Vol. 38 (Nº 52) Year 2017. Page 10

Yulia Ashumovna VLASOVA 1

Received: 21/06/2017 • Approved: 12/07/2017

ABSTRACT: The subject of the study is the budget risks of the constituent territories of the Russian Federation. The article is devoted to the study of possible budget risks typical for the Russian constituent territories budgets in the current economic situation, in the context of the need to contain unreasonable growth of budget expenditures and to keep the deficit level at an acceptable level. The purpose of the study is to identify budget regional risks and develop measures to level them. |

RESUMEN: El objeto del estudio es el riesgo presupuestario de los territorios constituyentes de la Federación de Rusia. El artículo se dedica al estudio de los posibles riesgos presupuestarios típicos de los presupuestos de los territorios constituyentes rusos en la situación económica actual, en el contexto de la necesidad de contener un crecimiento irrazonable de los gastos presupuestarios y de mantener el nivel de déficit en un nivel aceptable. El propósito del estudio es identificar los riesgos regionales presupuestarios y desarrollar medidas para nivelarlas. |

The importance of early assessment and identification of the risks of the constituent territories budgets is extremely important for the economy. Analysis and early detection of budget risks would have made it possible to reduce or level out their impact on the economy of both the region and the country as a whole by taking timely measures to manage them.

Budget risk is a broader concept than simply the risk of nonfulfillment of the budget. Thus, it is possible to formulate the notion of budget risk of constituent territory of the Russian Federation as the probability of the occurrence of such an unfavorable event that may lead to a violation of the current budget process, to a significant deviation of the main performance indicators of the budget from medium or planned, and, therefore, the need to adjust budget forecasts in short, medium and long-term periods.

In the aggregate of factors that may be risky for the budgets of the constituent territories of the Russian Federation, in our opinion, it is necessary to single out a group of economic risks, including insolvency risks, liquidity and credit risks.

So, for the Russian regions, the risk of shortfall in tax revenues is a significant risk in crisis periods. This can include the risk of shortfall in tax revenues: revenues from income tax due to the deterioration of the enterprises financial condition in the region, and the tax on personal income due to reduced wages or rising unemployment, transport tax due to a decline in living standards, etc. (ULYUKAEV, TRUNIN, 2008). The of risk of shortfall in non-tax revenues are, for example, a decrease in the profit from assets owned by regional authorities, certain types of fees due to a decrease in business activity in the region.

The risk of uncontrolled growth of expenditures also applies to the group of economic risks, especially in cases that lead to a simultaneous increase in revenues, an increase in the deficit/surplus, an increase in dependence on the federal budget, an increase in the debt of the entity, or a change in its structure towards deterioration, that is, more burdensome for the budget.

The group of organizational and technical risks can include the risks of the effectiveness of the implementation of programs, operations and other activities related to the implementation of the budget process and management of budget funds by individual structures of the entity management bodies (Figure 1). Also, it includes the risk of failure to comply with the standards, ineffective management of funds, including due to corruption, concealment of violations. These risks are still quite high in modern conditions in Russia.

Social risks are the risks associated with the implementation of such a state policy, in which the situation of socially unprotected strata of the population may worsen, which can cause social tension in the society.

The subject of our research is primarily economic risks. For more convenient analysis, we classify them into several segments:

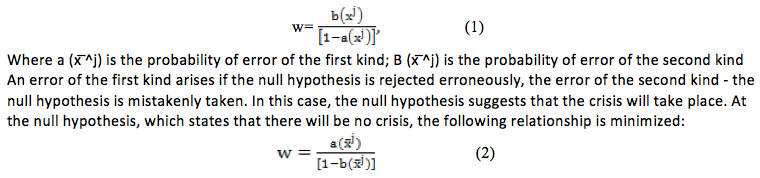

In models based on the signal approach, information of indicators behavior during the normal (non-recessionary) and crisis periods is studied. When implementing the signal approach, it is suggested that it is necessary to test the null hypothesis that the economy is in a normal state, in contrast to the alternative hypothesis that in the next three to six months, a crisis may arise. Indicators are selected on the basis of data on changes in their behavior under normal functioning economy and in crisis periods, as well as the ability to provide a real signal of the crisis. If more formally, then the indicator j(xj) gives a "signal" of the impending crisis if it passes a certain threshold requirement x ̅j. The critical threshold requirement is chosen in such a way as to achieve a balance between obtaining multitude of false signals (errors of the second kind) and the risks of missing the crisis (errors of the first kind). The optimal threshold requirement for each indicator is determined by minimizing the ratio:

Each time the indicator crosses the threshold requirement, signaling the approach of the crisis; further developments are possible in two scenarios:

1. The crisis will take place soon;

2. The crisis will not take place in the designated time frame (false alarm).

One of the first paper based on the signal approach is the study by B. Eichengreen, A. Rose and Ch. Vyplosh, devoted to the identification of currency crises on the basis of an analysis of panel data on 20 industrialized countries (white authors) over a thirty-year period. In accordance with this paper, the beginning of the currency crisis was determined at the moment when the currency market's stress index exceeded the threshold requirement (the sum of the average sample value and 1.5 standard deviation of the index).

The principle of the signal approach, including on the basis of the papers studied, suggests the following:

1. Define the concept and criteria of the crisis, as well as to establish crisis periods;

2. Determine the list of variables that can be used as leading indicators;

3. Establish criteria allowing classifying the indicator behavior as a signal of the onset of a crisis or the normal functioning of the economy;

4. Determine the signal power of each indicator in order to select the most informative indicators and evaluate the contribution to the final result of each indicator.

At the same time, as a rule, researchers do not have definite criteria for choosing periods within which a crisis can realize.

Some economists used signal approach to analyze budget risks. Thus, in the study by Cottarelli (COTTARELLI, 2011), it is shown that the risks leading to fiscal "instability" of the budget are related to the inability of the state to prolong the outstanding portion of liabilities without introducing additional control measures depending on the interaction between:

1. The current situation and the basic scenario of the forecast of the main fiscal variables;

2. Shocks around this basis (linked to macroeconomic fiscal policy or change, or the implementation of contingent liabilities) that would lead to a deterioration in the financial outlook and increase the likelihood of problems occurring;

3. Other factors, including the specifics of the organization in the country of fiscal policy.

These financial indicators should help identify early warning signals of a difficulty, thereby giving the government the opportunity to adjust policies before the accumulation of budgetary vulnerabilities leading to significant financial problems.

1. From 2014, the growth rate of revenues of own revenues of the consolidated budget of the constituent territories of the Russian Federation is reduced from 8.9 to 6.3%, respectively. If in 2014 only 7 Russian regions showed a decrease in their own budget revenues, in 2015 their volume increased more than 2-fold - up to 16 (TSUKAREV, DMITRIEV, 2014).

Despite the negative predictions of some experts on the absence of factors that cause an increase in own revenues of regional budgets in 2016, nevertheless, during this period, their growth occurred. The number of constituent territories that recorded a decline in their own revenues declined.

First and foremost, the positive effect was exacerbated by the increase in excise duties in 2016, the proceeds of which increased by almost 40% in 2016 (Figure 2). As a result, their share in tax revenues increased from 7.0 in 2015 to 8.7% in 2016. Nevertheless, the structure of tax revenues did not undergone drastic changes. And the largest revenues bring taxes on profits and personal revenues tax.

In the consolidated budget of the regions of the Russian Federation, revenues from non-tax revenues increased insignificantly by 2.2%, and the volume of inter-budgetary revenues decreased.

An analysis of the share of income tax from corporate profit tax in own revenues of the regional budgets reveals another feature of the revenue side of regional budgets is a high differentiation of budgets for tax revenues, it varies from 4.1 to 59.9%. In the two regions, the share of income tax from income tax exceeds 50% of the region own revenues (Tyumen Region 55.5% and Sakhalin Region 59.9% for 2016).

During the year, the number of regions decreased, in which (from 19 to 15) the share of revenue from income tax is less than 15%, with the minimum values being recorded in the Republic of Tyva (6.4%) and Chechnya (4.1%).

In 17 regions, the share of income tax in own revenues is higher than 30%. These include the industrialized regions of Tatarstan, the Leningrad Region, Khanty-Mansiisk Autonomous District, Chukotka and others.

High differentiation of constituent territories on the receipt of income tax in budgets (BOJKO, 2013) is a feature of the Russian economy as a whole related to the territorial and natural climatic features of the regions, the availability of a region of minerals. At the same time, this often leads to a high dependence of the revenue base on the external environment, which in the event of a crisis or a significant drop in resource prices negatively affects the budget of the region, and also reduces the effectiveness of long-term planning in view of the complexity of forecasting external factors. In the reverse situation, a low share of revenues from income tax on profits in tax revenues (less than 15%) in a number of constituent territories indicates a low economic activity of the region, its level of independence and independence from the federal budget. This is confirmed by the presence of a high proportion (more than 30%) of intergovernmental transfers in the revenues of the budgets of these constituent territories. Moreover, these are not only traditional regions of the North Caucasus, but also the Republic of Karelia, Mordovia, Kalmykia, Tuva, Penza and Kurgan regions, as well as the Trans-Baikal, Kamchatka and Khabarovsk Territories, the Jewish Autonomous Region.

These disproportions can also be considered a risk, since the unbalanced economy of individual regions may affect the economic situation of the federal district and the country as a whole.

A positive factor that reduces the budget risks of the regions in 2016 is the growth of income from the personal income tax (PIT), which accounts for a significant share in the tax revenues of the consolidated budgets of the constituent territories (on average about 40%). (Figure 3).

Particularly important for the country economy as a whole is the growth (by more than 10% in Russia) of revenues from taxation of small and medium-sized businesses (taxes on aggregate revenue), associated obviously with the development of the enterprises activities, in particular in the product area associated with the import substitution program food products.

Analysis of the structure of expenditures of regional budgets revealed several significant risks. Since 2012, the structure of expenditures of the consolidated budget of the constituent territories of the Russian Federation has changed somewhat.

The largest items of expenditures of the consolidated budgets of the Russian Federation are traditionally social (more than 60% of all expenditures).

The need for regions to solve most of the social issues independently leads to a low share of maneuver in expenditure management (BRAGINA, 2016). Nevertheless, certain changes still occur. Thus, expenditures on health care decreased, which is connected with the completion of the reform of this sphere.

Positive trends in 2016 should attribute to the growth of economy expenditures and the slowdown in the growth of expenditures on national issues and debt servicing.

The optimization of the structure of the state apparatus, the absence of duplicative powers, the use of electronic systems for providing services to the population, the reduction of travel expenditures, transportation costs (following the example of individual regions), the establishment of limits and tightened control over the use of funds in this area should significantly reduce overall government expenditures.

To prevent excessive growth of expenditures, each region developed programs designed to curb growth and even reduce expenditures (VLAAR, 2000). Nevertheless, in the first four years of 2016, expenditures as a whole increased by 4.6%, and in the majority of federal districts the growth was even higher (Figure 8). Only the Southern Federal District showed negative data, mainly due to a significant reduction in the expenditures of the Astrakhan region. Only 24 constituent territories reduced expenditures for the analyzed period.

First and foremost, it is necessary to note a decrease in the expenditures of debt servicing both in general for the consolidated budget and for individual constituent territories. This is a great merit of the Ministry of Finance of the Russian Federation, which took measures to stimulate the constituent territories in carrying out a more balanced debt policy.

However, some constituent territories are still over-burdened with this expenditures item. Although the share of expenditures for servicing state and municipal debt is not large (1.6% in total expenditure for 2015), but since 2012 it has been growing at a high rate. For the last 5 years, the volume of the debt of constituent territories and municipal authorities has increased more than two times (KRZNAR, 2004).

Also, over the past 5 years, the structure of the debt portfolio of constituent territories has changed significantly (see Table 3). The share of securities decreased significantly in the total volume of debt of constituent territories and municipal authorities, from 36.5% in 2007 to 16.7% in 2015. At the same time, the share of loans from banks and organizations and budgetary loans increased from 31.0 to 44.0% and from 10.6 to 34.3%. As a result, interest expenditures grew by more than 20% in 2015. Moreover, in many regions the growth rate of interest expenditures is much higher than this indicator. For individual regions, these expenditures are already burdensome. (COTTARELLI, 2011; BALDACCI, McHUGH, PETROVA, 2011; VLASOVA, 2015)

Against the background of the growth of deposits in commercial banks in regions that ended 2015 with a surplus, the aggregate regional debt grew by 11%, of which 2/3 took over the federal budget through the provision of budgetary loans at a minimum rate of 0.1%. 1/3 fell on loans of commercial banks, the average rate for which in 2015, according to our estimates, in some cases exceeded 15% per annum. The number (and composition) of regions that have debt in the form of securities for 2015 has not changed - 39. The problem of debt is most acute in the medium-developed regions, which have low own revenues and small amount of gratuitous transfers.

The deterioration of the economic situation is reflected in the growth of overdue accounts payable. Its volume is low, but according to the Ministry of Finance, it demonstrates strong growth: As of October 01, 2015 + 25%. Traditionally problem regions are probably the Kostroma Region (in 2013-2014 - about 5% of own revenues), as well as Saratov and Ulyanovsk Regions (3-4%) (BALDACCI, McHUGH, PETROVA, 2011).

"Excessive enthusiasm" for loans with the possibility of refinancing them, negatively affects the activities of regional authorities as a whole. First, the problem of long-term financial resources remains unresolved, since loans are generally provided for no more than a year. Secondly, in view of the lack of funds to repay loans previously taken, the regions are re-credited and take on new loans, which add to their debt burden, but do not lead to structural problems, covering only a part of the budget deficit.

In the market of state sub federal bonds, currently "direct" bonds, which provide for a fixed rate of coupon revenues paid in the currency of payment of the nominal value of the bond upon its acquisition, are the only fixed maturity date. Few issues provided for a floating rate of coupon revenue (for Chuvashia bonds in the event of a change in the refinancing rate by the Bank of Russia), early repayment (for St. Petersburg bonds) or the establishment of a coupon rate after the placement of the issue (for Moscow bonds). The bulk is represented by non-binding bonds with a fixed repayment date. Their emission is expedient in conditions of macroeconomic stability. An interesting example is the Tomsk region, which issued bonds for the population (VLASOV, DERYUGINA, VLASOVA, 2013; VLASOVA, 2015).

Thus, it is necessary to highlight the main risks of regional budgets. These include:

• Risk of reduction/limitation of the revenue tax base (significant for individual regions);

• Risk of reduction of gratuitous receipts from the federal budget;

• Risk of rising expenditures;

• Risk of reducing sustainability due to the growth of the regional budget deficit;

• Risk of lower liquidity due to an increase in the debt burden and deterioration of the debt structure.

To analyze the risks of constituent territories, we used a signal approach. We selected the most informative indicators, which change mainly under the influence of significant economic processes - economic crises, and are as independent as possible from the influence of economic agents on public policy and market conditions. In this case, we mean the absence of financial market indicators. This is also explained by the underdevelopment of financial markets in the regions. Selected indicators include: the growth rate of own revenues, the share of debt in own revenues, prices for residential real estate in the primary market. The Industrial Production Index (IPI), Real Disposable Cash Income (DCI), Consumer Price Index for goods and services (CPI). The authors studied the dynamics of the above indicators quarterly in the period from 2006 to Q3 2016.

The authors identified the crisis periods in the time interval under study based on the dynamics of the indicators.

To determine the crisis, the following indicators were selected: GDP, the index of prices for residential real estate, the growth rate of the debt of the constituent territories of the Russian Federation. The authors proceed from the assumption that the indicators signal the onset of the crisis for four quarters in order for the authorities to take measures to level it, reduce the consequences. Based on the results of the analysis, the threshold requirement of the indicators and their signal power were calculated.

1 Own income (OI),% to Q of previous year<104.35, signal power = 12.5

2 Share of debt in OI>0.57, signal power=13.6

3 Real Estate Prices<80.46, signal power=10.9

4 Industrial Production Index<87.90, signal power=17.9

5 RDCI<96.50, signal power=14.1

6 CPI>112.30, signal power=31.0

The index of fiscal stress is the accumulated sum of weights of indicators predicting a "crisis" situation. Its values range from 0 to 100%. The signal of the unstable state of public finances and the possible budget crisis is the excess of the value of the index of the 50% border (VLASOVA; BOCHKO, 2015). The index is calculated as follows:

where i is the indicator number; wi is the weight of the i-th index; di (t) is an indicative function that takes value of 1 for indicators that in some of the four quarters before the crisis exceeded the corresponding threshold requirement, and 0 for the others. With the help of these threshold requirement, you can calculate the index of fiscal stress. If the value goes to the threshold requirement, it is assigned 1, which is multiplied by the signal power.

Thus, the "regional index of fiscal stress" calculated by the authors will allow us to assess in time the probability of the crisis and take appropriate measures to neutralize or mitigate it.

Thus, in our opinion, the signal approach has proved to be a fairly effective method of risk management for the second level of public finance in the Russian Federation. It allows taking into account the peculiarities of each region. Repeatedly in the framework of this paper, there were significant different trends in the dynamics of individual indicators of regional development. Inhomogeneous dynamics of important socio-economic and financial indicators of the regions shows a high degree of differentiation of the financial status of the constituent territories of the Russian Federation and, accordingly, the existence of different risks and the need to take into account the individual characteristics of the constituent territories. Risks not only reduce the effectiveness of the implemented budget policy, but also lead to the failure to fulfill its conditions.

Without careful analysis and assessment of budgetary risks, budget planning cannot be organized, implementation of budgetary policy cannot be organized. Therefore, the application of the above-described approach to assessing the risks of the budgets of the constituent territories of the Russian Federation would call for a significant increase in the effectiveness of the budget policy pursued therein. Based on the results of the two-year work, the authors developed recommendations to constituent territories of the Russian Federation, which make it possible to improve the implementation of budgetary policy. Recommendations affect a wide range of problems (Analytical Credit Rating Agency survey, 2016; VLASOVA, 2015). These are the problems of the formation of the revenue base, and expenditure management, the issues of increasing the independence of constituent territories from the federal budget (ERMAKOVA, SEMERNINA, 2013; VLASOVA, 2015).

In the context of managing budget risks of the constituent territories of the Russian Federation, in our opinion, we should pay attention to:

1. Diversification and development of the economy of the constituent territories, to reduce the dependence of the budgets of regions on the receipt of funds from enterprises of any one type of activity. This contributes to a more stable receipt of individual taxes in the budgets of the regions.

2. Creation of favorable conditions for the functioning and development of small and medium-sized businesses will increase the region welfare not only in terms of tax revenues from the application of special regimes, but also income from other taxes (transport, property) and increase of certain social and economic indicators for the region - employment, wages, well-being.

3. Increase of independence of budgets of constituent territories from the federal center

4. Regions should pay much attention to expenditure items of budgets, reducing expenditures in some areas such as the state apparatus. Nevertheless, with the expenditures of costs, it is necessary to be guided and based on long-term strategies for the development of the region and take into account the need for long-term planning in the framework of environmental protection, housing and public utilities and public health service, while reducing expenditures, which will have a short-term positive effect, but in the future, a sharp deterioration in the state of nature, housing, infrastructure and health will entail higher costs.

5. There is a need for more careful planning of the debt management of the constituent territory, reducing the share of commercial debt in the direction of increasing other forms of borrowing, mainly the issue of securities.

6. Diversification of sub federal securities, including issuing bonds for the population.

7. Increase the quality of control over the use of targeted funds for specific programs.

Effective management of budget risks is a continuous dynamic and changing process, which requires constant monitoring and monitoring. Only if all these conditions and an integrated approach to solving regional problems are met, taking into account the specifics of each constituent territory, it is possible to reach a new level of regional development.

BALDACCI E., McHUGH J., PETROVA I. Measuring Fiscal Vulnerability and Fiscal Stress: A Proposed Set of Indicators, IMF Working Paper, 2011, No. 94

BOCHKO V.S. Accelerating and constraining factors of coordinated and balanced development of regions, Economy of the Region, 2015, No. 1, P. 39-52.

BOJKO J. Role and place of factor analysis in statistical research of tax receivabless in budget. Contemporary economic issues, 1, 2013, DOI:10.24194/11320, Retrieved from: http://economic-journal.net/index.php/CEI/article/view/37

COTTARELLI C. The Risk Octagon: A Comprehensive Framework for Assessing Sovereign Risks” presented in University of Rome “La Sapienza,” 2011, Retrieved from: www.imf.org/external/np/fad/news/2011/docs/Cottarelli1.pdf

ERMAKOVA E.A., SEMERNINA Yu.V. Attractiveness of bonded financing of expenditure obligations of the constituent territories of the Russian Federation in conditions of growing regional debts. Regional economy and practice, 44 (323), 2013, p. 33-42

GAMUKIN V.V. Combinatorics of the risks of the budget system. Finance and Credit, 22 (646), 2015, p. 28-39

GOROKHOVA D.V. The basic directions of development of management of budget risks of constituent territories of the Russian Federation. The Bulletin of the Saratov State Social and Economic University, 2013, No. 2 (46), P. 82-87

GUZHAVINA L.M., LITVINENKO V.A., POPOV A.G. Role of Investment Potential in the Socio-Economic Development of Russia, Academy bulletin, 2009, No. 4, P. 28-32.

RUKINA S.N. Management of budget risks of the constituent territories of the Russian Federation: Modern View and Development Prospects. Finance and Credit, 7 (583), 2014, p. 55-62

The Analytical Credit Rating Agency survey. The return of budget credits will increase the cost of debt and will increase inequality among the regions from 23.06.2016 p. 1-7

TSUKAREV T.V., DMITRIEV D.A. Development of an aggregated index of financial stability (macroeconomic approach), Bank Herald, 2014,Retrieved from: www.nbrb.by/bv/

ULYUKAEV А. V., TRUNIN P.V. Application of the signal approach to the development of indicators-precursors of financial instability in the Russian Federation, Problems of forecasting, 2008, No. 5, P. 100-108

VLAAR P.J.G. Currency Crises Models for Emerging Markets. DNB Staff Reports, 2000, 45, p. 36

VLASENKOVA E.A. Directions of increasing the revenue base of regional and local budgets. Regional economy and practice, 16 (295), 2013 p. 27-33

1. Plekhanov Russian University of Economics, Moscow, Russian Federation, e-mail: iulia.vlas2017@yandex.ru