Vol. 38 (Nº 33) Año 2017. Pág. 27

Anna Anatolievna BURDINA 1; Natalia Valerievna MOSKVICHEVA 2; Narmina Oktaevna MELIK-ASLANOVA 3; Alexander Nikolayevich ZAKHAROV 4; Tatiana Mikhailovna ROGULENKO 5

Received: 05/06/2017 • Approved: 15/06/2017

ABSTRACT: This research studies the current state and tendencies of developing aircraft industrial enterprises. Statutory and regulatory, and methodological estimation of the credit resources cost is researched. Ways to repay the principal and interests on credits and loans are analyzed. Based on this analysis, the research formulates and proves the theorem of the equivalence of methods to repay a credit, as well as develops the methodology of estimating the cost of credit resources taking into account the complexity of attracting them, stipulates the methodic approach to defining the factor of complexity and forming the structure of financial resources of the enterprise. It is recommended to apply the offered methodology to analytically supplement the management system, to improve the efficiency of management solutions on implementing industrial projects on the strategic, tactical and operative levels of planning taking into account the organizational structures and peculiarities of the processes that exist at industrial enterprises. |

RESUMEN: Esta investigación estudia el estado actual y las tendencias de desarrollo de las empresas industriales de aviones. Se investiga la estimación estatutaria y regulatoria y metodológica del costo de los recursos de crédito. Se analizan las formas de amortizar el capital y los intereses de los créditos y préstamos. Con base en este análisis, la investigación formula y demuestra el teorema de la equivalencia de métodos para el pago de un crédito, así como desarrolla la metodología de estimación del coste de los recursos de crédito teniendo en cuenta la complejidad de atraerlos, El factor de complejidad y formando la estructura de los recursos financieros de la empresa. Se recomienda aplicar la metodología ofrecida para complementar analíticamente el sistema de gestión, mejorar la eficiencia de las soluciones de gestión en la implementación de proyectos industriales en los niveles estratégico, táctico y operativo de la planificación teniendo en cuenta las estructuras organizativas y las peculiaridades de los procesos existentes empresas industriales. |

In Russia there is a concept of implementing federal programs of technological development and modernization of aircraft enterprises coordinated by the Russian President’s Council. The most important task of the industrial policy of the state is to develop the aircraft industry (On State Regulating of Aircraft Development” Federal Law dated 08.01.1988; Development of Aircraft Industry for 2013-2015” State Program of the Russian Federation). Under the modern conditions, the efficiency of the industrial (technical) policy of aircraft enterprises directly depends on successful implementation of investment projects that require high volumes of financing. Such investment projects include construction of new production complexes, modernization of production capacities, and scientific and research developments. The program of stage-by-stage update of technological equipment at aircraft enterprises and their technical re-equipment is an important area of the investment activity. Import substitution and technical re-equipment of enterprises, including modernization of production capacities, acquire the primary importance (Pospelova, 2013). The conducted analysis of the aircraft enterprises state has shown that the main production funds went out-of-date, and do not comply with the modern production requirements, and the exploitation expenses are too high (Moskvicheva 2013; Moskvicheva, and Melik-Aslanova 2015). The equipment requires to be modernized in order to successfully pursue the industrial policy on the microlevel. Special role for implementing the industrial policy is given to the investment component, searching for various forms and methods of financing. Efficient management of attracting credit resources taking into account the complexity of attracting contributes to the growth of production potential of industrial enterprises (Melik-Aslanova 2016). Thus, there is a need to formulate and prove the theorem about the equivalence of ways to repay the principal of credits and loans, and to develop the methodology of estimating the cost of credit resources taking into account the complexity of attracting them.

Works of national and foreign authors consider various types of crediting, ways of repaying the principal and interests, fundamental methods of estimating the cost of credit resources for improving the efficiency of managing the strategic development of enterprises (Horn and Vahovich 2015; Troshin, et al. 2009; Troshin, Burdina, Moskvicheva, et al. 2016; Brealy and Myers 1995).

However, the theory still requires to solve issues related to proving the theorem about the equivalence of ways to repay the principal of credits and loans, to develop the methodology of estimating the cost of credit resources taking into account the complexity of attracting them, to form economic mechanisms to manage the investment component of the industrial policy for aircraft enterprises taking into account the complexity of attracting resources.

The goal of the research is to prove the theorem about the equivalence of ways to repay the principal of credits and loans and to develop the methodology of estimating the cost of credit resources taking into account the complexity of attracting them.

The methodological basis of the research includes provisions of the economic theory, production and banking management, investment analysis, and works of national and foreign scientists in the area of estimating ways to repay credits and loans (Horn and Vahovich 2015; Troshin, et al. 2009; Troshin, Burdina, Moskvicheva, et al. 2016; Brealy and Myers 1995). The methodological base of the research includes modern concepts, principles of managing the strategic development of the enterprise in the context of implementing real projects (Burdina, et al., 2012). In order to solve the task on estimating the efficiency of implementing projects to modernize production capacities, methods of discounting monetary flows, investment analysis, theory of decisions taking and financial and economic analysis were applied (Troshin, Burdina, Moskvicheva, et al. 2016). In order to solve tasks of this research, system and cost approaches, and methods of economic analysis were used (Moskvicheva, Nikulina, Tarasova, et al. 2011; Nikulina, Tarasova, et al. 2009; Skrypnik 2016).

The research methodology includes the following:

The analysis of the practical situation shows that the decay in the Russian aircraft industry was caused by the insufficiently efficient industrial policy on the macro- and microlevel and the inaction of aircraft companies associated with it. In terms of companies of the sector, the indistinct system of taking decisions, maintaining unprofitable businesses and inefficient programs in the orders portfolio were observed. However, the main thing is that many enterprises still lack modern production complexes and technologies (Melik-Aslanova 2016). Weak role of competition caused the monopolization of suppliers and consumers, focus on the internal market, and lack of diversification to the associated (non-aircraft) markets. In this context, it is possible to observe investment attractiveness of aircraft enterprises, a high level of dependence on budgetary financing, and lagged positions on the world market of selling airplanes.

Due to the above reasons, many aircraft enterprises suffer a crisis. Technological lagging, out-of-date and inefficient technologies, the lack of the quality control, losses of the most fundamental competences in managing the technical progress, system integration, lack of qualified staff, i.e. inefficient industrial policy of enterprises prevent from solving the crisis. One of the main reasons of this state is the limited volume of own funds which does not enable aircraft companies to form and implement breakthrough projects in the relevant segment of aircraft construction.

To implement large-scale investment processes focused on modernizing production capacities of the leading enterprises of the aircraft industrial sector, the government developed federal target programs, including “Development of Aircraft Industry for 2013-2025” State Program of the Russian Federation (Development of Aircraft Industry for 2013-2015” State Program of the Russian Federation). The main resources of investments for modernizing the production base of enterprises include own and borrowed capital (Table 1). In the first variant it is necessary to single out the stock capital, accumulated depreciation, and unallocated profit. In the borrowed capital a special role is given to credits and loans in the form of corporate bonds. Every resource of investments is related to specific expenses (Troshin, Burdina, Moskvicheva, et al. 2016; Troshin, et al. 2013; Burdina, 2007). It is the most advantageous way for the enterprise to obtain target budgetary funds on a non-repayable basis. However, such funds are limited. Besides, according to the researches, budgetary funds are spent for scientific researches and developments, and other resources are raised for implementing investment projects (Troshin, Burdina, Moskvicheva, Nikulina, Tarasova,. Rogulenko 2016; Nikulina and Tarasova 2014).

The analysis of the structure of long-term obligations of aircraft enterprises showed that 90% of enterprises used credits and loans of the United Aircraft Corporation for investment purposes. In practice it is more habitual for enterprises to use bank loans. The research showed that the volumes of debt obligations of enterprises on credits were growing (Melik-Aslanova 2016; Moskvicheva and Melik-Aslanova 2015).

Table 1. Peculiarities of Using Own and Borrowed capital at Aircraft Enterprises

|

Advantages |

Disadvantages |

Own capital |

Simple to raise |

Limitation of the volume to raise |

Ability to generate profit in all areas of activity |

Higher cost of attraction as compared to borrowed resources |

|

Providing financial stability, payment capacity |

Lack of the growth of profitability of own capital due to attracting borrowed capital |

|

Borrowed capital |

Great opportunity for attracting |

Decrease in the payment capacity and negative impact on the financial stability |

Possibility of the financial potential growth |

Assets generate a lower profit |

|

Increase in the profitability of own capital |

Dependence on fluctuations of the fund market |

|

|

Complexity of the raising procedure |

Under the modern conditions, attracting credits and loans is extremely important for developing aircraft enterprises. Crediting process mediates the accelerated diversification of business, contributes to competitive struggle, taking on the sales market, etc. Thus, when attracting credits and loans, taking economically grounded decisions is an actual task that touches on many parties in interest. Mathematical apparatus and technology of payment mechanisms allow obtaining information required for taking a decision. However, due to the insufficiently accurate mathematical description of a number of important provisions on the fundamental level, the values that are not significant economically are built in the applied tasks when setting them. In some cases they are used as an objective function (for example, “minimum upcharge”, “without credit upcharge”, etc.). It disfigures the final conclusions. This article is devoted to one of such provisions related to selecting a method to repay the principal of credits and loans.

The schedule of payment on credits and loans, mainly, depends on the following conditions:

Various combinations of the above conditions define various schemes of mutual settlements between the lender/creditor and the borrower. The annuity scheme, equal repaying, repayment of the principal at the end of the lending/crediting term, etc. are the most wide-spread schemes in practice. It is necessary to note that various schemes of mutual settlements have been widespread in practice due to a good theoretical base and mathematical apparatus for settlements.

Let’s consider the case (hereinafter referred to as “Case A”) where schemes of mutual settlements differ only by the way to repay the principal, and the other conditions are the same and look as follows:

When fulfilling the condition about the collectibility, ways of repaying the principal for Case A are equivalent in relation to the efficient rate on the credit and loan.

Basic definitions for the further mathematical record of the theorem and its accurate proving will be determined below.

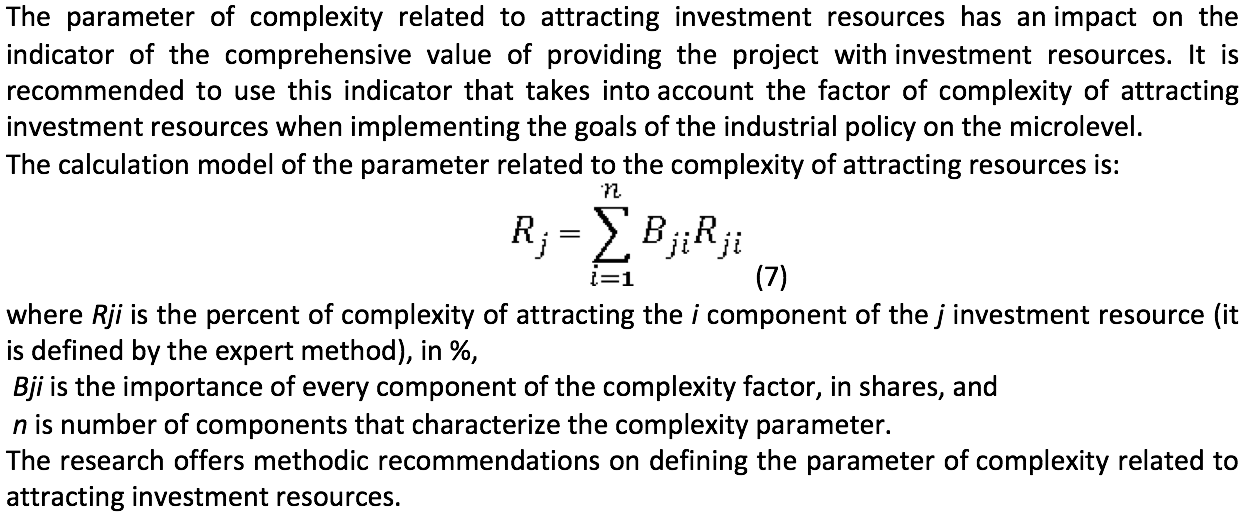

The percent of complexity related to attracting the i component of the j investment resource is defined by the expert method that takes into account the required conditions for attracting investment resources.

The table is made for every resource. It includes the relevant indicators that define the size of the complexity factor. The represented indicators are average in the aircraft sector (Melik-Aslanova 2016; Skrypnik, 2016).

The percent of complexity related to attracting the component is classified into three categories of complexity (low 1-3, medium 3-6, and high 6-10). Points are defined for every category of complexity. Depending on the result, the interval of the percent of the complexity related to attracting the component is defined (Table 2).

If the maximum number of points is 2.00, this complexity factor falls within the interval of the 1st complexity category (minimum). If the maximum number of points is 5.00, this complexity factor falls within the interval of the 2nd complexity category (medium), and if the maximum number of points is 8.00, this factor of complexity falls within the interval of the 3rd complexity category (maximum) (Burdina, and Melik-Aslanova 2015; Burdina and Soloveva 2013).

In accordance with the developed methodic tools, the price of the j investment is corrected in compliance with the complexity factor:

Pjcorr=Pj+Rj (8)

where Pj is the price of the investment resource, %;

Rj is parameter (indicator) of complexity related to attracting the j investment resource, %.

Table 2 shows the tools to estimate expenses on attracting credit resources that take into account the complexity of attracting when implementing the investment component of the industrial policy pursued by aircraft enterprises taking into account the sectoral specificity (Burdina and Melik-Aslanova 2015).

Table 2. Defining the Parameter of Complexity to Attract the Investment Resource (Bank Loans)

Time of obtaining funds,%

|

Rt, loan |

||||||

|

2,0 |

|

5,0 |

|

8,0 |

||

Time of waiting for obtaining monetary funds after collecting documents |

< =10 days |

2.0 |

(10;60] |

5.0 |

> 60 days |

8.0 |

|

Attraction probability

|

Rap, loan. |

||||||

|

2,00 |

|

5,00 |

|

8,00 |

||

System of indicators of estimating structural components of the investment element (Block – indicators of the investment attractiveness estimation):

|

|||||||

Equity ratio |

≥ 0.5 |

0.18 |

[0.1;0.5) |

0.45 |

< 0.1 |

0.73 |

|

Quotient of the relation of the borrowed resources to the own ones |

≤0.5 |

0.18 |

(0.5;1.0] |

0.45 |

> 1.0 |

0.73 |

|

Profitability of the capital stock |

≥ 0.25 |

0.18 |

[0.10;0.25) |

0.45 |

< 0.10 |

0.73 |

|

Sales profitability |

≥ 0.50 |

0.18 |

[0.40;0.50) |

0.45 |

< 0.40 |

0.73 |

|

Profitability of own capital |

≥ 0.25 |

0.18 |

[0.10;0.25) |

0.45 |

< 0.10 |

0.73 |

|

Quotient of absolute liquidity |

≥ 0.2 |

0.18 |

[0.08;0.2) |

0.45 |

< 0.08 |

0.73 |

|

Quotient of intermediary liquidity |

≥0.75 |

0.18 |

[0.50;0.75) |

0.45 |

< 0.50 |

0.73 |

|

Quotient of current liquidity |

≥2.50 |

0.18 |

[1.80;2.50) |

0.45 |

< 1.80 |

0.73 |

|

System of indicators of estimating structural components of the investment element (Block – indicators of the investment attractiveness estimation): |

|||||||

Term of the project re-payment, years |

≤ 3 |

0.18 |

(3;6] |

0.45 |

>6 |

0.73 |

|

Index of investments profitability, quotient |

≥1.6 |

0.18 |

[1.1;1.6) |

0.45 |

<1.1 |

0.73 |

|

Internal standard of profitability, quotient |

≥0.25 |

0.18 |

[0.15;0.25) |

0.45 |

<0.15 |

0.73 |

|

Security

|

Rs,y,loan |

||||||

|

2,00 |

|

5,00 |

|

8,00 |

||

System of indicators of estimating structural components of the investment element (Block – indicators of the investment attractiveness estimation): |

|||||||

Quotient of depreciation of fixed assets |

≤ 0.5 |

0.18 |

(0.5;0.75] |

0.45 |

>0.75 |

0.73 |

|

Quotient of suitability of fixed assets |

≥0.5 |

0.18 |

[0.25;0.5) |

0.45 |

<0.25 |

0.73 |

|

Quotient of update |

≥ 0.5 |

0.18 |

[0.1;0.5) |

0.45 |

<0.1 |

0.73 |

|

Including active fixed assets |

≥ 0.5 |

0.18 |

[0.1;0.5) |

0.45 |

<0.1 |

0.73 |

|

Retirement rate |

≥ 0.2 |

0.18 |

[0.08;0.2) |

0.45 |

<0.08 |

0.73 |

|

Including active fixed assets |

≥ 0.2 |

0.18 |

[0.08;0.2) |

0.45 |

<0.08 |

0.73 |

|

Quotient of real value of fixed assets in the organization’s property |

≥ 0.5 |

0.18 |

[0.2;0.5) |

0.45 |

<0.2 |

0.73 |

|

Level of technical equipment |

≥ 0.3 |

0.18 |

[0.08;0.3) |

0.45 |

<0.08 |

0.73 |

|

Returns on assets |

≥1.5 |

0.18 |

[1.0;1.5) |

0.45 |

<1.0 |

0.73 |

|

Return on production assets |

≥0.2 |

0.18 |

[0.1;0.2) |

0.45 |

<0.1 |

0.73 |

|

Counter-security |

≥0.5 |

0.18 |

[0.2;0.5) |

0.45 |

<0.2 |

0.73 |

|

Documents, registration

|

Rd,r, loan |

||||||

|

2,00 |

|

5,00 |

|

8,00 |

||

Collection of financial documents (financial reports, certificates from tax authorities and funds, certificates about invoice turnovers), days |

< =1 |

0.67 |

(1;5] |

1.67 |

> 5 |

2.67 |

|

Preparing business-plan, business case, days |

< =30 |

0.67 |

(30 -60 ] |

1.67 |

> 60 |

2.67 |

|

Conclusion, prolongation of agreements, days |

< =5 |

0.67 |

(5 -25 ] |

1.67 |

> 25 |

2.67 |

|

Readiness of staff for work on attracting credit funds

|

Rr, loan |

||||||

|

2.00 |

|

5.00 |

|

8.00 |

||

Quality of employees’ financial education |

High level |

0.67 |

Medium level |

1.67 |

Low level |

2.67 |

|

Previous experience of attracting loans |

Positive |

0.67 |

partially |

1.67 |

negative |

2.67 |

|

Staff’s experience, years |

>=7 |

0.67 |

[3-7) |

1.67 |

<3 |

2.67 |

|

Owners’ consent

|

Roc,loan |

||||||

|

2,00 |

|

5,00 |

|

8,00 |

||

Term of obtaining owners’ consent, days |

< =30 |

1.00 |

(30 -60 ] |

2.50 |

> 60 days |

4.00 |

|

Expenses for obtaining owners’ consent |

< =0.1 % of the amount |

1.00 |

(0.1;0.3] |

2.50 |

> 0.3 % of the amount |

4.00 |

|

Defining the complexity parameter |

Rt,loan.*Bt+Rвп,loan*Bap+Rs,y,loan*Bs,y+Rd,r,loan*Bd,r+Rr,loan*Br+ +Roc,loan*Boc |

||||||

The developed methodology of estimating the cost of credit resources taking into account the complexity of attracting them based on the equivalence theorem was tested at the Kazan Aircraft Plant. The Kazan Aircraft Plant is a modern enterprise with the high intellectual and technical potential. It is a unique aircraft complex in the Russian Federation. The main areas of its production policy include the batch manufacturing of the modernized TU-160, and works on mastering the manufacture of empennage for the Il-75-MD90A airplane. It pre-determines the investment strategy of the enterprise focused on the modernization of production capacities. The attraction of investment resources by the enterprise to modernize its production capacities is possible by bank loaning, issue of bonds, and leasing, the cost of which is shown in Table 3.

Table 3. Expenses Related to Attracting Investment Resources by the Kazan Aircraft Plant

Resources of investment resources |

Payments |

Resources estimation |

Bank loans |

Interest payments |

15% |

Bond-secured loan |

Coupon payments |

14% |

Leasing |

Leasing payments |

17% |

The enterprise management had estimated the cost of raising investment resources and chose the bank loan because the issue of bonds required a long-term procedure of preparing documents, and the leasing is the most expensive investment resource. At the same time, the estimation of the parameter related to the complexity of attracting and using of the bank loan can change the initial conclusions about the cost of these resources (Table 4).

Table 4. Calculation of the Parameter Related to Complexity of Attracting Investment Resources by Enterprise

Indicator |

Credits |

Leasing |

Value |

Time |

5 |

2 |

0.3 |

Probability of attracting |

7 |

7 |

0.2 |

Security, guarantees |

8 |

2 |

0.2 |

Documents, registration |

8 |

5 |

0.1 |

Readiness of staff for the work on attracting capital |

2 |

2 |

0.1 |

Owners’ consent |

4 |

2 |

0.1 |

Total parameter of complexity factor, % |

5.9 |

3.3 |

1 |

Price,% |

15 |

17 |

|

Price taking into account the complexity to attract capital, % |

20.9 |

20.3 |

Thus, calculations on the methodology of estimating the cost of credit resources taking into account the complexity of attracting them based on the equivalence theorem show that in this context the leasing was more advantageous than the credit.

The results of the research described in the article contain theoretical and methodical, and scientific and practical results on the issues related to analyzing the cost of credit resources taking into account the complexity of attracting them based on the equivalence theorem.

Studying the regulatory, methodological and methodic provisions and analyzing the current practice in Russia and abroad enabled the authors to make conclusions about the current state and tendencies of the development of aircraft enterprises, and to determine the main factors preventing the improvement of the efficiency of managing the investment component of industrial policy of enterprises.

The analysis of the practical situation revealed the reasons why aircraft enterprises raise insufficient volumes of investment funds to modernize production capacities, peculiarities and reasons of the organizational nature that made the raising of the required volumes of investments for implementing system-forming projects difficult. It is possible to show these reasons through the parameters of the factor related to the complexity of receiving funds.

The article states the methodology of estimating the cost of credit resources taking into account the complexity of attracting them based on the equivalence theorem. The latter makes it possible to quantitatively estimate the cost of credit resources taking into account attracting them to implement sectorial projects, to forecast changes in the resources structure, and as a consequence, to purposefully correct the system of projects management under various conditions of the economy state. The methodology of estimating the cost of credit resource taking into account the complexity of attracting them based on the equivalence theorem was practically implemented at the Kazan Aircraft Plant. The veracity of the results obtained by the authors is stipulated by using the data published in official periodicals of the Russian Federation, official reports of enterprises and organizations, and is confirmed by applying the materiality qualifiers.

The authors express their gratitude to members of the Financial Management Faculty of MAI for essential participation in the research and constructive review of the results.

Brealy, R.A. and Myers, St. C. (1995). Fundamentals of Corporate Finance. New York: McGRAW-HILL INC.

Burdina, A.A. (2007). Metodologiya upravleniya konkurentosposobnostyu rossiyskih promyshlennyh predpriyatiy [Methodology of Managing Competitiveness of Russian Industrial Enterprises]. Thesis. … Doctor of Economic Sciences. Moscow Aviation Institute, Moscow, pp. 392.

Burdina, A.A. and Melik-Aslanova, N.O. (2015). Instrumentariy otsenki zatrat investitsionnoy sostavlyayuschey promyshlennoy politiki predpriyatiy aviatsionnoy otrasli [Tools to Estimate Expenses of Investment Component of the Industrial Policy of the Aircraft Area]. Bulletin of the Solovyov Rybinsk State Aircraft Technological Academy, 3(34), 179-183

Burdina, A.A. and Soloveva, I.V. (2013). Analiz metodov analiza finansovyh riskov predpriyatiy aviatsionnoy otrasli [Analysis of Methods to Analyze Financial Risks of Aircraft Enterprises]. Economy and Entrepreneurship, 12-1(41-1), 659-663

Burdina, A.A. et al. (2012). Tehnologiya otsenki innovatsionnoy aktivnosti predpriyatiy aviatsionnoy otrasli [Technology of Estimating the Innovational Activity of Aircraft Enterprises]. Moscow: MAI Publishing House, pp. 176.

Federalniy zakon “O gosudarstvennom regulirovanii razvitiya aviatsii” ot 08.01.1988 N 10-FZ (s izm. i dop. ot 13 iyulya 2015 g.) [“On State Regulating of Aircraft Development” Federal Law dated 08.01.1988 No, 10-FZ (with amendments dated July 13, 2015)].

Gosudarstvennaya programma Rossiyskoy Federatsii “Razvitie aviatsionnoy promyishlennosti na 2013 - 2025 gody” [“Development of Aircraft Industry for 2013-2015” State Program of the Russian Federation]. (Approved by Order of the Government of the Russian Federation No. 303 dated 15.04.2014) Date View May 17, 2017 http://docs.cntd.ru/document/499091776.

Horn, J.K. and Vahovich, J.M. (2015). Osnovy finansovogo menedzhmenta [Basics of Financial Management]. Textbook. Moscow: Williams Publishing House

Melik-Aslanova, N.O. (2016). Ekonomicheskiy mehanizm upravleniya investitsionnoy sostavlyayuschey promyshlennoy politiki aviatsionnyh predpriyatiy [Economic Mechanism of Managing Investment Component of the Industrial Policy of Aircraft Enterprises]. Thesis of Candidate of Economic Sciences. Moscow Aviation Institute, Moscow, pp. 199.

Moskvicheva, N.V. (2013). Voprosy ekonomicheskoy effektivnosti protsessov reorganizatsii predpriyatiy aviatsionnoy promyshlennosti [Issues of Economic Efficiency of Processes Related to Reorganizing Aircraft Enterprises]. Bulletin of the Solovyov Rybinsk State Aircraft Technological Academy, 1 (24), 169-177

Moskvicheva, N.V. and Melik-Aslanova, N.O. (2015). Analiz osobennostey modernizatsii proizvodstvennyh moschnostey predpriyatiy aviatsionnoy promyshlennosti [Analysis of Peculiarities of Modernizing Production Capacities of Aircraft Enterprises]. Bulletin of the Moscow Aircraft Institute, 22(4), 208-213

Moskvicheva, N.V., Nikulina, E.N., Tarasova, E.V. et al. (2011). Voprosy otsenki stoimosti predpriyatiy aviatsionnoy promyshlennosti [Issues on Estimating Value of Aircraft Enterprises]. Moscow: MAI-Print Publishing House, pp. 204.

Nikulina, E.N. and Tarasova, E.V. (2014). Tehnologiya kommercheskoy i innovatsionnoy otsenki investitsionnyh proektov v aviatsionnoy otrasli [Technology of Commercial and Innovational Estimation of Investment Projects in the Aircraft Area]. Bulletin of the Solovyov Rybinsk State Aircraft Technological Academy, 1 (28), 151-157.

Nikulina, E.N., Tarasova, E.V. et al. (2009). Finansovaya matematika dlya investora [Financial Mathematics for Investor]. Moscow: MAI-Print Publishing House, pp. 184.

Pospelova, O. (April 15, 2013). Ob aviastroenii v Rossii. Intervyu [On Aircraft Construction]. Aviation Explorer. Date View May 17, 2017 https://www.aex.ru/docs/1/2013/4/15/1787/

Skrypnik, I.V. (2016). Razrabotka organizatsionno-ekonomichechskogo mehanizma formirovaniya korporativnogo obrazovaniya [Development of Organizational and Economic Mechanism of Forming the Corporate Establishment]. Thesis of Candidate of Economic Sciences. Moscow State Technological University “STANKIN”, Moscow, pp. 198.

Troshin, A.N. et al. (2009) Finansy i kredit [Finances and Credit]. Text-book. Moscow: INFRA-M Publishing House.

Troshin, A.N. et al. (2013). Voprosy ekonomicheskogo obosnovaniya protsessov reorganizatsii predpriyatiy aviatsionnoy promyshlennosti [Issues of Economic Grounding of Processes Related to Reorganizing Aircraft Enterprises]. Moscow: MAI Publishing House.

Troshin, A.N., Burdina, A.A., Moskvicheva, N.V. et al. (2016). Finansovyi menedzhment [Financial Management]. Textbook. Moscow: INFRA-M, pp. 331.

Troshin, A.N., Burdina, A.A., Moskvicheva, N.V., Nikulina, E.N., Tarasova, E.V. and Rogulenko, T.M. (2016). Mechanism to Analyze Economic Reliability of the Innovational Potential of Aircraft Enterprises. International Journal of Applied Business and Economic Research, 14, 747-765

1. Moscow Aviation Institute (State University of Aerospace Technologies), 125993, Russia, M oscow,Volokolamskoye Shosse, 4

2. State University of Management, 109542, Russia, Moscow, Riazanskiy Avenue, 99