HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN

HOME | ÍNDICE POR TÍTULO | NORMAS PUBLICACIÓN Espacios. Vol. 37 (Nº 10) Año 2016. Pág. 12

Nádia Campos Pereira BRUHN 1; Juciara Nunes ALCÂNTARA; Cristina Lelis Leal CALEGÁRIO

Recibido: 04/12/15 • Aprobado: 16/01/2016

ABSTRACT: The objective of this research is to investigate the factors determining spillover occurrence from MNEs presence to SMEs in Minas Gerais by performing a bivariate chi-square test (x2) analysis. The study population was composed of SME companies in the state of Minas Gerais that had declared any kind of relationship with MNEs. The result suggest that companies that have involvement with multinational companies are more likely to develop process innovation and strategic and organizational innovation. Upstream, downstream and horizontal links are associated with the ability of firms to develop strategic and organizational innovation and absorptive capacity. |

RESUMO: O objetivo desta pesquisa é investigar os fatores que determinam a ocorrência de repercussões da presença de empresas multinacionais para as PME em Minas Gerais, realizando uma análise bivariada teste qui-quadrado (x2). A população de estudo foi composta por PME empresas no estado de Minas Gerais que havia declarado qualquer tipo de relacionamento com empresas multinacionais. O resultado sugere que as empresas que tenham envolvimento com as empresas multinacionais são mais propensas a desenvolver o processo de inovação e inovação estratégica e organizacional. Montante, a jusante e horizontais links estão associados com a capacidade das empresas para desenvolver a inovação estratégica e organizacional e a capacidade de absorção. |

Small and medium enterprises (SMEs) has occupied a prominent position in the agenda on the development of a nation. It is understood that the smaller companies are the engine of growth of an economy (Lefebvre et al, 1998; Okpara, 2009). Mainly because they contribute to job creation at a relatively low cost, provide conditions to reduce disparities income, promote the qualification of workers, provide space for the development of organizational and managerial capabilities (Okpara, 2009) in addition to being the premier provider of technological innovations (Haahti et al., 2005).

The economy benefits arising from the performance of smaller companies are explained by the flexibility to adapt to environmental changes, the existence of few routines and unbureaucratic process. SMEs are able to handle complex situations such as innovation and internationalization in the face of the difficulties and limitations inherent to its size, such as limited resources (D'Angelo, 2012).

Researches developed on SMEs have shown how vulnerable these companies have been the recent trade liberalization and economic integration, characterized by the increased global and regional pressures. These forces intensify structural problems already faced by firms at the individual, regional and national levels. In this context, the ability of most SMEs to survive, finding efficient scale levels and create new jobs depends on a number of factors, including their ability to innovate and engage in collective activities (Ferrero and Maffioli, 2004). Thus, we argue that external knowledge spillovers from multinational enterprises (MNEs) may benefit local SMEs on its innovations process through various channels, such as imitation, worker mobility, competition and exports (Gorg and Greenaway, 2004).

The spillover discussion is part of a broad debate on the effects arising from MNE's strategies in host economies (Blomström and Kokko, 1998; Gorg and Greenaway, 2004; Buckley, Clegg and Wang, 2010). Government policy-makers in most countries today compete to attract MNE investments (Gorg and Greenaway, 2004; Caves, 2007; Casson, 2007; Navaretti and Venables, 2013) by offering special incentives, such as tariff reductions or exemptions, and subsidies for infrastructure (Caves, 2007). This effort to woo multinational investors (Spar, 2009) occurs with little consideration of how the benefits are to be appropriated by the host country (Casson, 2007). The argument in favour of such incentives is based upon the assumption that, when MNEs establish a subsidiary in a country, they are physically transplanting the means of production from one place to another, taking with them the jobs, knowledge and technologies that may spill over to locally owned enterprises, resulting in competitiveness increases and productivity gains, known as spillovers (Blomström and Kokko, 1998; Cohen, 2007).

Spillover effects are notably difficult to measure and, thus, determining exactly how MNE's strategies affects the innovative capacity of firms constitute a challenge for researchers (Moran, Graham and Blomstrom, 2005).

We aim with this study to answer the following research questions: Are there innovation spillovers effects arising from the presence of MNEs to Brazilian small and medium enterprises (SMEs)? How interactions between MNEs and SMEs contribute to the generate innovation spillovers effects?

The objective of the study is to investigate spillovers effects arising from foreign presence through an association analysis between multinational companies and innovation capacity of SMEs in Brazil. Specifically, we aim to investigate the factors associate with (i) product innovation; (i) process innovation; (iii) strategic and organizational innovation; and (iv) absorption capacity of small and medium firms that determines spillover occurrence?

Understanding those spillovers effects contributes not only to the identification of synergies between foreign and domestic enterprises in innovation processes, but also providing valuable information related to the decision-making process of public managers on whether they should encourage the entry of MNEs and if they should receive special treatment (Brambilla, Hale, and Long, 2009).

The objective of this research is to offer a more accurate understanding of the diverse nature and effects of MNEs on host economies and to stimulate a more relevant spillover effect discussion. As argued by Cohen (2007), MNEs spillover effects are extremely complex and heterogeneous phenomenon. Different kinds of businesses produce different kinds of corporate activity and the nature, objectives and effects of specific kinds of firms in different industries and institutional environments are not applicable to others. So, based on Cohen (2007) we defend that the heterogeneity in MNEs spillover effects requires disaggregation in studies in the various levels of analysis. In each category there is a vast heterogeneity of issues to be discussed and comprehended (Buckley & Lessard, 2010, p. 7).

Policymakers in particular need information that provides them with the necessary tools for the decision making process. They influence the regulatory regime in which MNEs and LOEs are embedded and, therefore, need to understand how national policies and domestic politics can induce or limit MNE's strategies so that they can offer benefits to LOEs. We also believe policymakers should appreciate both the critical need to preserve and maximize competition among MNEs and LOEs and the need to achieve at least a minimum level of domestic technological capability and technical education (Buckley, Wang, & Clegg, 2010; Cohen, 2007), comprehending that there is no way to stop MNEs from growing and increasing their market shares as they respond to market competitiveness. This doesn't mean that a passive government compliance is desirable, but they should consider looking at the ways in which initially disadvantaged LOEs could be helped in acquiring the necessary capabilities to compensate their disadvantages (Cohen, 2007).

Presenting particularities and specificities of the context of the SMEs belonging to Minas Gerais Brazilian State, contributes to the consolidation of studies in MNEs spillover and SMEs innovation process, as it may serve to support possible future studies that might deal with different contexts.

The article is structured as follows. The next section presents a general background on MNCs' subsidiaries and innovation spillovers. It is followed by a methodological issues sections. Subsequently, the results are presented and discussed. Finally, final considerations based on the analyzed results are presented.

The debate about spillovers effects refers precisely to the externalities generated from the activities of MNEs and their subsidiaries in the host country. When MNEs establish subsidiaries in other countries, they differ from existing companies in the host market primarily for two reasons (Blomstrom, and Kokko, 1998). The first is that they carry with them certain technological properties which compose their specific advantages and allow them to compete with other MNEs and local companies, that usually have more knowledge of the local market and consumer preferences. The second reason is that the insertion of MNEs alters the equilibrium of the existing market, forcing local companies to become more efficient and protect their market shares. These changes tend to generate spillovers that may increase the levels of performance of domestic companies (Blomstrom, and Kokko, 1998).

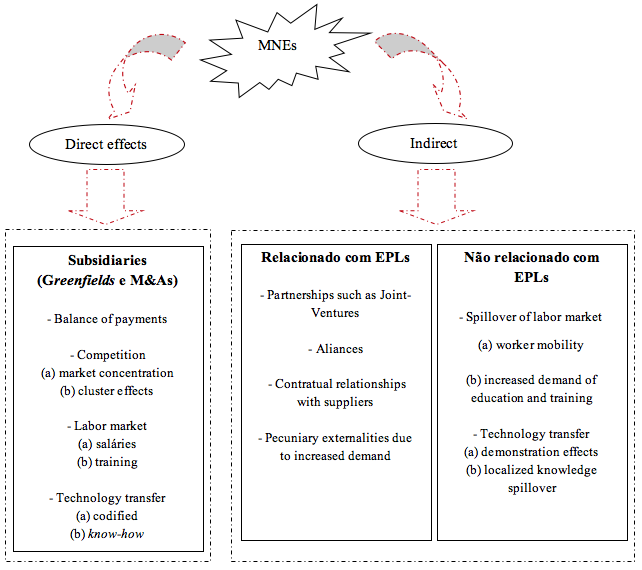

Dunning and Lundan (2008) identify the potential direct and indirect effects due to the strategies of MNEs and actions as well as the responses of firms and countries most affected by its presence (Figure 1). The direct effects are those related to the effects of the strategies of MNE's subsidiaries, such as those on the balance of payments, trade patterns and market structure, that will depend on a number of characteristic of the host economy, and that are beyond the control of the EM. The effects on labor markets and technology transfer are precisely those controlled by MNEs. The indirect effects involves both the "pecuniary" and "non-pecuniary" externalities. Dunning and Lundan (2008) define as pecuniary externalities those arising from vertical linkages formed by MNEs that occur when a MNE or its subsidiaries affects the amount and/or supply or demand conditions of related and no-related firms. Non-pecuniary externalities are our object of our study and are commonly known as "technological or inovation spillovers" and arise when spillover to the local economy occur through the mechanisms commonly cited in the literature (Dunning and Lundan, 2008).

Figure 1. The direct and indirect effects from FDI and the strategies of MNEs in host economies.

Source: Adapted from Dunning and Lundan(2008)

Gorg and Greenaway (2004) have argued that the possible mechanism for externalities from MNEs occur are imitation, worker mobility, competition and exports. The first mechanism, imitation, has as the cause of productivity gains the adoption of new production methods and new management practices. This mechanism requires the accession of new technologies and may also occur through human capital (Gorg, and Greenaway, 2004).

The second mechanism, worker mobility, provides increased productivity by means of tacit knowledge. It improves productivity through two mechanisms, direct externality generated by the complementarities of work, and knowledge transfer of employees from one firm to another (Gorg, and Greenaway, 2004).

The competition mechanism considers that the ability to adopt new technologies reduces inefficiency. Unless an incoming firm is offered monopoly status, it will compete with other local companies. Even if local companies are unable to imitate the technology and production process from the EMNs, their entry will already force them to become more efficient (Gorg, and Greenaway, 2004).

The fourth mechanism, exports, integrates productivity gains to economies of scale and it is believed that domestic companies can learn how to export with MNEs. The export activity usually involves fixed costs to form distribution networks, transportation infrastructure, learning about the preferences and habits of consumers, for example. MNEs usually already have this kind of information and use it to export from the host country. Through cooperation, or even imitation, domestic companies can learn how to work in new markets. Gorg and Greenaway (2004) emphasized the importance of taking into consideration the characteristics of the host country when assessing the generation of externalities from FDI. Once established the location, the fixed factors that influence the level of adherence of new technology and the effects of productivity gains should be considered (Gorg, and Greenaway, 2004).

The literature discusses the mechanisms through which MNEs can generate positive externalities and contribute to the development of innovations in SMEs. To make that happen, local firms must possess new technologies, skills, imitation capacity and inter-organizational relationships establishment learning capabilities. Aiming to identify the spillovers effects arising from foreign presence we have analyzed the association between multinational companies and innovation capacity of SMEs in Brazil by performing a bivariate chi-square test (x2) analysis. For all analyzed variables with P ≤ 0.10 in the x2 test, we have estimated the variables association using odds ratio (OR) statistics and its confidence interval of 95%.

The study population was composed of SME companies in the state of Minas Gerais that had declared any kind of relationship with MNEs. The SMEs were classificated according to the Brazilian Micro and Small Business Support Service (Sebrae, 2011), which is based on the number of employees, and in which small enterprises have 20-99 employees, and medium-sized enterprises have between 100 to 499 employees. Out of the total number of enterprises, 270 SMEs were identifyed as having some sort of relationship with MNEs, and information was collected from 74 enterprises, corresponding to approximately 27% of population. Although the study sample was relatively small, the response rate achieved coincided with other of SMEs internationalization studies such as the ones carried out by Macera & Urdan (2004), Gomel & Sbragia (2011), and Gonçalo & Zanluchi (2011).

The primary data was collected through a semi-structured questionnaire, and the data refers to both the characteristics of the firms and their operating environment, as well the industry in which they operate. The set of seleted variables are presented as follows:

The dependent variables were measured by a dummy variable that indicates whether the company introduced some product process or strategic and organizational innovation. Also, if the company could absorb knowledge by MNEs.

Product innovation: Dummy variable indicating whether the firm has introduced a product innovation in the period (receiving a value of 1, and 0 otherwise).

Process innovation: Dummy variable indicating whether the firm introduced a process innovation in the period (receiving a value of 1, and 0 otherwise).

Strategic and organizational innovation: Dummy variable indicating whether the company has implemented significant changes in management techniques, organizational structures, concepts, marketing strategies, design or other subjective changes in at least one of the products, new methods of control and management in order to meet certification standards such as ISO 9000, ISO 140000, QS, TS, OHSAS 18001, AS 800, etc. If the company has introduced some strategic and organizational innovation in the period, receiving value of if it the firm has introduced a strategic and organization innovation, and 0 otherwise.

Absorption capacity: Absorptive capacity was introduced by Cohen and Levinthal (1990) and reflecting the firm's ability to assimilate and apply new, external information, and it is also known as a key factor in maintaining long-term advantage over competitors. The information and knowledge provided by developing relationships with MNEs can only be incorporated and transferred into innovation if the local firm has a certain level of absorptive capacity. The variable was added to our model as a dummy indicating whether the company could absorb the knowledge brought by MNEs in the region (receiving value 1 if the firm could absorb, and value 0 otherwise).

Size: The size of the firm will be represented by the logarithm of the number of employees in the firm. For Gibson and Harris (1996), in a competitive environment, the probability of survival is higher for larger, more specialized firms and with lower production costs. Furthermore, as noted by Cohen and Klepper's (1996), the larger the size of the company, the higher are the investments in R&D and, consequently, the greater is its innovative capacity. The explanation lies in the fact that these companies can upgrade their production technologies and develop new products and processes more easily. Thus, we will test the hypothesis that there is a direct relationship between firm size and its innovative capacity, as well as the absorptive capacity of externalities generated by MNEs.

Experience: Experience variable will be represented by the logarithm of years in which the firm is established in the city. To Alfaro and Clare (2004), firms that are recently established in the market need time to stabilize and create relationships with other firms in order to strengthen their competitive position. Considering that experience accumulation plays an important role in innovative processes, it can be said that more experienced firms will have advantages in innovation when compared to less experienced firms. However, if the information outside the industry is relatively important in generating innovations, new entrants may also have advantages in innovation as well as a greater chance of survival and growth. Thus, we expect to find a positive coefficient for this variable. In other words, the age of the firm is directly related to higher levels of innovative and absorptive capacities.

Employees empowerment: This variable is represented by the qualification of workers measured by the average number of undergraduate and graduate employees in firm j in the year t, relative to the total number of persons employed by firm j at time t. The existing human capital in a given locality is essential for employees to benefit from exchanging knowledge. Blomstrom and Kokko (1998) argue that employee empowerment not only determines the FDI to a receiving location, but also how local firms will be able to absorb and benefit from a new knowledge brought with this investment. It is believed that the more qualified employees are, the higher the innovative performance of domestic firms. Thus, we expected to find positive signs in relation to the dependent variables.

Mobility of workers: This variable is represented by the number of employees hired by the domestic firm that have worked or have been trained previously in MNEs and were transferred to domestic firms. The hypothesis that we test is that that workers, while employees of MNEs, have access to the technology developed by them and, when transferred to domestic firms, they take with them lots of valuable knowledge to the new employer. They can also create their own businesses with the knowledge gained in the MNE. It is expected for this variable a positive sign meaning that the higher the number of employees transferred from MNEs to domestic firm, the greater the possibility of innovation spillovers.

Upstream vertical linkages: Dummy variable indicating whether the major supplier is a multinational headquarters or subsidiary located in Brazil. Received value 1 firms whose main supplier is a multinational headquarter or subsidiary and value 0 otherwise.

Downstream vertical linkages: Dummy variable indicating whether the main client is a multinational headquarters or subsidiary located in Brazil. Received value 1 firms whose main client is a multinational or subsidiary and value 0 otherwise.

Horizontal linkages: Dummy variable indicating whether the main competitor is an multinational headquarters or subsidiary located in Brazil. Received value 1 firms whose main competitor is a multinational headquarter or subsidiary and value 0 otherwise.

Exports: Exports have been the central themes of research in the international business academy. Innovation is an important factor that leads SMEs to achieve success within foreign market (Knight and Cavusgil, 2004). Innovative firms meet the customer needs and desires reinventing the firm's operations by introducing new goods and methods of production to serve those markets optimally (Nelson and Winter, 1982). Thus we can postulate that export is another drive of innovation for SMEs as firms have to adapt their product and processes to enter foreign markets and meet customer demands (Lall, 1992; Knight & Cavusgil, 2004; Ahmed & Julian, 2006; Peng et al, 2008). A variable representing firm export (EXPORTA) was added to our model as a dummy indicating whether the firm exports or not. Firms that do not export received value 0. Firms that have been exporting for at least one year received 1. We also expected a positive relationship between export and innovation.

Technological intensity: Lall (2000) proposed a classification of economic activities according to the level of their technological intensity, measured by investments in R&D: (1) exploitation of natural resources: food, leather, petroleum refining, etc.; (2) companies with low technology: textiles, clothing, footwear, etc., (3) medium-tech companies: automotive products, chemicals, etc., (5) high-tech sectors: electronics, electrical products, aircraft, pharmaceuticals, among others. Adapting the criteria, the sample companies were classified into two groups according to their technological level. The companies in the above group (1) and (2) formed a new group 1 and received value 0. The second group, classified by the union of groups (3) and (4) above received value 1. Our assumption is that the higher the technological intensity of the industry, the higher the innovative and absorptive capacity of firms (SETEC).

Multinational Involvement: Involvement with multinationals was measured by the percentage of the firm's involvement with MNEs related to the total business of the domestic firm.Partnership has been receiving great attention from literature on SMEs Innovation. It is well-know that SMEs use partnership as a source of information and knowledge to innovate (Knight, 2001; Calantone et al, 2002; Knight and Cavusgil, 2004). The relationship between SMEs and their business partners, suppliers, customers and competitors, enable SMEs to overcome their resource constraints by acquiring resources like technology (Chetty and Wilson, 2003). Moreover, any kind of relationship with MNEs can provide significant information for SMEs to make strategic changes to their products and processes. Foreign MNEs tend to maintain face-to-face contact with partners at a regional level within the host country in order to innovate (Cantwell and Piscitello, 2002), thus, SMEs can benefit and innovate through this kind of relationships.

The results from association analysis for product, process, strategic and organizational innovation and absorptive capacity of small and medium firms are presented in Tables 1, 2, 3 and 4, respectively.

Only technological intensity variable was associated with product innovation (Table 1). Still, technological intensity was associated only to product innovation, whereas, no association was found for process and strategic and organizational innovation variables. Results indicated that high-technology companies have 7,526 more chances to innovate in product. The non-significance of the other variables can be explained by the fact that, regardless of size, experience, qualification and mobility of employees or links, the company can develop product innovation that is embedded in high-technology sectors.

Table 1. Chi-square test for factors associated1 with product innovation of small and medium firms.

Technological intensity |

Product innovation |

Total (%) |

P Value |

Odds ratio |

Confidence interval (95%) |

|

No |

Yes |

|||||

Low |

13 |

38 |

51 |

0.051 |

1 |

0.921-61.500 |

High |

1 |

22 |

23 |

7.526 |

||

1. Chi-square Association analysis or Fisher's Exact, the latter when was observed at least one quadrant

with < 5 observations; only factors that were significantly associated (P <0.10) are presented.

2. n=74 firms.

The result indicates that the peculiarities of the industry have a strong relationship with the occurrence of product innovation and suggest that the heterogeneity across industries due differences in technological and learning capabilities exert distinct effects on the effects of product innovation of firms. In this sense, industries with better technological capabilities offer better conditions of knowledge absorptive capacity, thus, making local host country firms become more innovative and competitive.

According to Jajri (2007), the development of new products or new technologies allows production methods that result in the shifting upwards the production frontier. The development of innovations and technological capabilities are factors that differentiate the various types of organizations and industries and, consequently affect their economic performances (Reichert, Beltrame, Corso, Zawislak & Trevisan, 2011).

According to Buckley, Clegg and Wang (2010, p. 197), "the low technology nature of the host industry is thought to exacerbate the severity of negative competitive impact of foreign owned enterprises' presence.

Firms with more than 70 employees have 5.874 more chances to develop strategic and organizational innovation (Table 3) and 3.043 more chances to develop absorptive capacity (Table 4). Still, companies that export have 3.6 more chances to develop absorptive capacity (Table 4). The results also indicated that firms that have more than 20% on average of personnel with a medium and higher education level have 3,577 more chances to develop process innovation (Table 2); 7,750 more chances to develop strategic and organizational innovation (Table 3) and 2.819 more chances to develop absorptive capacity (Table 4).

Table 2. Chi-square test for factors associated1 with process innovation of small and medium firms.

Employees empowerment(%) |

Process inovation |

Total (%) |

Valor de P |

Odds ratio |

Confidence interval (95%) |

|

Não |

Sim |

|||||

<20 |

12 |

4 |

38 |

0.049 |

1 |

1.029-12.433 |

>20 |

4 |

31 |

35 |

3.577 |

||

Multinational involvement |

Process inovation |

|

||||

Não |

Sim |

|||||

No |

12 |

29 |

41 |

0.093 |

1 |

0.865-10.400 |

Yes |

4 |

29 |

43 |

3.000 |

||

Upstream linkages |

Process inovation |

|||||

Não |

Sim |

|||||

No |

13 |

32 |

45 |

0.083 |

1 |

0.0906-13.688 |

Yes |

3 |

26 |

29 |

3.521 |

||

1. Chi-square Association analysis or Fisher's Exact, the latter when was observed at least one quadrant

with < 5 observations; only factors that were significantly associated (P <0.10) are presented.

2. n=74 firms.

The results indicate that firm-specific assets, such as experience and management capabilities, technological know-how and reputation, that play important role in the traditional Eclectic Theory of FDI of Dunning (2000, 2008) are essential to the argument that ownership advantages of firms should relativity lead to higher economic performance (Buckley, Clegg and Wang, 2010, p 217;. Thang, 2011).

Also, the result is consistent with pioneer contributions developed by Romer (1986). He offered an alternative view of' long-run prospects for growth where the rate of investment and the rate of return on capital would increase rather than decrease with increases in the capital stock. He suggested that endogenous technological change was driven primarily by the accumulation of knowledge by forward-looking and profit-maximizing agents (Romer, 1986, p.1003). Another Romer's contribution was presented with the author's belief that "in contrast to models in which capital exhibits diminishing marginal productivity, knowledge will grow without bound" (Romer, 1986, p. 1003). He highlights the capital input importance (including physical and human capital) is in its ability to generate positive externalities that raise productive capacity of firms. Thus, human capital can be used as accumulated knowledge indicator and experience in the form of learning-by-doing, which externalities result in increasing returns (Romer, 1986; Marine & Bittencourt, 2007).

Thus, human capital is an important driver efficiency in business, and, sust as physical capital, it also increases the ability of a company to produce goods/services. In fact, organization efficiency depends on both material capital and human capital, acquired through investments in education. To Blomstrom and Kokko (1998), the existing level of capabilities in an industry is essential to knowledge exchange and training of workers is considered a determining factor of how local businesses can benefit from new knowledge to become more innovative and competitive. According to Jajri (2007), the education and training of the workforce to upgrade capabilities and knowledge will result in higher-skilled and more efficient workers, thus leading to better efficiency levels.

Table 3. Chi-square test for factors associated [1] with strategic and organizational innovation of small and medium firms.

Number of Employees |

Strategic and organizational innovation |

Total (%) |

P value |

Odds ratio |

Confidence Interval (95%) |

|

Não |

Sim |

|||||

<70 |

18 |

19 |

37 (51.3) |

0.001 |

1 |

1.872-18.432 |

>70 |

5 |

31 |

36 (86.1) |

5.874 |

||

Employees empowerment(%) |

Strategic and organizational innovation |

|

||||

Não |

Sim |

|||||

<20 |

19 |

19 |

38 |

0.000 |

1 |

2.288-26.253 |

>20 |

4 |

31 |

35 |

7.750 |

||

Multinational involvement |

Strategic and organizational innovation |

|

||||

Não |

Sim |

|||||

No |

19 |

22 |

41 |

0.002 |

1 |

1,863-21.045 |

Yes |

4 |

29 |

33 |

6.261 |

||

Upstream linkages |

Strategic and organizational innovation |

|

||||

Não |

Sim |

|||||

No |

20 |

25 |

45 |

0.002 |

1 |

1.830-26.265 |

Yes |

3 |

26 |

29 |

6.933 |

||

Dowstream linkages |

Strategic and organizational innovation |

|

||||

Não |

Sim |

|||||

No |

20 |

25 |

45 |

0.002 |

1 |

1.830-26.265 |

Yes |

3 |

26 |

29 |

6.933 |

||

Cooperation |

Strategic and organizational innovation |

|

||||

Não |

Sim |

|||||

No |

21 |

31 |

52 |

0.012 |

1 |

1.430-32.093 |

Yes |

2 |

20 |

22 |

6.774 |

||

1. Chi-square Association analysis or Fisher's Exact, the latter when was observed at least one quadrant

with < 5 observations; only factors that were significantly associated (P <0.10) are presented.

2. n=74 firms.

Companies that engage in upstream linkages have 3,521 more chances to develop process innovation (Table 2) and 6,933 more chances to develop strategic and organizational innovation (Table 3). In addition, companies that engage in downstream linkages have 6,933 more chances to develop strategic and organizational innovation (Table 3) and 0.409 more chance to develop absorptive capacity (Table 4). Still, companies that engage in horizontal linkages are more likely of developing absorptive capacity (Table 4).

Those results are consistent with theory and suggest that links that occur through existing efficient communication networks between local and foreign companies can promote innovation through demonstration of new technologies and sharing of knowledge in local environments (Findlay, 1994). According to Findlay (1994), knowledge tends to spread more easily among companies that are nearby and communicating more frequently.

Additionally, companies that establish cooperative relationships have 6,774 more chances to develop strategic and organizational innovation (Table 3) and 0,388 more chances to develop absorptive capacity (Table 4). The result is consistent with cooperation mechanism spillover that occur between companies and their suppliers, consumers and local / foreign partners. Pannekoek et al. (2005) adds that cooperation beyond the boundaries of the organization itself and is a prerequisite not only for the innovative capacity, but for the survival and success of firms.

Table 4. Chi-square test for factors associated 1 with absorption capacity of small and medium firms.

Number of employees |

Absorption capacity |

Total (%) |

Valor de P |

Odds ratio |

IC (95%) |

|

No |

Yes |

|||||

<70 |

14 |

23 |

37 |

0.043 |

1 |

1.013-9.142 |

>70 |

6 |

30 |

36 |

3.043 |

||

Exports |

Absorption capacity |

|

||||

No |

Yes |

|||||

No |

9 |

10 |

19 |

0.021 |

1 |

1.178-11.000 |

Yes |

11 |

14 |

55 |

3.600 |

||

Employees empowerment(%) |

Absorption capacity |

|

||||

No |

Yes |

|||||

<20 |

14 |

24 |

38 |

0.059 |

1 |

0.940-8.459 |

>20 |

6 |

29 |

35 |

2.819 |

||

Downstream linkages |

Absorption capacity |

|

||||

No |

Yes |

|||||

No |

9 |

36 |

45 |

0.090 |

1 |

0.144-1.166 |

Yes |

11 |

18 |

29 |

0.409 |

||

Horizontal linkages |

Absorption capacity |

|

||||

Não |

Sim |

|||||

No |

10 |

40 |

50 |

0.049 |

1 |

0.129-1.017 |

Yes |

10 |

14 |

24 |

0.350 |

||

Cooperation |

Absorption capacity |

|

||||

No |

Yes |

|||||

No |

11 |

41 |

52 |

0.080 |

1 |

0.132-1.141 |

Yes |

9 |

13 |

22 |

0.388 |

||

1. Chi-square Association analysis or Fisher's Exact, the latter when was observed at least one quadrant

with < 5 observations; only factors that were significantly associated (P <0.10) are presented.

2. n=74 firms.

Finally, companies that have involvement with multinational companies have 3 times more chances to develop process innovation (Table 2) and 6,261 more chances to develop Strategic and organizational innovation (Table 3). The result is consistent with spillovers theory and Caves (1971) argument that MNEs own certain technological properties that constitute their specific advantages that allow them to compete with local firms that usually have better knowledge of local market and consumer preferences (Aitken, Harrisson, & Lipsey 1996; Blomström & Kokko, 1998).

Another argument is that the entry or presence of MNEs alters existing market equilibriums, forcing local firms to become more efficient to protect their market shares and profits (Blomström & Kokko, 1998). Even if an MNE has as main motivation the technology use internationalization, it can spread or "spillover" for firms in the host economy (Blomström & Kokko, 1998). Our results are consistent with theory and show that the engagement with MNEs may lead to an increase in the competition level between companies, forcing them to become more innovative. Increased competition that occurs in the presence of MNEs is considered a knowledge intensifier diffusion mechanism, in particular if it induces industries to use existing resources more efficiently.

It is important to highlight that, in some analyzes of x2, the confidence interval of the OR passed throught 1. In these cases, care is needed in interpreting the relationship between variables, because even if there is a statistically significant association (p <0.10), there is a probability of misclassification of the relationship between the variables, that means, when the independent variable increases the occurrence of the dependent (OR> 1) or when the independent variable decreases the occurrence of the dependent (OR <1).

The results for product innovation factors indicated that only technological intensity variable was associated to product innovation. The result suggests that the heterogeneity across industries due to differences in technological capabilities and learning exert distinct effects on product innovation effects.

Exporting companies with more than 70 employees are more likely to develop strategic and organizational innovation and absorptive capacity, indicating that firm-specific assets, such as experience and management capabilities, technological know-how and reputation are fundamental to the argument that ownership advantages of firms should lead to relativity higher economic performances (Buckley, Clegg & Wang, 2010, p. 217; Thang, 2011). Still, the result suggests that the competitive advantage when entering world markets, such as experience and knowledge of international markets and international distribution networks contribute to innovative capabilities of local firms.

The results have also indicated that companies with more than 20% of the average number of personnel with a secondary and higher education level are more likely to develop process innovation and absorption capacity. The results confirm the hypothesis that human capital is an important driver efficiency in business and that education and training of workers are considered determinant factors of how local businesses can benefit from new knowledge to become more innovative and competitive.

The evidence from this study confirm that upstream, downstream and horizontal links are associated with the ability of firms to develop strategic and organizational innovation and absorptive capacity. This result is consistent with theory and suggests that links that occur through efficient communication networks can promote innovation through demonstration of new technologies and knowledge sharing environments.

Companies that have involvement with multinational companies are more likely to develop process innovation and strategic and organizational innovation. The result is consistent with spillovers theory and the assumption that the entry or presence of MNEs alters existing market equilibriums, forcing local firms to become more efficient to protect their market shares and profits (Blomström & Kokko, 1998). Our results are consistent with theory and show that the engagement with MNEs may lead to an increase in the competition level between companies, forcing them to become more innovative.

Finding that spillovers do not occur equally to all industries leads questions related to FDI unconditional or unrestricted liberalization policies. The result confirm Buckley, Clegg and Wang (2010) findings that the complexity of spillover effects challenges the laissez-faire view that the presence of EMNs in all types of industries is equally valuable in terms spillover benefits (Buckley, Clegg and Wang, 2010, p.192).

The analyzes bring implications for policymakers, as suggested by Buckley and Ruane (2010): (i) it is important that policy makers understand that MNEs strategies are not only local or regional, but global. Host countries need to focus on what immobile resources they can offer to combine with MNEs resources to achieve synergy that can benefit industries in the host country; (ii) sectoral directions requires selectivity projects considering a careful cost-benefit analyzes and strategic bargaining; (iii) combining both financial and fiscal performance-based incentives designed to ensure that outcome benefits to LOEs of the host industry; (iv) monitoring projects outcomes.

AHMED, Z.U., JULIAN, C.C., BAALBAKI, I., & HADIDAN, T.V. (2006). Firm internationalization and export incentives from a middle eastern perspective. Journal of Small Business and Enterprise Development, 13: 660-669.

AITKEN, B, & HARRISON, A. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, United States, 89(3): 605-618.

AITKEN, B., HARRISON, A., & LIPSEY, R. E. (1996). Wages and Foreign Ownership: a Comparative Study of Mexico, Venezuela, and the United States, Journal of International Economics, 40: 345-371.

ALFARO, L., & CLARE, A.R. (2004). Multinationals and linkages: An empirical investigation, Jornal of LACEA Economia: Latin American and Caribbean Economic Association.

ALI, H., KHAN, A.A., PIRZADA, D.S., ARIF, W., & SARWAR, Z. (2012). Technology spillover impacts on total productivity of the manufacturing sector in Pakistan. African Journal of Business Management, 6(9): 3490-3503.

BAMBRILLA, I.; HALE, G.; & LONG, C. (2009). "Foreign Direct Investment and the Incentives to Innovate and Imitate." The Scandinavian Journal of Economics, 111(4): 835–861.

BLOMSTROM, M., & KOKKO A. (1998). Multinational Corporations and Spillovers. Journal of Economic Surveys, 12(1): 247-77.

BLOMSTROM, M., KOKKO A., & ZEJAN M. (2000). Foreign direct investment: firm and host country strategies. London: Macmillan Press Ltd.

BUCKLEY, P. J., & CASSON, M. (2010). The multinational enterprise revisited. London: Palgrave Macmillan.

BUCKLEY, P.J., CLEGG, J., & WANG, C. (2010). Is the relationship between inward FDI spillover effects linear? An empirical examination of the case of China. In Buckley, P.J. (Ed.). Foreign Direct Investment, China and the world economy. London: Palgrave Macmillan.

BUCKLEY, P.J., & LESSARD, D.R. (2010). Regaining the Edge for International business research. In: Buckley, P.J. Foreign Direct Investment, China and the world economy. London: Palgrave Macmillan.

BUCKLEY, P.J., & RUANE, F. (2010). Foreign Direct Investment in Ireland: Policy Implications for Emerging Economies. In: Buckley, P.J. Foreign Direct Investment, China and the world economy. London: Palgrave Macmillan.

CALANTONE, R., DRÖGE, C., & VICKERY, S. (2002). Investigating the manufacturing-marketing interface in new product development: does context affect the strength of relationships? Journal of Operations Management. 20, 273-287.

CALEGARIO, C. L. L., BRUHN, N. C. P., & PEREIRA, M. C. P. (2014). Foreign Direct Investment and Trade: A Study on Selected Brazilian Industries. Latin American Business Review, 15(1): 65-92.

CANTWELL, J, & PISCITELLO. L. (2001) The location of technological activities of MNCs in European regions: The role of spillovers and local competencies, Journal of International Management, 8: 69–96.

CASSON, M. (2007) Multinational Enterprises: Their Private and Social Benefits and Costs. The World Economy. 30(2): 308-328.

CAVES, R. (1996). Multinational Enterprise and Economic Analysis, 2nd edition, Cambridge, U.K.: Cambridge University Press.

CHETTY, S.K., & WILSON, H.I.M. (2003). Collaborating with competitors to acquire resources. International Business Review, 12: 61-81.

COHEN, S. D. (2007). Multinational Corporations and Foreign Direct Investment. Avoiding Simplicity, Embracing Complexity, Oxford: Oxford University Press.

COHEN, W. M., & LEVINTHAL, D. A. (1990). Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly, 1(35): 128-152.

COHEN, W., & KLEPPER, S. (1996). A Reprise of Size and R+D. The Economic Journal, 106(1): 925-951.

D'ANGELO, A. (2012). Innovation and export performance: a study of italian high-tech SME's.

Journal of Management and Governance, 16(3): 393-423.

DUNNING, J., & LUNDAN, S. (2008). Multinational enterprises and the global economy. 2 ed., Cheltenham: Edward Elgar.

FERRERO, L., MAFFIOLI, A. (2004). The interaction between foreign direct investment and small and medium-sizedenterprises in Latin America and the Caribbean: a look at regional innovation systems. Inter-American Development Bank, Special Office in Europe, Paris, Working Paper Series, No. 6A.

FINDLAY, R. (1978). Some Aspects of Technology Transfer and Direct Foreign Investment, American Economic Review, 68(2): 275-79.

GIBSON, J. K., & HARRIS, R. I. D. (1996). Trade liberalisation and plant exit in New Zealand nanufacturing, The Review of Economics and Statistics, 78(3), 521-9.

GOMEL, M. M., & SBRAGIA, R. (2011). A Competitividade da Indústria Brasileira de Software e a Influência da Capacitação Tecnológica no Desempenho Exportador. Revista de Administração e Inovação, 8(1): 169-195.

GONÇALO, C. R., & ZANLUCHI, J. (2011). Relacionamento entre empresa e universidade: uma análise das características de cooperação em um setor intensivo em conhecimento. Revista de Administração e Contabilidade da Unisinos, 8(3): 261-272.

GÖRG, H., & GREENAWAY, D. (2004). Much Ado about Nothing? Do Domestic Firms really Benefit from Foreign Investment? Research Observer Oxford University Press, 19(2): 171-197.

HAAHTI, A., MADUPU, V., YAVAS, U. & BABAKUS, E. (2005). Cooperative strateg, knowledge intensity and export performance of small and medium sized enterprises. Journal of World Business, 40: 124-138.

KNIGHT, G.A. (2001) Entrepreneurship and strategy in the international SME, Journal of International Management, 7: 155–171.

KNIGHT, G., & CAVUSGIL, S. T. (2004). Innovation, organizational capabilities, and the born global firm. Journal of International Business Studies. 35: 124–141.

JAJRI, I. (2007). Determinants of Total Factor Productivity Growth in Malaysia. Journal of Economic Cooperation, 28(3): 41-58.

LALL, S. (2000). Technological Change and Industrialization in the Asian Newly Industrializing Economies, Achievements and Challenges. In Kim, l. (2000). Technology, learning, and innovation: experiences of newly industrializing economies. Cambridge: Cambridge University Press, 13-68

LALL, S. (1992). Technological Capabilities and Industrialization. World Development, 20 (2): 165-186.

LAPLANE, M., & SARTI, F. (1997). Investimento direto estrangeiro e a retomada do crescimento sustentado nos anos 1990. Economia e Sociedade, 8(1): 143-181.

LAPLANE, M., & SARTI, F. (1999). Investimento direto estrangeiro e o impacto na balança comercial nos anos 90 (Texto para discussão, n. 629). Brasília: IPEA.

LEFEBVRE, E., LEFEBVRE, L.A. & BOUGAULT, M. (1998). R&D-Related capabilities as determinants of export performance. Small Business Economics, 10: 365-377.

MACERA, A. P., & URDAN, A. T. (2004). Orientação para o Mercado Externo: Teste de um Modelo no Brasil e sua Aplicação a uma Amostra de Empresas Exportadoras Brasileiras. Revista de Administração Contemporânea, 8(2): 95-115.

MALIK, A.R.A., REHMAN, C.A., ASHRAF, M., & ABBAS, R.Z. (2012). Exploring the Link between Foreign Direct Investment, Multinational Enterprises and Spillover Effects in Developing Economies. International Journal of Business and Management, 7(1): 230-240.

MARINHO, E., & BITTENCOURT, A. (2007). Produtividade e Crescimento Econômico na América Latina: Abordagem da Fronteira de Produção Estocástica, Estudos Econômicos, 37(1): 5-33.

NAVARETTI, G. B., & VENABLES, A. J. (2013). Multinationals and industrial policy. Oxford Review of Economic Policy, 29(2): 361–382.

NELSON, R., & WINTER, S. (1982). An Evolutionary Theory of Economic Change, Belknap Press: Cambridge, MA.

OKPARA, J.O. (2009). Strategic choices, export orientation and export performance of SME's in Nigeria. Management Decisions, 47(8): 1281-1299.

PANNEKOEK, L., KOOTEN. O., KEMP, R, & OMTA, S.W.F. (2005). Entrepreneurial innovation in chains and networks in Dutch greenhouse horticulture. Journal on Chain and Network Science, 5(1): 39-50.

PENG, D. X., SCHROEDER, R.G., & SHAH, R. (2008). Linking routines to operations capabilities: a new perspective. Journal of Operations Management. 26: 730–748.

POOLE, J. P. (2007). Multinational Spillovers Though Worker Turnouver. Department of Economics, University of California.

REICHERT, F., BELTRAME, R., CORSO, K., TREVISAN, M., & ZAWISLAK, P. (2011). Technological Capability's Predictor Variables. Journal of Technology Management & Innovation. 6(1): 14-25.

ROMER, P. (1986). Increasing returns and long-run growth, Journal of Political Economy, 94(1): 1002-1037.

SEBRAE. (2011). Critérios e conceitos para classificação de empresas. Disponível em <http://www.sebrae.com.br/uf/goias/indicadores-das-mpe/classificacao-empresarial>. Acesso em 14/11/2011.

SERVIÇO BRASILEIRO DE APOIO À MICRO E PEQUENAS EMPRESAS. (2011). Taxa de Sobrevivência de empresas no Brasil. Coleção Estudos e Pesquisas, Available at: <http://www.sebrae.com.br>.

SPAR, D. L. (2009). National policies and domestic politics. In: Rugman, A. M. (Ed.) The Oxford Handbook of International Business (2nd Ed.), Oxford University Press, New York, 205-227.

THANG, T. T. (2011). Productivity Spillovers from Foreign Direct Investment: What if Productivity is no Longer a Black Box? South East Asian Journal of Management, 5(1): 1-18.1. email: nadiacpereira@yahoo.com.br