Vol. 38 (Nº 21) Año 2017. Pág. 28

Armando DALLA COSTA 1; Naijla Alves EL ALAM 2

Recibido: 09/11/16 • Aprobado: 29/11/2016

2. The theory and the firm's internationalization process

3. Brazilian export history to Latin America and world

4. The role of BNDES and others entities for Brazilian companies

5. Aspects that impact the internationalization of Brazilian SMEs

ABSTRACT: International trade of small and medium Brazilian companies for finished goods, in the last fourteen years, has remained constant. The costs involved in the internationalization process for SMEs, is one of reason that prevent their rapid advance. In order to analyze this process, from a theoretical point of view authors have different conceptions. Penrose (1950) highlights the following resources in its international expansion: financial, technological, business, administrative and behavior of entrepreneurs. Vernon, the product cycle theory, shows other items that make up the costs: local competition, geographic location, available inputs, and incentives, among other determinants. From these elements, the purpose of this article is to examine the interrelationship between internationalization and finance and the impact on the strategy of the Brazilian SMEs operating in Latin America. Exports is one of the forms of internationalization most used by small companies, requires investment as: research, development and innovation - R, D & I, adequacy of packaging, prospection trips, qualified professionals, website/manual translations, national and international logistics, distributors contract cost, trademark registrations, trading commissions companies, training, subcontracting, product manufacturing costs, among other variables. To achieve the goal, internationalization’s theories will be using, studies on evolutionary economics also government official statistics of Brazilian foreign trade. Unlike what happens with large companies and economic conglomerates, the paper highlights the little emphasis in the literature on the additional costs for SMEs to have access to foreigner markets, mainly with innovative products. The study aims to contribute to break this gap in the literature. |

RESUMO: O comércio internacional de pequenas e médias empresas brasileiras de produtos acabados, nos últimos 14 anos, tem-se mantido constante. Os custos envolvidos no processo de internacionalização de PMEs é um dos motivos que impedem seu avanço rápido. Para analisar este processo, a partir do ponto de vista teórico alguns autores têm concepções diferentes. (Penrose,1950) destaca que alguns recursos são necessários para a expansão internacional: financeiro, tecnológico, comercial, administrativo, bem como o comportamento dos empresários. Vernon, na teoria do ciclo do produto, apresentou outros itens que compõem os custos: a concorrência local, localização geográfica, incentivos entre outras determinantes. A partir destes elementos, o objetivo deste artigo é analisar a inter-relação entre a internacionalização e finanças e o impacto sobre a estratégia das PME brasileiras que operam na América Latina. A exportação é uma das formas de internacionalização mais utilizadas por pequenas empresas, exigindo investimentos como: pesquisa, desenvolvimento e inovação - P, D & I, adequação de embalagens, viagens de prospecção, profissionais qualificados, website, traduções, logística nacional e internacional, custo com distribuição, contratos, registros de marcas, comissões, subcontratações, custos de fabricação do produto, entre outras variáveis. Para atingir o objetivo, serão utilizadas as teorias de internacionalização, estudos sobre a economia evolucionária, estatísticas oficiais do comércio exterior brasileiro. Ao contrário do que acontece com as grandes empresas e conglomerados econômicos, o artigo destaca a pouca ênfase na literatura sobre os custos adicionais para a PME ter acesso aos mercados estrangeiros, principalmente com produtos inovadores. O estudo pretende contribuir para preencher essa lacuna na literatura. |

Although in the last twenty years Brazil started an international insertion, the fifth largest country in area and sixth in population (CIA, 2016), remains dependent mainly on commodities export. There is no doubt the agro-industry complex contributes to the country projection in the international scenario and boost the national economy, even though is insufficient for its development. Since 1950, there has been low significant change in the Brazilian exports products. The eightieth world’s economy (CIA, 2016), has presented slow growth in exportation, for the latest years, regarding its economic importance in Latin America and world (MDIC, 2015). Internationalization process contributes to the company increase productivity, incorporate knowledge, get better profitability among other benefits (SOBBET, 2007), requiring financial investment and ongoing training. The presence of small and medium enterprises - Brazilian SMEs on the world scenario remains low; some financial, economic, political and cultural issues contribute to the current stage.

The article purpose is to examine the interrelationship between internationalization and finance and the impact on the Brazilian SME strategy commercializing in Latin America.

Those firms faces several difficulties related to the internationalization process such as: research, development and innovation - R, D & I, adequacy of packaging, qualified professionals, international travel, tariff and non-tariff barriers, subcontracting, product manufacturing costs, among other variable impacting the Brazilian SME in the global market access; in all the situation above mentioned, the finance side is involved.

To achieve the main objective, this article has divided into six sections including this introduction. In the second section, shows in brief the principal theory of internationalization that emphasize financial subject. The third part makes a compact presentation on the Brazilian exports history in the last 21 years having the world as destination and last 14 years for Latin America according to date availability. The fourth is about the role of BNDES, other banks financing economic activity also national institutions programs available to SME. The fifth part presents the aspects and conditions of the internationalization process and financial needs involved, followed by the conclusion.

Some theories emphasize the importance of the financial agent in the internationalization process, present in two ways: i) exports; and ii) foreign direct investment – FDI to strengthen the external production base (Dalla Costa; Santos, 2011 apud Alem and Cavalcanti, 2005). In both, there are costs involved, although in exports a company has a certain type of cost, in the FDI, costs and investments can be multiplied.

Penrose, analyzing the firm's growth, highlighting some important elements for international expansion such: financial, technological, business and administrative resources, entrepreneur behavior as innovative Schumpeterian agents and attentive to macroeconomic issues (Penrose, 1950). Doing business internationally, demands financial resources, without money almost becomes impossible to move forward. Capital is nothing more than a lever with which the entrepreneur subdues his control the concrete goods that need (Schumpeter, 1934).

The product cycle theory (Vernon, 1966) contributed to the understanding of internationalization, taking into account that the product goes through three phases: introduction, maturity and standardization; in the third stage, the company needs high investments in R,D&I not always available, becoming difficult for a Brazilian SME negotiating in Latin America and /or in any other part of the world.

For the Uppsala Internationalization Model (U-Model), one of the strategies to market access, could be export to neighboring countries, thus the company gains knowledge and gradually build networks, starting the process of stability in the target market; reduces non-tariff barriers and may subsequently become a direct investment abroad (Johanson and Vahlne, 1977).

The theories highlight the incremental approach for error minimization in the internationalization process, consequently reducing the financial impact. The involvement deepens, while increasing knowledge and information channels.

The model tested by Nordic companies has been successful and many companies have become global as Volvo and Sandvik, however the model adopted in Europe can find barriers in Brazil due to the economic, social and infrastructure in the region. Also company’s behavior has changed, since the global competition also technological development has increased, opening a discussion about the effectiveness of the U-model for some enterprises.

There are two types of limiters knowledge of firms to operate on the international market: a) knowledge that can be teach (goal); and b) knowledge developed through the experience of each individual (experimental). The last one rated as critical, since is not rapid to acquire but gradually, from the abroad experiences (Johanson and Vahlne, 1977), in both process, financial investment is necessary.

By analyzing the export history by Brazilian SMEs, we realize that not always Latin America is the target region, even with physical and cultural proximity. Even though, increasing gradually in foreign country, can be a strategy to minimize mistakes and costs.

Technology-based firms are dynamic, innovative in the products, and less bureaucratic than a firm that uses a standard process (Knight and Cavusgil, 2004). Through international prior connections, enter the developed and emerging countries simultaneously market, benefiting from the surprise of his presence in the global market, unfortunately they are few.

Knowing the history of Brazilian international trade enables the understanding of the current situation in relation to internationalization process for SME enterprises. First, is necessary to know how the firm’s classification by size category is done in Brazil, since there is more the one parameter utilized. One of them is the Southern Common Market – MERCOSUR criteria, through the Resolution No. 90/93 and 59/98 (MDIC, 2014). Also is the classification for export credit supports utilize the Statute of Micro and Small businesses (Law No. 9,841 / 99) and SIMPLE (Law No. 9.317 / 96) analyzing the annual turnover of the companies and their size; There is also classification criteria for company size stipulated by other national institutions, such as SEBRAE, ANVISA and BNDES, hindering the statistical data collection; unfortunately there is no uniformity in the parameters. In the paper it is being used the MDIC standard presented in table 1:

Table 1 – Company Classification by Size

SIZE |

INDUSTRY |

|

Company Classification |

Employee Number |

Exported Value |

Micro |

Up to 10 |

Up to US$ 400 thousand |

Smal |

From 11 to 40 |

Up to US$ 3,5 millions |

Medium |

From 41 to 200 |

Up to US$ 20 millions |

Large |

Above 200 |

Above US$ 20 millions |

Person |

- |

- |

Source: MDIC (2015)

On the other hand, in South America and Latin America the classification follows different parameters, becoming difficult comparisons between countries in the region.

By law a Brazilian company needs to follow a set of rules to have a register number called National Register of Legal Entities – CNPJ, after that each new branch will be given, a new number; this allows a multinational to have five different CNPJ, and still be part in the Federal Government trade statistic classified as SME, impacting in the real statistics.

The Brazilian trade balance has been moved by exporting companies of all sizes and individual citizen, the last category has the lowest share of the international market. The indirect export operational process is done by a third party such as trading companies, who represents lots of SME manufacturers.

The Latin America region is a dynamic region, with approximately 570 million inhabitants formed by 30 countries: Brazil, Argentina, Belize, Mexico, Antigua and Barbuda, Colombia, Peru, Venezuela, Chile, Ecuador, Guatemala, Haiti, Bolivia, Dominican Republic, Honduras, Paraguay, Nicaragua, El Salvador, Costa Rica, Panama, Uruguay, Guyana, Suriname, Saint Lucia, Saint Kitts and Nevis, Saint Vincent and the Grenadines, Dominica, Grenada and Jamaica (Worldbank, 2015). The language predominance is Spanish. Only the MERCOSUR (Brazil, Argentina, Uruguay, Paraguay and Venezuela), has approximately 290 million citizens representing 45% of the population in Latin America. There is a history of 50 years since the first joints to form the block in the 1960s, with the Latin American Free Trade Association (ALAC) adopting the Ushuaia protocol. Actually, the trade agreement is responsible for to increase business between MERCOSUR countries in last decade. Brazil is the largest in the region with approximately 206 million inhabitants (IBGE, 2016), has frontier with ten out twelve countries even though there is a lack of business between them.

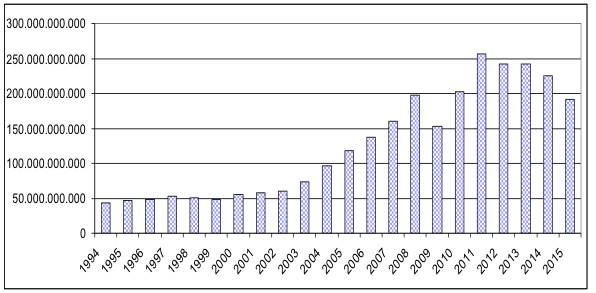

Chart 1 shows the evolution of Brazilian exports between 1994 and 2015, having the world as destination

Chart 1: Brazilian Export in (US$) between 1994 and 2015

Source: MDIC (2016)

The exported volume to the world has increased gradually; in 1994 was $ 47.7 billion in negotiation; in 2015 reached $ 191 billion totaling more than $ 2.7 trillion in negotiations in the last twenty one year. All the trade movement has contributed to an increase of more than 480% over the time; from this total the majority were exported by large companies including multinationals, followed by $ 104 billion from medium, $ 23 billion from small and $ 3 billion micro enterprises, where mostly of revenue is from commodities (MDIC, 2016).

According to the Economic Cooperation and Development - OECD more than 95% of companies in Latin America are SMEs, responsible for 60% to 70% of generating jobs in most countries (OECD, 2000). Still, few operate globally, due to the complexity and lack of financial resources. For the neo-Schumpeterian economy, the three pillars for development is the monetary side and the other two are the real side of the economy and the public sector (Hanusch and Pyka 2007).

According to the Brazilian Institute of Tax Planning – IBPT, there are in Brazil in 2016 more than 19 million companies distributed among industries, construction, commerce, trade, services and agriculture (Empresômetro, 2016). From this total more than 95% are micro and small enterprises, and few of them deal with international commerce.

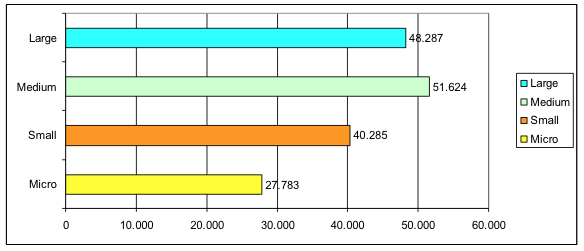

Although Brazil is part of Latin America the commerce in the region is not dynamic as should be. The Chart 2, shows Brazilian companies’ exportation to Latin America by size from 2002-2015, totalizing 167,979 and: 27,783 were micro; 40,285 small; 51,624 medium and 48,287 large enterprises (MDIC, 2016).

Chart 2: Brazilian Export by Company Size in (US$) between 1994 and 2015

Source: MDIC (2016)

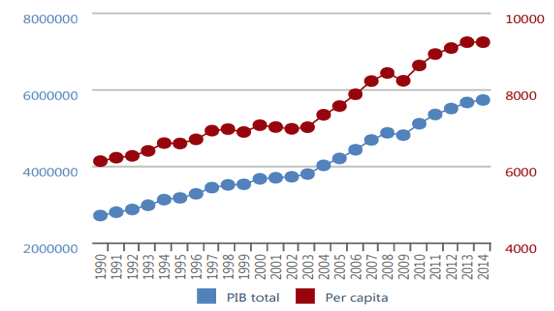

Studies of the Economic Commission for Latin America and the Caribbean – CEPAL 2012, demonstrated the reduction of poverty in the region presented a trend of its reduction even if slowly. Due to the growth of GDP in the Latin region over the past 24 years, there has been an increase in consumption enabling regional trade as shown in Figure 1.

Figure 1: Latin America PIB (1990-2004)

Source: CEPAL 2016

Other variables influence the choice of doing business such as: a) low financial investments b) international agreements. Brazil has few trade agreements active or in negotiation if comparing to other countries in the region such as Mexico, the second largest country in Latin America that has free trade agreements with major world economies; the most recent one is the Trans-Pacific Partnership - TPP (formed by twelve countries: United States, Japan, Australia, Brunei, Canada, Chile, Singapore, Malaysia, Mexico, New Zealand, Peru and Vietnam). It is also important to highlight that World Trade Organization - WTO is responsible for the regulation and supervision of world trade, including trade agreements (WTO, 2016).

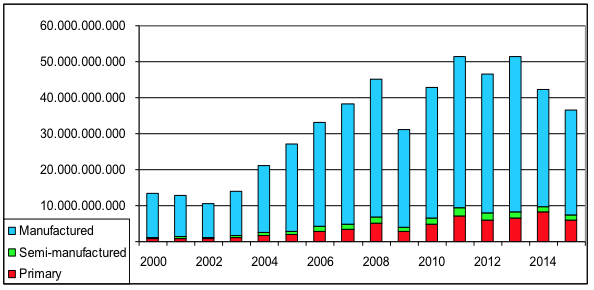

Chart 3 shows the growth of monetary volume exported by Brazil for Latin America in the last 15 years.

Chart 3: Brazilian Export to Latin America in (U$$) 2000 - 2015

Source: MDIC (2016)

To the region is important to highlight the volume of industrialized products, approximately $ 457 billion over the commodities $ 61 billion (MDIC, 2016). In the region Brazil is more representative with manufactured instead of commodities, representing an opportunity to new SME interest in to start internationalization process for close markets.

The lack of financial resources is one of the impediments to international expansion of SMEs (OECD, 2009). Schumpeter (1934) highlights the role of the financial system and shows that the banker is not primarily an intermediate of the goods "purchasing power", but a producer of this merchandise (Schumpeter, 1934, p.83). The banker stands between those who wish to form new combinations and the possessors of productive assets (Schumpeter, 1934, p.83). In Brazil, the banker is in the economy through various entities, financing SMEs in their decisions by several mechanisms, some firms are unaware of these possibilities.

The Federal Government in many situations assumes the banker role in Brazil through public institutions. The National Bank for Economic and Social Development - BNDES is a federal public entity promoting socioeconomic development; founded in 1952 and, throughout its history, has become one of the world's largest development banks with capacity to assist companies in different segments. The credit lines offered enable the long-term financing and investment in all segments of the economy (BNDES, 2015).There are some criteria applied by the institution, such as the environmental and economic impact, but there are no restrictions on the size of the company, benefiting from it. Some highlights of actions supported relate to innovation, manufacturing plant modernization, continuous or structuring actions (BNDES, 2015). In Table 2, is associated the disbursement of BNDES to smaller companies in the last five years in Brazil.

Table 2 – BNDES System Disbursement in the Last 5 Years in (R$ million)

Company Size |

2011 |

2012 |

2013 |

2014 |

2015 |

Micro |

23,295.50 |

23,888.50 |

30,686.10 |

28,694.90 |

19,062.80 |

Small |

11,997.90 |

12,507.60 |

16,703.50 |

15,925.70 |

10,003.90 |

Medium |

14,366.80 |

13,725.80 |

16,15.80 |

14,755.60 |

8,286.60 |

Total |

49,660.20 |

50,121.90 |

63,543.40 |

59,376.20 |

37,353.30 |

Source: Own elaboration based on BNDES data

Some companies have benefited from BNDES loan: ALL - América Latina Logística, Braskem, Cemig, Cia Siderúrgica Nacional, Copasa, CPFL, Eco rodovias, Eletrobrás, Embraer, Equatorial, Gerdau, Iochpe, Klabin, Light, Linx, Marfig, Oi, Petrobras, Renova, Suzano, TOTVS, Transmissão Aliança de Energia Elétrica, TPI Triunfo, Vale, among others (BNDES, 2015). In the first quarter 2014 BNDES through the National Treasury, financed approximately 608,000 Brazilian companies, thereby demonstrating that firms of different sizes and industries are using financial aid for their activities (BNDES, 2015).

Especially SME needs financial resource to expand capacity, acquire skills, develop productive and management structures also to implement strategies (CEPAL, AL INVEST, 2014, p. 25). Decision making funding depends on several factors, such as macroeconomic issues. In this way the SWOT analysis, ally with PESTEL are essential for internationalization. Normally these two techniques are been used combining, applied in ambience and groups to provide effective support in strategic planning, decision-making and action plan (UNICEF, 2015). Regarding PESTEL analysis, it is complementary to SWOT, relevant to the projects and allows anticipating changes rather than later action (UNICEF, 2015). In Figure 2, shows the main items to be evaluated.

Figure 2: PESTAL Analysis

Source: Own elaboration based on (UNICEF, 2015) data

In practice the items can be “market regulations, taxation, consumer protection, interest rate, exchange rate, unemployment, inflation, GDP, religion, lifestyle, life expectancy, income distribution, internet access, compatible technologies, products environmentally friendly, wages and local labor laws”. Other may be taken into consideration such as “corruption, legal certainty and social development of countries, pointing out to the fact that the more information available and planning done, minimizes the possibility of financial losses”. Credit is the only type of support with a positive and significant impact on all outcome variables (IDB, 2014). The Inter-American Development Bank - IDB works in partnership with Brazilian institutions (The Brazilian Agency for Industrial Development – ABDI; the Brazilian Agency for Export and Investment Promotion – APEX; Brazil's Northeast Bank, the National Bank for Economic and Social Development – BNDES; the Financier of Studies and Projects – FINEP; the Institute national Metrology, Quality and Technology - INMETRO and the Brazilian Service of Support to Micro and Small Enterprises -SEBRAE ) all those institution supports development of SMEs .

The success of the IDB credit lines, for example, is been related to the incentives created by the way the programs are formulated, supporting SMEs in Latin America and the Caribbean. Table 3, contains the other institutions and financing available to Brazilian SMEs, for expansion and confirming the banker's role in the process.

Table 3 – Additional Financial Institutions Assistance for SME

Institution |

Program |

Banco do Brasil

|

Productive Micro-credit Guided |

Entrepreneurial Micro-credit |

|

BB Fast trade and BB Company’s credit |

|

PROEX |

|

MTE - Ministry of Labour and Employment

|

PROGER Urban |

FAT Pro Innovation |

|

BNDES for SME |

BNDES MPME innovative |

CEF - Caixa Econômica Federal

|

Micro-credit Grow Caixa |

PROGER Investment |

|

Consumer durables |

|

Turnover Caixa |

|

Turnover Caixa Fácil |

|

BID Inter-American Development Bank

|

FINPYME |

OMJ and SCF |

|

AFAP – Funding Agency Amapá

|

AFAP Baking industry |

AFAP SMEs |

|

AFAP Credmais |

|

AFAP Individual Entrepreuner |

|

AFAP Youth credit |

|

Banks and State Institutions with specific financing credit

|

Amazon Bank |

Funding Agency Paraná |

|

Region Development Bank – BRDE |

Source: Own elaboration based on BNDES, IBD and SEBRAE data

The internationalization process is complex, time consuming, requires extensive knowledge of internal operations, entrepreneurial spirit and financial availability. The company life cycle is divided into born, grow, develops and death (Brazil, 1997, p.15) in order to build a long life, the financial function is to capture sufficient funds to maintain business in operation, which means using the best resources. Fundamentally, the finance function is concerned with the challenges associated with the efficient acquisition and the further implementation of capital (Kato, 2012, p.27).

Usually SMEs starts their internationalization thru export, although requires the definition of export policy and / or import (raw material). However, to do business abroad it is necessary to know the main business areas in which national and international transactions differ (Bergstrand, 2012, p.11). For better performance, the company needs to be aware of their internal capacity (production) also to know the market possibilities.

The tax system is one of the most basic control mechanism to the government, also has direct impact on firms; in Brazil the tax system is from March 25, 1824, when revenues mainly was from international trade. After constitutional reforms (the most important in 1946) profoundly changed the tax issue and later with the spread of income among the public administration in the country (IPEA, 1996). In Brazil, there are currently more than 58 taxes, fees and contributions, spread between: Federal, State and Municipal level, becoming hard to understand demanding strict control, affecting competitiveness also creating an internal barrier to expansion and development of firms.

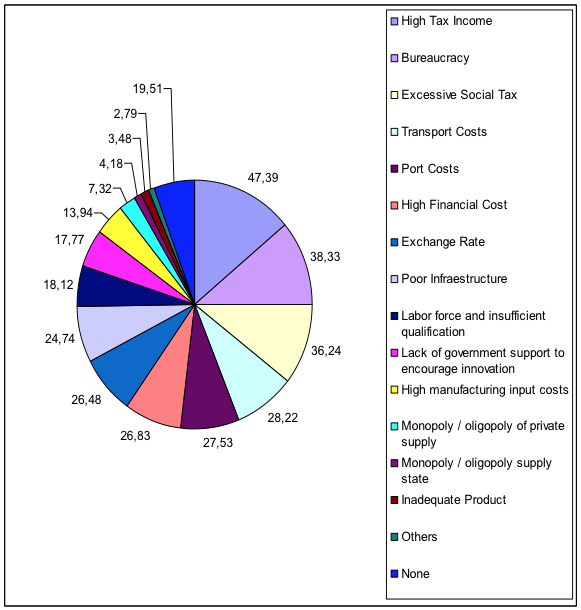

In order to hear entrepreneur’s opinion, annually the Federation of Industry conducts research on various issues regarding the performance of the Brazilian industry nationally. The Federation of Industries of Paraná State – FIEP (represents the industry from Paraná state, supports the industrial sector, realize research and economic analysis about the industrial sector also gives supports in negotiation.) has conducted the industrial survey in Portuguese called “sondagem industrial” for twenty years; the enquiry shows the perception of entrepreneurs from Paraná about conditions in the industrial activities (FIEP, 2015). In the last survey editions high taxes, social charges on the payroll of salaries appear as an impediment to the smooth functioning of their activities. The selection is made at random, sending questionnaire to 2,000 companies that are part of a base of the state industrial catalog data, so the relationship with those firms helps a significant interest for the answer (FIEP, 2015). The survey 2014/2015, interviewed 310 industries from Paraná state, representing about 110,000 employees. The questionnaire comprised six areas of interest: productivity, international affairs, competitiveness, strategies, sales and purchasing, quality, infrastructure and environment, with closed questions.

In the Chart 4, there is a result of the research, all questions was focused in subjects such as international competitiveness and cost Brazil.

Chart 4: Barriers to the Competitiviness and Brazil Cost 2014-2015

Source: Sondagem Industrial 2014/2015 - Federation of Industry of Paraná State

Entrepreneurs answered that high tax income is the strongest barrier to international competitiveness with 47,39%; followed by bureaucracy 38,33%; excessive social tax 36,24% and transport costs 28,22% impacting in SME performance, affecting the grow modernization and job’s creation, consequently slowing down the economy.

For the success in the internationalization process, tax planning and management are important. Items such as organizational chart setting, suppliers of raw materials and knowledge of the installed and future production capacity; this kind of definition is extremely important. The production chain is linked at its inception to suppliers and flows on clients (Brazil, 1997, p. 1). Brazil has an excessive and complex tax system in the world, impacting directly in the company’s competitiveness. In Table 4, are listed some of the taxes for SME affecting directly the profits and investments of companies

Table 4 – Taxation for Brazilian SMEs

Federal Taxes |

Brazil |

II – Import Tax; IPI - Industrial Products Tax; ITR- Tax on the Territorial Rural Property |

Variable

|

IE - Export Tax for National Products |

Variable |

IRPJ - Income Tax for Companies |

25% up to 34% |

IOF - Financial Operations Tax also for exchange, insurance and Securities. |

0,0041+0,38%

|

State VAT |

Brazil |

ICMS – Value-added tax on sales and services relative to merchandise and transportation services negotiation

|

17%

|

IPVA – Road Tax

|

1% up to 3%

|

ITCD - Inheritance and gift transfer tax

|

2% up to 4%

|

Taxes |

Variable |

Municipal VAT |

Brazil |

IPTU - Property taxes

|

0,5 up to 4%

|

ITBI - Property taxes in operation relatated to sales and transfer

|

2%

|

ISS - Service tax |

2% up to 5% |

Taxes |

Variable |

Contributions |

Brazil |

INSS – Social Security

|

20% a 8%

|

PIS and COFINS - Contribution to the Social Integration for sales |

3% up to 1,65% |

CSLL -- Social contributions on net income |

9% |

PIS and COFINS - Contribution to the Social Integration for goods import |

7,60% and 1,65% |

S System Contribution |

1% avarege |

Source: FIEMT (2015)

All the taxes shown above is not only excessive to pay is also complicated to control and understand; the Brazilian tax system is one of the most complex in the world, preventing FDI also national investment. The costs of doing business abroad constituted a barrier to their growth, and firms could continue to grow only if the advantages on which they were based are big enough (Buckley and Casson, 1976, p.157). With 8.515.770 sq km Brazil is one of largest country in the world, regions has different infrastructure, this means for a company based in specific part of Brazil freight and insurance freight are higher, also strikes and political issues, influences the cost of the product consequently the competitiveness in the global market.

Table 6, shows the social responsibility for a company in Brazil inclusive some of them have specific rules, becoming a cost to the company.

Table 5 – Social Responsibility for Companies in Brazil

Social Responsability |

Brazil |

Annual Holiday |

30 days per year |

FGTS – Employees Severance Indemnity Fund

|

8% of salary and 40% dismissional notice

|

Labour Unit Contribution

|

0,02% a 0,8% per year, above social capital of company |

Social Security Contribution |

Employer 20% Worker 8%,9% or 12%

|

Working Hours |

8 hour daily / 44 hour weekly |

Break Hour Inter Working |

Minimum 11 hours |

13th Salary

|

Extra salary per year equivalent to 1/1 of salary per each working month related to December salary

|

Dismissional Notice |

30 days indemnified |

Source: FIEMT (2015)

In Brazil the enterprise is taxed according to annual revenue, depending on the tax regime. All variables combined influence the expansion strategy of Brazilian SMEs.

The importance of financial resources becomes even clearer when exemplify categories of costs involved in SMEs internationalization process, until now was presented determinants that impacts. To sell a merchandise to a foreign market is necessary a price formation, the price must be competitive , the company need to delivery a quality product, with a good price to get in return a good profit.

The example 1, shows a price formation model, considering all costs involve, is possible to find some of those costs in the price formation in a company in Brazil, independent of the size.

Example 1 – Price formation for export

Total Cost [3] + Expected profit [4] + National tax [5] – Internal sale price [6] – (internal tax exemption for export + Cost and expenses [7]) + others export expenses [8]= Sales price for export [9]

Price formation is only a variable, some market rules must be observed such as: “pirate goods, smuggling, illegal trade practice, unfamiliarity product, and competitors with consolidated brand”.

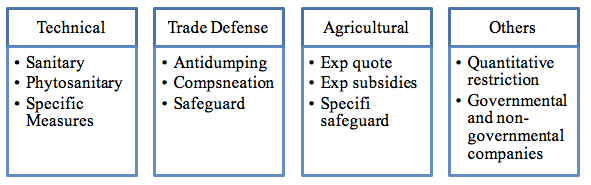

The Figure 3 shows some of the most common non-tariff barriers important for international seller’s knowledge. Those ones are issued by economies in order to create greater control on goods entering their countries and protect local industry (MDIC, 2016).

Figure 3: Non Tariff Barriers

Source: Own elaboration based on http://www.tradebarriers.org/ntb/non_tariff_barriers data.

Mostly of them require product adaptations, packaging, labeling to attend the rules consequently demanding financial resources investment.

The Brazilian tax system and economics issues, has contributed to the low number of SME internationalized, since without financial resources to enable R & D , I and administrative competencies , those companies become unable to expand globally.

The agribusiness system has not increased since 1950, although automotive and others parts of manufactured product were introduced to the export list, country remains dependent of raw material. All the costs involved in the internationalization process, limit SME to expand; although Latin America is a close market is not a guarantee of success, since all the PESTEL items influences directly, and demands financial investment, exemplified throughout the article. Some action may require from a SME cash flow availability starting with the minimum investment up to the maximum, affecting the strategy, both on the national and international market. Due to this, Brazilian SME starts the internationalization process through exports directly or indirectly. The destination may vary according to the indication of previous market studies, logistics costs, trade agreement analysis, product adaptation and purpose, demanding a specialized research to evaluate the benefits and profits.

Brazil follows the global trend where most companies are small and the sectors in which they operate are diverse, ranging from agriculture to automotive. However, mostly those firms have no cash available, little or no knowledge of how to benefit from the opportunities such agreements likes MERCOSUR also funding. There is a preference to remain in the domestic market by low necessity of product adaptation also large demand of consumers, rather than start in a new country and to deal with unknown.

The complexity to operate globally demands international research, qualified professionals, product and process adaptation, packaging, labeling, travel, investment in innovation, high interest rates for loans, new technologies among others; all those needs sometimes may discourage international expansion of Brazilian SMEs, due to uncertainty of the return on investment.

It is possible to note that only tax incentives for export offered by Federal or regional Government in Brazil, does not enable SME to become competitive in the global market as still depends on macroeconomic issues, politics, tax, infrastructure, national and international competition and so on.

The behavioral Uppsala model incentivizing the nearby markets, may be a viable option for the gradual learning, continuous expansion also minimizing errors, thus avoiding financial losses, after all the market research and strategic planning; for technology companies the U-model strategy may not be adequate, since those companies run a different business model, some of them born global thru the network.

One of the positive points in Brazilian SMEs internationalization process for both Latin America and worldwide, is the economic stabilization occurred in Brazil also in the region in the past recent years, even with the current economy fluctuations, countries are improving compared to years ago in general.

Profit is the main reason for an international expansion, although for succeed globally is mandatory planning and investment. The inter-connection between internationalization and finance is present at all stages of the process independent of the country destination also the company’s size.

Banco Nacional de Desenvolvimento. (2016). Available at: http://www.bndes.gov.br

Banco Interamericano de Desenvolvimento. (2016). Available at: file:///C:/Users/user/Downloads/Supporting-Trade-Integration-and-Regional-Cooperation-in-Latin-America-and-the-Caribbean.pdf;file:///G:/pme%20-%20Dalla/artigo/BID%20-%20SME_BRIK_Portuguese.pdf.

Barreiras não Tarifárias. (2016). Available at: http://www.tradebarriers.org/ntb/non_tariff_barriers.

Bergstrand, Jeffrey H. (2002). Empresa Global: 25 Princípios para Operações Internacionais. São Paulo: Publifolha.

Brasil, Haroldo Vinagre. (1997). Perguntas & Respostas para a Administração da Pequena e Média Empresa. Rio de Janeiro: Qualitymark.

CEPAL/AL INVEST. (2004). Como melhorar a competitividade das PME na Europa, América latina e Caribe. Santiago de Chile: Nações Unidas.

Comisión Económica para América Latina y El Caribe. (2016) Available at: http://estadisticas.cepal.org/cepalstat/WEB_CEPALSTAT/Portada.asp; http://www.cepal.org/sites/default/files/infographic/files/15-00878_odm_fichas_web_espanol-1.pdf.

Dalla Costa, Armando y Souza Santos, Elson Rodrigo. (2011). Estratégias e negócios das empresas diante da internacionalização. Curitiba: Ibpex

Empresômetro. (2016) Available at: http://empresometro.com.br/Site/Estatisticas.

FISCOSOFT. (2016). Available at: http://www.fiscosoft.com.br/main_online_frame.php?page=/index.php?PID=158573&key=3224330.

Federação das Indústrias do Estado do Paraná. (2016). Available at: http://www.fiepr.org.br/cinpr/projeto-inseri---pequenos-negocios--2-24434-279730.shtml.

Food Safety Brazil. (2016) Available at: http://foodsafetybrazil.org/fumigacao-para-o-embarque-controle-fitossanitario-em-cargas-alimenticias-e-embalagens-de-madeira/.

Fundação Dom Cabral. (2016). Available at: http://www.fdc.org.br/blogespacodialogo/Documents/2015/ranking_fdc_multinacionais_brasileiras2015.pdf.

Guia Tributário. (2016). Available at: http://guiatributario.net/2013/12/13/regimes-de-tributacao-no-brasil/.

Hymer, H. Stephen (1976). The International Operation of National Firms. A Study of Direct Foreign Investment. MIT Press.

Johanson, Jan, & Vahlne, Jan-Erik. (1977). The Internationalization Process of the Firm—A Model of Knowledge Development and Increasing Foreign Market Commitments. Journal of International Business Studies , 8, p.23-32.

Kato, Jerry. (2012). Curso de Finanças Empresariais: Fundamentos de Gestão Financeira em Empresas. São Paulo. M. Books.

Knight, G, & Cavusgil, S. (2004). Innovation, Organizational Capabilities and the Born Global Firm. Journal of International Business Studies, 35, p.124-142.

Mercado Comum do Sul. (2016). Available at: http://www.mercosul.gov.br/.

Ministério do Desenvolvimento Indústria e Comércio Exterior. (2016). Available at: http://www.desenvolvimento.gov.br/arquivo/secex/mpm/forpermanente/dadsegmento/definempe.pdf.

Morais, José Mauro de. (2008). Políticas de Incentivo a Inovação Tecnológica no Brasil. Instituto de Pesquisa Econômica Aplicada – IPEA, p. 389-430.

Penrose, T. Edith.(2003). The Theory of Growth of the Firms: Revista Brasileira de Inovação. v. 2, n. 1 jan/jun.

Pyka, Andreas, & Hanusch, Horst. (2007). A Roadmap to Comprehensive Neo-Schumpeterian Economics. Elgar Companion to Neo-Schumpeterian Economics 70, P. 1160-1170.

Vernon, Raymond. (196). International Investment and International trade in the Product Cycle. Harvard Graduate of Business Administration. Quarterly Journal of Economics, p.190-207.

Sondagem Industrial XIX 2014/2015. (2016). Available at http://www.fiepr.org.br/sindicatos/sindbor/News11328content272120.shtml.

Serviço Brasileiro de Apoio as Micro e Pequenas Empresas.( 2016). Available at: http://www.sebrae.com.br.

Sociedade Brasileira de Estudos de Empresas Transnacionais e da Globalização Econômica. (2007). Internacionalização das empresas brasileiras. 1 ed. São Paulo: Clio.

Soluções Inteligência Comercial. (2016). Available at: http://www.solucoesic.cni.org.br.

UNICEF, SWOT and PESTEL / Tools / UNICEF KE Toolbox. (2016). Available at: http://www.unicef.org/knowledge-exchange/files/SWOT_and_PESTEL_production.pdf.

Vernon, Raymond. (1966). International Investment and International trade in the Product Cycle. Harvard Graduate of Business Administration. Quarterly Journal of Economics, p.190-207.

World Trade Oganization. (2016). Available at: https://i-tip.wto.org/goods/Forms/GraphView.aspx .

World Bank. (2016). Disponível em http://data.worldbank.org/region/LAC.

1. Doctor by the Université de Paris III (Sorbonne Nouvelle). Post-Doctor by the Université de Picardie, Jules Verne, Amiens (2008) and by the University of Illinois at Urbana-Champaign (2015-2016). Professor in the Economic Department and in the Economic Development Graduation Course. CNPq Productivity Researcher. Email: ajdcosta@uol.com.br

2. Master in Economic Development by the Federal University of Paraná. Works at the Federation of Industry of Paraná State with internationalization of SMEs performing advisory and international market studies. Email: naijla23@gmail.com

3. Raw material cost, labor and overhead costs in the manufacture process; regulations and rules; financial expenses; administrative costs;

5. ICMS, IPI, PIS, COFINS, CSLL, IRPJ, others;

6. Internal Market sales price;

7. ICMS, IPI, PIS, COFINS, IOF, sales commission, financial expenses, import cost, drawback and tax particularity

8. Specialize consulting services, market research, international travel prospection, transportation package R, D & I costs, national and international transportation and insurance costs, consulate taxes. Also exchange, agent commission financing export expenses , credit insurance, certificate of origin, fumigation certification, label, manual, document, website translations, product and packaging adequacy, tariff and non-tariff barriers, advertisement, storing, handling, THC among others according to the product category.