HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 12) Año 2016. Pág. 7

Edmundo R. LIZARZABURU 1; Gabriela BARRIGA A.

Recibido: 04/01/16 • Aprobado: 15/02/2016

2. A brief review about Bonds and Market makers Importance

3. How you can join in “the party”: Rules for a Designated Market Makers program in Peru

4. The Peruvian Bond Instrument: Treasury bills and bonds

5. How this works: A review about the process of a purchase in Peruvian bond market

6. A view of the country risk: the evolution of EMBI Peru

ABSTRACT: The needs of capital and money for develop in emerging economies and the use of the bond market in this economies have develop a new important alternatives one of this are the called Designated Market Maker (DMM) program. In this paper we use information of the Minister of Economy and Finance from Peru and explain the DMM, his benefits and requirements then we show the evolution of the sovereign bond market in Peru. Keywords: Bond, Government, Designated Market maker, Sovereign bond, Global bond, Yield, Maturity, date Face value, Coupon rate, Coupon dates, Issue price. |

RESUMEN: Las necesidades de capital y dinero para el desarrollo de las economías emergentes y el uso del mercado de bonos en estas economías ha obligado a desarrollar nuevas alternativas; Una de estas es el Programa llamado Creador de Mercado Designado (CMD). En este trabajo utilizamos información del Ministro de Economía y Finanzas del Perú y su explicación sobre el CMD, sus beneficios y requisitos para su continuación; Asimismo mostramos la evolución del mercado de Bonos Soberanos en el Perú. |

A bond is a kind of financial instrument that can be use for invests or as a way of raise funds for different purposes. Some definitions of bond are provide for The Macmillan dictionary (2015) that defined Bond as a business document given to someone who invests money in a government or company, promising to pay back the money with interest.

This instrument can be issue for companies or governments. In this opportunity, this paper focus in the government issues because it use this instrument with more frequency and for show that The Bank for international Settlements (BIS) give us some statistics (see table 1 in the annex): the international debt securities from general government by nationality of issuer represent, in Dec. 2012, the sum of 1627.5 billions of US dollars in the total countries, in Dec. 2014 this sum is 1637.4 billions of US dollars. This information shows us that the bond market is a great funder for governments and other institutions.

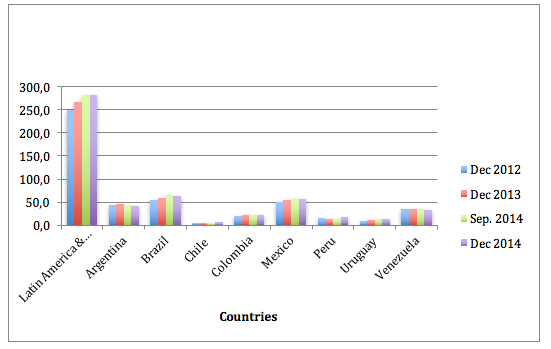

The current conditions, financial bankruptcy and economies in recovery plans, have lead to focus in Latin America bond issues because this became a development center and the main investment destination that is why this paper try to show us how the Government can develop this tool and generate an important opportunity. For show the importance of the bond market, in Latin American and Caribbean, according the BIS, the total amount of international debt securities, in Dec 2014, are 282.9 billions of US dollars an increase over the year 2012, where we had the sum of 250.6 billions of US dollars.

But of all this Latin American countries we focus in Peru because have an important evolution in economic indicators, monetary policy and other important aspects and this generate some interest in show how was the evolution of his international bond issues and other important characteristics about bonds in the local market.

Other important characteristic of the Peruvian bond market is the initiative of Designated Market Makers program. This is a way to ensure the development of the local market as mention Rodriguez (2004) when say about the advantages of develop a local market. All these characteristics and other important aspects about bonds will be review in the next section.

So that we can better understand more about the particular Government bond market we must know some particular characteristics of a bond. We initiate this with a brief definition for a bond, this are provide for Berk, J. & DeMarzo, P. (2014) a bond is a security sold by governments and corporations to raise money form investors today in exchange for promised future payments. Like we mentioned before this is a kind of funding the needs of money in the market.

This instrument has terms and this is described as part of the bond certificate, which indicates the amounts and dates of all payments to be made. These payments are made until a final repayment date, called the maturity date of the bond. (Berk, & DeMarzo, 2014, p. 170).

The promised interest payment of a bond are called coupons this will be paid periodically but exit bond, that we call zero-coupon bonds, that no pay coupons until the maturity date of the bond. The principal or face value of a bond is the amount we use to compute the interest payments. Usually at the face value is repaid at maturity. (Berk & DeMarzo, 2014, p. 170).

The amount of these payments, made periodically, is determinate by the coupon rate of the bond and we calculate the payments when we apply this in the face value and obtain the coupon in amount of money. This coupon rate is set by the issuer and stated on the bond certificate. These are the principal characteristics of a bond in the market. Now we can see the different classification of bonds, there are a lot of then but we mention only a few.

Another important concept are the yield to maturity (YTM), this is the discount rate that sets the present value of the promised bond payments equal to the current market price of the bond. This are consider too the internal rate of return of an investment in a bond.

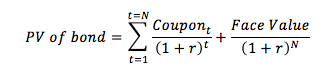

An important aspect is found the value of the bond and for this we use the formula provided for Damodaran, A. (2002) this say that the value of a bond is the present value of promised cash flows on that bond, discounted at an interest rate that reflects the default risk associated with the cash flows. The formula for we found the value of the bond is shows us next.

About the kind of bonds Berk, J. & DeMarzo (2014) mention two kinds of bonds according if it pays or no coupons: the zero-coupon bond and the coupon bonds. The zero-coupon bond doesn't make coupon payments, the only cash payment the investor receives in the face value of the bond on the maturity date. The coupon bond pays investors their face value at maturity plus the regular coupon interest payments.

About other kind of bonds Eun, C. & Resnick, B. (2012) mention bearer bonds, registered bonds, global bonds, straight fixed-rate bond, floating-rate notes, equity-related bonds and dual-currency bonds. The straight fixed-rate bond have a designated maturity date at which the principal of the bond issue is promised to be repaid, during the life of the bond, fixed coupon payments are paid as interest to the bondholders.

The bearer are bonds where the possession is evidence of ownership, the issuer of this bond do not keep any records indicating who is the current owner of a bond. In the registered bonds, the owner's name is on the bond and it is also recorded by the issuer, or else the owner's name is assigned to a bond serial number recorded by the issuer. (Eun, C. & Resnick, B., 2012).

About the global bonds, Eun, C. & Resnick, B. (2012) mention this is a very large bond issue that would be difficult to sell in any one country or region of the world. Also floating-rates notes are typically medium-term bonds with coupon payments indexed to some reference rate.

The equity-related bonds, Eun, C. & Resnick, B. (2012) mention that are two types: convertible bonds (issue allows the investors to exchange the bond for predetermined number of equity shares of the issuer) and bonds with equity warrants (this can be viewed as straight fixed-rate bonds with the addition of a call option feature).

At the last kind of bond mentioned by Eun, C. & Resnick, B. (2012) is the dual-currency bond that is a straight fixed-rate bond issued in one currency that pays coupon interest in the same currency but the principal, at the maturity, is repaid in another currency.

But the bond we want study is the sovereign bond, the definition about that if provided for Berk. J. & DeMarzo, P. (2014) this are bonds issued by national governments, usually this bonds are considered risk free because they are free to the default risk but some countries in developed markets are issued by countries with high possibilities of default and for that this bonds have high yields and low prices.

For mention what is the importance of create a local bond market or the Designated Market Maker program Rodríguez (2006) mention the next points:

The Designated Market Maker program is tool to promote or develop of the Lima stock exchange of some instruments. The participants of the program are credit entities and other securities firms designated for the MEF. The principal objective of the Designated Market Maker program is promoting the smooth operation of the market and cooperates in the fundraising of the bonds. The responsible unit is the MEF. To apply to be a Designated Market Maker there are two categories: (1) for local market participants, (2) for foreign participants. The entities eligible have to fulfill some characteristics this are mentioned below.

Insurance companies: In this category we can consider as eligible the insurance companies and general insurance companies authorized for the Peruvian Banking Regulator (Superintendecia de Banca, Seguros y Administradoras de Pensiones – SBS).

Investment Entities: In this category we can consider as eligible pension insurance, investment funds, trust funds through its authorized agents.

Securities firms: In this category we can consider eligible the brokerage firms authorized by the SBS.

Credit institutions: In this category we can consider eligible the financial institutions authorized by the SBS.

Other entities: In this category we can consider eligible are the deposit insurance found, FONAFE and other institutions authorized by the SBS. The National Fund for Financing State Enterprise Activity (FONAFE) is a company attached to the Public Law Sector Economy and Finance responsible for managing the business of government.

Insurance companies: In this category we can consider as eligible the entities which typical activity is issuing policies or similar contracts in which it undertakes, by charging a fee (premium) to compensate (indemnify) to a beneficiary with a sum of money or benefit equivalent in one or more acts, verified the occurrence of an event (accident) provided (covered) for a specified period.

Investment Entities: In this category we can consider as eligible an investment entity is any special purpose entity to be constituted as separate assets without legal personality and administered by an entity of securities. As funds are usually (investment, securitization, foreign exchange, etc.), open or closed, which are managed by a manager, administrator, or trustee and whose property is represented by shares or securities that may, or may not have sections with varying degrees of subordination.

Securities firms: In this category we can consider eligible the typical activity to carry out securities brokerage and related activities. Some processed orders for third parties, or other custodian securities portfolios managed by mandate, other managed funds through special purpose entities (investment companies) and others also intermediated securities for its own account and may even lend to their investor clients.

Credit institutions: In this category we can consider eligible an institution with the typical activity to receive funds through deposits or other repayable funds (including those obtained by issuing securities), which involves an obligation of restitution, to apply on their own in granting credit or other similar transactions.

Other entities: In this category we can consider eligible all the institutions under financial regulation and supervision.

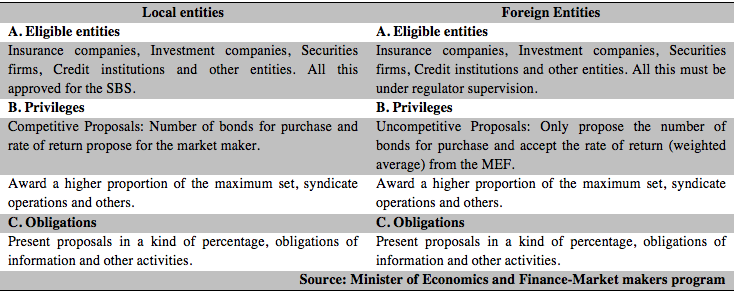

These are the profile for credit makers for a local or foreign participant, which can be part of this program, but it have privileges and obligations that we can list below:

Privileges: These institutions have the next obligations.

Obligations: These entities have the next obligations.

These brief review of the principal obligations and privileges of the Designated Market Makers program in which companies in that have to accomplish are reviewed in the table 1. An additional, but not least important is that this entities are evaluate according to a several criteria for his participations. All this information we mention before can be found in the web of the Ministry of Economy and Finance - MEF (see the web page in the references).

Table 1: Rules for the market makers in Peru

For the final point in this topic we show in the table 2 the list of the participants in the Designated Market Makers program in the Peru, according to the legal document RD N0 011-2014-EF/52.1 from the Minister of Economics and Finance approve the list of that entities.

Table 2: List of Markets Makers authorized for operate in 2015

Another important aspect for this program is the centralized mechanism of negotiation because for this channel occur the operations and the settlement of this operations. The SBS (Peruvian Regulator) give you some characteristics that this mechanism have to fulfill, this are the next:

In the Peruvian market, the issue is two kinds: letters from the public treasury (LPT) and bonds. About LPT this are instruments of debt issue by the Minister of Finance an Economics (MEF) in representation of the government, it sold at a discount. The maturity for this is three, six, nine, and twelve months. Each LPT has a face value equivalent to one hundred nuevos soles (Peruvian currency).

About the bonds, in Peru are two types: the issued in local market; called Sovereign Bonds and the bond issued in global market; called Peru global bonds. These bonds are issue for the MEF in representation of the government of Peru.

For a better understand about an issue of a sovereign bond you can see the conditions, in table 3, in a real example about an auction, in March 2015, of this kind of bond in the Peruvian market.

Table 3. Auction of Peruvian sovereign bond March, 2015

In this table we see some of the most important aspects in a sovereign auction in the Peruvian market, as we see, in some cases this don't raise the total amount of money they want because the rate of return or the conditions of the auction not are the most favorable for the parties.

About the size of the Peruvian bond market the MEF mention in 2011 the sovereign bonds issue locally close to S/. 28,785 millions and in 2012 was S/. 31,723 millions. This amount represents 6.8% of GDP. The current rating of the Peruvian bonds has A- according Standard & Poor's and Fitch Ratings, of BBB according to Moody's. All of these ratings consider a stable performance in the Peruvian sovereign bond market.

The institutions can participate in an auction are called "eligible entities" this entities must be send an application form to MEF and this must be approved. The kind of entities may be participating in this auction must be accomplishing two conditions: (1) must be securities firms like brokerage firms authorized for Superintendence of Market Values or SMV for Spanish acronym, (2) other financial institutions authorized for the SBS. Also the foreign companies can participate but with "non competitive bids" but they should be regulated for a regulator in his country of origin.

The auction of this bonds has a specific date, this occur the second and fourth Tuesday of each month, according o the schedule of the program of regular auction, but may exist special auctions anytime. The liquidation of the winners of the auction occurs the next day of the process previously pay of the value adjudicated.

The contribution rate for this operation (taxes) is 0% for spot transactions; the only cost is applied for CAVALI an institution to carry on the register of all securities in the Peruvian market. This cost ranges from 5 USD to 0.5 USD.

In this point we see how is the principal procedure of realize a purchase in the Peruvian market, remember that in all this process we use a centralized mechanisms of negotiation for the correct and faster procedure.

In the next section we see a proxy of the country risk for the Peruvian market and a comparative with Latin America, this view is related to a way to measure the risk to invest in the Peruvian country, the data for this analysis come from Central Bank of Reserve of Peru and the value is an average of monthly Basic Points (Pbs) of EMBI in that year. This date is show you in the table 4.

Table 4: Evolution of the EMBI Peru monthly average

As we see in the table, the country risk for this EMBIG is the difference in the interest rate of the Treasury bill in USA and the interest rate pay for the sovereign bond in Peru. In graph 2 (see the annex) we see that the EMBIG of Peru from 2002 to 2012 always be lower than the Latin America EMBIG, this show us Peru has a lower country risk of the average of Latin American. If we look more close the table we see the Pbs are shorter than 2002 and maybe is the reason for the Government can issued more amount of money in the international market.

If we calculate a coefficient of correlation between the difference of Peru EMBIG variation and Latin American EMBIG variation we see a value of 0.94415 this explain a direct relationship between both. This explains why when the EMBIG Latin America goes up or down the Peruvian EMBIG go in the same way. For the calculation of this see the table 6 in the annex.

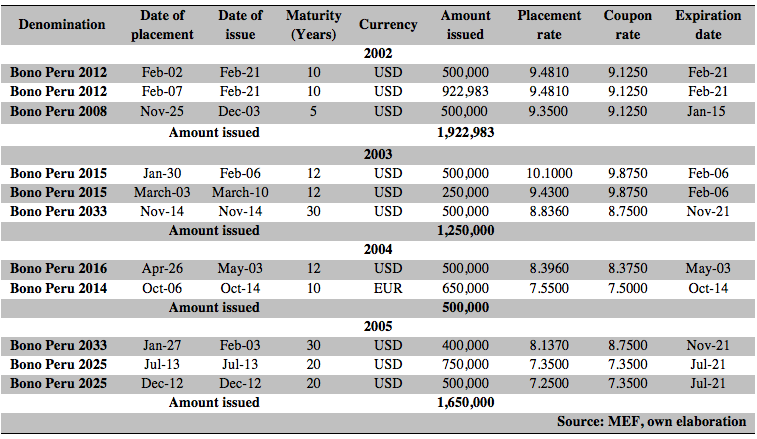

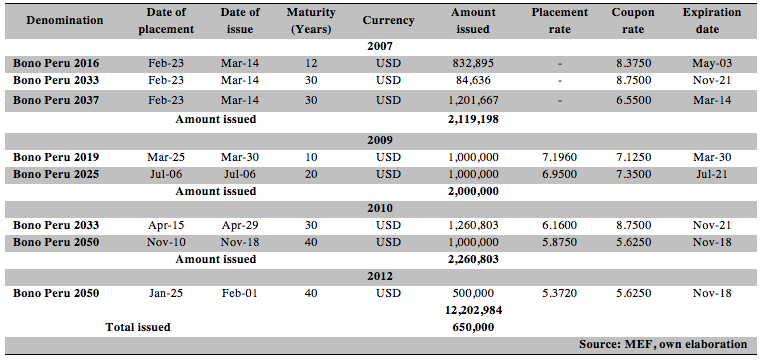

For this section we describe the principal auctions or placements, in thousands of dollars. We obtain the information for this section of the Foreign Minister of Economics and Finance. We describe in table 5 and table 6 the International auction; we cover the period from 2002 to 2012.

Table 5: International Peruvian bond issues from 2002 to 2005 (Thousand of dollars)

As we see in the table the government issued, in mostly cases in USD dollars, but in the 2004 it issued in Euros too. The expiration date is write in the day and the month but the year of expiration depend of the maturity. For example, in 2002 the government issued "Bono Peru 2012" his expiration date is in February 21, 2012 (12 years of maturity) this rule apply for the others bonds issued.

As we see in these tables, the evolution of the amount issue by the government of Peru was 1,922,983 dollar for two thousand and two; 1,250,000 dollar for two thousand and three; 500,000 dollar for two thousand and four; 1,650,000 dollar for Two thousand and five; 2,119,198 dollar for two thousand and seven; 2,000,000 dollar for two thousand and nine; 2,260,803 dollar for two thousand and ten; and 500,000 dollar for two thousand and twelve. The total amount issue by the government was 12,202,984 dollars.

Table 6: International Peruvian bond issues from 2006 to 2012 (Thousand of dollars)

As we see in table, in some years the Peruvian government doesn't issue any bond, for example in the period of 2006, 2008 and 2011. Remember these issues are related to the Bonds issued in the international market. The total amount issued from 2002 to 2012 was USD 12,202,984 thousands and EUR 650,000 thousands.

If we analyze more slowly the evolution of the international Bond issue for the Peruvian government, we observe an increase of the amount allowed in the international market, this as a result of the better qualification of the Peruvian market and the trust in its economy.

As we see in this study, the international Peruvian government bond issues has growth in recent years this is supported for the better development of the Peruvian economy this we can see with the evolution of the EMBI Peru because the lowest is the EMBI the better is the qualification of the country. All this factors and other political aspects do Peru can fund a lot of money for his Bond issue.

We can consider too the biggest amount of bonds issues is in United States Dollars this is in response to the dollar is the most common currency or a global currency in the world but Peru has too issue in Euros (European Union currency).

Another important aspect is the Designated Market Maker program and how ensures the current work of the Lima stock exchange and create the best conditions for raise capital and reduce the risk of the monetary policy in the economy.

Bank for International Settlements (2015, 30th of March) Recovered from https://www.bis.org/statistics/secstats.htm?m=6%7C33

Berk, J. & DeMarzo, P. (2014). Corporate Finance. (3th Ed.) Boston: Pearson Education.

Damodaran, A. (2002). Investment Valuation: Tools and techniques for determining the value of any asset. (2nd Ed.) New York: John Wiley and Sons.

Eun, C. & Resnick, B. (2012). International Financial Management. (6th Ed.) Mexico, DF: Mc Graw-Hill Irwin.

Investopedia. (2015, 30th of March) Bonds. Recovered from http://www.investopedia.com/terms/b/bond.asp

Jaramillo, C., Ortiz, N. & Asencio, L. (2013). Los Bonos Latinoamericanos. Debates IESA, volume XVIII, número 2, Abril-Junio. Recovered from EBCSO Host repository.

Macmillan dictionary (2015, 30th of March). Bonds. Recovered from http://www.macmillandictionary.com/dictionary/british/bond_1#bond_1__2

Pereda, J. (2010). Estimación de la curva de rendimiento cupón cero para el Perú y su uso para el analisis monetario. Economía, Volumen XXXIII, número 65, semester Enero-Junio. Recovered from EBCSO Host.

Peruvian Minister of Economics and Finance (2015). Recovered from http://www.mef.gob.pe/index.php?option=com_content&view=article&id=942&Itemid=101984&lang=es

Rodríguez, Augusto (2006) Programa de creadores de Mercado de Deuda Pública Interna: Evaluación de la estrategia de colocaciones y de operaciones de manejo de deuda. Universidad del Pacífico.

Rodas, W. (1995). Bonos instrumentos de inversion y financiación. Revista alternativa financiera. Recovered from EBCSO Host repository.

Table 1: International debt securities-General Government |

|||||

In Billions of US dollars |

|||||

Countries |

Amounts outstanding |

||||

Dec 2012 |

Dec 2013 |

Sep. 2014 |

Dec 2014 |

||

All countries |

1627.5 |

1681.8 |

1655.5 |

1637.4 |

|

Developed countries |

895.6 |

883.5 |

846.8 |

826.2 |

|

Australia |

11.7 |

10.1 |

4.4 |

4.3 |

|

Austria |

103.0 |

113.1 |

103.4 |

103.5 |

|

Belgium |

31.2 |

31.6 |

22.4 |

22.1 |

|

Canada |

129.5 |

126.3 |

125.4 |

124.7 |

|

Cyprus |

5.4 |

0.8 |

3.8 |

3.7 |

|

Denmark |

17.6 |

14.2 |

11.4 |

11.1 |

|

Finland |

19.8 |

23.0 |

25.8 |

25.8 |

|

France |

10.4 |

11.2 |

10.1 |

9.4 |

|

Germany |

108.0 |

100.3 |

87.2 |

87.0 |

|

Greece |

56.0 |

49.0 |

49.5 |

47.7 |

|

Iceland |

3.8 |

3.8 |

4.5 |

4.4 |

|

Ireland |

16.3 |

19.4 |

23.7 |

23.8 |

|

Italy |

138.8 |

138.0 |

121.3 |

117.3 |

|

Japan |

3.8 |

4.8 |

5.6 |

5.5 |

|

Luxembourg |

6.6 |

4.1 |

3.8 |

3.9 |

|

Netherlands |

31.5 |

17.7 |

25.9 |

14.2 |

|

New Zealand |

1.3 |

0.9 |

1.3 |

1.2 |

|

Norway |

… |

… |

… |

… |

|

Portugal |

35.5 |

35.7 |

32.4 |

26.1 |

|

Slovakia |

15.1 |

17.9 |

15.9 |

14.7 |

|

Spain |

70.2 |

62.6 |

56.8 |

54.5 |

|

Sweden |

45.7 |

59.8 |

65.1 |

74.2 |

|

Switzerland |

- |

- |

- |

- |

|

United Kingdom |

21.2 |

22.2 |

22.5 |

22.7 |

|

United States |

4.6 |

4.6 |

4.5 |

4.5 |

|

Offshore centres |

50.8 |

55.7 |

56.8 |

56.8 |

|

Aruba |

0.4 |

0.4 |

0.4 |

0.4 |

|

Bahamas |

0.9 |

0.9 |

1.2 |

1.2 |

|

Bermuda |

1.0 |

1.7 |

1.7 |

1.7 |

|

Cayman Islands |

0.3 |

0.3 |

0.3 |

0.3 |

|

Curacao |

… |

… |

… |

… |

|

Hong Kong SAR |

1.3 |

1.3 |

_ |

_ |

|

Lebanon |

32.2 |

34.1 |

34.5 |

34.5 |

|

Panama |

8.7 |

9.9 |

11.1 |

11.1 |

|

Singapore |

… |

… |

… |

… |

|

West Indies UK |

… |

… |

… |

… |

|

Developing countries |

681.1 |

742.6 |

751.8 |

754.5 |

|

Africa & Middle East |

70.5 |

81.8 |

87.2 |

87.2 |

|

Israel |

11.8 |

13.2 |

14.3 |

14.1 |

|

Qatar |

19.9 |

19.9 |

17.9 |

17.9 |

|

South Africa |

11.4 |

11.7 |

12.2 |

12.2 |

|

Tunisia |

- |

- |

0.5 |

0.5 |

|

United Arab Emirates |

9.7 |

7.9 |

4.8 |

4.8 |

|

Source: BIS Quarterly Review, March 2015 |

|||||

Table 1: International debt securities-General Government (Continues) |

|||||

In Billions of US dollars |

|||||

Countries |

Amounts outstanding |

||||

Dec 2012 |

Dec 2013 |

Sep. 2014 |

Dec 2014 |

||

Asia & Pacific |

93.7 |

98.3 |

105.1 |

110.7 |

|

China |

13.6 |

15.1 |

14.7 |

15.3 |

|

Chinese Taipei |

… |

… |

… |

… |

|

India |

… |

… |

… |

… |

|

Indonesia |

29.1 |

32.8 |

36.4 |

36.2 |

|

Korea |

7.1 |

7.1 |

6.4 |

6.4 |

|

Malaysia |

4.1 |

4.5 |

4.5 |

4.5 |

|

Philippines |

29.7 |

28.0 |

27.6 |

27.5 |

|

Tailand |

0.3 |

0.1 |

0.1 |

0.1 |

|

Europe |

266.3 |

296.5 |

276.9 |

273.7 |

|

Croatia |

8.4 |

11.8 |

12.5 |

12.3 |

|

Hungary |

23.7 |

28.7 |

26.1 |

25.7 |

|

Poland |

70.0 |

70.3 |

63.0 |

61.0 |

|

Russia |

43.7 |

49.3 |

35.0 |

34.2 |

|

Turkey |

53.5 |

59.3 |

62.3 |

62.6 |

|

Latin America & Caribbean |

250.6 |

266.0 |

282.6 |

282.9 |

|

Argentina |

44.6 |

45.4 |

43.4 |

42.1 |

|

Brazil |

53.6 |

58.5 |

65.8 |

63.3 |

|

Chile |

5.4 |

4.3 |

4.3 |

6.3 |

|

Colombia |

20.4 |

21.4 |

23.2 |

23.2 |

|

Mexico |

49.7 |

54.2 |

56.3 |

57.6 |

|

Peru |

14.6 |

14.3 |

14.1 |

17.1 |

|

Uruguay |

10.0 |

11.5 |

12.8 |

12.7 |

|

Venezuela |

36.0 |

34.9 |

34.8 |

33.3 |

|

Source: BIS Quarterly Review, March 2015 |

|||||

1. Email: elizarzaburub@gmail.com

Mr Rayko Zecevich colaborate with the present research