Vol. 38 (Nº 24) Año 2017. Pág. 19

Saule YEGEMBERDIYEVA 1; Assel KADYRBERGENOVA 2; Aygul BERZHANOVA 3

Recibido: 06/03/17 • Aprobado: 20/04/2107

2. Analysis of the main publications

3. Parts of common problem unresolved earlier

ABSTRACT: In article the role of functioning of a petrochemical cluster, allowing to reach sinergetichesoky effect and giving possibilities of creation of subbranch links on a chain of the subsequent repartitions with increase in a value added directed on production of the final products of a consumer demand is considered. |

RESUMEN: En el artículo se discute el papel del funcionamiento de un clúster petroquímico, permitiendo llegar a un efecto sinergetichesoky dando posibilidades de creación de enlaces subbranches en una cadena de las reparticiones posteriores con incremento en un valor agregado dirigido a la producción de los productos finales de una demanda de consumo . |

The oil and gas complex plays a large role in Kazakhstan economy for which also the important place in fundamental strategic programs industrial and innovative the countries is allocated. At the same time the priority of effective use of energy resources is focused on withdrawal from a raw orientation and development of manufacturing industry. One of the important ways of implementation of this direction in development of the oil and gas complex are cluster educations which suggest a creation of a single structure uniting the development of oil and gas fields, processing of resources and sales of products with a high value added. As a result of a cluster will increase the competitiveness and innovative activity petrochemical industries, productivity growth. Therefore in the national economy it is necessary to develop full-fledged production clusters.

Numerous scientific works are devoted to questions of development of a petrochemical cluster. Objective need and versatility of research demands scientific justification of priorities, tools for development of an innovative petrochemical cluster which has to become a decisive factor of acceleration of diversification of economy, promote activization of activity of non-raw, knowledge-intensive and hi-tech productions.

A founder of the theory of a cluster is Michael E. Porter (2005, 2000). Works of many classics, starting with A. Smith (2007), V. Petty, D. Riccardo (1993), etc. are devoted to questions of absolute and relative competitive advantages of the countries.

This problem by means of research of competitive advantages of branches was studied by domestic scientists-economists: A.A. Alimbayev (2005), U.B. Baymuratov (2000), A.Sh. Beysenbina (2009), O.I. Egorov (2012, 2013), A.E. Esentugelov (2011), S.M. Yegemberdiyeva (2013), M.B. Kenzheguzin (2005), A.K. Kenzhegaliyev (2000), D.M. Madiyarova (2010), N.K. Nadirov (2000), N.K. Nurlanova (2009), K.N. Orazbayeva (2013, 2008), T.P. Serikov (2008), O.A. Chigarkina (2013), G.T. Shakulikova (2005), U.Zh. Shalbolova (2003, 2003).

Nevertheless, questions of activization of growth of cluster structures taking into account branch specifics in the conditions of the economy of Kazakhstan are insufficiently developed.

The competition, occupying all new and new countries, certainly, it has turned into a constant subject of our time. Its intensity increases and today. According to the concept of competitiveness of the country of M. Porter, the country is achieved success not just in separate branches, but in group of the interconnected branches or in sector of economy (Porter, 2005).

Basis of competitiveness of the modern country in foreign and domestic markets is the empirical form of the organization of production – cluster structure which in total and system of economic relationship allows to concentrate, and also effectively to realize all competitive advantages. According to M. Porter, the cluster is, first of all, the interindustry complex closed by system of reproduction communications and cemented by technological innovations (Porter, 2000).

Formation of such competitive advantages to Kazakhstan means that it has to move in the development from an export and raw way of development with prevalence of production of a low value added to activization of internal resources of economic development. Now the available resource capacity of the country is successfully involved, these are rather low prices of natural resources, the cheap and rather classified labor, presence of production capacities in the sphere of production and preprocessing of natural resources. However, for ensuring high competitiveness of the country of this base it isn't enough. Therefore, the support on cluster structures which provide competitiveness of the modern countries in world economic space has to become a basis of fixing of the positive results and further economic development achieved by Kazakhstan. Base of such structures are the enterprises which, cooperating and at the same time competing among themselves, work at a basis of innovative and information technologies, use labor with modern skills and competences, function in the conditions of the developed transport and communication system, have modern distribution channels, control the market positions in foreign and domestic markets (Egorov, Chigarkina, 2013; Madiyarova, 2010; Shakulikova, 2005). The petrochemical cluster can become that structure in our economy.

One of the main components of slow realization of a petrochemical cluster is unstructured development of branch that is generally one investor and processing - others are engaged in oil production. And also volatility of the prices in the global market of oil is the main reason for less interest of mining companies to sell crude products in domestic market. Therefore for increase of efficiency, high-quality updating and extension of the nomenclature of the made production it is necessary to accelerate completion of new links of more advanced processing within a petrochemical cluster. Better use of the available potential by means of creation and development of a cluster will increase the level of deep processing of the Kazakhstan oil to 33% (The state program of industrial-innovative development of Kazakhstan for 2015-2019 years, 2014; The master plan of development of petrochemical production in Kazakhstan, 2005).

Practical use of theoretical experience of modeling of territorial and production complexes in combination with foreign experience of carrying out cluster policy can play a certain role in increase of competitiveness of Kazakhstan. In this regard it should be noted that in the republic the idea of development of clusters becomes the tool of economic policy (Egorov, Chigarkina, 2013; Kenzheguzin, 2005; Madiyarova, 2010).

The research objective consists in justification of functioning of a petrochemical cluster and development of mechanisms of its activization for increase of competitiveness of domestic oil processing productions.

The Republic of Kazakhstan is rich with oil and gas resources. Therefore, on the basis of these resources there is a potential of development of the petrochemical industry (The master plan of development of petrochemical production in Kazakhstan, 2005).

By the last estimates oil reserves, including recently found field on the shelf of the Caspian Sea is from 7 to 10 billion tons relates among the largest industrial complexes on the planet (Yegemberdiyeva, 2013). Kazakhstan has huge stocks, both oil, and gas. Kazakhstan, the leading exporter of production of the extracting branches (first of all at the expense of oil), on an indicator of average per capita export advances all CIS countries (The state program of industrial-innovative development of Kazakhstan for 2015-2019 years, 2014).

The oil processing sector is the integral link in development of the processing branch. The main indicators on oil processing sector are given in table 1.

Table 1. Dynamics of oil processing sector for 2008-2014, developed by authors on the basis

(The state program of industrial-innovative development of Kazakhstan for 2015-2019 year;

These Customs Control Committee of the Ministry of Finance of the Republic of Kazakhstan

for 2008-2014; Manufacturing industry. Basic indicators of the industry of the Republic of Kazakhstan

for 2008-2014)

Indexes |

Years |

||||||

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

|

Crude oil extraction,mil.tons. |

70,6 |

76,5 |

79,7 |

80,1 |

79,0 |

81,8 |

80,8 |

Oil refining, mil.tons. |

12,3 |

12,1 |

13,7 |

13,7 |

14,2 |

14,3 |

14,9 |

Oil processing share in the extracted, % |

17,4 |

15,8 |

17,2 |

17,1 |

18,0 |

17,5 |

18,4 |

Volume of import of oil products, mil.tons. |

1,26 |

1,91 |

1,71 |

1,84 |

2,64 |

2,94 |

1,97 |

Volume of export of oil products, mil.tons. |

4,58 |

5,04 |

5,2 |

6,21 |

5,67 |

7,04 |

9,96 |

Level of loading of power, % |

49,7 |

47,7 |

56,7 |

61,5 |

62,1 |

62,8 |

63,0 |

The share of oil processing sector in total output of manufacturing industry tends to increase. If in 2008 it was 6,3%, then by 2013 – 13,8%.

In the Kazakhstan market except three main oil refineries was fixed 37 mini-oil refineries of which 27 are acting. Oil processing on them makes respectively by years: 2012 – 880,9 thousand tons, 2013 - 975,7 thousand tons, 2014 – 1471,9 thousand tons.

Annually import of oil products to Kazakhstan grows. 2013 became record. Hardly it is necessary domestic oil refineries in the competition to the Russian enterprises for the price and quality of production as niches of the market of oil products are engaged in them more and more.

For export of oil products there was record 2014. In comparison with 2013 it has grown by 30%. Export is increased to the European countries and China. Reexecution of the main planned targets is in every respect noted: processing of raw materials and production of socially important oil products, including the actual execution of volume of processing of raw materials on three main oil refineries has made 12 378 thousand tons (table 2). Increase in volume of processing in comparison with 2013 on 510 thousand tons is noted (KazMunaiGas-processing and marketing, SPG, 2015; Egorov, 2012).

But despite growth of oil production and oil refining, Kazakhstan is on one of the last places on an index of a ratio oil refinery of capacity and volume of the extracted oil. Total design capacity three the domestic oil refinery has to make 19 million tons of oil a year, but as we see, for today their production capacities allow to process no more than 14,9 million tons of oil so far, that is it demonstrates that 20,5% of production capacities aren't used. At the same time more than 50% of oil processed at our oil refineries are imported from Russia.

Table 2. Indicators of processing of hydrocarbonic raw materials, developed by authors on the basis

(Annual Report of the company KazMunaiGas-processing and marketing for the 2015)

Indexes |

2012 year |

2013 year |

2014 year |

2015 year |

Oil refining, th.tons, including |

11 837,5 |

11 868,0 |

12 378,3 |

12000 |

«AORP» LLP |

4 422,8 |

4 429,5 |

4 920,0 |

4 866 |

«POCR» LLP |

5 037,5 |

5 010,5 |

4 925,7 |

4 809 |

«PKOP» LLP |

2 377,1 |

2 428,5 |

2 532,6 |

2 325 |

Processing depth, % |

68,7 |

69,7 |

70,48 |

68 |

«AR» LLP |

57,6 |

59,80 |

62,77 |

56 |

«POCR» LLP |

72,46 |

74,18 |

76,27 |

79 |

«PKOP» LLP |

76,00 |

74,44 |

74,19 |

72 |

Limiting factors of oil processing sector, in our opinion, are:

- domestic oil refineries function by fuel option therefore they can't make the wide range of products of oil refining. For example, paraffin, lubricant oils, raw materials for petrochemistry;

- because of absence at oil refinery of installations of secondary processes of oil refining or their technological discrepancy to modern requirements the low level of high-quality production of jet fuel, winter diesel fuel, high-quality octane gasoline, motor fuel, etc.;

- оil refinery work at processing conditions, rendering services in oil refining to suppliers enterprises, that is owners of raw materials and by that directly aren't engaged in realization of finished goods;

- inadequate legislation, and also lack of basic petrochemical production and development of sector of downstream only in branch principle.

The main index of material development and perfection of oil refinery is an indicator of depth of oil refining. The maximum high result on depth of processing has to be 93-95%, and the lowest scale – 50% which in a minimum has to provide payback of oil refining. For example, in the American plants depth of processing is 95%, in the western companies - 85%, in the Russian enterprises – 71%, and in Kazakhstan – 70%. The difference on processing depth between the USA and Kazakhstan is 20%. Here also technological backwardness of the main oil refineries of the country affects, that is the degree of depreciation of fixed assets in sector in 2008 24,2, by 2012 – about 33%, and the coefficient of updating of funds varies from 2 to 7% and by years it doesn't raise.

Also for today Kazakhstan imports about 40% of high-octane gasoline from Russia. And if it quicker doesn't resolve issues of fuel deficiency, then in the future we can be a state of those countries which completely depend on importers. Therefore, in the short term, in our opinion, the main objective and a problem of oil processing sector accumulation of depth of oil refining, security of internal needs of the country with own high-quality production, and also its exports.

Therefore, we believe that we have to become the main directions of oil processing:

-bringing depth of processing of oil refinery to 90-95%;

-development of petrochemical productions and providing them with raw materials;

-creation of competitive domestic market of oil products.

According to the State program of industrial and innovative development of the Republic of Kazakhstan for 2015-2019 has provided release of the range of the most significant commodity groups, such as production of motor fuels of a class of Euro 4 both by Euro 5 and increase in the output of light oil products up to 76-82% (The state program of industrial-innovative development of Kazakhstan for 2015-2019 years, 2014; These Customs Control Committee of the Ministry of Finance of the Republic of Kazakhstan for 2008-2014, 2014; Republic of Kazakhstan Agency on Statistics, 2014 ).

The choice of a way of further development of petrochemical branch with application of cluster policy and an initiative is quite logical. The advantage of cluster approach consists in effect of coverage of productions of several types of production at minimization of expenses. The innovative structure of the cluster helps decrease in cumulative costs of research and development of innovations due to increase of effect of production structure that allows participants of a cluster to carry out steadily activity (The state program of industrial-innovative development of Kazakhstan for 2015-2019 years, 2014; Egorov, 2012; 2013; Orazbayeva,2013).

Development of the petrochemical cluster is offered to be carried out in two main directions: 1) deeper oil refining; 2) processing of natural gas by its division into the corresponding components (propane, butane, ethane); 3) development of petrochemical productions (figure 1).

High competitiveness and stable economic growth are provided, first of all, by the conditions and factors stimulating dissemination of new technologies. As modern competitive advantages are almost fully provided due to advantages in production technologies, managements, the organizations of promotion of goods, successful development of competitiveness of economic system is possible at complex use of the theory of the cluster mechanism and modern concepts of innovative development (The state program of industrial-innovative development of Kazakhstan for 2015-2019 years, 2014; Egorov, 2012, 2013; Orazbayeva, 2013).

The main objective of the integrated petrochemical cluster should be the release most important for petrochemistry of production – polyethylene and polypropylene which will become initial raw materials for all new and operating productions.

In the new scheme of petrochemical cluster should be provided for the introduction and construction of a new oil-refinery (refinery), which is necessary not only to increase production but also increase the level of competition. Among the priority projects of petrochemical plants are capable of complex oil and gas raw materials should be used the construction of the refinery in Mangistau region, the raw material for which is to serve as an oily Uzen oil field, Zhetybai construction of gas processing plant in Aksai, the raw material for which the oil is hydrocarbonic resources of the Karachaganak field and in perspective and resources of the shelf of the Caspian sea Karabatan accelerated construction of an integrated petrochemical complex and the new refinery, the raw material for which could serve as Kashagan oil.

Figure. 1. The scheme of formation of a petrochemical cluster,

developed by authors.

In addition to the technological part of the Shymkent refinery is expedient to create a production of synthetic materials that formed in conjunction with the Southern cotton cluster region allows to set up production of a wide range of new modern Kazakhstan market for ready products.

The main idea is in contents of this scheme is that oil refining or associated gas can happen in various technological fields. However, the preference has to be given only to thanks to what the technology for deep processing of initial raw materials takes root that gives the chance to take considerably a big share of production which is potentially contained in its at the expense of what the efficiency of oil and gas increases and, respectively, efficiency of all elements making a cluster grows. In this regard it is necessary to recognize that formation of petrochemical productions shouldn't be limited to development of intermediate products. Efficiency of their functioning is, as a rule, directly connected with the level of complexity of use of primary resources that predetermines need of release of end products, the requirement for which is big in various branches of national economy.

Besides, the considerable part of this range allows to give, first, incentive to development of separate industries (light, mechanical engineering, rubber), secondly, to export to the countries of near and far abroad.

Creation of competitive export-oriented petrochemical production for the purpose of satisfaction of need of domestic market for the major petrochemical production will promote development of small enterprises in release of wide product range of technological appointment, increase of competitiveness of their production due to replacement of the imported raw materials on domestic (Egorov, Chigarkina, 2013; Strategic planning of territorial development: the forecast for the development of Atyrau region for the period up to 2015, 2007; Serikov, 2008).

Besides, it will be necessary to create the production base and human potential allowing to carry out in the subsequent more advanced processing of petrochemistry connected with production of medical preparations, explosives, solvents, additives, synthetic fibers on the basis of processing of polyamide pitches.

The analysis of expected indexes of development of an oil and gas complex of Kazakhstan till 2025 shows that the volume of oil production will be reached to 120 million tons, and also after modernization of three oil refineries plant, and also construction of new oil refineries plant their total design capacity from 15 million tons will increase to 20 million tons (table 3). By 2025 demand for polyethylene is predicted in volume to 137 million tons that is twice more in comparison 2011 - 71 million tons. Western and Eastern Europe, and also China and East Asia will be the main markets of consumption of the Kazakhstan polyethylene (The state program of industrial-innovative development of Kazakhstan for 2015-2019 years, 2014).

Table 3. The forecast of demand for oil products in the Republic of Kazakhstan for 2015-2025

(one thousand tons), developed by authors on the basis (Egorov, Chigarkina 2012, 2013)

Name of products |

2015 y. |

2020 y. |

2025 y. |

Condensad gas |

680 |

827 |

982 |

Naphtha |

1000 |

1000 |

1000 |

Petrol |

4410 |

5129 |

5897 |

Avitionfuel |

506 |

605 |

696 |

Diesel fuel |

4690 |

5600 |

6531 |

Fuel oil |

1704 |

1811 |

2089 |

Other |

1832 |

2351 |

2847 |

Total |

14822 |

17323 |

20042 |

Scope of petrochemical production – polymeric materials, synthetic fibers, plastic and others is so wide that there is practically no industry and social sector of economy where they wouldn't be used as commodity products. Durability, resistance to thermal and chemical influence, ability to keep a long time the set parameters (properties), comparative low cost and relative ease, availability and sufficiency of necessary raw materials for receiving them – here those main advantages which allow to compete successfully to synthetic fibers with other materials.

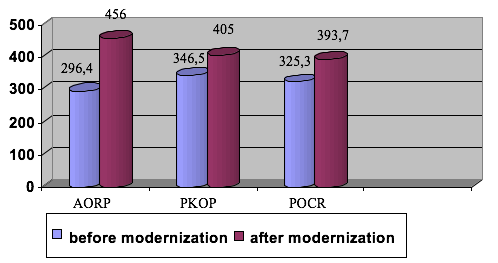

The basis for similar judgment are the indicators of high-quality increase in production of oil products given by us after modernization of ORP (oil refinery plant) oil refinery with increase in an exit of light types of oil products, such as gasoline, diesel fuel and reduction of production of dark types of oil products as fuel oil, bitumen (table 4).

Table 4. Balance of oil products after modernization of oil

refineries of Kazakhstan by 2025, calculated by authors

Name of products |

«AR» LLP |

«POCR» LLP |

«PKOP» LLP |

|||

% wt. |

thousand tons per year |

% wt. |

thousand tons per year |

% wt. |

thousand tons per year |

|

Condensad gas |

4,0 |

200 |

4,2 |

252 |

3,9 |

234 |

Jet propulsion fuel |

4,0 |

200 |

4,2 |

252 |

3,9 |

234 |

Petrol |

40,1 |

2000 |

37,9 |

2275 |

39,7 |

2385 |

Diesel fuel |

30,2 |

1520 |

29,5 |

1770 |

30,3 |

1820 |

Fuel oil |

10,5 |

520 |

8,3 |

499 |

9,5 |

565 |

Bitumen |

- |

- |

2,7 |

162 |

- |

- |

Petroleum coke |

2,8 |

140 |

3,7 |

222 |

3,4 |

204 |

Sulfur |

0,9 |

45 |

0,8 |

48 |

0,8 |

48 |

Consumption fuel |

6,5 |

325 |

7,7 |

462 |

7,5 |

450 |

Loss |

1,0 |

50 |

1,0 |

60 |

1,0 |

60 |

Total |

100,0 |

5000 |

100,0 |

6000 |

100,0 |

6000 |

Thus, by 2025 the output of gasoline will increase more than twice, diesel fuel by 1,5 times. The share of production of fuel oil will decrease due to increase in the end of boiling of vacuum gasoil up to 560 °C. Results of 5-6 million t of oil what capacities of a petrochemical cluster practically are also calculated on, will allow to take from the involved raw materials a row of competitive production in the markets of world petrochemistry.

Therefore, it is possible to judge unambiguously that the raw option of development loses and besides in the considerable sizes in all cases. So, at export orientation the income from realization of the extracted gas in full is 150-160 mln dollars less, than in case of realization of products of gas processing. By the carried-out calculations on prospect the economic result in the conditions of internal consumption of production of gas processing by 2,5 times exceeds the income from export of production in the comparable prices. The similar situation will develop also in oil processing (table 5).

Table 5. Economic results on processing of oil and gas resources by 2025,

calculated by authors

Feed stock, conversion products |

Export |

Internal consumption |

||||

Quantity |

Price, dollars per 1000 cub.meters or 1 tons |

Sum, mil.dollars |

Quantity |

Price, dollars per 1000 cub.meters or 1 tons |

Sum, mil.dollars |

|

Gas realization in full volume, bil.cub.meters |

6,0 |

85 |

510 |

6,0 |

85 |

510 |

Gas refining |

||||||

Residue gas, bil.cub.meters |

0,6-1,0 |

85 |

51-85 |

1,6-2,0 |

85 |

136-170 |

Sulfur gas, th.tons |

600 |

120 |

72 |

|

|

|

Condendas gas, th.tons |

300 |

100 |

30 |

|

|

|

Ethylene, polyethylene, th.tons |

350 |

570 |

200 |

|

|

|

propylene, th.tons polypropylene |

|

480 |

144 |

|

|

|

Butane, th.tons |

|

385 |

154 |

|

|

|

Results of gas refining |

|

|

651-685 |

|

|

966-1040 |

Realization of crude oil, mil.tons |

5-6 |

120 |

600-720 |

- |

- |

- |

Oil refining |

||||||

Petrol, mil.tons |

|

|

|

2,6-3,5 |

300 |

780-1050 |

Diesel fuels, mil.tons |

|

|

|

2,0-2,7 |

250 |

500-675 |

Jet propulsion fuel, th. tons |

|

|

|

500 |

200 |

100 |

Mercaptans, th.tons |

|

|

|

6 |

1000 |

6 |

Results of oil refining |

|

|

600-720 |

|

|

1386-1832 |

Total resuls of oil and gas processing |

|

|

1251-1405 |

|

|

2352-2872 |

Note: The extracted ethylene and propylene are shown as export products,

polyethylene and polypropylene - are used for internal consumption.

Therefore, complex processing of oil and gas resources, consisting in use of processes of their deep processing, brings notable benefit. So, at price of oil in the world markets within 250-300 dollars in case of profound processing, extraction of finished goods in which should be 85-90%, its total size in terms of money can increase by 3-3,5 times. The same situation is peculiar also to gas processing – the total cost of production in the world prices received from processing of each 1000 cubic meters by 7-8 times will surpass the size of income gained from export of the same volume of a gas resource.

Thus, in the conditions of the growing competition in the world markets and progressive exhaustion of resource base more and more actual are questions of use of the advanced achievements of the world oil and gas industry in systems and methods of processing of hydrocarbonic raw materials. In this sense, completion of reconstruction and modernization of domestic oil refineries by 2016 has to give possibilities of providing consumers of the country with the qualitative oil products and petrochemical products conforming to requirements of ecological classes 4,5, decrease in harmful effects on environment, ensuring need of the republic for automobile and aviation fuel. By our calculations, on the basis of the analysis of oil processing, the cost of a basket of oil products per 1 ton has to increase in domestic oil refineries considerably (figure 2).

For the purpose of determination of innovative activity of oil refineries, it would be necessary to consider the indicators capable to reflect intensity of innovations in this branch. In practice it is possible to carry an index of complexity of V. Nelson according to which for each technological process on oil processing production there corresponds the certain coefficient of complexity characterizing and estimating its capital intensity and progressiveness (Shalbolova, 2003) to such indicators. Coefficients of complexity of technological processes according to V. Nelson are specified in table 6.

Figure. 2. The cost of a basket of oil products, dollars/ton,

it is calculated by authors

The essence of determination of coefficient of complexity of oil refinery consists in the following, power on primary oil refining is taken for 100%, and the power of secondary processing at oil refinery is expressed as a percentage in relation can be multiplied primary processing, then these relations multiply by complexity coefficient for each technological process. The share of secondary processes and production of high-quality oil products raises with increase in coefficient of complexity. The comparative analysis shows that in the USA modern oil refineries have V. Nelson's index from 15 to 17. In our domestic oil refineries also pass the oil refinery at the moment is an index makes about from 3,5 to 5. It is expected that after modernization of oil refinery the complexity coefficient much more will improve.

Table 6. Coefficients of complexity of technological processes of oil processing, developed by authors

% p/p |

Production process |

Coefficient of complexity of process according to V.Nelson |

Coefficient of complexity of process at IPO of Kazakhstan |

1 |

Primary oil refining |

1,0 |

0,05-0,06 |

2 |

Vacuum fibrillation |

2,0 |

0,1-0,15 |

3 |

Coking |

6,0 |

0,3-0,44 |

4 |

Hydrotreating |

3,0 |

0,15-0,22 |

5 |

catalytic reforming |

5,0 |

0,25-0,36 |

6 |

Catalytic cracking |

6,0 |

0,3-0,4 |

7 |

Catalytic hydrocracking |

6,0 |

0,3-0,48 |

8 |

Isomerization |

15,0 |

0,76-1,09 |

9 |

Alkylation |

10,0 |

0,54-0,69 |

10 |

Thermal cracking |

3,0 |

0,15-0,22 |

11 |

Production of oils |

6,0 |

0,3-0,42 |

12 |

The slow down coking |

6,0 |

0,3-0,46 |

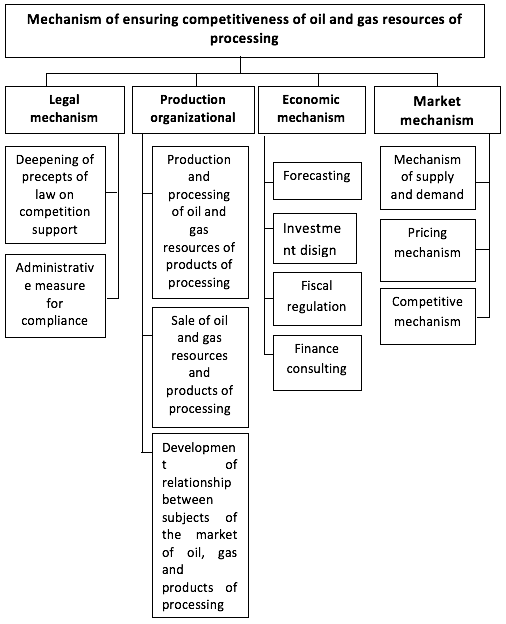

In general, development of cluster initiative in petrochemical branch of the country has to provide high competitiveness of oil products in the internal and external markets. The effective mechanism of ensuring competitiveness of products is for this purpose necessary.

At the heart of such mechanism all its basic elements have to be involved: legal, organizational and production, economic and market (figure 3).

In our opinion, in the field of improvement of a legal mechanism the debugged legal system of interaction of participants of the market of oil and oil products has to be created, to be taken in due time administrative measures for observance of accepted standards of the legislation.

At improvement of the production and organizational mechanism it is necessary to place emphasis on reliability of quality and quantitative indices of oil and gas resources and products of processing, to introduce innovative technologies in production, to deepen processing of oil and gas resources on the basis of introduction of waste-free technology. This mechanism provides formation, improvement and development of the market of oil and oil products, contains the organization of production, the organization of realization and formation of system of relationship between subjects of the market of oil and oil products.

In the development plan for the economic mechanism it is important to strengthen a role of forecasting and planning, to stimulate investment into innovations, to improve system of the taxation. This mechanism is proved by system of the economic incentives and methods of management aimed at providing competitiveness of production.

In the field of regulation of a market mechanism there has to be a system of interaction of supply and demand, the competition on pricing, output and sales of oil and gas resources and their processing.

Figure. 3. Mechanism of ensuring competitiveness of oil and

gas resources and products of processing, developed by authors

Thus, mechanisms of ensuring competitiveness of oil and gas resources and products of processing will influence development of a petrochemical cluster and to give opportunities to define the target markets for him, to improve corporate management, to develop infrastructure of a cluster, to improve the level and skills of experts, to provide certain conditions for production and investments.

In the further development the petrochemical cluster has to cooperate with the key allied industries: automobile which 17% in specific weight consumes production of petrochemistry, and also power where the share of chemistry and petrochemistry in 30% takes in industrial electricity consumption. For this purpose formation of the concept of the interindustry innovative cluster uniting the petrochemical and automobile building enterprises at integration of a power complex is necessary. The main goal consists in the organization of an interdependent chain of a value added of innovative production by means of transfer on technological channels of resources between these branches for the maximum satisfaction of raw requirements of automobile production when ensuring effective development of petrochemistry.

The petrochemical branch has to become a kernel of the considered cluster as a backbone element, and the enterprises of power and automobile branch in this case have to act as ancillary industries. Set of the enterprises of a cluster is differentiated on suppliers of raw material and energy resources for production of hi-tech production and on the overworking enterprises of an innovative orientation of automobile and petrochemical branch.

Practical realization of the mechanism of cooperation should be directed to formation of conditions under which participants of the offered cluster are ready to refuse rivalry for receiving an economic benefit at cooperation in innovative activity. Interindustry innovative interaction of this sort, within the designated uniform production line of innovative products, will allow to create an interindustry chain of a value added that will positively affect product cost. Also as a result of increase of a value added of production on average from 600 dollars/t (rubbers, polyethylene) to 900 dollars/t (a product from plastic, the tire) economic effect can reach 300 dollars per 1 ton of production.

Thus, using cluster approach in Kazakhstan in the next five years it is possible to master release more than 15 types of production, having invested more than 3 billion dollars in petrochemical branch. It is expected that effective functioning of a petrochemical cluster will provide the multiplicative growth of allied industries.

Development of a petrochemical cluster provides creation of export-oriented petrochemical production. At the expense of cluster mechanisms conditions of transition of the Kazakhstan enterprises to an innovative stage of development which will be built in in the long term programs of social and economic development of the country and to promote development of the market of petrochemistry in the region can be satisfied.

Alimbayev, A. A. (2005). Problems of formation of the middle class and the development of the cluster model in Kazakhstan. Monograph. Karaganda: Sanat-Printing, 316 p.

Annual report of the Joint Stock Company KazMunaiGas - Processing and Marketing for 2015. KazMunaiGas-processing and marketing, SPG. Retrieved from: www. thkmg.kz.

Baymuratov, U. B. (2000). National economic system. Almaty: Gylym, 536 p.

Egemberdieva, S. M. (2013). Oil business development strategy of the Republic of Kazakhstan in conditions of globalization. Monograph. Astana: LLP "Master Po", 239 p.

Egorov, O. I. (2012). Modernization of Kazakhstan's oil and gas industry as the basis of its competitiveness. Almaty. Oil and gaz, 5, 125-135.

Egorov, O. I. (2013). The role of modernization in enhancing the competitiveness of petrochemical complex. Bulletin of the National Engineering Academy of Kazakhstan, 3, 119-127.

Egorov, O. I., Chigarkina, O. A. (2013). Substantiation of ways of formation and effective functioning of the petrochemical cluster in the Republic Kazakhstan. Almaty: IE CN MES, 40 p.

Kenzhegaliev, A. K. (2000). The ecological state of the natural environment of the region Tengiz. Oil and Gas, 2, 91-99.

Kenzheguzin, M. B. (2005). Regional aspects of the diversification of the economy of Kazakhstan: Karaganda regional development. Herald, 2(6), 8-12.

Madiyarova, D. M. (2010). The Development of the petrochemical cluster in the Republic of Kazakhstan. Herald TREASURY. Economic Series, 2, 89-92.

Manufacturing industry. Basic indicators of the industry of the Republic of Kazakhstan for 2008-2014 years. Agency of the Republic of Kazakhstan on statistics. Retrieved from: www.stat.kz

Nadirov, N. K. (2000). Oil and gas complex of Kazakhstan. Oil & Gas, 3, 9-31.

Nurlanova, N. K., and Beysenbina, A.S. (2009). The implementation of cluster initiatives as a condition for the growth of competitiveness of Kazakhstan's economy in crisis. Collective monograph "The global economic crisis: the theory, methodology and practice." Almaty: Economy, pp. 871-892.

Orazbayeva, K. N. (2013). Investigation of the state of formation and creation of petrochemical cluster integrirovannnogo petrochemical complex in Kazakhstan. Retrieved from: http: group-global. org / ru / publication. 3211 - issledovanie-sostoyaniya-formirovaniya-neftehim-icheskogo - klastera-i - sozdanie

Petty, V., Smith, A., Ricardo, D. (1993). Anthology of economic classics. Key Economy, 750 p.

Porter, E. M. (2000). Competition: Trans. from English. M.: Williams, 495 s.

Porter, E. M. (2005). Competitive Strategy: Methods for Analyzing Industries and con rival to. Trans. from English. M .: Alpina Business Books, 454 p.

Serikov, T. P., Serikova, Z. F., Orazbayeva, K. N. (2008). The current state of technology of oil refining in Kazakhstan Atyrau. Monograph: Ep-Tostik. A Printing – Aktobe, 206 p.

Shakulikova, G. T. (2005). Methodological issues of cluster formation in the oil and gas sector of Kazakhstan. Karaganda. Bulletin of Regional Development, 2(6), 12-17.

Shalbolova, U. ZH. (2003). The market of hydrocarbons in Kazakhstan: experience and priorities. Scientific Monograph Almaty, 260 p.

Shalbolova, U. ZH. (2003). The reasons for limited production on deep processing of hydrocarbon raw materials in Kazakhstan. Almaty: High school of Kazakhstan, 2, 179-184.

Smith, A. (2007). The Wealth of Nations. Eksmo, 960 p.

Strategic planning of territorial development (2007). Forecast of development of Atyrau region for the period up to 2015. Astana. EFI, 2(6). Retrieved from: www.economy.kz

The master plan of petrochemical production development in Kazakhstan. Approved by the Government of the Republic of Kazakhstan from September 12, 2005. Retrieved from: http://www.nexant.com.

The state program of industrial-innovative development of Kazakhstan for 2015-2019 years. Astana, 2014. Approved by Decree of the President of the Republic of Kazakhstan from August 1, 2014 № 874. Retrieved from: www.zakon.kz.

These Customs Control Committee of the Ministry of Finance of the Republic of Kazakhstan (2008-2014). Retrieved from: http: www.customs.kz

Yesentugelov, A. E. (2011). Prosperity of the country's strategy in a changing world. Lessons from the global crisis and the modernization of Kazakhstan's economy. Almaty, 400 p.

1. L.N.Gumilyov Eurasian National University, Department of Economics. Professor. E-mail: saule_8@mail.ru

2. L.N.Gumilyov Eurasian National University, Department of Economics. PhD.

3. L.N.Gumilyov Eurasian National University, Department of Economics. Associate professor.