Vol. 38 (Nº 51) Year 2017. Page 5

Olga SHAVANDINA 1; Galina MAKUSHEVA 2; Ruslan SULIPOV 3; Yury KHOLODENKO 4

Received: 06/06/2017 • Approved: 30/06/2017

ABSTRACT: The article is devoted to the problems of segmentation of accounting and reporting information and analysis while observing the unity of accounting principles and the targeted nature of managerial decisions of internal and external users in Russia. The authors have proposed methods for analytical diagnosis of a corporate organization using the rating of its segments. |

RESUMEN: El artículo está dedicado a los problemas de segmentación de la información contable y de informes y análisis, observando la unidad de los principios contables y la naturaleza específica de las decisiones administrativas de los usuarios internos y externos en Rusia. Los autores han propuesto métodos para el diagnóstico analítico de una organización corporativa utilizando la calificación de sus segmentos. |

Vertically integrated corporate organizations and enterprises with complex organizational structure in the event of a decision to disclose information on segments in the financial statements should initially solve the task of identifying reportable segments. In accordance with the Russian Accounting Standards "Segment Information" (RAS 12/2010), the allocation of a segment for accounting purposes consists in isolating information on a part of the organization's activities that can bring economic benefits, the results of which are systematically analyzed and on which financial indicators.

Criteria for the allocation of reporting segments are indicated by this normative act and do not cause difficulties in the identification process, but there are a number of issues that are problematic:

- Organization of separate accounting;

- Unity of the assessment and disclosure of accounting and reporting information in the context of individual segments in the financial statements.

Symmetrical distribution of income and expenditure between the reporting segments is the result of applying a reasonable basis and method of distribution as an element of the accounting policy of the business entity, as well as the subjective opinion of the specialist who forms the accounting and reporting information. The probability of obtaining objective data in dynamics based on the results of analytical calculations depends on the consistent application of methods for the formation and disclosure of information by segments of the corporation, which is complicated in some cases by the need to review the list of reporting segments under conditions that do not meet the criteria for their allocation and a retrospective approach to disclosure Information.

If an entity prepares consolidated financial statements in accordance with the requirements of International Financial Reporting Standards (IFRS), it is necessary to be guided by the basic principle of the international financial reporting standard (IFRS) 8 "Operating segments". An operating segment is a component of an enterprise that is involved in activities that generate revenue and incur expenses (including revenues and expenses associated with transactions with other components of the same enterprise). Operating results are regularly reviewed by management (it is responsible for decisions about resources allocated to the segment), in order to evaluate the performance results of this segment, and for which discrete financial information is available (Yermakova, Sharipova, 2011).

Globalization of the capital market, integration of the Russian economy into the world community, emergence and strengthening of new forms of management of the subjects of the economic space made the issues of formation and analysis of consolidated financial statements relevant for discussion. Outstanding financial analysis expert Warren Buffett rightly notes: "... accounting data ... provide assistance to all those who are engaged in valuation of the enterprise and analyze the results of their activities" (Buffett, 2015). This statement determines the formation of reliable, up-to-date corporate reporting, which is a set of consolidated accounting data of companies - members of the group. Despite the principle of unity of the accounting information of a group of interrelated economic entities, it is necessary to reflect the variety of activities in the consolidated statements in order to assess risks and determine the key business development trends. This is possible if the information is presented by business segments or is grouped by geography.

According to Schneidman L.Z. "... corporate reporting plays an important role in ensuring transparency in the activities of economic entities, strengthening investor confidence in them, mobilizing national and international financial resources, achieving financial stability ..." (Schneidman, 2011). This view characterizes the approach in which corporate reporting is understood as a system of reports that characterize the financial and economic activities of an enterprise at a given time and in the future, to provide quality, reliable information to various investors. Foreign economists-scientists believe that corporate reporting is reporting, which is the link in providing full, transparent information to various investors. Thus, K. Hütten asserts that "... corporate reporting allows not only the leadership of a particular company, but also the investors to be able to analyze the ever increasing volumes of information ..." (The Future of Corporate Reporting: striving for a common vision). On the other hand, according to S. Hadrill "... corporate reporting provides information and assists the board of directors in the performance of its governing functions ..." (The Future of Corporate Reporting: striving for a common vision).

The issues of the relationship between the shareholders and the executive body of the corporate organization, its management, regarding the choice of effective management of the company arise quite often. As D. Millon notes, conflicts between large and small shareholders, subordination to the will of other shareholders, obtaining information on the activities of an economic entity adversely affect the effectiveness of business components and the company as a whole. D. Millon asserts that corporate management is an agent of shareholders and within the corporation a privileged role belongs to shareholders (Millon, 2014).

In addition, the economy faced the problem of ranking enterprises and business components (segments) in terms of their investment attractiveness and financial stability. At the moment, there is no single methodology for rating, which would contain a specific list of indicators that allow unambiguous interpretation of the results obtained during the analysis. So in foreign countries, many economic and mathematical models have been developed, which are described in the works by E. Altman(Altman, 2006), J. Konan, M. Golder, G. Stringate (Stringate, Gordon, 1978), D. Fulmer (Fulmer, 1984), R. Lees, A. Strickland (Schneidman, 2011) and others. These scientists became classics, as they used a rich mathematical and statistical apparatus to study economic problems. The works of the authors have not lost relevance to the present.

The rating of enterprises, including corporate organizations, is of scientific interest for Russian economists. In this connection, the works by A. D. Sheremet, G. V. Savitskaya, I. A. Yermakova, L. I. Sharipova and others deserve attention (Yermakova, Sharipova, 2011; Sheremet, 2012).

However, the processes taking place in the world economy at the present time (the development of integrated structures, the creation of a single information space, etc.) dictate the requirements for the modernization of approaches to the analysis of the activities of the corporate organization, in order to enhance the role and importance of the company's board of directors and management. According to D. Millon, shareholders should influence management to maximize their financial interests (Millon, 2014).

In modern conditions, the purpose of compiling and analyzing consolidated accounting and segment reporting is to satisfy the information requests of internal and external users on the economic potential of the corporate organization, development strategy and significant risks. Accounting and reporting information on operating segments is formed in accordance with the accounting policies of the corporate organization; it should ensure a sufficient degree of attractiveness of business components and help minimize the conflict of interests of shareholders and investors. The indicators presented in the reporting segments allow you to more accurately assess the effectiveness of the diversified business, and the results of the analysis of segment reporting are the basis for making management decisions that can be aimed at optimizing the structure of the corporate organization, the distribution of material resources and pricing, development of certain business areas and improvement Investment attractiveness of the entire enterprise. In addition, segmental reporting can identify problematic issues of the component, determine its competitive advantages compared with the enterprises of the group and/or industry, develop or adjust the development strategy of the segment and the corporation as a whole (Yermakova, Sharipova, 2011).

Quite often the management of enterprises seeks to hide inefficient (unprofitable) lines of business at the expense of profits received from other divisions of the company (Yermakova, Sharipova, 2011). Shareholders and founders who are not involved in the management process do not have complete information about the financial condition of the company as a whole. A detailed analysis of financial results, revenues and expenses, assets and liabilities, cash flows and other indicators in the context of individual segments will allow the enterprise's owners to perform an assessment of the management effectiveness and enterprise performance (Schneidman, 2011).

Methods for assessing the effectiveness of corporate management can be divided into two groups: managerial (ratings and monitoring systems) and economic (assessment of economic potential and performance).

The basis for calculating the rating is the comparison of enterprises for each indicator of financial condition with a conditional reference enterprise that has the best results for all compared indicators. Thus, the benchmark for obtaining a rating assessment of a company's financial condition is not the subjective assumptions of experts, but the highest results in the real market competition from the total set of compared objects. The reference for comparison is the most successful competitor, who has all the best indicators (Sheremet, 2012).

The plurality of subjects of financial analysis cause a variety of goals, the main ones of which can be considered: evaluation of the performance of the activities not only of the enterprise as a whole, but also of its segments (from the point of view of achieving the result); assessment of risks of investors' financial investments (from the point of view of their minimization), estimation of the accuracy of forecasts (for the purpose of adjusting planned indicators), etc. (Asuman, 2012). Despite the existence of standard methods, the orientation towards public external reporting limits the tasks of financial analysis.

Within the system of intraeconomic management analysis, financial analysis expands its capabilities, drawing on information management accounting data. Use more sources of information; study of all aspects of the enterprise; lack of regulation of analytical procedures by the state; orientation of the analysis results to the goals and objectives of minimizing managerial risks contribute to the integration of accounting, analysis, planning and management decision-making. Using rating evaluation of segments allows us to realize the specified tasks.

Segment ratings represent an integrated assessment of the quality of management of a corporate organization and serve as an indicator for investors of the level of relevant risks in this company. The main objective of forming the rating coefficients is to provide investors and other interested parties with an external and independent risk assessment of the management of the company's segments, on the basis of which they can make informed decisions about certain actions regarding the activities of each component (segment) of the corporate organization. This condition involves the use of different groups of indicators for management (internal) and financial (external) analysis.

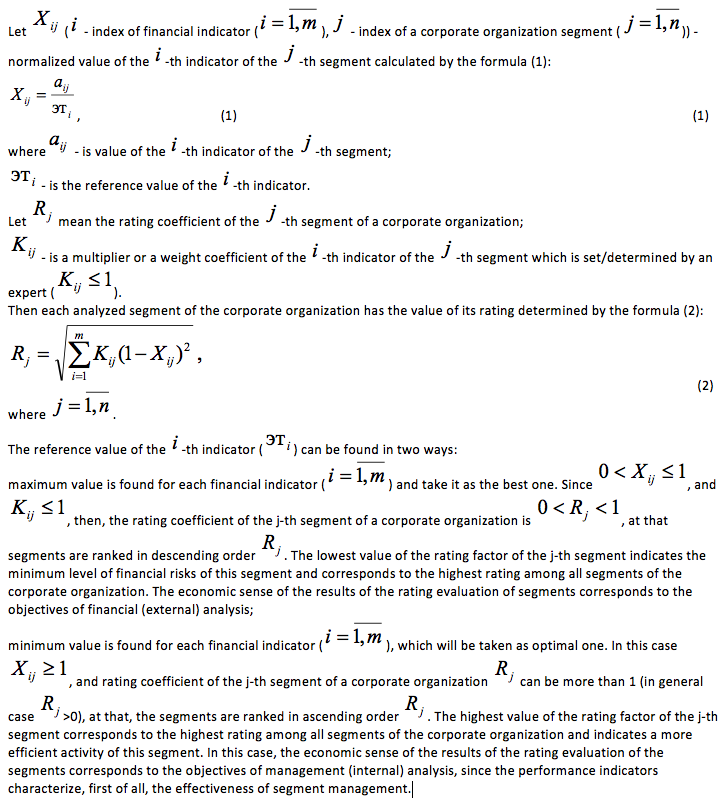

The core of the methodology proposed by the authors for determining the rating of the economic efficiency of segments of a corporate organization is the algorithm of a comparative rating evaluation of a company's financial condition.

The use of methods of empirical research made it possible to compare approaches to the analysis of the activities of complex enterprises and their segments. Correction of the method of rating evaluation of segments of the corporate organization was carried out on the basis of methods of economic and mathematical modeling.

According to the analysis of the consolidated financial statements presented on the website of the corporate organization of JSC "Group", we will perform a rating evaluation of the segments using the revenue from external customers as a criterion for calculations, prime cost, gross and operating profit, value of assets and capital investments. These indicators are presented in Table 1, are included in the perimeter of consolidation and act as aggregation criteria in accordance with the principles of IFRS 8 "Operating Segments".

It should be noted that initially the company operated only in the metallurgical region, producing iron ore concentrate, steel and rolled products. The activity of the industry is highly competitive and cyclical. Any downturn in the industry at the local or international level could adversely affect the performance and financial position of the Group. To produce these products, coking coal is needed, so the company decided to expand its business through the acquisition of coal mining enterprises (extracting segment). In the future, the production of ferroalloys allowed the division of the metallurgical segment into two components. The use of ferroalloys in smelting allows the use of lower temperature conditions than when melting pure metal. In connection with this, energy costs are also reduced, which reduces the cost of metal compared to what it would have had when using it in its pure form. At the same time, such alloys have high quality indicators, they can be given the necessary properties, as well as the required structure. These peculiarities enabled the management of the Group to identify the ferroalloy segment.

The largest revenue indicator falls on the metallurgical segment and accounts for more than 57% of the total amount. However, the gross profit of the extracting segment is almost twice that of the metallurgical component, which is due to the lower cost of coal mining. The extracting segment is also characterized by the high cost of assets and capital investments, more than 51 and 62 percent, respectively, of the aggregate value of these indicators.

According to Table 1, each component has calculated profitability ratios (Table 2), which are indicators of the performance of a particular segment, are of interest to the management of the operating segment and external users of accounting and reporting information.

As a multiplier (weight coefficient), it is proposed to use the share of the -th financial indicator (table 1) of the -th segment. The multiplier strengthens the effect of the corresponding coefficient of profitability in the rating estimate of the -th segment. Values of multipliers , where , are presented in Table 3.

About 5% of total profit is receipts from external buyers of the ferroalloy segment. The share of the first cost of production of the energy component is the smallest one (about 5.5%). About a third of the total assets value, capital investments and gross profit falls on the metallurgical segment of the organization, the lowest indicators characterize the activities of the ferroalloy and power sectors of the Group. The values of these indicators are determined by the features of production of products and services of each operating segment of the corporate organization.

Table 4 presents the values of standardized (normalized/normative) indicators and rating coefficients of the identified operating segments.

The results of the calculations show that the largest segment has the production segment, despite the fact that the share of the revenue of this segment in the total revenue is just over 31%. Values of the rating indicators of other segments are significantly lower than the rating of the extracting segment. The rating of the metallurgical component is lower than the estimate of the extracting segment by almost 10 points (by 9.9076), while the share of the revenue of this segment is more than 57%. All profitability coefficients of the power segment are greater than those of the metallurgical sector. But the rating of the power segment is 1.19 points below the rating of the metallurgical segment and is 1.5208, which is due to the fact that the shares of the financial indicators of the power sector enterprises do not exceed 8.33% of the aggregate values of the corresponding values presented in the segment reporting. The smallest share of revenue belongs to the ferroalloy sector and is 4.68%, the rating of this segment is also the lowest - 0.0065.

This situation requires the intervention of the management of the corporate organization, since the founders (shareholders) participating in the activities of certain segments are in unequal conditions.

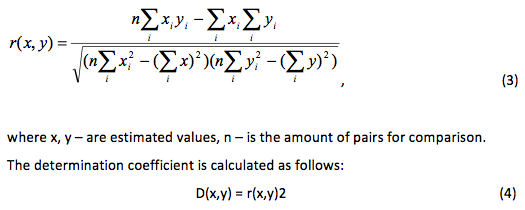

In our opinion, the use of correlation analysis methods for calculating the correlation and determination coefficients will allow us to assess the tightness of the relationship between the level of profit and the rating indicator of the relevant segment.

The correlation coefficient is calculated by the Formula 3:

Using the consolidated financial statements and Table 4, we calculate the tightness of the relationship between the level of operating profit and the value of the rating of the identified segments.

If x is the operating profit for the year, and y is an indicator of the rating of the relevant operating segment, then in Table 5 we will present the correlation and determination indicators.

The magnitude of the correlation can take values from 1 to -1, and, the closer the absolute value of the correlation coefficient to 1, the closer the relationship between the indicators. The determination coefficient shows the possible interrelation in percent.

The correlation indices are close to 1, we can conclude that there is a close relationship between the valuation evaluation and the profitability of the corresponding segment, and the determination indicators show that in 67% the profit level determined the value of the rating of the extractive segment. For other components of the corporate organization, the determination coefficient is about 50%, which determines the impact of other indicators (not only profits) of the consolidated financial statements on the value of the rating of the relevant operating segments.

The next group of indicators, which, according to the authors, are subject to mandatory monitoring, is the concentration of capital in each segment, which determines the degree of participation of each shareholder in the rating of the relevant operating segment.

The charter capital of the joint-stock company is formed by combining the funds of individual investors to carry out large-scale commercial activities. Each investor pursues his own goals, participating in the activities of the joint-stock company, and expects to receive certain economic benefits. The effectiveness of capital investment is determined by the profit indicator, which has a close connection with the rating assessment of the relevant component of the joint-stock company. Thus, the share of the rating estimate corresponding to a certain participant (shareholder) reflects the effectiveness of the invested capital and determines the degree of influence on the management of the operating segment.

The share capital of a corporate organization can be represented by foreign organizations/enterprises and individuals, state organizations of the Russian Federation, legal entities and individuals who are residents of the Russian Federation. Considering that four segments are identified in JSC "Group", the share capital can be represented as the sum of four shares corresponding to each operating segment (formula 5).

The largest values of shares determine the degree of influence, including financial, on the adoption of managerial decisions. These decisions can be stimulated by a certain amount of state support, promotion of products of this segment in the domestic or foreign market. Commercial structures participating in the share capital of the operating segment can participate in resolving crisis situations at the world level (usually non-residents of the Russian Federation) and neutralize negative industry phenomena (residents of the Russian Federation).

Using the coefficients of concentration of the share capital and the value of the j-th segment rating, it is possible to estimate the contribution of each owner (shareholder) in the rating indicator (formula 8).

Since the segment's revenue, product cost, gross and operating profit, cost of assets and capital investments were used to calculate the rating, formula 8 reflects the average level of participation of the respective owner (shareholder) in the rating of the listed segment indicators. It should be noted that the positive dynamics of the financial indicators of the segment, with constant concentration of capital, increases the degree of influence of each participant (shareholder) in the rating of the relevant operating segment and as a consequence in making decisions aimed at improving the efficiency of this component of the business.

Thus, the guidelines on the rating of operating segments included in the perimeter of consolidation, on the one hand, are part of the financial analysis of the corporate organization as a whole. On the other hand, the rating analysis, which is fragmentary, does not take into account the concentration of capital of the relevant segment, may act as an instrument of influence of owners (shareholders) in making decisions on the management of the operating segment.

The formula (2) is a modification of the basic formula for calculating of rating. It takes into account the significance of individual indicators when calculating the rating evaluation in relation to the reference indicator.

It is necessary to highlight the main characteristics of the methodology for rating the identified components of the business of a corporate organization:

- The methodology is based on an integrated, multidimensional approach to assessing the financial performance of a corporate organization;

- The evaluation is carried out on the basis of consolidated accounting data, which is of a public nature;

- The rating evaluation corresponds, among other things, to the objectives of management (internal) analysis, since performance indicators characterize, first of all, the effectiveness of segment management;

- The rating evaluation of segments is carried out both in space, that is, in comparison with other segments, and in time, that is, for several periods;

- Flexible computational algorithm is used that implements the possibilities of economic and mathematical modeling.

The rating analysis of the segments of the corporate organization shall be supplemented by an analysis of the correlation and determination coefficients, analysis of the concentration of capital in each segment, in order to determine the degree of participation and influence of each shareholder in the rating of the relevant operating segment (Figure 1).

The influence of foreign companies and individuals owning shares of a corporate organization, participation of the public sector of the economy, as well as legal entities, residents of the Russian Federation, is reflected in the algorithm for calculating capital concentration ratios and part of the segment's rating estimate for a certain participant (shareholder) (formulas 7, 8).

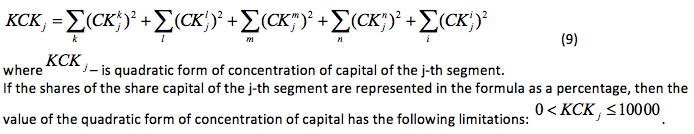

In addition to the concentration ratios and rating estimates of the segments corresponding to each participant in the share capital, a quadratic form can be used, whose range of variation is much wider (formula 9).

This range can be divided into three periods:

1. If the value of the quadratic form of concentration of capital of the j-th segment ranges from 2000 to 10,000, then the concentration of capital is very high. For this value, it is characteristic that the number of shareholders with a dominant position is in the range from 1 to 5, which causes a very high degree of influence of these participants (shareholders) on the management of the relevant segment.

2. If the value of the quadratic form of concentration of capital of the j-th segment ranges from 1000 to 2000, the concentration of capital is characterized by a fairly high level. This value of the coefficient corresponds to the limit value of the number of shareholders - (5; 10]. The degree of influence on the adoption of managerial decisions is significantly reduced, which increases the responsibility of the segment managers.

3. If the value of the quadratic form of capital concentration of the j-th segment is less than 1000, then the concentration of capital is very low. This situation is typical for a large number of shareholders (more than 10). The influence of participants in the share capital is not significant, which determines the high degree of responsibility of the management personnel in matters of management effectiveness of the segment.

The situation when the activity of the segment is controlled by a small number of participants in the share capital is not always effective for the corporate organization as a whole. Dominating owners (shareholders) can establish requirements that satisfy only their interests, ignoring the requests of other participants in the share capital.

Thus, modification of models makes it possible to analyze the changes in each term participating in the algorithm for calculating the coefficient of the quadratic form of concentration of capital in the j-th segment and their impact on changes in the coefficients of the rating of the identified business components.

ALTMAN E. (2006). Corporate Financial Distress and Bankruptcy: Predict and Avoid Bankruptcy, Analyze and Invest in Distressed Debt, 3rd Edition / E. Altman, E. Hotchkiss // John Wiley and Sons, Ltd. – 368 p. – ISBN: 978-0-471-69189-1.

ANDRUSH A. (2012). The Reverse Synergy: Another Way of Thinking // International Journal of Economic Practices and Theories.– Vol. 2. – No. 2.

ASUMAN A. A. (2012). Strategic Investment Decision: “Internationalization of SMEs”: A Multiple Appraisal Approach and Illustration with a Case Study. iBusiness, vol. 4, no. 2, pp. 146–156. doi: 10.4236/ib.2012.42017

BALABANIS G. (2012).The relationship between diversification and performance in export intermediary firms. British Journal of Management, 12, p. 67-84.

BEAVER William H. (1966). Financial Ratios as Predictors of Failure, Empirical Research in Accounting Selected Studies. – Supplement to Journal of Accounting Research. – 4.pp. 71-111.

BECKER J.-M., RAI A., RINGLE C.M., VÖLCKNER F. (2013). Discovering unobserved heterogeneity in structural equation models to avert validity threats. MIS Quarterly, vol. 37, iss. 3, pp. 665–694.

BUFFETT W. (2015).Essays on investment, corporate finance and company management / trans. from English. M.: Alpine Business Books. 268 p.

CIAVOLINO E., NITTI M. (2013).Using the hybrid two-step estimation approach for the identification of second-order latent variable models. Journal of Applied Statistics, vol. 40, iss. 3, pp. 508–526. doi: 10.1080/02664763.2012.745837

CORNESCU V., ADAM R. (2014).Considerations Regarding the Role of Indicators Used in the Analysis and Assessment of Sustainable Development in the E.U. Procedia Economics and Finance, vol. 8, pp. 10–16.

doi:10.1016/S2212-5671(14)00056-2

DVOŘÁKOVÁ L., ZBORKOVÁ Ji.(2014). Integration of Sustainable Development at Enterprise Level. Procedia Engineering, vol. 69, pp. 686–695. doi: 10.1016/j.proeng.2014.03.043

FULMER J.G. Jr. (1984).Bankruptcy Classification Model for Small Firms. Journal of commercial Bank Lending. –pр. 25-37.

HULL J.C. (2015). Risk Management and Financial Institutions. Wiley, 742 p.

IVASHKOVSKAYA I.V. (2014). Going Internationally and Value Creation: The Evidence from Emerging Capital Market of Russia. Proceedings of the XV April International Academic Conference on Economic and Social Development. HSE, pp. 50–59.

MILLON D. (2014).Radical Shareholder Primacy. University of St. Thomas Law Journal. Vol.10. P.1013.

Report of the United Nations Conference on Sustainable Development. Rio de Janeiro, Brazil, 20-22 June 2012. Available at: http://www.uncsd2012.org/content / documents/ 814UNCSD%20REPORT%20final%20revs.pdf

RINGLE C.M., SARSTEDT M., SCHLITTGEN R., TAYLOR C.R. (2013). PLS path modeling and evolutionary segmentation. Journal of Business Research, vol. 66, iss. 9, pp. 1318–1324. doi: 10.1016/j.jbusres.2012.02.031

SHAVANDINA O., RUDAKOVA T., SANNIKOVA I. (2015). Analysis of the Competitive Environment in Motor Fuel Regional Market // Review of European Studies; Vol. 7, No.3. – pp. 276-287.

SCHNEIDMAN L. Z. (2011).Evaluation of the infrastructure of corporate reporting in Russia. Accounting. No. 11

SHEREMET A. D. (2012).Complex analysis of economic activity. Moscow: Publ. house INFRA-M, 426 p.

SPRINGATE, GORDON L.V. (1978).Predicting the Possibility of Failure in a Canadian Firm. Unpublished M.B.A. Research Project, Simon Fraser University. – 200 p.

SZYMURA-Tyc M. (2013). Measuring the Degree of Firms' Internationalization at Their Early Stages of International Commitment. Journal of Economics & Management, No. 13, pp. 102–118

The Future of Corporate Reporting: striving for a common vision. URL:http:\\urlid.ru|cfkm.

VELDYAKSOV V. N., SHVEDOV A. S. (2014).On the method of least squares with regression with fuzzy data. // The economic journal of the Higher School of Economics. Vol. 18. No. 2. P. 328–344.

World Economic Forum Annual Meeting (2016). Davos-Klosters, Switzerland. 20-23 January 2016.

https://www.weforum.org/events/world-economic-forum-annual-meeting-2016

YERMAKOVA N. A., SHARIPOVA L. I. (2011).Analysis of segment reporting [Electronic resource] / N. A. Yermakova. L. I. Sharipova // International Accounting. – No. 26. / SPS Consultant Plus. – Version 3000.03.37. – Access mode: Intra-university computer network. - Capture from the screen.

ZATONSKIY A. V., SIROTINA N. A. (2014). Prediction of economic systems by the model on the basis of the regression differential equation // Economics and mathematical methods.Vol. 50. No. 1. P. 91–99.

ZWIßLER F., OKHAN E., WESTKÄMPER E. (2013).Lean and Proactive Liquidity Management for SMEs. Procedia CIRP, vol. 7, pp. 604–609. doi: 10.1016/j.procir.2013.06.040.

Table 1 - Financial information of reporting segments of JSC "Group", mln. USD

S/N |

Indicator name |

Extractive segment |

Metallurgical segment |

Ferro-alloy segment |

Power segment |

TOTAL |

1. |

Revenues from external customers |

3055.9 |

5586.2 |

455.2 |

649.3 |

9746.6 |

2. |

First cost |

964.3 |

4482.4 |

361.6 |

350.3 |

6158.6 |

3. |

Gross profit |

2091.6 |

1103.8 |

93.6 |

299.0 |

3588.0 |

4. |

Operating profit |

1185.9 |

297.6 |

23.0 |

46.7 |

1553.2 |

5. |

Assets |

8159.8 |

4863.1 |

2186.7 |

568.6 |

15778.2 |

6. |

Capital investment |

621.9 |

315.2 |

41.7 |

12.7 |

991.5 |

Table 2 - Reporting segments profitability, coefficient.

S/N |

Indicator name |

Extractive segment |

Metallurgical segment |

Ferro-alloy segment |

Power segment |

Reference |

1. |

Operating profitability coefficient |

0.3881 |

0.0533 |

0.0505 |

0.0719 |

0.0505 |

2. |

Product profitability coefficient |

1.2298 |

0.0664 |

0.0636 |

0.1333 |

0.0636 |

3. |

Return on assets |

0.1453 |

0.0612 |

0.0105 |

0.0821 |

0.0105 |

4. |

Gross profit margin |

0.6844 |

0.1976 |

0.2056 |

0.4605 |

0.1976 |

5. |

Capital investment margin |

1.9069 |

0.9442 |

0.5516 |

3.6772 |

0.5516 |

Table 3 - Values of multipliers, coefficient.

S/N |

Indicator name |

Extractive segment |

Metallurgical segment |

Ferro-alloy segment |

Power segment |

TOTAL |

1. |

Share of revenue from external customers |

0.3135 |

0.5732 |

0.0467 |

0.0666 |

1.0 |

2. |

Share of first cost |

0.1566 |

0.7278 |

0.0587 |

0.0569 |

1.0 |

3. |

Share of assets |

0.5172 |

0.3082 |

0.1386 |

0.0360 |

1.0 |

4. |

Share of gross profit |

0.5829 |

0.3077 |

0.0261 |

0.0833 |

1.0 |

5. |

Share of capital investment |

0.6272 |

0.3179 |

0.0421 |

0.0128 |

1.0 |

Table 4 - Standardized indicators and rating coefficients of segments, coefficient.

S/N |

Indicator name |

Extractive segment |

Metallurgical segment |

Ferro-alloy segment |

Power segment |

1. |

Normalized operating profitability coefficient |

7.6851 |

1.0554 |

1 |

1.4238 |

2. |

Normalized product profitability coefficient |

19.3365 |

1.0440 |

1 |

2.0959 |

3. |

Normalized return on assets |

13.8381 |

5.8286 |

1 |

7.8190 |

4. |

Normalized gross profit margin |

3.4636 |

1 |

1.0405 |

2.3305 |

5. |

Normalized capital investment margin |

3.4570 |

1.7117 |

1 |

6.6664 |

7. |

Rating score |

12.6187 |

2.7111 |

0.0065 |

1.5208 |

Table 5 - Correlation and Determination Coefficients of Identified Segments, coefficient.

S/N |

Indicator name |

Extractive segment |

Metallurgical segment |

Ferro-alloy segment |

Power segment |

1. |

Correlation coefficient |

0.8171 |

0.7257 |

0.7089 |

0.7119 |

2. |

Determination coefficient D(x,y) |

0.6677 |

0.5266 |

0.5025 |

0.5068 |

Figure 1 – Recommended indicators of rating analysis of segments of a corporate organization.

1. Altai State University, Associate Professor of the Department of Theory and History of State and Law; Email: shavandina.olga@yandex.ru

2. Altai State Technical University. I. I. Polzunov, Associate Professor of the Department of Mathematics

3. Altai State University, Senior Lecturer of the Department of Civil Law

4. Altai State University, Associate Professor of the Department of Civil Law