets. On the contrary, if the uncertainty in the area (in the market) is private information, the enterprises may have more incentives to integration than in determined markets.

The results when the uncertainty in the area (in the market) is private information have been achieved under the condition that the enterprises receive ideal signals regarding their uncertain and independent characteristics. The enterprises also have more incentives to integration in case these characteristics are interrelated. However, in case these characteristics are correlated to a large extent, the enterprises can have more incentives to integration than in determined markets. Actually, in this case, the enterprises can estimate all the information on their competitors and, therefore, the situation is close to the one when the uncertainty in the area (in the market) is public information. Consequently, integration in the markets characterized by uncertainty is more profitable in case the enterprises save a certain part of the private information.

The impact of horizontal integration on the national welfare in the markets characterized by uncertainty also depends on the type of information. In case the uncertainty in the area (in the market) is public information, horizontally integrated companies can produce a more negative impact on the national welfare than when they act in determined markets. In case the uncertainty in the area (in the market) is private information, horizontally integrated companies are a more frequent phenomenon and are more favorable for the national welfare.

In markets characterized by high volatility these benefits can compensate for the anti-competitor effects of horizontal integration and, therefore, horizontally integrated companies, in case the uncertainty in the area (in the market) is private information, increase the national welfare.

The publication has been prepared within the Russian Foundation for Humanities (RFH). Project #17-12-59009 “Features of Development of a Regional Industrial Complex in the Conditions of the Current Economic Crisis”.

Amir, R. (1996). Cournot oligopoly and the theory of supermodular games. Games and Economic Behavior, 15(2), 132-148.

Friedman, J. (1982). Oligopoly theory. Handbook of mathematical economics, 2, 491-534.

Harrigan, K. R. (1986). Matching vertical integration strategies to competitive conditions. Strategic Management Journal, 7(6), 535-555.

Hoskisson, R. E., & Busenitz, L. W. (2002). Market uncertainty and learning distance in corporate entrepreneurship entry mode choice. Strategic entrepreneurship: Creating a new mindset, 151, 172.

Kadiyali, V., Sudhir, K., & Rao, V. R. (2001). Structural analysis of competitive behavior: New empirical industrial organization methods in marketing. International Journal of Research in Marketing, 18(1), 161-186.

Kumar, A., Srivastava, S. C., & Singh, S. N. (2005). Congestion management in competitive power market: A bibliographical survey. Electric Power Systems Research, 76(1), 153-164.

Li, J., Kendall, G., & John, R. (2016). Computing Nash equilibria and evolutionarily stable states of evolutionary games. IEEE Transactions on Evolutionary Computation, 20(3), 460-469

Nachbar, J. (2016). Game Theory Basics I: Strategic Form Games.

Nash, J. (2016). The Essential John Nash. Princeton University Press.

Qing Yang, Lei Zhang, Xin Wang (2017) Dynamic analysis on market structure of China's coal industry. Energy Policy, Vol. 106, 498-504

Satoh, A., & Tanaka, Y. (2016). Maximin and minimax strategies in symmetric oligopoly: Cournot and Bertrand.

Shinozaki T., Kunizaki M. (2017) Basic Properties of a Mixed Oligopoly Model. In: Yanagihara M., Kunizaki M. (eds) The Theory of Mixed Oligopoly. New Frontiers in Regional Science: Asian Perspectives, vol 14. Tokyo: Springer.

1. Perm Branch of the Institute of Economics of the Ural Branch of the Russian Academy of Sciences, 614990, Perm Krai, Perm, 13a Lenin Street. Federal State Budgetary Educational Institution of Higher Education “Perm State National Research University”, 614990, Perm Krai, Perm, 15 Bukireva Street. E-mail: annaalexandrowna@mail.ru

2. Federal State Budgetary Educational Institution of Higher Education “Perm National Research Polytechnic University”614990, Perm Krai, Perm, 29 Komsomolsky Avenue. E-mail: pk.pnrpu@gmail.com

3. Federal State Budgetary Educational Institution of Higher Education “Perm National Research Polytechnic University”, 614990, Perm Krai, Perm, 29 Komsomolsky Avenue. E-mail: plotnikov-av@mail.ru