HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 18) Año 2016. Pág. 11

Luciano Luiz DALAZEN 1; Wesley Vieira DA SILVA 2; Rodrigo Alexandre de MELO 3; Sandro Valdecir DERETTI 4; Claudimar Pereira DA VEIGA 5

Recibido: 02/03/16 • Aprobado: 23/03/2016

5. Analysis and Discussion of the Results

ABSTRACT: The understanding of risk tolerance bias is critical to properly optimize the investor's portfolio. In this context, the objective of this study is to investigate the academic production that involves risk tolerance and social demographic characteristics in decision making on investments. For this, a search was carried out in bases available in literature, considering the articles published between 1974 to 2014, searching for the key words: risk tolerance and financial. A systematic review was developed, exploring the theoretical contributions to the understanding of risk tolerance. However, the articles included in this study show a diversity of interests and findings of the main researchers in area. The results indicate that the field is still under construction and open to a lot of research possibilities. Thus, the interests and directions of research in the field of risk tolerance become evident, heading the field and the future possibilities of investigations about theme. |

RESUMO: O entendimento do viés tolerância ao risco é fundamental para otimizar adequadamente a carteira do investidor. Neste contexto, o objetivo deste estudo é investigar a produção acadêmica que envolve tolerância ao risco e características sócio-demográficas na tomada de decisões sobre investimentos. Para isso, realizou-se uma buscas nas bases disponíveis na literatura, considerando-se os artigos publicados entre 1974-2014, procurando as palavras-chave: tolerância ao risco e financeira. Uma revisão sistemática foi desenvolvida, explorando as contribuições teóricas para a compreensão da tolerância ao risco. No entanto, os artigos incluídos neste estudo mostram uma diversidade de interesses e conclusões dos principais pesquisadores na área. Os resultados indicam que o campo ainda está em construção e aberto a uma série de possibilidades de pesquisa. Assim, os interesses e as linhas de pesquisa no campo da tolerância ao risco tornam-se evidentes, indo do campo de conhecimento às possibilidades futuras de investigações sobre o tema. |

Behavioral finance represents a new field of research and acquire recognition in the world, because shows a new model for decision making towards risk. Research in this horizon evolves significantly, stimulating special attention in this field of study (Gava; Vieira, 2006; Halfeld; Torres, 2001; Lima, 2003; Nobre et al., 2016). For Castro Junior and Famá (2002), behavioral finance results of the interaction between two fields: finance and psychology, in order to explain the rationality of the decision maker. It can be seen that the world is constantly changing, and time is becoming smaller to learn, evaluate and make decisions. In this sense, the decision-making becomes an increasingly complex process and the rationality of the decision maker in relation to risk gains importance in the study of behavioral finance.

Although the behavior related to risk is an important element in theories of consumer choices, evaluation of assets and safe contracts, there is not an understanding of how risk tolerance should be modeled (Holt; Laury, 2002; Moralejo et al., 2016; Moreira et al., 2016). According to Irwin (1993, p.11), the systematic review of factors related to risk tolerance is defined as the willingness to engage in "behaviors that the results remain uncertain with the possibility of identifying a negative result." So the systematic review of behavior in relation to risk, has become an important research subject in financial planning, psychological and economic occupations. For over the past decade the academic and financial communities have appreciated the service of professionals with knowledge of risk tolerance, an appreciation that has been growing substantially.

However, according to Anbar and Eker (2010), demographic characteristics are thoroughly investigated to determine risk tolerance. Although some researchers use the term "demographic characteristics" and other researchers use "sociodemographic characteristics", there is a consensus between investment researchers about the fact that socio and demographic characteristics can be used both to differentiate levels of investor risk tolerance, and to classify the categories of risk tolerance (Anbar; Eker, 2010). Also according Anbar and Eker (2010), there are some unresolved issues regarding the determinants of risk tolerance. In this sense, the objective of this research is to investigate the academic production that involves risk tolerance and social demographic characteristics in decision making on investments. The results of this study can lead researches, from the analysis of its key contributions about the topic discussed, showing the diversity of interests and findings of the researchers in the field that is still under construction.

Studies related to the Theory of Behavioral Finance were added to financial context in the last two decades as an option to the traditional finance theory, which considers that financial markets are efficient (Júnior; Fama, 2002). So, for Junior and Famá (2002), behavioral finance is the product of combining two fields of knowledge, finance and psychology, and the reason to address these two fields is to explain the rationality of individuals in decision making situations, considering the aspects related to finances, combined with aspects from behavioral psychology. Thus, the limited rationality of the individual is considered as a factor that precludes him to make the best possible decision regarding their investments.

According to Fama and French (1988), many models of individual behavior were identified by several researchers, for example, loss aversion and overconfidence, but these models have not been able to formulate a consolidated model that comprise all of the characteristics of individual behavior. According Halfeld and Torres (2001b), only at the end of the 70s Behavioral Finance began to be discussed in academia, especially with the publication of the psychologists Kahneman and Tversky (1979) about behavior and decision making process of individuals in situations involving some degree of uncertainty. In addition to the study of Kahneman and Tversky 1979, there was a predecessor to this study, conducted in 1974, but both represent the theoretical basis regarding investor behavior, and played an important role in the development of behavioral finance.

For Bikas et al. (2013) behavioral finance is based on human recognition research, social research and emotional tolerance aspects seeking to identify and understand financial decisions. Behavioral finance analyzes the recognition and influence of the emotional factor relative to changes in the market, converging on the bounded rationality of human beings (BIKAS et al., 2013). The behavioral finance has his foundations on psychology, providing arguments on the financial activities to better explain financial phenomena, considering that financial market participants are not totally rational, and its decisions are bounded (BIKAS et al., 2013). According Souza et al. (2011), the goal to study behavioral finance is to identify and understand the cognitive illusions that make individuals commit errors of judgment in decision making. That is why individuals do not act rationally, because they are prone to the effects of cognitive illusions (Souza, 2011).

Risk tolerance is a common term in financial market, but there are considerable variations in the definitions that are used, however, the most cited consider risk tolerance as the level of volatility that an investor can tolerate, the degree that people feel comfortable with risk and return, or the amount of loss that someone risks incurring (Roszkowski; Davey; Grable, 2005; Veiga et al. 2016). Thus, risk tolerance is a level at which investor accepts the risks of an investment, and each individual presents greater or lesser risk tolerance, considering his behavioral aspects.

Some individuals are more willing to make decisions that involve greater risks than others, so, these individuals tend to tolerate better market fluctuations (Halfeld; Torres, 2001a). The age of the investor, for example, is a determinant factor in investment decision making, and the most risky investments are the most recommended for young investors, because if the younger investor has losses, he will has a longer time to recover his money (Halfeld; Torres, 2001a). Risk tolerance is a determinant factor for the proper composition of a portfolio of assets for individual investors, and the portfolio is optimized in terms of risk and return considering the individual needs (Droms, 1987; Ciscato el tal., 2016). So, the investment fund managers shall forecast risk tolerance of each investor before plans that customer investment portfolio, aiming to structure consistent portfolios with the client willingness to take risk (Droms; Strauss, 2003; Rocha et al., 2016). Jacobs and Levy (1996) show that the lack of determine effectively risk tolerance of each investor can lead to a homogenization of the chosen investment funds.

There are studies considering a lot of variables that impact risk tolerance and this risk could be greater or lesser considering investor's individual characteristics. Some examples of variables are age, individual needs and psychosocial factors, these variables impact in the level than one investor will tolerate more or less risk. Thus, behavioral finance is an important field to understand the investor's action from his bounded rationality, due to his behavioral factors.

This study is a descriptive research, because "notes, records, analyzes and correlates events or phenomena without manipulating them" (Hart; Bervian, 2002). The descriptive approach was adopted to show the risk tolerance field, it is still a field under construction and open to different possibilities of research. , so this descriptive approach explores the field and provides an analysis of it. Was adopted a systematic review to undertake a thorough summary of the papers related to a specific issue in a specific period of time (Tranfield; Denyer; Smart, 2003). Systematic review differs from literature review, since it seeks to overcome possible biases at every stage, following a rigorous method of search and selection of research, making evaluation of the relevance and validity of research, and found collection, synthesis and interpretation of data from the research (Ciliska; Cullum; Marks, 2001; Zembo et al., 2016). A systematic review starts with a clear question, with an appropriate definition for bibliographic search, besides an adequacy of inclusion and exclusion criteria of works already done on the subject, and a critical analysis of the selected material (Sampaio; Mancini, 2007). Is intended to explore risk tolerance field, to understand what contributes to individual tolerates more or less risk in his investment decisions. For this, seeks to answer the following question: what are the main studies that involve risk tolerance and sociodemographic characteristics in decision making on investments? Was made a survey of articles on the basis of journals CAPES/MEC/Web of Science (http://www.periodicos.capes.gov.br), and the data collection followed some parameters:

Were indexed 27 articles that showed positive result for the adopted filters, of these 7 were excluded in the first purification because appeared in duplication with other bases of journals, resulting 20 articles. In a second analysis were excluded 8 articles, because they did not presented relationship with sociodemographic characteristics, as the term risk tolerance is also used in health care. There were 12 articles related to risk tolerance and sociodemographic characteristics. The detailing of these articles is presented in Table 1, organized by the number of articles published in the year (P), the year of publication, and the quotes.

Considering the articles collected to this research, in 2004 came the first article covering risk tolerance, held by John E. Grable and So-Hyun Joo (2004), and they attempted to increase the understanding of the determinants of risk tolerance, using classifications of environmental and biopsychosocial factors as the basis of research. Grable and Joo (2004) obtained results of a test conducted to determine the effects of demographic, socioeconomic and psychosocial in risk tolerance, this work promote over 50 other articles, as verified by citations in Google Scholar.

The work Grable and John (2004) instigated the research in this field, which can be seen in the year of 2005 with three productions, totaling 136 citations in the field. However there has been a gap between the years of 2005 and 2008, there were no one production in the field. In 2008 there was only one work, the work of John E. Gillian, Joseph W. Goetz and Vickie L. Hampton, which aimed to determine the disposition of couples on investment financial risk, trying to analyze if there was differences in the level of risk tolerance in the families interviewed, based on the action of the spouse. The work of Gillian, Goetz and Hampton (2008) impacted in 16 articles. The year 2010 had the highest number of productions that involve risk tolerance and sociodemographic characteristics, totaling four productions, but promoting a total of 52 new works. In an overview, it can be seen that generally the works were carried out by pairs and trios; only one work was carried out by four authors, in 2010.

Table 1 - Total of articles published per year

N |

Year |

P |

Article Title |

Q |

Authors |

1 |

2004 |

1 |

1 - Environmental and Biophysical Factors Associated with Financial Risk Tolerance |

50 |

John E. Grable So-Hyun Joo |

2 |

2005

|

3 |

1 - The financial risk tolerance of Blacks, Hispanics and Whites |

90 |

Rui Yao Michael S. Gutter Sherman D. Hanna |

3 |

|

2 - Estimating risk tolerance: The degree of accuracy and the paramorphic representations of the estimate |

35 |

Michael J. Roszkowski John E. Grable |

|

4 |

|

3 - Assessing Financial Risk Tolerance of Portfolio Investors Using Data Envelopment Analysis |

11 |

Parisa H. Ardehali Joseph C. Paradi Mette Asmild |

|

5 |

2008 |

1 |

1 - Spousal differences in financial risk tolerance |

16 |

John E. Gillian Joseph W. Goetz Vickie L. Hampton |

6 |

2010

|

4 |

1 - Measuring the perception of financial risk tolerance: A tale of two measures |

26 |

John E. Gillian Swarn Chatterjee John E. Grable |

7 |

|

2 - An empirical investigation for determining of the relation between personal financial risk tolerance and demographic characteristic |

18 |

Adem Anbar Melek Eker

|

|

8 |

|

3 - The role of assertiveness in portfolio risk and financial risk tolerance among married couples |

1 |

John E. Gillian Mayukh Dass Dorothy B. Durband Vickie L. Hampton |

|

9 |

|

4 - 2010 Outstanding AFCPE ® Conference Paper : Gender Differences in Financial Socialization and Willingness to Take Financial Risks |

7 |

Selena T. Garrison Michael S. Gutter

|

|

10 |

2011 |

1 |

1 - An Investigation of Response Bias Associated with Electronically Delivered Risk-Tolerance Assessment |

1 |

John E. Grable Sonya L. Britt |

11 |

2012 |

1 |

1 - A longitudinal study of financial risk tolerance |

13 |

Gerhard Van de Venter David Michayluk Geoff Davey |

12 |

2013 |

1 |

1 – Financial Attributes and Investor Risk Tolerance at the Nairobi Securities Exchange – A Kenyan Perspective |

1 |

G. S. Namusonge T. Olweny S. Onyango |

Legend: N (serial number of the article); P (Production); Q (Quote).

Source: data research

Figure 1 illustrates the citations occurred from works during the period 2004 to 2013, totaling 269 citations, this is, 269 new works were held, considering on the 12 articles analyzed in this study. A downward trend can be observed looking to the number of quotes of the 12 articles, as citations drastically reduced in a short range of time. This could be related to several factors.

Figure 1 – Quotes per year

Source: data research

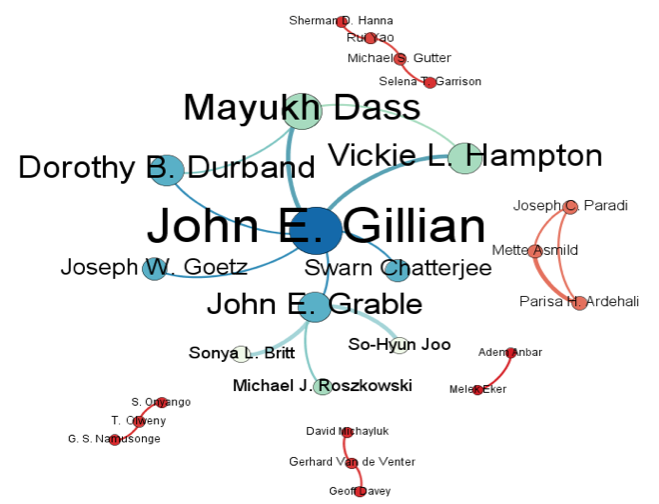

Table 2 presents authors with greater Betweenness Centrality, it is observed that the authors John E. Gillian and John E. Grable have the highest rates of this indicator, therefore they have greater influence on the network. According to Newman (2004) Betweenness Centrality is an important indicator to measure the interdisciplinary, enabling assess when an author is open to interaction with other groups of authors.

Table 2 - Betweenness Centrality of the authors

Authors |

Betweenness Centrality |

John E. Gillian |

27.5 |

John E. Grable |

21.0 |

Michael S. Gutter |

2.0 |

Rui Yao |

2.0 |

T. Olweny |

1.0 |

Gerhard Van de Venter |

1.0 |

Mayukh Dass |

0.5 |

Source: data research

The results of network statistics are presented in Table 3, together with the network visualization in Figure 2, allows a detailed analysis of possible interpretation of the network. Thus, the network interpretation considers the network as undirected, this is all the edges are two-dimensional. An important point is that the sizes of the nodules vary according to its centrality. Eigenvectory Centrality is a centrality measure for each node, which indicates how many times it appears between any two random nodes of the network. Since the node acts as a junction of communication within the network, and the greater the volume of it, the greater the influence of the node (Brandes 2001; Freeman, 1977). However, this influence does not concern about the impact (i.e. the number of citations in other studies) of an author. Looking at Figure 2, John E. Gillian has the greater number of connections in the network. However, it is interesting to note that despite the influence do not represent the number of quotes, going back to Table 1, John E. Grable has authored or co-authored articles that have been quoted in other 112 works and is the author most quoted in this field of study as well. Furthermore, the modularity measure is applied to detect the different communities within the network, considering values greater than 0.4. There are nodes in the network that are more densely connected to each other than with the rest of the network, so the density is noticeably higher than the centrality of the graph (Blondel Et Al., 2008). Finally, the 12 articles included in this study have seven communities about the subject.

Table 3 - Results of network statistics

Estatísticas |

Valores |

Network interpretation |

Undirected |

Eigenvectory Centrality |

0,003872 |

Density |

0,073 |

Modularity |

0,751 |

Number of Communities |

7 |

Source: data research

To better understand the communities, it is necessary to resort to Figure 2, this figure shows the map of interactions between the articles, from the name of the authors, setting up a network that illustrates these relationships.

Figure 2 - Network mapped from the interactions of authors

Source: data research

To view the graphs, that is, the graphic representation of an interactive network, was used the Force Atlas algorithm. This algorithm has the ability to bring together the nodles through the strength of their iterations, creating cluster within the same network (Jacomy; Venturini, 2011). Force Atlas algorithm is the type directed force, in other words, it constantly analyzes each node and reposition the node until the user manually stop its execution (Jacomy; Venturini, 2011). This is one of the advantages of this algorithm because the user decides when the network presents a better visual aspect for analysis (Jacomy; Venturini, 2011).

The analysis of 12 studies follows with the purpose of the study, description of each author and the main results obtained by them. In the first of 12 studies, Grable and John (2004) aimed to previously expand academic efforts about the understanding of the determinants of risk tolerance, using classifications of environmental and biopsychosocial factors as the basis of research, raising the effects of demographic characteristics, socioeconomic and psychosocial on risk tolerance. To Grable and John (2004) the level of education, marital status, assets, financial literacy and household income are related to the risk tolerance as environmental factors, as well as another factor that is related to the risk tolerance, self-esteem, a biopsychossocial variable. The results of Grable and John (2004) recommend that future research take into account both environmental factors, as biopsychosocial factors to explain the risk tolerance to risk.

In the following year, Yao, Gutter and Hanna (2005) aimed to analyze the relationship between financial risk tolerance and race and ethnicity, their results indicate that Caucasian have higher risk tolerance in relation to Afros and Hispanics, who in turn have less likely to take high financial risks. In the same year, Roszkowski and Grable (2005) had as its first objective to determine as financial advisors and clients are effective in estimating risk tolerance, and to identify the process of judgement through a multiple regression using the items of a risk tolerance and demographic characteristics test. The results of Roszkowski and Grable (2005) showed that when it comes to estimating the own risk tolerance, clients are more assertive than financial advisors, in addition, accessor attributes high values in the diagnosis of certain demographic characteristics in the estimation of risk tolerance. In the latest study of this year, Ardehali, Paradi and Asmild (2005) analyzed the profile of investor risk using a envelopment data analysis and demographic characteristics, which proved be successful, and can be applied in situations where there is no other scientific methods consolidated.

In 2008 there was only one study in relation to the 12 studies raised to this investigation. Gillian, Goetz and Hampton (2008) sought to determine the disposition of the couples against the risk of investments and consider if there was differences in risk tolerance of families based on action of the spouse. The results of Gillian, Goetz and Hampton (2008) showed a positive relationship between risk tolerance and the level of education of wives, indicating that individuals with higher levels of education tend to have higher risk tolerance levels.

The year 2010 had the largest number of publications. Gillian, Chatterjee and Grable (2010) compared two risk tolerance measures and examined the association between risk tolerance measures and asset allocation, confirming items that offer a reasonable way to assess risk tolerance. Anbar and Eker (2010) investigated the relationship between sociodemographic characteristics and risk tolerance, indicating that gender, department, personal income, family income and total net assets were significant in differentiating individuals at risk tolerance levels, but age, marital status and the number of children were not significant. Gillian et al. (2010) had two goals: to determine if the couples joint assertiveness had impact on risk tolerance and examine the effect of education, asset ownership, gender, relative income of the husband and wife on the assertiveness of both. The results of Gillian et al. (2010) indicated that the assertiveness of the couple had no impact on risk tolerance, however the wives assertiveness had a positive correlation with the average age of the couple and a negative correlation with the husbands income. Garrison and Gutter (2010) sought to determine the effect of gender and financial social learning opportunities at different levels of willingness to take financial risks, revealing that there is a difference between gender in relation of the willingness to take financial risks in older populations, but there is just a little attention to evaluating university students.

Grable and Britt (2011) sought to determine if the evaluation methods influence how individuals answer the questions related to perceived risk investments. The results of Grable and Britt (2011) indicated that men had a higher risk tolerance than women, when responding electronically a risk tolerance questionnaire, suggesting that future research in the area should consider these possibilities as influencing factors to risk tolerant assessment for answers. This study was the only one of the 12 studies conducted in 2011.

Venter, Michayluk and Davey (2012) sought to check over five years if there is variability in relation to risk tolerance of college students. Venter, Michayluk and Davey (2012) obtained results that indicated a very small annual variation in financial risk tolerance to individuals, which suggests that financial risk tolerance is a stable personality trait and is unlikely to change substantially over the life of an individual. This year had also only one study, considering the 12 articles.

Last but not the least, Olweny, Namusonge and Onyango (2013) investigated financial attributes which affect risk tolerance of individual investors in Nairobi Securities Exchange of Kenya. To do this, Olweny, Namusonge and Onyango (2013) conducted an analysis of variance on incomes, this analysis was significant in relation to individual income, so influences risk tolerance. Following, Olweny, Namusonge and Onyango (2013) evaluated that risk tolerance is higher in situations of higher individual income, except for those individuals who earned more than $120,000 monthly. This was the last of the studies raised in this article, for the period under review publications.

Table 4 shows the total number of articles collected in the journal databases, considering the period from January 1st of 1974 to June 26th of 2014. The database which had the highest number of articles was Scopus (i.e. Elsevier) with 10 articles.

Table 4 - Total of articles published by the Database of Journal's (1974-2014)

Database |

Journal |

Q |

Impact Factor |

|

JCR |

SJR |

|||

Scopus (Elsevier)

|

Journal of Financial Counseling and Planning |

7 |

- |

0.326 |

Asian Social Science |

1 |

- |

0.139 |

|

International Journal of Information Technology & Decision Making |

1 |

1.890 |

0.778 |

|

Journal of Economic Psychology |

1 |

|

1.257 |

|

Directory of Open Access Journals (DOAJ) |

Ege Academic Review |

1 |

- |

- |

Journal of Financial Therapy Association |

1 |

- |

- |

|

Legenda: Q (Quantity)

Source: data research

However, because it is a systematic review, it is important to identify the principal investigators and their institutions. Then, as shown in Table 1, the main researchers of behavioral finance, studying risk tolerance, are linked to institutions located in the United States of America. However, there are researchers in other parts of the world, Australia, Canada, Kenya, Turkey and the United Kingdom. The institutions are presented in Table 5, considering the authors.

Table 5 - Location of the University of Authors

University |

Country |

University of Technology |

Australia |

University of Toronto |

Canada |

Jomo Kenyatta University |

Kenya |

KCA University |

Kenya |

Uludağ üniversitesi |

Turkey |

University of Nottingham |

United Kingdom |

Dakota State University |

USA |

Kansas State University |

USA |

La Salle University |

USA |

Ohio State University |

USA |

Texas Tech University |

USA |

Univerity of Georgia |

USA |

University of Florida |

USA |

University of Wisconsin-Madison |

USA |

Source: data research

A new field of research in management is based on the subject of behavioral finance, important to show a new model for decision-making before the investment risk. On the other hand, in this field there are still some unresolved issues regarding the determinants of risk tolerance. This study aimed to investigate the academic production that involves risk tolerance and sociodemographic characteristics, raising 12 articles.

The seminal study in this field was produced in 2004, developed by the authors John E. Grable and So-Hyun Joo, they sought to expand the understanding of the determinants of risk tolerance, using classifications of environmental and biopsychosocial factors as the basis of research. The study of Grable and John instigated the research in this area of knowledge, and reflects in other 3 studies in the following year (2005), totaling 136 quotes. The year of 2010 had the highest number of productions which involve risk tolerance and sociodemographic characteristics, totaling four productions, and promoting a total of 52 new works. The quotes occurred from works during the period 2004 to 2013 add up to 169 new works. John E. Gillian has the largest number of connections in the network of sociodemographic characteristics relate to risk tolerance in decision making on investments. While John E. Grable was author or co-author in articles that have been quoted in other 112 works, and he is the author most quoted in this field.

As regards sociodemographic characteristic founded, Grable and John (2004) analyzed educational level, marital status, assets, financial literacy and household income, as well as self-esteem. Yao, Gutter and Hanna (2005) analyzed race and ethnicity, whereas Roszkowski and Grable (2005) evaluated gender, marital status, age, number of dependents, level of education, years in the same job, income, net wealth, sector in which is employed and the type of investment. In addition, Ardehali, Paradi and Asmild (2005) looked pretty much to the same sociodemographic characteristics, but including number of dependents. Gillian, Chatterjee and Grable (2010) also used similar features but included male or female primary earner. Gillian, Goetz and Hampton (2008) looked to the husbands and wives level of education. Anbar and Eker (2010) evaluated gender, department, personal income, family income and total of assets as significant in differentiating individuals at risk tolerance levels, but age, marital status and number of children were not significant. Gillian et al. (2010) evaluated the assertiveness of the couple, and had no impact on risk tolerance, however the women assertiveness had a positive correlation with the average age of the couple and a negative correlation with the husband's income. Garrison and Gutter (2010) sought to determine the effect of gender and financial social learning opportunities available in different levels to take financial risks. Grable and Britt (2011) evaluated that men had a higher tolerance for risk than women when responding electronically a risk tolerance questionnaire. Venter, Michayluk and Davey (2012) sought to check over five years if there is variability in relation to the risk tolerance of college students. Finally, Olweny, Namusonge and Onyango (2013) conducted an analysis of variance on income.

Despite the descriptive feature, this research fulfills its purpose, thus leaving a contribution to the field. The objective of this research was to investigate the academic production which involves risk tolerance and social demographic characteristics in decision making on investments. From this, the results indicated that literature is incipient, based on the analysis of the main contributions about the topic discussed, showing that there is a diversity of interests and findings of the researchers in this field, but it is still under construction. The opportunity for further studies is based on the description of this field, 12 studies were raised to analysis, and researchers who seek to study risk tolerance can take they as fundamental articles for their research. The 12 articles described herein, can be used either to support theoretical foundation, as to appropriate concepts and criticize them noticed the downward trend in the number of quotes. So this fall of quotes may be related to several factors, from the abandonment of the field, even new concepts and items that may be coming to replace the 12 articles raised here. Finally, this research is limited because it is merely descriptive, but it makes its contribution to evaluate a field that still is incipient, providing an outlook for future studies from the raised articles.

ANBAR, A.; EKER, M. An empirical investigation for determining of the relation between personal financial risk tolerance and demographic characteristic. Ege Academic Review, v. 10, n. 2, p. 503–523, 2010.

BIKAS, E. et al. Behavioural Finance: The Emergence and Development Trends. Procedia - Social and Behavioral Sciences, v. 82, p. 870–876, jul. 2013.

BLONDEL, V. D. et al. Fast unfolding of communities in large networks. journal of statistical Mechanics: Theory and Experiment, p. 1–12, 2008.

BRANDES, A. Faster Algorithm for Betweenness Centrality. In Journal of Mathematical Sociology, v. 25, n. 2, p. 163–177, 2001.

CERVO, A. L.; BERVIAN, P. A. Metodologia científica. 5a. ed. São Paulo: Prentice Hall, 2002.

CILISKA, D.; CULLUM, N.; MARKS, S. Evaluation of systematic reviews of treatment or prevention interventions. Evidence-Based Nurs, v. 4, n. 4, p. 4–100, 2001.

CISCATO, C., BARDEN, V., CASTOLDI, A. V., FREITAS, W. A., VEIGA, C. P., DUCLÓS, L.C.Mapa Estratégico: Uma Pesquisa-Ação para a melhoria do fluxo de caixa em uma indústria têxtil no sul do Brasil. Espacios, v. 37, p. 6, 2016.

DROMS, W. G. Investment asset allocation for FPF clients. Journal of Accountancy, p. 114–118, abr. 1987.

DROMS, W.; STRAUSS, S. N. Assessing risk tolerance for asset allocation. Journal of Financial Planning, mar. 2003.

FAMA, E. F.; FRENCH, K. R. K. R. Permanent and temporary components of stock prices. The Journal of Political Economy, v. 96, n. 2, p. 246–273, 1988.

FREEMAN, L. C. A Set of Measures of Centrality Based on BetweennessSociometry, 1977. Disponível em: <http://www.jstor.org/stable/3033543?origin=crossref>

GAVA, A. M.; VIEIRA, K. M. Tomada de Decisão em Ambiente de Risco: uma Avaliação sob a Ótica Comportamental. Revista Eletrônica de Administração, p. 1–17, 2002.

GRABLE, J. E.; JOO, S.-H. Environmental and Biophysical Factors Associated with Financial Risk Tolerance. Journal of Financial Counseling and Planning, v. 15, n. 1, p. 73–82, 2004.

HALFELD, M.; TORRES, F. Finanças comportamentais: a aplicações no contexto brasileiro. Revista de administração de empresas, v. 41, n. 2, p. 64–71, 2001a.

HALFELD, M.; TORRES, F. L. Finanças Comportamentais: aplicações no contexto brasileiro. Revista de Administração de empresas, v. 41, 2001b.

HOLT, C. A.; LAURY, S. K. Risk aversion and incentive effects. The American Economic Review, v. 92, n. 5, p. 1644–1655, 2002.

IRWIN, C. E. Adolescence and risk taking: How are they related? In: Newbury Park CA: Sage, 1993. p. 11.

JACOBS, B. .; LEVY, K. N. Residual Risk: How much is too Much? Journal of Portfolio Management, v. 22, p. 10–16, 1996.

JÚNIOR, F. C.; FAMÁ, R. As novas finanças ea teoria comportamental no contexto da tomada de decisão sobre investimentos. Caderno de pesquisas em …, v. 9, n. 2, p. 25–35, 2002.

KAHNEMAN, D.; TVERSKY, A. Prospect theory: an analysis of decision under risk. Econometrica, v. 47, n. 2, p. 263–291, mar. 1979.

KUDLAWICZ, C., BACH, T. M., VEIGA, C. P., SENFF, C. O., SILVA, W. V.Cointegrations Relationship and Causality between Exportations and Economic Growth from Southern Americas Countries and the United States. WSEAS Transactions on Business and Economics, v. 13, p. 162-174, 2016.

LIMA, M. Um estudo sobre finanças comportamentais. RAE eletrônica, v. 2, p. 1–19, 2003.

MILANEZ, D. Y. Finanças comportamentais no Brasil. São Paulo: Universidade de São paulo, 2003.

MORALEJO, L., ROGERS, P., DUCLÓS, L.C., VEIGA, C. P. Brazilian Residential Real Estate Bubble. WSEAS Transactions on Business and Economics, v. 13, p. 86-93, 2016.

MOREIRA, V. R., FREIER, Axel; VEIGA, C. P. A Review of Concepts, Strategies and Techniques Management of Market Risks in Agriculture and Cooperatives. International Business Management, v. 10, n. 6, p. 739-750, 2016. DOI: 10.3923/ibm.2016.739.750

NEWMAN, M. E. J. Coauthorship Networks and Patterns of Scientific Collaboration. Proceedings of the National of Academic Sciences, v. 101, p. 5200–5205, 2004.

NOBRE, L. H. N., GRABLE, J. E., SILVA, W. V., VEIGA, C. P., A Cross Cultural Test of Financial Risk Tolerance Attitudes: Brazilian and American Similarities and Differences. International Journal of Economics and Financial Issues, v. 6, p. 314-322, 2016.

ROCHA, C., DUCLÓS, L.C., VEIGA, C P., BISCHOF DOS SANTOS, C., NEVES, N. A. F. The control mechanisms on the performance of the strategic initiatives management: analysis of critical sales process in a metallurgical business. International Business Management, v. 10, p. 357-369, 2016. DOI: 10.3923/ibm.2016.357.369

ROGERS, P.; FAVATTO, V.; SECURATO, J. R. Efeito educação financeira no processo de tomada de decisões em investimentos: um estudo a luz das finanças comportamentais. Salvador: 2008

ROSZKOWSKI, M. . J.; DAVEY, G.; GRABLE, J. E. Questioning the questionnaire method: insights from psychology and psychometrics on measuring risk tolerance. Journal of Financial Planning, 2005.

SAMPAIO, R.; MANCINI, M. Estudos de revisão sistemática: um guia para a síntese criteriosa da evidência científica. Revista Brasileira de Fisioterapia, v. 11, n. 1, p. 83–89, 2007.

SOUZA, F. J. V. DE et al. A Educação Financeira e a Sua Influência na Tomada de Decisões. Revista de Contabilidade UFBA, v. 5, n. 2, p. 81–95, 2011.

TRANFIELD, D.; DENYER, D.; SMART, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, v. 14, p. 207-222, 2003.

TVERSKY, A.; KAHNEMAN, D. Judgment under uncertainty: Heuristics and biases. Science, v. 185, n. 4157, p. 1124–1131, set. 1974.

VEIGA, C. P., VEIGA, C. R. V., TORTATO, U. Demand Forecasting Strategies: understanding the most important concepts. Espacios, v. 37, n. 5, p. 6, 2016.

ZEMBO, A. S., ROCHA, C., ZDZIARSKI, A. D., VEIGA, C. P., DUCLÓS, L. C., Balanced Scorecard: a reflection on its use in an Brazilian Organization of the Third Sector. European Journal of Social Sciences, v. 51, p. 91-105, 2016.

1. Pontifícia Universidade Católica do Paraná – PUC PR, Brasil - ldalazen@yahoo.com.br

2. Pontifícia Universidade Católica do Paraná – PUC PR, Brasil – wesley.vieira@pucpr.br

3. Pontifícia Universidade Católica do Paraná – PUC PR, Brasil – rodrigoMelo09@hotmail.com

4. Universidade Estatual do Paraná – UNESPAR, Brasil – sandro.deretti@unespar.edu.br

5. Pontifícia Universidade Católica do Paraná – PUC PR e Universidade Federal do Paraná – UFPR , Brasil - claudimar.veiga@gmail.com