Vol. 38 (Nº 33) Año 2017. Pág. 42

Valentina Sergeevna VARIVODA 1; Julia Mikhailovna ELFIMOVA 2; Anna Grigorievna IVOLGA 3; Svetlana Vladimirovna LEVUSHKINA 4

Received: 30/05/2017 • Approved: 15/06/2017

ABSTRACT: Necessity for modeling of processes of small and medium-sized businesses development to ensure their sustainability has been highlighted in the paper. Modeling for sustainability enhancement was carried out through a system of indicators characterizing the development of small and medium enterprises (SMEs), which consists of three groups: parameters of the SMEs system; indicators of disturbances to the entrepreneurial system; controlled variables of SMEs. Trend analysis and forecasting were used in the paper as key statistic methods of implementing a model of small and medium enterprises’ sustainable development. |

RESUMEN: La necesidad de modelar procesos de desarrollo de pequeñas y medianas empresas para asegurar su sostenibilidad ha sido destacada en el documento. El modelado para la mejora de la sostenibilidad se llevó a cabo a través de un sistema de indicadores que caracterizan el desarrollo de pequeñas y medianas empresas (PYME), que consta de tres grupos: parámetros del sistema de PYMES; Indicadores de perturbaciones del sistema empresarial; Variables controladas de PYME. El análisis de tendencias y la predicción se utilizaron en el documento como métodos estadísticos clave para implementar un modelo de desarrollo sostenible de las pequeñas y medianas empresas. |

The development of small and medium enterprises (SMEs) in Russia is relatively stable by nature. In recent years, there has been a dynamic stability both in the number of small enterprises, and in the share of employees in small enterprises, and, very importantly, the value added GDP, an indicator most fully and purposefully reflecting the new level of quality characteristics of small businesses growth. However, the trend of sustainable growth is minimal, and in comparison with foreign countries, where the level of entrepreneurial activity has a long-term traditional and historical perspective, Russia has a high level of retard in some qualitative indicators of small business development. Functional and generally accepted indicators for assessing the sustainability of country’ economic development, industries and businesses are the growth rate of GDP and the share of their economies in it. Thus, according to the Ministry of economic development of the Russian Federation, by the end of 2013 the contribution of small and medium enterprises in the country’s GDP amounted for 21%. While this rate in the USA and Germany was at the level of 50-52%, in France - 56-62%, in Japan - 52-55%. By share of employment in SMEs in total employment, Russia ranks 25,2 % (for comparison: the US and France - 54%, Germany - 46%, Japan 78%). The target is declared by the Russian government to achieve the level of 50-60% (Cantillon 1755).

All this has led to the formation a new model of small and medium enterprises sustainable development. Such modeling will allow solving a number of problems:

1. Forming the trajectory of SMEs’ system development through analysis of time series;

2. Monitoring the processes of SMEs’ system development in a certain point or period in their development;

3. Diagnosing the sustainability of SMEs’ development processes according to the monitoring results;

4. Predicting pre-crisis or crisis situations to determine the possibility of confrontation or prevent their occurrence;

5. Ensuring the sustainability of SMEs system with the transition to a new stage of development through timely arrangements correcting the trajectory of the system under investigation.

Implementation of the model mentioned above will allow SMEs in the pre-crisis or crisis to come to a new level and gain the ability in the course of development to achieve strategic objectives for the formation of competitive advantages and efficiency of operation. In addition, sustainable growth should occur in conditions where the entrepreneurial risk factors and the changing business environment have a significant impact on the state of equilibrium and directions to achieve the maximum stable growth of entrepreneurial income (Juglar 1868).

Modeling in given conditions is a necessary tool in the sustainable development of complex socio-economic systems, including the system of SMEs.

An extremely important stage of any modeling is the choice of indicators that reflect both the object of modeling and its external environment and the relationships between them. The solution to this problem is very difficult, since it is associated with following the contradictory requirements of completeness and simplicity. In addition, as we know, socio-economic systems are described by a huge number of various indicators (Bondarenko 2005; Greiner 1972).

From the standpoint of system analysis, synthesis sustainability of SMEs systemic development is possible only with the use of interrelated indicators system, each of which characterizes a particular facet of the investigated processes and phenomena.

In the process of studying the stability of small and medium-sized businesses, we have found the need to allocate three main groups of indicators characterizing respectively:

The decision-making about the use of an indicator should be based on several aspects that determine the feasibility and effectiveness of its use (Levuchkina 2013). It is important to note that the choice of indicators is not a localized procedure for each of them. The system of interrelated and interdependent metrics demonstrating integrity and completeness in the framework of the challenge of ensuring the sustainability of the system development of SMEs is being built. This system is a dynamic object that requires periodic updating and composition of indicators and their significance (Kitchin 1923).

Based on the above, we have proposed the following system of indicators for use in the process of ensuring the sustainability of the system development of small and medium enterprises (Table 1). Note that this list of indicators can be widened or narrowed depending on tasks, socio-economic situation and the availability of information and analytical resources.

Mathematical modeling algorithm of sustainable development is carried out in the following areas:

Table 1. System of indicators for assessment the SMEs’ sustainable development

Production potential |

Financial opportunities |

Organizational and management activity |

|

Managed (active-reactive) variables X of SMEs system |

|||

fixed assets (income ratios, disposal, depreciation); turnover; cost of production; number of innovative enterprises; costs of technological innovation proportion of enterprises with technological innovation; coefficient of internal funds availability |

investment in fixed assets; equity and debt; proportion of funding sources to power its own funds and long-term liabilities |

number of enterprises; average number of employees; number of newly established and liquidated companies; average wage; competitiveness; turnover rate; skill level of workers; fund utilization rates of working time; index of business activity |

|

Parameters of Y development of SMEs |

|||

profitability (total, production); operational performance |

return on assets; financial stability; profit per enterprise - growth rates; liquidity; trial balance financial result |

net profit per 1 ruble turnover; volume of 1 ruble wages; return on sales; share of profitable enterprises |

|

Indicators of disturbances Z on the SMEs system |

|||

Internal |

External |

||

composition and use of fixed assets; movement of working capital; consumption of materials; efficient use of human resources; level of marketability of production; selling expenses (internal pricing mechanism) |

inflation and price indices; budget expenditure for the implementation of state support for SMEs; interest on the loan; regional average wages; rates of taxes and fees; deductions for social insurance, health insurance, the Pension Fund, the State Fund for Employment of the Russian Federation; natural resource potential; purchasing power of the population; rental fee; Indicators of the competitive environment; economically active population. |

||

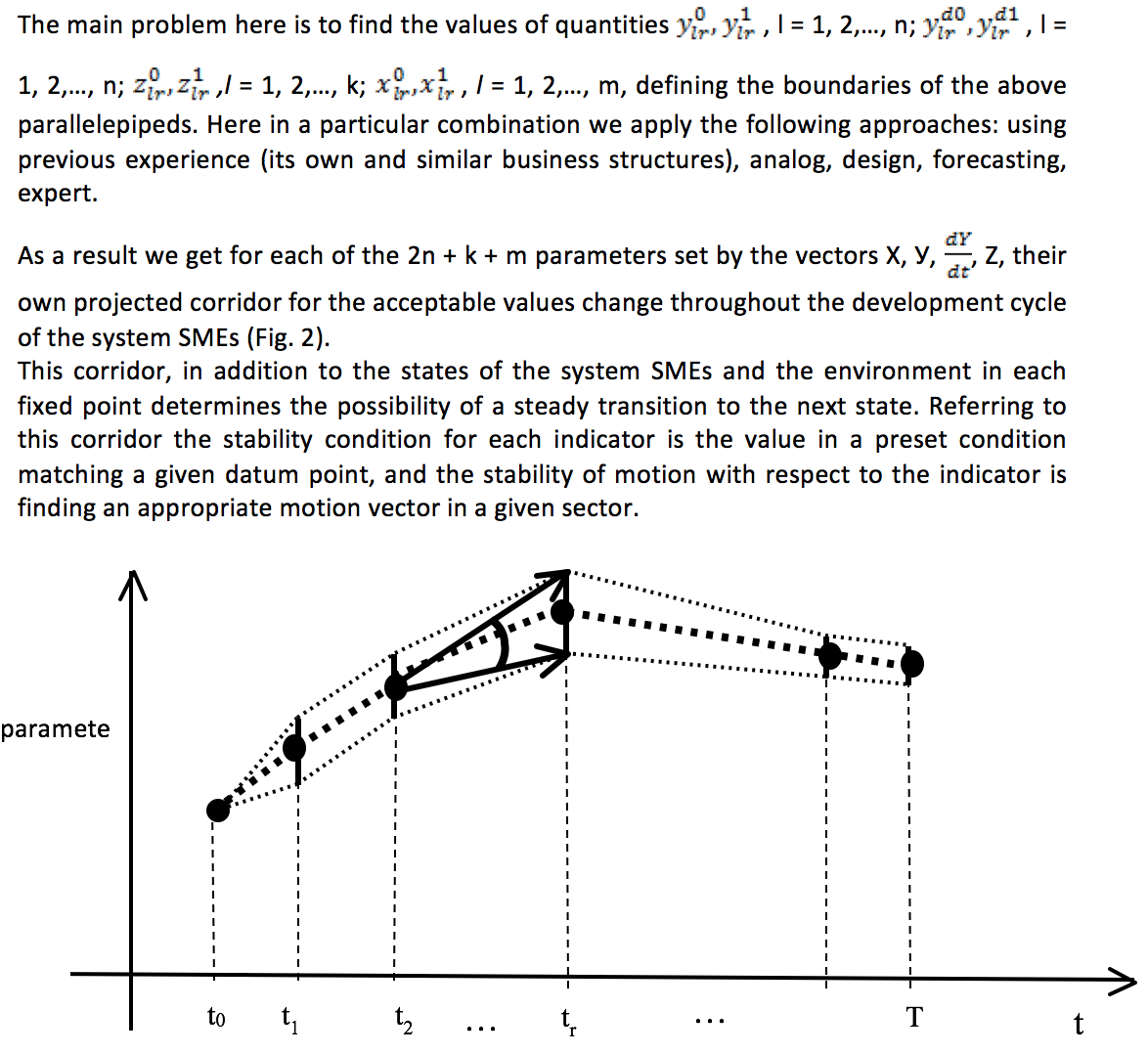

General scheme of using mathematical modeling methods in the sustainable development of the SMEs system is presented in figure 1. It should be noted that mathematical modeling is required to serve all stages of the algorithm ensure the sustainability of SMEs system development, and that is reflected on the submitted scheme (Litvak 2004).

Figure 1. Mathematical modeling in the sustainable development of SMEs system

The definition of indicators X, Y, Z system on the one hand is a common problem, and its solution is associated with many problems: informational, analytical, financial. Despite existing both its own and similar business systems' experience, it often requires taking into account specifics of both a particular system SMEs and chronotopes features of a certain socio-economic situation should be taken into consideration. Here appropriate expert technology should be used in the framework of the organization of the information and analytical processes (Levushkina, et. al. 2016).

The formation and use of the information base to ensure stability of the system development of SMEs should occur continuously. It should reflect each step of the algorithm as a whole, and mathematical modeling in particular. Taking into account the scale of tasks, the necessary condition for the success of their solution is the use of modern computer technology.

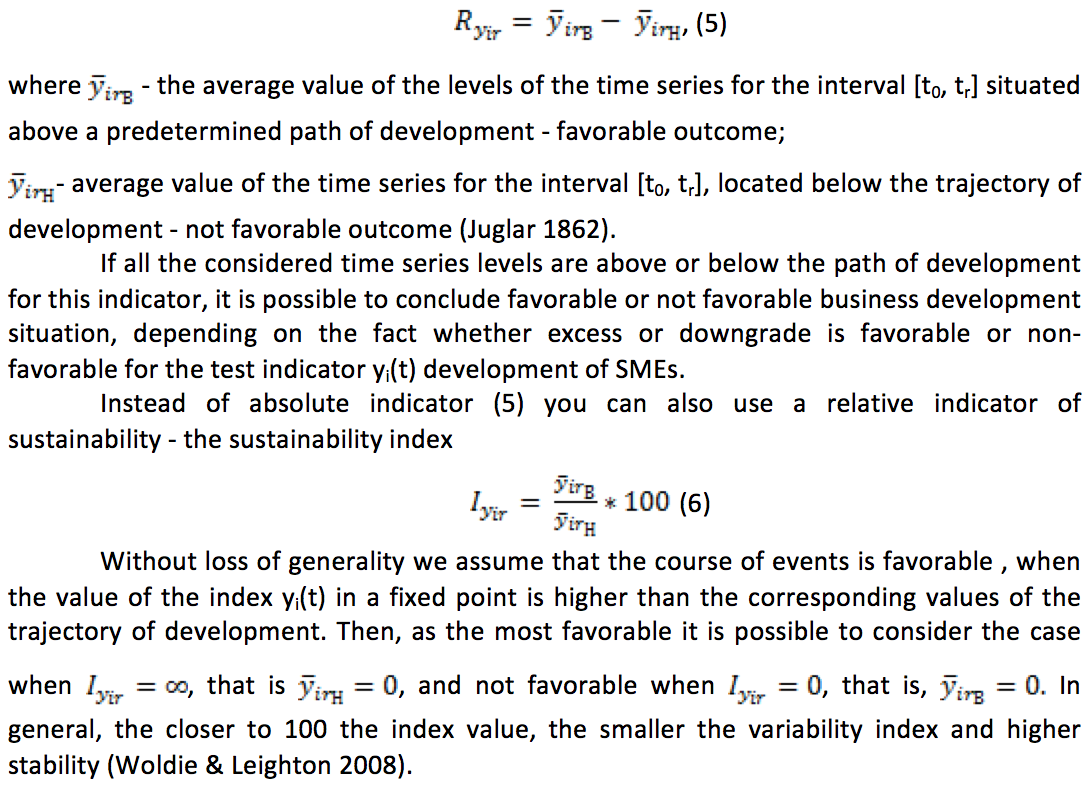

During the implementation cycle of SMEs development in the result of monitoring of development processes time series for all monitored parameters are generated. Measurement of their sustainability provides quantitative indicators for assessing the sustainability of the business system as a whole.

The stability of time series is usually considered in two aspects - the resistance levels of the time series and sustainability trends. We need to monitor changes in the values of the two groups of indicators, as well as the dynamics of their values for the following time periods (and corresponding time series of values of indicators): [t0, tr], [t0, tr+1], [tr-1, tr], [tr, tr+1]. This approach allows us to assess the sustainability of the system development of SMEs taking into account historical data, current situation and predicted values of the studied variables (Kuznets 1973).

In this case, we assume that for sufficiently large systems due to their inertia, the development processes in the absence of crisis conditions occur evenly, smoothly. Violation of this uniformity can also be seen as symptoms of unsustainable development of SMEs, and often as signs of a crisis.

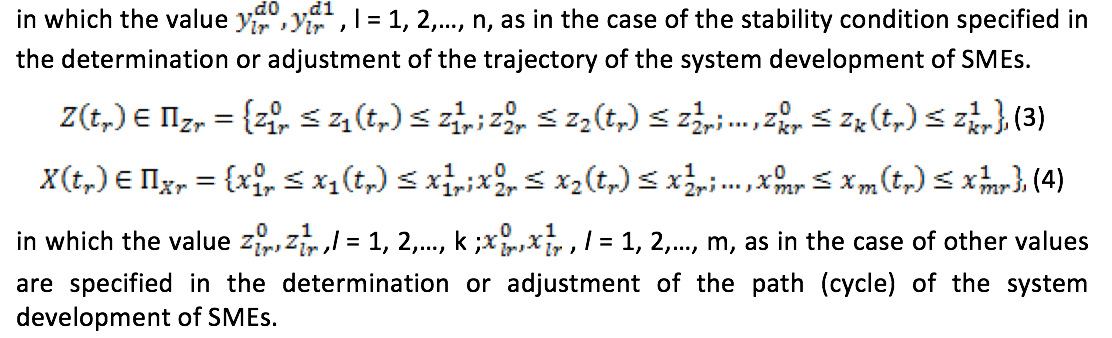

Usually the sustainability indicators time series are considered from the point of view of preserving the desired trend. In our case, the role of this trend, or rather, because of the multiplicity of indicators, trends, is given to the generalized trajectory of the system development of SMEs, which is determined by the vector of the resulting indicators У(t) = (у1(t), у2(t),…, уn(t)), variable on the interval [t0, T] at the fixed points. Moreover, a generalized trajectory can be set both to reflect certain points and "corridors" . The first one serves as the basis for calculation of indicators of sustainable development, and the second one defines the boundaries of acceptable variations in the values of these indicators. It is also obligatory to calculate indicators of stability of the time series, reflecting disturbance (vector Z) on the studied entrepreneurial system, and the available means to counteract with them (the vector X).

Approaches discussed below to assess the time series sustainability are applicable to all of the above indicators. We will bring them to the resulting indicators Y(t) = (у1(t), у2(t),…, уn(t)). In this case, we assume that the interval [t0, tr] contains sufficient for the correct calculation number of reference points and therefore members of the time series. Members of a time series can be both actual and projected.

The magnitude of variability average time series for indicator development уi(t), i = 1, 2,…, n, at the time of passing the reference point tr is calculated from the classification levels of the time series corresponding to favorable or non- favorable values of this indicator. In particular, one can use the following formula

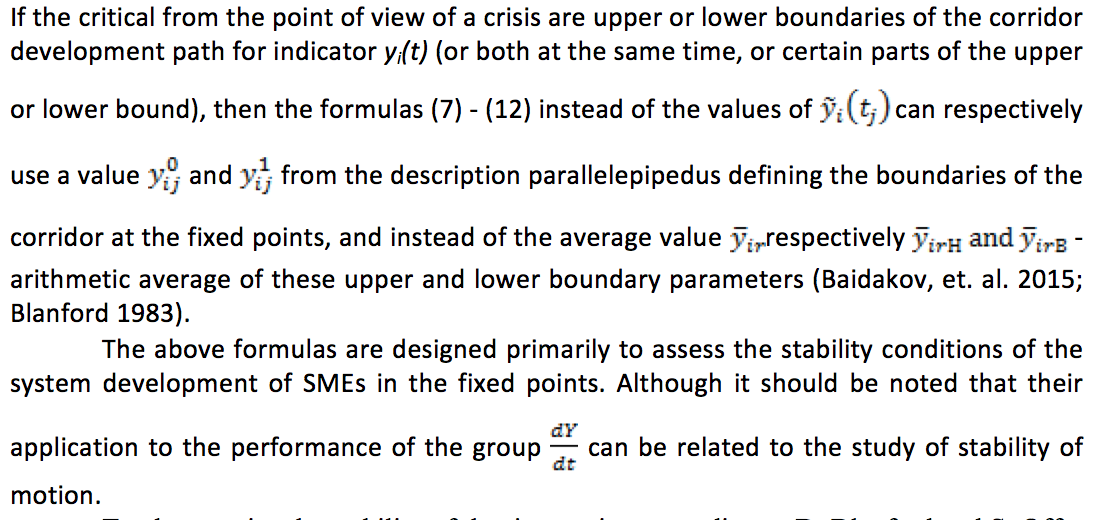

In our opinion, one should take into account the situations where the levels of the time series being located above or below the trajectory for this indicator, may go beyond the specified corridor of its variations, that is, not to get into the appropriate parallelepipeds . Then, for generalization of formulas (5) and (6), it is advisable to use the following situational gradation depending on the location level time series in relation to the trajectory of development for this indicator, namely, the level of the time series is:

However, one should take into account the fact that in the study of stability of development of SMEs in each situation one determines which provisions are favorable or not favorable (Lyles, et. al. 2004).

The variability of the values of yi(t) and hence their stability on the interval [t0, tr] in absolute values represent the average linear and the mean square deviation. Usually these deviations are calculated relative to the mean value of the values on an interval or relative trend that represents the trend on the interval [t0, tr]. We as a reference point we start from the set indicator trajectory of development for this segment. As a result we get the formula for each datum point tr:

average linear deviation -

To characterize the stability of the time series, according to D. Blanford and S. Offut , you can also use the indicators: percentage range (Percentage Range - PR), moving averages (Moving Average - MA), the average percentage change (Average Percentage Change - APC). These indicators are of the nature of the formation and meaning, similar to those reported in (11), (12), which, however, unlike them are directly aimed at the assessment of deviations from specified development paths and are more in line with the goals of our research (Levushkina, et. al. 2015).

With increasing magnitude K the probability of reducing the level of a time series the following fixed point decreases. Thus, in particular, when K = 1, the decrease probability will ammount to 0.16.

Such indicators can be constructed and used for other types of trends, but statistically meaningful use requires sufficiently long time series for the exponential trend - 11-15 members of the series, for a parabolic - not less than 20. This restriction is essential, if measurement is conducted, for example, once a year. And for a sufficiently long period of time, the trend may change – both efficiently, and from the point of view of parameter changes of its trend. Therefore, the use of a linear trend is more practically applicable (Zaitseva, et. al. 2016).

Thus, when building areas of possible changes in the parameters - coordinates of the vectors Х, У, , Z it is necessary to apply prognostic studies using retrospective information available at the time of development characteristics of a new cycle of development of SMEs (Malthus 1820).

After passage of a sufficient number of reference points one should conduct correlation and regression analysis with the inclusion of the greatest possible number of variables characterizing the system itself SMEs and the impact on it. Its results allow us to establish correlations between the variables of interest and, where possible, to build the regression equation for the resulting indicators of development, where the factor variables are the parameters defined by the vectors X and Z. That is, one should seek to identify and use in the sustainable development of the SMEs system of regression equations of the form Y = F(Z, X). These equations allow us to quantitatively justify actions to ensure the sustainability of development. Very useful is also the dependencies of the form X=F(Z, Y), which determine the values of control actions X to achieve the required level of development of the system in the presence of perturbations Z (Savitskaya 2008).

The use of predictive methods is an essential tool for the sustainable development of the SMEs system. Thus, it is necessary to point out some aspects of the use of the results of predictive activity:

Afanasev V. N. (2010). Time Series Analysis and Forecasting. Finance and statistics, pp. 35-47.

Alrabeei H. and Kasi B. R. (2014). Barriers to Growth: key challenges facing Bahraini small and medium enterprises. Arabian Journal of Business and Management Review (OMAN Chapter), 4(3), 56-68.

Baidakov A.N., Chernobay N.B., Nazarenko A.N., Zaporozhets D.V. and Sergienko E.G. (2015). Methodical bases for developing predictive scenarios of agribusiness. Asian social science, pp. 9-18.

Bondarenko N. N. (2005). Statistics: Indicators and Methods of Analysis. The Modern School, p. 628.

Blanford D. A. (1983). Review of Empirical Techniques for the Analysis of Commodity Instability. Moscow: Ussl, p. 275.

Cantillon R. (1755). Essai sur la nature du commerce en gnral. London: Augustus M. Kelley, pp. 85-99.

Greiner L. (1972). Evolution and revolution as organizations grow. Harvard Business Re-view, 4(50), 37-46.

Juglar C. (1862). Des Crises Commercials Et De Leur Retour Periodique En France. Paris: Guillaumin et C-ie, Libraires-Editeurs, p. 258.

Juglar C. (1868). Du change et de la liberte d'emission. Paris: Guillaumin et C-ie, Editeurs, p. 496.

Kitchin J. (1923). Cycles and Trends in Economic Factors. Review of Economics and Statistics, 1(5), 10-16.

Kuznets S. (1973). Modern Economic Growth: Findings and Reflections. American Economic Review, 63, 247-258.

Levuchkina S. V. (2013). Tools and Parameters for Quantitative and Qualitative Measurement of the Sustainability of Economic Growth of Small and Medium Businesses. Microeconomics, 6, 100-107.

Levushkina S.V., Elfimova Y.M. and Lubenko A.M. (2015). Ensurance of sustainable development of small and medium entrepreneurship in a lifecycle phase. Actual Problems of Economics, 8(170), 177-187.

Levushkina S. V., Miroshnichenko R. V., Kurennaya V. V. and Agalarova E. G. (2016). Program development of small and medium enterprises in Stavropol region of the Russian federation. International Journal of Economics and Financial Issues, 6(2), 151-157

Litvak B. G. (2004). Expertise Techniques in Management. Moscow: Delo, pp. 105-112.

Lyles M., Saxton T., Watson K. (2004). Venture Survival in a Transition Economy. Journal of Management, 30(3), 351-375.

Malthus T. R. (1820). Principles of political economy: Considered with a view to their practical application. London: Murray, pp. 603-609.

Nikitenko G.V., Nazarenko A.V., Zaporozhets D.V., Sergienko E.G. and Baydakov A.A. (2015). Cyclical pattern of structural changes in entrepreneurship. Journal of advanced research in law and economics, 1(11), 138 – 146.

Savitskaya G. V. (2008). Analysis of the Effectiveness and Risks of Entrepreneurial Activity. Methodological Aspects. Infra-M, p. 272.

Woldie A. and Leighton P. (2008). Factors influencing small and medium enterprises (SMEs): an exploratory study of owner. Banks and Bank Systems, 3(3), 5-13.

Zaitseva I.V., Kruilina E.N., Ermakova A.N., Shevchenko E.A. and Vorokhobina Y.V. (2016). Application of Factor Analysis to Study the Labour Capacity of Stavropol Krai. Research Journal of Pharmaceutical, Biological and Chemical Sciences, 7(4), 2183- 2186.

1. FGBOU VO Stavropol State Agrarian University, Russian Federation, 355000, Stavropol, zootechnical lane, 12. Email: nikitenko_eg@mail.ru

2. FGBOU VO Stavropol State Agrarian University, Russian Federation, 355000, Stavropol, zootechnical lane, 12

3. FGBOU VO Stavropol State Agrarian University, Russian Federation, 355000, Stavropol, zootechnical lane, 12

4. FGBOU VO Stavropol State Agrarian University, Russian Federation, 355000, Stavropol, zootechnical lane, 12