Vol. 38 (Nº 48) Year 2017. Page 13

Irina Aleksandrovna GANIEVA 1; Arkady Nikolaevich CHURIN 2; Aleksandr Borisovich MELNIKOV 3; Pavel Valeryevich MIKHAYLUSHKIN 4; Andrey Leonidovich POLTARYKHIN 5

Received: 12/06/2017 • Approved: 30/06/2017

ABSTRACT: Nowadays, under the conditions of negative external economic impacts that influence the internal stability, the objective necessity to increase the result and sustainability of the functioning of the agrarian market appears regarding solving the problem of food security. Meat is an important and strategically necessary product for the human life that is of everyday demand and included into the food basket. Thus, the development of the meat market as a multifunctional direction of the agrarian economy of the country is of great importance. Within the framework of this problematic situation, the development of the meat market is a multi-faceted, complicated and important task, for the solution of which no particular measures are now taken in the agroindustrial complex on the whole. Therefore, there is a need to eliminate the arisen disproportions, and to ensure the effective work along the whole chain of the reproduction processes, and for this the deep scientific grounding of the estimation of the existing tendencies in the macro- and microeconomic (regional) format is necessary by means of realization and formation of the forecasts and programs of the development of the meat market. Not only the food security of our country in terms of the important strategic food product depends upon its efficient development but also the development of other markets, as well as the solution of many problems of the social sphere under conditions of the import phase-out. |

RESUMEN: Hoy en día, bajo las condiciones de impactos económicos externos negativos que influyen en la estabilidad interna, la necesidad objetiva de aumentar el resultado y la sostenibilidad del funcionamiento del mercado agrario aparece en cuanto a la solución del problema de los alimentos seguridad. La carne es un producto importante y estratégicamente necesario para la vida humana que es de la demanda diaria y se incluye en la canasta de alimentos. Así, el desarrollo del mercado cárnico como dirección multifuncional de la economía agraria del país es de gran importancia. En el marco de esta problemática situación, el desarrollo del mercado cárnico es una tarea polifacética, complicada e importante, para la solución de la cual no se toman medidas concretas en el conjunto agroindustrial. Por lo tanto, es necesario eliminar las desproporciones surgidas, y asegurar el trabajo eficaz a lo largo de toda la cadena de los procesos de reproducción, y para ello la profunda fundamentación científica de la estimación de las tendencias existentes en la macro y el formato microeconómico (regional) es necesario por medio de la realización y de la formación de los pronósticos y de los programas del desarrollo del mercado de la carne. No sólo la seguridad alimentaria de nuestro país en términos del importante producto alimenticio estratégico depende de su desarrollo eficiente, sino también del desarrollo de otros mercados, así como la solución de muchos problemas de la esfera social en condiciones de la importación eliminación gradual. |

The up-to-date direction of the domestic Russian agrarian policy under the conditions of internal problems and introduction of sanctions is to solve the main economic problems of the economic food security, and the main tool of solving them is formation of the efficient agrarian market that includes the meat market.

According to its significance, the meat market takes the main position in the structure of the agrarian market which is understood as a complicated system of multiple economic and interfarm relations of market entities arising in the process of reproduction, where there are some specific characteristics that take into account the peculiarities of the considered object and entities forming the supply and demand.

Some characteristic (belonging to the agrarian market) and special peculiarities can include the following ones:

4) tendency to the increasing demand for expensive organic food products at the increasing consumption of meat and cheap food products at the same time;

5) non-uniform level of consumption of meat products among the regions of the country;

6) insufficient maturity of the infrastructural links of the studied market;

7) low possibility to balance the demand and supply that leads to the swinging of market;

8) dependence of the internal meat market upon the import of the finished products that influences the formation of the internal price for meat and meat products;

9) necessity to perform the protective policy of the state regarding the domestic meat manufacturer by means of the economic mechanisms to provide the flexibility and order of economic relations (Poltarykhin 2011;-4, Poltarykhin 2010).

The definition of the specific character of the meat market allows clarifying and representing in a new way the functions that help to provide the dynamic relation, including the manufacturers of meat for processing, meat industry, commerce and consumers of meat products.

The content, characteristic and specific peculiarities, functions of the meat market form the objective need for the further scientific grounding of the level of economic development of the considered market and the determination of directions of its impact on some elements.

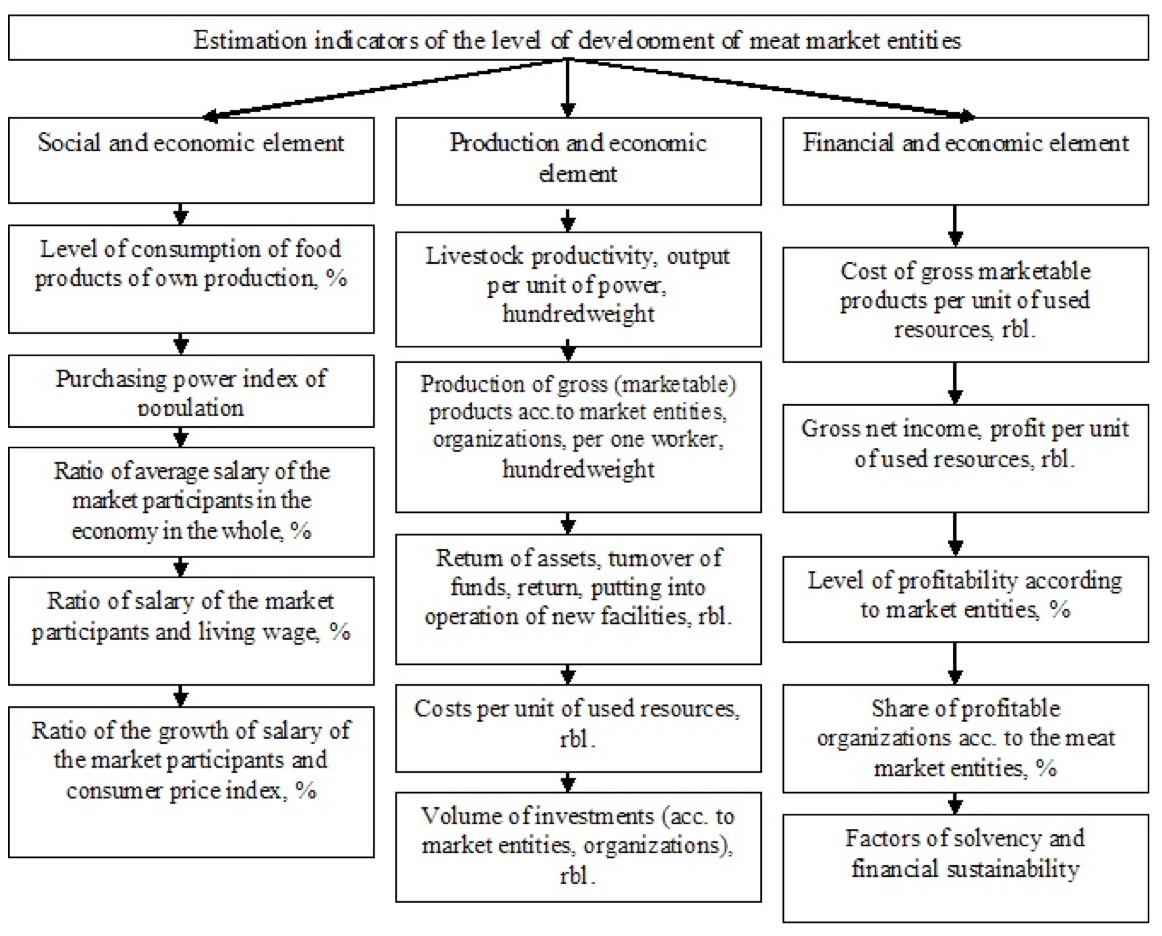

The authors’ methodological approach to the formation of the system of indicators of the efficiency estimation of the meat market functioning is based upon the use of the system of indicators that take into account all elements of entities that compose it. Such approach takes into account the criteria that reflect the result and influence the category of demand and supply. This allows estimating the efficiency of the meat market entities along the whole reproduction chain: "production – reprocessing – realization of products – consumption" (Ganieva 2011; Southgate 2011; Sowlati, & Paradi 2002).

In our opinion, the complex method of economic estimation of the meat market shall reflect the reproduction concept that is based upon the understanding of the reproduction process as a reproduction form of interfarm process between the economic entities of the meat market. Reproduction is considered as complete, continuous, regular motion of resources via interaction of the various forms and types of the contributed public labour till the obtaining of the effect of the functioning of the whole system that will satisfy the interests of all economic entities. As a result, the reproduced concept determines the production and consumption as a system of consumption of the produced products and consumption is connected to the production in one way or other. The volumes of consumption are determined by the capacity of the market and the volume of consumption and also by the possibilities of production as a consumer of the production process factors (Poltarykhin 2011).

Consequently, this methodological approach allows reflecting and estimating the unity of the reproduction stages and also taking into account the interconnection of the interfarm processes along the whole chain of reproduction "production – reprocessing –realization, final stage – consumption", as well as studying the elements of the structure of these processes that presuppose the change of the results of the economic activity. We notice that the method of economic estimation of the meat market efficiency is built within the frameworks of the specific character of the composing market entities (fodder production, meat for processing, meat production, and sale) and the meat market in the whole. The method shall be built in the context of blocks that reflect the consequence of the economic processes and determine the category of supply and demand with the direct involvement of the state as a market entity (Figure 1).

Figure 1. System of estimation indicators of the development level of the meat market

Thus, as a result of the offered system of indicators that characterize the social, production and financial components, we added the estimation indicators and this promotes the obtaining of the objective information about the state of the meat market and allows determining the level of production, social, financial sustainability, completeness of the structural changes and revealing of the regulatories of the meat market development in the time and space aspects of activity.

The agrarian market is the most vulnerable market of the national economy. In comparison with many other developed countries, Russia is located in not very favorable climatic conditions, the material and technological base is rather deteriorated and the freedom of import leads to the put-out of the Russian manufacturers from the agri-food markets. To solve the mentioned problems we determined the directions of the development of the meat market in the Altai Territory (Mikhailushkin 2012; Cramer, Jensen, & Southgate 2001).

Within the Territory there are seven natural and economic zones in which there is an uneven concentration of the meat production in the live weight. The livestock and the production of meat for processing are concentrated in the Kulundinskaya and Priobskaya natural and economic zones (Table 1). The disproportions were determined that define the reasons of losses during the transportation of raw materials, storage and high cost of production. There are capacities to increase the livestock and production of meat for processing by 2025 in every natural and economic zone of the Altai Territory.

Table 1. Concentration of production of meat for processing

Natural and economic zone |

1991 |

2001 |

2008 |

2011 |

2015 |

2025 |

1991 |

2001 |

2008 |

2011 |

2015 |

2025 |

Per 100 ha of agricultural lands: |

||||||||||||

Farm livestock, cond. animals * |

Meat in live weight, ton |

|||||||||||

Altaiskaya |

10.1 |

7.9 |

8.1 |

8.2 |

9.8 |

13.7 |

1.8 |

1.4 |

1.5 |

1.0 |

1.1 |

1.5 |

Biysko-Chumishkaya |

20.1 |

13.5 |

14.0 |

14.1 |

7.1 |

11.7 |

2.5 |

1.2 |

1.1 |

1.2 |

1.3 |

1.7 |

Prialeyskaya |

8.1 |

7.1 |

8.3 |

8.2 |

8.3 |

12.8 |

2.2 |

1.2 |

1.2 |

1.4 |

1.4 |

1.8 |

Prialtaiskaya |

12.4 |

9.4 |

9.6 |

9.8 |

7.6 |

12.2 |

1.8 |

1.8 |

2.0 |

1.5 |

1.5 |

2.1 |

Priobskaya |

15.6 |

6.4 |

6.7 |

6.9 |

8.8 |

13.0 |

2.3 |

1.5 |

1.5 |

1.6 |

1.8 |

2.2 |

Prisalairskaya |

11.6 |

8.1 |

8.2 |

8.3 |

8.3 |

12.8 |

1.9 |

1.4 |

1.6 |

1.5 |

1.6 |

2.1 |

Kulundinskaya |

12.9 |

5.9 |

7.3 |

7.6 |

7.6 |

12.2 |

2.3 |

1.6 |

1.7 |

1.6 |

1.6 |

2.1 |

Altai Territory |

13.9 |

8.6 |

8.6 |

8.7 |

8.8 |

13.0 |

2.1 |

1.9 |

2.3 |

1.4 |

1.5 |

2.0 |

The facilities of the meat processing plants of the Territory taking into account those put into operation in 2015 were the following ones (thousand tons per year): poultry and poultry by-products of barn-door fowl – 68.8; meat and meat by-products of slaughter animals – 210; meat by-products – 50.5; sausage products – 64.5; canned meat – 10,110 cans per year. Considering that 239.5 thousand tons of livestock in the slaughter weight were slaughtered in 2015 at the slaughtering capacity of 385 thousand tons per year, the whole volume of the meat for processing (excluding the poultry) can be reprocessed in the Territory. However, the concentration of facilities in the Territory takes place regardless of the formation of the raw material base and this leads directly to the losses of meat for processing, inefficient use of the production potential and non-rational transportations. The reserve of the increase in the volume of pig meat production is 103.0 thousand tons, cattle – 101.7 thousand tons.

The structure of the meat production in the Altai Territory has changed drastically, so the beef production decreased almost five times, also the production of lamb meat and pork decreased (Table 2).

Table 2. Production of meat products in the Altai Territory, thousand tons

Indicators |

2001 |

2008 |

2011 |

2012 |

2013 |

2015 |

Use of facilities in 2015, %* |

2025 |

Pork |

10.0 |

10.8 |

11.6 |

11.9 |

12.1 |

13.4 |

43.6 |

30.7 |

Beef |

16.3 |

19.0 |

18.4 |

18.6 |

18.5 |

18.6 |

42.7 |

|

Lamb |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.23 |

|

Semi-finished products |

28.8 |

28.1 |

25.3 |

25.9 |

27.1 |

28.9 |

51.2 |

56.4 |

Sausages |

14.2 |

18.6 |

25.2 |

26.0 |

26.8 |

29.4 |

48.3 |

60.7 |

Canned meat, mln stand. cans |

1.1 |

2.2 |

3.7 |

4.1 |

3.6 |

3.8 |

52.1 |

7.3 |

Production facilities give the possibilities to increase significantly the production of meat products and correspondingly to change its structure.

The efficiency of the meat production changed for the period of study. In 2015 in comparison with 1991, the average day growth of the cattle grew by 10.5%, sheep – by 46.0%, pigs – by 50%. The cost-intensive livestock breeding during growing, fattening of livestock leads to the huge running costs. The cost of meat for processing is much higher than the selling price. The Table 3 shows that in the Altai Territory there is the potential for increase in the livestock productivity.

Table 3. Production efficiency of the meat for processing in

the agricultural organizations of the Altai Territory

Indicators |

1991 |

2001 |

2008 |

2011 |

2012 |

2013 |

2015 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

Cost of sold livestock in live weight (compared with cost in 2010 г.), thousand roubles per |

|

|

|

|

|

|

|

100 ha of food acreage |

90.1 |

91.9 |

80.0 |

75.8 |

74.9 |

74.4 |

74.8 |

Cost of sold livestock in live weight (in the selling prices), roubles per |

|

|

|

|

|

|

|

1000 roubles |

546.0 |

225.7 |

177.0 |

139.0 |

163.7 |

184.2 |

201.2 |

1 livestock unit |

3.3 |

4.2 |

3.4 |

3.2 |

3.2 |

3.3 |

3.2 |

1 average annual worker |

109.2 |

110. |

98.0 |

95.4 |

96.8 |

98.3 |

99.8 |

Profit, thousand roubles, per |

|

|

|

|

|

|

|

1 livestock unit |

0.2 |

-0.3 |

-0.4 |

-0.4 |

-0.2 |

-0.2 |

-0.3 |

1 worker |

8.2 |

-8.3 |

-10,0 |

-11.5 |

-5.6 |

-7.6 |

-8.3 |

100 ha of food acreage |

6.7 |

-6.9 |

-8.2 |

-9.1 |

-4.3 |

-4.6 |

-5.1 |

1 ton of sold products |

4.1 |

-4.1 |

-5.6 |

-6.5 |

-3.1 |

-3.6 |

-4.1 |

Growth (average day growth), g |

|

|

|

|

|

|

|

Pigs |

269 |

283 |

331 |

356 |

375 |

391 |

405 |

Cattle |

409 |

400 |

428 |

454 |

467 |

452 |

452 |

Sheep and goats |

50 |

37 |

46 |

54 |

64 |

71 |

73 |

Profitability (unprofitability), % |

25.0 |

-9.9 |

-11.2 |

-10.7 |

-4.2 |

-5.1 |

-4.8 |

The monopolistic position of meat plants allows undercutting the prices for meat for processing and forming the lower cost for the processed products in regard to the external counteragents, and this influences favorably the category of demand but as a result it decreases the raw material base, that is, the category of supply of the raw material and the finished products in the whole. The manufacturers of meat for processing have to process it by themselves building their mini complexes. Such mini complexes, however, cannot perform the complete processing of the raw material (Poltarykhin & Churin 2016; Puzakov 2014).

In comparison with large plants, they have a big percent of waste of the meat processing and this leads to the rise in price of the products and again to the disbalance in the formation of the supply and demand for the meat products.

We determined the imperfect interrelations between the processing, agrarian and commercial enterprises of the Altai Territory that is an important factor of risk under conditions of sanctions and the key direction of the meat market production (Table 4).

The costs of the meat market entities for the production of the meat for processing are 71.9%, in the processing – 23.9%, commerce – 4.2%, and the level of profitability is 0.9; 30.7 and 18.2%, respectively. This situation leads to the decrease in the raw materials resources and incomplete use of production facilities (Poltarykhin, & Mikhailushkin, 2013).

Table 4. Economic efficiency of the meat market, thousand roubles

Indicators |

2008 |

2010 |

2012 |

2015 |

Purchasing price of raw material |

36.3 |

62.8 |

75.4 |

80.5 |

Actual cost price of raw material |

40.2 |

69.5 |

74.5 |

79.8 |

Actual cost price of products |

93.4 |

144.1 |

160.6 |

178.9 |

Costs of realization |

6.4 |

7 |

7.4 |

7.8 |

Wholesale price of 1 ton of products |

101.2 |

163 |

195.2 |

233.8 |

Retail price of 1 ton of products |

138.8 |

202.6 |

240.5 |

285.5 |

Income (loss) of realization of 1 ton of products |

|

|

|

|

production |

-6.7 |

-11.3 |

1.5 |

0.7 |

reprocessing |

12.8 |

27.9 |

32.0 |

54.9 |

commerce |

31.2 |

32.6 |

37.9 |

43.9 |

Level of profitability (unprofitability), % |

|

|

|

|

-9.7 |

-9.6 |

1.2 |

0.9 |

|

reprocessing |

14.4 |

20.6 |

19.6 |

30.7 |

commerce |

29.0 |

19.2 |

18.7 |

18.2 |

Specific weight of costs per 1 ton of products, % |

|

|

|

|

production |

68.1 |

76.5 |

73.1 |

71.9 |

reprocessing |

25.6 |

18.9 |

22.5 |

23.9 |

commerce |

6.3 |

4.6 |

4.4 |

4.2 |

Thus, the functioning of the meat market of the Altai Territory is estimated as extensive and this, of course, makes it difficult to use it as the main source of funds to achieve the regional food provision and also for an increase in the living standard of the population. With regard to WTO countries, the advantage of Russia and its regions is in its peculiarity of the meat market that allows ramping up production of meat for processing and finished products basing upon:

- enforcement of the material and technical base of meat market entities by means of acquiring high-productive breeds of animals and retrofitting the meat industry;

- complete load of the existing reprocessing facilities for the manufacturing of product and raw material processing that will allow decreasing the cost price of the products;

- development and introduction of the interbranch connections along the whole reproduction chain of the meat market of the region due to the which the structural change of the raw material production and redistribution of the livestock will take place;

- optimization within the frameworks of the redistribution of incomes between the market entities that will allow applying the resources reasonably and introducing the innovations; the information provision of the market participants also shall become better;

- developments of the efficient interbranch connections between market entities of the whole reproduction chain of the Altai Territory, creation of the integrated structure;

- increase in the efficiency of the production of finished products and raw material that will allow decreasing the losses during storage, production and transportation.

Since the introduction of the research, the positive changes have already taken place in the production of finished products and raw material; therefore, it is necessary to develop the measures aimed at improving the performance of the meat market elements (Poltarykhin 2011; Poltarykhin & Mikhailushkin 2013).

We determine the development of the meat market as a construction of the system within the frameworks of the reproduction process of all its elements beginning from the agrarians and processors till the consumers. The growing of the productive livestock is connected to the needs of meat of the population of the Altai Territory; the reprocessing facilities are connected to the raw material resources; proportions of the development of the fodder base are connected to the livestock. When connecting the raw material resources and the production facilities, we presuppose the possibility to use the recoverable raw material on the modernized facilities. Therefore, on the basis of the specific character of the agrarian market at this stage, it is necessary to perform the process of alignment of interests of all entities of the meat market. In our opinion, the best form of integration is an agroindustrial association capable to unite the interests of the parties, from the manufacturers of the raw material to the realization of the finished products. The main features of such form of integration will be the following ones: the unification of the part of capital; coordination of activity; clear separation of functional responsibilities; possibility of coordination of the economic interests.

The wish of reprocessing enterprises and agrarians to change the negative situation in the meat market and to smooth over the differences in the interrelations shall be an initiative of creation of the agroindustrial association to work together and cooperate and to increase the efficiency of production at all its stages to achieve the final result.

The results of the research.

On the base of the efficient work of the introduced association, we proved the project efficiency of the meat production in the Territory as recommendations for the further development of the integrated formation within the frameworks of the following stages:

1. Demand of the population for meat and meat products, on the base of the recommended norms of the Institute of Nutrition – 34 thousand tons of pork, 60.7 tons of beef, 26.7 tons of sausage products and 20.1 tons of other meat products.

2. Demand of the production reprocessing facilities for the complete provision of the population with meat – 385 thousand tons of meat for processing.

3. The cost price of the products was proved. In the performed calculations, taking into account the dynamics of the price growth by 2025, the cost price of 1 ton of pork will be 98 thousand roubles, beef – 115.1 thousand roubles (Table 5).

Table 5. Project efficiency of the meat production in the Territory

Indicators |

2015 |

2025 |

||||||||||

pork |

beef |

other |

pork |

beef |

other |

|||||||

Cost price of 1 ton of meat for processing, thousand roubles |

69.8 |

81.1 |

205.4 |

98.1 |

115.1 |

316.0 |

||||||

Sold meat for processing, thousand tons |

64.2 |

52.7 |

1.1 |

159.9 |

157.8 |

4.2 |

||||||

Purchasing price of meat for processing, thousand roubles/ton |

73.2 |

84.2 |

225.3 |

120.1 |

138.1 |

379.2 |

||||||

|

pork |

beef |

sausage |

other |

pork |

beef |

sausage |

other |

||||

Cost price of products, thousand roubles/ton |

130.1 |

152.0 |

250,0 |

203.1 |

206.0 |

254.2 |

348.3 |

318.0 |

||||

Sold products, thousand tons |

13.4 |

18.6 |

29,4 |

28.9 |

43.6 |

76.2 |

64.4 |

53.0 |

||||

Costs of commerce for sale of products, thousand roubles/ton |

9.2 |

8.3 |

7,8 |

8.1 |

9.1 |

8.9 |

8.7 |

8.8 |

||||

Wholesale price of products, thousand roubles/ton |

160.4 |

178.3 |

293,8 |

238.4 |

253.0 |

305.2 |

421.0 |

388.0 |

||||

Retail price of products, thousand roubles/ton |

203.0 |

213.1 |

360,3 |

288.0 |

321.0 |

376.2 |

519.0 |

476.3 |

||||

Growth of income per 1 ton of products, % to the previous indicator |

- |

35 |

||||||||||

Specific weight of costs per 1 ton of products, % |

|

|

|

|

|

|

|

|

||||

production |

61.5 |

96.2 |

38.1 |

53.4 |

65.3 |

69.7 |

47.9 |

58.2 |

||||

reprocessing |

31.5 |

25.8 |

58.8 |

42.8 |

29.8 |

26.4 |

49.4 |

38.8 |

||||

commerce |

6.6 |

5.2 |

3.0 |

3.8 |

4.8 |

3.9 |

2.7 |

3.0 |

||||

4. The mathematical model was developed that consists of the blocks, where each block corresponds to the particular specific weight of the retail price at every stage of production. The main function of such model is obtaining the maximal profit. When building such model, the price factors were taken into account (volume of product realization, prices for raw material, population income index, consumer price index, currency rate of rouble) that allowed considering the supply and demand. The retail price of 1 ton in 2025 will be: beef – 376.2 thousand roubles, pork – 321 thousand roubles, sausage products – 519 thousand roubles.

5. The standard way of income distribution of every element of the technological chain was offered, that allows increasing the profit at the equal level of profitability by 65% in 2025 in comparison with 2015 per 1 ton of the finished products in the Altai meat product association.

By 2025, it is planned to completely replace the import raw material and finished products in the meat market of the Altai Territory and also to satisfy the consumer demand of the population of the Altai Territory with the local range of products.

The determination of the specific character of the meat market allowed clarifying and supplementing the content of the functions of the considered market that help to provide the dynamic connection of the manufacturers of the meat for processing with meat industry, commerce and consumers of the finished products. The key content of the functions represented in this work is that the structure of the finished products production shall reflect the demands of the population in this product at the optimal combination of the interbranch, territorial and intraproductive proportions.

The methodological approach to the formation of the system of estimation indicators of the efficient functioning of the meat market was developed; it is based upon the system of indicators that consider all elements of its entities, where the key criteria reflect the result and impact on the category of demand and supply. This allows estimating the efficiency of the meat market entities along the whole reproduction chain: "production – reprocessing – realization of products – consumption".

The low level of interactions between the market entities was revealed that is one of the main risk factors. In 2015 the specific weight of the costs for production of 1 ton of meat was 71.9%, for reprocessing – 23.9%, for commerce – 4.2%, and the level of profitability was 45.4; 40.1 and 14.5 %, respectively. Such situation leads to the decrease in the raw material resources, and all this leads to the incomplete use of the production facilities and as a result there is no proper system of import phase-out of the meat products under conditions of sanctions.

The level of optimization of the prices of meat market entities for the predicted period was proved, and this allowed determining the normative costs of the manufacturers of the meat for processing, meat industry and commerce depending upon the dynamics of the price growth for resources consumed during production. The solution of the economic and mathematical model allowed calculating the price of product of meat market entities and proving the measures of unification of the interests of the partners along the whole reproduction chain.

The project of the development of the meat market was produced that provides for satisfying the population demand for meat and meat products in the region at the complete load of the facilities existing in the Altai Territory. The general production facilities of the meat for processing will be 385 thousand tons, the existing facilities of the meat output will be extended up to 237.2 thousand tons and the level of meat demand satisfaction of the population in the Altai Territory will reach 148.8%.

The economic effect of the meat market development in the Altai Territory till 2025 has been calculated. The level of profitability will be 95% according to the main types of products. For the predicted period, the demand and supply for meat and meat products will be optimized, the consumer demand will be satisfied and the interests of the manufacturers of products, processors and commerce will be coordinated, the lost raw material resources will be renewed, the competitiveness of the local products will be increased building the proper system of import phase-out.

Thus, the developed offers on the development of the meat market of the Altai Territory will allow it to function on the base of the single regulating mechanism of the demand and supply. This will allow developing the interfarm and intrerbranch relations from production to realization and this will influence favorably the decrease in the cost of meat and meat products and also will make it possible to satisfy the consumer demand and finally to build the proper system of import phase-out of meat products. The income from realization of meat products distributed between all participants of the production process of the meat market according to the material and cash costs will allow providing the level of profitability of the manufacturer, processes and commerce of 45; 40 and 14%, respectively.

Cramer, G., Jensen, C., & Southgate, D. (2001). Agricultural Economics and Agribusiness (8th ed.). New York: Wiley, pp. 165.

Ganieva, I.A. (2011). Sovershenstvovanie regionalnoi infrastruktury osvoeniya agroinnovatsii [Improvement of the Regional Infrastructure of the Agroinnovations]. Dostizheniya nauki i tekhniki APK, 5, 12-14.

Mikhailushkin, P.V. (2012). K otsenke ekonomicheskogo razvitiya agroproizvodstva [Estimation of the Economic Development of Agroproduction]. Ekonomika selskogo khozyaistva Rossii, 1(9), 66-76

Poltarykhin, A.L. (2011). Integratsionnoe razvitie sveklosakharnogo podkompleksa APK regiona: Avtoreferat dissertatsii na soiskanie uchenoi stepeni doktora ekonomicheskikh nauk [Integration Development of the Beet Sugar Subcomplex of AIC of the Region (Ph.D. Thesis Abstract)]. Novosibirsk State Agrarian University, Novosibirsk.

Poltarykhin, A.L., & Churin, A.N. (2016). Osnovnye problemy i perspektivy razvitiya rynka myasa v regione [Main Problems and Perspectives of Development of the Meat Market in the Region]. Konkurentosposobnost v globalnom mire: ekonomika, nauka, tekhnologii, 7-2(19), 37-41.

Poltarykhin, A.L., & Mikhailushkin, P.V. (2013). Otsenka effektivnosti realizatsii i pererabotki syrya v ramkakh davalcheskoi skhemy vzaimootnoshenii partnerami [Efficiency Estimation of Realization and Reprocessing of the Raw Material under the Give-and-Take Scheme of Interaction by the Partners]. Ekonomika ustoichivogo razvitiya, 15, 104-111.

Poltarykhin, A.L. (2010). Produktovye podkompleksy agropromyshlennogo proizvodstva [Food Subcomplexes of Agroindustiral Production]. Ekonomika selskogo khozyaistva Rossii, 3, 43-46.

Puzakov, A.V. (2014). Rynok myasa i myasoproduktov v Rossii: sostoyanie i perspektivy razvitiya [Market of Meat and Meat Products in Russia: State and Perspectives of Development]. Ekonomika, statistika i informatika. Vestnik UMO, 6-2, 446-452.

Southgate, D. (2011). Food Sovereignty: The Idea’s Origins and Dubious Merits. African Technology Development Forum Journal, 8(½), 18-22

Sowlati, T., & Paradi, J.C. (2002). Establishing the "Practical Frontier" in Data Envelopment Analysis. In International DEA Symposium "Efficiency and Productivity Analysis in the 21st Century", 24-26 June 2002 (Moscow, Russia): Abstracts. Moscow: International Research Institute of Management Sciences.

1. Kemerovo State Agricultural Institute, 650056, Russia, Kemerovo, Markovtsev Street, 5

2. Kemerovo State Agricultural Institute, 650056, Russia, Kemerovo, Markovtsev Street, 5

3. Kuban State Agricultural university, 350044, Russia, Krasnodar, Kalinin Street, 13

4. Kuban State Agricultural university, 350044, Russia, Krasnodar, Kalinin Street, 13

5. Plekhanov Russian University of Economics, 117997, Russia, Moscow, Stremyanny Lane, 36

Contact e-mail: i.sob.asu@bk.ru