HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 14) Año 2016. Pág. 30

Gilberto Joaquim FRAGA 1

Recibido: 02/02/16 • Aprobado: 14/03/2016

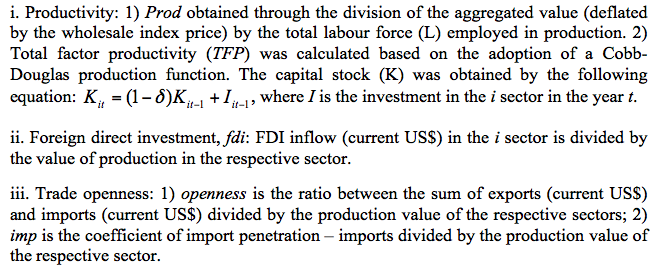

2. Variables and Empirical Specification

ABSTRACT: This paper aims to analyse the relationship among foreign direct investment (FDI), trade openness, and labour and total factor productivity in the Brazilian manufacturing industry. To achieve the proposed objective, twenty-two sectors are analysed from 1996 to 2007, and dynamic panel data are used. The results show that FDI, trade openness and import penetration coefficients present parameters with a positive sign and are statistically significant in affecting labour productivity. However, when the total factor productivity is analysed, the main indicators are FDI and trade openness. |

RESUMO: O presente artigo busca analisar a relação entre investimento estrangeiro direto (IED), abertura commercial e produtividade do trabalho e total dos fatores na indústria de transformação do brasileira. Para alcançar os objetivos propostos utilizou-se o procedimento de dados em painel dinâmico a partir dos dados de vinte e dois setores no período de 1996 a 2007. O IED, abertura commercial e a penetração das importações apresentaram coeficientes positivos e estatísticamente significantes para afetar a produtividade do traalho. Entretanto, quando se analisa a produtividade total dos fatores, as variaveis de maior influência são IED e abertura comercial. |

Amongst the developed countries, Brazil has been designated as a major recipient of foreign direct investment (FDI), primarily since the second half of the 1990s, with the consolidation of economic stability and greater trade and financial openness. In 2007, FDI inflows [2] in Brazil showed a level approximately 5.6 times greater than the amount recorded in 1996. Although the degree of trade openness of the Brazilian manufacturing industry has not grown with great intensity, it has increased by approximately ten percentage points. Of this large inflow of FDI to the Brazilian economy, the manufacturing industry received an FDI share of 22.7% in 1996, and this share increased to 36.1% in 2007. With this strong growth in global FDI flows, the potential economic well-being benefits for receiving countries have been discussed more frequently (Borensztein et al., 1998; Alfaro et al., 2004, 2009; Crespo and Fontoura, 2007; Haskel et al., 2007; Yasar and Paul, 2007, Calegário et al., 2014).

Some of the potential gains from FDI inflows to a country (sector) would be productivity gains through technology transfer, the introduction of new processes, management skills, domestic market knowledge, international production networks and access to new markets (ALFARO et al., 2004).

Regarding trade openness, there is evidence from both macro- and microeconomics that recommends accelerating of the opening process to increase the productivity of the economy (Edwards, 1998; Alcalá and Ciccone, 2004). Knowledge of these effects is crucial to the formulation of policies to promote productivity and economic growth.

The aim of this study is to evaluate whether FDI inflows and trade openness can contribute to increasing the productivity of the Brazilian manufacturing industry after trade openness consolidation. The econometric procedure uses dynamic panel data that allows for considering the potential endogeneity of the variables. This study is expected to contribute to the literature by assessing whether there is a statistically significant relationship among FDI, trade openness and productivity.

Following the introduction, this article is organised as follows: the variables and empirical specification are provided in section 2, the estimates are presented in section 3, and section 4 concludes the paper.

The data used in this study were obtained from twenty-two sectors of the Brazilian manufacturing industry from 1996 to 2007 [3]. The industry data were acquired from IBGE's Annual Industrial Survey. The data related to FDI inflow in the sector were obtained from the Brazilian Central Bank. The variables linked to international trade were obtained through the aliceweb2 system from the Ministry of Development, Industry and Foreign Trade of Brazil. The following variables are used:

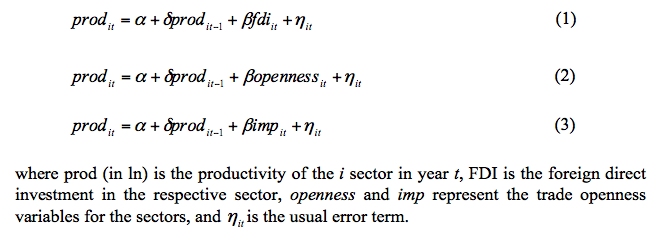

The empirical strategy uses a specification similar to that used in other studies in this field (e.g., Bloom et al, 2011) and the econometric procedure with dynamic panel data (GMM-System), which can solve potential endogeneity (see Arellano and Bond, 1991; Blundell and Bond, 1998) and reverse causality problems. The direct effect of FDI and trade openness on productivity (labour and TFP) is demonstrated by the following general empirical specification:

The main objective of the econometric estimate is to assess the economic effects and statistical significance of the coefficients of the interest variables. First, the study will analyse the relationship between FDI and labour productivity in the manufacturing industry according to equation (1). The estimates shown in table 1 (regressions 1 and 1a) confirm that there is a statistically significant positive relationship (at the 5% level) between FDI and industrial productivity, considering both labour productivity (ProdL) and TFP. Thus, the results suggest that a greater inflow of FDI to the Brazilian industry contributes to increased productivity, which confirms the benefits of the firms' activities with foreign participation in the capital.

Table 1 Estimated Results: FDI and Productivity

Variables |

Labour (Prod-L) |

TFP |

(1) |

(1a) |

|

prodt-1 |

0.781*** |

-0.4623*** |

(0.0755) |

(0.1383) |

|

fdi |

0.653** |

0.7336** |

(0.290) |

(0.328) |

|

constant |

0.732*** |

-0.020* |

(0.268) |

(0.012) |

|

dummy time |

yes |

yes |

AR2 |

0.990 |

0.159 |

Validity of the instruments (Sargan/Hansen) |

0.137 |

0.99 |

Notes: Robust SE are in parentheses. Fixed effects are controlled.

The year 2007 has been excluded from the estimates because of numerous missing observations.

*, **, and *** denote significance at 10, 5 and 1% levels, respectively.

This result is consistent with the current literature, such as the studies by Javorcik (2004) and Haskel et al. (2007). The results above are conditional upon testing for serial correlation according to Arellano and Bond (AR2) and the validity of the instruments [4] used. According to the statistics, the hypothesis of second-order correlation is rejected (0,990), and the Sargan statistic (0,137) shows that the instruments are appropriate. Thus, the results confirm that the findings are valid for ProdL and TFP and indicate that one means of achieving higher productivity growth in Brazilian industry is to allow the inflow of FDI.

Table 2 presents the results of estimated equations (2) and (3) for the trade openness indicators and import penetration, respectively.

Table 2 Estimated Results: openness, import and productivity

Variables |

Openness |

Import penetration |

||

ProdL |

TFP |

ProdL |

TFP |

|

(2) |

(2a) |

(3) |

(3a) |

|

prodt-1 |

0.889*** |

-0.257** |

0.896*** |

0.041 |

(0.0482) |

(0.127) |

(0.0358) |

(0.1371) |

|

openness |

0.115* |

0.329* |

|

|

(0.0697) |

(0.197) |

|||

imp |

|

0.102*** |

0.0099 |

|

(0.0375) |

(0.0286) |

|||

constant |

0.308* |

11.047 |

0.310*** |

-0.0019 |

(0.184) |

(12.669) |

(0.112) |

(0.0105) |

|

dummy time |

yes |

yes |

yes |

yes |

AR2 |

0.817 |

0.724 |

0.768 |

0.089 |

Validity of the instruments (Sargan/Hansen) |

0.256 |

0.129 |

0.113 |

0.99 |

Notes: Robust SE are in parentheses. Fixed effects are controlled.

The year 1996 has been excluded from the estimates because of numerous missing observations for trade.

*, **, and *** denote significance at 10, 5 and 1% levels, respectively.

The results of regressions (2) and (2a), in which the coefficient of trade openness (openness) is positive and statistically significant, indicate that the greater integration of the industry into world trade contributes to increased productivity in terms of both labour productivity and total factor productivity, as suggested by the related literature (Edwards, 1998; Henry et al., 2009). This effect arises because firms have greater exposure to international competition.

Regressions (3) and (3a) show the coefficient parameter of import penetration (imp), which has an inferior magnitude of trade openness. However, it has a positive and statistically significant relationship with labour productivity only; when the indicator is total factor productivity, the coefficient is not statistically significant. When a different econometric procedure is used to capture the sector's heterogeneity and potential endogeneity, these results contribute new evidence consistent with the literature. However, the coefficients presented here are upper that ones found by Ferreira and Rossi (2003), part of this different result is explained by used period (early 2000´s) when productive restructuring in Brazilian economy had advanced. The regression results listed in Table 2 depend on the serial correlation tests of Arellano and Bond (AR2) and the validity of the instruments used. According to the statistics obtained, (0.817 and 0.768, respectively), the hypothesis of second-order correlation is rejected (AR2); however, the Sargan test results (0.256 and 0.113, respectively) indicate that the instruments are suitable and that the estimates are consistent.

The results show that FDI can contribute to economic growth through an increase in productivity. Moreover, the found results are novelty in Brazilian literature by show that FDI could contribute to productivity labour raise. The indicators of trade openness and import penetration coefficients indicate that expanded trade with world markets can increase productivity. From the 1990s through the early 2000s, growth in the use of imported input and greater competition have exerted pressure on the Brazilian industry to pursue greater efficiency, which is reflected in the rising productivity.

This study aimed to assess the relationships among FDI, trade openness and productivity in the Brazilian manufacturing industry. Therefore, three different specifications were used for two productivity indicators, and the procedure used dynamic panel data because this method is the most appropriate for controlling characteristics of the data, such as the potential reverse causality between FDI and productivity.

The results suggest a positive and statistically significant relationship between the ratio of FDI inflow in the sector and labour productivity and TFP, with greater elasticity in the relationship with TFP. The results show that, on average, trade openness as the coefficient of import penetration can increase labour productivity in sectors, with greater elasticity in the relationship with trade openness. The results also indicate that import penetration does not affect TFP. In terms of policies to be elaborated, the results of this research suggest that the integration of the industry into the world economy and participation of FDI in the sector should not be neglected.

ALCALÁ, F.; Ciccone, A. (2004). "Trade and productivity". Quarterly Journal of Economics, 119 (2), 613-646.

ALFARO, L.; Chanda, A.; Kalemli-Ozcan, S.; Sayek, S. (2004). "FDI and economic growth: the role of local financial markets". Journal of International Economics, 64 (1), 89-112.

ALFARO, L.; Kalemli-Ozcan, S.; Sayek, S. (2009). "FDI, productivity and financial development". The Word Economy, 32 (1), 111-135.

ARELLANO, M.; Bond, S. R. (1991). "Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations". Review of Economic Studies, 58 (2), 277-297.

Banco Central do Brasil (2013). Censo de capitais estrangeiros no país. Avaliable at http://www.bcb.gov.br/?censoce (accessed 20 july 2013).

BLOOM, N., Draca, M.; Reenen, J. V. (2011) "Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, it and Productivity." NBER Working Paper w16717.

BLUNDELL, R.; Bond, S. (1998). "Initial conditions and moment restrictions in dynamic panel data models". Journal of Econometrics, 87 (1), 115-143.

BORENSZTEIN, E.; Gregorio, D.; Lee, J-W. (1998). "How does foreign investment affect economic growth?" Journal of International Economics, 45 (1), 115-135.

CALEGÁRIO, C. L. L; Bruhn, N. C. P.; Pereira, M. C. (2014). "Foreign direct investment and trade: a study on selected brazilian industries". Latin American Business Review, v. 15 (1), 65-92.

CRESPO, N.; Fontoura, M. P. (2007). "Determinants factor of fdi spillovers – what do we really know?" World development, 35 (3), 410-425.

EDWARDS, S. (1998). "Trade openness, productivity and growth: what do we really know"? Economic journal, 108 (447), 383-398.

FERREIRA, P. C.; Rossi, J. L. (2003). "New evidence from Brazil on trade liberalization and productivity growth". International Economic Review, 44 (4), 1383-1404.

HASKEL, J. E.; Pereira, S. C.; Slaughter, M. J. (2007). "Does inward foreign direct investment boost the productivity of domestic firms"? Review of Economics and Statistics, 89 (3), 482-496.

IBGE (Instituto Brasileiro de Geografia e Estatística). (2013). Pesquisa industrial anual. Available at http://www.ibge.gov.br (accessed 10 july 2013).

JAVORCIK, B. S. (2013). "Does foreign direct investment increase the productivity of domestic firms? Is search of spillovers through backward linkages". American Economic Review, 94 (3), 605-627.

Ministério do Desenvolvimento, Indústria e Comércio Exterior (2013). Aliceweb2 – Sistema de informação do comércio exterior. Avaliable at http://aliceweb2.mdic.gov.br (accessed 25 july 2013).

UNCTAD (2013). World investment report. Available at http://unctad.org/en/Pages/DIAE/World%20Investment%20Report/World_Investment_Report.aspx (accessed 30 july 2013).

YASAR, M.; Paul, C. J. M. (2007). "International linkages and productivity at the plant level: foreign direct investment, exports, imports and licensing". Journal of International Economics, 71 (2), 373-388.

1. Department of Economics, UEM, Brazil. E-mail: gjfraga@uem.br

2. UNCTAD data (thousands current USD).

3. The period ends in 2007 because the series changed in 2008. More details are available at http://www.cnae.ibge.gov.br/

4. Lags of the prod and ied variables were used as instruments.